Ready to see the market clearly?

Sign up now and make smarter trades today

Education

March 28, 2025

SHARE

Inflation Expectations in 2025: Where Are Markets Heading?

Inflation is the market’s favorite troublemaker. If inflation were a person, it would be that one guest at a party who never leaves. Do you remember someone? Yes, inflation always stirs things up, makes headlines, and keeps traders on their toes. Even in 2025, inflation is expected to remain a dominant force. It will influence interest rates, stock markets, and global economic trends.

Worried? Don’t be! This article will help you make sense of it all.

In this article, we’ll explain how inflation impacts different sectors, from tech stocks to energy and real estate. You’ll also learn how traders can adapt using innovative strategies like rotating asset classes and leveraging futures spreads. We’ll also explore key macroeconomic indicators like CPI and wage growth, which influence market direction.

Beyond that, we’ll look at geopolitical factors, including rising NATO defense spending and how global uncertainties influence investment opportunities. Finally, we’ll discuss whether markets are headed for stability or fresh turbulence. Let’s begin.

Inflation Expectations: Stabilization or Continued Pressure?

Current Inflation Trends

In 2025, global inflation remains a key concern. In the U.S., there are indications that inflation is starting to ease. This happened due to aggressive Federal Reserve rate hikes. However, the core inflation still remains above target. The Eurozone also faces persistent price pressures due to:

- Energy costs

and

- Supply chain constraints.

Meanwhile, emerging markets are experiencing varied inflation trends. Some are benefiting from lower commodity prices, while others are struggling with currency depreciation. Observing market trends and inflation, we can see that while some regions may see stabilization, others could face prolonged challenges due to geopolitical risks and disrupted trade routes.

Impact of Interest Rate Policies

Please note that the central banks, like the U.S. Fed, use interest rates to control inflation. When inflation is too high, they increase interest rates to make borrowing more expensive. This event:

- Reduces spending,

- Slows down the economy and

- Helps to lower inflation.

On the other hand, when inflation is too low, they cut interest rates to encourage borrowing and spending. This boosts economic growth.

Have Higher Interest Rates Reduced Inflation?

Recently, the U.S. Fed maintained interest rates in the range of 5.25%–5.5% to control inflation. While inflation has fallen from its highest levels in 2021–2022, it is still above the 2% target, currently at 3.5%. This means inflation has not decreased as quickly as expected, so the Fed is waiting before making further decisions.

In an alternative view, some experts believe cutting interest rates may actually increase inflation in the short term. If rates are lowered too soon, borrowing and spending may rise too quickly. This will cause inflation to go up again within nine months.

Raising interest rates helps lower inflation, but it takes time to see the full effect. In the U.S., inflation has dropped, but it is not enough to meet the Fed’s target. Other global factors also keep prices high. Some believe that cutting rates too soon could make inflation worse, so central banks are being cautious before making further changes.

