Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 22, 2024

SHARE

Dark Pools and Dark Pool Transactions: What Traders Need to Know

Ever wondered how big trades happen without making headlines? Thank Dark Pools! These are special places where institutional investors buy and sell large amounts of stock in secret.

But how does it impact me? On the downside, dark pool transactions primarily affect retail traders. What you see might not be a true reflection of the market!

To learn more, read this article, where we will break down what dark pools are and why they matter to traders like you. You’ll learn about the different types of dark pools, how they work, and the pros and cons of hidden transactions. Then, we will see some real-life examples, like the GameStop short squeeze, to show you how dark pools can influence the market.

You’ll also discover how dark pool activity affects retail traders and often leaves them in the dark about real supply and demand. But don’t worry! We will also explain ways to monitor these hidden trades using our tools like Bookmap, helping you spot potential market movements before they happen. Let’s begin.

What Are Dark Pools?

Dark pools are private exchanges that allow large-volume transactions outside public stock markets. These platforms are specifically designed for institutional investors (such as hedge funds and pension funds) so that they can conduct trades without revealing the details to the public.

If large trades were made on public exchanges, they could move the stock price unfavorably. Therefore, by using dark pools, these investors buy or sell shares discreetly, ensuring they don’t distort the market. Want to learn more? Check out our blog post, ‘What Are Dark Pools?’ for detailed information.

Are Dark Pool Transactions Executed Over-the-Counter (OTC)?

Yes, dark pool transactions are over-the-counter (OTC) trades. This means they occur outside traditional stock exchanges. Dark pools allow large investors to trade without public visibility. This keeps their actions hidden from the general market. These OTC platforms are mostly used for stock trading, allowing institutions to trade discreetly without impacting stock prices.

What are the Different Types of Dark Pools?

Dark pools can be categorized into three main types:

Stay ahead of market moves by understanding dark pool transactions. Join Bookmap now!

