Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

January 15, 2026

SHARE

Why ETH Trades Differently Than BTC: A Microstructure Breakdown

For most traders, the best alter-ego of Bitcoin is Ethereum. They feel ETH always copies the way BTC moves. But these statements are only partially true!

Bitcoin moves at a measured pace. It has a smooth order flow and deep liquidity, which is dominated by big institutions. On the other hand, Ethereum is more volatile. Its price fluctuations are sharper and often surprise even seasoned traders with sudden swings.

Yet, many people still treat both markets the same way! And that’s where mistakes happen. Don’t want to be in their league? You must understand how each market really works and how its liquidity, order flow, and trader behavior differ.

Read this article to learn why trading ETH feels so different from trading BTC, what influences their price, and how to adjust your approach for each. You’ll also understand how market analysis tools like Bookmap can make these differences visible.

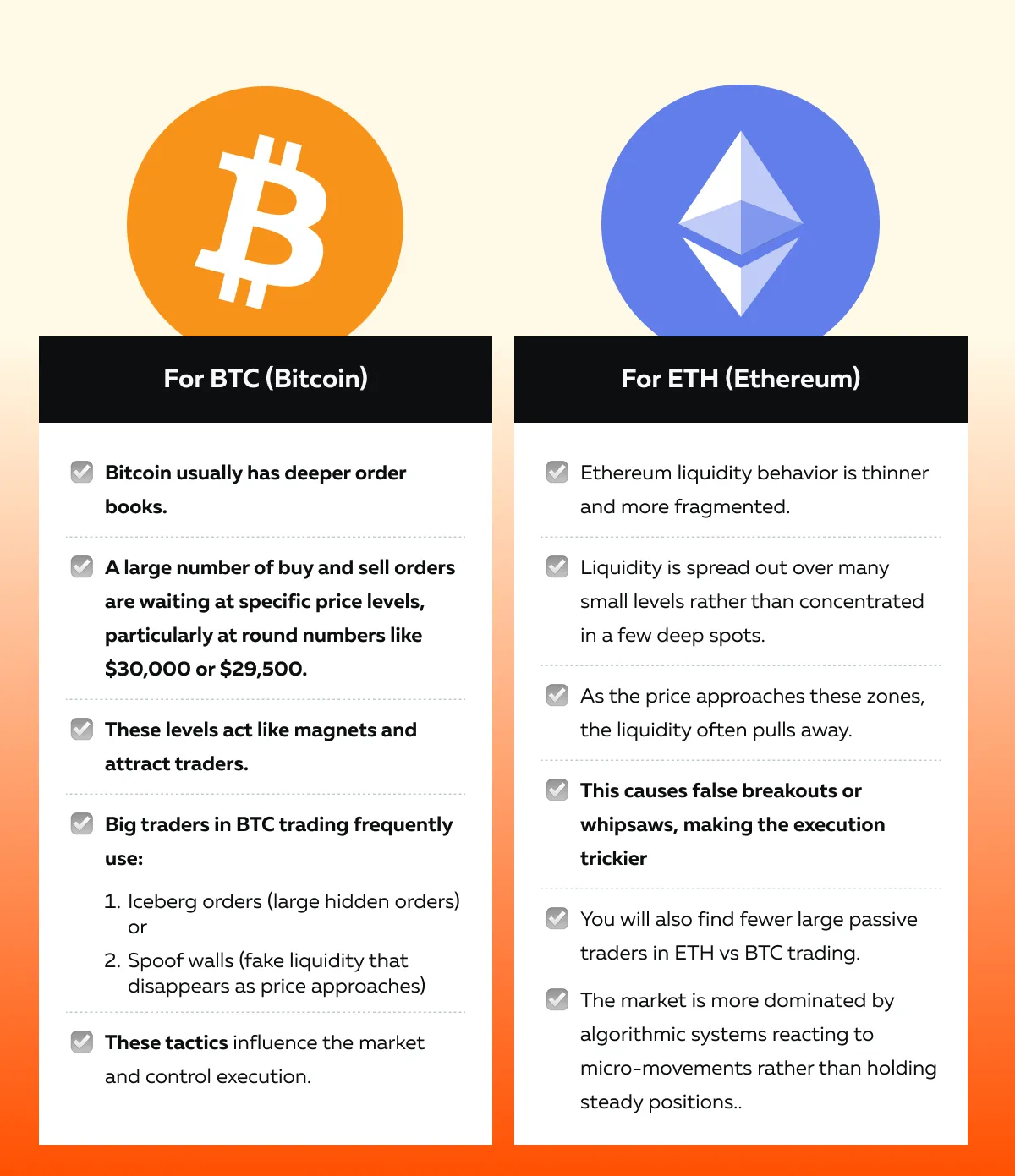

Liquidity Depth and Distribution: BTC Is Thicker, ETH Is Fragmented

When you compare Bitcoin and Ethereum order flow, their liquidity structure stands out as the key point of difference. Let’s understand it:

What Should Be Your Trading Approach?

In the Ethereum microstructure, you need to trade more reactively. Liquidity in ETH trading often vanishes before the move completes, leaving early entries exposed. Thus, ETH rewards those traders who wait for breakout retests instead of placing early bets near visible liquidity.

Who’s Trading ETH? The Participant Mix Is Different

When you look at ETH vs BTC trading, the type of people and institutions involved are quite different. If we talk about Bitcoin (BTC), it attracts a lot of institutional money! You’ll find:

- CME futures traders,

- ETF investors, and

- OTC desks.

