Ready to see the market clearly?

Sign up now and make smarter trades today

News & Announcements

May 5, 2025

SHARE

Emerging Markets Rally as U.S. Rate Cuts Loom: What Traders Need to Know

When the Fed sneezes, emerging markets either catch a cold or sprint ahead. The U.S. Federal Reserve is considering rate cuts in 2025, and most investors are closely watching how emerging markets will react.

Historically, it has been observed that lower U.S. interest rates weakened the dollar and boosted capital inflows. It made emerging market stocks and bonds more attractive. But the story is not that simple! That’s because currency volatility, geopolitical risks, and shifting investor sentiment all play a role.

Want to learn how? In this article, we’ll explore why emerging markets benefit from U.S. rate cuts, identify key emerging markets poised for growth, discuss effective trading strategies, and show you how to use our avant-garde tool, Bookmap, for order flow analysis. Additionally, we will see potential risks you can face (like currency fluctuations and unexpected Fed policy reversals). Read till the end to spot the best emerging market investments in 2025.

Why Emerging Markets Benefit from U.S. Rate Cuts

When the U.S. Federal Reserve cuts interest rates, it has a significant impact on global financial markets. The relationship between U.S. monetary policy and emerging economies is primarily driven by:

- Capital flows,

- Currency movements, and

- Relative yield differentials.

Let’s understand in detail:

Capital Flows Shift Towards Higher-Yielding Emerging Markets

When the Fed cuts rates, borrowing costs in the U.S. decline. As a result, U.S. Treasury yields drop. This makes them less attractive to global investors. Be aware that emerging markets often offer higher-yielding bonds and equities. This attracts most investors, and they shift their capital to these markets in search of better returns.

For example:

- Suppose the U.S. 10-year Treasury yield drops from 4% to 3% following a rate cut.

- An emerging market bond might offer an 8% yield in comparison.

- Investors (especially institutional funds and hedge funds) redirect capital toward emerging market bonds.

- They do so to capitalize on the higher yields.

This influx of foreign capital increases liquidity in emerging markets. As a result, the price of assets increases in those countries.

