Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

January 11, 2025

SHARE

Crypto Bubbles: How to Spot and Protect Your Investments from the Next Crash

Cryptocurrencies rise like rockets and fall like meteors. If you are aware of the Bitcoin 2017 crash or maybe the 2021 Meme Coin Bubble Burst, you won’t deny this statement. Indeed, cryptocurrencies are complex and highly volatile. If you are less informed or do not have strong market skills, you will likely get caught in the infamous “crypto bubble”.

We have prepared this exclusive article to safely navigate you through crypto bubbles, equipping you with essential information and a fair understanding of their complex nature. The article will help you recognize the early signs of crypto bubbles and implement smart exit strategies. Here, we will explore key concepts such as rapid price increases, excessive media hype, and the role of market sentiment. Also, traders will learn how to spot potential bubbles before they burst.

Moreover, we will cover several real-life examples of famous bubbles, like Bitcoin’s 2017 surge and the ICO craze, to understand past market behavior. Additionally, we will introduce our advanced market analysis tool, Bookmap, and explain how you can use it to visualize market data and spot bubble peaks easily. Let’s get started.

What is a Crypto Bubble?

Firstly, let’s understand a “market bubble”. A bubble forms in financial markets when the price of an asset rapidly inflates beyond its real value, usually due to intense speculation. When this happens with cryptocurrencies, it is known as a “crypto bubble”.

In this bubble, the prices of cryptos are driven by excitement and hype. Both these factors push the prices far above their actual worth. During the formation of this bubble, investors keep buying the cryptos, expecting prices to rise indefinitely. However, once enthusiasm cools or reality sets in, prices crash dramatically. Cryptocurrencies, being new and often misunderstood, are more prone to such speculative bubbles. Understand this better through the graphic below:

Stay abreast of market trends and avoid costly crashes. Our market visualization tools at Bookmap can help you deal with volatile crypto markets. Join now!

A classic example of this was observed in 2017 when Bitcoin experienced a bubble. Let’s see how:

- In 2017, Bitcoin’s price surged from around $1,000 in January to nearly $20,000 by December. This was driven largely by speculation and media hype.

- Many new investors entered the market.

- They expected continuous price increases.

- However, the crypto bubble burst in 2018.

- As a result, Bitcoin’s price dropped sharply to around $3,000.

Here, investors can observe that this dramatic rise and fall shows the volatility and speculative nature of crypto markets.

What is the role of market sentiment in crypto bubbles?

Market sentiment significantly impacts crypto markets. While cryptocurrencies are innovative, their prices do not always reflect their long-term utility. As a result, investors sometimes confuse speculative hype with real value.

It must be noted that when sentiment is overly optimistic, prices rise rapidly, but they can collapse just as quickly when doubts emerge. Therefore, investors must recognize the difference between:

- Real technological value

and

- Speculative buying.

Concerned about market bubbles? Use our heatmap and order flow tools at Bookmap. Identify key liquidity zones before the bubble bursts.

Signs of a Crypto Bubble

One of the first signs of a bubble is a rapid rise in the price of a cryptocurrency. Usually, this rapid price increase happens without any improvement in its underlying value or utility. This means the price increase is not driven by the actual development or usage of the cryptocurrency but by speculation.

For example,

- Say a coin’s price doubles in a short time.

- However, there are no major technological updates or new partnerships.

- Now, this signals that the market is overhyped and inflated.

Apart from this, you must also consider these two signs while checking for hype:

Excessive Media Hype and FOMO

Widespread media coverage often fuels a bubble. This happens as news outlets highlight skyrocketing prices, creating a “fear of missing out” (FOMO). Consequently, people rush to buy cryptocurrency, fearing they will miss potential gains. As more people enter the market, the price rises even further, leading to more hype.

Now, this again is a clear sign of a crypto bubble, as this price surge is happening without careful analysis of the coin’s actual value. To better understand, study the 2021 Meme Coin Bubble example:

- In 2021, meme coins like Dogecoin and Shiba Inu saw massive price increases.

- This surge happened not because of their utility but due to social media hype and celebrity endorsements.

- Dogecoin, originally a joke, surged thanks to attention from figures like Elon Musk.

- Similarly, Shiba Inu gained momentum through online communities. B

- Both coins rose rapidly.

- There were no technological improvements or any other genuine cause for this price surge.

- This case shows a classic speculative bubble.

