Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 2, 2025

SHARE

Economic Signals and Major Earnings: How Key Indicators Are Shaping Market Sentiment in 2024

Trading is tricky! Deciphering market conditions sometimes feels like you are guessing the password of a secret vault. Yet, by understanding a few key indicators, you can turn confusion into clarity. As we move through Q4 2024 and into 2025, staying informed about economic signals and major earnings data is more important than ever.

In this article, you will learn about the vital trends and strategies that shape investor sentiment. We’ll explain GDP growth, employment trends, and the “Magnificent Seven” tech giants’ influence on markets. You’ll see how inflation impacts sectors like energy and how Federal Reserve rate decisions affect everything from bonds to real estate. Additionally, we’ll explain sector rotation strategies and how you can time trades using market insights.

Lastly, we will also demonstrate how our advanced market analysis tool, Bookmap, can help you respond quickly to changing financial conditions. Let’s begin.

Key Economic Signals and Market Sentiment in Q4 2024

Firstly, let’s talk about the Q3 earnings review. The U.S. economy expanded at an annualized rate of 2.8% in Q3 2024. It fell slightly short of the expected growth rate of 3.0%. This growth was driven mainly by strong consumer spending, which grew at an annual rate of 3.7%. Such a situation reflects strong domestic demand despite tighter financial conditions.

Business investment grew modestly at 3.3%. A sharp rise in equipment investment largely supported it. In comparison, the investment in non-residential structures declined. Also, residential investment continued to face headwinds and fell by 5.2% as high interest rates dissuaded potential investors. Government expenditures, especially in federal defense, also supported economic expansion, with a 5.0% increase in spending.

For more clarity, study the graphic below:

Consumer Spending Patterns and Sector Dynamics in Q3 2024

Consumer resilience in Q3 remained a highlight. However, spending patterns suggest varying impacts across income groups. Lower-income households showed signs of constrained spending, whereas higher-income families contributed to a significant share of consumption. Durable goods spending was particularly notable. It bolstered manufacturing activity, although signs of moderation are emerging as borrowing costs remain elevated.

Now, if we talk about the investment side, strength in business equipment purchases signals ongoing corporate optimism in productivity-enhancing investments. Yet, the decline in residential and non-residential structures points to lingering challenges in real estate. Be aware that the current interest rate environment is influenced by these challenges.

Q4 Economic Projections

As we move into Q4 2024, growth is projected to decelerate to between 1.5% and 2.0%, coinciding with a moderation in consumer spending growth. The demand is expected to be tempered among more debt-sensitive households due to these two reasons:

When it comes to the labor market, it remains slightly softened and fundamentally stable. The inflation trends are aligning more closely with the Federal Reserve’s target, which provides some relief. The anticipation of potential rate cuts in response to evolving economic conditions adds a layer of uncertainty to Q4 economic dynamics.

Considering all these factors, we can say that the economic outlook for the final quarter shows a cautious but continued expansion.

Future Outlook for Q4 and Beyond

The Q4 2024 economic projections remain a topic of debate among analysts. Most of them make GDP forecasts that range widely from 0.8% to 2.9%. The conservative projections reflect concerns over the following:

- inflationary pressures,

and

- high borrowing costs.

These factors are expected to dampen consumer spending and business investments. However, the more optimistic outlook is based on expectations of continued strength in consumer expenditure and strategic business investments. While growth rates are projected to be moderate compared to earlier in the year, analysts highlight the resilience of consumer spending. This resilience is well supported by:

- wage growth,

and

- a strong labor market (despite the gradual cooling from post-pandemic highs).

