Our 4th of July Sale is Live

Offer Valid July 4 – July 11

Get 50% off Global+ AND data for 3 months—or save 30% on Global+ for the full year

Claim Your DealReady to see the market clearly?

Sign up now and make smarter trades today

Education

May 19, 2025

SHARE

How the U.S.-China Chip Tariff Clash Is Shaking Up Markets (and How Traders Can Respond)

When chips fall, markets shake! Currently, the world’s two biggest economies are playing tariff poker. Are you prepared?

The tension between the U.S. and China over semiconductor trade is rising. What started as a tech rivalry has now turned into a full-scale tariff battle! Both sides are targeting chips, which are essential components for a wide range of devices, from smartphones to satellites.

News-driven markets pose sudden risks for both investors and day traders due to increased volatility, sector rotations, and shifts in capital. To effectively meet these challenges, it is essential to utilize real-time market analysis tools like Bookmap. These tools allow for tracking of real-time market changes. Read this article till the end to learn what is happening, how it is affecting markets, and how you, as a trader, can stay one step ahead!

Understanding the U.S.-China Chip Tariff Escalation

The current tension between the U.S. and China over semiconductors is not just about trade! It is connected to a much bigger global power struggle. One key issue is Taiwan. China has a long-standing political goal of reunifying with Taiwan.

This situation is significant because Taiwan is home to TSMC, the world’s leading semiconductor manufacturer. These chips are used for everything from smartphones to military equipment. So, any risk to Taiwan or its chip production affects the following:

- World economy

and

- Technology supply chains.

The U.S. Sanctions

In this broader context, the U.S. has recently introduced new chip tariffs. Through these tariffs, the U.S. is trying to limit China’s access to high-end semiconductors, which will restrict China’s ability to produce or buy the chips needed for:

- Artificial intelligence,

- Advanced computing,

and

- Military use.

China’s Retaliation

China also quickly responded. It introduced trading semiconductor tariffs of its own. This affects American chipmakers and other tech firms operating in China. These retaliatory moves are making it more difficult for companies to do business across borders.

Why Is All This Important?

Semiconductors are the backbone of modern life, found in a wide range of devices, including:

- Phones,

- Cars,

- Medical devices,

- Computers,

and

- Defense systems.

Because of this, the chip tariff market impact is huge! It influences global trade and national security. Hence, please realise that this situation is about more than just economics. Instead, it is about who controls the tools that power the future. Clearly track market reactions to tariff news—try Bookmap’s advanced liquidity visualization.

Immediate Market Reactions to the Tariff Clash

Recently, the Trump administration has initiated a Section 232 national security investigation into semiconductor imports. It could lead to new tariffs of 25% or higher on chips and related equipment. This comes in addition to existing tariffs, which include:

- 20% tariffs on Chinese goods

and

- A 145% baseline tariff on select Chinese imports (with exemptions for smartphones, computers, and some chips).

Now, let us see how the market is reacting to these political moves.

