Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

January 2, 2025

SHARE

Top Trading Trends of 2024: Strategies and Market Shifts Every Trader Should Know

In the fast-paced world of trading, every trader wants to stay ahead. Yet most of them limit themselves to just reacting to market shifts. Do you think that’s enough? Definitely not! The real competitive advantage lies in understanding macro trends deeply and adapting strategies swiftly as conditions evolve.

As we head into 2025, traders will face a challenging environment influenced by Inflation and interest rates, retail investors’ collective power, and global geopolitical tensions. Even in 2024, each of these factors has impacted trading sentiment and sector performance. The effect was particularly felt more in high-growth areas like tech, energy, and real estate.

In this article, we will learn about the various market forces shaping 2024. We will see top trading strategies in 2024, such as scalping, trend-following algorithms, and sector rotation. We’ll examine how sentiment analysis, risk management, and asset diversification are required to prepare portfolios for uncertain times. Readers will also learn how tools like Bookmap aid in backtesting and refining strategies. By mastering these elements, traders can approach 2025 with an informed perspective and better prepare for both opportunities and risks in the coming year. Let’s get started.

Macro and Market Dynamics Shaping 2024

Let’s begin our conversation with the relationship between inflation and interest rates. In 2024, inflation and recent rate hikes continue to impact trading sentiment. They are increasing uncertainty across asset classes. Be aware that rising interest rates reduce the present value of future cash flows. This way, they make high-growth and long-duration assets less attractive.

In 2024, this shift is especially visibly in equities and in that too, particularly “growth stocks”. In these stocks, investors have become increasingly selective. They are favoring companies with stronger cash flows and more predictable earnings. For more clarity, let’s have a look at the sectoral responses:

| Real Estate Sector | Technology Sector | Energy Sector |

|

|

and

|

Now, let’s study an example related to the Fed’s rate hikes and the tech sector:

-

- The Fed’s rate hikes over the past year have pressured the tech sector.

- It has particularly impacted companies with high price-to-earnings ratios.

- Companies like Tesla and Amazon have experienced price recalibrations.

- In 2024, investors have revalued the sector under a new and less forgiving interest rate environment.

- As a result, increased volatility has been observed.

Growing Retail Investor Influence

Retail investors have gained unprecedented influence in recent years. It is mainly due to the ease of access to:

- Trading platforms

and

- Information through social media.

Be aware that platforms like Reddit and Twitter amplify sentiments quickly. This leads to rapid price movements in certain “meme stocks”. Sometimes, it even creates disproportionate volatility. This especially happens in sectors with fewer institutional investors or limited research coverage. Let’s understand better through a classic example of AMC Entertainment:

- AMC Entertainment is a stock propelled by social media hype.

- It gained traction on Reddit.

- Then, retail investors coordinated to boost the stock’s value.

- This move challenged institutional short positions and led to price spikes.

- Also, this movement generated increased volume and attention.

- This showcases the power of retail investors to move markets.

Stay on top of market trends with Bookmap’s real-time trading tools. Track market shifts like a pro with Bookmap’s advanced analysis tools.