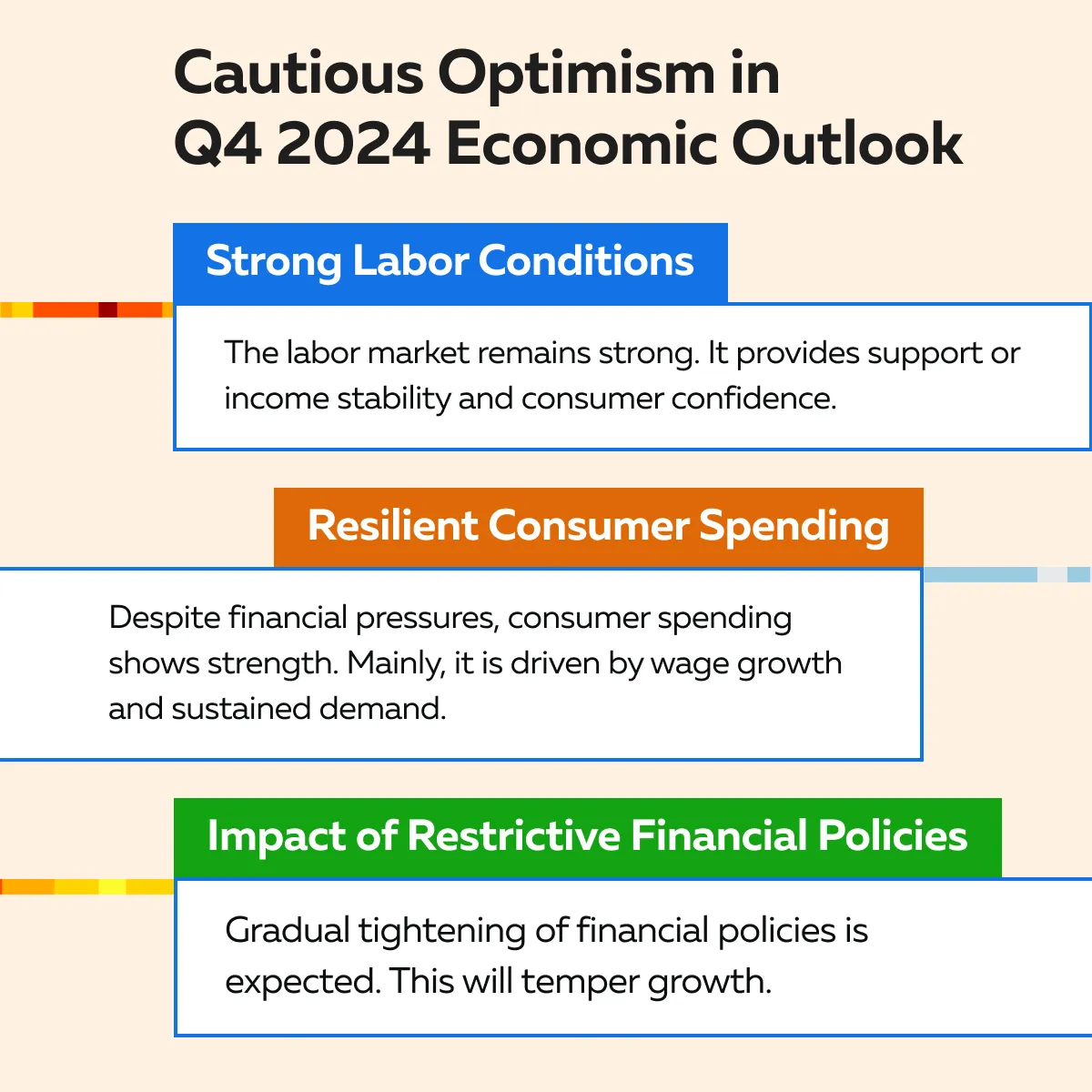

For a better understanding, read through the graphic below:

Now, when it comes to “employment,” it is expected to remain stable in the last quarter of the year. However, job creation may slow in tandem with easing GDP growth. High-turnover sectors, like healthcare and professional services, continue to show resilience.

