Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

January 3, 2025

SHARE

How Futures Markets Influence Stock Prices: A Beginner’s Guide

Do you know you can time-travel with futures markets? Yes, this is possible, at least financially! The futures markets offer a fascinating glimpse into the direction the stock market might take. By analyzing the futures contracts, traders can easily anticipate price movements and prepare accordingly.

Confused? This article will help you explore how futures markets work and why they matter. We’ll break down key futures contracts like the S&P 500, Nasdaq-100, and Dow Jones futures to explain how they influence everything from tech stocks to industrial giants. You’ll learn how futures markets provide important market sentiment indicators during pre-market futures trading and after-hours futures trading.

Retail traders, in particular, will discover how futures signal potential market volatility. We will also explain how to shape strategies ahead of regular market hours. By reading till the end, traders can better prepare for volatile sessions and spot potential market moves before they happen. Let’s begin.

What Are Futures Markets?

Futures markets are platforms. On these platforms, traders buy and sell contracts to purchase or sell assets (like commodities, indices, or currencies). These contracts are made for a future date and at a fixed price. The idea here is to lock in a price today, even though the transaction will happen later. These markets allow investors to:

- Speculate on future price movements

or

- Hedge against risks in price changes.

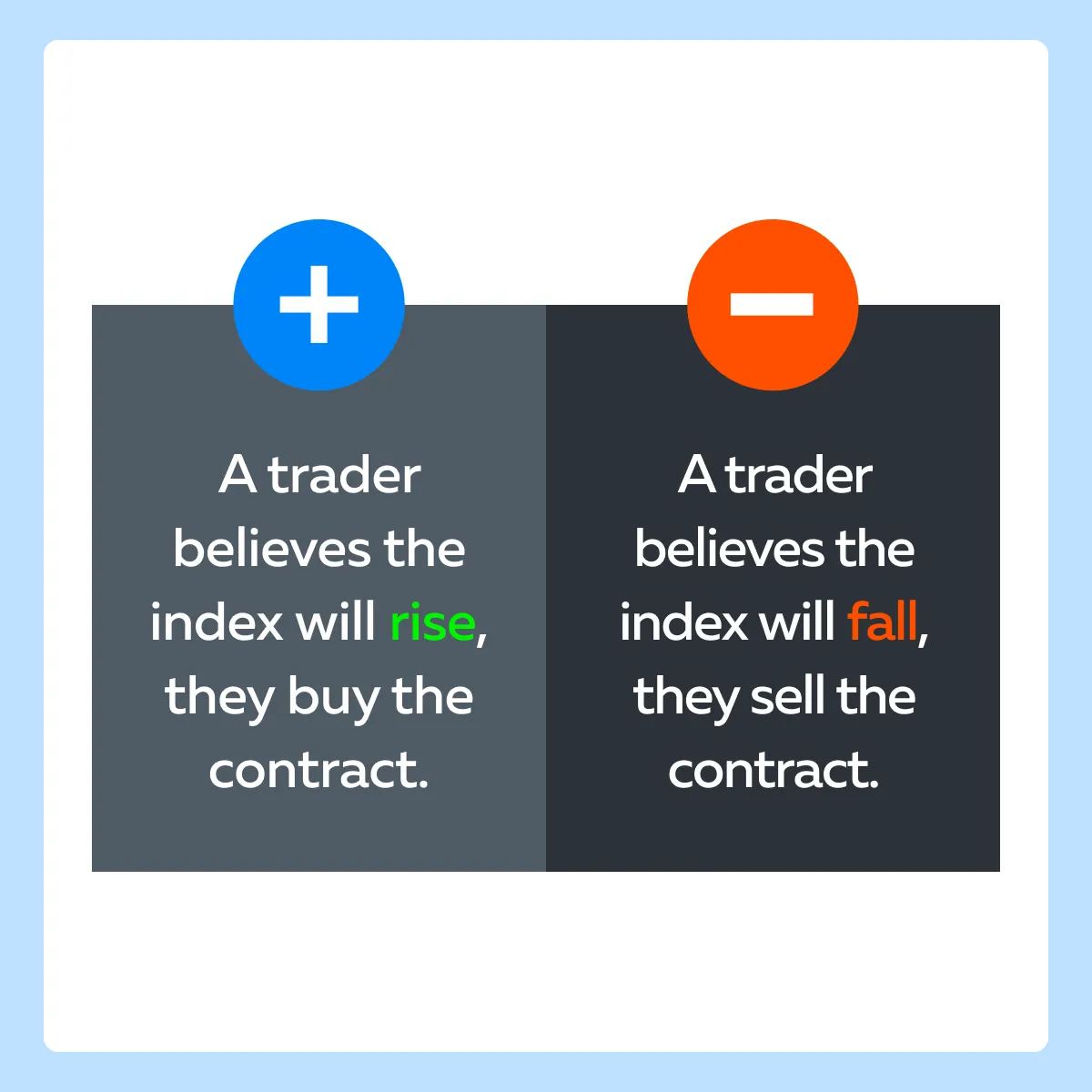

Example: Using an S&P 500 futures contract, traders can bet on the future direction of the S&P 500 index. See the graphic below to understand how:

Why Do Futures Market Matter?

Futures markets are important because they show market sentiment before regular stock trading hours. By analyzing futures contracts, traders can predict how the stock market will react when it opens. This helps them make informed decisions and manage risk better.

How do Futures Markets Affect Stock Prices?

As mentioned above, futures markets are commonly viewed as a predictor of stock market trends. When futures contracts point upward, it signals optimism in the market. It suggests that stock prices might rise once the regular trading session begins. On the other hand, if futures are trending down, it reflects bearish sentiment. This indicates likely declines in stock prices. For more clarity, see the graphic below:

For example:

- Say the S&P 500 futures rise significantly during the night.

- This is a sign that major stocks in the index will open higher the next day.

- This helps traders prepare for market movements in advance.

Pre-Market and After-Hours Impact in Futures Markets

Futures markets provide insights into market direction outside regular trading hours. Stock futures trade almost around the clock, 23 hours a day and 5 ½ days a week. They open on Sunday evening and close on Friday afternoon. This extended trading period is particularly important because it allows investors to react to new information even when the stock market is closed.