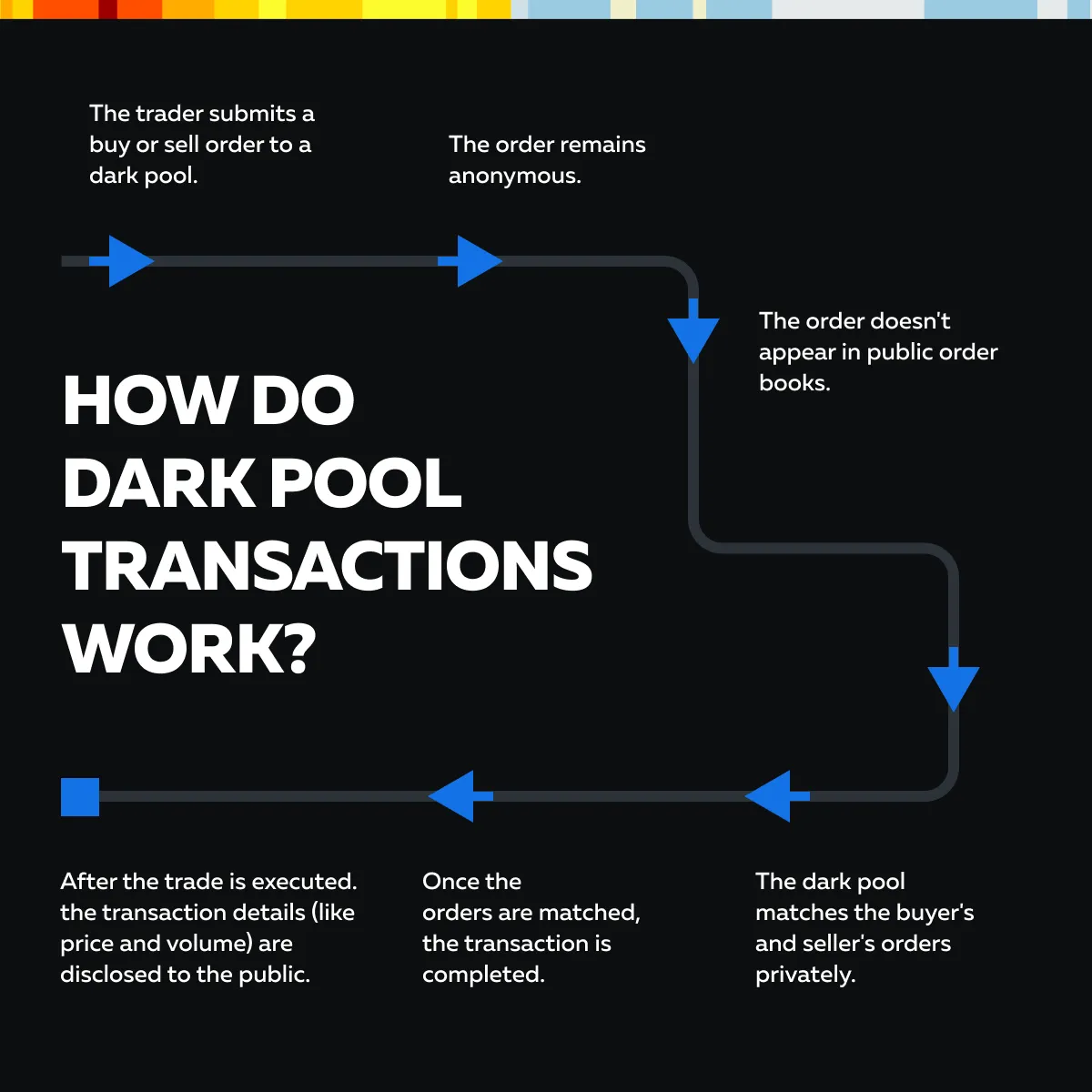

How Do Dark Pool Transactions Work?

To execute dark pool transactions, traders place orders that keep both the buyer and seller anonymous. An order placed in a dark pool is not visible in the public order book. The trade only becomes public after the transaction is executed. This provides privacy and minimizes the chance of influencing the stock’s price. For more clarity, understand the process through the graphic below:

What are the Pros of Dark Pools?

One of the biggest advantages of dark pools is that they allow institutional investors to “avoid price slippage”. For those unaware, price slippage occurs when large trades on public exchanges shift the stock price. If a big order is placed publicly, it can cause the price to rise (for buys) or fall (for sells). This makes it more expensive or less profitable for the investor, respectively.

In a dark pool, since the order remains hidden, large trades can be executed without influencing the stock’s market price. This allows investors to get a better deal. With this anonymity, investors can execute large-volume transactions discreetly without moving the market or signaling their intentions.

What are the Cons of Dark Pools?

On the negative side, dark pools “reduce market transparency”. They obscure the true supply and demand of a stock. This lack of visibility makes price discovery less efficient and leaves everyday traders with less information to make informed decisions. Hence, we can state that dark pools contribute to a less transparent and balanced market for retail investors.

Track market transparency with real-time insights on dark pool activity. Sign up for Bookmap today!

Example: Dark Pool Transactions During Market Volatility

Let’s check out how dark pools come into play during market volatility. To explain better, we will use the GameStop short squeeze as an example:

The Background

During the GameStop short squeeze in early 2021, GameStop’s stock price soared dramatically. This happened because retail investors collectively bought shares, which caused a massive surge in its value. This volatility created a challenging environment for institutional investors who needed to manage their large positions in the stock.

Institutional Investors Use Dark Pools

To manage their holdings and reduce risks, institutional investors used dark pools to sell their shares. If they tried to sell these large amounts of stock on public exchanges, their actions could have driven the price even higher which could have further exacerbated the volatility.

It’s important to note that dark pools operate differently from traditional stock exchanges, where data on bids, offers, and trades is public. The dark pool transactions are not shown on the public order books, so other investors cannot see:

- The size of these trades

and

- The timing of these trades.

This helped prevent the stock price from spiking further due to large public sell orders.

Resulting Market Effects

By using dark pools, institutional investors protected themselves from further market impact. But, it also meant that the true supply and demand dynamics of GameStop stock were obscured from the public. This made it tough for retail investors to get a clear picture of the market’s actual condition. Without seeing these large trades, they might not fully understand how much buying or selling pressure exists for a particular stock.

