Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

October 22, 2024

SHARE

S&P Futures: Key Factors to Watch and How to Analyze Them

Peer into the future with S&P Futures. But are they that powerful? Well, for most traders they are the ultimate indicator of market sentiment and allow them to profit from rising and falling markets.

Curious? In this article, we’ll explain S&P Futures trading in detail by focusing on how they can impact your trading decisions and strategies. You’ll learn about S&P Futures, including their relationship with the S&P 500 Index and how they reflect market sentiment. Also, we’ll discuss the role of economic indicators, Federal Reserve decisions, and corporate earnings in influencing S&P Futures.

Next, you will learn the various trading strategies for S&P Futures, such as day trading and swing trading. Additionally, we’ll cover hedging strategies, showing how you can use S&P Futures to protect your stock portfolio from potential downturns. Let’s get started.

What is S&P Futures?

S&P Futures are financial contracts. They derive their value from the S&P 500 Index, which represents the performance of 500 leading U.S. companies. Using these futures, traders speculate on the future direction of the S&P 500 Index. They do so by agreeing to buy or sell the index at a predetermined price on a future date. Moreover, S&P Futures are often used for hedging positions or betting on market movements without holding individual stocks.

It’s important to understand that each futures contract specifies a particular:

- Value

- Expiration date

- Minimum price fluctuation.

Thus, we can say that S&P Futures are standardized contracts with a set size (e.g., $250 times the S&P 500 Index level for full-size contracts). They are traded on exchanges like the CME and expire quarterly. This also creates a need for active management and attention to expiration dates.

To better understand the practical usage of S&P Futures for “hedging,” let’s study this hypothetical example:

- Say a trader has a portfolio that mirrors the S&P 500.

- They fear a market downturn.

- To hedge against losses, the trader sells S&P Futures equivalent to the value of portfolio..

- Now, if the S&P 500 declines, losses in the portfolio are offset by gains from the futures position.

- In this way, the trader manages risk while maintaining exposure to the likely upside in the long term.