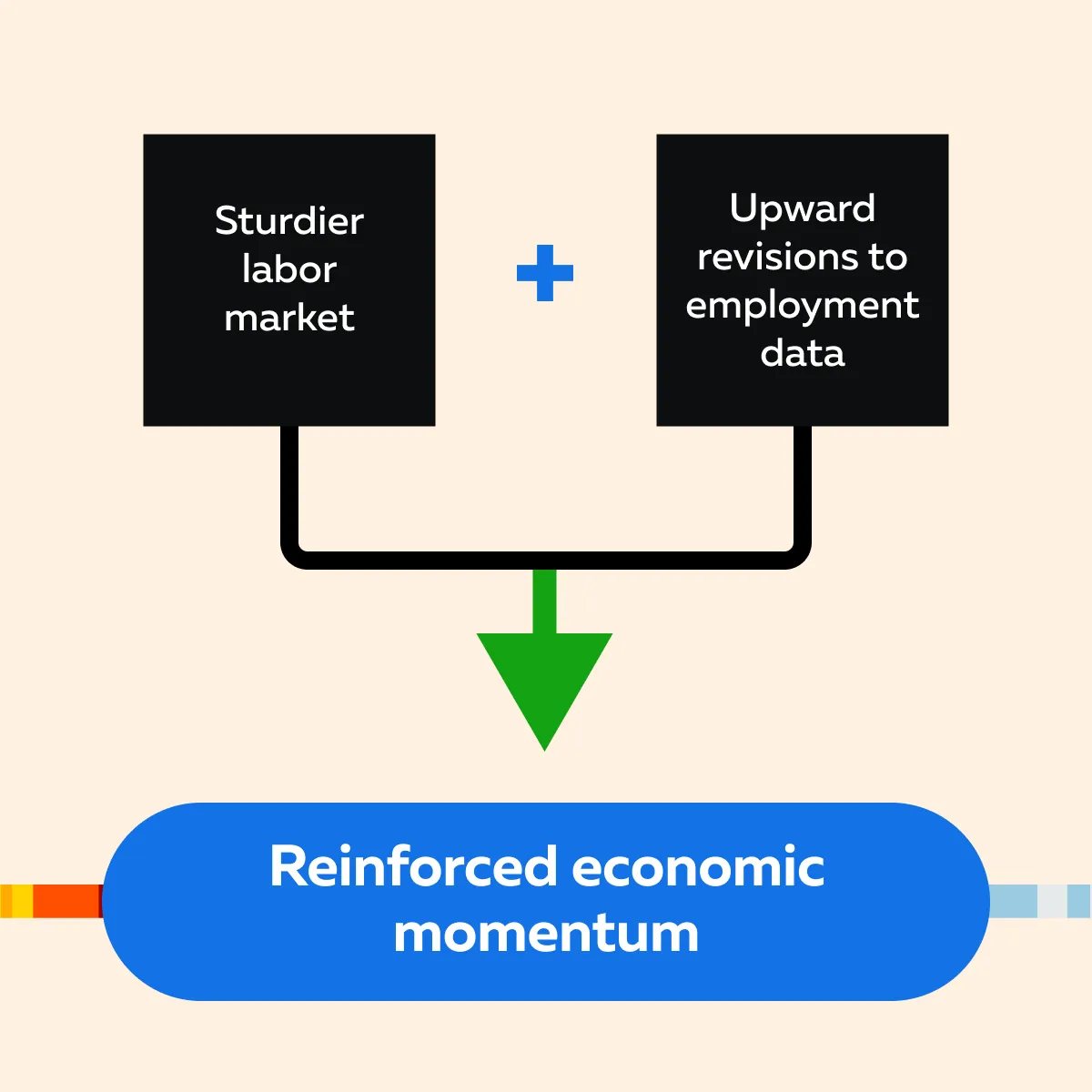

Some analysts also note that wage growth has recently outpaced inflation. This event has helped sustain household purchasing power. Check out the graphic below to learn what has reinforced economic momentum:

Furthermore, strong job gains at the beginning of the year laid a foundation that is still positively influencing consumer activity. Nonetheless, the potential for a slowdown in job growth looms. This is expected to happen as restrictive monetary policy is more focused on economic sectors sensitive to interest rates, such as:

- housing,

and

- durable goods.