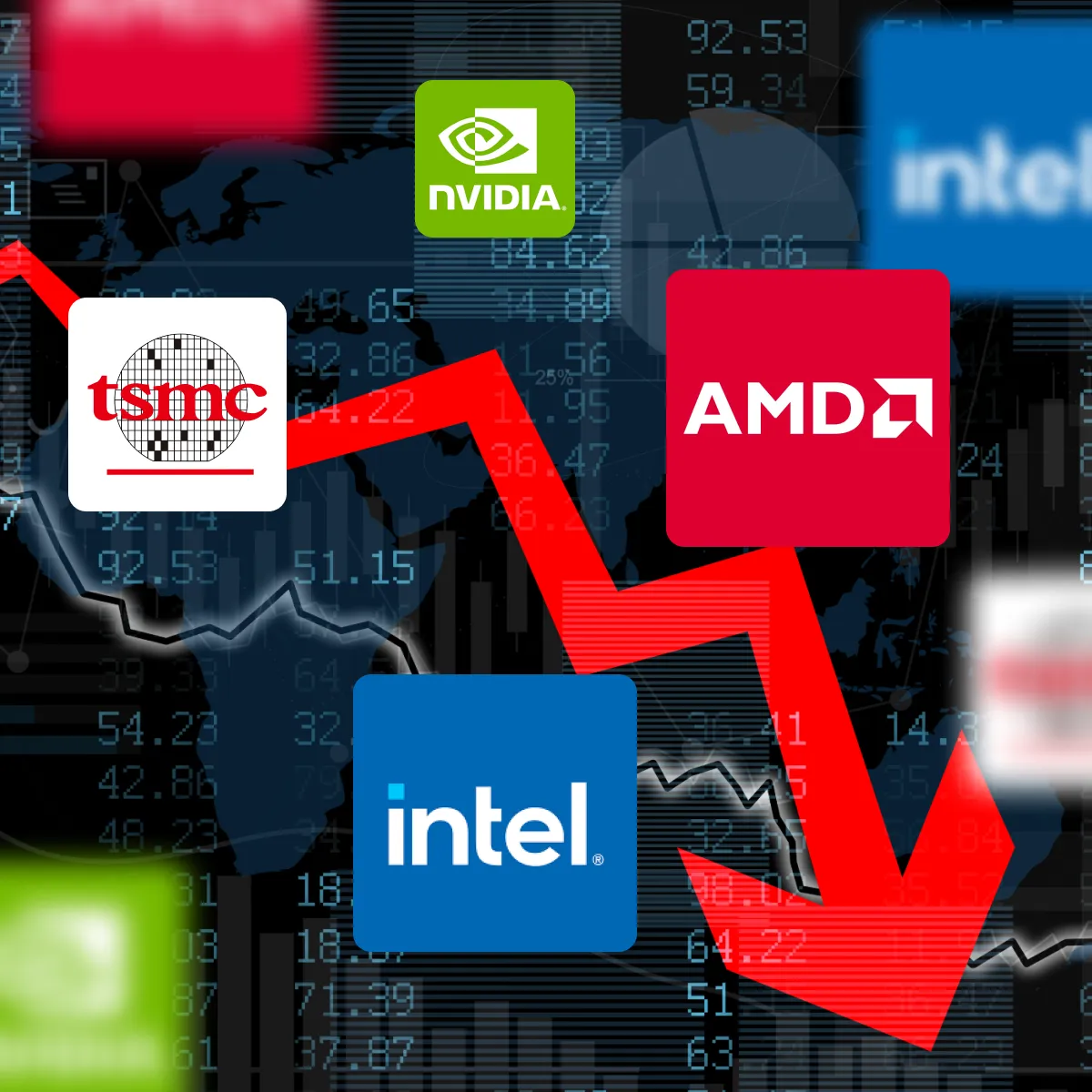

Volatility in Semiconductor Stocks

Right after the tariff news broke, stock prices of major semiconductor companies became unstable. It created a volatile market environment. Investors were unsure how the trading semiconductor tariffs would affect:

- Future profits

and

- Global chip demand.

Thus, they started buying and selling shares rapidly. Let us see what happened to the stock prices of major chip companies:

| NVidia | AMD | Intel | TSMC |

|

|

|

|

Hence, as a trader, you can clearly see when governments change trade policies, particularly in a crucial industry like semiconductors, which can lead to rapid market responses. Most investors try to predict which companies will benefit from or be negatively impacted by these new regulations, which often leads to fast price changes.

