Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 11, 2024

SHARE

Trading Bots and Visualization – How Visual Data Aids Automated Trading Systems

Are robots taking control of the trading world? Well, machines can analyze

vast amounts of data, execute trades at lightning speed, and even spot

manipulative tactics in financial markets. It’s not fiction; it’s modern

reality.

Through this article, we will show you the world of trading bots and their

evolving role in the financial markets. We’ll dive deep into the basics of

automated trading systems and understand their different behaviors.

Also, we will understand the several limitations and opportunities where

human traders come into play. So, let’s get started.

What Are Trading Bots?

Trading bots are computer programs designed to automate the process of

buying and selling financial assets, such as stocks, cryptocurrencies,

foreign exchange (forex), and commodities. These bots can:

-

Work without direct human intervention

-

Operate 24/7, and

-

Execute trades with high speed and precision

In recent years, trading bots have gained popularity. They are an integral

part of

High-frequency Trading

(HFT) and can capitalize on market opportunities swiftly. Let’s understand

the basics.

The Basics of Automated Trading Systems

Automated trading systems, also known as trading bots, can analyze vast

amounts of market data in real time, which would be impractical for a human

to do. They make informed trading decisions by using:

-

Various technical indicators

-

Historical price data

-

Several other market factors

After being programmed with specific criteria or strategies, trading bots

can execute buy and sell orders automatically. This automation helps in

taking advantage of market opportunities even when the trader is not

actively monitoring the markets.

What are Some Major Benefits?

-

Risk Management:

-

Bots can incorporate risk management rules, such as setting

stop-loss and take-profit orders. -

This helps them to limit potential losses and lock in profits.

-

-

Emotion-Free Trading:

-

Emotions can cloud judgment and lead to impulsive decisions.

-

Trading bots operate based on predefined algorithms.

-

They are devoid of emotional influence, which leads to more

disciplined trading.

-

-

Diversification:

-

Bots can manage multiple trading strategies and assets

simultaneously. -

This provides a level of diversification that might be

challenging for an individual trader to maintain manually.

-

-

Scalability:

-

Trading bots can handle a high volume of trades simultaneously.

-

This allows for scalability in trading operations.

-

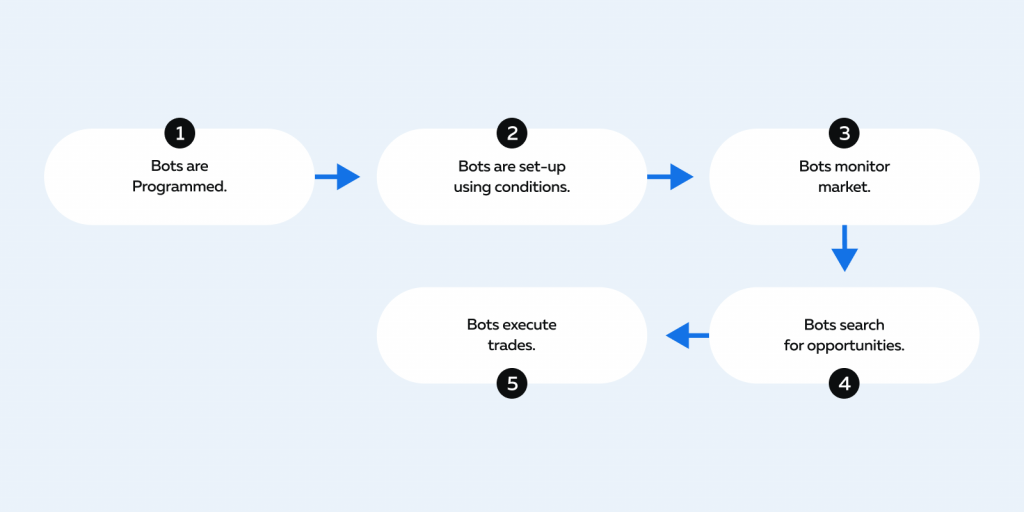

The Automated Nature of Trading Bots

-

The trading bots are programmed using a combination of coding

languages, such as Python. -

They are set up with specific criteria or trading strategies.