Next, let’s talk about sectoral shifts and start with the manufacturing sector, which experienced a slowdown in earlier quarters. Now, it appears to be stabilizing and may add modestly to overall growth. On the downside, services sectors may encounter headwinds as:

- consumer preferences evolve,

and

- inflationary effects persist.

Government spending, though still supportive, may face constraints as state and local budgets become tighter. Also, a kind of cyclical weakening is observed in the economy. However, it is not uniform, as different sectors are impacted at varying times. This makes the slowdown challenging to time and predict.

Despite these uncertainties, analysts generally agree that while growth will likely cool, the U.S. will avoid a recession. This cautious optimism in Q4 2024 points to three major factors. Check the graphic below:

Moreover, inflationary concerns and potential adjustments to interest rates by the Federal Reserve continue to cloud the outlook for Q4 2024 and early 2025. Even though inflation has moderated compared to recent peaks, it still poses challenges. Its effect is even more evident due to persistent costs in key sectors like:

- energy,

and

- housing.

Be aware that any moves by the Federal Reserve to either raise or hold rates will depend on evolving data about inflation and employment. Geopolitical factors, such as tensions in trade relations or global conflicts, add another layer of unpredictability. These factors influence everything from commodity prices to international investment flows. Please note that these uncertainties are likely to contribute to market volatility. There could be sharp swings in investor sentiment based on economic data releases or global events. Amid these uncertainties, investors might gravitate toward safer assets, like bonds or gold.

It is worth mentioning that the technology and energy sectors are particularly sensitive to these economic shifts. Let’s see how:

| Technology sector | Energy sector |

| Tech companies mostly rely on low borrowing costs and future-oriented investments. Higher interest rates can curb their growth and valuations. | Similarly, energy markets are deeply influenced by global economic conditions and geopolitical events. This affects both their supply and demand. |

However, defensive sectors like consumer staples and healthcare might gain appeal. In contrast, speculative assets could see reduced investor interest in a more cautious climate.

What Does the Jobs Data Tell Us?

The U.S. job market has remained resilient, but it shows signs of gradual softening. As of Q4 2024, the unemployment rate has held relatively steady at around 3.7%. This indicates a still-healthy labor market. Moreover:

- Wage growth continues to outpace inflation. It supports consumer spending and underpins overall economic activity.

- Average hourly earnings have been rising. In some months, they even showed growth rates of around 0.4% to 0.6%. This helped to preserve workers’ purchasing power.

