Ready to see the market clearly?

Sign up now and make smarter trades today

Education

September 21, 2024

SHARE

Inside The Market: Order Books And What You’re Missing Out On

Success in the financial markets hinges on a trader’s ability to decipher the intricate workings of market dynamics. Those who possess a profound understanding of market microstructure gain a distinct advantage, enabling them to make informed decisions, manage risk effectively, and seize profitable opportunities.

In this article, we’ll look at how to elevate your trading strategies by offering a comprehensive understanding of market microstructures. We’ll delve into the fundamentals, dissect the pivotal role of order books, recognize the significance of bid-ask spreads, and explore how tools like Bookmap empower you to navigate the complexities of financial markets.

What Is Market Microstructure?

Market microstructure is the study of financial markets, addressing fundamental questions such as:

-

How do financial markets function?

-

What drives order execution?

-

How are prices determined?

A thorough understanding of market microstructures provides traders with invaluable insights, unraveling the mechanics of the market.

Bookmap offers an Education Course on trading order flow and market depth, in which it covers various key aspects of market microstructure. Let’s understand them here.

A) Basic Market Mechanics

Several terms form the building blocks of market analysis and decision-making. By monitoring liquidity, BBO, LOB, DOM, and aggressor volume, traders can:

-

gain valuable insights into market conditions,

-

identify emerging trends,

-

make well-informed trading decisions.

Let’s break down these crucial terms:

|

Term |

Meaning |

Importance |

|

Liquidity |

It represents the presence of limit orders in a marketplace that provides buying or selling opportunities.

|

|

|

Best Bid and Offer (BBO) |

|

|

|

Limit Order Book (LOB) |

|

|

|

Depth of Market (DOM) |

|

|

|

Aggressor Volume Classification |

|

|

B) Order Flow Data and Market Understanding

Order flow data provides a wealth of real-time market intelligence, which includes:

-

Real-time information on market liquidity

-

Best bid and offer prices

-

Current spreads

-

Volume metrics

Analyzing high liquidity areas can help traders predict future price movements. Tools like Bookmap facilitate the visualization of this invaluable data, enabling traders to make more informed decisions.

C) Liquidity with Bookmap’s Heatmap

The heatmap in Bookmap displays the historical limit order book liquidity. Brightly colored areas indicate higher liquidity, while darker areas represent lower levels. Traders use this information to identify areas with significant buying or selling pressure.

D) Sweeping through the Order Book:

Sweeping involves trading through one or more price levels, often using imbalances and aggressive market orders. This can create vacuums in the order book and lead to substantial price movements.

E) Absorption and Exhaustion:

Market microstructure involves the concepts of absorption and exhaustion, where traders learn:

-

Absorption: Occurs when limit orders soak up aggressive buying or selling pressure.

-

Exhaustion: Refers to a lack of aggressive volume activity.

Recognizing these patterns is invaluable for anticipating market movements.

Order Books Explained

Order books serve as a live record of all active buy and sell orders for a specific asset or market. Their primary role is to provide real-time insights into supply and demand dynamics.

Let’s delve deeper into the structure and significance of order books in trading.

-

-

Bid and Ask Sides:

-

Order books are typically divided into two sides:

-

The “bid / buy” side: Lists all the buy orders from traders who want to purchase the asset at a specific price, starting with the highest bid at the top.

-

The “ask” / sell” side: Lists all the sell orders from traders looking to sell the asset at specific prices, starting with the lowest ask at the top.

-

-

-

-

Quantity:

-

Alongside each price level, there is a “quantity of the asset” that traders are willing to buy or sell at that particular price.

-

This quantity reflects how much of the asset is available at a given price level.

-

-

-

Constant Updates:

-

Order books are dynamic and are continuously updated in real-time as new orders are placed and existing orders are filled or canceled.

-

-

This constant stream of updates provides traders with a live view of the changing market sentiment and liquidity.

-

-

-

-

Order Matching:

-

When a buy order matches a sell order in terms of price and quantity, a trade occurs, and both orders are removed from the order book.

-

This is how price discovery and trading activity take place in financial markets.

-

-

-

Transparency and Fairness:

-

Order books provide transparency in the market by showing all orders.