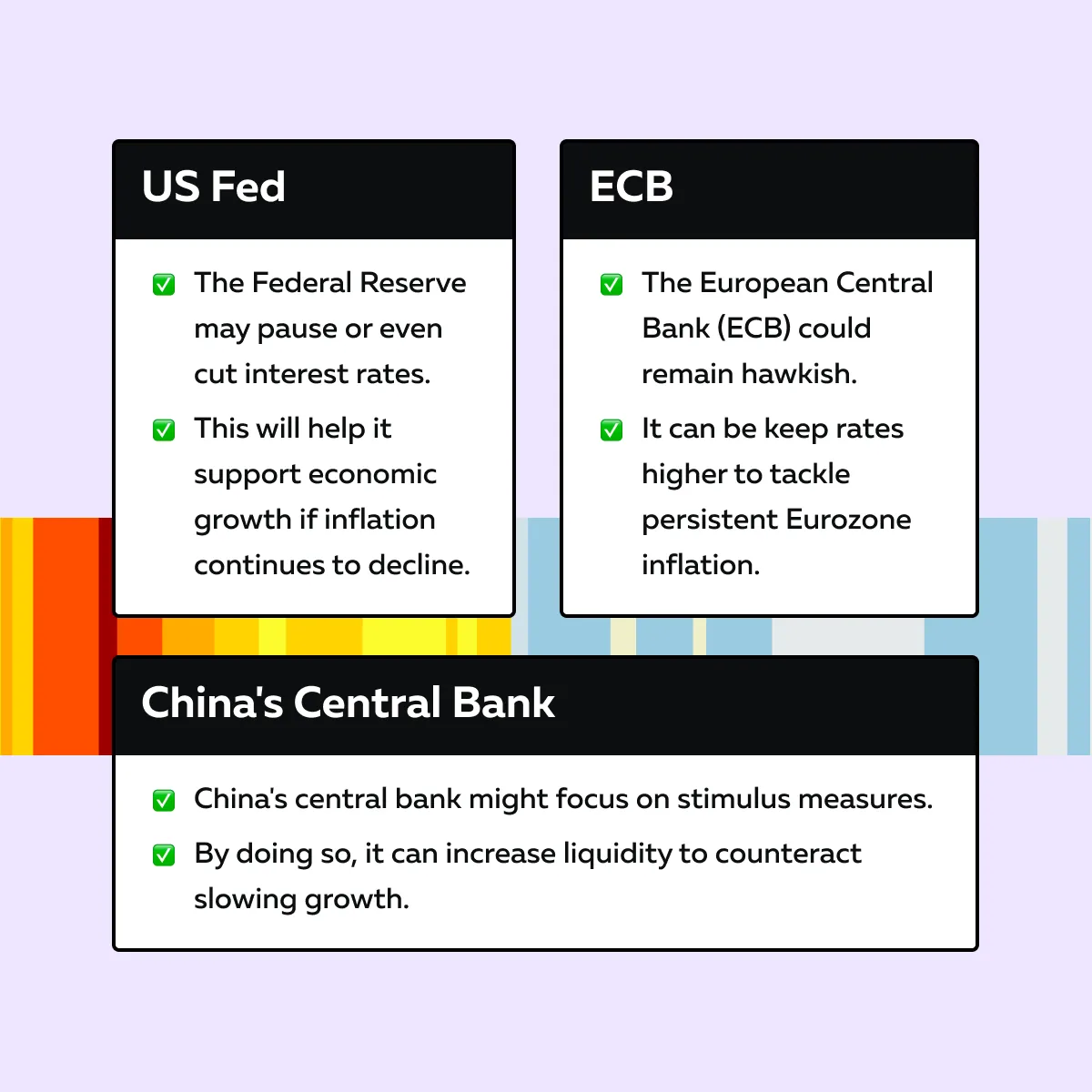

Diverging Central Bank Policies

In response to inflation in 2025, global central banks are expected to take different policy paths based on their economic conditions. Check out the graphic below:

These policy shifts will impact market trends and inflation worldwide. If the Fed cuts rates, the U.S. dollar could weaken, while higher rates in Europe might strengthen the euro. At the same time, increased liquidity in China may boost its stock markets. However, it clearly raises valid concerns about the potential for long-term inflation.

Investors who want to trade during inflation must consider these divergences. That’s because they influence:

- Asset flows,

- Bond yields, and

- Commodity prices (across global markets).

Use Bookmap to navigate inflation volatility and spot key market opportunities.

Key Drivers of Inflation in 2025

Inflation 2025 is expected to be influenced by the following key drivers:

A) Tariffs and Trade Policies

Inflation is not just about supply and demand. Trade restrictions also influence it. If the U.S. imposes higher tariffs on Chinese imports, production costs for businesses could rise. This will lead to more expensive goods for consumers.

In response, China and other countries may also introduce their own tariffs. This will create a cycle of rising prices.

B) Economic Isolationism

Protectionist policies (such as reshoring manufacturing) could further impact market trends and inflation. If companies move production from China to the U.S. or Mexico, costs may increase due to:

- Higher wages

and

- More operational expenses.

This shift can secure supply chains, but it will drive consumer prices higher in the short term. Even historically, markets have struggled in isolationist environments. That’s because such an environment slows innovation and reduces economic efficiency.

