Ready to see the market clearly?

Sign up now and make smarter trades today

Education

July 17, 2024

SHARE

Maximizing Profitability: The Crucial Role of Tight Spreads in Trading Strategies

In the high-stakes game of trading, every penny counts, and even the slimmest of spreads or margins of profit or loss can significantly impact your trading outcomes. By leveraging spreads, you can achieve optimal trading performance and maximize your profit potential. In this article, we will understand the meaning of spreads and see how they impact your swing trading and day trading strategies.

Also, we will understand how selecting the right broker, utilizing limit orders, and using advanced market analysis tools like Bookmap, can enhance your trading predictions and decision-making processes. Let’s get started.

The Basics of Spreads in Trading

Spreads in trading refer to the difference between the:

- Bid (buy) price and

- Ask (sell) price.

It can be calculated for all financial instruments, such as stocks, forex, or cryptocurrencies. The spreads can be of two types:

The concept of spreads has been integral to trading since the inception of financial markets. As trading technology has advanced, spreads have become narrower due to:

- Increased competition and

- Improved market efficiency.

Spreads have a significant impact on traders. Let’s understand in detail.

Understanding the Impact of Spreads on Trades

Spreads influence the execution and profitability of trades. They impact traders’ costs and potential gains. Let’s see how:

- Execution Speed

-

-

- Narrow spreads facilitate faster trade execution.

- Traders aiming for quick trades prefer tighter spreads as they can enter and exit positions with minimal delay.

-

- Transaction Costs

-

-

- The width of the spread directly affects transaction costs.

- When spreads are tight, traders pay lower costs per trade.

- This happens because traders:

- Buy at a price close to the market’s selling price and

- Sell close to the buying price.

- Conversely, wider spreads increase transaction costs as traders face a larger gap between buying and selling prices.

-

- Profitability

-

-

- Tight spreads contribute to higher potential profitability.

- With narrower spreads, traders need smaller price movements to:

- Break-even or

- Generate profits.

- Wider spreads, on the other hand, require larger price movements to:

- Cover transaction costs and

- Achieve profitable outcomes.

-

- Market Liquidity

-

-

- Spreads are closely tied to market liquidity.

-

- Highly liquid markets have tight spreads.

-

- This happens because there’s ample buying and selling activity, which narrows the gap between bid and ask prices.

- In illiquid markets, spreads tend to widen, which makes it costlier for traders to execute trades.

Let’s understand better through a hypothetical example,

- You’re trading a currency pair with a tight spread of 1 pip (the smallest price movement).

- If you buy at 1.2000, and the ask price immediately rises to 1.2001, you’ll only incur a small cost to enter the trade.

- Conversely, if the spread widens to 5 pips, buying at 1.2000 means you’ll need the ask price to increase to 1.2005 just to break even.

- In this situation, it will be more challenging for you to achieve profitable trades.

Scalping and Tight Spreads: A Perfect Match?