-

This helps in ensuring fairness and integrity.

-

Traders can see the exact price levels and quantities at which transactions are taking place.

-

Bid-Ask Spreads: Why They Matter

The bid-ask spread is the difference between the highest price a buyer is willing to pay for an asset (bid price) and the lowest price at which a seller is willing to sell the same asset (ask price). In other words, it’s the cost of entering or exiting a trade.

Let’s understand why bid-ask spreads matter and how they impact traders:

|

Importance |

Meaning |

Relevance for Traders |

|

Market Liquidity Indicator |

Bid-ask spreads are a key indicator of market liquidity. |

|

|

Impact on Trading Costs |

For traders chasing the ‘buy low, sell high’ mantra to pocket profits, the bid-ask spread wields significant influence and affects the immediate profitability of a trade.

|

|

|

Breakeven Point in Trading |

To breakeven on a trade, a trader must patiently wait for the asset’s price to shift in their favor by at least the extent of the bid-ask spread. |

|

|

Scalping and Day Trading |

Traders engaged in high-frequency trading, such as scalpers and day traders, are particularly sensitive to bid-ask spreads. |

|

How Does Depth Of Market (DOM) Impact Trading?

DOM provides traders with a real-time view of the order book for a specific asset or market. It displays a list of buy and sell orders at different price levels, along with the corresponding quantities. understanding DOM is pivotal for those trading regularly, as it offers several key advantages:

-

-

Real-Time Market Transparency:

-

DOM offers real-time transparency into market activity.

-

Traders can see the current bid and ask prices.

-

This allows them to make informed decisions based on the best available prices.

-

-

-

Price Levels and Liquidity:

-

DOM shows the depth of liquidity at different price levels.

-

Traders can identify support and resistance levels by observing where a significant number of buy or sell orders are concentrated.

-

This information helps traders make decisions about entry and exit points.

-

-

-

Order Book Imbalances:

-

DOM allows traders to identify order book imbalances, such as large buy or sell walls.

-

These imbalances signal potential price reversals or breakouts, helping traders anticipate market movements.

-

Seeing Market Depth Through Bookmap

Bookmap, a powerful trading tool, visualizes market depth and order flow, empowering traders with valuable insights through its array of features:

|

The Feature |

The Meaning |

The Benefit for Traders |

|

Heatmap Visualization |

Bookmap uses a heatmap to display historical and live market data.

|

|

|

Real-Time Data Flow |

Bookmap offers real-time data flow. |

It allows traders to see order book changes as they occur. This feature provides traders with up-to-the-minute information, enabling them to react swiftly to market dynamics. |

|

Historical Depth Data |

Bookmap shows historical depth data to gain a deeper understanding of market mechanics and price movements over time. |

Historical perspective aids traders in developing better trading strategies. |

|

Volume Dots |

Bookmap uses volume dots within the heatmap to indicate the type and quantity of trades that took place during specific periods. |

It helps traders assess the aggressiveness of market participants, offering insights into the intensity of buying or selling pressure. |

|

Zoom Feature |

Bookmap offers a zoom feature that enables traders to analyze market activity at different levels, from sub-second to microsecond levels. |

This granularity allows traders to seek detailed insights, helping them make precise trading decisions. |

|

Aggregated Delta |

Bookmap visually aggregates the overall delta of traded volume.

|

This helps traders quickly assess the net buying or selling pressure in the market, providing a concise snapshot of market sentiment. |

Incorporating Bookmap into your trading toolkit enhances your ability to navigate market dynamics efficiently, making well-informed decisions based on real-time data, historical insights, and visual representations of market depth.

Types Of Orders And Their Role

In financial markets, traders have various order types to execute trades according to their specific strategies and preferences. Each order type serves a distinct purpose and has a unique impact on the order book.