A Weaker U.S. Dollar Boosts Emerging Market Assets

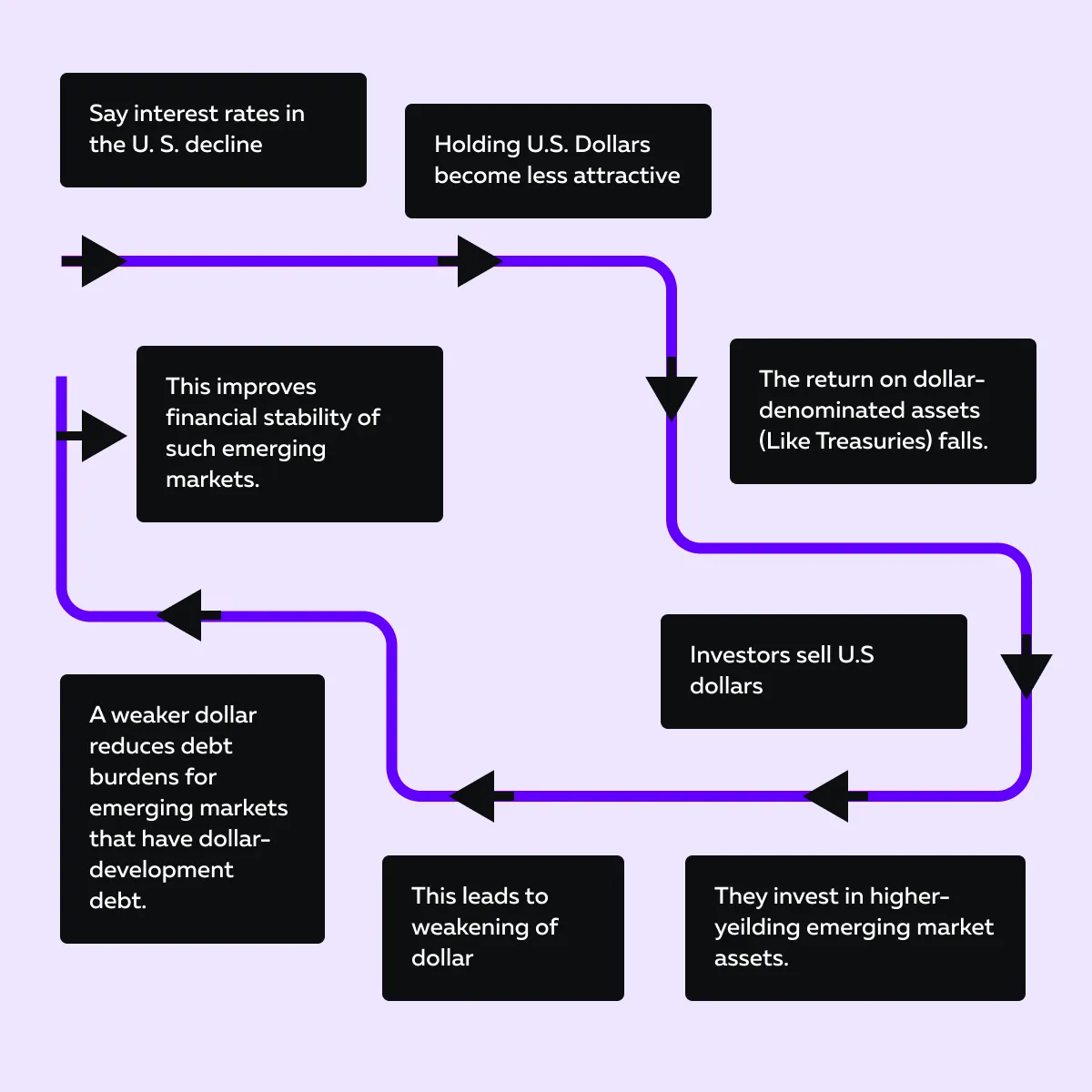

Historically, U.S. rate cuts have led to dollar depreciation. Check the graphic below to learn why:

For example:

- Say an emerging market country (such as Brazil or Indonesia) has significant U.S. Dollar-denominated debt.

- If the U.S. Dollar weakens, the relative cost of repaying this debt declines.

- That’s because it takes fewer local currency units to buy the required dollars.

- This eases financial pressure and improves the creditworthiness of emerging market governments and corporations.

- This makes them more attractive to investors.

A Rising Demand for Emerging Market Stocks

With higher capital inflows and a weaker U.S. Dollar, trading emerging market stocks becomes an attractive opportunity. More capital in emerging markets means companies have better access to financing. This allows for expansion and growth.

Historically, emerging market equities have outperformed during U.S. rate-cut cycles. This happens as risk appetite increases and global investors look for growth opportunities outside of the U.S.

Key Sectors That Benefit

- Financials: Banks benefit from increased credit demand.

- Commodities and Energy: A weaker dollar pushes up commodity prices. This benefits commodity-exporting emerging markets (like Brazil and South Africa).

- Technology and Consumer Goods: Increased liquidity leads to growth in emerging economies. This benefits sectors driven by domestic demand.

Cheaper Debt for Emerging Market Economies

U.S. rate cuts lead to a reduction in debt servicing costs for countries that borrow in U.S. Dollars. Since many emerging market economies rely on dollar-denominated debt, a lower U.S. interest rate environment provides financial relief. Let’s understand in detail:

a) Lower Interest Rates Reduce Emerging Market Debt Burden

Many developing nations issue bonds or take loans denominated in U.S. Dollars. When the Federal Reserve cuts interest rates:

- The cost of servicing these loans declines.

- This eases pressure on government budgets and corporate balance sheets.

- Also, investors are willing to lend at lower rates.

- This reduces borrowing costs for new debt issuance.

For example:

- Suppose Brazil has $200 billion in U.S. Dollar-denominated debt.

- If U.S. interest rates fall, the interest payments on this debt become cheaper.

- This happens because refinancing becomes more affordable.

