Ready to see the market clearly?

Sign up now and make smarter trades today

Education

September 13, 2024

SHARE

The Biggest Black Swan Events in Financial History: Lessons for Traders

Black swan events are those rare and unexpected occurrences that can shake financial markets. Often, these events lead to severe market volatility and massive financial losses. Most market participants face sudden declines in asset values and are forced to exit at a huge loss.

Can you avoid them? Definitely not.

But, can you prepare for them? Definitely yes.

In this article, you will learn what black swan events are, with examples like the 1929 Wall Street Crash, the 1987 Black Monday, and the 2008 financial crisis. We’ll discuss the lessons traders can learn from these events while emphasizing the importance of risk management, diversification, and being prepared for sudden market changes.

Also, you’ll discover how modern market analysis tools, like Bookmap, can help you better prepare for these unpredictable events. We’ll explain how features like the liquidity heatmap, volume bubbles, and order book visualization can give you real-time insights and help you make smarter trading decisions during volatile periods. Read the complete article to better understand how to protect your investments and even find opportunities during market downturns. Let’s begin.

What Is a Black Swan Event?

Black swan events are rare and unpredictable occurrences, usually, with significant consequences. The name “black swan events” is derived from the ancient belief that black swans didn’t exist until they were discovered in the wild. Since then, this creature has often been used to symbolize events that seem impossible until they happen.

Due to their unpredictability, black swan events often catch markets off guard, leading to drastic and unforeseen changes. It is worth mentioning that a black swan event is impossible to anticipate because it falls outside “regular expectations.”

However, once it occurs, people often attempt to rationalize it in hindsight and try to make it seem more predictable than it was. Some common examples of black swan events are the 2008 global financial crisis and the COVID-19 pandemic, both of which had profound and lasting impacts on financial markets.

What traders can learn from black swan events?

For traders and investors, understanding black swan events is important. That’s because these events highlight the need for robust risk management and preparedness. Let’s study in detail:

| Risk Management | Preparedness | Contingency Planning |

|

|

|

The Wall Street Crash of 1929

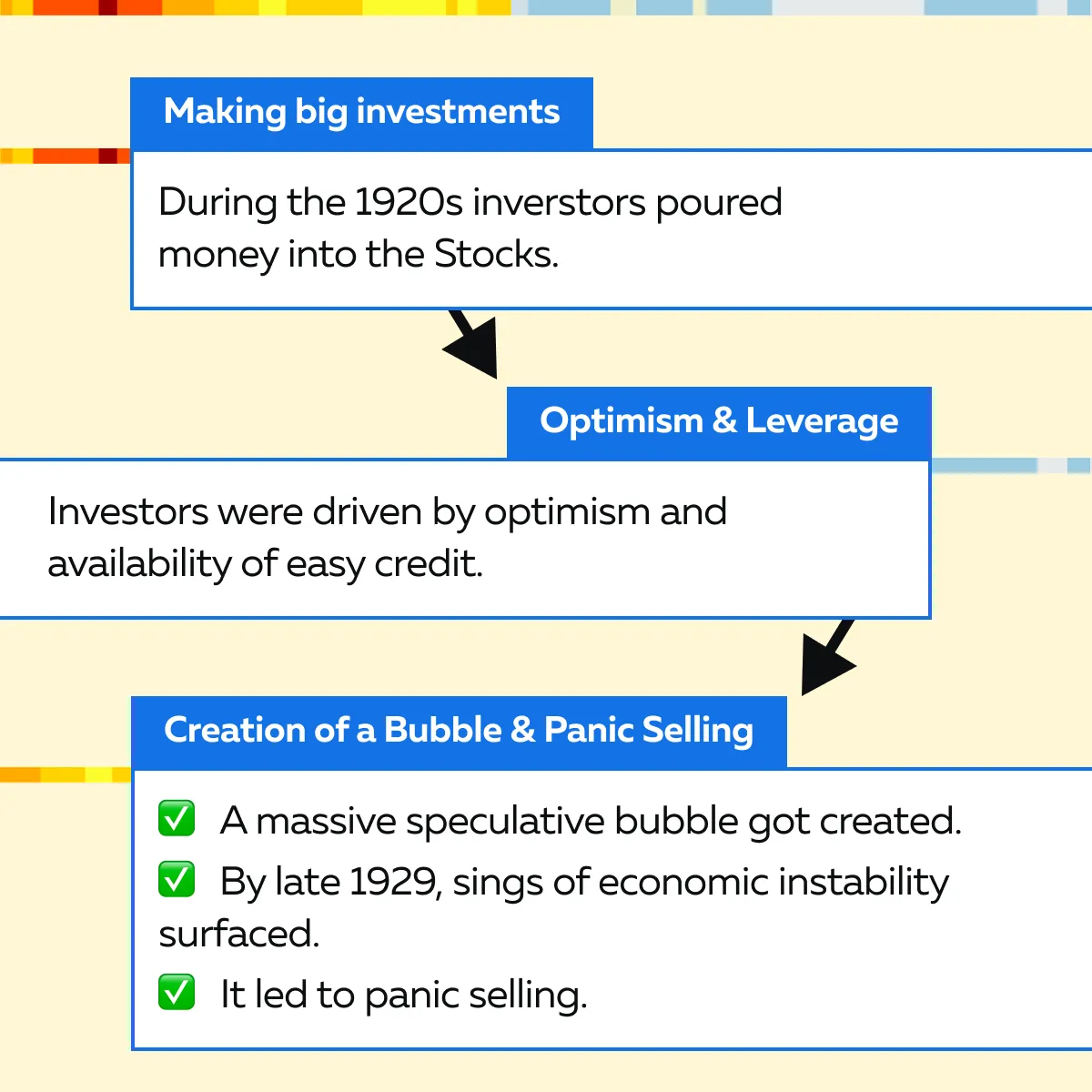

The Wall Street Crash of 1929 is also known as Black Tuesday. On October 29, 1929, the U.S. stock market suddenly collapsed. See the graphic below to understand why this event happened:

The crash began on October 24, 1929, with the market plummeting further on October 29. Billions of dollars were wiped out. This event caused a loss of confidence in financial institutions and even triggered a global economic downturn. The immediate aftermath saw:

- Banks failing

- Businesses collapsing

- Widespread unemployment

The crash was a key factor in the onset of the Great Depression, which is represented as a prolonged period of “economic hardship” that lasted through the 1930s. During this period, there were several global repercussions, which led to massive declines in industrial output.

What traders can learn from this event?

The events of the 1929 crash provide valuable lessons for modern traders:

| Diversification | Caution against excessive leverage | Speculative bubbles | Risk management |

|

|

|

|

Reveal hidden limit orders and order flow trends with Bookmap’s liquidity heatmap. Using this tool, you can also, detect unusual market activity and get potential warning signs. Sign up with Bookmap today!

Black Monday (1987)

On October 19, 1987, global stock markets experienced a severe crash known as Black Monday. The Dow Jones Industrial Average plummeted by 22.6% in a single day, which marked the largest one-day percentage drop in its history. Other global markets followed suit, with significant declines in Europe, Asia, and Australia.

Do you know the cause of the market crash? It was largely driven by the rise of computer-driven trading strategies, specifically program trading, which led to massive sell orders and further aggravated the market decline. Some other contributing factors were:

- Overvaluation,

- Geopolitical tensions, and

- Lack of coordinated global response.

It is significant to state that the immediate reaction to Black Monday was widespread panic. However, it also led to market safeguards, such as “circuit breakers.” These breakers were introduced to prevent such rapid declines in the future. For those unaware, these mechanisms temporarily halt trading during significant market drops, which gives investors time to assess and respond rationally.

What traders can learn from this event?

The crash emphasized that financial markets require better protection mechanisms to prevent downturns. Additionally, the event highlighted the importance of having robust risk management strategies. Traders need to develop practices that can handle market volatility, such as:

- Setting stop-loss orders

and

- Maintaining diversified portfolios.

Moreover, Black Monday exhibits the role of technology in trading. As markets evolve, so do trading tools and systems. Hence, traders must adopt technological advancements, such as:

- Sophisticated trading algorithms

and

- Data Analytics.

Lastly, the crash serves as a reminder that markets can be highly volatile, and traders must be prepared for sudden and extreme changes.

The Financial Crisis of 2008

The 2008 financial crisis was triggered by the collapse of the:

- U.S. housing bubble

and

- The consequent subprime mortgage crisis.

If we look somewhat at the background, during the early 2000s, credit was available easily due to lax lending standards. This led to a surge in home loans, many of which were given to borrowers with poor credit histories. Moreover, these subprime mortgages were bundled into complex financial products, spreading risk throughout the global financial system.

As the housing prices began to fall, defaults on these mortgages skyrocketed. Eventually, it led to the collapse of major financial institutions like Lehman Brothers. Also, the crisis quickly spread globally and triggered a severe recession.

It must be noted that to stabilize the financial systems, governments worldwide responded with massive bailouts and stimulus packages. Additionally, regulatory overhauls were introduced, including stricter capital requirements and the Dodd-Frank Act in the U.S., to prevent such a crisis from recurring.

What traders can learn from this event?

The 2008 crisis demonstrated how risks in one part of the financial system can quickly spread and impact the entire global market. Hence, traders must understand:

- What is systemic risk and its impact?

- How interconnected financial institutions and markets are?

- How a problem in one area can affect the broader system?