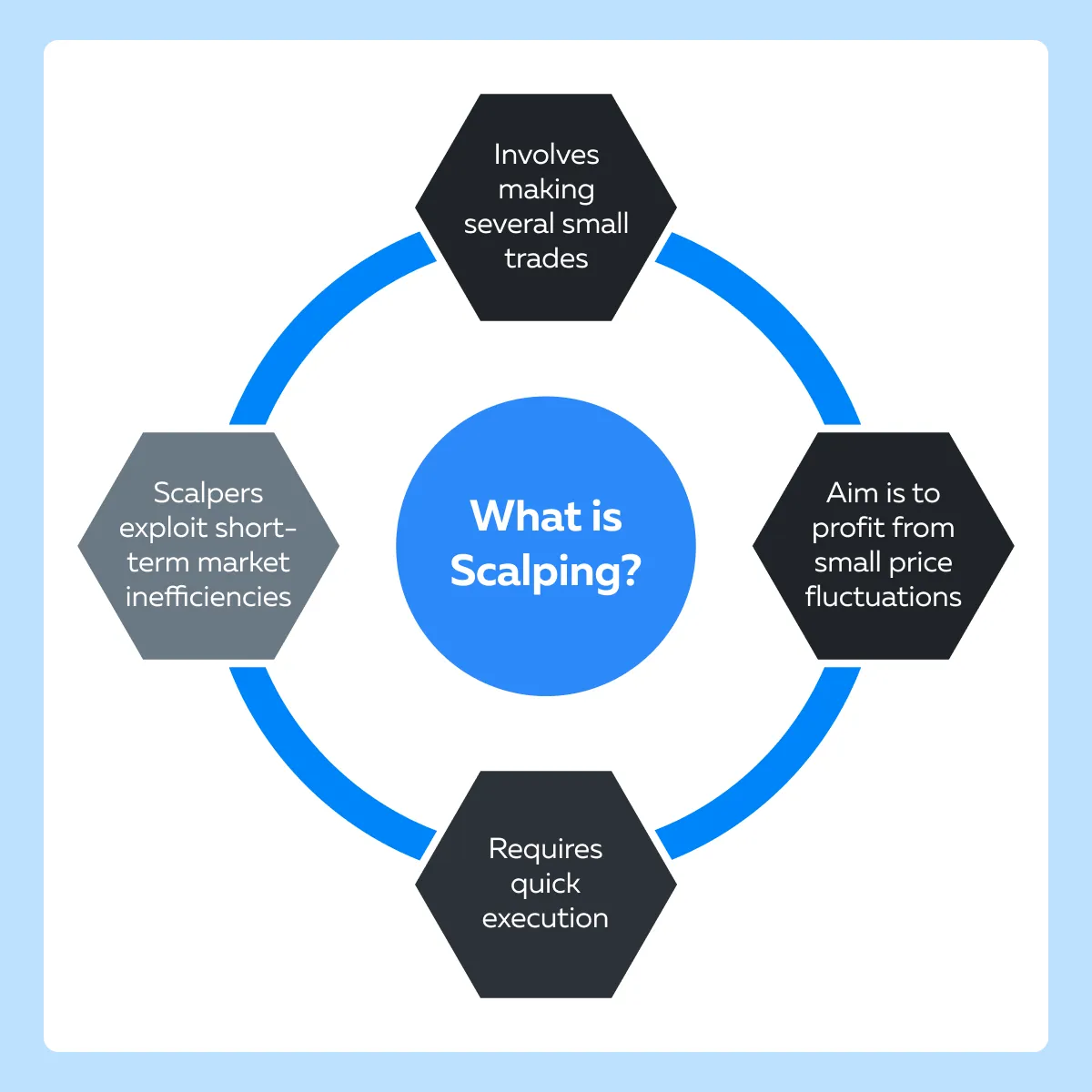

Scalping is a trading strategy that involves making numerous small trades to profit from small price movements. See the graphic below for a better understanding:

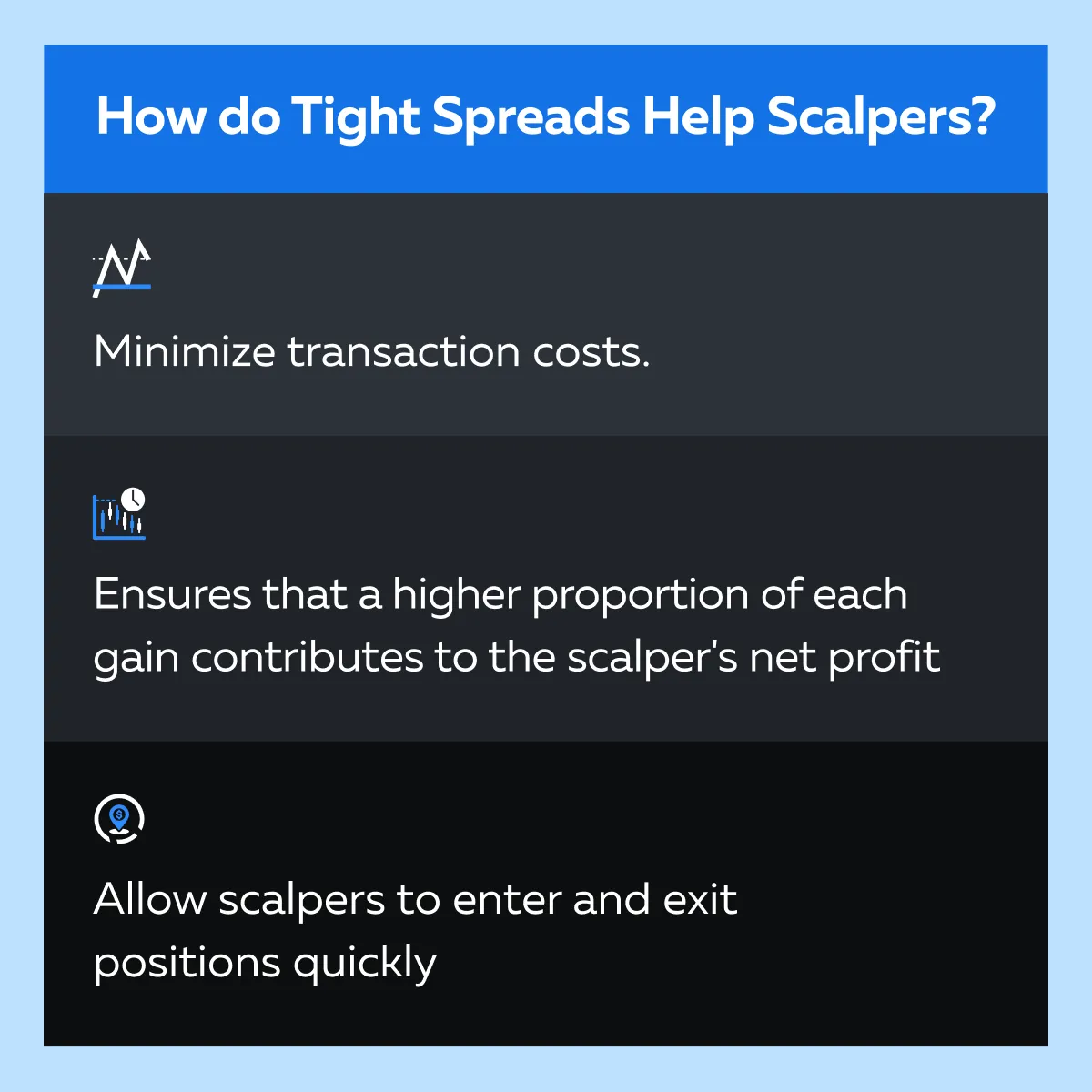

How do tight spreads help in successful scalping?

Let’s have a look at some major benefits:

- Quick Trade Execution

-

-

- Scalpers capitalize on small price movements within a short time frame.

- They often hold positions for just a few seconds or minutes.

-

- Tight spreads help in the rapid execution of trades or more frequent trades within a short time frame.

-

-

- They allow scalpers to enter and exit positions swiftly without incurring significant transaction costs.

-

- Reduced Costs

-

-

- Since scalpers execute a large number of trades, even small differences in spreads can significantly impact their overall profitability.

-

- Tight spreads minimize the cost per trade.

-

- Enhanced Profit Potential

- With tight spreads, scalpers require smaller price movements to generate profits.

- This means they can profit from even the slightest market fluctuations.

- Thus, tight spreads help in maximizing their potential earnings within a short time frame.

- Market Selection

- Scalpers often prefer trading in highly liquid markets with tight spreads, such as:

- Major currency pairs in the forex market or

- Highly traded stocks in equities markets.

- Scalpers often prefer trading in highly liquid markets with tight spreads, such as:

The Essentials of Scalping

Scalping is a trading strategy that follows a high-frequency and low-profit-per-trade approach. Scalpers aim to capitalize on small price movements. They do so by executing a large volume of trades within short time frames, typically holding positions for only a few seconds to minutes. This strategy demands:

- A keen eye for market opportunities,

- Rapid trade execution, and

- Tight risk management.