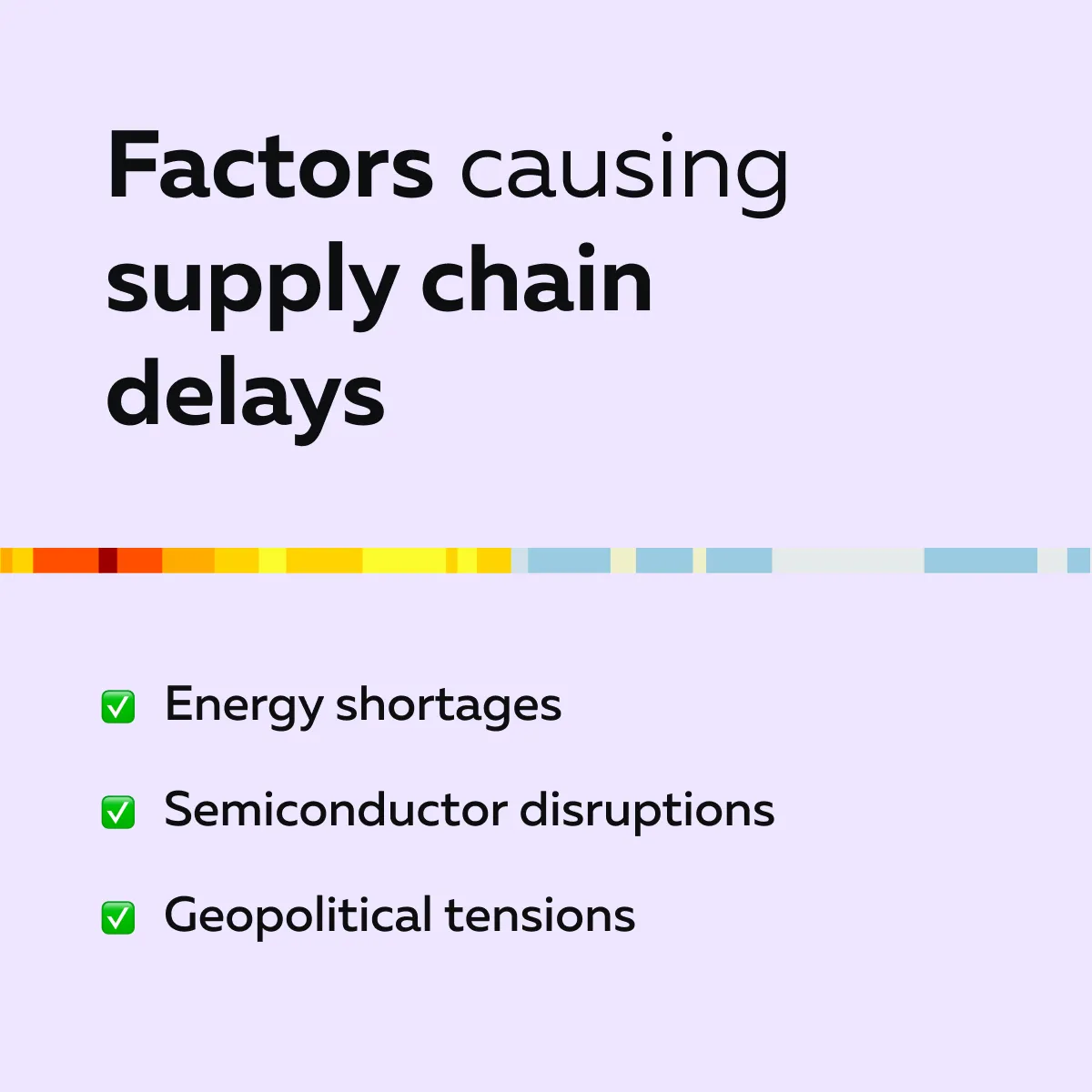

C) Supply Chain Bottlenecks or Recovery

Although some supply chain issues from 2022-2023 have improved, challenges remain. Below are some factors that can cause new delays:

For example:

- Shipping route conflicts or restrictions could push up transportation costs.

- This could severely affect trading during inflation.

- During these times, investors must consider rising costs in sectors like agriculture and technology.

Always remember that if supply chains recover smoothly, inflation may ease, but any disruption could keep price pressures high.

