Ready to see the market clearly?

Sign up now and make smarter trades today

Education

August 26, 2024

SHARE

The Future of Algorithmic Trading: Trends to Watch in 2024

Trading has evolved, and now the secret to success is speed. Acting on this secret, most tech-savvy traders nowadays perform “algorithmic trading.” By using sophisticated computer programs, they not only accelerate their trading speed but also their accuracy and predictive capabilities—without human error and emotional bias. But how?

In this article, we’ll explore the exciting future of algorithmic trading and what to expect in 2024. You’ll learn about the history and evolution of algorithmic trading, from its early days in the 1970s to today’s modern technologies.

We’ll also discuss how advancements like AI, big data, and quantum computing shape trading strategies. You’ll also discover new trends, such as Decentralized finance (DeFi) and how blockchain improves security and transparency. Moreover, we will clarify things using practical examples and case studies, including the strategies used by leading firms like Renaissance Technologies. Let’s begin.

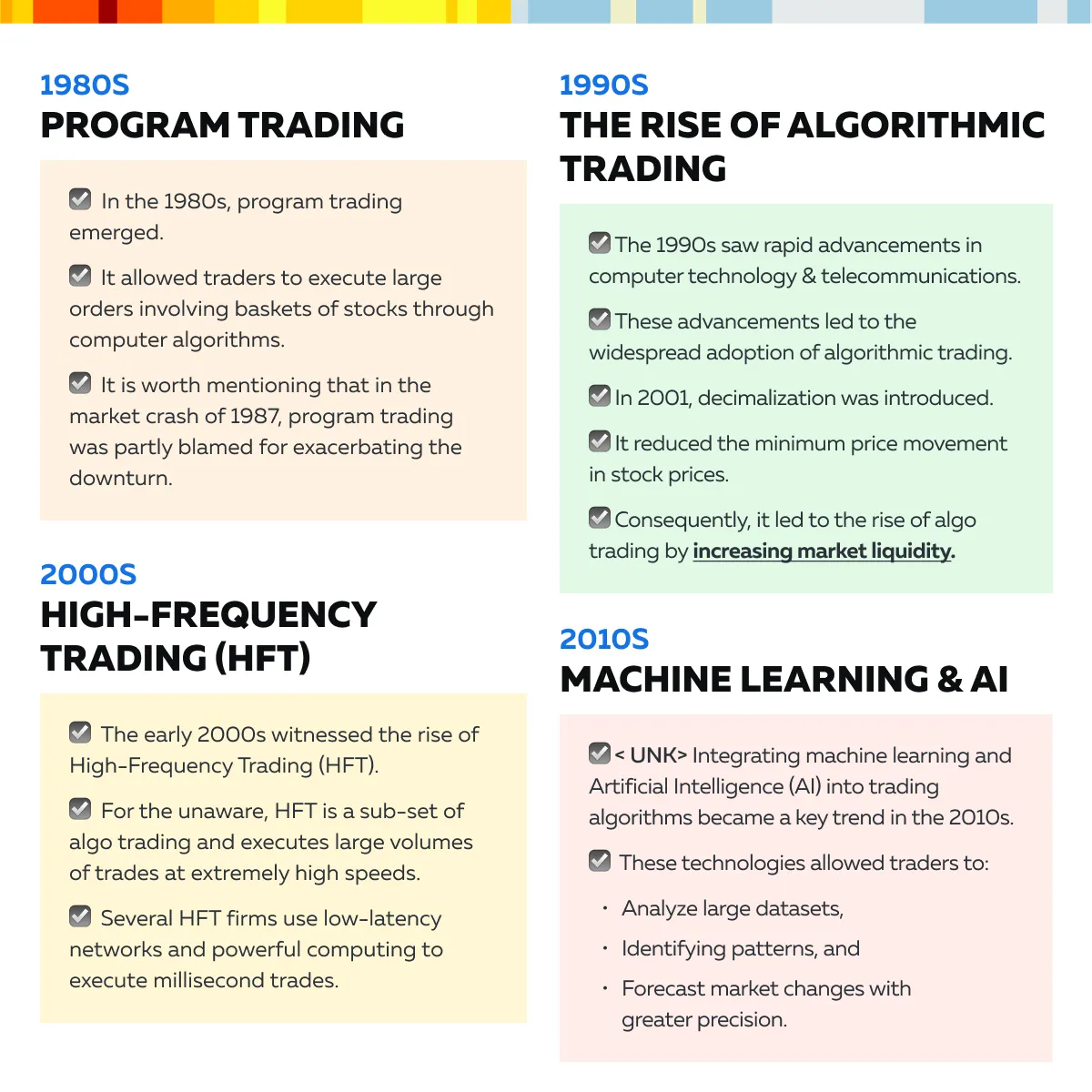

The Evolution of Algorithmic Trading

Algorithmic trading, or “algo trading,” involves using computer algorithms to automatically execute trades in financial markets. This practice has evolved significantly since its inception, which can be traced back to the 1970s. In this era, stock exchanges like the New York Stock Exchange (NYSE) began transitioning from manual to electronic trading systems. Also, the introduction of the NASDAQ in 1971, the world’s first electronic stock market, marked a significant milestone.

For a better understanding, let’s have a look at certain key events that led to the evolution of algo trading:

Having understood the evolution, let’s see the current state of algo trading in the next section. Do you wish to explore cutting-edge trading technologies? Transition to Bookmap – Join now!

What is the Current State of Algorithmic Trading?

It must be noted that algorithmic trading is now a dominant force in global financial markets. This technique accounts for a significant portion of trading volume. Let’s see the several prevalent technologies that enable algo trading:

| Big Data | AI and Machine Learning | Low-Latency Networks |

|

|

|

Hence, we can clearly state that algorithmic trading is evolving with technological advancements. Market participants are developing increasingly sophisticated and adaptive trading algorithms by integrating AI, big data, and machine learning.

However, several trading strategies have been developed to use these algorithms effectively. Let’s check the popular ones:

- Statistical Arbitrage:

- This strategy involves exploiting pricing inefficiencies between related financial instruments.

- Algorithms are used to identify and capitalize on these inefficiencies in real-time.

- Market Making:

- Market makers provide liquidity by placing buy and sell orders.

- Algorithms facilitate this process by continuously adjusting orders based on market conditions.

