Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 3, 2025

SHARE

Best Year-End Trading Strategies to Maximize Your 2024 Gains

As the year winds down, many investors begin to feel the same way as a marathon runner! Almost at the finish line and ready to close out strong. But they are wondering if they have enough left in the tank for one final push.

If you’re a trader looking to make the most of the last few weeks of 2024, you’re in the right place. The year-end trading period is not just about tying up loose ends; it’s about implementing smart strategies that can:

- Maximize your gains,

- Minimize your risks,

and

- Set up your portfolio for the coming year.

Wondering how? In this article, we’ll explore five powerful year-end trading strategies specifically designed to help you finish strong. From locking in profits and sector rotation to hedging against volatility and positioning for Q1 2025 trends, these strategies are all about making the most of the market opportunities that come with the season.

Also, you will learn pragmatic methods and real-world examples, like how Sarah, a retail investor, would apply these strategies to her portfolio. Moreover, we will tell you how you can use our advanced market analysis tool, Bookmap, and deal with the final weeks of 2024 with confidence. Let’s get started.

Key Considerations for Year-End Trading

Towards the year-end, traders must keep these three key considerations in mind:

- Market sentiment,

- Tax implications,

and

- Sector performance.

Their analysis allows traders to develop smart year-end trading strategies, which help them close out the year strongly. Let’s understand these key considerations in detail.

1. Market Sentiment at Year-End

Generally, market sentiment shifts as the year-end approaches. This primarily happens due to strategic moves of investors to either:

- Lock in profits,

or

- Hedge against potential volatility in the new year.

As investors assess the year’s performance, there is often a mix of optimism from gains and caution about the uncertainties of the upcoming year. This sentiment results in increased activity. It is usually characterized by profit-taking, which can put selling pressure on certain stocks.

In other cases, some investors might hold onto their positions. This especially happens if they’re optimistic about early 2025 performance. Looking to refine your strategy for year-end gains? Try Bookmap’s advanced trading tools today.

2. Tax Implications

Tax considerations strongly influence year-end trading strategies. Tax-loss harvesting is a common approach. For the unaware, in this approach, investors sell underperforming assets to offset capital gains. This strategy offers them a gateway to lower their taxable income.

Mostly, such moves lead to an uptick in trading volume. That’s because most individuals and institutions use such strategies to reduce their tax liabilities before the fiscal year closes. Additionally, some investors engage in profit-taking. They do so when they anticipate higher capital gains tax rates in the future.

Thus, investors must understand these tax implications. This helps them to identify temporary market shifts. Post-identification, they can use these shifts to their advantage by strategically timing entry into or exit from certain stocks.

