Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 2, 2025

SHARE

BRICS Countries: Their Growing Influence on Global Markets in 2025

Think of the world economy as a high-stakes poker game. If that’s true, the BRICS countries are raising the stakes with every move.

As Brazil, Russia, India, China, and South Africa strengthen their economic ties, their influence is shaking up global trade, finance, and investment markets. From reducing reliance on the U.S. dollar to expanding BRICS stock market influence, these nations are challenging traditional economic powerhouses.

Do you want to understand the growing influence of BRICS on the world markets? This article will break down everything you need to know about the BRICS economy: the way these countries are boosting direct trade, their impact on forex and commodities, and some emerging investment opportunities. You’ll also learn about the impact of BRICS trading on oil, gold, and agriculture, as well as key stock market trends and risks. Let’s begin.

What Are the BRICS Countries and Why Do They Matter?

The BRICS countries represent a powerful economic alliance. This alliance consists of:

- Brazil,

- Russia,

- India,

- China, and

- South Africa.

Originally coined as BRIC by economist Jim O’Neill in 2001, the group initially included Brazil, Russia, India, and China. In 2010, South Africa became a member of the group. This transformed it into BRICS.

Why Does BRICS Matter?

The BRICS economy is a dominant force in global trade and finance. It accounts for 40% of the world’s population and over 25% of global GDP. Due to its power, the bloc is actively involved in the following:

- Reshaping international trade,

- Challenging Western financial institutions and

- Promoting intra-BRICS trade through alternative payment systems.

With discussions around a BRICS currency shift, there is growing speculation about reducing dependency on the U.S. dollar in cross-border transactions. This shift could significantly alter global trade flows.

Key Economic Strengths of Each BRICS Nation

Let’s individually assess the strengths of each country that is a part of the alliance:

a) Brazil: Commodity Export Leader

Brazil is a leading exporter of:

- Agricultural goods,

- Iron ore, and

- Oil.

With vast natural resources, it supplies soybeans, coffee, and meat to global markets (especially China). Its economy heavily depends on global commodity demand. This makes it sensitive to price fluctuations.

b) Russia: Energy Superpower

Russia plays a significant role in the global energy market, being a leading exporter of:

- Oil,

- Natural gas, and

- Coal.

The country’s control over energy supplies gives it a significant geopolitical advantage (particularly in Europe). Any changes in Russian energy policy or production levels can influence global commodity prices and affect the BRICS economy and beyond.

c) India: Tech and Services Giant

India has a rapidly expanding economy. It is largely driven by:

- Technology,

- Pharmaceuticals, and

- Financial services.

With a strong IT industry and a growing digital economy, it is a key destination for outsourcing and software development. India’s rising stock market also attracts global investors looking for high-growth opportunities.

d) China: Global Manufacturing Hub

China is the largest manufacturing economy. It is also a major consumer of raw materials from BRICS partners. The country is a major producer of:

- Electronics,

- Machinery, and

- Consumer goods.

This makes China a vital link in global supply chains. With ongoing trade disputes and economic reforms, China’s policies directly affect the BRICS countries.

e) South Africa: Mineral-Rich Economy

South Africa contributes to the BRICS economy through its vast reserves of:

- Gold,

- Platinum, and

- Diamonds.

It plays a strategic role in global mining and trade, particularly in precious metals. As the only African nation in BRICS, it strengthens the bloc’s influence on the continent. It plays a key role in expanding economic partnerships and investment opportunities.

BRICS and Global Trade: A Shift Away from the U.S. Dollar?

The BRICS countries are working together to reduce their reliance on the U.S. dollar for trade and financial transactions. This process, called de-dollarization, aims to strengthen their economies by avoiding risks linked to dollar fluctuations. Check the graphic below to learn how de-dollarization helps the BRICS economy:

Why Are BRICS Nations Reducing Dollar Dependence?

The BRICS countries want more control over their financial systems. This can only be done by using their own currencies instead of the dollar. That’s because de-dollarization reduces the risk of external economic pressure. Additionally, by shifting away from the dollar, the BRICS economy becomes less dependent on the U.S. This creates a more balanced global financial system.