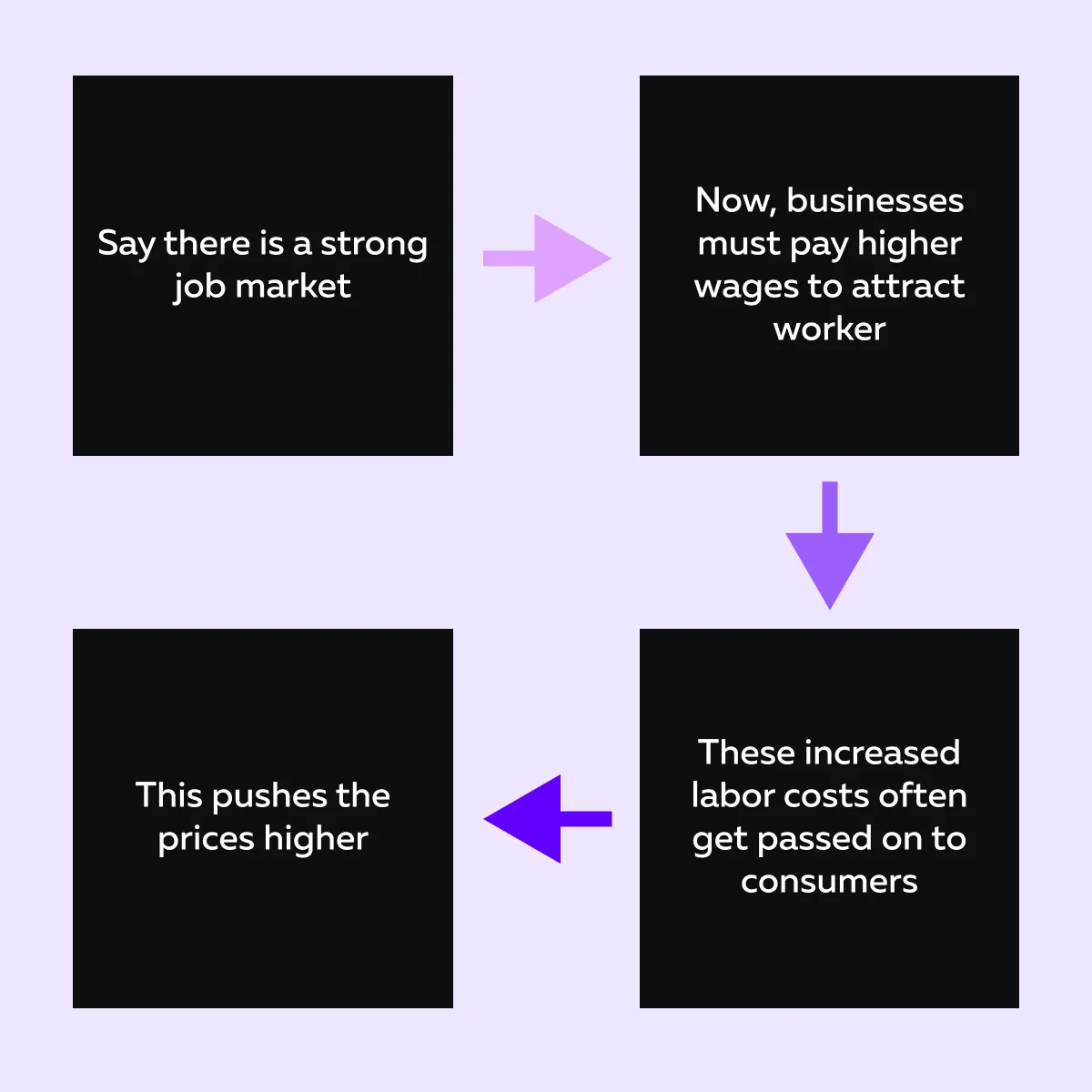

D) Wage Growth and Labor Market Strength

A strong labor market keeps inflation high (especially in service-based industries). Let’s see why it happens:

When analyzing inflation in 2025, sectors like retail, hospitality, and healthcare may continue to see wage-driven price pressures. If unemployment remains low, inflation could persist (despite efforts to control it through interest rate hikes).