Be aware that these markets are especially active during pre-market (before the stock market opens) and after-hours trading. As a result, many large investors, such as institutional investors and hedge funds, trade futures during these off-hours. Usually, their trading decisions provide insights into what might happen once regular stock trading resumes. This gives other traders clues about market trends.

Additionally, because futures markets are active after hours, they often serve as an early indicator of the next trading day’s movement. They show how the broader market might open once the stock exchange begins trading again. Let’s understand better through a hypothetical example,

- Say a company releases its earnings report after the stock market closes.

- The futures market reacts instantly.

- If the report is positive, futures prices could rise.

- This could happen as a positive result signals a strong stock performance when the market opens the next day.

- In contrast, bad earnings news can lead to a drop in futures.

- That’s because it signals likely losses in the stock market’s opening.

Get ahead of the market! Bookmap’s real-time analysis of futures and stock price movements helps you make better-informed trading decisions.

Pre-Market & After-Hours Trading: How Futures Influence These Sessions

Futures markets have a significant influence on both pre-market and after-hours trading sessions. Thus, traders closely monitor futures contracts during these times. This monitoring helps them to get a sense of where the market might be headed once regular trading hours begin. Let’s understand in detail:

The Influence of Pre-Market Futures Trading

For the unaware, pre-market futures trading occurs before the stock market officially opens. In this phase, futures are a key indicator used by both retail and institutional investors to predict the day’s outlook. Most investors use them to analyze movements in the futures markets during the pre-market session. This analysis helps them to decide how to position their trades for the day ahead.

For example:

- Say S&P 500 futures rise overnight due to positive economic data.

- In this case, day traders interpret this as a bullish signal.

- They decide to enter long (buy) positions in pre-market trading.

- By doing so, they capitalize on the expected rise in stock prices once regular trading starts.

In this way, futures provide a critical reference point for investors. Using it, investors can anticipate market sentiment. Consequently, they can adjust their trading strategies accordingly before the official market hours begin.

The Influence of After-Hours Futures Trading

After-hours futures trading takes place after the stock market’s regular session closes. During this time, traders can still buy and sell stocks. They can make these trading decisions by reacting to news or reports released after the market has officially closed for the day. Futures markets, which continue trading during these hours, play an important role by showing any market-moving developments immediately.

Now, if major news comes out during after-hours sessions (say earnings announcements), futures contracts will quickly adjust to reflect the market’s reaction to that news. This provides an early signal of where the market might head when it reopens.