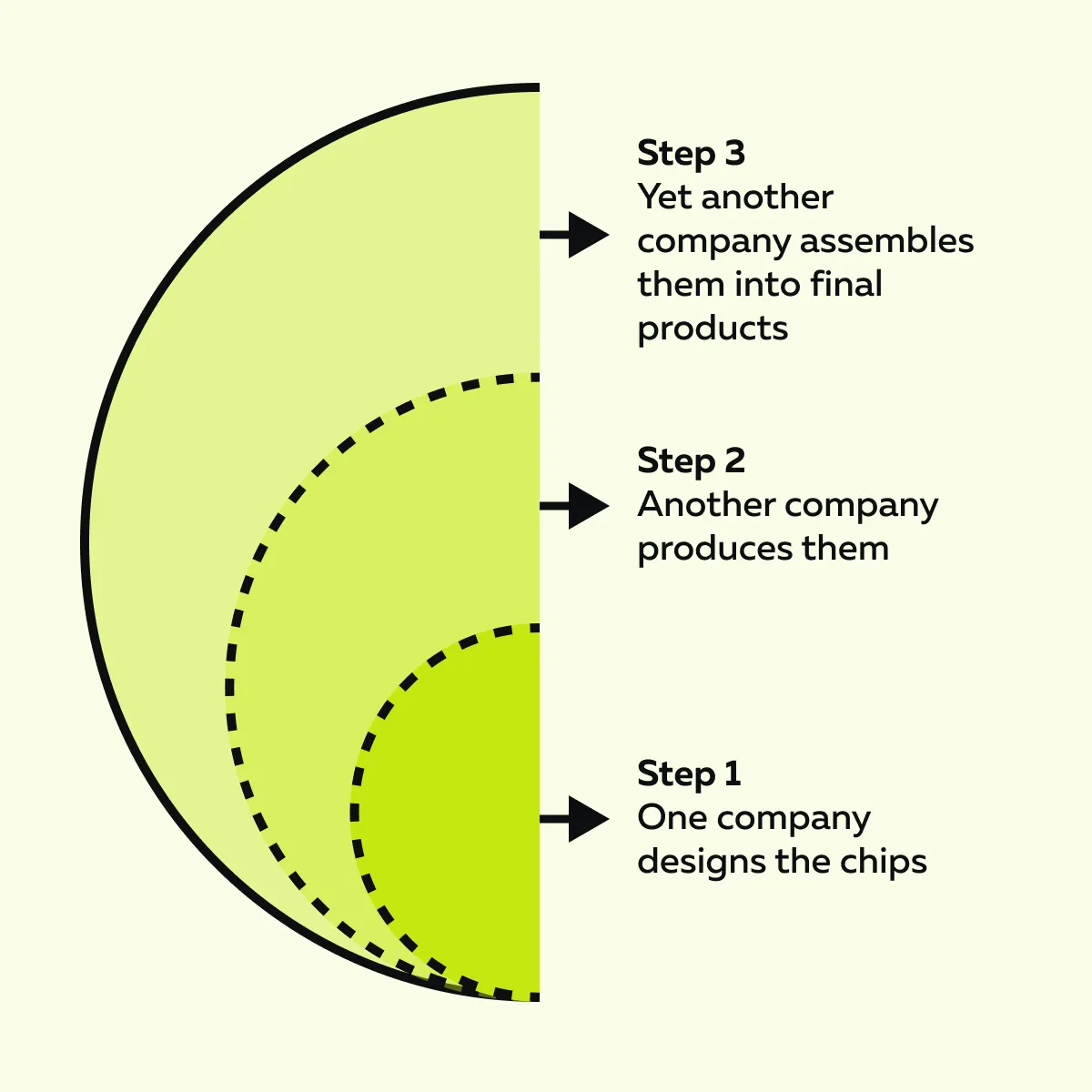

Supply Chain Disruption

Please realize that the U.S.-China chip tariffs are not just affecting chipmakers! Instead, they are also creating major problems for companies that rely on those chips to build their products. This is because the international semiconductor industry works like a tightly connected supply chain. Let us see how:

A significant portion of the activity mentioned in the graphic above involves China either as a:

- Supplier,

- Manufacturer,

and

- Logistics hub.

Now, please note that when new trading semiconductor tariffs are introduced, they add extra costs and introduce delays and uncertainty in this process. As a result, companies that import semiconductors from China now have to:

- Pay more

or

- Face delays while finding other suppliers.

This slows down manufacturing and raises the final cost of goods. Let us understand better through a real-world example:

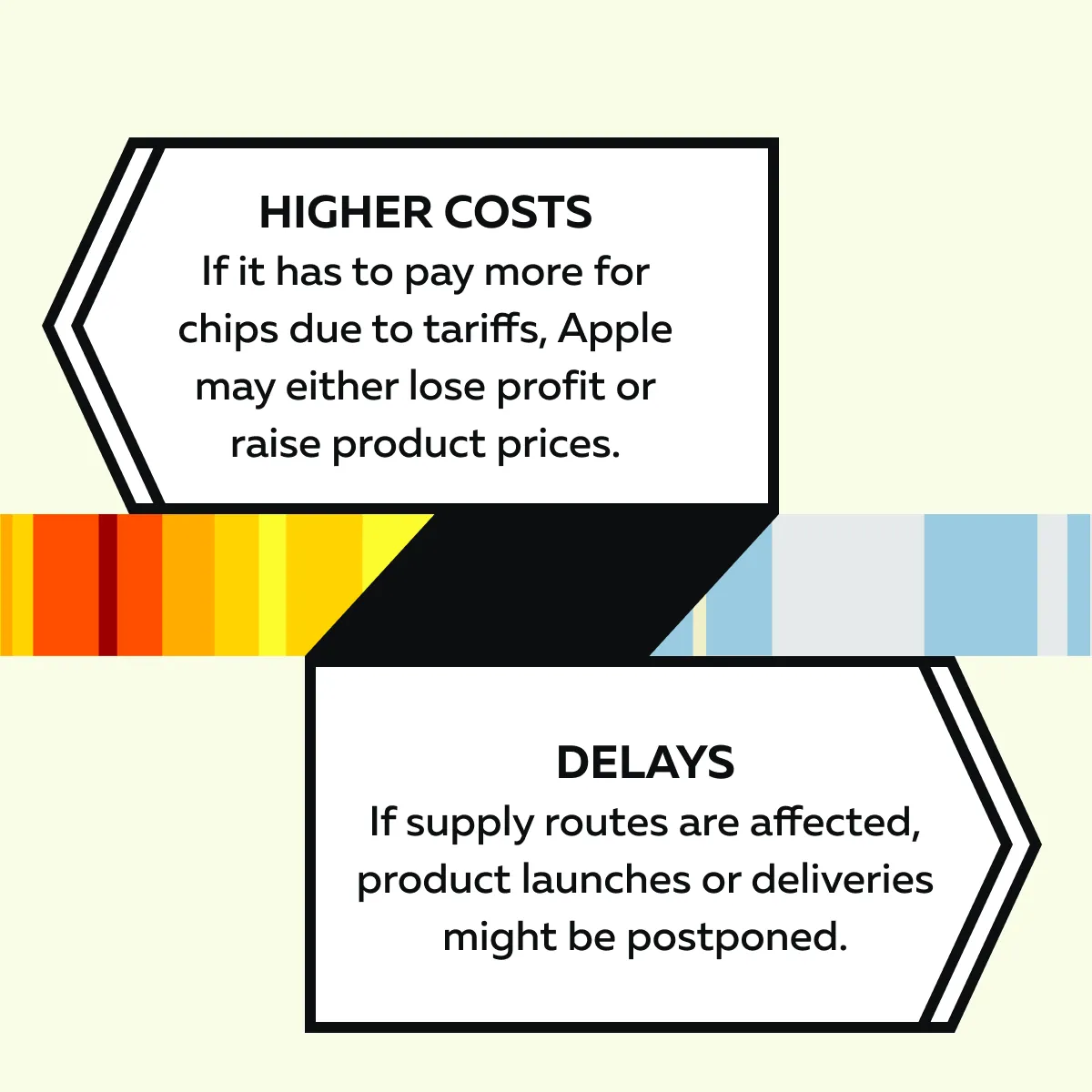

The company “Apple” depends on a vast global network to make iPhones, iPads, and Macs. Many of its parts, including semiconductors, come from or pass through China. When tariffs go up, Apple faces two risks:

This uncertainty causes investors to worry! Usually, such an investor panic leads to more frequent ups and downs in Apple’s stock.

Broader Tech Sector Spillover

The U.S.-China tariff war impacts the entire technology sector. When investors hear news about rising trade tensions, particularly concerning critical components like chips, their concerns extend beyond just semiconductor manufacturers. They also become fearful of any tech business that depends on chips or global trade.

This leads to a general drop in investor confidence. As a result, people start selling shares not only in chipmakers like Nvidia and AMD but also in:

- Software companies,

- Cloud services,

- Electronics makers,

and

- Telecom firms.

This broader reaction is called a tech sector spillover. Let us understand this concept better through an example:

- The technology ETF, XLK, includes a wide mix of top U.S. tech companies.

- After the announcement of new tariffs, XLK saw a noticeable drop.

- This happened because traders priced in the uncertainty and risks.

Additionally, please note that companies that do not directly import semiconductors from China can even get caught in this. If a major partner, supplier, or customer is affected by the tariffs, that impact can quickly travel down the line.

Be aware that in the tech world, everything is connected:

- Hardware,

- Software,

and

- Services.

A disruption in one area often shakes the whole system.