Let’s explore some common types of orders and their roles:

|

Order |

Role |

Impact on Order Book |

|

Market Orders |

These are executed at the current market price and guarantee immediate execution.

|

Market orders contribute to the liquidity on the opposite side of the order book by either:

|

|

Limit Orders |

|

|

|

Stop Orders |

|

|

|

|

|

|

Fill-or-Kill (FOK) Orders |

|

|

|

Immediate-or-Cancel (IOC) Orders |

|

|

Leveraging Market Microstructure for Better Trades

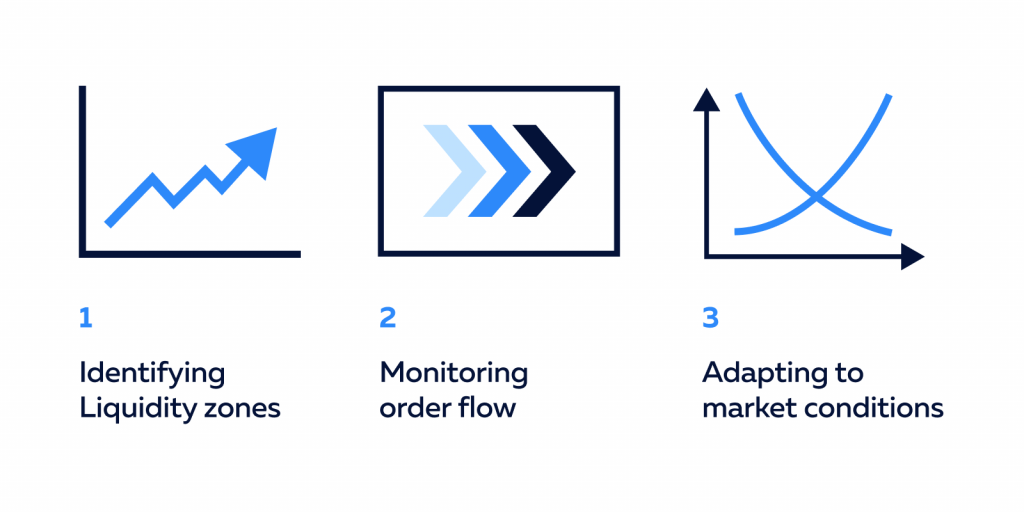

Understanding market microstructure empowers traders to make more informed decisions, leading to improved predictions and choices. Here’s how market microstructure can be leveraged for better trades:

-

-

Identifying Liquidity Zones:

-

By analyzing order flow and the depth of the market (DOM), traders can identify areas with high liquidity.

-

These areas often serve as support or resistance levels.

-

Most traders use this information to identify entry and exit positions.

-

-

-

Monitoring Order Flow:

-

Keeping an eye on order flow data allows traders to gauge market sentiment and the aggressiveness of market participants.

-

This information can help in making timely trading decisions.

-

-

-

Adapting to Market Conditions:

-

Traders who grasp market microstructure are better equipped to adapt to changing market conditions.

-

They can adjust their strategies when they observe shifts in liquidity, volatility, or order book dynamics, ensuring flexibility in their approach to trading.

-

Conclusion

Understanding market microstructure is paramount for traders. It empowers informed decision-making, efficient risk management, and adaptability to changing markets. In today’s dynamic financial landscape, market microstructure knowledge is the foundation for confident trading.

Market analysis tools like Bookmap help in refining strategies and gaining a competitive edge. Mastering market microstructure can significantly elevate your trading performance and overall success.

Ready to delve deeper into the intricacies of market microstructure with state-of-the-art tools? Start your journey with Bookmap today and gain an edge in understanding the market’s inner workings.

FAQ

What is market microstructure and why is it important for traders?

Market microstructure studies how financial markets operate, focusing on order execution, price formation, and liquidity. Understanding it helps traders make better decisions, manage risk effectively, and recognize hidden market opportunities.

How do order books provide an advantage in trading?

Order books offer real-time insight into buy and sell orders at different price levels, helping traders spot liquidity zones, anticipate potential reversals, and assess market sentiment based on supply and demand dynamics.

Why are bid-ask spreads important to watch?

Bid-ask spreads reflect market liquidity and directly impact trading costs. Narrow spreads indicate higher liquidity and lower transaction costs, while wider spreads can make trades more expensive and harder to profit from, especially for short-term traders.

How does Bookmap improve market transparency compared to traditional trading tools?

Bookmap visualizes real-time and historical order flow with heatmaps, volume dots, and depth data. This provides a clear picture of liquidity changes, aggressive buying/selling activity, and market sentiment shifts that traditional charts may miss.