Emotional Decisions by Novice Investors

Novice investors often chase quick gains during a bubble. Most of their trading decisions are driven by emotions rather than logic. They see others making profits and simply jump in, hoping for similar success. However, they must understand that emotional decisions often lead to buying at inflated prices, pushing prices even higher. When the bubble bursts later, these investors face heavy losses because they bought based on hype and not based on the actual value of the cryptocurrency. Want to track market sentiment in real time? Use our sentiment analysis tools at Bookmap to gauge market hype before it’s too late.

How to Protect Your Investments During a Crypto Bubble

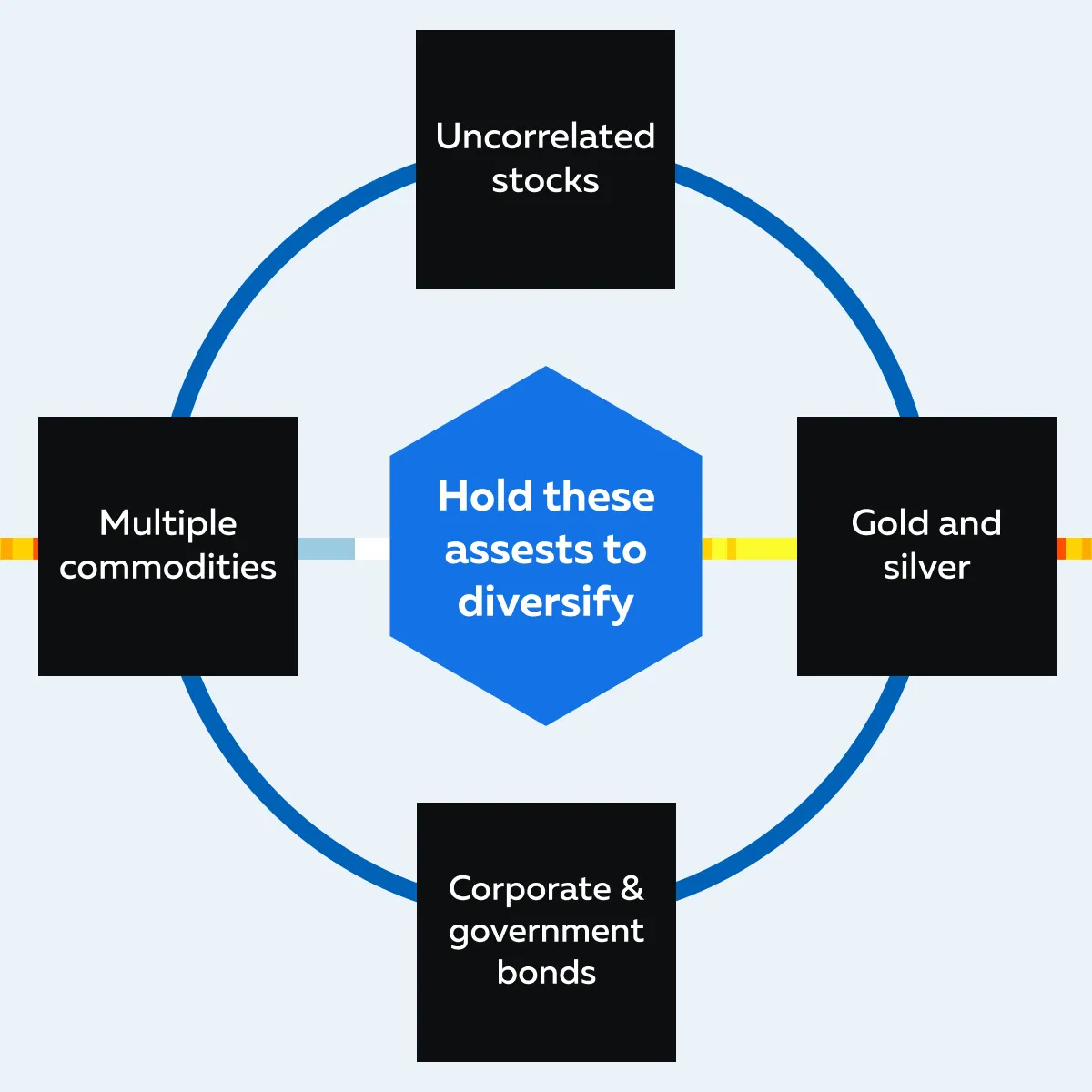

One of the most effective ways to protect your investments during a crypto bubble is by “diversifying your portfolio”. This means not putting all your money into one cryptocurrency but spreading it across different assets. By investing in multiple cryptocurrencies and other asset classes like stocks, bonds, or commodities (e.g., gold), you minimize your risk. Now, if one asset crashes, your other investments may hold their value. This reduces the overall impact on your portfolio. For more clarity, see the graphic below:

Moreover, be aware that in the case of a “crypto bubble bursting,” you should ideally invest in non-crypto assets. This strategy will prevent you from incurring significant losses, as other markets might not be affected in the same way.

Apart from diversification, you can also follow these steps:

A) Use Stop-Loss Orders to Limit Losses

A stop-loss order is a pre-set instruction that lets traders sell their cryptocurrency if its price falls to a certain level. It helps traders avoid massive losses in case the market drops suddenly. For example,

- Say you own Bitcoin, and its price is $50,000.

- Considering market volatility, you fear that Bitcoin’s value will drop.

- You set a stop-loss order at $45,000 (10% below the current price).

- Now, if Bitcoin’s value drops to $45,000, the order will automatically sell your Bitcoin.

- This prevents you from holding on during a steep crash that usually takes the price even lower.

- This way, you are saved from greater losses.

B) Balancing Emotion with Strategy

Investors often fall into “emotional traps” during a bubble. Check the graphic below to learn about the two most common types of emotional traps:

Now, when you use strategies like diversification and stop-loss orders, you remove much of the emotional aspect from trading. You rely more on strategic planning and less on gut feelings or market hype. This is particularly useful in:

- Avoiding panic selling

or

- Holding on too long during a downturn.

C) Hedge with Deribit Options

Deribit is a popular platform for cryptocurrency derivatives. It specializes in futures and options trading. It must be noted that “options trading” is a powerful strategy during a crypto bubble, as it allows traders to hedge against potential losses. For the unaware, a hedge is a risk-management strategy that offsets losses in one investment by taking an opposite position.

With Deribit, traders can use options to protect their portfolio from significant price swings, whether they expect prices to rise or fall. For more clarity, let’s study an example showing how to use put options to hedge:

- Say a trader suspects that a crypto bubble is about to burst and Bitcoin’s price may drop.

- Instead of selling their Bitcoin immediately, they buy a put option on Bitcoin through Deribit.

- A put option grants the trader the right to sell Bitcoin at a specified price.

- If Bitcoin’s price falls as predicted, the trader can either:

- Sell the option for a profit

or

- Use it to sell Bitcoin at a higher price than the market offers.

- This way, they profit from the drop while protecting their holdings.

D) Use Bookmap to Enhance Decision-Making

To protect their investments during a crypto bubble, traders can also use our advanced market analysis tool, Bookmap. It connects with Deribit and allows traders to visualize market data and order flow.

Using Bookmap, traders can get “real-time information” on where large buy and sell orders are placed. This information helps decide when to enter or exit their options trades. Moreover, this kind of insight is especially useful in volatile markets, as it gives a clearer picture of market sentiment.

Using Market Data to Spot Bubble Peaks

A bubble peak is the highest point of a cryptocurrency’s price. This point is reached during a speculative bubble. It occurs just before a market crash, when prices stop rising and instead start dropping rapidly. Traders and investors should spot bubble peaks, which can be easily done using “market data” in two different ways:

| Way I: Track Liquidity with Real-Time Data | Way II: Spot Imbalances in Buy and Sell Orders |

|

|

Monitor your investments with Bookmap’s real-time data and heatmaps to spot market shifts before a bubble bursts. Join Bookmap Today!

Strategies for Exiting a Crypto Bubble

One of the most important strategies for exiting a crypto bubble is to take profits gradually as prices rise. Instead of trying to time the market and sell everything at the peak, it is always smarter to sell portions of your holdings over time. This ensures you lock in profits and reduce risk, even if the bubble bursts unexpectedly. By selling in increments, you also avoid the emotional rollercoaster of trying to predict the exact moment the market will reverse. Let’s understand better through an example where a trader sold their holdings in batches:

- Say a trader bought Bitcoin at $10,000.

- As the price rose to $15,000, they sold 25% of their Bitcoin holdings.