These market participants manage large BTC portfolios. Along with them, there are long-term HODLers who hold BTC for years, and big players or “whales” who sometimes use spoof orders to test liquidity zones.

Because of these participants, Bitcoin trading is usually more structured. It responds clearly to macro news, such as interest rate decisions or inflation data.

Okay, Then, Who Trades Ethereum (ETH)?

On the other hand, the Ethereum microstructure is influenced by a different crowd. ETH draws the following:

- Retail traders

- DeFi users who hedge their exposure

- Short-term algorithmic traders chasing crypto futures trading opportunities

These players create higher turnover and more noise! This unique ETH liquidity behavior makes Ethereum’s price action more unpredictable. You’ll often see quick “whips” or fake moves. In contrast, BTC is less volatile and mirrors global risk sentiment.

See ETH order flow in action with Bookmap →

Reaction to Macro Events: BTC Leads, ETH Follows (But Not Always)

In crypto futures trading, Bitcoin and Ethereum don’t always move at the same time! The divergences are particularly visible during major macro events like:

- FOMC announcements,

- CPI releases, and

- ETF approvals.

For more clarity, let’s individually understand how BTC and ETH react to macro events:

| The BTC Reaction | The ETH Reaction |

|

|

What Can You as a Trader Do Safely?

In ETH vs BTC trading, you can use BTC’s first move as a timing signal for Ethereum entries. However, don’t assume ETH will always copy BTC. Watch carefully for Bitcoin vs Ethereum order flow divergences. Those moments often reveal the best trading opportunities! Bookmap helps uncover the real microstructure beneath ETH and BTC charts →

Volatility and Pace of Tape: ETH Trades Faster and Less Predictably

If you compare ETH vs BTC trading, you’ll notice that Ethereum moves with more speed and noise. In contrast, Bitcoin order flow moves more smoothly. Let’s understand the volatility of both these instruments:

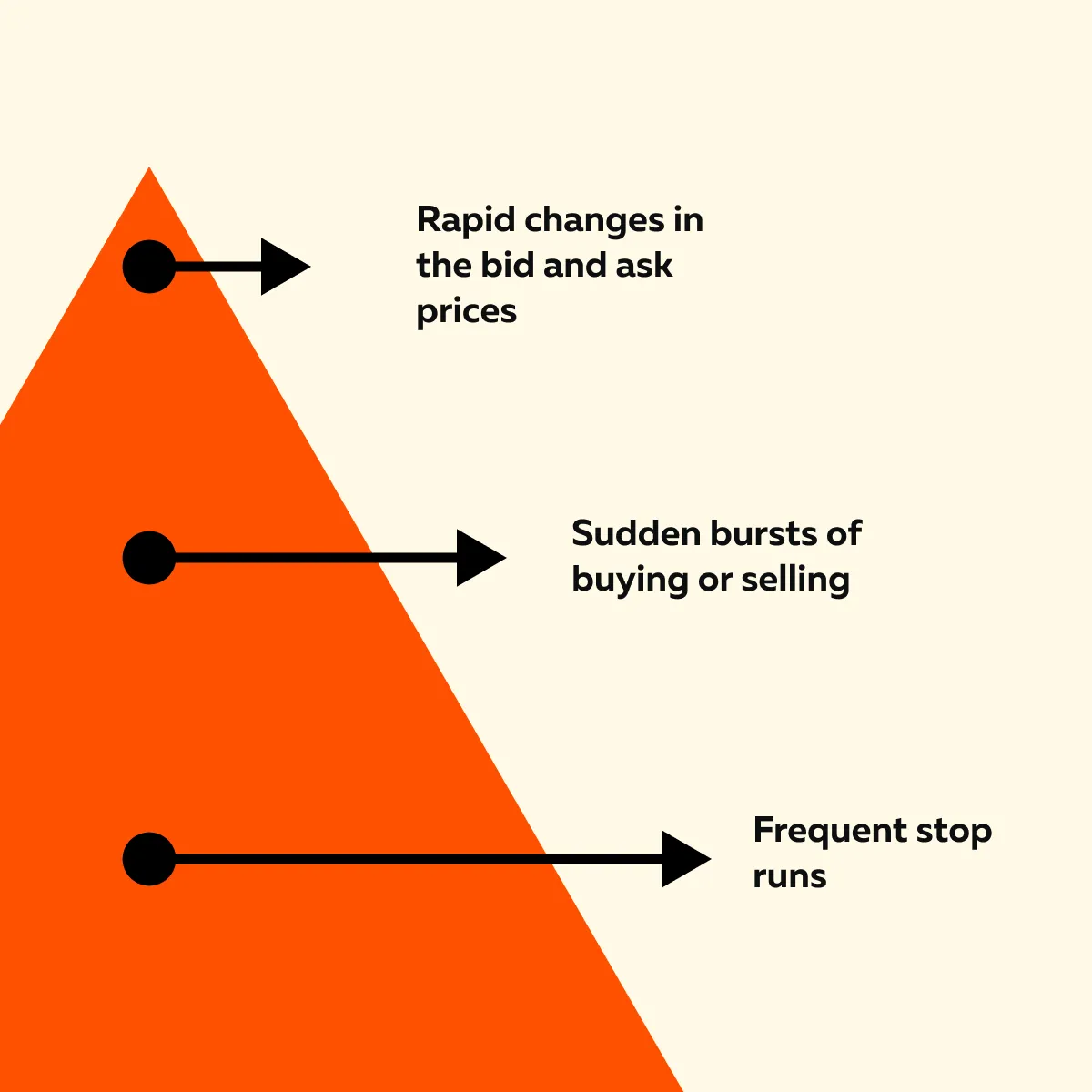

The Ethereum Microstructure is Very Active!

While trading ETH, you’ll observe the following:

This happens because ETH liquidity behavior is thinner! There isn’t as much resting liquidity to absorb pressure when the price fluctuates. As a result, ETH can spike or drop faster and less predictably than BTC.

BTC Trading Feels Steadier!

On the BTC tape, you’ll see smoother transitions and clear signs of:

- Absorption (large players soaking up orders)

and

- Stronger liquidity holds at key levels.

Note that in BTC, Big traders behave more consistently. This makes BTC reactions easier to read.

A Key Takeaway for Traders

In crypto futures trading, ETH requires tighter discipline. Because of its thin liquidity and fast tape, it’s harder to sit through temporary losses. Besides, in ETH trading, tight stops often get hit before the move plays out.

As a tip, you can start using advanced real-time order flow tools, like Bookmap. Using them, you can visualize whether a breakout is genuine or if liquidity is disappearing ahead of price. This knowledge lets you spot a potential fake-out.

Spoofing and Bait Walls: ETH Is More Reactive

Both Bitcoin and Ethereum markets experience spoofing! This manipulative tactic involves traders placing fake buy or sell orders (called spoof walls) to mislead others about market direction. However, the nature of this activity differs sharply between the two markets.