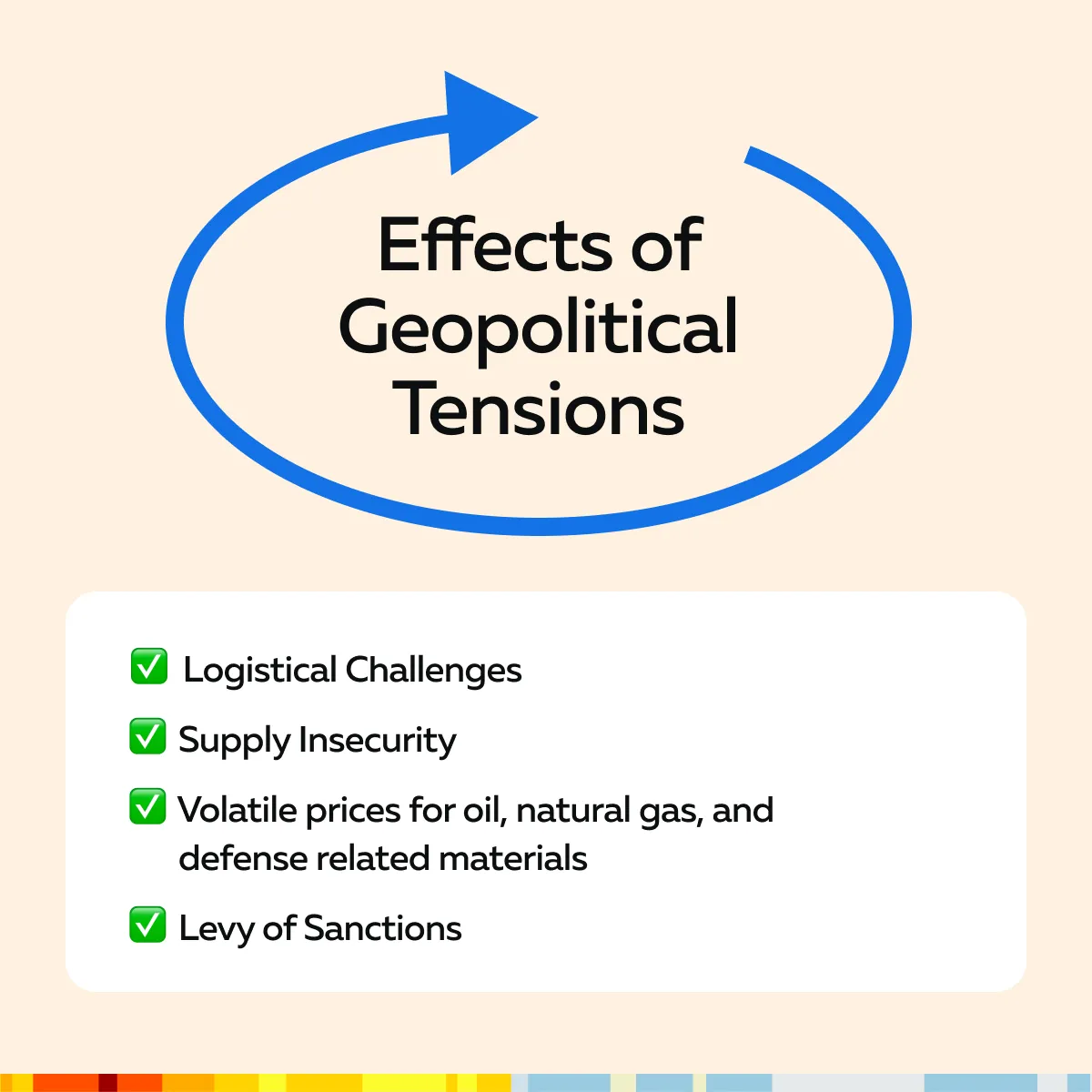

Global Geopolitical Tensions

Geopolitical tensions (particularly between Ukraine and Russia) and the potential conflict over Taiwan have created supply chain disruptions. These events have increased volatility in commodities. As a result, the energy and defense sectors have been directly impacted. Let’s see how through the graphic below:

Commodity prices (particularly for oil and gas) remain sensitive to ongoing geopolitical developments. This creates “risk premiums” as countries assess energy security in uncertain times. Let’s understand better through an example:

- Sanctions were imposed on Russia due to its invasion of Ukraine.

- This disrupted the global oil and gas supply.

- It led to price spikes as Europe sought alternatives to Russian gas.

- This volatility impacted energy prices.

- Also, it spilled into other sectors dependent on stable energy supplies.

2024’s Top Trading Strategies

This year, traders can follow these top trading strategies 2024:

1. Scalping and High-Frequency Trading

Scalping or scalp trading has gained momentum in 2024. Market volatility this year has presented numerous short-term profit opportunities. With rapid market movements, scalpers make multiple trades per day. They try to capitalize on small price changes. Be aware that high-frequency trading (HFT) complements this strategy. It uses advanced algorithms and executes a high volume of transactions at lightning speeds. This way, traders can capture small profit margins across large trades.

Example:

- During earnings season, tech and energy stocks often experience:

- Increased volume

and

- Heightened volatility.