- Sentiment Analysis:

- AI-driven sentiment analysis allows traders to gauge market sentiment.

- This analysis is done by examining:

- News articles,

- Social media posts, and

- Other text data.

Key Trends in Algorithmic Trading for 2024

AI and Machine Learning are significantly shaping the future of algorithmic trading. These technologies are now being used to develop sophisticated trading algorithms capable of:

- Predictive analytics

and

- Real-time decision-making.

AI models, particularly those tailored for niche markets, are becoming more prevalent. This is happening because they provide more precise and domain-specific insights. Moreover, the use of such customized generative AI tools allows traders to optimize their strategies by:

- Analyzing vast amounts of data quickly

and

- Adjusting to market conditions dynamically.

This trend is further enhanced by integrating machine learning operations (MLOps). This technique ensures that AI systems are effectively deployed and maintained in real-world trading environments.

Similarly, some other latest key trends (2024) in algorithmic trading are delineated below:

- Quantum Computing

It must be noted that “quantum computing” holds the potential to revolutionize algorithmic trading. That’s because it offers unparalleled computational power. Quantum algorithms can process vast amounts of data at unprecedented speeds. Using them, traders can solve complex problems and explore multiple market scenarios simultaneously.

This capability allows for more accurate predictive models and risk management strategies. As quantum computing technology matures, we are seeing the emergence of QuantumAI. This technique integrates quantum algorithms with AI to enhance market analysis and optimize trading performance.

Financial institutions are beginning to invest in this area, recognizing the long-term benefits of implementing quantum strategies in trading.

- Decentralized Finance (DeFi)

Also, Decentralized Finance (DeFi) has introduced significant innovations in algorithmic trading, particularly within cryptocurrency markets. Automated market makers (AMMs) and decentralized exchanges (DEXs) are creating new trading opportunities. Let’s see how:

| Automated Market Makers (AMMs) | Decentralized Exchanges (DEXs) |

|

|

Now, let’s have a look at some expected regulatory developments in algorithmic trading:

Regulators increasingly focus on algorithmic trading to enhance market transparency and mitigate risks. The expected new regulations will certainly increase transparency in algorithmic trading practices. They will require firms to disclose:

- Trading Strategies,

- Algorithms used, and

- Execution methods.

Such disclosure will reduce information asymmetry and enhance market integrity. Moreover, the current regulatory frameworks are also evolving to eliminate market manipulation risks associated with algorithmic trading. Usually, this includes monitoring for abusive trading practices, such as spoofing and layering, and implementing stricter controls on algorithmic trading activities.