Also, this lack of transparency makes it harder for them to assess:

- True market demand,

- The real supply, and

- The genuine price trends.

Such a situation puts them at a disadvantage compared to institutional investors.

How Do Dark Pools Affect Retail Traders?

As mentioned above, dark pools are designed to let large players execute big trades without causing market disruptions or price swings. These trades don’t appear in public order books, which creates several disadvantages for retail traders. Let’s check them out:

- Lack of Transparency

Dark pools shield large trades from public view. Retail traders cannot see these activities until after they’re completed; hence, they miss out on crucial signals, like large buy or sell orders. Under normal circumstances, these signals would have influenced their trading decisions.

- Delayed Information

Retail traders only become aware of these trades when market reports reveal large volumes. This causes price changes that seem “sudden” or “unexplainable”. This lag in information puts retail traders at a disadvantage in understanding real-time market position.

- Skewed market perception

Since dark pools hide transactions, the amount of liquidity visible to the public appears smaller than it actually is. Retail traders looking at a stock’s order book might assume there’s less buying or selling interest than there really is.

- False signals

Let’s understand this point through an example. Say a retail trader believes there is a low demand for a stock based on public data. However, at the same time, institutional investors were trading significant volumes in dark pools. Now, this creates a misleading picture of supply and demand and makes it harder for retail traders to make informed decisions.

Discover how dark pools influence market trends using advanced trading tools. Get started with Bookmap here!

How to Monitor Dark Pool Activity?

Dark pool trades are private and hide large trades from the public order books. This makes them difficult for traders to monitor in real-time. It must be noted that dark pools operate differently from traditional stock exchanges, where data on bids, offers, and trades is public. Dark pools don’t report transactions until the trade is completed.

However, still there are ways for traders to gather information and spot dark pool activity. This can be done using specialized tools and reports. Let’s understand in detail:

FINRA’s Trade Reporting and Compliance Engine (TRACE)

TRACE provides post-trade transparency by reporting large transactions, particularly in corporate bonds and other securities. However, for equities, there are similar platforms that offer insights into off-exchange trades.

Dark pool data providers aggregate this information and offer retail traders a way to see large transactions that occurred in the background. While not real-time, these reports can still give an idea of:

- The volume of institutional trading

and

- It likely impacts on price movements.

Bookmap and MBBO Data

Bookmap is our advanced market analysis tool. It offers real-time market visualization and allows traders to see the liquidity heatmap and order flow.

MBBO (Market Best Bid and Offer) data in Bookmap shows the best bid (the highest price buyers are willing to pay) and the best offer (the lowest price sellers are willing to accept) across various exchanges and dark pools. Even though dark pool trades are not visible in real-time, using Bookmap, traders can still “notice changes” in the market that might suggest a dark pool transaction has taken place. For example, they might see sudden shifts in the order flow, such as:

- Unusual increases in buying or selling activity

or

- Price movements that indicate a large trade occurred.

These signs often hint that a significant transaction in a dark pool has impacted the overall market, even if the details of the trade aren’t publicly disclosed.

How to Spot Dark Pool Activity Using Bookmap?

Let’s understand the two primary ways:

| Way I: Spot Sudden Liquidity Shifts | Way II: Visualize Through Liquidity Heatmap |

|

|

Conclusion

Dark pools are private exchanges. They allow institutional investors to execute large trades without revealing their intentions to the public. This hidden trading significantly impacts stock prices and market transparency. Dark pools not only help large players avoid price slippage but also reduce visibility for everyday traders. For them, it becomes harder to gauge real demand and supply. Also, this means less information to base decisions on and greater difficulty in understanding market movements.

However, by using our Bookmap, traders can easily detect dark pool activities by monitoring unusual market behavior. For this purpose, Bookmap offers several modern features like MBBO data analysis, order flow analysis, liquidity heatmaps, and much more. Don’t be a victim! Join our trading platform Bookmap today and optimize your trading like never before.