- A scalper focuses on these sectors.

- They especially operate when market-moving events occur, such as quarterly reports from major companies.

- The goal here is to capture quick profits from these short-lived price movements.

- Usually, they enter and exit positions in minutes or even seconds.

Need help tracking scalping trends? Bookmap’s order flow tools provide real-time data insights.

2. Trend-Following Algorithms:

As per Market Trends 2024, trend-following algorithms have become an important part of trading strategies due to intensified market volatility. Please note that these strategies use algorithms. These algos identify and capitalize on sustained price trends, whether upward or downward.

With advancements in AI, traders can even automate trend-following. By doing so, they can benefit from algorithms that detect patterns and trends in real time.

Example:

-

- A trend-following bot tracks the S&P 500.

- It identifies when the index aligns with long-term uptrends.

- When the algorithm detects bullish momentum, it initiates buy orders.

- This bot follows the trend until signs of a reversal appear.

This approach allows traders to participate in larger market movements without the need for continuous monitoring.

3. Sector Rotation Based on Economic and Market Cycles

In a sector rotation strategy, traders shift capital among sectors. They try to capitalize on cyclical performance changes.

Example:

- Early in the year, investors focused on energy stocks.

- That’s because they benefited from inflation and geopolitical events that elevated oil prices.

- As rate hikes showed signs of slowing down, tech stocks became appealing again.

- This prompted investors to rotate capital back into growth-oriented sectors.

4. Copy Trading

Copy trading is one of the top trading strategies in 2024. It allows inexperienced retail investors to replicate the trades of seasoned professionals. This replication is done through platforms that enable “automated mirroring”. Through this technique, several retail investors benefit from the expertise of more experienced traders without needing extensive technical skills.

Example:

- Suppose a novice investor uses a copy trading platform.

- They mirror the trades of a successful crypto trader.

- By replicating this trader’s moves, the investor benefits from the pro’s strategies.

- Also, they gain insights into the timing and rationale behind each trade.

- This allows for a hands-on learning experience while participating in the market.

5. Social Trading

Social trading platforms have democratized access to insights. They enable traders to do a lot of activities together. Check the graphic below:

For retail investors, this is a valuable source of real-time sentiment. They can check the nerves of the market, especially in trending sectors like high-growth stocks or new cryptocurrencies.

Example:

- Let’s say a retail investor is interested in growth stocks.

- They consult social trading platforms to see community sentiment.

- By viewing discussions and sentiment scores, the investor gauges the broader market view.

- Hence, they could make more informed trading decisions.

5. Commodities and Safe-Haven Strategies

As per market trends in 2024, commodities (particularly metals like gold, energy, and agricultural products) will become popular inflation hedges in 2024. It must be noted that investing in commodities helps to diversify portfolios amid the following:

- Currency depreciation,

and

- Heightened inflation fears.

Also, safe-haven assets like gold appeal to investors as a store of value. Their importance increases, especially when inflation erodes the purchasing power of traditional currencies.

Example:

- Historically, gold (as a traditional inflation hedge) has attracted investors looking for stability during periods of high inflation.

- Additionally, any signs of U.S. dollar weakness further increase demand for gold.

- That’s because it becomes cheaper for foreign investors.

- This trend is particularly evident in times of economic uncertainty when safe-haven assets are in high demand.

Key Markets and Sectors to Watch

Considering the top trading trends in 2024, below are some key markets and sectors that investors and traders must watch:

1. Renewable Energy and ESG

Renewable energy and ESG (Environmental, Social, and Governance) stocks remain strong areas of investor interest in 2024. They are well supported by government incentives and commitments to reduce carbon emissions. Favorable policies in major economies (such as tax credits for clean energy initiatives) have attracted investments in sectors like:

- Solar,

- Wind, and

- Hydrogen energy.

Additionally, there is growing consumer and institutional demand for sustainable and ethical investments. This has directed capital toward ESG-focused companies.

Example:

- Investments in battery production and electric vehicle (EV) manufacturing have increased demand for renewable energy stocks.

- Companies involved in lithium, nickel, and other battery materials are seeing heightened interest due to the global push for EV adoption.