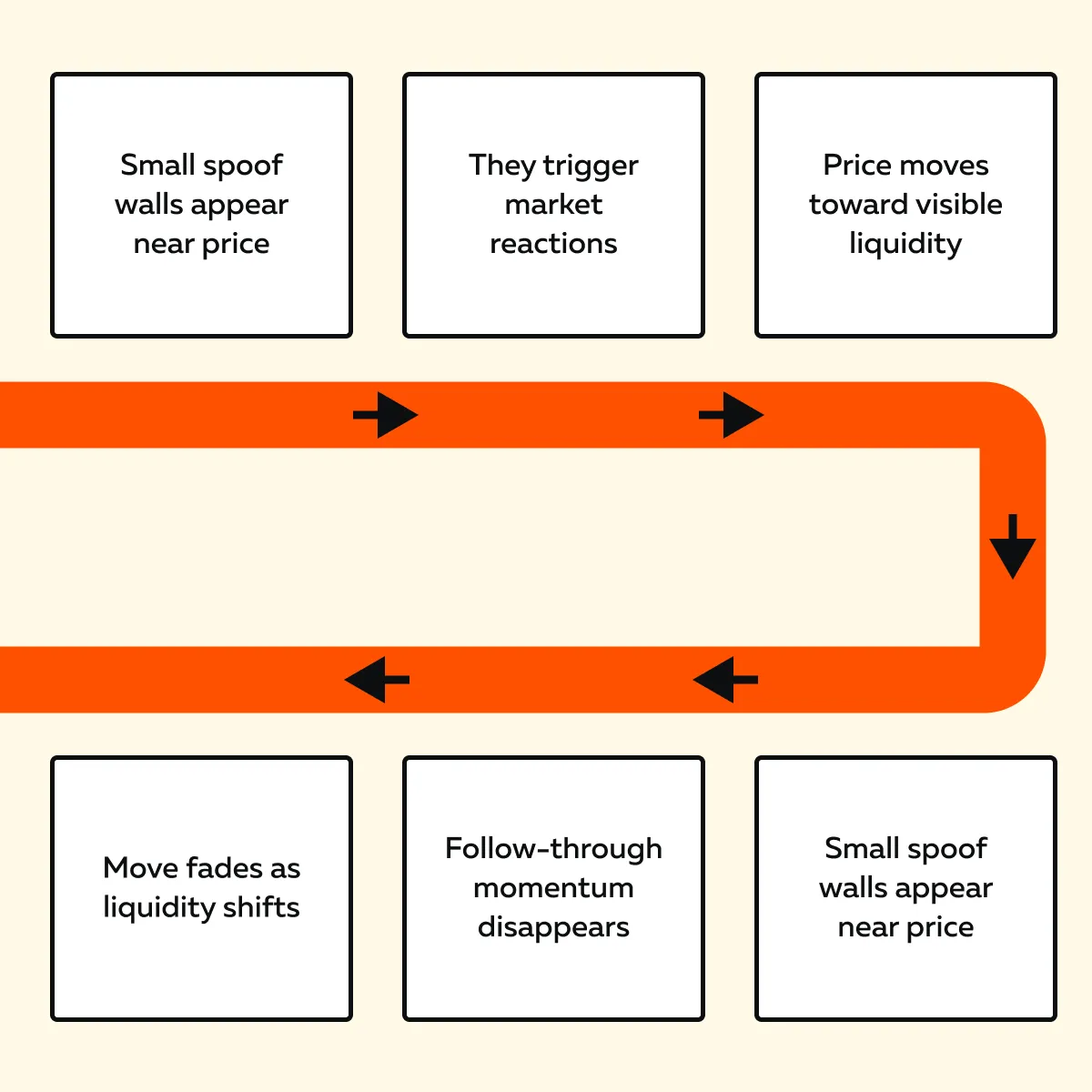

How is Spoofing Executed in Ethereum (ETH)?

As compared to BTC trading, the Ethereum microstructure is more reactive. Spoof walls in ETH are smaller and move more often. Traders place them close to the current price to create short-term reactions. Next, they pull them quickly once the price gets near.