Longer-Term Impacts Traders Should Monitor

As a trader, you must pay close attention to the deeper and long-term changes these tariffs could cause in:

- Global markets,

- Business strategies,

and

- Currencies.

Let us check them out:

Shifts in Investment and Capital Allocation

If trading semiconductor tariffs stay in place for a long time, tech companies may decide it is too risky to rely on Chinese manufacturing. That could lead them to shift factories and suppliers to other countries like:

- Vietnam,

- India,

and

- Even back to the U.S.

These changes involve major costs and time. However, they let companies reduce their exposure to future trade disruptions. For example,

- Intel and AMD are both actively discussing and planning new manufacturing strategies outside China.

- This business decision influences:

- Where do they invest their money

and

- How much do they spend to stay competitive

- These strategies may reduce long-term risk.

- However, they impact:

- Short-term profits

and

- Product timelines.

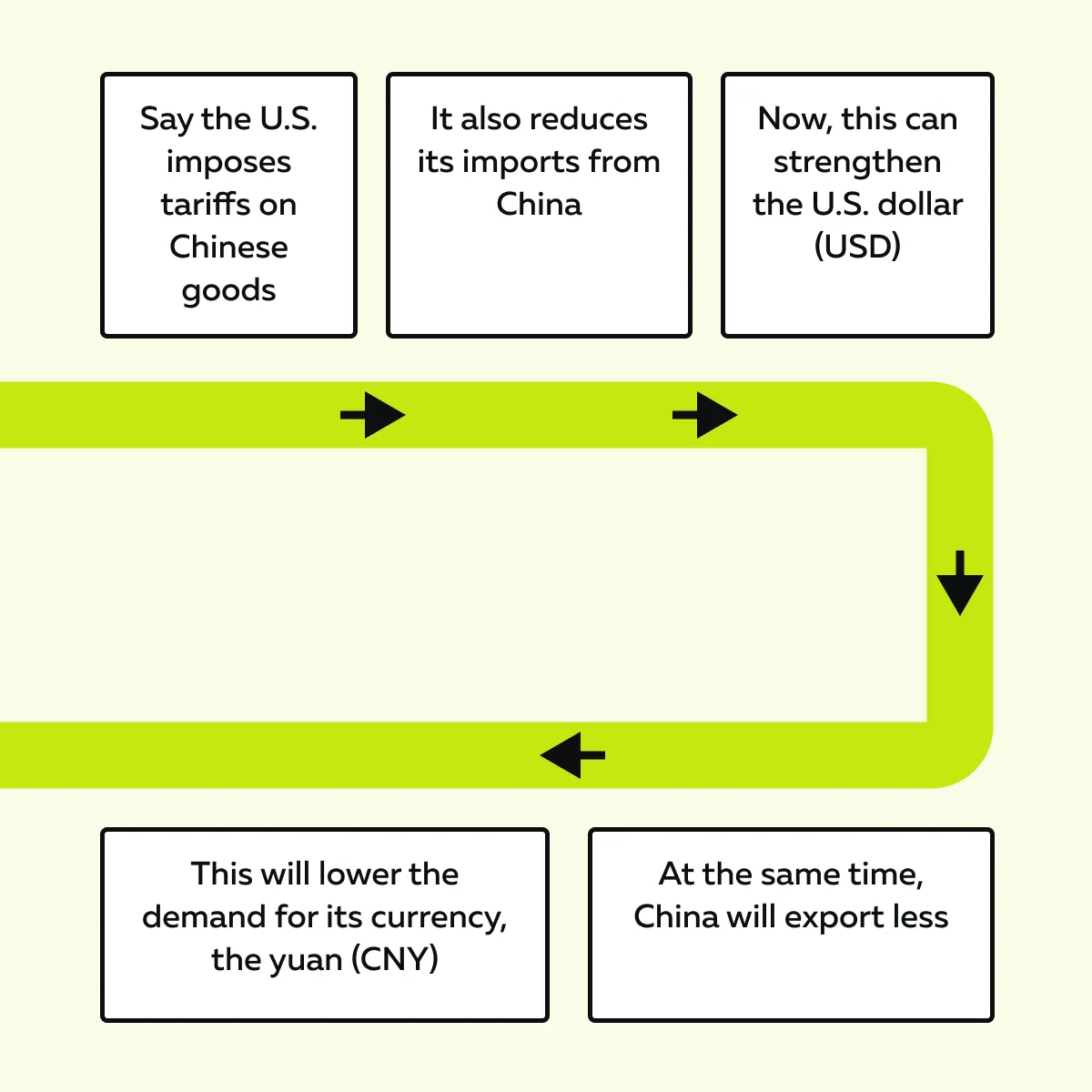

Currency Market Implications

One must note that tariffs usually shift trade balances. Let us see how:

The process mentioned in the above graphic also changes in the USD/CNY exchange rate. After recent tariff announcements, the USD/CNY pair rose sharply as the dollar got stronger compared to the yuan.

