Ready to see the market clearly?

Sign up now and make smarter trades today

Education

July 17, 2024

SHARE

How Tech is Powering a New Era for Retail Investors

Growing technology has revolutionized retail trading. Unlike before, even individual retail investors can now access advanced tools and resources from the comfort of their homes to discern market trends, plan strategies, and make wise decisions.

Through this article, we will see how technology has created a level playing field for retail traders. From advanced trading platforms to algorithmic strategies and real-time data analysis, the possibilities for retail traders have never been more promising.

Also, we’ll discuss the benefits of using algorithmic trading tools in automating strategies and understand how to enhance market understanding by using institutional-level data. Let’s begin.

The Technology Driving the Trading Renaissance

In recent years, retail trading has remarkably transformed. Thanks to rapid advancements in technology, now individual traders have access to tools and resources that were once reserved for institutional investors.

Owing to this trading renaissance, key technologies have enabled retail traders to:

- Access advanced platforms,

- Use algorithmic strategies, and

- Analyze real-time data with precision.

Let’s understand in detail.

Accessing Advanced Trading Platforms

Modern trading platforms and market analysis tools, like Bookmap, have improved the decision-making process of retail traders by offering:

- Intuitive interfaces,

- Robust functionality, and

- Seamless execution.

Using these platforms, traders can access a wide range of financial instruments and execute trades swiftly and efficiently. Some key features include:

- Customizable charting tools,

- Real-time market data,

- Integrated news feeds, and

- Unique visualization capabilities.

Additionally, mobile trading apps have further democratized access to the markets by allowing traders to monitor and manage their portfolios on the go.

Using Algorithmic Trading Tools

Algorithmic trading has now become increasingly accessible to retail traders. Algorithmic trading tools allow traders to automate their trading strategies based on predefined criteria. This automation eliminates emotional biases and helps in executing trades with precision and speed.

Also, these tools offer a range of functionalities, which include:

- Backtesting,

- Optimization, and

- Strategy deployment.

Benefitting from Real-Time Data Analysis Software

Analyzing real-time market data is the key to achieving trading success. Now, retail traders can use real-time data analysis software to instantly:

- Monitor market movements,

- Discern trends, and

- Spot potential trading opportunities.

Additionally, certain advanced market visualization tools, like Bookmap, offer heatmaps and volume indicators. An analysis of these tools provides traders with valuable insights into:

- Depth of Market (DOM) and

- Liquidity patterns.

From Information to Action

Access to real-time market data enables retail traders to stay ahead of market movements. By analyzing them, traders can:

- Identify emerging trends, and

- Seize opportunities promptly.

Let’s have a look at some proven benefits:

- Timely Information

-

-

- Real-time market data provides retail traders with up-to-the-second information on:

- Price movements,

- Volume, and

- Market sentiment.

- This allows traders to react swiftly and capitalize on emerging opportunities.

- Real-time market data provides retail traders with up-to-the-second information on:

-

- Enhanced Market Awareness

-

-

- Retail traders can stay informed about breaking news and corporate events that impact asset prices.

- With real-time access to this information, traders can make more informed decisions based on the latest developments.

-

- Technical Analysis

-

-

- Real-time market data enables retail traders to conduct technical analysis.

- They can determine their entry and exit points by analyzing price charts to

- Identify trends, and

- Spot key support and resistance levels in real-time.

-

- Risk Management

- Using real-time data, traders can closely monitor real-time price movements and market volatility.

- This monitoring can be used to:

- Implement stop-loss orders.

How does the availability of institutional-level data help?

Due to advancements in technology, now retail traders have access to institutional-level data. Using it, they have significantly enhanced their market understanding. Let’s see how this accessibility has helped retail traders:

| Advantages | Meaning | Trader Benefits |

| Deeper Market Insight | Traders gain deeper insights into:

|

Visualization of market depth and gauging of market sentiment. |

| Strategy Refinement | Traders can access granular market data and obtain a clear view of market dynamics | Refinement of trading strategies |

| Observe real-time order flow | Traders can use visualization tools to observe the depth of the market and order flow. | Detection of hidden liquidity and potential market manipulation. |

How Does Bookmap Help Traders?

Bookmap is a modern market analysis tool that provides retail traders with institutional-level data and analytics. It offers visualization tools, such as the heatmap and volume profile. These are widely used by traders to:

- Spot hidden liquidity,

- Detect iceberg orders, and

- Precisely analyze price action.

Using Bookmap, traders can gain a competitive advantage and trade with confidence.

Algorithmic Trading and Automation

Algorithmic trading has offered a level playing field to the retail traders. Now, they can execute complex trading strategies efficiently and systematically. Traditionally, algorithmic trading was the domain of institutional traders, who dominated the market at the cost of retail traders.