This crisis clearly showed how issues in one country or sector can have ripple effects worldwide. Moreover, it showed the complexity of financial products and the lack of transparency, which eventually contributed to the crisis. Thus, traders need to ensure that financial products are transparent and that effective risk management practices are in place to understand and mitigate potential risks.

Lastly, the 2008 crisis is a reminder of the perils associated with taking on too much risk. It exhibits the need for caution and thorough risk assessment in both trading and investing.

Other Significant Black Swan Events

Tulip Mania, which occurred in the Netherlands in 1637, is often cited as the first recorded speculative bubble. During this period, the prices of “tulip bulbs” soared to extraordinary levels as people speculated on their value. Tulips became so expensive that a single bulb could cost more than a house.

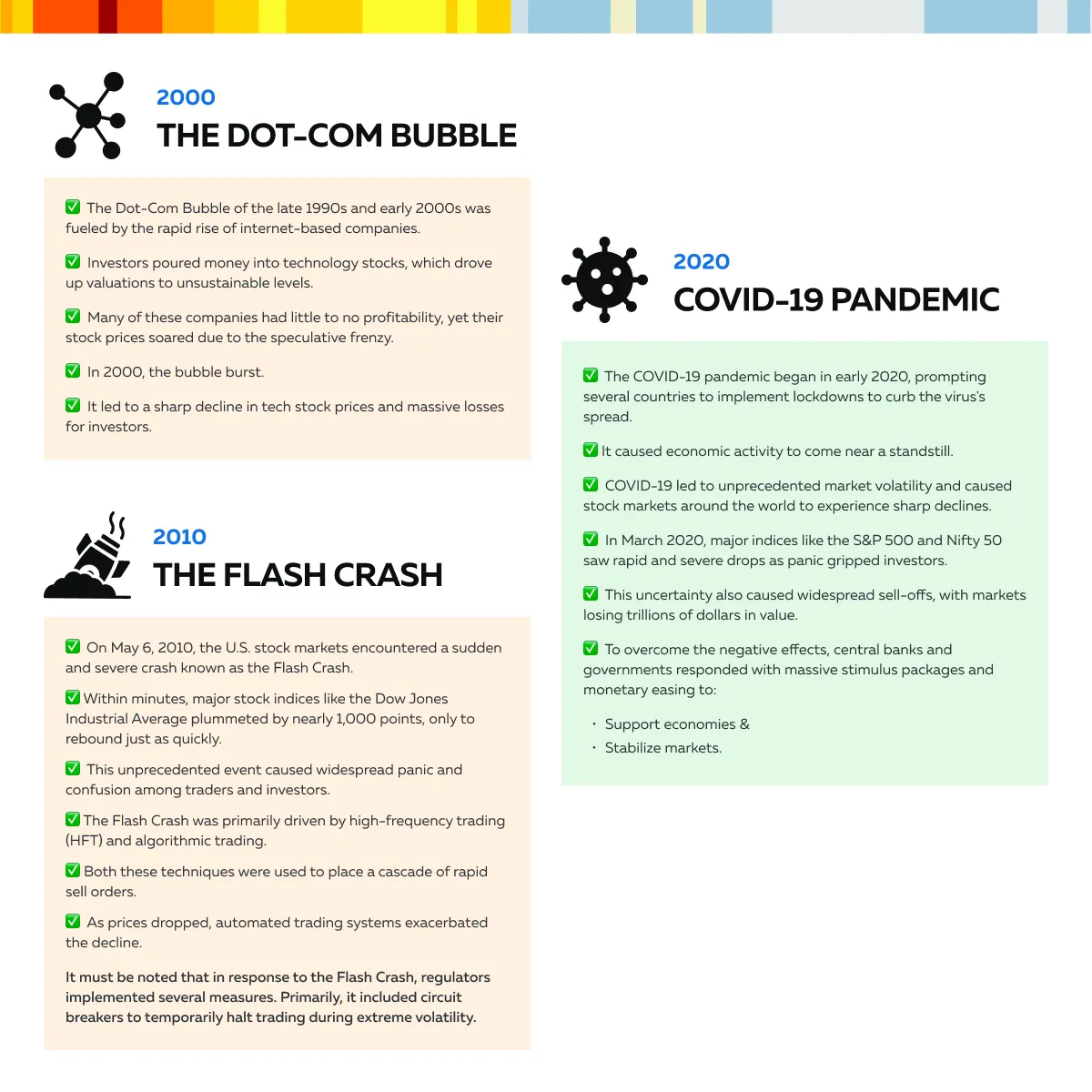

However, the bubble burst abruptly when demand suddenly declined. This caused the prices to plummet, and consequently, many investors faced massive losses. Apart from this, there are some other major black swan events as well that you must be aware of:

Do you wish to optimize your trading strategies? Learn from past market crashes with Bookmap – Join now!