This implies firms developing renewable infrastructure and energy storage solutions are positioned to benefit.

2. Blockchain and Digital Asset Investments

The blockchain sector continues to grow beyond Bitcoin. Check the graphic below to see where investors are now pouring money:

DeFi projects aim to provide decentralized financial services without traditional banks for the unaware. On the other hand, NFTs continue to expand into new applications, such as:

- Digital art

and

- Virtual real estate.

Also, the metaverse (supported by blockchain-based assets) is gaining traction. Now, more investors and companies are exploring virtual worlds and decentralized digital spaces.

Example:

- Ethereum and Solana crypto have become prominent assets in the DeFi space.

- Ethereum’s strong developer community and established smart contract ecosystem make it a go-to platform for DeFi projects.

- Solana, known for its fast transaction speeds, has also gained attention.

- Many DeFi developers are using Solana as a cost-effective blockchain solution.

Please note that price movements in these assets are often tied to adoption rates and the success of new blockchain-based applications.

3. Artificial Intelligence and Automation

The AI and automation sectors have attracted significant investment. They streamline operations and cut costs across industries. Nowadays, companies are focusing on:

- AI-driven analytics,

- Machine learning, and

- Robotic process automation.

This helps them to improve efficiency and maintain competitiveness. Cloud computing providers also play a key role in supporting AI initiatives. They offer the necessary infrastructure to process large datasets and train complex AI models.

Example:

- AI-focused ETFs have grown.

- That is because more investors now want to get exposure to the sector’s potential to transform industries ranging from finance to healthcare.

- Be aware that these ETFs mostly invest in companies specializing in:

- AI software,

- Cloud computing, and

- Automation hardware.

AI’s rapid adoption is due to its ability to save costs and increase productivity. This makes it a high-growth area and is a top trading trend of 2024. Several investors are closely watching this sector for long-term gains.

Preparing for 2025: Steps to Adapt to Emerging Trends

In 2025, several traders are anticipating shifts in market dynamics. As a result, they are refining their strategies and focusing more on “backtesting.” For the unaware, it refers to testing a strategy on historical data. It allows traders to optimize and adjust their approaches for possible future scenarios. By simulating how a strategy would have performed under different market conditions, traders can:

- Identify areas for improvement

and

- Enhance the robustness of their strategies.

Use Bookmap for Deeper Backtesting

Our advanced market analysis tool, Bookmap, provides simulation tools. It replicates various market scenarios. Using it, traders can check their strategies in realistic trading environments.

Example:

- Let’s say a trader uses Bookmap for backtesting.

- They see how their strategy would fare under both stable and volatile conditions.

- Using Bookmap, they perform the following functions:

- Tests assumptions,

- Refines entry/ exit points,

- Adjusts position sizes, and

- Sets risk management parameters based on historical patterns.

For more clarity, let’s see another example related to trend-following strategy on volatile assets:

Assume that a trend-following trader is focusing on tech or energy stocks. The trader backtested a moving average crossover strategy on volatile assets that responded dramatically to economic events in 2024.

By analyzing data from periods of high volatility, the trader determines whether the strategy consistently captures trends and profits from fluctuations. Now, if backtesting shows positive results under 2024’s conditions, the trader will carry this strategy forward into 2025. If not, they refine parameters as needed.

Use Simulation Tools for High-Stress Scenarios

To further prepare for unexpected conditions in 2025, traders can simulate specific events like:

- News-driven volatility

or

- Sudden economic data releases.

By recreating these situations, traders understand how their strategies might react under high-stress conditions. Additionally, recreating these situations helps them to identify weaknesses and adjust strategies proactively. Ready to test your strategies in realistic conditions? Try Bookmap’s backtesting and simulation tools.

Apart from backtesting, traders should also perform the following steps to adapt to the market trend in 2024:

A) Keep Up with Sentiment Analysis

Market sentiment has become a critical indicator. Its importance has increased even more with the surge of retail trading activity in 2024. By monitoring sentiment, you get to know about the collective market psychology. This often foreshadows price movements. Sentiment trends can be analyzed from:

- Social media platforms

and

- News Headlines.

