Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

December 27, 2024

SHARE

Trading Circuit Breakers and Halts: How They Protect Markets and What Traders Should Know

When the stock market hits the brakes, it’s not just to slow things down. Instead, it is usually done to put an end to chaos. In this article, we will explain “circuit breakers” and “trading halts” to you. These are two major mechanisms that put trading on pause when things get too wild. These tools are crucial for protecting both traders and investors during times of extreme market volatility.

First, you’ll explore circuit breakers, which temporarily halt all trading in major indexes like the S&P 500 when prices drop too sharply. You’ll learn how they’re tiered based on percentage drops and how they’ve helped prevent market crashes since their introduction after the 1987 Black Monday crash.

Next, you’ll look into trading halts, which affect individual stocks rather than the entire market. They are triggered by major news or unusual price movements. Toward the end, you will learn how these mechanisms impact your trading strategies and what steps you can take to prepare for them. Lastly, we will explain how our advanced market analysis tool, Bookmap, can prepare you better for these halts and breakers. Let’s begin.

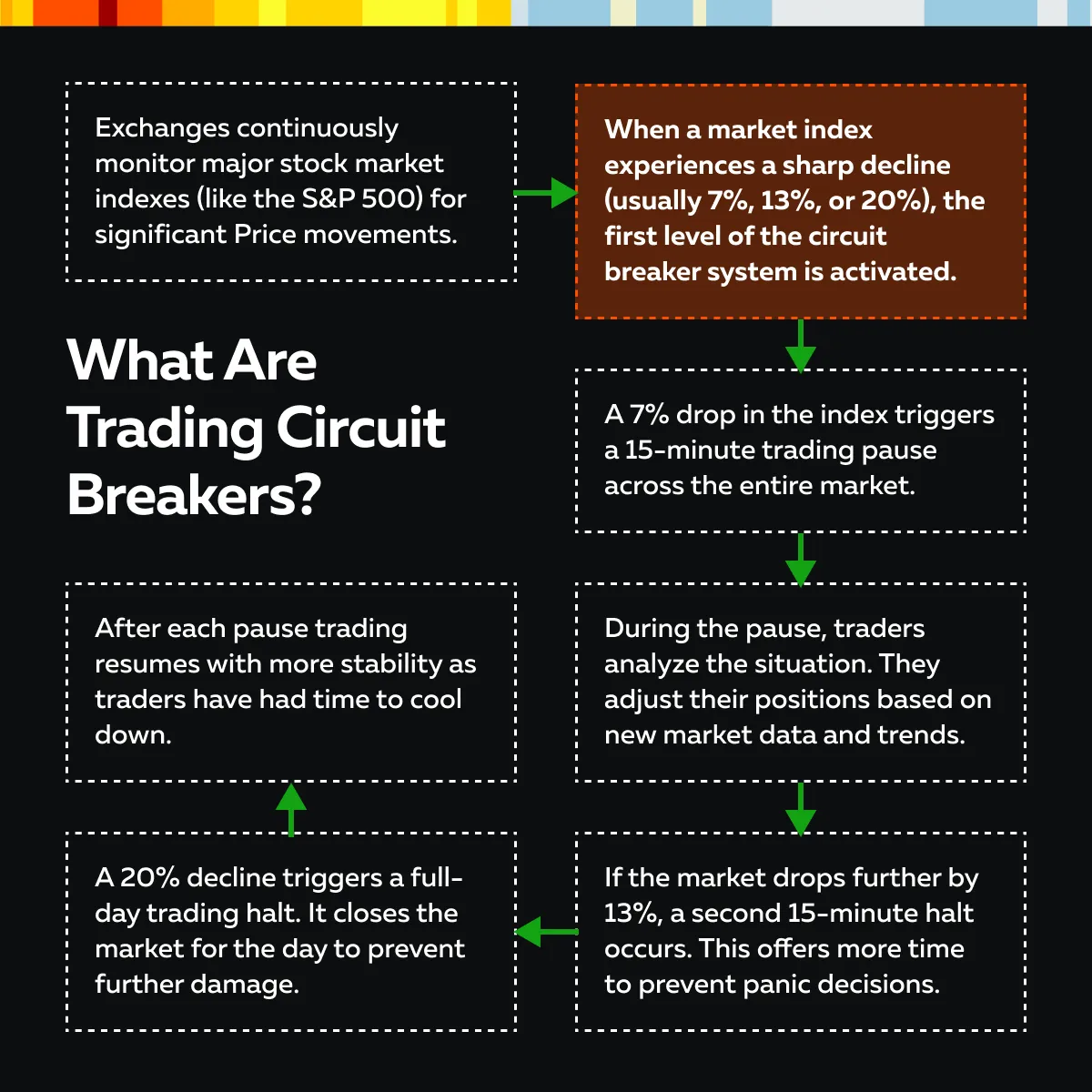

What Are Trading Circuit Breakers?

Trading circuit breakers are temporary pauses in the stock market. They are designed to prevent panic selling during significant declines in major indexes like the S&P 500. These mechanisms slow down rapid drops and provide time for traders to assess market conditions. This helps to avoid market crashes.