Because of this rapid movement, there’s usually less follow-through even when that liquidity gets hit. The trader’s interpretation? The move may fade soon after! This pattern reflects ETH liquidity behavior, where fast algos dominate and liquidity constantly changes.

How is Spoofing Executed in Bitcoin (BTC)?

In BTC markets, spoofing is more strategic! The fake orders are often placed farther from the price. These orders also come with larger sizes and more intent to trap traders. As a result, these setups move less frequently and are easier to spot because BTC’s order flow is more stable.

The Trading Tip

If you rely on visible liquidity zones in ETH, you can easily get trapped by fake intent. In crypto futures trading, it’s always recommended to track real-time liquidity changes using tools like Bookmap. They let you distinguish genuine interest from disappearing bait.

Compare crypto trading setups using real-time volume and liquidity tools →

Execution Tactics: ETH Requires More Precision

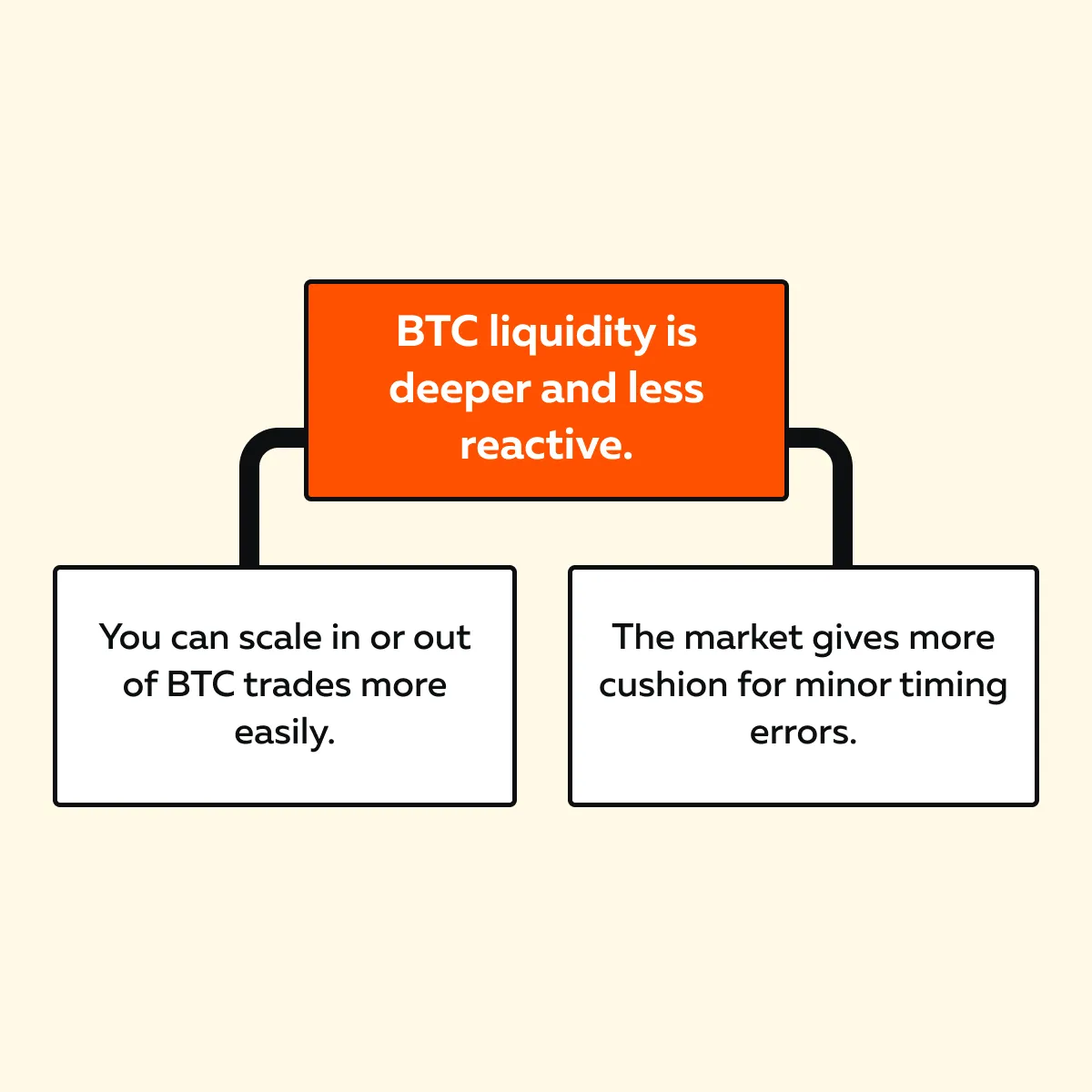

When it comes to ETH vs BTC trading, execution style makes a big difference! Ethereum’s market structure demands faster reactions + tighter control. In contrast, Bitcoin gives traders a bit more room for error. Let’s understand in detail:

You Must Go After Precision Over Comfort in ETH

Ethereum microstructure is thinner and faster. Thus, every small order matters. In ETH trading, the price can move sharply even with moderate volume. As a trader, you can follow these three major tips:

- Limit orders must be placed carefully. That’s because slippage (getting filled at a worse price) is common.

- During breakouts, don’t rely only on candle closes. Instead, wait for confirmation through strong volume and visible liquidity pulls.

- Stop-losses need extra thought! ETH often forms erratic wicks that hit stops before the real move begins.

BTC Allows for More Cushion!

Bitcoin vs Ethereum order flow shows that BTC is generally easier to manage. The liquidity zones are better defined, and big players hold their positions more consistently. There’s more to it:

Need a Pro Tip? Try to Learn from Market Replay!

In crypto futures trading, you must study past behavior. This sharpens your execution! But how? Use Bookmap’s Market Replay mode to re-watch ETH setups. You’ll see:

- How fake moves form,

- When liquidity disappears, and

- Where the best entries actually appear.

These insights significantly refine your timing for real-time trading.