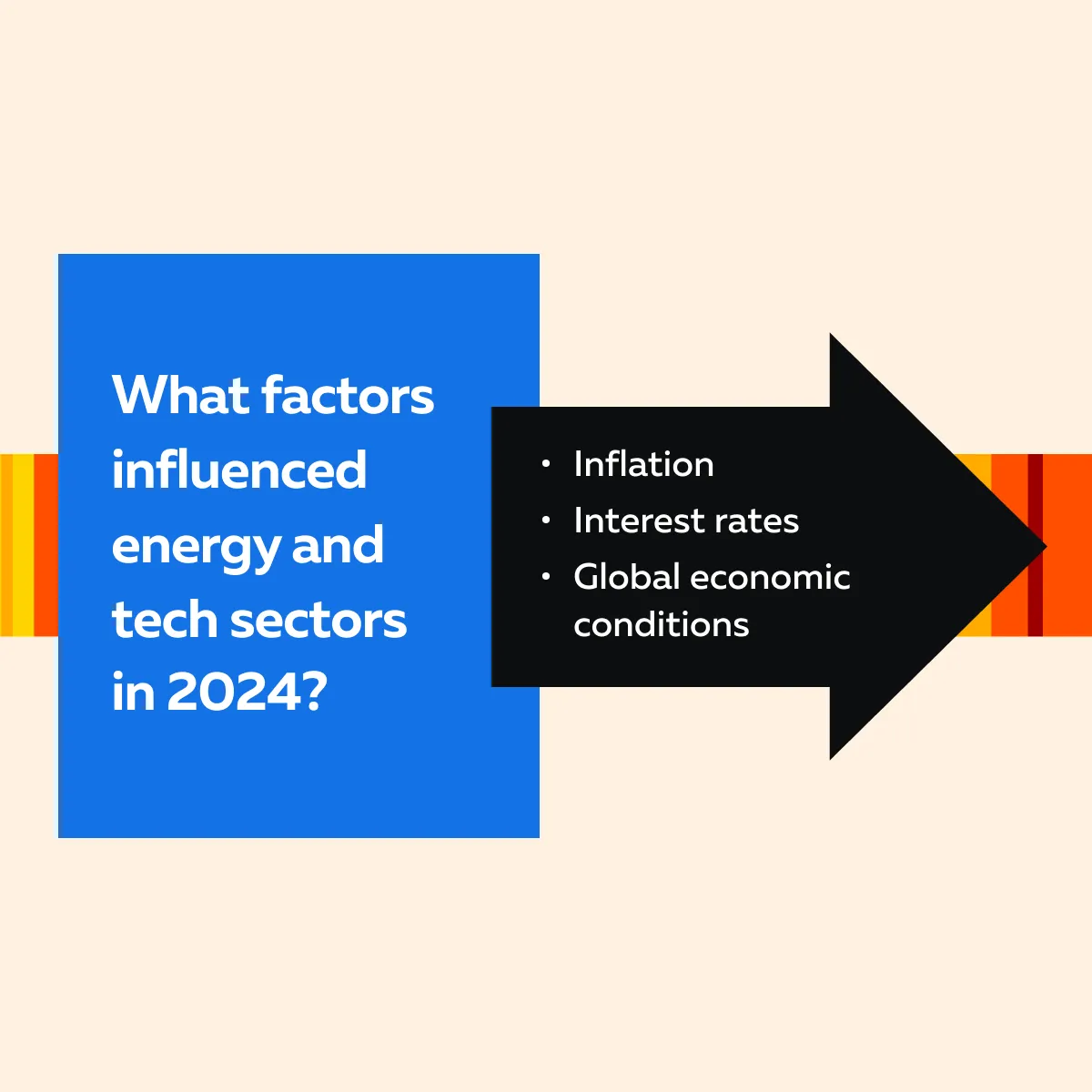

3. Sector Dynamics and Economic Indicators

Analyzing sector dynamics and economic indicators is also important for successful year-end trading strategies. Please note that in 2024, sectors like energy and tech have seen notable shifts due to several factors. Check the graphic below:

Example:

- Energy stocks experienced heightened volatility due to fluctuating oil prices and geopolitical concerns.

- In comparison, tech stocks faced challenges from rising interest rates.

Furthermore, several economic indicators also influence these sectors. Some common examples are inflation data, employment figures, and central bank policies. Now, let’s have a look at some of the best year-end portfolio tips or strategies you must consider to maximize gains.

Strategy #1: Locking in Profits Before Year-End

This year-end trading strategy combines tax-efficient selling with careful timing of profit-taking. This way, you can enhance overall returns and prepare better for the coming year. Let’s understand in detail:

| Tax-Loss Harvesting | Repositioning for Year-End Gains |

|

and

|

Strategy #2: Sector Rotation and Seasonal Trends

Sector rotation and holiday seasonality trends are important year-end strategies. They allow traders to capture momentum. Generally, this momentum is captured in sectors that naturally benefit from seasonal demand. Let’s understand in detail:

| Focus on High-Performing Sectors | Holiday Seasonality Effects |

|

|

Use Bookmap’s heatmap to identify liquidity zones in seasonal stocks and make well-timed entries or exits.