For this purpose, the bloc has created financial organizations like the following:

- New Development Bank (NDB)

and

- Contingent Reserve Arrangement (CRA).

These organizations provide loans in local currencies. This reduces the need for dollar-based borrowing. Get ahead of market volatility driven by BRICS policy changes using Bookmap’s real-time order flow analysis.

The Impact of a BRICS Currency Shift

The immediate impact of de-dollarization would be less dependence on the U.S. Dollar. A common BRICS currency shift would make international trade and investment less reliant on dollars. Moreover, using local currencies allows BRICS countries to have more control over their economies.

However, most BRICS countries still depend on the dollar in some way. Thus, financial systems need significant improvements before 100% de-dollarization can happen.

Bilateral Trade Agreements Among BRICS Countries

The BRICS countries are actively increasing direct trade with each other to reduce dependence on the U.S. dollar. By using local currencies for trade settlements, the BRICS economy gains financial stability. Check out the graphic below to learn the benefits of dealing in local currencies:

For more clarity, let’s study an example related to India and Russia’s rupee-based oil trade:

- A key development in the BRICS trading impact is India and Russia settling oil transactions in rupees instead of dollars.

- Due to global sanctions on Russia, both nations agreed to use the Indian rupee for payments.

- By doing so, they bypassed the dollar-based system.

- This allowed Russia to continue exporting oil.

- On the other hand, India secures energy supplies at favorable rates.

- This kind of arrangement enhances financial cooperation within the BRICS economy.

Track global market shifts in real time with Bookmap’s liquidity tools.

Impact on Forex & Global Markets

If more BRICS countries adopt local currency settlements, the demand for U.S. dollars in global trade could decline. This will impact its strength in the forex market. Moreover, a shift away from the dollar could cause fluctuations in exchange rates. This will make forex markets more volatile.

Trading Opportunities in Forex Pairs

To benefit from de-dollarization, traders can focus on currency pairs such as:

- USD/CNY,

- USD/RUB, and

- BRL/USD.

Changes in BRICS trade policies influence their value. A stronger BRICS economy could make these pairs more active and create new opportunities for forex traders.

Commodities and BRICS: Key Markets to Watch

Be aware that the BRICS countries play an important role in global commodity markets. They influence everything from energy to metals and agriculture.

Now, having understood this relationship, let’s look at some key markets you can watch as a trader:

A) Energy Dominance (Oil & Natural Gas)

Russia and China are deepening their energy cooperation. Russia, one of the world’s largest oil and gas exporters, is redirecting supplies toward China and India. By doing so, it is reducing its reliance on Western markets.

This shift significantly affects oil futures and natural gas contracts and leads to price fluctuations. As a trader monitoring the influence of the BRICS stock market, you should look at crude oil (WTI and Brent) and natural gas futures to gauge market direction.

B) Gold & Precious Metals

South Africa is a major gold producer. At the same time, Russia holds vast reserves of precious metals. Thus, the BRICS economy has a significant influence over the gold market. Talks of a possible BRICS currency shift toward a gold-backed system could drive volatility in:

- Gold futures (GC)

and

- Mining stocks.

If BRICS countries introduce a gold-backed trade settlement system, it could alter global gold demand and impact the value of fiat currencies.

C) Agriculture & Food Security

Brazil is the world’s largest exporter of soybeans and a key supplier of grains. It plays a vital role in global food security. Also, China is gradually increasing its demand for Brazilian agricultural products, which is influencing global prices.

This BRICS trading impact extends to commodities like corn, wheat, and soft commodity futures. You should closely watch agricultural futures as trade agreements between BRICS countries reshape food supply dynamics.

BRICS Stock Markets: Emerging Opportunities

The influence of the BRICS stock market is growing as investors look beyond traditional Western markets. With the rising interest in BRICS-listed companies, stock exchanges in these countries are becoming major global investment hubs.

Due to this shift in economic power, new opportunities emerge for traders and investors like you who are looking to gain exposure to high-growth markets. Let’s check out some emerging opportunities:

i) Growth of BRICS Stock Exchanges

As mentioned above, the stock markets in the BRICS countries are gaining prominence. Several global investors are diversifying away from U.S. equities. Due to this shift, they have faced increased volatility.