Key Factors Influencing S&P Futures

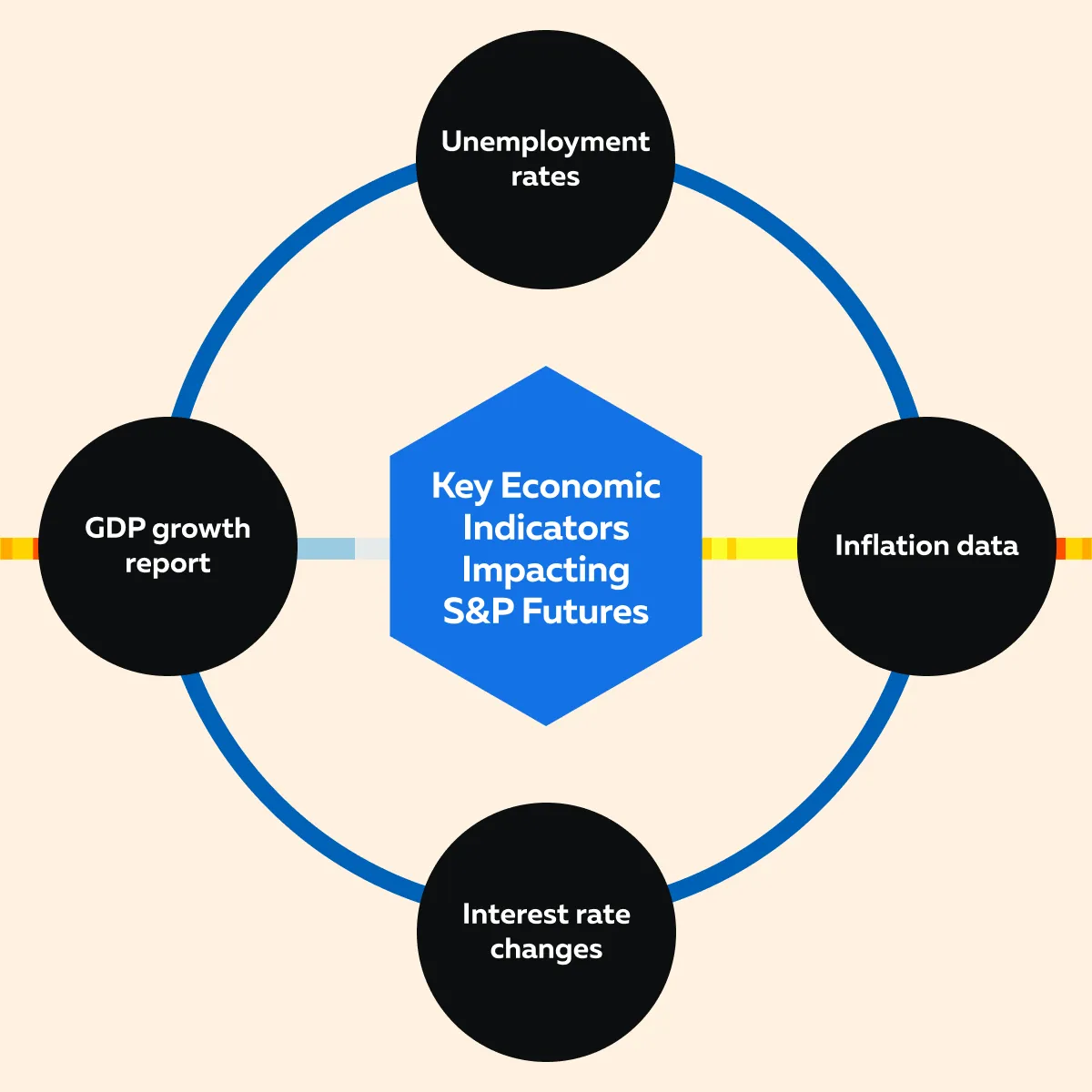

S&P Futures are heavily influenced by several economic indicators. See the graphic below:

Interpretating positive factors such as strong GDP growth report, a low unemployment rate, or falling inflation indicate a robust economy. It often causes S&P Futures to rise as traders expect:

- Higher corporate profits

and

- Continued economic expansion.

On the other hand, negative factors like unfavorable GDP growth reports, high unemployment, or rising inflation, signal economic weakness. Generally, this leads to a decline in S&P Futures. Next, Federal Reserve Decisions and Corporate Earnings Reports are also crucial to S&P Futures. Let’s see how they influence:

| How Do Federal Reserve Decisions Impact S&P Futures? | How S&P Futures React to Corporate Earnings Reports? |

|

|

Gain an edge in S&P Futures trading with Bookmap’s real-time analysis tools. Sign up today!

How Do Global Events Impact on S&P Futures?

It is pertinent to note that apart from the Fed’s decisions and corporate earnings, S&P Futures are also sensitive to global events, such as:

Generally, these events create uncertainty or optimism in the markets which significantly influences futures prices. For example, geopolitical tensions like conflicts or sanctions trigger fears of economic instability resulting in a drop in S&P Futures as investors seek safer assets.

Whereas, positive global developments, such as a trade agreement between the U.S. and another major economy, boosts S&P Futures. This happens because news of such an agreement creates optimism related to:

- Improved global trade conditions

- Reduced tariffs

- Increased market access for U.S. companies.

In such a positive environment, traders usually bid on S&P Futures. Enhance your market predictions by mastering S&P Futures with Bookmap. Join now!

How S&P Futures Reflect Market Sentiment?

One must be aware that S&P Futures often act as a “leading indicator of market sentiment.” They can provide early signals about the direction of the broader market. Notably, S&P Futures trades nearly 24 hours a day. Therefore, they can better reflect investor reactions to global news and events outside regular trading hours.

It is for this reason that traders and analysts closely monitor S&P Futures during pre-market hours to understand how the market might open. Let’s understand this concept better through a hypothetical example:

- Say the S&P 500 Index closed at 4,500 points the previous day.

- Before the market opens, S&P Futures are trading 30 points higher at 4,530.

- This 30-point increase in the futures market indicates that traders expect the S&P 500 Index to open 0.67% higher (calculated as 30 points divided by the previous closing level of 4,500).

- Be aware that this upward movement shows “investor optimism,” which is based on overnight news or economic data.

- Most likely, this optimism will positively impact the stock market.