- This allows Brazil to redirect resources toward:

- Infrastructure,

- Healthcare, and

- Economic stimulus.

- They save money that would otherwise be spent on debt repayments.

b) Countries with High U.S. Dollar Debt Benefit the Most

Some emerging markets (especially those with significant external debt positions) experience economic relief when U.S. rates fall. A few key beneficiaries are:

- Brazil: High levels of corporate and government debt in U.S. Dollars make it sensitive to interest rate shifts.

- Turkey: It is a nation with significant foreign currency-denominated debt. Lower U.S. rates ease financial pressure on its economy.

- Indonesia and South Africa: These economies benefit from cheaper refinancing and improved investment inflows.

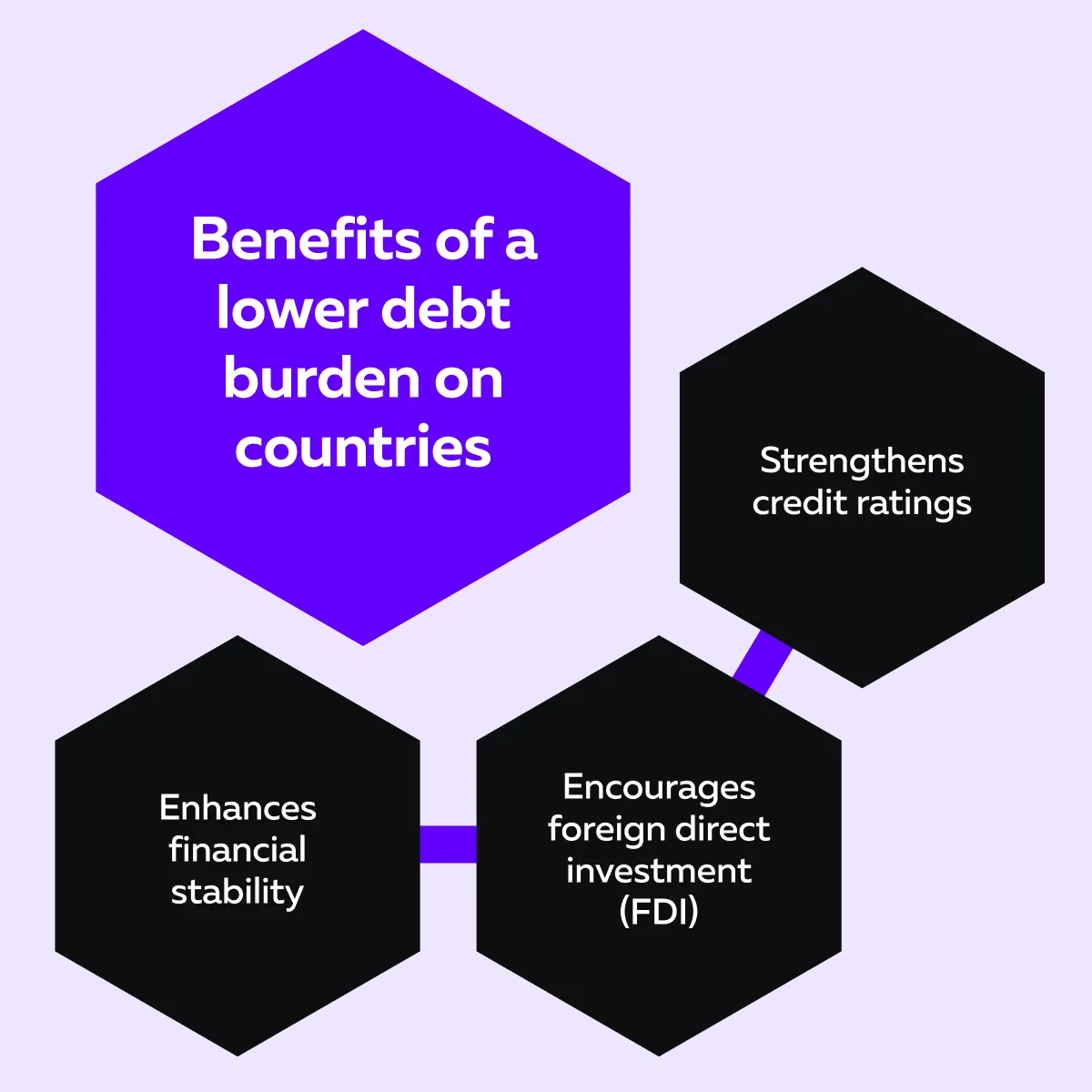

See the graphic below to understand how a lower debt burden helps countries:

Lower Borrowing Costs Lead to Economic Growth

When emerging markets face lower debt servicing costs, both governments and corporations have more financial flexibility. This often leads to:

- Increased public spending on infrastructure, social programs, and economic stimulus.

- Greater corporate investment leads to expansion, hiring, and innovation.

- Higher consumer confidence (as lower interest rates also reduce the cost of loans for businesses and individuals).

Key Emerging Markets Poised for Growth

U.S. rate cuts impact global capital flows. However, certain emerging market investment opportunities stand out. Let’s check them out:

Latin America: Commodity-Driven Growth

Latin American economies, especially Brazil, Chile, and Mexico, are heavily reliant on commodity exports such as:

- Oil,

- Copper,

- Soybeans, and

- Iron ore.

A lower U.S. interest rate environment supports these economies in several ways:

| Weaker U.S. Dollar | Increased foreign capital inflows | Easing financial conditions |

| Commodities are priced in dollars, so when the dollar declines, commodity prices usually rise. This boosts export revenues. | Lower U.S. yields push investors toward high-yielding Latin American assets. This includes government bonds and equities. | With cheaper debt servicing, governments and businesses have more room for investment and economic expansion. |

Brazil Becomes a Top Investment Destination

Brazil stands out among emerging markets in 2025. Study the table below:

| Factors | Impact |

| High real interest rates (even after local rate cuts). | Attracts yield-seeking investors. |

| Stable economic policies under the current administration. | Improves investor confidence. |

| Strong exports of agricultural and mineral commodities. | Increase in exports driven by a weaker U.S. dollar. |

As a trader or investor, you can find investment opportunities in the following indices:

- Bovespa Index: Brazil’s main stock exchange. It includes top companies in finance, energy, and consumer goods.

- iShares MSCI Brazil ETF (EWZ): A popular way for investors to gain exposure to Brazilian equities.

Chile & Mexico Act as Additional Growth Markets

Chile is a major copper exporter. It benefits from the increasing global demand for metals, which has especially increased due to the expansion of EV batteries and renewable energy infrastructure.

Additionally, Mexico is a country near the U.S. It has a growing manufacturing sector. Mexico is a key player in supply chain shifts as companies look for alternatives to China.

Southeast Asia: Manufacturing and Tech Expansion

The impact of the U.S. rate cuts extends beyond Latin America and to Southeast Asia. Lower U.S. rates:

- Encourage Foreign Direct Investment (FDI)

and

- Increase capital inflows into emerging markets such as Vietnam, Indonesia, and Thailand.

But why does this happen? Let’s study the key reasons for this trend:

|

|

|

Get ahead of global market trends with Bookmap’s advanced order flow analytics.

Vietnam Has Become a Rising Global Tech Hub

Vietnam is a key player in electronics and semiconductor manufacturing. It attracts major companies like Apple, Samsung, and Intel. U.S. rate cuts make it cheaper for multinational companies to invest in Vietnam’s supply chain. As an investor, you can look for:

- VN Index: Vietnam’s benchmark stock index. It features top industrial and tech firms.

- VanEck Vietnam ETF (VNM): It is a way to gain exposure to Vietnam’s stock market.

Indonesia and Thailand Benefit from Supply Chain and Infrastructure Gains

Indonesia is benefiting from EV battery production and nickel mining, both of which are crucial to the green energy transition. Additionally, Thailand remains a major player in automotive manufacturing and tourism, both of which gain from improved economic conditions.

