Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

December 29, 2024

SHARE

Understanding CME Micro E-mini Futures: A Low-Cost Entry for New Traders

Want to trade in the big leagues but worried about your wallet? CME Micro E-mini futures might be your perfect entry point. These are miniature versions of the popular E-mini contracts that allow you to trade without risking large amounts of capital. Besides, you can get the same level of exposure to major indices like the S&P 500, Nasdaq-100, and Dow Jones.

In this article, you’ll discover everything you need to know about Micro E-mini futures. We will explain their affordability and scalability as well. You will also learn how they can help you refine your trading strategies with minimal risk and explore the key differences between Micro E-mini and standard E-mini contracts, as well as how traders use them for hedging and diversification. Let’s get started!

What Are CME Micro E-mini Futures?

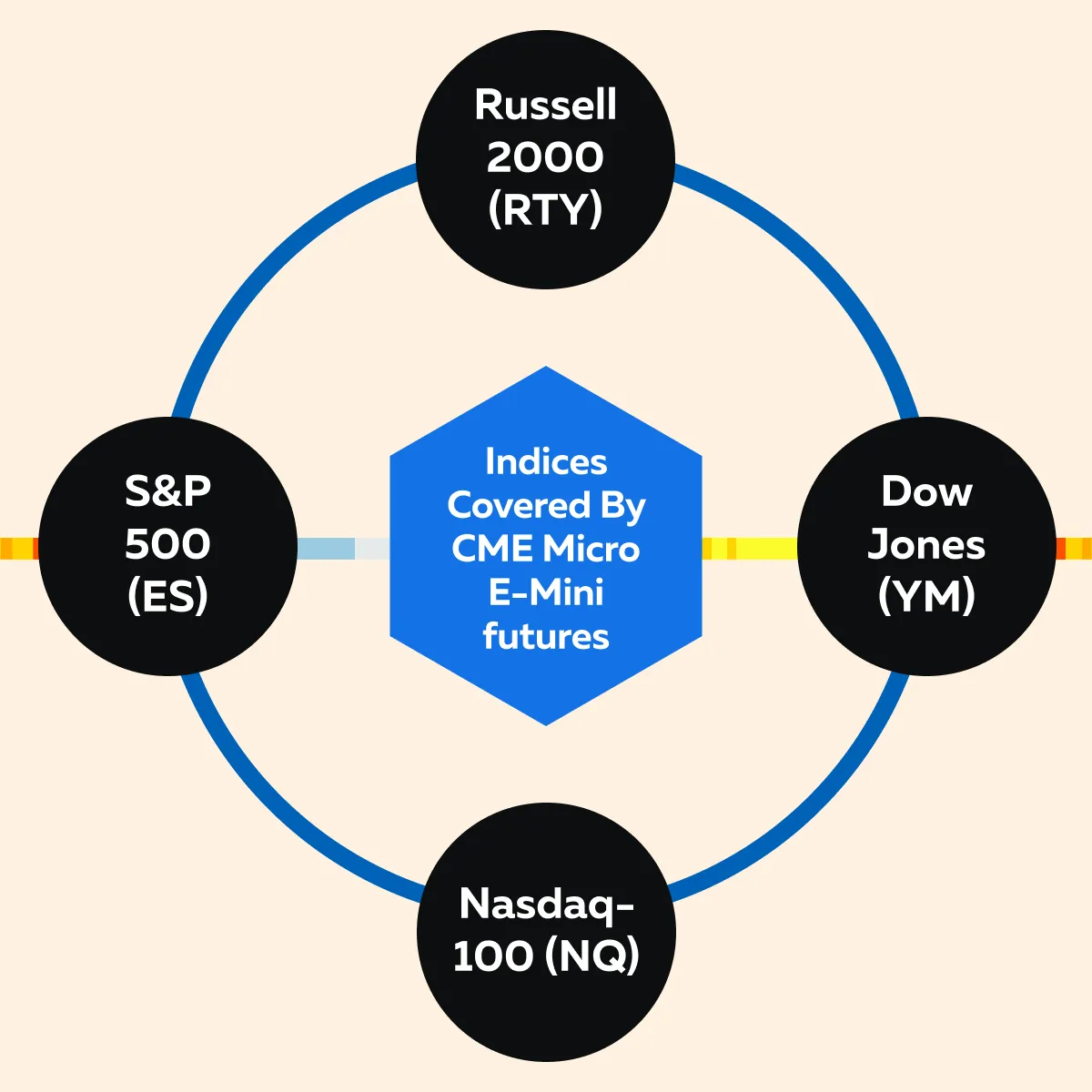

CME Micro E-mini futures are smaller and more accessible versions of standard E-mini futures contracts. They offer exposure to several major stock indices. Check the graphic below:

These future contracts are traded on the Chicago Mercantile Exchange (CME). Traders utilize these contracts to speculate on or hedge against the performance of these key indices. It should be noted that these contracts mimic their larger counterparts and provide retail investors with a way to participate in the same markets without the high capital requirements of standard contracts.

Micro E-mini Futures vs. Standard E-mini Contracts

Micro E-mini futures are designed to be fractional in size as compared to standard E-mini contracts. Specifically, their notional value is only 1/10th of the standard contracts. For example:

- The S&P 500 E-mini contract represents $50 per point.

- The Micro E-mini S&P 500 contract represents $5 per point.

This reduced size makes them significantly more affordable for traders with smaller accounts.

Low-Cost Alternative for Retail Traders

The smaller notional value of Micro E-mini futures means:

and

- reduced risk exposure.

For retail traders who are looking for a cost-effective way to participate in futures markets, these contracts are an attractive option. They differ from standard E-mini futures, which require larger capital investments. Instead, Micro E-minis allow traders to take similar positions with much smaller account balances, providing a more accessible entry into these markets.

Example of Micro E-mini Futures