Emerging Technologies and Tools

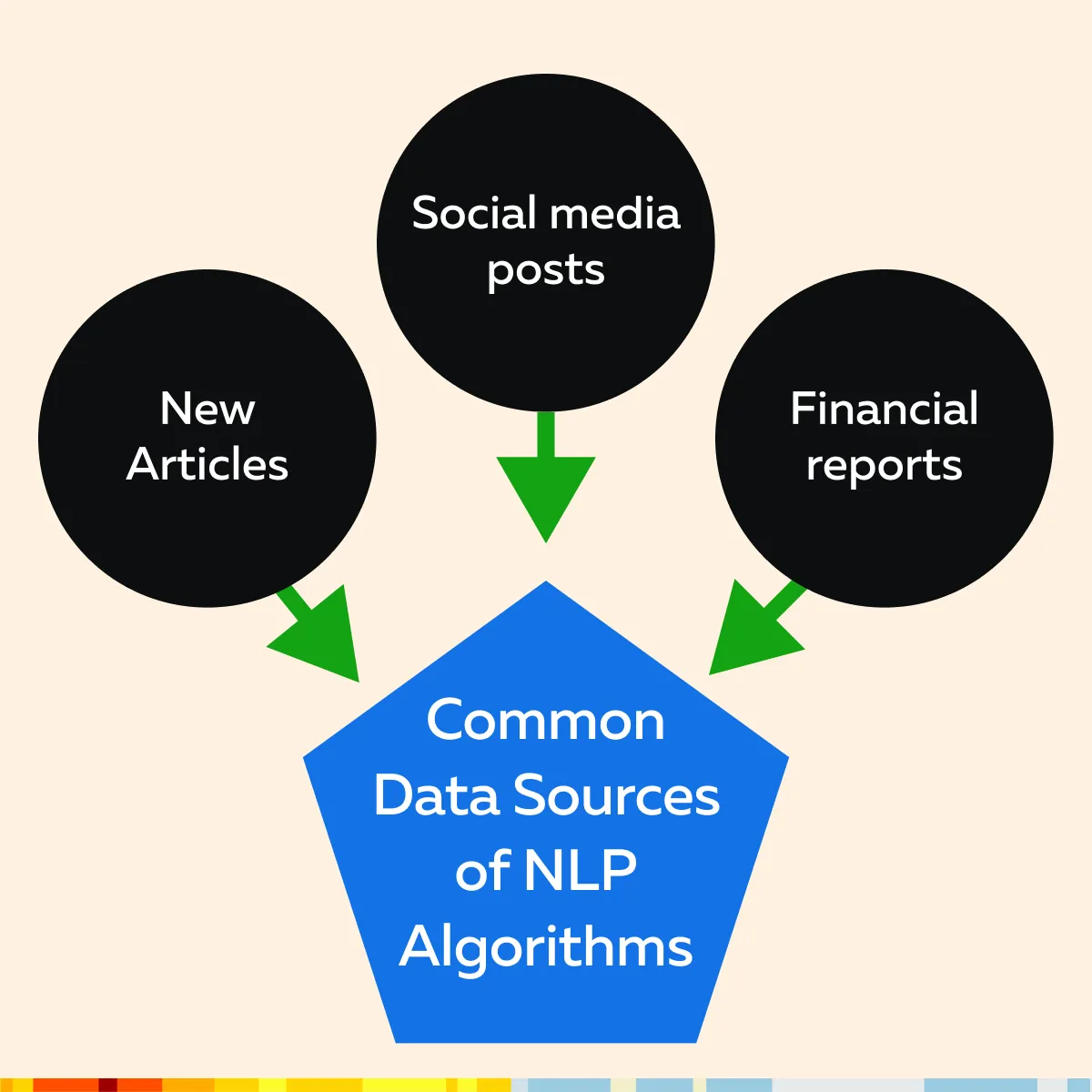

The use of NLP (Natural Language Processing) in trading strategies has recently increased significantly. These days, NLP algorithms are playing a crucial role in parsing:

- Financial news

and

- Social media sentiment.

Most NLP algorithms gauge market sentiment by analyzing text data. See the graphic below to learn about the common sources of this data:

Post analysis, these NLP algorithms identify positive or negative sentiments towards specific assets or sectors. Using this information, traders can now anticipate market movements and adjust their strategies accordingly.