E) Commodity Price Fluctuations

Energy prices play a significant role in market trends and inflation. If the supply of oil and gas is restricted, fuel costs rise, increasing businesses’ transportation and production expenses.

For example:

- Say OPEC enforces supply cuts.

- Now, global oil prices could spike.

- This adds renewed inflation pressure.

Additionally, sudden demand surges, like a sharp economic recovery, could also drive commodity prices higher. This makes inflation harder to control.

How Can Traders React to Inflationary Trends?

During high inflation, traders often focus on inflation-resistant assets. To trade smartly during inflation, you need to monitor commodities, energy stocks, and real assets like real estate, which perform well.

If inflation fears persist, you may shift toward:

- Gold,

- Oil, and

- Agricultural commodities.

These assets act as hedges against rising prices. By understanding these asset trends, you can better deal with volatile markets and protect your portfolios from inflation risks.

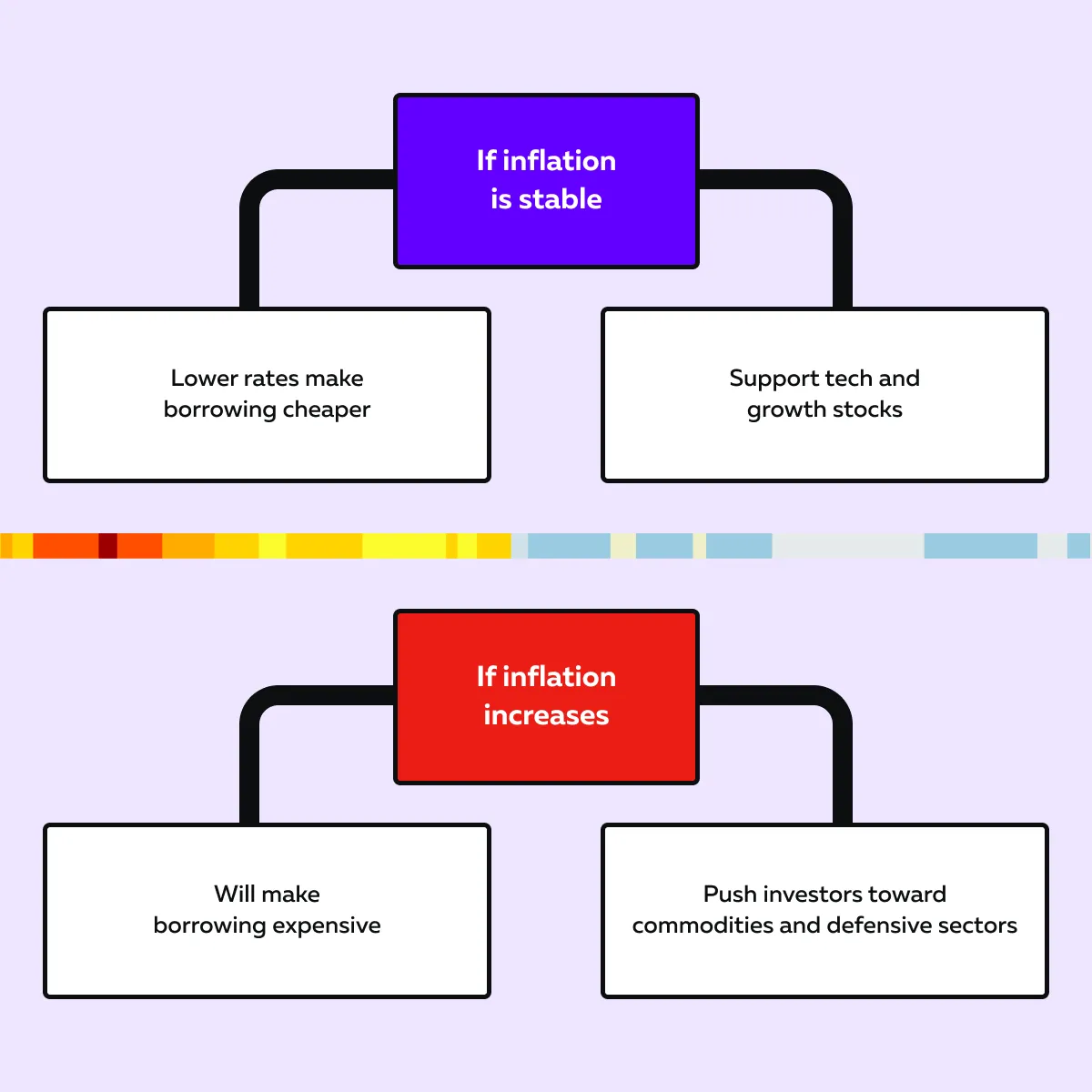

Choose Your Sectors Wisely

In 2025, if inflation cools, central banks might start cutting rates. Due to this, growth stocks (especially in tech) may see substantial gains due to decreased borrowing costs. However, if inflation stays high, rate cuts may be delayed. In this case, you can prefer defensive sectors like utilities and consumer staples. These sectors perform well in uncertain economic conditions.

Stay Nimble with Trading Strategies

Be aware that high inflation can create unpredictable market swings. This requires traders to stay flexible. To trade during inflation, you should:

- Adjust position sizes

and

- Use stop-loss strategies.