Tight spreads play a crucial role in scalping. Even minor fluctuations in spreads can significantly impact a scalper’s profitability.

Optimizing Scalping Strategies with Tight Spreads

To gain the most out of scalping, traders can consider the following tips:

- Trade During Peak Hours

-

-

- It has been commonly observed that during peak trading hours:

- Liquidity is the highest and

- Spreads are the tightest.

- To optimize trades, scalpers should focus on these active periods, such as the overlap between the London and New York trading sessions in the forex market.

- It has been commonly observed that during peak trading hours:

-

- Choose the Right Broker

-

-

- Select a broker that offers:

- Tighter spreads,

- Fast order execution,

- Low latency, and

- Reliable trade execution.

- Select a broker that offers:

-

- Prefer Advanced Trading Platforms

-

-

- Scalpers should prefer using advanced trading platforms that provide:

- Fast order execution, and

- Customizable trading interfaces.

- These platforms enable scalpers to react quickly to market movements

- Scalpers should prefer using advanced trading platforms that provide:

-

- Utilize Technology and Real-Time Data

-

-

- Technology plays a crucial role in scalping success.

-

- Scalpers can utilize advanced market analysis tools like Bookmap, which provides visual representations of market depth and order flow in real-time.

-

- By analyzing order book dynamics, scalpers can identify areas of:

- High liquidity and

- Potential price reversals.

- By analyzing order book dynamics, scalpers can identify areas of:

Day Trading in the Context of Tight Spreads

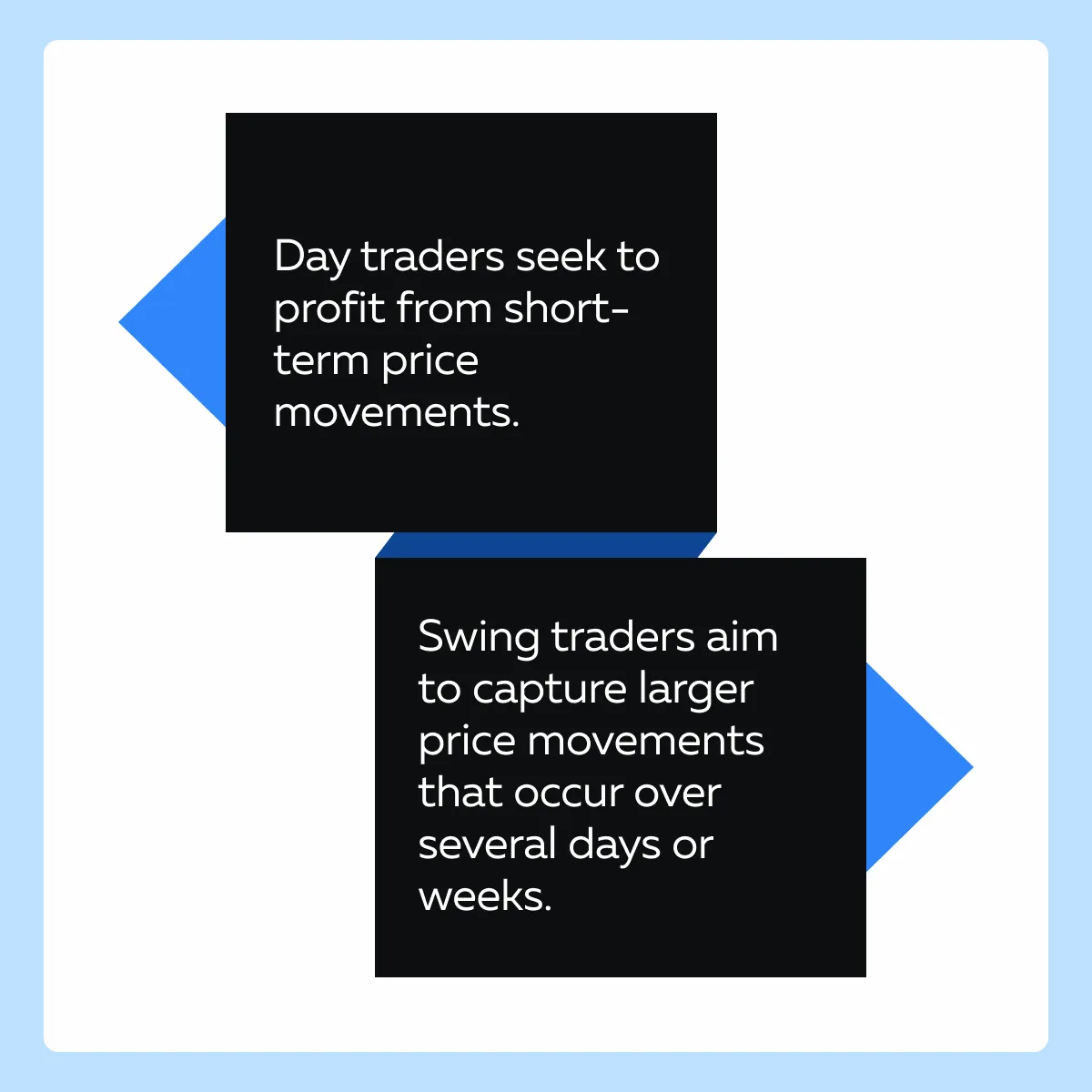

The primary goal of ay traders is to profit from short-term price movements within a single trading day. They do so by often opening and closing multiple positions throughout the session. Let’s understand why tight spreads are advantageous for day traders:

| Advantages | Explanation | Trader’s Benefit |

| Cost Efficiency |

|

Narrow spreads enable day traders to enter and exit positions with minimal impact on their overall profitability. |

| Quick Trade Execution |

|

Day traders can seize fleeting market opportunities and maximize profits. |

| Enhanced Profit Potential | Tight spreads enable day traders to capture incremental price changes more efficiently. |

|

| Risk Management | Tight spreads minimize transaction costs and help day traders maintain a favorable risk-reward ratio. |

|

The Dynamics of Day Trading

Day trading involves buying and selling financial assets within the same trading day. The goal is to profit from short-term price movements. Spreads play a crucial role in day trading and influence trade execution in the following ways:

- Tight spreads facilitate swift trade execution and allow day traders to enter and exit positions quickly.

- Day traders closely monitor spreads to assess market liquidity and trading conditions.

- They usually opt for markets with tighter spreads to:

- Maximize profitability and

- Minimize trading costs.

Strategies for Leveraging Tight Spreads in Day Trading

To maximize trading profits, day traders can take advantage of tight spreads in the following ways:

- Scalping

-

-

- Traders can capitalize on tight spreads by executing numerous trades to profit from small price movements.

- They should focus on markets with tight spreads to:

- Optimize profit potential and

- Minimize transaction costs.

-

- Range Trading

-

-

- Day traders can employ a range of trading strategies, which include:

- Buying at support levels and

- Selling at resistance levels.

- This strategy helps day traders exploit price fluctuations within the defined range.

- Day traders can employ a range of trading strategies, which include:

-

- News Trading

-

-

- Day traders can take advantage of tight spreads during significant news events or economic releases.

- They must anticipate market reactions and execute trades quickly.

- This rapid execution helps in capitalizing on short-term price movements.

-

- Utilize Advanced Tools

-

- Day traders can identify opportunities presented by tight spreads by using:

- Advanced trading platforms and

- Analytical tools.

- Some popular tools include:

- Level II market data,

- Order flow analysis, and

- Volume profile indicators.

- Day traders can identify opportunities presented by tight spreads by using:

Swing Trading Amidst Variable Spreads

Swing trading is a trading strategy that aims to capture gains over several days to weeks by exploiting short-to-medium-term price movements. This strategy is typically less sensitive to spread as swing traders typically focus more on market trends and patterns rather than immediate price fluctuations. However, spread size can still impact their trading performance, especially in longer-term trades.