How are retail traders using algorithmic trading?

Let’s see the three major benefits:

- Strategy Testing

-

-

- User-friendly algorithmic trading platforms allow retail traders to backtest their trading strategies using historical data.

- Using these platforms, traders can:

- Simulate different market scenarios and

- Assess the performance of their strategies over time.

-

- Trade Execution

-

-

- Algorithmic trading platforms enable retail traders to automate trade execution based on predefined criteria and rules.

- These platforms offer a range of order types, including:

- Market orders,

- Limit orders, and

- Stop orders.

- Trade automation helps in:

- Eliminating emotion-driven decisions,

- Reducing latency, and

- Capitalizing on market opportunities in real-time.

-

- Risk Management

-

- Algorithmic trading platforms provide retail traders with advanced risk management tools.

- Using them, traders can protect their capital and minimize losses

- These platforms offer features such as:

- Stop-loss orders,

- Trailing stops, and

- Position sizing algorithms.

Changing Market Dynamics: The Impact on Institutional vs. Retail Trading

Advancements in technology have democratized access to financial markets. Now, retail traders can use sophisticated tools once exclusive to institutions. This shift has led to:

- Increased market participation from retail traders,

- Altered traditional trading strategies, and

- Challenged the dominance of institutional players.

Now, retail traders have a greater influence on the financial markets. Let’s understand in detail.

The Democratization of the Markets

Widespread technology adoption among retail traders has led to increased market liquidity as more individuals participate in trading activities. Retail traders now have access to:

- Advanced trading platforms,

- Algorithmic tools, and

- Real-time market data.

This democratization has reduced barriers to entry and allowed retail traders to compete more effectively with institutional investors. Furthermore, it can also be assumed that the collective actions of retail traders, facilitated by online communities and social trading platforms, have the potential for significant market impact. That’s because coordinated buying or selling activities among retail traders can:

- Influence short-term price movements,

- Contribute to market volatility, and

- Impact liquidity.

The Evolving Relationship between Retail and Institutional Traders

The technological empowerment of retail traders has disrupted traditional market hierarchies. Now, a more level playing field is created with retail traders having access to tools that were once exclusive to institutional investors.