This will allow you to manage risk. Also, please note that short-term price movements can be sharp. Hence, economic indicators and central bank policies should be monitored closely. By staying nimble, you can protect your portfolios while taking advantage of opportunities in volatile markets.

Sectors to Watch: Winners and Losers of Inflation Trends

Inflation impacts different sectors in unique ways, creating both opportunities and risks for investors. While rising prices benefit commodities and defensive industries, they can hurt growth stocks.

Hence, you should learn how various sectors react to inflation. This will help you make smart decisions in an unpredictable market. Let’s see how you can do it:

Look Out for Growth vs. Defensive Sectors

Generally, growth stocks (such as tech and consumer discretionary companies) struggle in high-inflation periods. That’s because rising interest rates make borrowing expensive. However, if inflation cools and central banks cut rates, these stocks recover. This happens as investors seek high-growth opportunities.

Conversely, defensive sectors like utilities and healthcare often perform better when inflation remains high. This is because they offer essential services that people require, regardless of the economic conditions.

Analyze Commodities and Energy Stocks

Please note that energy prices are closely tied to inflation. Higher inflation often drives up oil and gas prices. This benefits energy companies and makes these assets useful as inflation hedges.

For example,

- Say inflation pushes up fuel costs.

- Now, oil companies may see increased profits (even as renewable energy continues to expand).

- This will boost their stock prices.

Therefore, to trade profitably during inflation, you should monitor commodity trends. That’s because rising energy prices shape market movements and influence investment strategies.