India and China: The Diverging Paths

India and China present two very different narratives. While India is gaining momentum as a top destination for foreign investment, China faces headwinds due to regulatory uncertainties and slower economic growth. Let’s understand in detail:

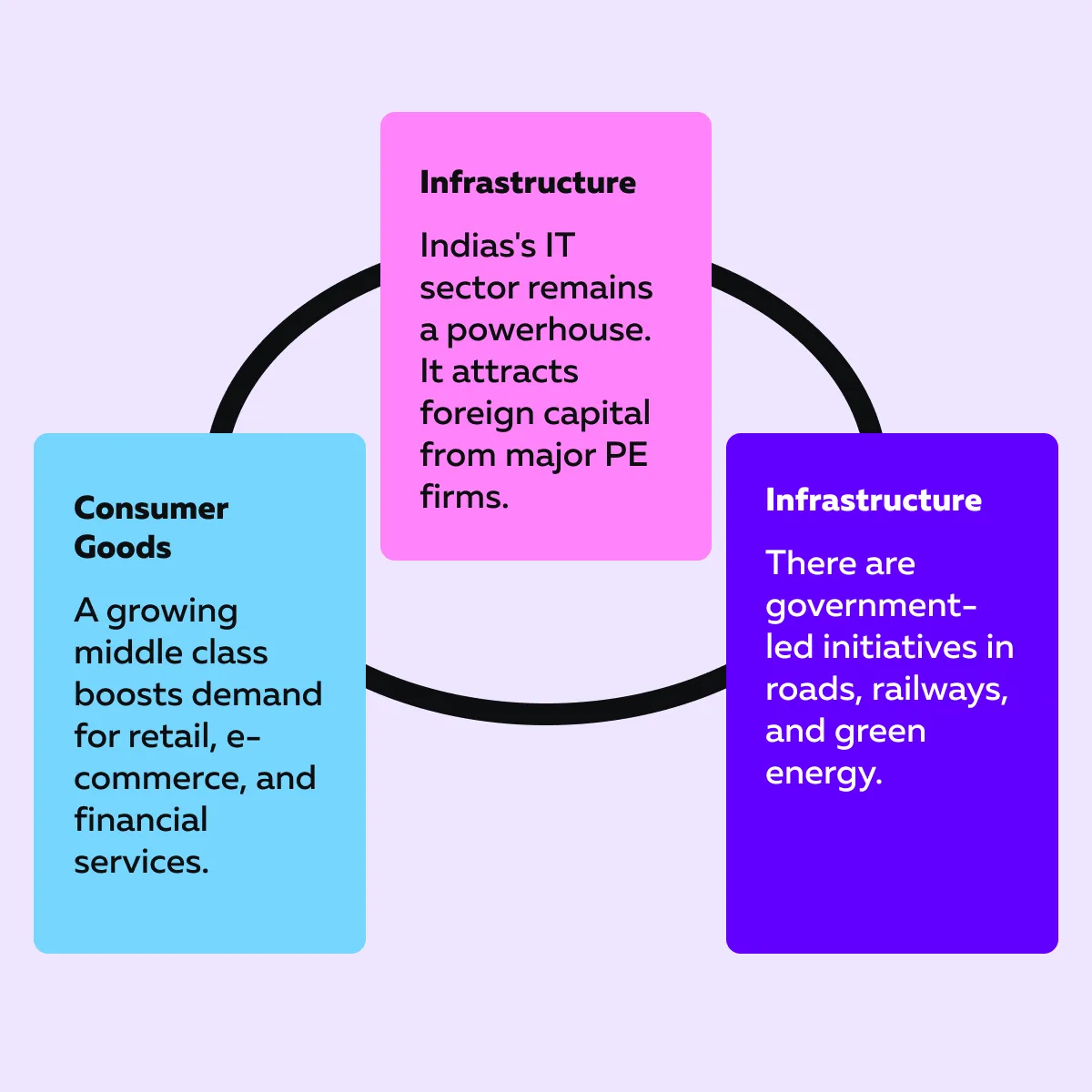

India is a Leading Emerging Market Investment Destination

India is one of the fastest-growing economies, benefiting from:

- Strong GDP growth (expected to remain above 6%),

- Manufacturing expansion as global companies diversify away from China (China+1 strategy), and

- Rising foreign inflows into tech, infrastructure, and industrial sectors.