A standard E-mini S&P 500 contract controls $50 per point. This means that every one-point move in the S&P 500 index changes the value of the contract by $50. In comparison, the Micro E-mini S&P 500 controls just $5 per point.

This allows smaller accounts to access the same index but with lower financial exposure. Additionally, this makes it ideal for:

- traders with limited capital,

or

- those seeking to manage their risk.

Are you looking to get started with futures trading? Try Bookmap’s powerful tools to gain an edge in Micro E-mini markets.

Popularity Among Retail Traders

Micro E-mini futures have gained popularity among retail traders primarily due to their lower margin requirements. Despite their smaller size, these contracts provide the same liquidity and access to market movements as the larger E-mini contracts.

Retail traders benefit from the ability to trade major indices with lower financial risk, making Micro E-minis a good tool for portfolio diversification and short-term market speculation.

Micro E-mini vs. Standard E-mini Futures: What’s The Difference?

Micro E-mini futures and standard E-mini contracts both offer exposure to major stock indices. However, they serve different types of traders. The key differences between these two products lie in their:

- size,

- margin requirements,

and

This makes Micro E-mini contracts an attractive choice for smaller accounts or less experienced traders. Let’s understand these key differences in detail:

- Lower Margin Requirements

One of the main distinctions between Micro E-mini and standard E-mini futures is the margin requirements. Micro E-mini contracts have significantly lower margin requirements. For example, while trading a standard E-mini S&P 500 contract might require around $12,000 in margin, a trader could trade a Micro E-mini S&P 500 contract with just about $1,200.

These minimal margin requirements allow more individuals to participate in futures markets without needing substantial capital.

- Risk-Reward Comparison

When comparing the risk-reward ratio between Micro E-mini and standard E-mini futures, the primary difference lies in the exposure. Micro E-mini contracts control 1/10th the value of their standard counterparts. This means the potential gains or losses are proportionately smaller, making them ideal for newer traders.

Also, the reduced risk profile offers a safer environment to learn the market’s dynamics or fine-tune trading techniques. For more clarity, let’s understand with a hypothetical example:

- Let’s assume a trader holds a standard E-mini S&P 500 contract.