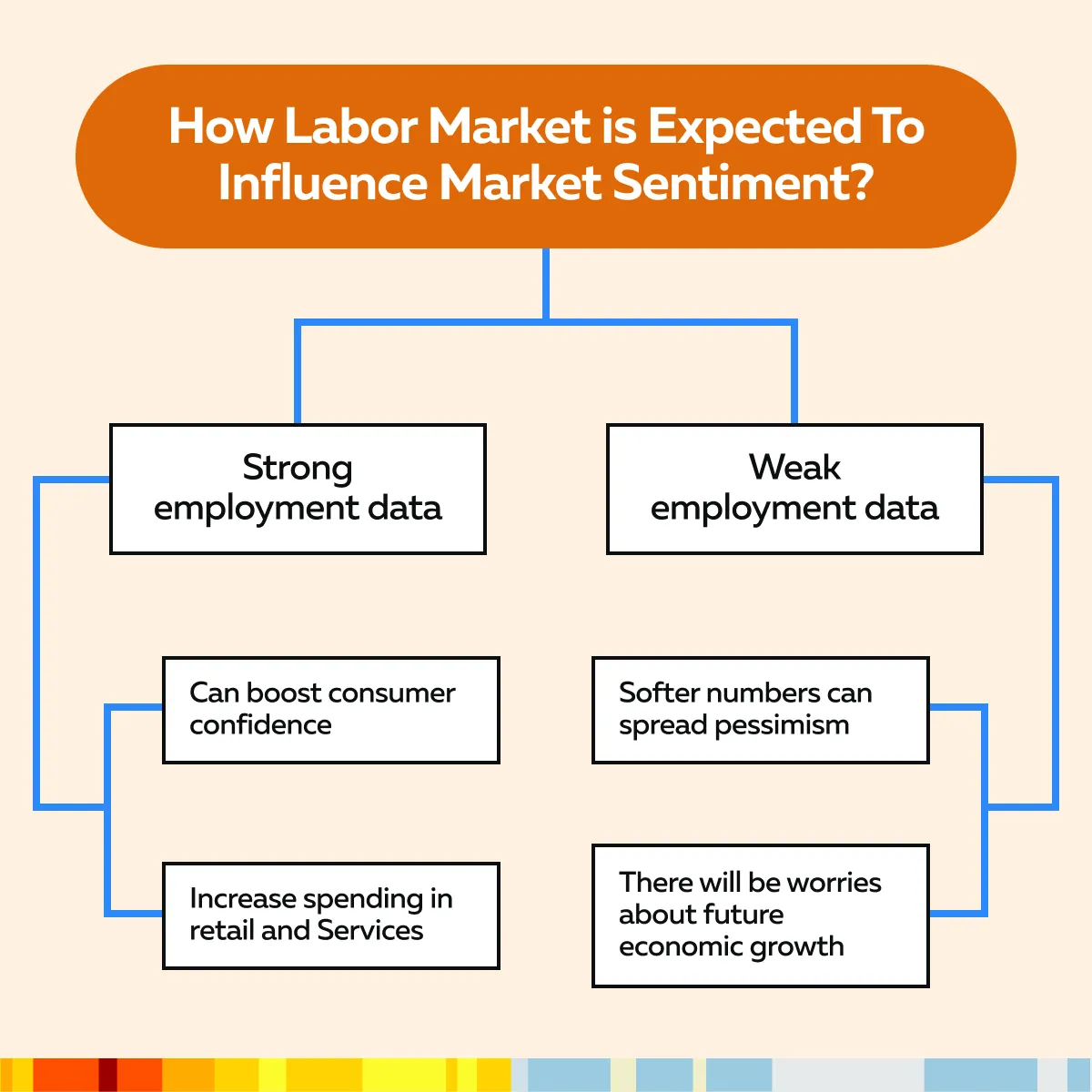

However, the pace of job creation is slowing compared to earlier in the year. Hiring trends have become more cautious as companies are preparing for likely economic headwinds. Now, be aware that these labor market dynamics influence market sentiment. To learn how study the graphic below:

Explore Bookmap’s tools to monitor and react to critical U.S. market movements as economic data and earnings reports roll in.

Insights Into Various Sectors

Several sectors are showing contrasting employment estimates. Healthcare continues to see strong hiring. It is driven by high demand for medical and support staff due to:

- ongoing workforce shortages,

and

- an aging population.

This strength has supported stocks tied to healthcare services and medical technology. On the other hand, the technology sector remains pressured, with most companies laying staff off to:

- streamline their operations,

and

- adjust to a post-pandemic reality of moderated digital demand.

This contrasts sharply with energy and construction. These sectors have shown steady employment figures. However, one must note that the construction sector faces uncertainties tied to fluctuating mortgage rates.

Impact of Economic Data on Market Sentiment

Investors and traders must note that major stock market indices, like the S&P 500 and Dow Jones Industrial Average, react sharply to economic data releases. When data reveals stronger-than-expected economic growth (say a surge in GDP or higher consumer spending), investor sentiment often turns bullish. This usually leads to rallies in these indices. Sectors like consumer discretionary and industrials also see gains as growth optimism rises.