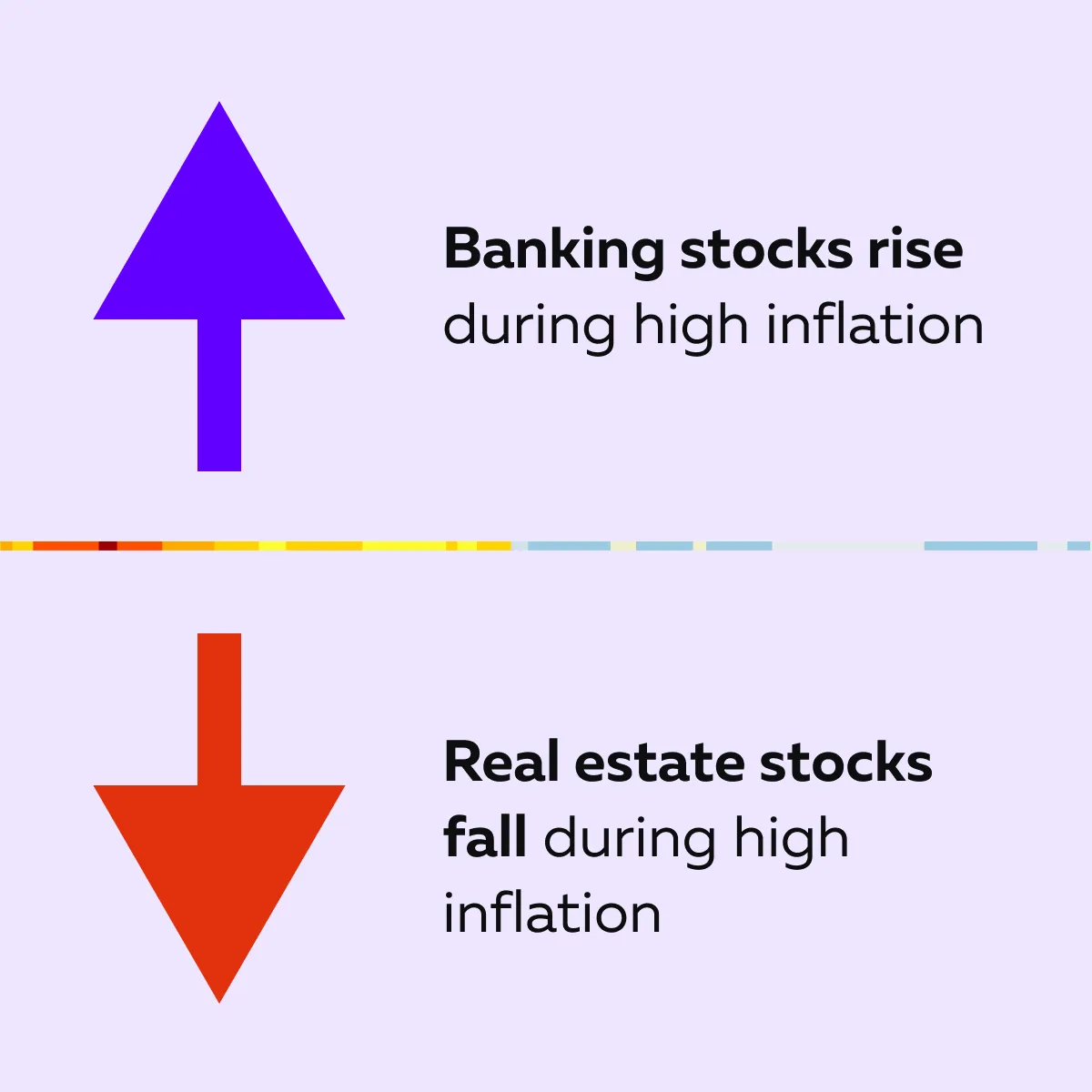

Real Estate and Financials

As mentioned above, higher inflation leads to increased interest rates, making borrowing more expensive. Rising mortgage rates reduce demand for homes and commercial properties, slowing down real estate growth.

However, financial stocks (especially banks) benefit. Higher interest rates allow banks to charge more on loans. This increases their profit margins. Check out the graphic below:

Anticipate inflation-driven trends with Bookmap’s real-time order flow tools.

The Role of Defense and NATO Spending

Rising geopolitical tensions and inflation are pushing NATO and European countries to increase defense budgets. European nations are committing to higher military spending. This is particularly benefiting companies like:

- Lockheed Martin,

- Northrop Grumman, and

- Rheinmetall.

Additionally, increased government budgets are increasing the demand for advanced weapons, cybersecurity, and aerospace technology. Companies like Raytheon, Boeing, and General Dynamics could see substantial growth if military expenditures continue to rise.

Trading Strategies for Inflation-Driven Markets in 2025

To better deal with inflation in 2025, you can follow these trading strategies:

I) Rotating Between Asset Classes

Based on inflation trends, traders must shift between:

- Stocks,

- Bonds, and

- Commodities.

Be aware when inflation rises, commodities like gold and oil often perform well. In contrast, growth-heavy stocks decline due to higher interest rates.

As an investor, if you are actively monitoring market trends and inflation, you might:

- Reduce exposure to tech stocks

and

- Shift toward energy and real assets.

Later, when inflation cools, you may rotate back into equities. You particularly shift to growth sectors that benefit from lower borrowing costs.

II) Benefit from Futures Contracts

Futures contracts allow you to:

- Hedge against inflation risks

or

- Profit from market shifts.

Most traders use commodity futures, such as gold or oil, to protect portfolios from rising prices. For example:

- Say inflation weakens a currency’s value.

- Now, gold futures can act as a hedge.

- Similarly, stock index futures also provide opportunities.

- Here, you can short major indices if you expect inflation to pressure equity markets.