Strategy #3: Window Dressing and Institutional Activity

Understanding window dressing and tracking institutional moves is another proven year-end portfolio tip. Through these techniques, you can capitalize on temporary market shifts as 2024 wraps up. Let’s understand these techniques in detail.

| Understanding Window Dressing | Monitoring Institutional Order Flow |

|

and

|

Strategy #4: Positioning for Q1 2025 with Early Rebalancing

To build a better portfolio for the next year, you can also rebalance and make an early trend entry. This increases the potential to maximize gains in early 2025. Let’s understand in detail:

| Portfolio Rebalancing | Early Entry into Q1 Trends |

|

|

Bookmap’s tools for liquidity tracking can help identify early movement into new sectors for Q1 positioning.

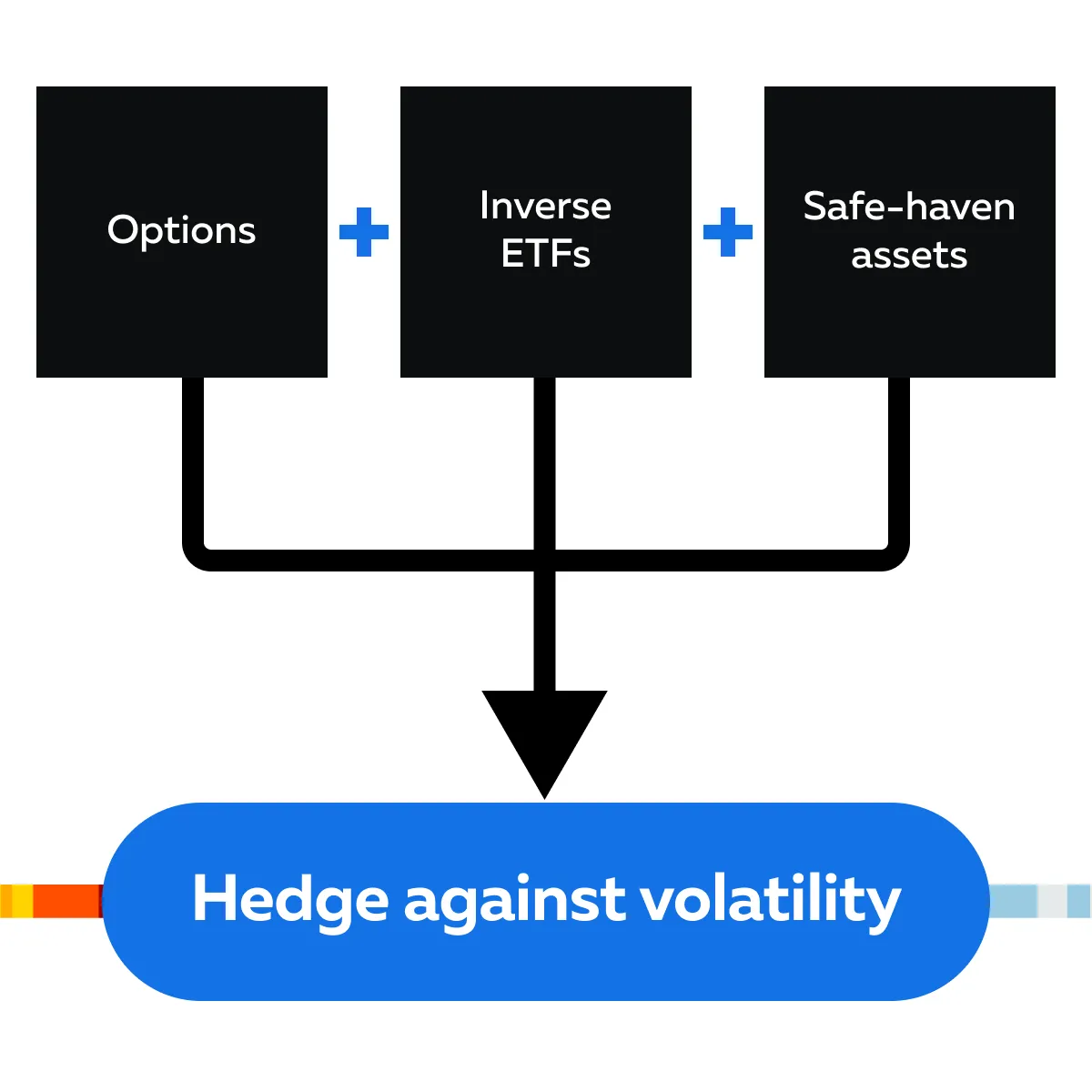

Strategy #5: Hedging Against Market Volatility

It is worth mentioning that hedging makes year-end trading strategies more effective. It protects and even maximizes gains in uncertain market conditions. See the graphic below to learn how you can hedge:

Let’s understand this strategy in detail.

| Using Options and Inverse ETFs for Hedging | Adding Safe-Haven Assets |

|

|

Leverage Bookmap’s insights to assess volatility patterns and protect your portfolio with timely hedges.

How to Implement Year-End Strategies?

For a greater understanding, let’s understand how you can implement year-end strategies through the story of Sarah, a retail investor.

Sarah had a successful 2024. She made investments in tech stocks, particularly in areas like AI and cloud computing. Now, as the year draws to a close, Sarah wants to maximize gains. So, she is exploring new opportunities. At the same time, she wants to protect her portfolio from likely year-end and early-January market volatility.

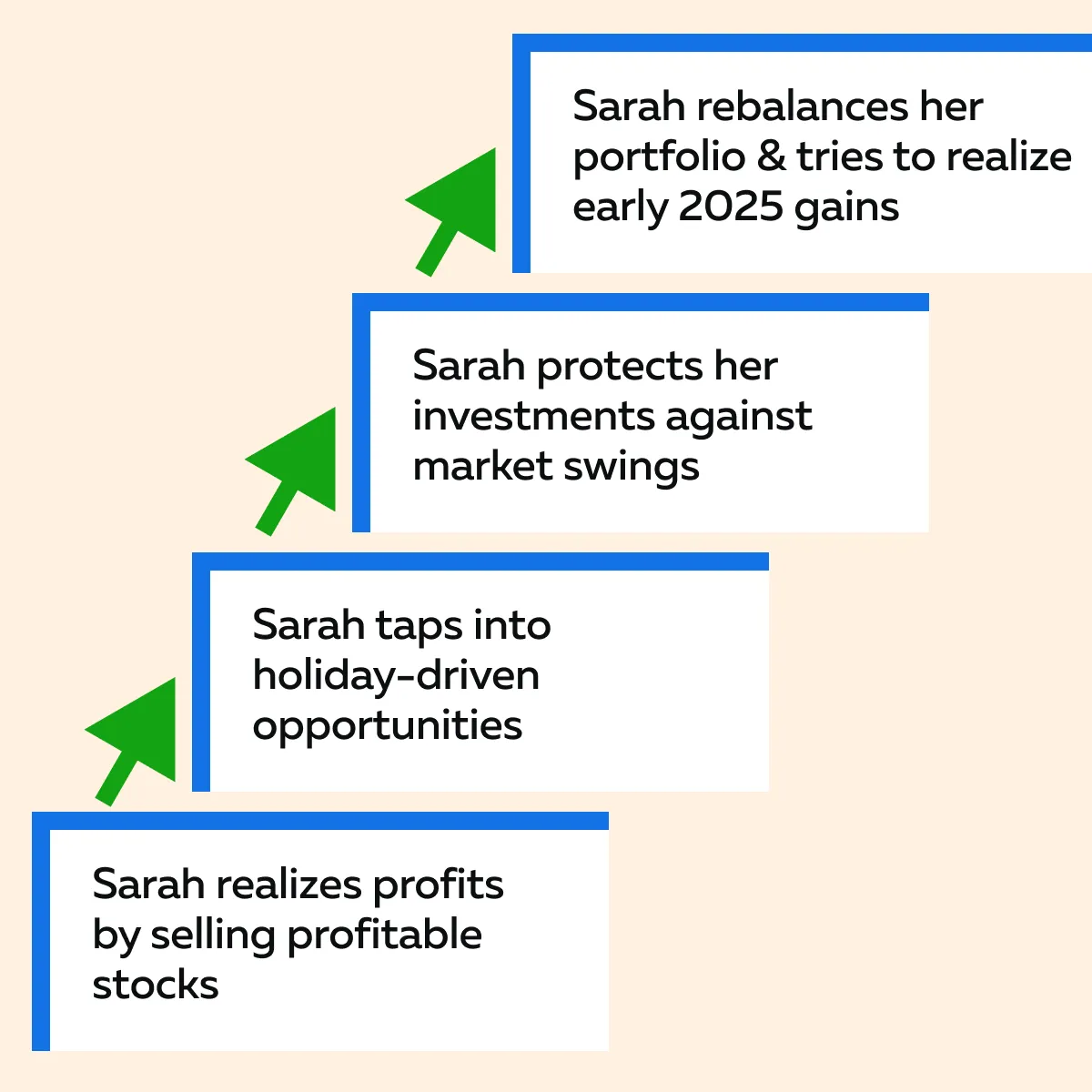

Let’s see how she brings together year-end trading strategies and achieves a balanced approach:

a) Locking in Gains

Sarah’s tech-heavy portfolio has performed well, and she has decided to lock in some of her profits. By selling shares of a few tech stocks that have shown substantial growth, she realizes those gains. The cash she frees up serves two purposes:

- It provides a buffer against any likely market losses,

and

- Gives her the flexibility to reallocate into new areas with potential.

This step is a part of Sarah’s year-end trading strategy of securing profits. This helps her to balance her gains while preparing for her next moves. Maximize your trading potential with Bookmap’s order flow and liquidity heatmap as you close out 2024.

b) Reallocating into Holiday-Driven Sectors

Sarah thinks about maximizing gains during the holiday season. She shifts her focus toward sectors that historically performed well in Q4, like:

- Consumer goods,

and

- E-commerce.

Sarah is anticipating strong retail demand. Hence, she decides to reinvest some of her profits into well-known retail and consumer goods stocks that generally see boosts during the holiday shopping season.

By doing so, she diversifies her portfolio and reduces her tech concentration. Also, she positions herself to benefit from holiday seasonality effects (trying to capture seasonal gains).

c) Hedging with Put Options