Check out the graphic below to learn about some key sectors gaining investor interest:

As an investor, you can look for:

- Nifty 50 Index: India’s benchmark index. It includes top blue-chip companies.

- iShares MSCI India ETF (INDA): Use this to gain exposure to Indian equities.

China Represents Cautious Optimism Amid Policy Uncertainty

China remains a major global economy. However, investors are cautious due to:

- Regulatory risks in the tech and real estate sectors,

- Slowing economic growth as it impacts consumer spending and business expansion, and

- Geopolitical tensions that affect investor sentiment.

However, it is expected that government stimulus could improve sentiment. The Chinese government has been rolling out monetary easing policies and stimulus efforts. This includes:

- Lower interest rates to boost lending,

- Infrastructure spending to support economic growth, and

- Relaxation of regulatory pressures on key industries like tech and real estate.

As an investor, you can look for:

- Hang Seng Tech Index: This index includes major Chinese tech firms like Alibaba and Tencent.

- iShares MSCI China ETF (MCHI): You can use this ETF to gain broad exposure to China’s stock market.

Monitor capital flows into emerging markets with Bookmap’s liquidity and order flow tools.

Trading Emerging Market Stocks and ETFs

Investors looking to capitalize on the impact of U.S. rate cuts have multiple options. While individual stock selection can offer high returns, ETFs provide diversified exposure with lower risk. Let’s gain more clarity:

ETFs for Emerging Market Exposure

For traders who want exposure to emerging markets in 2025 without picking individual stocks, exchange-traded funds (ETFs) are a great option. These ETFs track broad or country-specific emerging market indices. They benefit from capital inflows driven by lower U.S. rates. Have a look at their various types:

1. Broad Emerging Market ETFs

These ETFs cover multiple emerging economies and sectors. They offer a balanced exposure. Let’s check out some popular options:

- iShares MSCI Emerging Markets ETF (EEM): Tracks large and mid-cap stocks across various emerging markets.

- Vanguard FTSE Emerging Markets ETF (VWO): A low-cost alternative that provides diversified exposure to emerging market equities.

Why Consider These ETFs?

- They provide broad exposure to major emerging markets like China, India, and Brazil.

- They benefit from capital inflows when U.S. interest rates decline.

- They are highly liquid, making them ideal for trading and long-term investment.

2. Country-Specific ETFs for Targeted Investments

For traders looking to focus on specific high-growth regions, country-specific ETFs allow for more strategic allocations. Some popular options are:

- iShares MSCI Brazil ETF (EWZ): It provides exposure to Brazilian equities. They benefit from commodity-driven growth.

- iShares MSCI India ETF (INDA): It is a popular choice for investors looking to tap into India’s economic expansion.

- VanEck Vietnam ETF (VNM): It is used to get exposure to Vietnam’s fast-growing tech and manufacturing sectors.

Why Consider Country-Specific ETFs?

- Allows investors to target high-performing regions based on macroeconomic trends.

- Provides an easier way to trade emerging market stocks without direct stock-picking risk.

Using Bookmap for Institutional Order Flow Analysis

To successfully trade in emerging market stocks, you must understand institutional order flow. That’s because emerging markets often experience rapid shifts in liquidity due to large-scale institutional positioning. By using our real-time analysis tool, Bookmap, you can visualize:

- Market depth,

- Liquidity zones, and

- Large order executions.

This allows you to gain insights into capital inflows and outflows. By using Bookmap’s popular features (heatmaps, liquidity analysis, and order flow tools), you can spot where institutions are placing large buy/ sell orders and anticipate price movements.

How Bookmap Helps Identify Capital Flows

Bookmap provides real-time visual data on market liquidity. It is especially useful for trading emerging market ETFs and stocks. Some key benefits of using Bookmap are:

| Tracking Large Orders | Liquidity Zones | Volume Deltas |

| Identify whether institutions are accumulating or distributing emerging market assets. | Find key support and resistance levels where institutional traders place their orders. | Analyze the buy vs. sell pressure to detect trend reversals in ETFs like EEM, VWO, or EWZ. |

For more clarity, let’s study an example:

- Let’s say you’re tracking iShares MSCI Emerging Markets ETF (EEM) using Bookmap.