III) Order Flow Analysis for Market Sentiment

Understanding market sentiment during inflationary periods is essential for trading profitably. Our advanced market analysis tool, Bookmap, allows you to analyze the real-time order flow to detect liquidity shifts.

For example:

- Say there is a release of a surprising CPI report.

- You use Bookmap and observe that large sell orders are appearing in growth stocks.

- This signals potential weakness.

- You accordingly adjusted your positions in response to institutional moves.

Key Macroeconomic Indicators to Watch in 2025

By tracking specific key economic indicators, you can better understand market trends and inflation risks in 2025. Let’s check them out:

i) Consumer Price Index (CPI) and Core Inflation

The Consumer Price Index (CPI) is a primary measure of inflation. It tracks price changes in essential goods and services. Usually, a sudden rise in CPI shifts investor sentiment. It pushes markets toward defensive stocks like utilities and consumer staples.

To manage inflation in 2025, you should closely monitor CPI reports and assess whether inflation is cooling or persisting. This assessment will influence your asset rotation strategy.

ii) Producer Price Index (PPI)

The Producer Price Index (PPI) tracks wholesale price changes. It often serves as a leading indicator for CPI trends. If the PPI rises significantly, it suggests that businesses may pass higher costs on to consumers, keeping inflation elevated.

To trade during inflation, you should monitor PPI data. This will help you anticipate future consumer price movements. Also, you can position yourself in inflation-resistant assets like commodities or energy stocks.

iii) Wage Growth and Labor Market Data

Please note that strong wage growth:

- Supports consumer spending

and

- Helps in sustaining inflationary pressures.

If wages rise faster than productivity, businesses usually raise prices. This further fuels inflation. Therefore, in 2025, labor market data will play a crucial role and will influence monetary policies. If job growth remains strong, central banks may delay rate cuts. This will affect investment strategies tied to market trends and inflation.

iv) Energy and Commodity Prices

Fluctuations in commodity prices directly influence inflation expectations. Higher oil prices usually increase transportation and production costs. It feeds into overall inflation.

Therefore, as a trader, you should focus on tracking energy markets. That’s because rising commodity prices shift investment flows toward inflation hedges like:

- Gold,

- Oil, and

- Agricultural commodities.

So, Where Are Markets Headed in 2025?

Due to inflation in 2025, markets could follow different paths. Let’s see how:

Please note that the direction of market trends and inflation will largely depend on central bank actions and global supply chain stability.

The Role of Investor Sentiment

Investor confidence will fluctuate in response to the new data. If inflation declines steadily, risk appetite could return. This will boost equities. However, if inflation remains unpredictable, traders may stay defensive. This will favor trading during inflation strategies like rotating into:

- Real assets

or

- Dividend-paying stocks.

In early 2025, many may take a wait-and-see approach until clearer trends emerge in inflation and interest rates.

Emerging Market Opportunities

It is expected that high inflation in developed markets may shift investor focus toward emerging markets with more stable price levels. Countries with lower inflation risks and strong growth potential could attract capital. This will benefit stocks and currencies in these regions.

While trading during inflation, the equities and bonds of emerging markets will also provide diversification benefits. This will happen as investors seek alternatives to rate-sensitive assets in the U.S. and Europe.

Conclusion

Tracking inflation in 2025 is very important for both traders and investors. That’s because inflation affects everything – stocks, bonds, commodities, and even currencies. If inflation stays high, some sectors like energy and commodities may do well. If it falls, tech and growth stocks could recover. Thus, by understanding market trends and inflation, you can make better decisions.

Furthermore, to succeed, traders must stay informed and adapt their strategies. Ideally, they should watch key indicators like CPI, interest rates, and energy prices. This will help them better predict market movements. Using the right approach (like rotating between stocks and commodities or using hedging strategies) can protect investments. Smart investors should adjust their plans based on new data and central bank policies. Also, you should consider using our real-time analysis tool, Bookmap. Using it, you can see market shifts as they happen. Through insights from Bookmap, you can:

- Detect liquidity changes

and

- Spot big buy or sell orders.

This allows you to react quickly. Prepare for 2025’s inflationary market shifts using Bookmap’s advanced trading insights.