- The market moves by one point.

- The profits or losses will be $50 per point.

- In comparison, for a Micro E-mini S&P 500 contract, the impact of a one-point movement would only result in a $5 change.

New to Micro E-mini futures? Start trading confidently with the visualization tools on our platform, Bookmap, to see liquidity and market depth clearly.

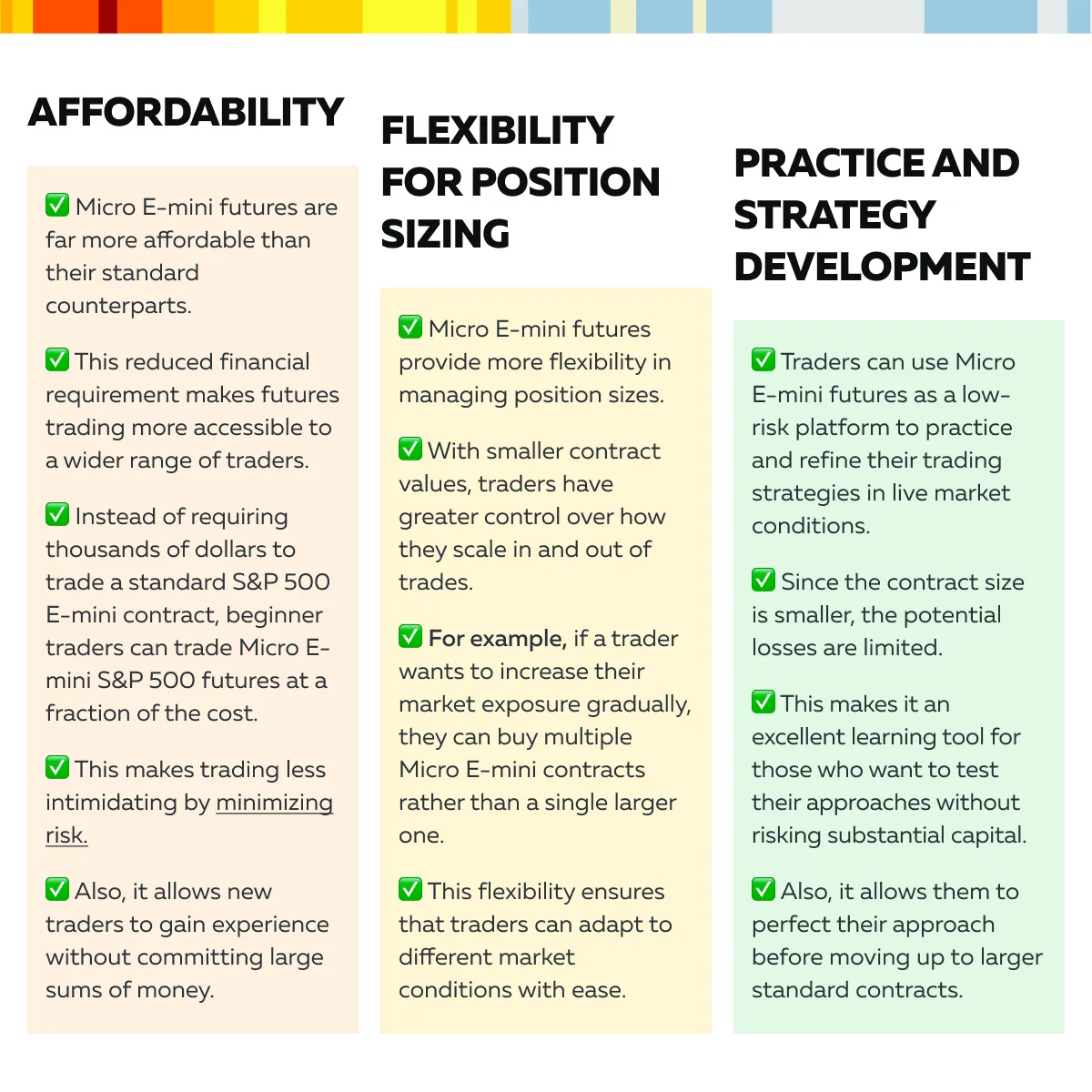

Advantages of Trading CME Micro E-mini Futures

CME Micro E-mini futures offer multiple benefits for retail traders. These contracts lower the financial barriers to entry and provide a safe environment for strategy development. Let’s check out some of their major advantages:

Want to track CME Micro E-mini futures in real time? Use the advanced order flow tools on our platform, Bookmap, for more precise trading decisions.