-

Once the bot is active, it continuously monitors the market and

executes trades based on the predetermined conditions. -

These trades happen without human intervention.

For example,

A trading bot could be set to buy Bitcoin when its price falls below a

certain level and sell it when it exceeds another threshold.

Evolution of Trading Bots

Traditionally, trading bots were simple rule-based algorithms and were

primarily used to automate trading decisions. However, gradually, they were

driven by technology and evolved into more sophisticated AI-powered systems.

Let’s understand this evolution.

The Simple Rule-Based Algorithms

The early bots followed predefined rules, such as moving average crossovers

or basic technical indicators, to make buy and sell decisions. While these

bots were a significant step toward automation, they had limited

adaptability and were heavily reliant on fixed criteria.

How Did the Transition Happen?

-

With advancements in technology, trading bots transitioned into

high-frequency trading (HFT) systems. -

These bots capitalized on technological progress, such as faster

internet connections and improved hardware. -

High-frequency trading bots operate at extremely high speeds and can

make thousands of trades per second. -

Their programming is designed to exploit even the slightest market

inefficiencies.

How Did the Integration of Machine Learning Happen?

The integration of machine learning marked a significant leap in trading bot

capabilities. Machine learning algorithms allow bots to adapt and learn from

historical data. This advanced learning allowed them to:

-

Make more complex and data-driven decisions.

-

Analyze extensive datasets.

-

Identify patterns that rule-based systems couldn’t discern.

How Trading Bots Evolved Into AI-Powered Systems

These systems incorporate advanced artificial intelligence and deep learning

techniques to analyze massive amounts of data, including news sentiment

analysis and social media trends.

AI-powered bots can:

-

Make highly nuanced trading decisions.

-

Swiftly adapt to changing market conditions.

-

Develop their strategies over time.

What Are Some Major Technological Advancements?

Several technological advancements have contributed to the rising prominence

and efficiency of trading bots, such as the availability of:

-

High-speed internet connections

-

Low-latency trading infrastructure

-

Big data technology and cloud computing

-

Machine learning libraries and frameworks like TensorFlow and

PyTorch -

Advanced quantitative research tools and data sources

Understanding Different Trading Bot Behaviors

Trading bots come in various types. See the table below:

|

Trading Bots |

Behavior |

Strategy |

|

Trend-Following Bots |

|

To capture profits as long as a trend continues and exit |

|

Mean Reversion Bots |

|

They buy low and sell high, aiming to profit from price |

|

Arbitrage Bots |

|

These bots aim to make risk-free profits by exploiting |

|

Scalping Bots |

|

Scalping bots aim to capture minimal price differentials |

|

Market-Making Bots |

Market-making bots provide liquidity to the market by |

Market-making bots earn profits from the bid-ask spread |

Trading Bots’ Impact on Market Dynamics

Trading bots impact market dynamics by injecting liquidity into the markets.

They do so via the following activities:

-

Bots execute trades at much higher frequencies than human traders.

This increased trading activity contributes to market liquidity. -

Bots operate 24/7 without the need for breaks, making markets more

liquid even during non-trading hours. -

By actively participating in the market, trading bots aid in the

process of price discovery and help in attaining fair and efficient

pricing. -

In times of market volatility, trading bots provide stability by

buying or selling assets when human traders might hesitate, thereby

preventing extreme price swings.

Spoofing as a Tactic

Spoofing is a manipulative trading tactic where large quantities of orders

are placed with no intention of execution. The primary goal of spoofing is

to:

-

Create false market signals and

-

Trick other traders into making decisions that benefit the spoofer’s

predefined trading strategies.

This is how spoofing is practiced:

How Do Trading Bots Detect Spoof-like Tactics?

Some trading bots are programmed to engage in

spoofing behavior

to manipulate market conditions in their favor. They aim to create

artificial supply or demand imbalances. Additionally, some anti-spoofing

bots are also designed to detect spoofing tactics. They identify potential

spoofers by analyzing:

-

Order book data and

-

Trading patterns

Note: Manipulative tactics like spoofing are illegal in many jurisdictions.