Also, several advanced NLP techniques, such as natural language understanding (NLU) and machine learning models, are used to extract actionable insights from unstructured text. This includes predicting market reactions to:

- News events,

- Earnings reports, and

- Geopolitical developments.

How is Blockchain Integrated in Algorithmic Trading?

One must know that blockchain technology and smart contracts are revolutionizing algorithmic trading by providing enhanced security and transparency. This is happening because of the two most prominent features of blockchain technology, as explained in the given table:

| Smart Contracts | Immutable Ledger |

|

|

Ready to up your trading game? Explore cutting-edge trading technologies with Bookmap – Join now

What is the function of Advanced Data Analytics?

Advanced data analytics are pivotal in algorithmic trading. That’s because they extract deeper market insights. Let’s see how:

- Market Trend Analysis

- Big data analytics processes large volumes of structured and unstructured data

- This helps in identifying the following:

- Market trends,

- Patterns, and

- Correlations.

- This analysis informs the development of predictive models and algorithmic trading strategies.

- Machine Learning Algorithms

- By applying machine learning to big data, traders can build models that adapt to evolving market conditions.

- Also, it improves decision-making and trading performance over time.

Do you wish to stay ahead of the curve? Use Bookmap’s advanced trading tools. Sign up today!

The Rise of Cloud-Based Solutions

Cloud computing has transformed algorithmic trading by offering scalable and flexible solutions. These cloud-based platforms allow traders to deploy algorithms across:

- Multiple markets

and

- Geographic regions seamlessly.

This scalability allows for rapid expansion and adaptation to changing market conditions. Moreover, cloud computing resources can be dynamically allocated based on trading demands. This allocation optimizes performance and reduces operational costs compared to traditional on-premises infrastructure.

How Important is Cybersecurity?

Cybersecurity safeguards trading platforms and sensitive financial data. They protect against cyber threats targeting trading algorithms and financial transactions. See the graphic below to check some popular cybersecurity measures:

Case Study: Implementing Advanced Algorithmic Trading Strategies

Renaissance Technologies, founded by mathematician and former Cold War codebreaker James Simons, is one of the world’s most successful hedge funds. The company is known for pioneering advanced algorithmic trading strategies.

When it comes to advanced trading algorithms, Renaissance Technologies uses AI and machine learning to develop predictive trading models. Let’s see how:

| Data Collection and Analysis | Machine Learning Models |

|

|

It must be noted that trading algorithms developed by Renaissance Technologies are implemented through sophisticated infrastructure capable of processing high-frequency data. The firm uses high-performance computing systems and low-latency networks, both of which allow for rapid execution of trades across global markets. See the graphic below to check some major benefits achieved by Renaissance Technologies:

It wasn’t all rosy. Now, let’s see some challenges faced by Renaissance Technologies during the implementation of algorithmic trading:

| Aspects | Challenge I: Superior Data Quality | Challenge II: Algorithmic Bias | Challenge III: Regulatory Compliance |

| Problem | The firm required accurate and timely data feeds from diverse sources. | The firm was supposed to mitigate biases in predictive models so that they are fair and reliable. | The firm was required to navigate complex regulatory environments to ensure adherence to market regulations. |

| Solution | They implemented robust data cleansing and validation processes. | They performed rigorous testing and validation of the developed algorithms. | They implemented stringent compliance protocols. Also, they engaged in ongoing dialogue with regulatory authorities. |

Conclusion

Algorithmic trading is rapidly evolving due to advancements in AI, quantum computing, and blockchain technology. AI and machine learning are getting increasingly used for predictive analytics, enhancing real-time decision-making and trading efficiency. On the other hand, Quantum computing is emerging as a powerful tool for solving complex trading problems faster, while DeFi and blockchain technologies are being adopted for enhanced security, transparency, and automation in trading. Additionally, NLP is being utilized to analyze news and social media sentiment, providing traders with deeper insights into market trends.

In addition to these trends, big data analytics is also being used to extract deep market insights and smartly adapt trading strategies to dynamic conditions. Traders can also benefit from tools like Bookmap, which provides sophisticated analytics and real-time data visualization to optimize trading strategies. To stay ahead in algorithmic trading, consider exploring Bookmap’s advanced tools that can enhance your trading strategies. Join Bookmap today and trade like never before!