Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

January 3, 2025

SHARE

How Market Depth Impacts Crypto Trading: A Guide for Retail Investors

Are you a crypto trader? Market depth can be the difference between a smart trade and a costly misstep. Market depth doesn’t just tell us about the current price of an asset; rather, it shows the buying and selling potential at different price points in the order book. By analyzing market depth, you can easily gauge how stable the price of an asset is and predict potential price movements.

In this article, we’ll study:

- What does market depth mean in order book crypto trading?

- How do order books reveal the actual buying and selling interest across price levels?

- Why does an order book matter in terms of price stability and volatility?

- How does liquidity affect crypto prices?

You will also learn about the impact of large trades, both legitimate and manipulative, on price and liquidity. We’ll cover practical examples showing how large orders affect shallow and deep markets and how traders can utilize this knowledge. Let’s begin.

What is Market Depth in Crypto Trading?

Market depth represents the capacity of the market to absorb large buy or sell orders. It shows how much liquidity is available at various price levels in the order book. For example, say the order book contains substantial buy and sell orders at varying prices. This means the market has deep liquidity. The market could potentially process large trades with minimal price fluctuation.

Most investors and traders remain confused with the terms market depth and liquidity. They often use it interchangeably out of sheer ignorance. However, both terms differ as “liquidity” is all about the ease of buying or selling an asset quickly. On the other hand, “market depth” shows the scale of liquidity at different price levels. Both concepts are important for smooth trading, but market depth holds more relevance as it provides deeper insight into how trades will influence price.

For example, if we talk about crypto market depth, in a deep market for Bitcoin, even a large order might not significantly shift the price. In contrast, in a thin market with low liquidity, the same order size could lead to considerable price changes.

How Order Books Reveal Market Depth

An order book is a real-time market analysis tool. It is widely used in crypto and other financial markets to help gauge the market’s liquidity and depth. A typical order book displays all buy (bid) and sell (ask) orders currently placed by market participants. It is continuously updated and gives a snapshot of demand and supply across different price levels.

Using this tool, traders can analyze where they might buy or sell without moving the market price too significantly. For more clarity, let’s study the order book structure in detail:

| Buy Orders (Bids) | Sell Orders (Asks) |

|

and

|

Together, buy and sell orders reveal the potential entry and exit points in the market. This helps traders understand where there’s significant buying or selling interest. Now, let’s practically understand how traders do order book crypto trading through an example:

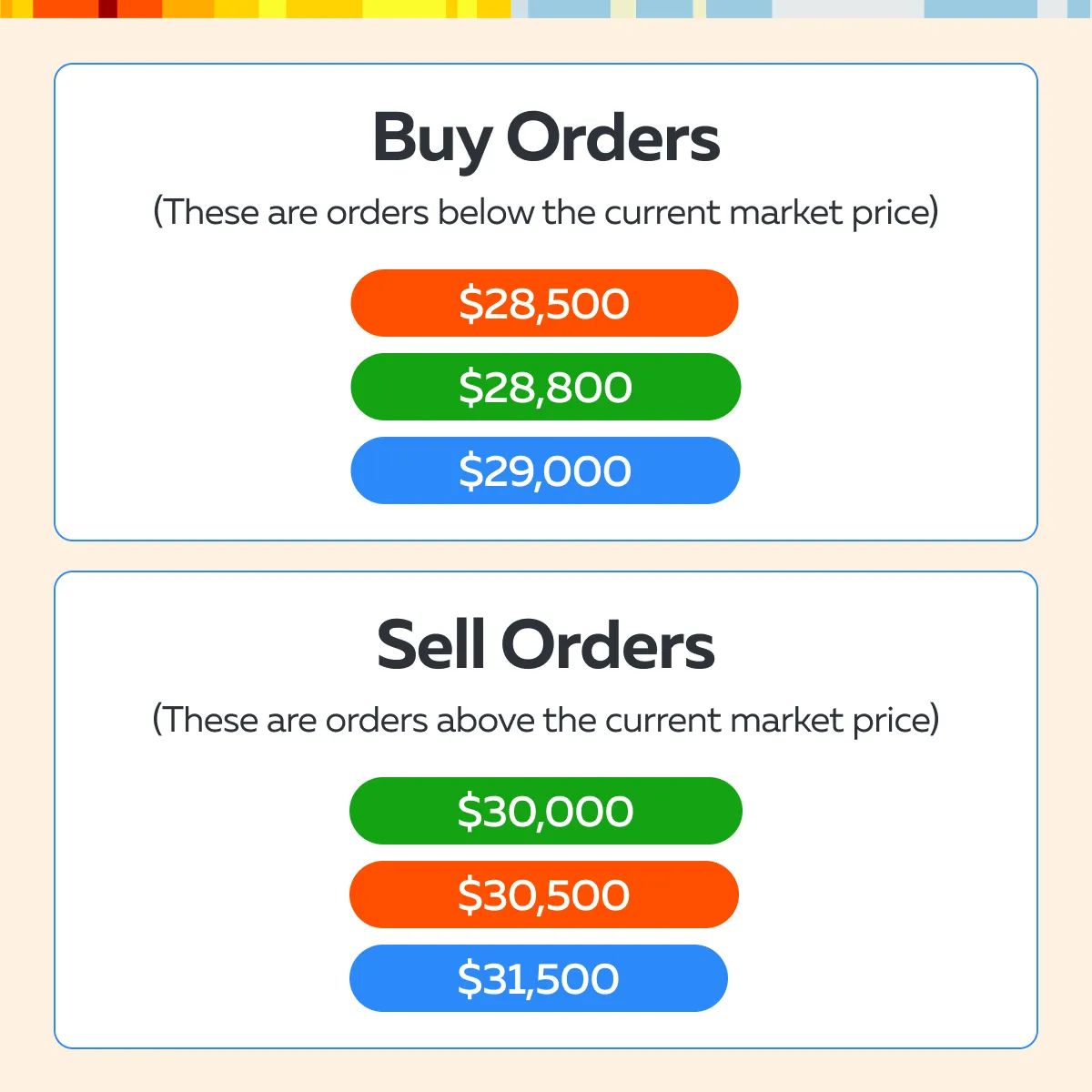

Let’s say there is an order book for Bitcoin. It shows many buy orders at various price levels. There is a cluster of buy orders around $29,000 and sell orders around $30,000. See the graphic below:

This order book snapshot tells traders where participants are willing to enter (buy) or exit (sell) Bitcoin positions. By analyzing this data, traders can assess market depth. They can specifically see how the market might absorb trades without drastically affecting the price.

In this case, the clusters of buy orders around $29,000 and sell orders around $30,000 suggest that the market may bounce between these levels. That’s because there is enough interest on both sides to stabilize the price within that range.

How to Use Order Books to Gauge Market Depth?

Traders analyze the volume and number of orders at different price levels in the order book. This analysis helps to gauge market depth. When an order book has many buy and sell orders at various price points, it indicates a “deep” market. In a deep market, the abundance of orders provides resilience to price changes. That’s because large trades can be absorbed without major price shifts.

Let’s understand the concepts of large clusters and thin markets through an example:

-

- Say a trader sees a large number of buy orders at $29,000.

- There is an equally large cluster of sell orders at $30,000.

- Now, they can expect that the market will trade within this range.

- The presence of so many orders at each level shows significant liquidity.

- This shows the market’s ability to handle sizeable trades without allowing the price to jump or fall dramatically.

- In contrast, if the order book shows only a few orders at each price level, it’s a sign of a “thin” market.

- Here, even small trades could significantly impact the price.

- Please note that thin markets are more prone to volatility.

- That’s because fewer orders mean the market lacks sufficient liquidity to absorb large trades.

In this way, by monitoring order books, traders may spot viable entry or exit points for a trade. Usually, this assessment is done based on the likelihood of prices fluctuating within certain ranges.

Why Market Depth Matters in Crypto Trading?