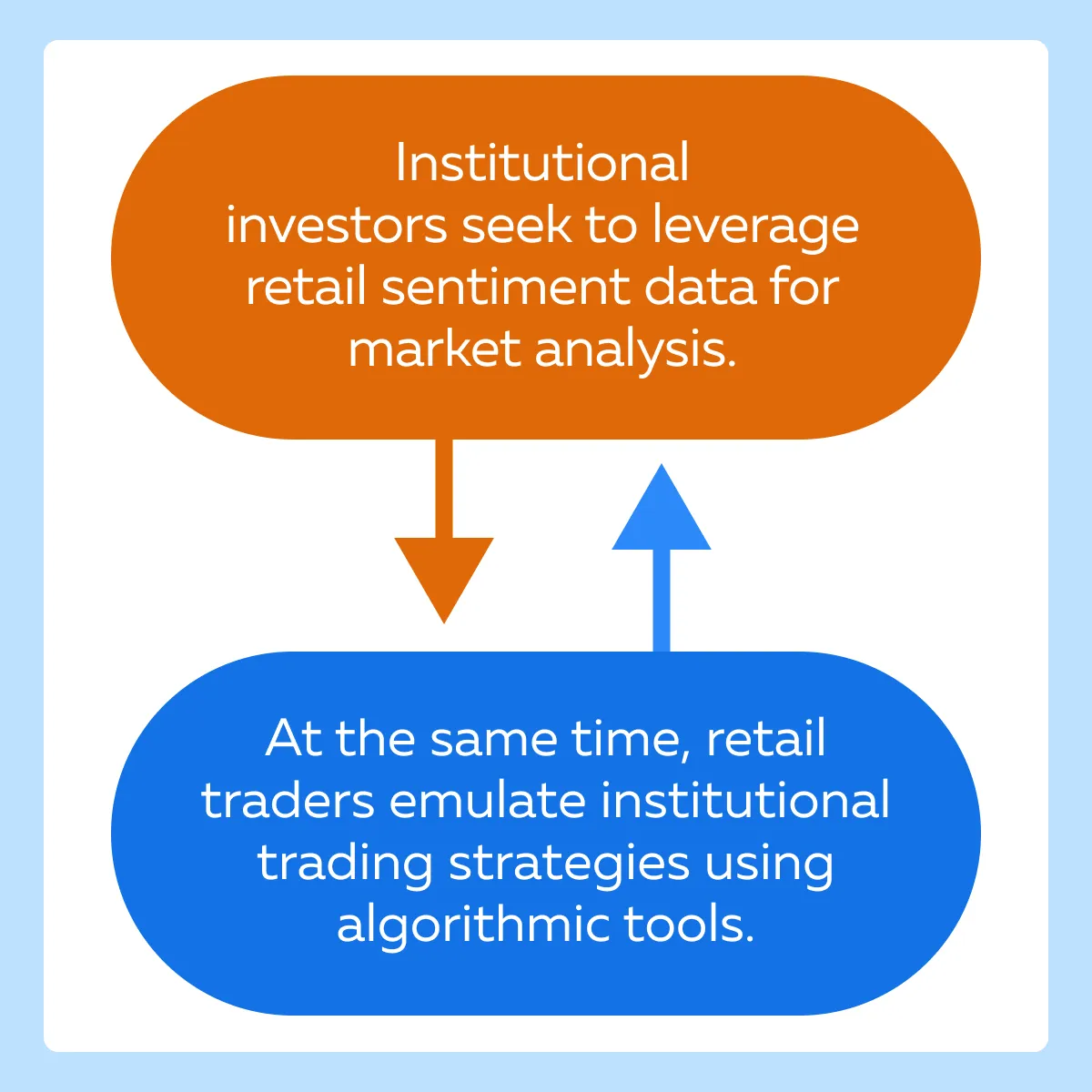

This shift has led to new opportunities for collaboration between retail and institutional traders. See the graphic below to understand:

Challenges and Opportunities for Institutional Traders

In response to the rise of technologically empowered retail traders, institutions are changing their strategies to remain competitive. Let’s see some popular institutional adjustments:

- Focus on High-Frequency Trading (HFT)

-

-

- High-frequency trading has become increasingly prevalent among institutions.

- Now, they are executing large volumes of trades at lightning speed

- HFT strategies capitalize on microsecond-level market movements to identify and exploit fleeting arbitrage opportunities.

- Institutions invest heavily in cutting-edge technology infrastructure to support HFT operations

-

- Expansion into Retail Trading Platforms

-

-

- Some institutions are exploring opportunities to partner with or acquire retail trading platforms.

- They are doing so to:

- Access new sources of liquidity and

-

- Diversify their client base.

-

-

-

- By tapping into retail investor sentiment and order flow, institutions can identify profitable trading opportunities.

-

-

- Development of Retail-Focused Products

-

-

- Institutions are developing retail-focused products and services tailored to the needs of individual investors.

- These offerings include:

- Robo-advisors,

- Thematic investing platforms, and

- Socially responsible investment products.

- This helps institutions to attract new clients and expand their market reach.

-

- Increased Focus on Technological Innovation

- Institutions are investing heavily in technological innovation to:

- Enhance their trading capabilities and

- Maintain a competitive edge.

- This includes the development of advanced:

- Algorithmic trading systems,

- Machine learning algorithms, and

- Data analytics platforms.

- Using technology, institutions aim to optimize trade execution and manage risk more effectively

The Unique Perspective

Most institutions view the growing influence of retail traders as both a challenge and an opportunity for the financial markets. Let’s see how:

| Viewing Retail Traders as a Challenge | Viewing Retail Traders as an Opportunity |

|

|

Looking Ahead: The Future of Retail Trading Technology

Future trends in trading technology include advancements in:

- Artificial intelligence,

- Machine learning algorithms,

- Decentralized finance (DeFi) platforms, and

- Blockchain technology.

These developments could democratize access to financial markets further and allow retail traders to participate in previously inaccessible assets. Let’s understand in detail.

Emerging Technologies and Their Potential

| Latest Technologies | Usage | Trader Benefits |

| Artificial Intelligence (AI) | AI has the potential to provide personalized trading insights by

|

AI-powered algorithms offer:

|

| Blockchain | Blockchain records transactions on a decentralized and immutable ledger. This recording helps in:

|

Blockchain technology secures retail transactions and increases transparency in retail trading. |

| Decentralized Finance (DeFi) | Using blockchain technology, DeFi protocols enable:

|

Retail traders can access a wide range of financial services and investment opportunities without relying on centralized intermediaries. |

Conclusion

The rapid evolution of technology has transformed retail trading by bridging the once substantial gap between individual investors and institutional players. Today, retail traders can access and benefit by using advanced trading platforms, algorithmic tools, and real-time data analysis.

This democratization of the markets has expanded the market participation of retail traders and increased market liquidity. Looking ahead, future trends in trading technology, such as artificial intelligence, blockchain, and decentralized finance, promise to further democratize access to financial markets

However, to fully benefit from these advancements, continuous learning and adaptation are essential. By staying informed, retail traders can execute profitable trades and enjoy sustainable growth. For a deeper understanding of the market dynamics, visit our blog ‘Understanding the Players in the Market’.