- Later, when the market opens, this optimism leads to a higher opening price for the S&P 500 Index.

- Now, if a trader holds a standard S&P Futures contract (each point is worth $50), a 30-point rise translates to a gain of $1,500 per contract (30 points x $50).

How is S&P Futures Correlated with the S&P 500?

There is a strong correlation between S&P Futures and the S&P 500 Index. Generally, movements in the futures market often precede those in the cash market. This happens because futures allow traders to express their views on where they believe the index will go. For example, a sharp rise or fall in S&P Futures can signal expected changes in the S&P 500 Index when the market opens. This correlation makes futures a valuable tool for predicting market moves. For more clarity, let’s study a historical example:

- On November 9, 2016, after the U.S. presidential election, S&P Futures dropped sharply during overnight trading.

- This happened as news outlets began projecting an unexpected win for Donald Trump.

- The futures market reflected immediate concerns about:

- Policy uncertainty

and

- Expected market volatility.

- The S&P 500 initially dropped when the market opened the next day.

- But later, it quickly rebounded.

- Despite the initial drop, the market quickly changed direction and began to rise again.

- After the early drop, investors’ sentiment shifted from negative to positive.

- This led to a recovery in stock prices.

- The S&P 500 Index, which fell initially, started gaining value again.

- This situation reflected the earlier change in sentiment that had been observed in the S&P Futures.

Strategies for Trading S&P Futures

To trade S&P Futures, you will need a strategic approach. Usually, this involves understanding and implementing the various strategies. Let’s check them out:

Strategy I: Day Trading

Day trading S&P Futures strategy tries to exploit short-term price movements within a single trading day. Be aware that these price movements are driven by market sentiment shifts or economic data releases. For example,

- Say a day trader prefers trading around scheduled events like a Federal Reserve announcement.

- Now, assume that the Fed unexpectedly raises interest rates.

- This causes immediate market volatility.

- At this point, the trader quickly enters a short position in S&P Futures.

- They try to profit from a rapid decline.

- Later, when the market stabilizes, the trader exits the position within minutes or hours.

- By doing so, they lock in gains from the intraday price swings.

See market moves before they happen with advanced S&P Futures analysis. Get started here!