For example:

- Say a company reports strong earnings after the closing bell.

- The futures market spikes in response.

- This spike provides traders with an opportunity to act on the news.

- They decide to buy stocks in the after-hours session.

- This positioning helps them to a favorable market position and potentially profit when the market officially reopens the next day.

In this way, futures act as a bridge. They keep the market informed and active during periods when the stock exchange is closed.

Key Futures to Watch

Certain futures contracts are particularly instrumental in:

- Shaping market sentiment

and

- Predicting stock market trends.

See the graphic below to check out some of the prominent futures contracts:

These futures contracts are often used as a critical tool by both traders and investors. Let’s understand them individually:

- A) S&P 500 Futures

S&P 500 futures track the performance of the S&P 500 index. This index consists of 500 major publicly traded companies in the U.S. By monitoring S&P 500 futures, traders get an early read on the market’s mood. Because the S&P 500 is a broad indicator of the U.S. economy, its futures provide valuable insight into market trends. This analysis helps to make informed decisions ahead of regular trading hours. Let’s learn its practical application through an example:

- Say S&P 500 futures trade higher overnight.

- This signals a positive market sentiment.

- Now, investors can expect an optimistic opening when the stock market begins trading.

- They can anticipate that major stocks within the index will rise as well.

- Using this information, traders adjust their strategies.

- They buy stocks and take long positions based on the bullish outlook.

- B) Nasdaq-100 Futures

Nasdaq-100 futures track the performance of the Nasdaq-100 index. For the unaware, this index includes 100 of the largest non-financial companies. These companies have a strong focus on technology stocks. Usually, tech stocks influence the broader market because of their large market capitalizations and rapid growth.

Nasdaq-100 futures allow traders to gauge the performance of major tech companies like Apple, Amazon, and Microsoft. This analysis gives them a sense of how tech stocks may behave during regular trading hours.

- C) Dow Jones Futures

Dow Jones futures follow the Dow Jones Industrial Average (DJIA). It is an index of 30 large U.S. companies across various industries. These futures provide insights into how large industrial and blue-chip companies are expected to perform in the market. As a result, Dow Jones futures are watched by traders.

By analyzing it, they try to understand trends in industrial stocks and large-cap companies. Since the DJIA includes companies like Boeing and Caterpillar, which are often seen as economic indicators, these futures also give traders clues about the overall direction of the market, particularly in the manufacturing and industrial sectors.

Example:

-

- Say traders are monitoring Dow futures.

- They are assessing how major industrial companies like Boeing or Caterpillar could impact the market.

- If Dow futures rise overnight, it signals strength in the industrial sector.

- It suggests those companies are expected to perform well.

- Also, it indicates that the broader market will have a bullish sentiment when trading opens.

Why Futures Matter for Retail Traders?

It is worth mentioning that futures markets are not just for institutional investors. They are also meant for retail traders. By observing futures prices, retail traders can get a sense of the market’s direction. Post-observation, they can:

- Adapt their strategies,

- Adjust risk tolerance, and

- Better position themselves to manage market volatility.

Let’s see how:

| Aspects | Meaning | Example |

| Futures Markets Offer Signal for Market Opening |

|

|

| Futures Markets Act as a Volatility Indicator |

|

|

Conclusion

Futures markets allow traders to buy and sell contracts for various assets (like indices, commodities, and currencies) at a fixed price for future delivery. They act as indicators and help to predict stock market trends. By analyzing futures contracts, both traders and investors can prepare for upcoming market movements.

Generally, futures serve as a leading indicator of market sentiment, especially in pre-market futures trading and after-hours futures trading. Investors and traders use them to anticipate market direction based on various factors, such as economic reports or company earnings released outside regular trading hours. Some key futures contracts to watch out for are S&P 500, Nasdaq-100, and Dow Jones futures. They provide valuable insights into:

- Broader market performance,

- Tech-heavy portfolios, and

- Industrial stocks.

For retail traders, futures contracts also show how the market may open, enabling them to adjust their strategies accordingly. By monitoring futures prices, they can easily decide when to buy or sell. Even they can determine how much to invest based on predicted market movements. Want to monitor futures data and its influence on stock prices in real-time? Try Bookmap’s advanced market tools for accurate market predictions.