Let’s begin with understanding the swing trading fundamentals and then see the impact of spreads on swing trading.

Swing Trading Fundamentals

Swing trading involves identifying and capitalizing on price swings or “swings” within an established trend. Swing traders often use technical analysis tools and chart patterns to identify potential entry and exit points. They operate differently from day traders. See the graphic below:

How do tighter spreads enhance swing trade profitability?

- Reduced Transaction Costs

-

-

- Tight spreads minimize the cost of entering and exiting trades.

- This efficiency is particularly beneficial for swing traders who hold positions for multiple days or weeks.

- Lower transaction costs improve the overall risk-reward ratio.

-

- Enhanced Trade Efficiency

-

- Tight spreads facilitate smoother trade execution.

- They allow swing traders to enter and exit positions more efficiently.

- This is particularly crucial when swing traders try to capture larger price movements over longer timeframes.

Managing Spread Impact in Swing Trading

To ensure optimal profitability and achieve trading efficiency, swing traders can employ several strategies to mitigate the effects of variable spreads on their trades:

- Choose the Right Broker

-

-

- Select a broker that consistently offers tight spreads.

- Look for brokers with:

- Reputation for competitive pricing,

- Reliable trade execution, and

- Access to deep liquidity pools.

-

- Utilize Limit Orders

-

-

- Use limit orders to control the price at which trades are executed.

- Traders can do so by setting buy and sell orders at predetermined price levels.

- This setting helps in:

- Ensuring that trades are executed at favorable prices,

- Mitigating the risk of slippage, and

- Achieving optimal trade execution.

-

- Focus on High-Liquidity Markets

-

-

- Prioritize swing trading opportunities in markets known for:

- Tight spreads and

- High liquidity.

- An example of such a major market is forex pairs or large-cap stocks.

- These markets offer optimal conditions for swing trading strategies due to:

- Narrow spreads and

- Ample trading volume.

- Prioritize swing trading opportunities in markets known for:

-

- Comprehensive Market Analysis

-

- Conduct a thorough market analysis to discern:

- Potential market moves,

- Emerging trends, and

- High-probability trading opportunities.

- Swing traders can do so by using:

- Technical analysis tools,

- Chart patterns, and

- Fundamental analysis.

- Conduct a thorough market analysis to discern:

Why should traders use advanced market analysis tools?

Tools like Bookmap offer invaluable market depth visibility, which enhances swing traders’ ability to make informed predictions and decisions. Let’s see some major features and their benefits delineated in the given table:

| Features | Meaning | Swing Trader’s Benefit |

| Visualizing Order Flow Dynamics |

|

Swing traders can gauge market sentiment and anticipate potential price movements by visualizing the distribution of buy and sell orders at different price levels. |

| Identifying Key Support and Resistance Levels | With market depth visibility provided by tools like Bookmap, swing traders can identify significant support and resistance levels. | By observing where buy and sell orders are clustered, traders can pinpoint levels where price action is likely to:

|

| Analyzing Order Flow Dynamics | Bookmap allows traders to analyze order flow dynamics, including the speed and intensity of order book changes. | By observing how quickly orders are added or removed at specific price levels, swing traders can assess the strength of price movements. |

Conclusion

Spreads refer to the difference between bid and ask prices. They are directly related to liquidity; markets showing higher liquidity often exhibit tighter spreads. Tight spreads influence several trading strategies, ranging from lightning-fast scalping to more measured swing trading.

In scalping, where traders capitalize on minor price movements in mere seconds, tight spreads help minimize transaction costs and maximize profitability. Contrarily, for day traders who aim to profit from intraday price fluctuations, tight spreads enable quick trade execution and enhance profit potential.

To maximize benefits, traders must prefer choosing the right broker, utilizing limit orders, and focusing on high-liquidity markets. Also, they can gain a competitive advantage by leveraging advanced market analysis tools, such as Bookmap, which offers visual representations of market depth and order flow.

Looking to enhance your understanding of spreads? Check out our blog post on “What is a Spread in Financial Markets” and level up your trading knowledge.