Through these sources, traders can detect shifts in enthusiasm or pessimism surrounding investment assets.

How Important is Sentiment Analysis in Retail Markets?

Sentiment analysis captures the unpredictable retail-driven surges. Platforms like Reddit and X (formerly Twitter) have been powerful amplifiers of retail interest. They create momentum around certain stocks or sectors, such as “meme stocks” or trending tech companies. These retail movements lead to sudden spikes in volatility. By following sentiment, traders can:

- Anticipate such movements early

and

- Adjust strategies accordingly.

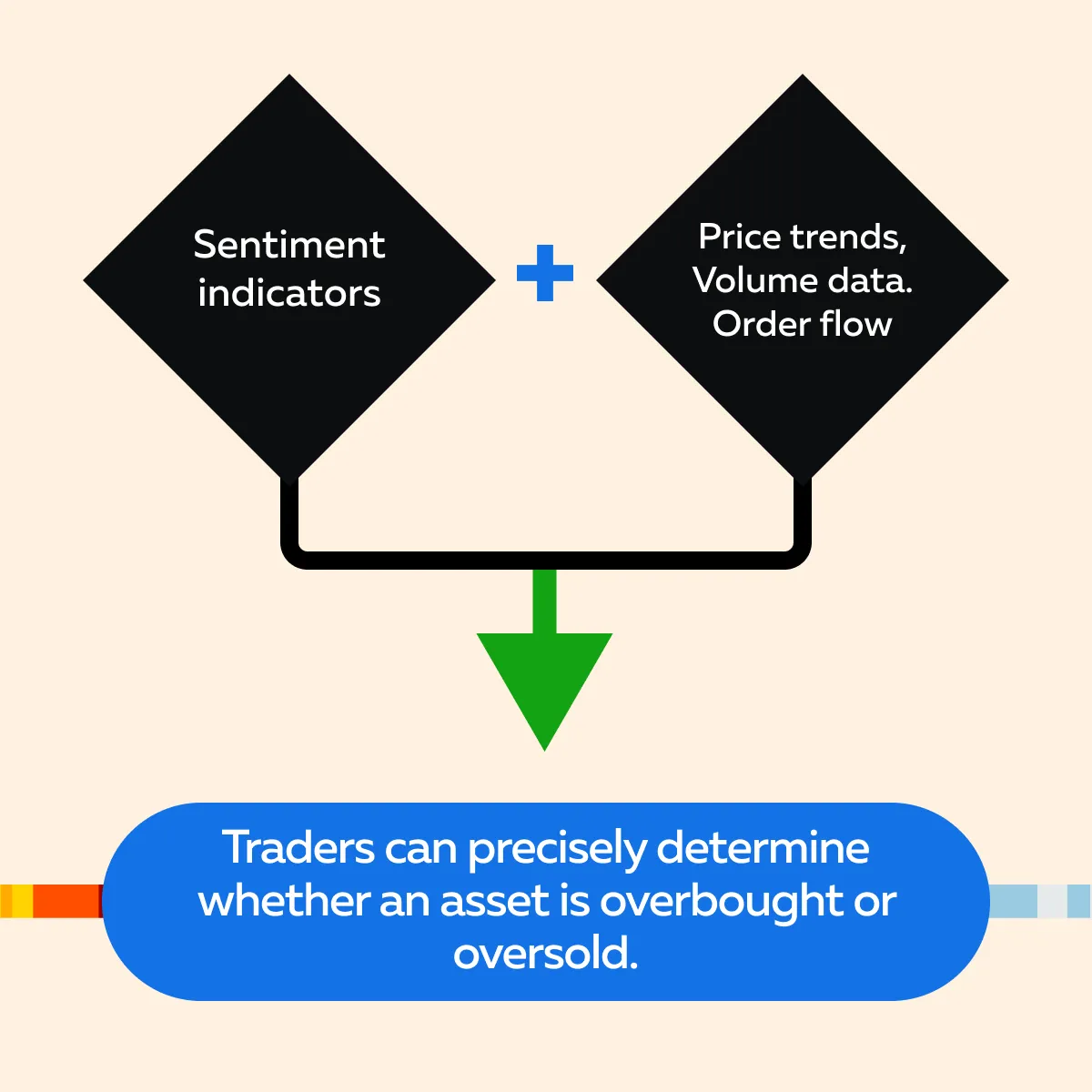

How to Incorporate Sentiment Data into Trading Strategies?