Who Should Trade Micro E-mini Futures?

Micro E-mini futures are an ideal option for retail traders and beginners. They are specifically designed for traders who are new to the world of futures or do not have the capital to trade standard E-mini contracts.

Retail traders, in particular, benefit from the smaller contract sizes, which offer access to the same indices (S&P 500, Nasdaq-100, Dow Jones, and Russell 2000) as the larger contracts but at a fraction of the cost. For amateurs, the low barriers to entry allow them to gain hands-on experience in real-time trading without taking on substantial financial risks.

Let’s see how it helps retail traders and beginners:

A) Lower Capital Requirement

One of the pros of Micro E-mini futures is their significantly lower margin requirements. Instead of needing thousands of dollars in margin to trade standard E-mini futures, traders can open a Micro E-mini position with just a small fraction of that amount. This way, traders can gain exposure to major indices and market movements while minimizing their financial risk.

B) Risk Management for Developing Traders

For traders who are still developing their strategies, Micro E-mini futures are an ideal choice due to their reduced size. The smaller contract value means that the risk associated with each trade is significantly lower compared to standard E-mini futures. This allows traders to:

- experiment with different strategies,

- analyze market conditions,

and

- learn from their trades without the fear of incurring large losses.

As they grow their confidence, they can incrementally increase their risk exposure. In this way, the smaller position sizes help traders focus on refining their decision-making without risking substantial capital.

C) Strategy Refinement for Experienced Traders

Even advanced traders use Micro E-mini futures to fine-tune their trading strategies. Experienced traders employ them to back-test and refine new strategies in real-time market conditions. By observing how their approach performs under live conditions, they can make the necessary adjustments before scaling up to larger E-mini contracts. This ensures that their strategies are robust and optimized before committing significant resources.

D) Scalability for Precise Positioning

For traders accustomed to using standard E-mini contracts, Micro E-mini futures offer greater precision when scaling trades. Because these contracts are 1/10th the size of standard E-mini futures, traders can adjust their positions in smaller increments. This allows for:

- more accurate risk management,

and

- trade optimization.

Traders can tailor their exposure to market conditions without being forced into larger and riskier positions. As a result, using Micro E-mini futures, traders can easily fine-tune trades and manage risk in a more granular way.