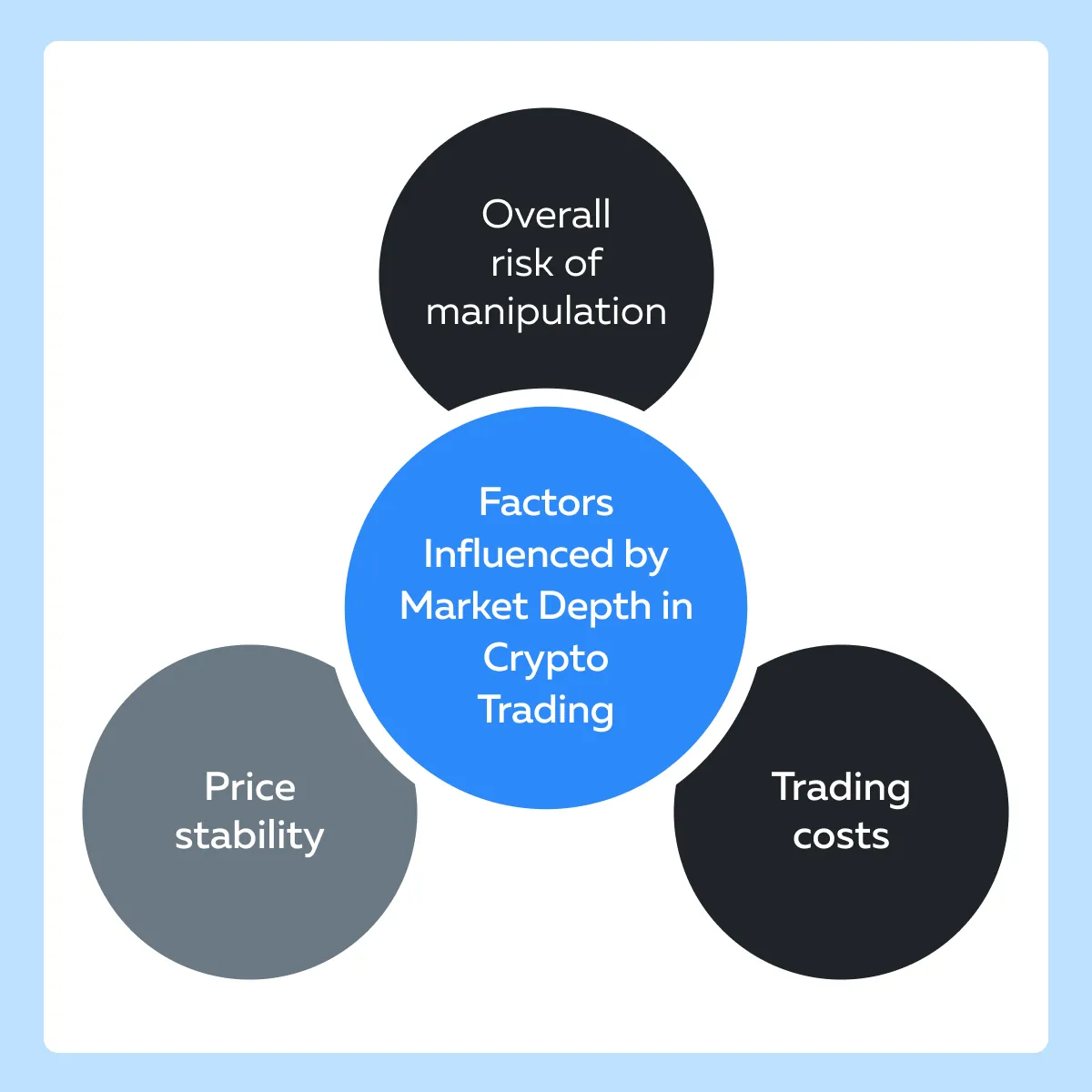

Market depth is a key factor in order book crypto trading. It influences a variety of other factors in crypto trading. Check the graphic below:

When traders and investors assess a market, understanding its depth helps them anticipate the following:

- How their trades could impact prices?

and

- how can they manage volatility risks?

For a greater understanding, let’s see why market depth is so crucial:

Market Depth Impacts Price Movement

Market depth directly affects how prices respond to large buy or sell orders. A market with deep liquidity can absorb large trades without significantly altering the asset’s price. This provides a stable trading environment. In contrast, a shallow market with low liquidity will experience sharp price movements from large trades. Such a market makes it riskier for those attempting to buy or sell large positions. For example:

Let’s consider a large trader, often called a “whale.” They want to buy a million dollars worth of Bitcoin. Now, let’s see how this transaction unfolds in deep and shallow markets:

| Deep Bitcoin Market | Shallow Bitcoin Market |

|

|

Hence, we can observe that the ability to handle large trades with minimal price impact is important for market stability. It helps attract institutional traders, who often deal with significant trade volumes. Gain real-time insights into crypto market depth with Bookmap’s advanced trading tools.

Volatility and Thin Markets

Market depth also plays a major role in price volatility. In thin markets, there is low liquidity and few orders at each price level. Also, the price movements are more volatile. Study the graphic below:

It is worth mentioning that without sufficient buy and sell orders, the market cannot absorb large trades smoothly. This leads to frequent and sometimes erratic price swings. For example:

-

- Many low-volume altcoins lack deep liquidity.

- This makes them more prone to wild price changes.

- In thin markets, even modest buy or sell orders cause dramatic price fluctuations.

- This volatility makes trading riskier and increases the potential for market manipulation.

- Larger traders usually exploit this lack of depth.

- They do so by executing trades that move prices sharply in their favor.

- This impacts smaller traders who lack the liquidity to counteract such moves.

This is why many traders prefer assets with high market depth. Check the graphic below for the benefits of deeper markets:

How Large Trades Affect Market Depth and Price?