For Example:

- Say the S&P 500 drops by 7%.

- Now, trading halts for 15 minutes to give traders time to evaluate the situation.

- The market drops further.

- It reaches a 20% decline.

- All trading stops for the day to prevent further instability.

For more clarity on the workings of the trading circuit, check the graphic below:

Circuit breakers ensure that the market stabilizes during high volatility and prevent crashes driven by panic selling. Some other key points are mentioned in the table below.

| Tiered System Based on Percentage Drops | Gradual Halts as Drops Intensify |

|

|

Now, if we talk about some historical background, the use of circuit breakers was pioneered after the 1987 “Black Monday” crash. In this event, markets dropped 22% in a single day. This system was installed to avoid similar panic-driven selloffs in the future.

Want to gain a competitive edge while navigating volatile markets? Our platform’s advanced liquidity and heatmap tools can help you react quickly when trading halts are lifted. Start trading with Bookmap!

Why Are Circuit Breakers Important in Stock Trading?

Circuit breakers maintain stability and order during periods of extreme market volatility. They temporarily halt trading, which prevents emotional reactions that could lead to market crashes. By doing so, they give investors and traders time to assess the situation and make more informed decisions. Let’s understand in detail:

| Market stability | Investor protection |

|

|

Again, if we talk about history, the effectiveness of circuit breakers has been demonstrated time and again. One prominent example is the COVID-19 market crash in March 2020. In this period, circuit breakers were triggered multiple times due to the extreme volatility.

On March 9, 2020, the S&P 500 dropped by 7%. It triggered the first-level circuit breaker and caused a 15-minute halt in trading. Similar pauses occurred on March 12, March 16, and March 18, as the market continued to react to the pandemic. These trading halts reduced panic selling and gave investors time to adjust. Some other instances include the 2010 “Flash Crash” and the 2015 China market turmoil. Both these events saw circuit breakers getting triggered.

Use advanced tools to monitor real-time order flow data and see where the market is heading. Easily predict price shifts during and after volatile periods. Get started!

What Are Trading Halts?

Trading halts are temporary pauses in the trading of individual stocks rather than the entire market. They are usually implemented due to specific reasons like:

- Important news,

- Regulatory matters, and

- Unusual price movements.

These halts allow the market to absorb new information. Also, they prevent wild price swings caused by emotional reactions. Usually, there are three types of trading halts:

For a greater understanding, let’s study these key points.

- Initiated by Exchanges

-

-

- Trading halts are initiated by NASDAQ, the New York Stock Exchange (NYSE), or any other major exchange.

- They help to protect market integrity.

- The exchanges monitor stocks for unusual activity.

- They decide to halt trading when a specific stock’s price fluctuates rapidly or when important news is announced that could significantly impact its value.

-

- Purpose of Trading Halts

-

-

- The primary purpose of a trading halt is to give the market time to process information.

- These halts prevent erratic price movements.

- If a stock experiences sudden and extreme buying or selling pressure, the halt acts as a buffer to prevent irrational trading behavior.

- Also, this pause ensures that investors have the opportunity to:

- Digest news

- Perform analysis

- Avoid making decisions based on raw emotion.

-

- Duration of Halts

-

-

- Trading halts are usually brief.

- They last between 5 and 10 minutes.

- Their length varies and depends on the circumstances.

- If more time is needed for investors to process news or for the exchange to investigate unusual activity, the halt may be extended.

-

- However, most halts are short, and trading resumes as soon as the market stabilizes.

For example:

Say a biotech company announces that it has received FDA approval for a groundbreaking new drug. Now, the stock could be subject to a trading halt. This temporary pause will allow investors to digest this news and prevent erratic buying or selling based solely on headlines.

Use Bookmap’s liquidity tracking to see where buy and sell orders are concentrated. Plan your next move when trading resumes after a halt. Start today!