Regulatory authorities have taken measures to identify and sanction those

who engage in such practices.

Observing Trading Bot Activity with Tools like Bookmap

Recognizing trading bot activity is crucial for traders. Advanced market

analysis tools like Bookmap can help in observing the activities of trading

bots as they offer a visual representation of order flow. This display makes

it easier to spot patterns or activities that suggest algorithmic trading.

How Does Bookmap Help Traders Spot Bot Activities?

Bookmap displays order book data in a visual format, showing the

distribution of buy and sell orders at different price levels on a heatmap.

Traders can see the depth of the market and how orders are evolving. This

representation helps in:

-

Identifying Algorithmic Trading:

-

Trading bots often exhibit specific patterns in their trading

activity. -

For example, they may place a high volume of small orders in

rapid succession or follow specific technical indicators. -

These patterns can be more easily recognized through the visual

representation.

-

-

Adapting Strategies:

-

Recognizing bot activity can help manual traders adapt their

strategies. -

For example, if they notice a bot driving the price in a certain

direction, they can choose to:-

Follow the trend or

-

Look for opportunities when the bot pauses its activity.

-

-

Bookmap’s real-time data visualization helps in spotting potential spoofing.

Let’s understand through a hypothetical example.

The Backdrop

On a normal trading day, Mr. A observed sudden spikes in buying/selling

activity. This spike was followed by rapid cancellations. A clear sign of

spoofing was observed.

How did the Trader Use Bookmap to Detect Spoofing?

-

Mr. A observed the real-time view of the order flow using Bookmap.

-

This allowed him to see orders being placed, modified and canceled

instantly. -

He observed rapid changes in the order book, with orders appearing

and disappearing rapidly. -

He used this data to understand unusual order behavior that was due

to spoofing. -

As a result, Mr. A:

-

Chose to wait for more stable market conditions and

-

Took protective measures to mitigate the impact of manipulative

activities.

-

Limitations and Challenges of Trading Bots

Trading bots operate based on predefined algorithms and strategies. They are

highly efficient at strategy execution but lack the adaptability and

flexibility of human traders. Let’s understand their limitations.

-

Misinterpretation

-

It is common for markets to behave unexpectedly or experience

extreme events. -

In such situations, bots misinterpret the situation and make

miscalculations.

For example, a sudden news event can trigger extreme market volatility that

bots may not have been programmed to handle, leading to unintended

consequences.

-

Lack of Emotion

-

Bots don’t possess emotions, which can be an advantage in avoiding

emotional trading decisions. -

However, this lack of emotion can also be a drawback when it comes

to understanding or reacting to market sentiment. -

In times of extreme market stress, bots may not “panic” or “fear”

like humans, but they may also fail to recognize the significance of

such situations and continue executing trades as programmed.

-

Human Oversight:

-

Trading bots lack human intuition and the ability to make nuanced

judgments. -

Human traders can consider factors beyond the quantitative, such as

geopolitical events or broader market sentiment. -

This broad view is essential in certain trading situations.

-

It is also observed that bots do not adequately respond to such

qualitative information.

The Need for Balancing Automation with Human Intervention

Trading bots aren’t foolproof. To address their limitations, it’s important

to strike a balance between automated trading systems and human oversight.

Automated systems offer speed and efficiency in executing predefined

strategies, but human traders can provide the necessary judgment and

adaptability. They can intervene when bots misinterpret market events, or

when a more nuanced approach is needed for making trading decisions.

Conclusion

Trading bots have revolutionized the financial markets with their speed,

precision, and ability to operate 24/7. However, bots fall short in terms of

intuition, and some traders misuse them for spoofing, causing disruptions in

the overall market dynamics.

Visual data, as exemplified by platforms like Bookmap, helps traders

recognize market patterns and respond to changing conditions swiftly. Also,

striking a balance between automation and human intervention is the key to

success.

Ready to delve deeper into the world of algorithmic trading and how it

aligns with visual data? Check out our comprehensive guide on algorithmic

trading and boost your trading knowledge.