Potential Inflationary Pressures

Tariffs usually raise the cost of imported goods. In the case of U.S.-China chip tariffs, there are higher prices for semiconductors. These chips are found in almost everything:

- Phones,

- Laptops,

- Smart home devices,

and

- Cars.

Thus, when the cost of these components rises, the final products mentioned above become more expensive for consumers. In effect, this translates into inflation. Most analysts have already projected a rise in U.S. consumer electronics prices. Also, in their opinion, these hikes will be passed on to buyers.

Now, if we talk about immediate price reactions to these tariffs:

- Major electronics manufacturers like Gigabyte and Sony have already initiated price hikes. This marks the first wave of adjustments.

- Acer has announced 10% laptop price increases directly tied to import taxes.

- Apple devices are also expected to rise in price due to Chinese manufacturing dependencies.

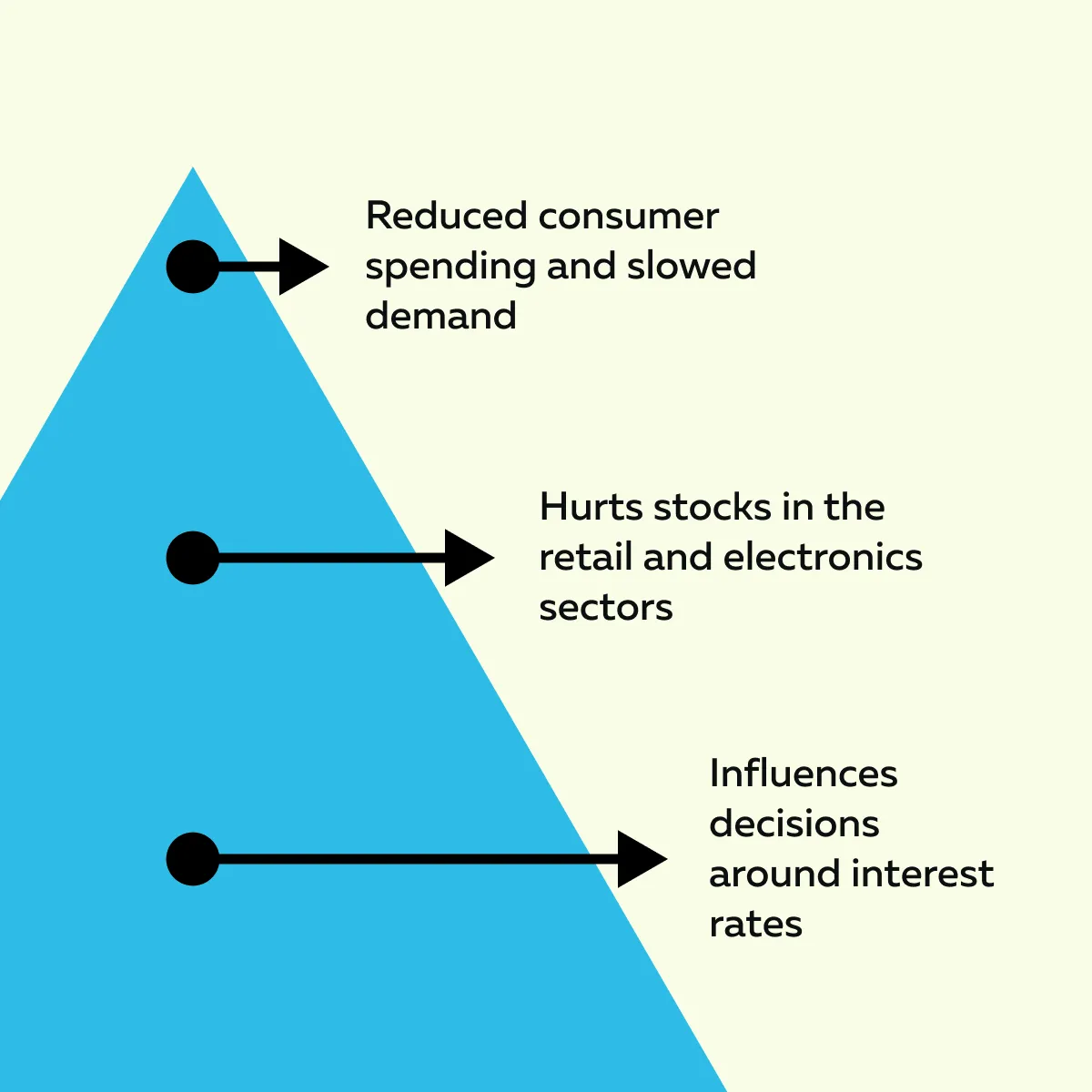

This inflation risk matters to equity traders. Let us see why:

Navigate tariff-driven volatility with better trade timing using Bookmap’s real-time insights.

How Traders Can Navigate Chip Tariff Volatility?

The ongoing U.S.-China chip tariffs create rapid market swings. To trade profitably, you as a trader need focused strategies to:

- Manage risk

and

- Seize opportunities.

Also, you must learn how to respond to short-term movements. Let us understand everything in detail:

Short-Term Trading Approaches

In the immediate aftermath of trading semiconductor tariffs, markets often become highly reactive. Stocks move quickly, and large institutional traders shift their positions within minutes! In such times, both retail and professional traders can use our avant-garde market analysis tool, Bookmap. Using it, you can easily visualize real-time liquidity and order flow.

Our avant-garde market analysis tool, Bookmap, shows where large buy and sell orders are sitting in the market. This gives insight into what big players might do next! Let us gain more clarity through an example:

- Let us say the U.S. announces a new round of chip tariffs.

- Within minutes, traders see a sudden withdrawal of liquidity in stocks like Nvidia and AMD on Bookmap.

- This means large buyers are pulling their orders.

- Such a situation clearly signals uncertainty or fear.

- When this happens, price drops are likely.

- Now, as a trader using Bookmap, you:

- Took a short position (betting the price will fall)

or

- Square off existing long positions to avoid losses.

Using Bookmap gives you an edge in spotting and acting on these sudden shifts.