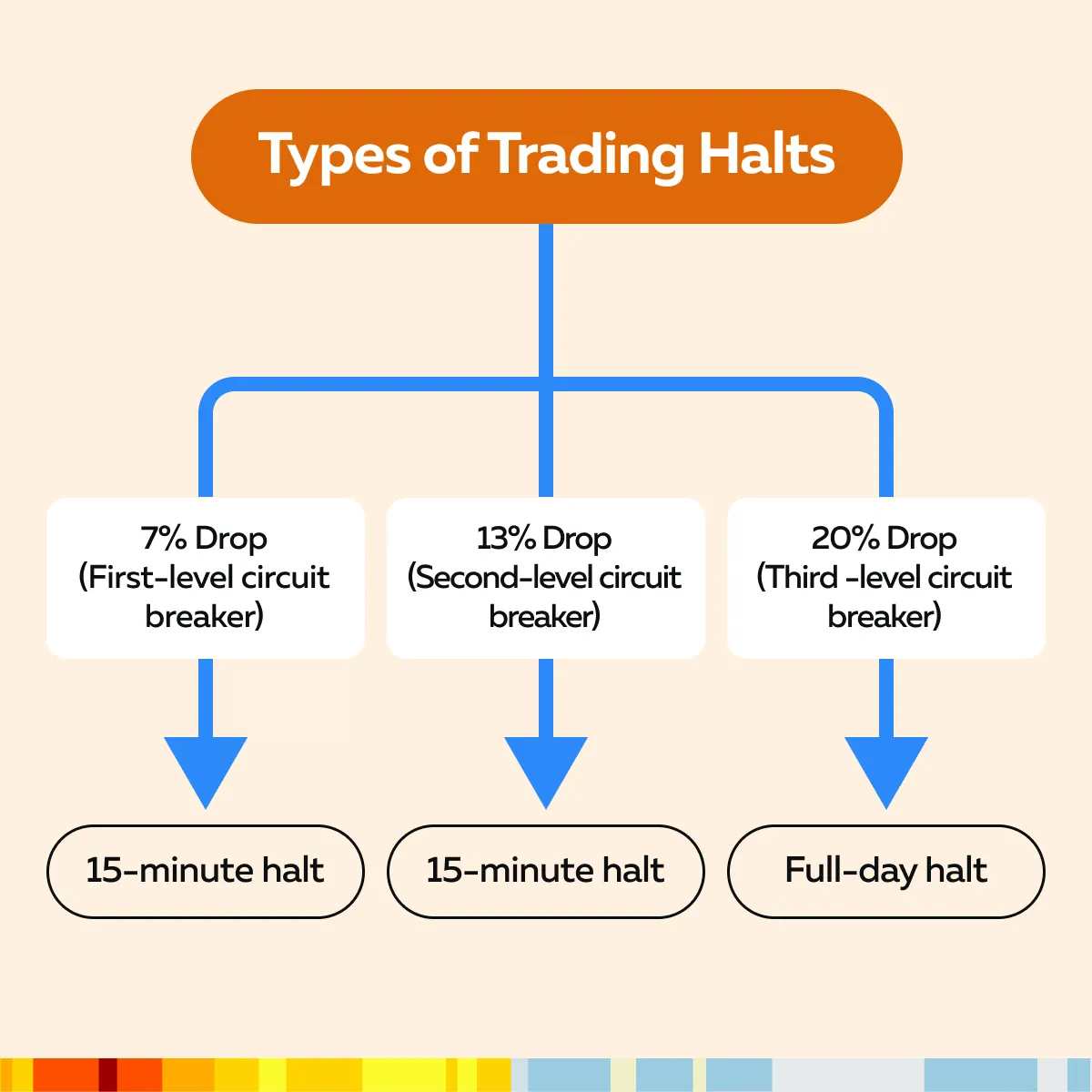

Different Types of Trading Halts

Apart from the three levels of circuit breakers, we also have certain trading halts that are implemented at specific times to ensure orderly trading. Let’s explore three main types of trading halts.

| News Pending Halt | Volatility Trading Pause | Regulatory Halts |

|

|

|

Ready to navigate volatile markets? Our platform’s advanced liquidity and heatmap tools can help you react quickly when trading halts are lifted. Start trading with Bookmap!

Impact of Circuit Breakers and Halts on Traders

Circuit breakers and trading halts have significant effects on trading strategies, especially for those who rely on short-term price movements. These mechanisms are designed to stabilize markets, but they also create challenges and opportunities for different types of traders. Let’s explore their impact in detail.

| Challenges for Day Traders | Opportunities for Swing Traders and Long-term Investors |

|

|

Use the Latest Trading Tools to Your Advantage

Do you wish to adapt better during circuit breakers or trading halts? You should definitely use our advanced market analysis tool, Bookmap, and its modern features like liquidity tracking and heatmaps. They can help you visualize market activity and order flow in real time. Also, these tools enable traders to monitor how buy and sell orders are positioned. This information helps to better anticipate market direction once trading resumes. By using these tools, traders can:

- Make quicker adjustments,

- Manage risk better, and

- React faster when trading halts are lifted.

How to Respond to Trading Halts and Circuit Breakers?

Traders must be prepared for sudden market pauses caused by trading halts and circuit breakers. While these events can be disruptive, you maintain composure by adopting the right strategies. Let’s see how:

| Prepare for Volatility | Risk Management | Avoid Emotional Trading |

|

|

|

Conclusion

By understanding circuit breakers and trading halts, you can protect your portfolio and maintain control during volatile market periods. Please note that these mechanisms act as safety measures. They slow down rapid market declines. This gives you time to reassess your strategies and avoid making decisions driven by panic. Significant percentage drops in major indexes trigger circuit breakers. On the other hand, trading halts apply to individual stocks. Specific events like news or regulatory concerns often cause them.

Both tools provide stability during unpredictable times. By being aware of how these mechanisms work, traders can better mitigate their risk and avoid getting caught off guard during market pauses. Also, it is important to stay calm during these events and use the time wisely to gather information. Review trends and plan your next moves thoughtfully.

Furthermore, to stay prepared, traders can also use our real-time market analysis tool, Bookmap. It allows you to track liquidity and offers heatmaps to monitor market conditions closely. By using it, you can stay informed during halts and circuit breaker events. This helps you quickly adjust your strategy once trading resumes again.

Prepare for market volatility with Bookmap’s advanced tools for real-time market monitoring. Join us now!