- Further, when the Bitcoin surged to $22,000, they sold 50% of their holdings.

- Finally, when the prices reached the bubble peak, they sold the remaining 25%.

In this way, the trader kept on locking some profit while still being exposed to further price increases. When the price continued to rise, they kept selling more portions. This gradual approach ensures that they don’t miss out on potential gains but also avoid holding too much if the market suddenly crashes.

Now, just to realize the importance of batch selling, let’s read a real-life example related to the 2018 crash:

- During the 2018 crash, many traders ignored early warning signs.

- They held onto their crypto positions as prices plummeted.

- Bitcoin had risen to nearly $20,000 in 2017.

- But by late 2018, it had dropped to around $3,000.

- Traders who didn’t take profits during the run-up and held onto their investments faced significant losses.

Readers must observe that this example clearly highlights the risks of not exiting a bubble in time. In the above case, many were swayed by FOMO (fear of missing out) and thought prices would keep rising indefinitely. However, when the bubble burst, they were left with heavy losses.

Timing the Market Is Impossible

Furthermore, please note that it is nearly impossible to time the market perfectly. This challenge becomes even harder when timing a volatile market like cryptocurrency. That’s because prices can fluctuate dramatically in short periods. Therefore, waiting for the “top” of a bubble is a highly risky strategy, and ideally, traders should keep taking profits at various stages.

This approach reduces the exposure to sharp declines and ensures that traders have secured gains, even if the market turns against them unexpectedly. Ready to implement better exit strategies? Try Bookmap’s trading tools to monitor liquidity and track market sentiment. Join us today!

Famous Crypto Bubbles: A Look at Past Examples

For a greater understanding of the concept of crypto bubbles, let’s have a look at some past examples:

Example I: Bitcoin’s 2017 Bubble

In 2017, Bitcoin experienced one of the most famous bubbles in cryptocurrency history. Its price skyrocketed from around $1,000 in early 2017 to nearly $20,000 by December. This price surge was driven largely by FOMO and media hype. Many new investors flooded the market, and they expected that prices would keep rising indefinitely. However, the bubble burst in early 2018. Interestingly, by the end of the year, Bitcoin had plummeted to around $3,000.

This rapid rise and fall shows how speculative the market can be. In the instant scenario, many who entered late suffered significant losses. Here, investors and traders must note that this bubble was largely fueled by “over-enthusiasm”. Traders hardly considered Bitcoin’s actual value or use cases at the time.

Example II: The ICO Bubble (2018)

The Initial Coin Offering (ICO) craze of 2017 and 2018 was another significant bubble in the crypto space. During this time, countless new cryptocurrencies were launched via ICOs. These new and lesser-known cryptos even raised billions of dollars from investors. Many of these projects were based on little more than whitepapers and promises. Very few of them had actual products or working platforms.

As a result, when the market sentiment shifted, most of these ICOs collapsed. This caused a market-wide crash.

Moreover, many ICOs during this period had wildly inflated valuations. They were not offering any real product or service. For example,

- Some tokens reached billion-dollar market caps.

- This happened purely on hype, as they had no working technology behind them.

- When investors started realizing that many of these projects would not deliver on their promises, the market crashed.

- Investors who did not exit early faced significant losses.

- Eventually, a majority of ICO tokens lost almost all of their value within a short period.

Conclusion

Be aware that recognizing a crypto bubble early and taking timely action is key to protecting your investments. That’s because bubbles are often driven by hype and speculation. Their only goal is to inflate prices far beyond their real value. While it’s tempting to ride the wave and wait for maximum gains, waiting too long can also lead to significant losses when the bubble bursts.

Therefore, both investors and traders must stay alert. They should identify and respond to warning signs like:

- Rapid price increases,

- Excessive media hype, and

- Shifts in buy and sell orders.

Moreover, they should exit gradually rather than trying to time the perfect peak. This approach helps lock in profits and reduce risk. Additionally, they must utilize tools like stop-loss orders to limit potential losses.

Lastly, we would state that it is also important to stay informed about market conditions and sentiment. Advanced market analysis tools like Bookmap can really help you in this regard. Using it, you can analyze real-time data and see liquidity visualizations. The information so obtained can help you easily spot market shifts and make better exit decisions before the bubble collapses. Want to protect your investments during the next crypto bubble? Try our advanced trading tools at Bookmap and monitor market trends in real-time.