Medium-Term Sector Rotations

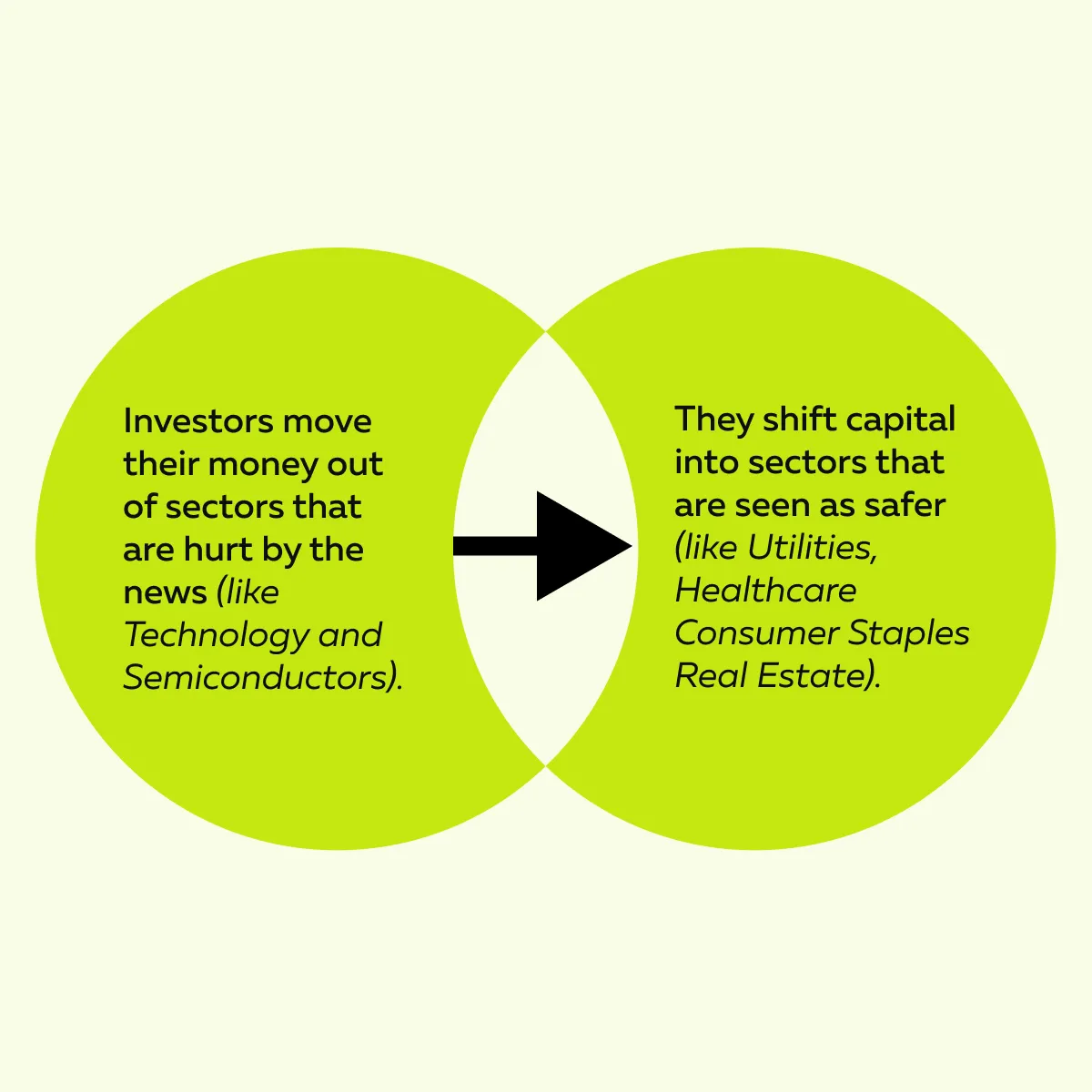

The U.S.-China chip tariffs create ongoing uncertainty. During such uncertain times, markets often go through a process called sector rotation. Let us see what this means:

As a trader, you can identify market rotations by observing:

- Which sectors are losing momentum?

and

- Which ones are gaining strength?

For example:

- Say there are chances of levying trading semiconductor tariffs.

- This raises concerns about earnings and supply chain problems.

- In response, traders start selling tech stocks like Nvidia, AMD, or Intel.

- At the same time, they rotate into defensive sectors such as utilities or healthcare.

- For the unaware, these industries are less dependent on global trade.

- Also, they hold up better during periods of uncertainty.

- You can adjust your portfolios by:

- Reducing tech exposure

and

- Buying into ETFs that track sectors like XLU (Utilities) or XLV (Healthcare).

Risk Management Techniques

Tariff-driven markets are much more volatile. Here, prices move sharply and unpredictably. Thus, good risk management becomes highly important during these times. You can follow these two clear strategies to manage risk:

| Tight stop-losses | Smaller position sizes |

|

|

Let us understand how our Bookmap can help you:

- By using our market analysis tool, Bookmap, you can identify “liquidity boundaries.”

- These are levels where there is heavy buying or selling interest.

- Ideally, you should set a stop-loss just beyond one of these boundaries.

- Now, if the price moves aggressively past that point, you can automatically exit.

- This limits your losses.

For example,

- Say a new chip tariff news hits the market.

- Now, liquidity disappears at $400 on Nvidia stock.

- As a trader, you set a stop-loss at $402 (if going short).

- This offers you a quick exit if the market reverses.

By managing risk this way, you can survive and stay in the game, even when the markets are moving unpredictably because of U.S.-China chip tariffs.

Conclusion

The ongoing U.S.-China chip tariff escalation brings both risk and opportunity for traders. These tariffs impact not only semiconductor companies but also the wider tech market, supply chains, and even currency and commodity prices.

Additionally, it creates sharp market movements and uncertainty. For you as a trader, this creates chances to profit. However, you must know where to look! By using real-time tools like our Bookmap, you can clearly see liquidity changes and market reactions as they happen.

This gives you a strong edge in spotting short-term opportunities and adjusting positions. So, want to analyse real-time market data? See the market clearly with us. Improve your trade execution around geopolitical events with insights from Bookmap’s Learning Center.