Conclusion

So now you know that while ETH and BTC often move together, their market microstructures tell very different stories! Bitcoin usually has deeper liquidity and smoother price movement.

In contrast, Ethereum moves faster and is far more volatile.

If you use the same trading strategy for both, you’ll likely miss what really influences ETH’s sudden moves and liquidity shifts. Thus, to succeed in ETH vs BTC trading, you must understand how Ethereum liquidity behavior differs and adapt your approach accordingly.

To make this easier, you can start using advanced real-time market analysis tools, like Bookmap. They let you see the:

- Real-time order flow

- Spoofing patterns

- Liquidity pulls that influence price action

Bookmap can let you trade Ethereum on its own terms and not just as “Bitcoin’s little brother.” Trade both BTC and ETH with live heatmap data →

FAQs

1. Why does ETH trade more erratically than BTC?

ETH has less liquidity and more short-term traders compared to BTC. Due to this, its price is more volatile and less predictable.

Additionally, in ETH, orders appear and disappear quickly. This often creates sharp spikes or fake breakouts that further make trading trickier.

2. Is ETH less “institutional” than BTC?

Yes! Bitcoin attracts more institutional investors through:

- ETFs,

- CME futures, and

- Big trading desks.

In contrast, Ethereum is traded more by retail traders and crypto-native users. The dominance of these participants makes their behavior faster and more reactive.

3. Can I use BTC order flow as a leading indicator for ETH?

Usually yes! Bitcoin often reacts first to big news like CPI or FOMC. By watching BTC’s direction, you can better time your ETH trades. However, this is not always true, as sometimes ETH moves differently. Now, these divergences can also offer strong trading opportunities.

4. How does Bookmap help with ETH trading?

Bookmap lets you see live liquidity and order flow! Using it, you can spot:

- Fake orders,

- Sudden liquidity changes, and

- Areas where big traders are active.

This knowledge is a must-have to trade profitably in Ethereum’s fast and volatile market.

5. Do I need a different strategy for ETH vs BTC?

Yes! In ETH trading, you need to:

- Make quick reactions,

- Place tighter stop-losses, and

- Closely track liquidity.

In comparison, the trading of BTC is slower and more structure-based. As a trader, you should not treat both the same, as it can lead to poor timing and missed setups.