Use sentiment as a supplementary signal. Traders can use sentiment analysis as a complementary tool alongside traditional price and volume indicators. Let’s see how:

This layered approach improves decision-making. Traders can easily filter out noise. They can focus on assets with both positive sentiment and technical signals. Let’s understand better through an example:

- Let’s say a trader is following a major tech stock.

- They monitor both social sentiment and order flow data.

- Now, a positive earnings report has been released.

- This release sparked a wave of social media discussions and increased retail interest.

- Assume that Reddit and Twitter indicate strong and sustained buying interest.

- Also, order flow data shows high buy-side volume.

- In this case, the trader interprets this as a strong buy signal.

- They enter a long position and expect a price surge.

Stay on top of market sentiment with Bookmap’s real-time sentiment tools, helping you make informed trading decisions.

B) Do Risk Management

Economic uncertainties are likely to persist into 2025. Therefore, strengthening risk management and ensuring portfolio diversification will be important. Also, volatile conditions can lead to rapid shifts in asset prices. Hence, traders must:

- Follow a well-balanced approach

and

- Try to reduce exposure to high-risk assets.

Whatever exposure traders have, they can pair the high-risk assets with more stable options. By doing so, traders can achieve a combination of growth potential and safety.

Risk Management Tactics for High-Volatility Markets

In high-volatility markets, reducing position sizes limits exposure to any single asset. Such a strategy provides protection against sharp declines as you hold only smaller positions. By doing so, you:

- Reduce the impact of adverse price movements,

- Allow them to stay within risk tolerance levels, and

- Avoid excessive drawdowns.

Moreover, you should use tight stop-loss orders. This allows you to cap losses at a set level. When this level is reached, you exit a trade if prices move against their positions. This approach is particularly useful in volatile conditions. Tighter stops allow you to automatically trigger an exit when an asset dips below a predetermined level.

Additionally, avoid overleveraging. That’s because leveraging can amplify gains but also increase potential losses. This situation makes it risky in uncertain markets. By reducing leverage, traders can limit the size of losses. Also, it provides a safety buffer during turbulent periods.

C) Diversify Across Asset Classes and Sectors

Diversifying a portfolio (across sectors and asset classes) offers protection from sector-specific downturns. It also balances exposure to different market conditions.

Example:

- Let’s say a portfolio includes:

- Tech stocks,

- Commodities like gold or oil, and

- Bonds.

- Such a portfolio is less reliant on a single sector’s performance.

For more clarity, let’s study another example and see how a trader balances tech stocks with bonds and commodities:

- Let’s say a trader holds a portfolio, which has:

- Growth-oriented tech stocks,

- Safe-haven assets like bonds, and

- Inflation-resistant commodities like gold.

- Now, if inflation persists, commodities can provide a hedge.

- They can preserve value even as inflation erodes purchasing power.

- Meanwhile, tech stocks offer growth potential.

- Lastly, bonds add stability.

- They offset riskier positions and reduce overall portfolio volatility.

Stay ahead in uncertain markets with Bookmap’s tools for advanced risk analysis and portfolio management insights.

Conclusion

To succeed in the challenging markets of 2025, you must stay informed and remain adaptable. You should keep tracking trends in renewable energy, digital assets, and AI. This helps you to understand market sentiment and anticipate changes. Also, you must apply disciplined risk management and diversification strategies. This helps you to protect your portfolio and capitalize on emerging opportunities.

Moreover, refining trading strategies is just as crucial. Our advanced market analysis tool, Bookmap, offers capabilities to test and adjust strategies based on real data. These functions and features enable you to prepare for various market scenarios. Through backtesting, you can learn how a strategy might perform under different conditions.

As 2025 approaches, maintaining a proactive approach to learning and using advanced market analysis tools like Bookmap is almost necessary. Want to align with 2024’s trading trends? Explore Bookmap’s liquidity and order flow insights.