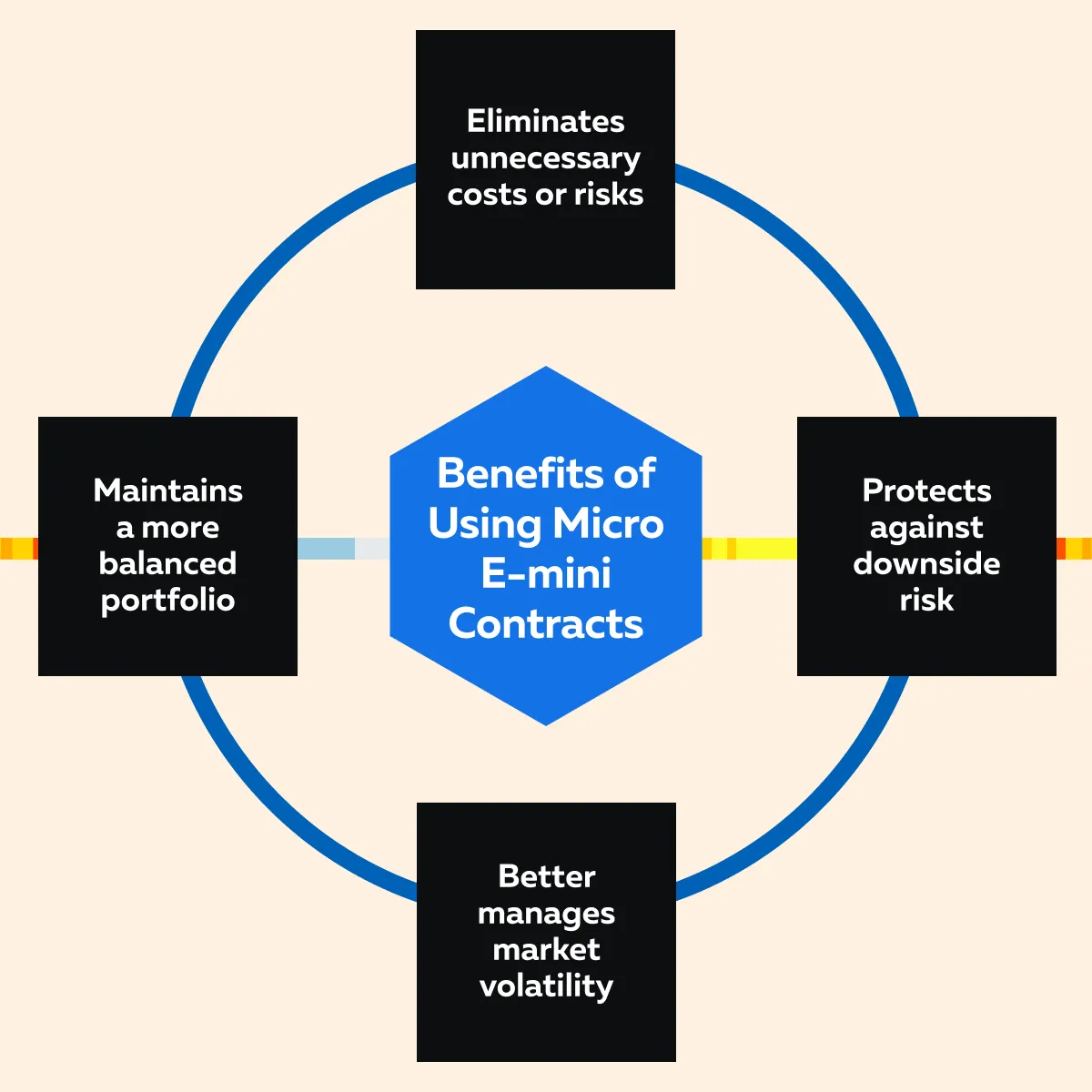

E) Hedging and Diversification

Micro E-mini futures also serve as an excellent hedging tool. They allow traders to hedge smaller portions of their portfolios with more flexibility. Instead of using larger contracts and putting in big capital, traders can use Micro E-minis and reduce their market exposure incrementally.

This fine-tuned approach ensures that traders have just the right amount of protection without sacrificing excess capital. By using Micro E-mini contracts, traders can achieve several benefits. Check the graphic below:

Conclusion

CME Micro E-mini futures are an affordable way for retail traders to participate in major stock indices. They are smaller in size and carry lower margin requirements, making them accessible to traders with smaller accounts. Using them, such traders can gain exposure to the same markets as larger contracts. They also provide excellent opportunities for risk management and allow traders to scale their positions in smaller increments. Furthermore, due to lower capital commitment, these contracts can be used to experiment with strategies without taking on excessive risk.

Additionally, Micro E-mini futures are highly liquid. Traders can also use them to hedge smaller portions of their portfolios or diversify their exposure in a more controlled way. To further enhance trading strategies, traders can use our advanced market analysis tool, Bookmap. By using it, you can gain real-time information related to market movements, liquidity, and order flow. Are you really looking to refine your strategies in live market conditions? Use our platform, Bookmap, and trade smartly in some of the world’s most liquid markets. Try Bookmap today!