Analyzing Common Patterns

To better manage and prepare for black swan events, traders can look for early warning signs by closely monitoring:

- Market sentiment

and

- Macroeconomic indicators.

How can you mitigate the impact?

To mitigate the impact of black swan events, traders can employ several strategies:

| Diversification | Maintain liquidity | Use stop-loss orders |

|

|

|

Preparing for the Next Black Swan Event

Black swan events, by nature, are unpredictable. Hence, traders must have strategies in place that can mitigate potential risks. Traders who anticipate and prepare for market disruptions can:

- Protect their portfolios

and

- Even capitalize on opportunities that arise from such events.

How to gain a competitive edge?

By using market analysis tools like Bookmap, traders can stay informed and make quick decisions during volatile market conditions. Let’s see how a trader using Bookmap and its modern features (as listed below) can better prepare for black swan events:

- Liquidity Heatmap

-

- The liquidity heatmap shows the concentration of limit orders at various price levels over time.

- By analyzing this, traders can identify strong support and resistance levels where large orders are placed.

- Also, by understanding these areas, traders can anticipate where the market might stabilize or reverse (even during unexpected events).

- Such a preparation can, therefore, minimize losses by:

- Avoiding entering positions at vulnerable levels

or

- Planning exits around these critical zones.

- Volume Bubbles

-

-

- Volume bubbles highlight imbalances between aggressive buyers and sellers.

- They offer real-time insight into market sentiment.

- By closely monitoring these bubbles, traders can quickly detect unusual spikes in buying or selling pressure, which could be early signs of a black swan event.

- Acting on this information, traders can reduce exposure or place protective orders.

-

- Current Order Book

-

-

- The order book visualization allows traders to see the depth of market liquidity at different price levels.

- This helps in gauging the market’s resilience to sudden shocks.

- By being aware of the liquidity levels, traders can estimate how the market might react to a sudden influx of orders.

- This estimation allows them to anticipate slippage or significant price moves that might occur during a Black Swan event.

-

- Record and Replay

-

- Bookmap’s ability to record live sessions and simulate orders provides an opportunity to test and refine strategies under different scenarios, including potential black swan events.

- By replaying past market conditions and stress-testing strategies, traders can:

- Develop contingency plans

and

- Improve their response to unexpected market turmoil.

- Customizable Charts

-

- Bookmap offers customizable charts (including traditional candlesticks and volume bars) that allow traders to incorporate their preferred technical indicators.

- By setting up charts that best align with their trading style, traders can quickly interpret market movements.

- Also, they can swiftly react accordingly during chaotic conditions brought on by a black swan event.

By using Bookmap’s advanced features, traders can prepare for extreme scenarios and better handle the black swan events. Optimize your trading strategy for unpredictable events today. Get started here!

Some Successful Examples

Preparation, adaptability, and the use of advanced tools are pivotal in dealing with black swan events. Let’s check out some real-life stories of traders who followed these principles and better thrived during market crises.

Jesse Livermore and the 1929 Crash

Jesse Livermore was a legendary trader. He successfully managed the Wall Street Crash of 1929 by shorting stocks. His strategy involved:

- Meticulous analysis

and

- Early recognition of market bubbles.

Livermore’s ability to adapt and benefit from market downturns allowed him to profit significantly, even when many others faced financial ruin.

Black Monday (1987) and Paul Tudor Jones

Paul Tudor Jones successfully navigated the 1987 crash by using:

- Market Indicators

and

He successfully anticipated the downturn and shorted stocks. This way, he profited significantly. Also, his approach shows the importance of data-driven decision-making in volatile markets.

Financial Crisis of 2008 and John Paulson

John Paulson made a fortune during the 2008 financial crisis by betting against subprime mortgages. Recognizing the impending collapse, he positioned his hedge fund to profit from the decline in housing prices. His approach illustrates the value of:

- Foresight

and

- Strategic positioning.

Conclusion

Black swan events are rare and unpredictable occurrences. Often, they have a profound impact on financial markets by leading to severe and sudden changes. Some popular historical examples are the Wall Street Crash of 1929, Black Monday in 1987, the 2008 financial crisis, and COVID-19. These events highlight the need for traders and investors to be prepared for extreme market conditions.

Moreover, for traders and investors, black swan events specifically show the importance of understanding systemic risk, diversifying investments, avoiding excessive leverage, and maintaining strong risk management practices.

Furthermore, to gain a competitive advantage and better deal with such unexpected events, traders can start using advanced market analysis tools like Bookmap. These tools offer real-time insights into market dynamics and help traders make quick and informed decisions during volatile periods.

Do you wish to earn when others are losing? Better prepare for market volatility with Bookmap’s advanced tools. Sign up today!