Strategy II: Swing Trading

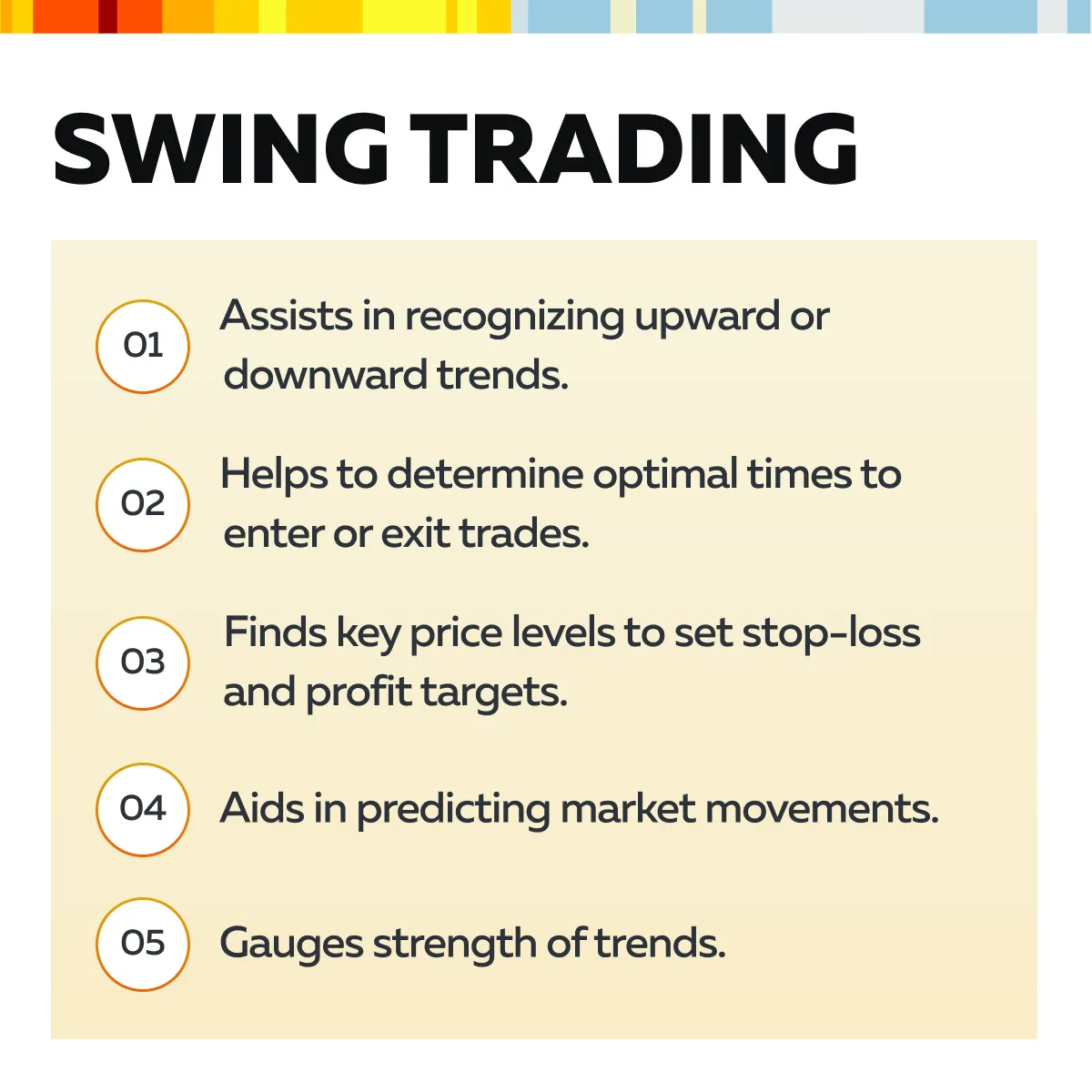

Swing trading S&P Futures is a longer-term approach where traders hold positions over several days or weeks to capture larger market moves. This strategy mostly relies on “technical analysis”. See the graphic below to understand how technical analysis helps traders execute this strategy:

Now, let’s get more clarity through an example:

- Say a swing trader notices a bullish pattern developing on the S&P Futures chart.

- They enter a long position.

- Their aim is to profit from an upward trend over the next few weeks.

- They hold the position through minor market corrections or rallies.

- While doing so, they use stop-loss orders to manage risk and protect gains if the trend reverses.

- After 15 days, the stock rallied and surged 33%.

- In this way, the trader benefits from sustained market movements rather than short-term fluctuations.

Strategy III: Hedging with S&P Futures

Investors often use S&P Futures to hedge against the losses in their stock portfolios. This strategy is especially followed during uncertain market conditions. In this technique, traders take an opposite position in S&P Futures. By doing so, later when the market declines, investors can offset losses. This is particularly useful for portfolios closely tied to the performance of the S&P 500 Index, as it allows for a more direct hedge against market-wide risks.

Let’s check an example,

- Suppose an investor holds a diversified portfolio of S&P 500 stocks.

- They expect increased volatility or a downturn due to an upcoming economic report.

- To protect against potential losses, the investor shorts (sells) S&P Futures contracts.

- Now, if the market falls, the value of the investor’s stock portfolio will decrease (say by 5%).

- However, at the same time, the short position in the futures contracts will increase in value.

- The profit from the short futures position will compensate for some or all of this decline.

- This will offset the losses and reduce the effect of unfavorable market shifts.

S&P Futures Conclusion

S&P Futures helps both traders and investors to gain valuable insights into market sentiment. They reflect the broader S&P 500 Index and offer a way to speculate on market direction. Also, they are used to hedge against potential losses or capitalize on short-term price movements. Some proven trading strategies to trade S&P Futures are day trading, swing trading, and hedging.

Moreover, these futures contracts are a leading indicator of market sentiment. This makes them useful for predicting market movements even before they happen. As a trader, if you know how global events, economic indicators, and corporate earnings reports affect S&P Futures, you can better anticipate changes and respond quickly to protect or grow your investments.

Do you wish to stay ahead of the competition? To trade S&P Futures with confidence and enhance your trading, consider using Bookmap, our advanced market analysis tool. Check out the various packages available from here.