The Shanghai Stock Exchange, India’s NSE, and Brazil’s B3 are now among the world’s largest exchanges. The BRICS economy is attracting foreign capital, with major funds reallocating assets to these emerging markets.

As geopolitical tensions rise, investments in BRICS-listed stocks are expected to grow.

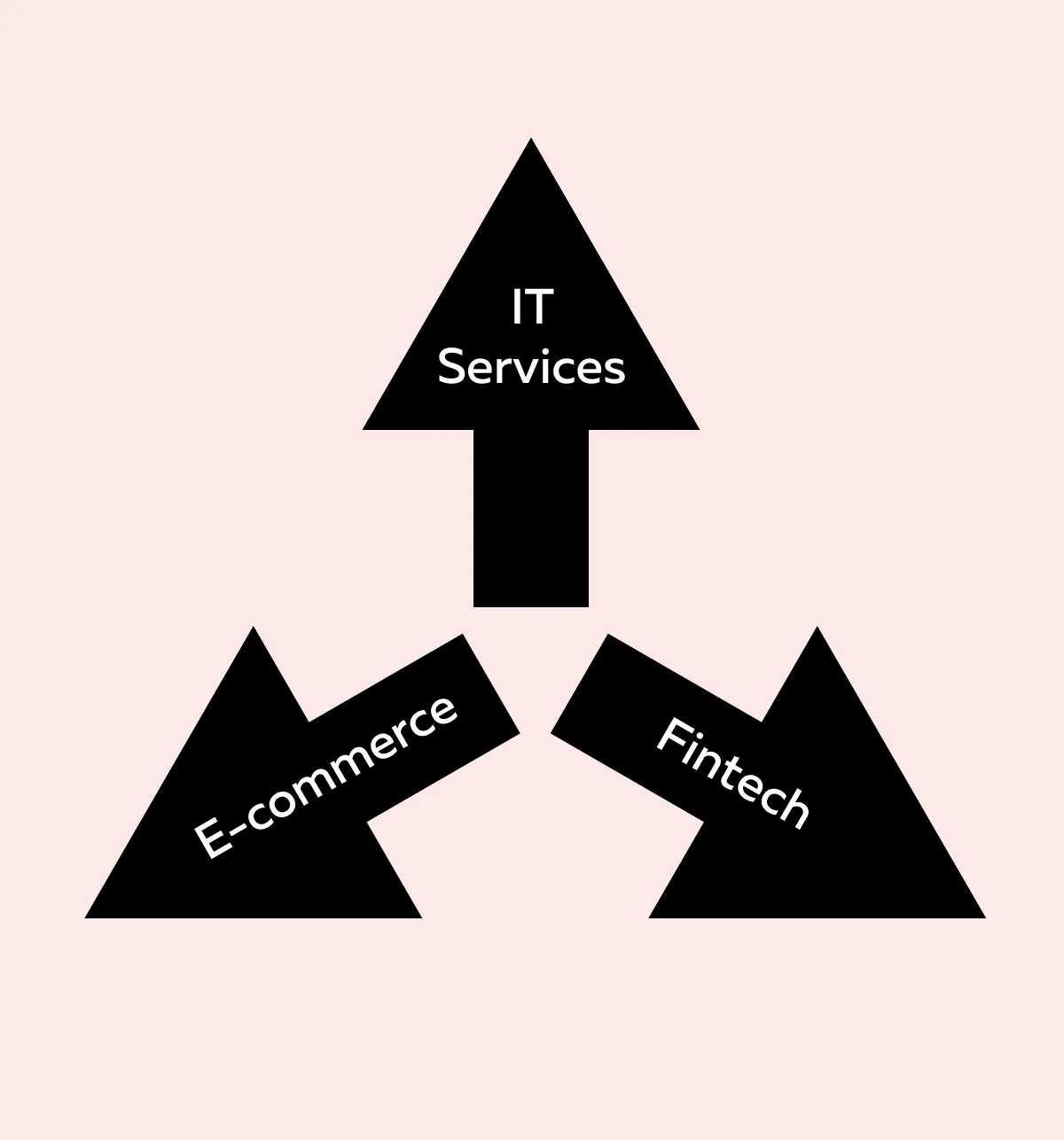

ii) Sector-Specific Stock Trends

The Chinese government’s stricter regulations on major tech firms have pushed investors to explore alternative markets. India’s booming technology sector is becoming a preferred investment destination. Check the graphic below to see which firms operating in which segments drive this growth:

iii) Russian Energy Stocks and Regional Investment

As Western sanctions limit access to Russian stocks, regional investors are increasing their holdings in Russian energy companies. Please note that Russia supplies oil and gas to the BRICS nations. Thus, its energy stocks could remain resilient despite restrictions.

Key BRICS ETFs & Index Futures to Watch

Several ETFs and index futures provide exposure to the BRICS economy:

- iShares MSCI Brazil ETF (EWZ): Tracks Brazilian equities. It offers exposure to Latin America’s largest economy.

- VanEck Russia ETF (RSX): If relisted, this ETF could provide opportunities in Russian stocks (particularly in energy and natural resources).

- India’s Nifty 50 Index Futures: It is a key indicator of India’s stock market. This index offers insights into the country’s rapid economic expansion.

Additionally, the correlation between the BRICS stock market influence and major U.S. indices like the S&P 500 and Nasdaq is becoming a critical factor in global investing. As the BRICS economy evolves, its impact on global equity markets will continue to grow.

Challenges & Risks in BRICS Investing

Investing in BRICS countries presents exciting opportunities but also comes with significant risks.

These challenges can significantly impact returns. Let’s understand them in detail:

1. Political Risks

Political instability and trade conflicts among BRICS countries can create uncertainty for investors. Sanctions on Russia have already restricted its access to global financial markets.

Additionally, trade disputes between India and China have raised concerns about long-term economic cooperation. In China, regulatory crackdowns on tech firms have made investors cautious.

2. Market Volatility

The BRICS stock market influence is growing. However, be aware that these markets are more volatile than developed ones. As an investor or trader, you can experience rapid price swings in these markets due to:

- Economic policies,

- Inflation, and

- External shocks.

Unlike mature markets like the U.S., BRICS exchanges often experience sharp rallies and downturns.

3. Currency Instability

Emerging market currencies are prone to large fluctuations. These fluctuations usually affect forex traders and multinational companies. Exchange rates in BRICS countries can also shift dramatically due to:

- Economic policies,

- Inflation, and

- Global capital flows.

Thus, if you are trading forex pairs like USD/CNY, USD/RUB, and BRL/USD, you must account for these fluctuations.

4. Regulatory Barriers

Each BRICS country has different rules for foreign investments. This creates barriers for international investors. For example, there are:

- Strict capital controls in China and

- Russia has several restrictions on foreign ownership.

Similarly, there are varying regulations in Brazil, India, and South Africa that can make direct investments challenging. With the influence of the BRICS stock market growing, you, as an investor, must deal with these regulatory hurdles to exploit the full potential of these emerging markets.

Conclusion

The BRICS countries are reshaping global trade, commodities, and financial markets. They are doing so through increasing economic cooperation and reducing reliance on the U.S. dollar. Their growing influence in energy, agriculture, and precious metals markets is shifting global supply chains. Additionally, BRICS’s trading impact is creating new opportunities in forex, stock markets, and commodity futures.

As an investor or trader, you must closely track macroeconomic trends within the BRICS economy. Specifically, you should look for policy changes, currency shifts, and trade agreements.

Stock markets in China, India, Brazil, and other BRICS nations are becoming more attractive, but they also come with risks like volatility and regulatory challenges. If you are looking to manage risk and identify profitable trades, you can start using Bookmap, our real-time liquidity tool. Using it, you can easily analyze market trends, spot price movements, and react quickly to volatility driven by the impact of BRICS trading.

As BRICS continues to shape the global economy, staying informed and using advanced trading technology will be key to making better investment decisions. See how BRICS-driven commodity trends affect your trades with Bookmap’s heatmap insights.