- You observe the following:

- Heatmaps show large buy orders at a key support level. This indicates institutions are accumulating.

- Order flow confirms aggressive buyers stepping in. This suggests a shift in sentiment toward emerging markets.

- Volume spikes coincide with U.S. rate cut speculation. This signals that institutional investors expect capital inflows to continue.

Risks and Challenges in Emerging Market Trading

Emerging markets in 2025 present significant investment opportunities. However, they also come with macro risks that traders and investors must monitor. Let’s check them out:

Currency Volatility and USD Strength

One of the most significant risks when trading emerging market stocks is currency fluctuations. Many emerging markets have weaker currencies compared to the U.S. Dollar. Be aware that a stronger USD can erode investment returns.

Why does it matter?

- A strengthening U.S. Dollar reduces the value of foreign investments when converted back to USD.

- Emerging market central banks struggle to manage inflation if their currency weakens too much.

- Companies with USD-denominated debt (common in emerging markets) may face higher repayment costs.

For example:

Say the U.S. delays rate cuts due to persistent inflation. Now, the USD could rally. A stronger dollar makes emerging market investments less attractive and leads to capital outflows. This could pressure ETFs like EEM, VWO, and EWZ, as well as local equity markets.

How to Mitigate?

As a trader, you should track U.S. interest rate expectations. Also, you should consider hedging currency exposure through forex instruments or currency-hedged ETFs.

Geopolitical Risks and Local Policy Changes

Please note that emerging markets are more sensitive to:

- Political instability,

- Government intervention, and

- Trade policies.

Why It Matters

- Regulatory shifts (e.g., China’s crackdown on tech companies in 2021) can create market shocks.

- Trade tensions (e.g., U.S.-China relations) affect supply chains and investor sentiment.

- Debt crises (e.g., Argentina) can impact global confidence in emerging markets.

For example:

Say China implements unexpected economic reforms. This could affect sentiment in ETFs like MCHI or FXI. Similarly, a debt default in Argentina could cause regional sell-offs and would impact Latin American markets.

How to Mitigate?

As an investor, you should diversify across multiple emerging markets. Also, you should stay updated on local political developments.

Interest Rate Reversals Could Shift Capital Quickly

The assumption that the Federal Reserve will cut rates in 2025 is a key driver for emerging market investment. However, if inflation rebounds unexpectedly, the Fed may pause or even reverse rate cuts, triggering capital outflows.

Why It Matters

- Higher U.S. rates make emerging market assets less attractive.

- EM central banks may be forced to hike rates to defend their currencies.

- The rise of bond yields could lead to stock market corrections in riskier markets.

For Example:

Say U.S. inflation data (CPI) comes in hotter than expected. Now, the Fed may delay rate cuts. This could lead to a sell-off in emerging market stocks and ETFs. In response, traders reallocate capital back to the U.S.

How to Mitigate?

As a trader, you should monitor key economic indicators like U.S. CPI, jobs reports, and Fed statements to anticipate policy shifts.

Conclusion

Emerging markets are well-positioned to benefit from the likely U.S. rate cuts in 2025. Lower interest rates in the U.S. usually lead to capital inflows into emerging market stocks and bonds. In such times, countries like Brazil, Vietnam, and India stand out as top investment destinations. That’s primarily due to their strong economic fundamentals.

As an investor, you can gain diversified exposure through ETFs like EEM, VWO, and EWZ. They provide an easy way to tap into these opportunities without picking individual stocks. However, you should remain cautious of currency volatility, geopolitical risks, and likely Fed policy reversals. To mitigate these risks, you can start using our liquidity tracking tool, Bookmap. Through it, you can identify institutional buying patterns and market trends in real time.

Track institutional positioning in emerging market ETFs and stocks using Bookmap’s real-time data.