Although Sarah is optimistic, she’s aware of the risk of a January market pullback. To protect her gains, she buys put options on a broad market ETF. This move acts as insurance. See how through the graphic below:

This hedging strategy allows her to keep her core portfolio intact while gaining protection against volatility.

d) Positioning for Q1 Trends

Finally, Sarah looks ahead to early 2025. She is anticipating growth in sectors like renewables and healthcare. These sectors have shown resilience and are expected to benefit from policy support and increased demand.

By starting small positions in these areas, she positions her portfolio for Q1 gains. She is also preparing to capture January’s effects. This early rebalancing aligns her investments with year-end portfolio strategies that don’t just end in December but set her up for early gains in 2025.

Bringing It All Together

By blending these year-end trading strategies, Sarah strikes a perfect balance. Let’s see how through the graphic below:

In this way, Sarah prepares herself to maximize gains, not only as 2024 concludes but also as the new year begins. By following the above steps, she creates a stable and growth-focused strategy. This strategy can carry her success forward into 2025.

Conclusion

To finish strong in 2024, you must have a well-thought-out year-end trading plan. By focusing on key strategies, you can maximize gains and better prepare for the year ahead. To start with, lock in profits on high-performing assets and try to secure gains. Build a cash reserve for new opportunities.

Next, consider reallocating into seasonal sectors (like retail and consumer goods). These sectors generally perform well during the holiday season. To manage market volatility, you should consider hedging with options or inverse ETFs. Adding safe-haven assets like gold or treasury bonds can also balance risk in uncertain conditions.

For those looking forward, early rebalancing and positioning in sectors expected to perform in Q1 (such as renewables or healthcare) can give a head start on 2025 trends. Position yourself for a strong finish to 2024 with Bookmap’s real-time data tools and insights. Easily visualize the market and place smarter trades!