Large trades, especially from institutional investors, significantly influence:

- market depth,

and

- price movement.

These sizable trades are often referred to as “block orders.” These block orders create imbalances in the order book. This happens due to shifts in the asset’s price, which depletes liquidity at various price levels. Let’s explore how this process works in detail:

Block Orders and Liquidity Imbalance

As mentioned above, a block order is a large buy or sell order. It is executed in a single transaction or series of rapid transactions. When such an order is placed, it quickly consumes all the available liquidity at certain price levels in the order book.

The order book, which reflects both the demand (buy orders) and supply (sell orders) for the asset at different prices, gets impacted. This happens as these large trades remove a significant number of buy or sell orders.

Also, note that when a block order is executed, the price moves in the direction of the trade. Let’s see how this happens:

- A large sell order will deplete buy orders at multiple price levels.

- It will push the price downward as each level of liquidity is exhausted.

- Similarly, a large buy order increases the price.

- It does so by consuming all available sell orders at higher price levels.

This chain reaction shifts market sentiment. This makes other traders react to the price movement by adjusting their own buy or sell orders. For more clarity, let’s study an example related to the impact of a large sell order in a shallow market:

- Say an institutional investor places a $5 million sell order for Ethereum.

- This order is placed in a market with shallow liquidity.

- With limited buy orders available, this large sell order quickly depletes:

- all existing buy orders at the latest price level

and

- buy orders at multiple levels below the current price level.

- This causes the price to drop significantly.

- This kind of trade leads to a dramatic price decline as buy-side liquidity is drained.

It must be noted that in shallow markets, large block trades like these create temporary but substantial price swings. These swings sometimes make other traders panic and trigger additional buy or sell orders. This amplifies the initial price movement.

How Large Orders Can Manipulate Market Depth?

In order book crypto trading, some traders use large orders to create an illusion of market depth. They do so by manipulating prices by creating false signals. This strategy is often referred to as “spoofing” or “layering”.

In this strategy, spoofers place large orders on one side of the market (buy or sell). They make it appear as if there is significant buying or selling pressure. Once the price moves in the intended direction, the trader cancels the orders. By doing so, they capitalize on the temporary price movement they caused.

How Spoofing Works in Practice?

Traders who use spoofing artificially influence the perception of other traders related to demand and supply. They first place large orders and then cancel them. This tactic is especially effective in markets with low depth, where there are fewer buy or sell orders at each price level. This makes price shifts easier to achieve with large orders.

Let’s understand better through an example:

-

- Say a trader places a large sell order for Bitcoin.

- It creates the illusion that there is heavy selling pressure.

- Other traders, seeing this large order, anticipate a price drop.

- They begin selling their holdings to avoid losses.

- This causes the price to fall.

- Once the price declines, the spoofer cancels their initial large sell order.

- Next, they quickly buy the asset at the now lower price.

- In this way, they profit from the dip they artificially created.

Why This Affects Market Depth and Price?

Manipulative tactics like spoofing distort the true picture of market depth. This makes it harder for genuine traders to gauge actual demand and supply. As the fake orders get canceled, the order book reverts to its previous state. This often causes a sudden price rebound. For unsuspecting traders, this leads to:

- unnecessary losses,

and

- increased market volatility.

By understanding spoofing, traders can be more cautious when interpreting large orders in the order book. Be aware that several platforms and regulators often monitor for spoofing, but it remains a risk in both crypto and traditional markets. Its prevalence especially increases in less regulated exchanges or markets with thinner liquidity.

Conclusion

Understanding the crypto market depth is important for anyone who is into order book crypto trading. Market depth reveals how many buy and sell orders exist at various price levels. It shows how much the market can absorb large trades without dramatic price changes. By analyzing market depth, traders can easily predict how prices might react to significant trades. Based on this analysis, they can plan their trades accordingly. This holds more relevance for retail traders who usually do not have the large resources of institutional players.

Next, by knowing the difference between deep and shallow markets, traders can better deal with volatility. In deep markets, large trades won’t move the price much. This makes it easier to trade as there are no major price shifts. In comparison, in shallow markets, big orders cause quick and sharp price changes. These movements can be risky but also create opportunities for quick gains if timed well.

These insights are also useful for retail traders. They must use these insights to avoid getting caught in rapid price swings. Also, they can recognize potential manipulation tactics like spoofing. By watching order books and understanding market depth, they can make more informed decisions. This gives them a better chance to trade smartly in the fast-moving crypto market.

Want to see how large trades affect price? Bookmap’s crypto tools provide you with real-time order flow data.