Conversely, weak data (say disappointing job numbers or slowing business investment) trigger selloffs. These sell-offs particularly occur in economically sensitive sectors such as materials and technology. As a result, market participants adjust their expectations for corporate earnings based on these reports. This creates immediate price volatility.

Bond Market Influence

U.S. economic indicators significantly impact the bond market. Positive data, such as strong GDP growth or solid employment figures, lead to higher bond yields. This happens as investors anticipate:

- tighter monetary policy,

or

- rate hikes from the Federal Reserve.

When yields rise, bond prices fall. Conversely, in times of economic uncertainty or rising inflation concerns, investors seek the safety of government bonds. This drives prices up and yields down. During periods of high inflation, bond yields increase. This happens as investors want higher returns to compensate for eroding purchasing power.

For more clarity, let’s study a recent example:

- The Q3 2024 GDP data showed robust growth.

- However, it was accompanied by persistent inflationary pressures.

- As a result, the S&P 500 experienced a brief rally.

- It was driven by optimism over economic strength.

- This increased the bond yields due to the expectations of prolonged higher interest rates.

Conversely, weaker-than-expected job reports in early 2024 led to a dip in stock indices. It created fears of an economic slowdown. At the same time, bond prices rallied and showed a flight to safety.

Major Earnings Reports and Bellwether Stocks

Let’s talk about the Q3 earnings and implications for Q4. The Q3 2024 earnings reports revealed a mixed economic landscape. However, they also provided critical insights into the performance of key sectors. Tech and consumer discretionary companies generally showed resilience, with significant revenue growth in some areas. On the other hand, sectors like real estate and utilities felt the impact of higher borrowing costs.

As we head into Q4, investors are closely watching whether these trends persist or evolve. Companies like Procter & Gamble, McDonald’s, and other consumer-oriented firms are particularly important. That’s because their earnings reflect:

- consumer behavior,

and

- spending patterns.

Both are crucial for economic sentiment. Additionally, reports from major financial institutions are also important to analyze while influencing forecasts for early 2025. See the graphic below to learn what these reports indicate:

Stay updated with Bookmap’s advanced analytics to align your trading strategy with the latest economic indicators and stock performance.

The Overview of Magnificent Seven

The “Magnificent Seven” tech giants consist of:

- Apple,

- Microsoft,

- Google (Alphabet),

- Amazon,

- Meta,

- Nvidia, and

- Tesla.

These companies have a strong influence on market sentiment. In Q3, strong earnings from these companies led to market rallies. This significantly increased confidence among investors. For example:

- Nvidia’s exceptional performance in AI-driven technology reflects the ongoing investment in AI. It received positive reactions across related sectors.

- Google’s ad revenue trends provided critical clues about consumer spending habits and economic resilience.

- Amazon’s e-commerce and cloud business data signaled broader retail and enterprise technology conditions.

It is important to note that positive results from these companies can lift the entire market, while disappointments can trigger broad selloffs.

Sector Reactions

When tech giants post a strong earnings season, it often lifts economic confidence. For example, an uptick in ad revenue at Google shows consumers and businesses are willing to spend more on marketing, signaling economic strength. Similarly, robust sales at Apple imply resilient consumer demand despite higher prices.

In contrast, weak results indicate fears of economic slowdown. They impact not just the tech sector but also industries that rely on tech for growth, like retail and manufacturing. In this way, the performance of these companies becomes a litmus test for broader economic conditions. They even affect sectors beyond technology.

Bellwether Stocks and Market Trends

Bellwether stocks, like Caterpillar, Walmart, or ExxonMobil, are also viewed as indicators of economic health. They offer a window into broader trends because of their:

- wide market reach,

and

- exposure to global economic forces.

For example, Caterpillar’s earnings signal shifts in industrial and construction activity worldwide. They also impact related sectors like materials and manufacturing. Likewise, energy companies like ExxonMobil reflect the state of global energy demand.

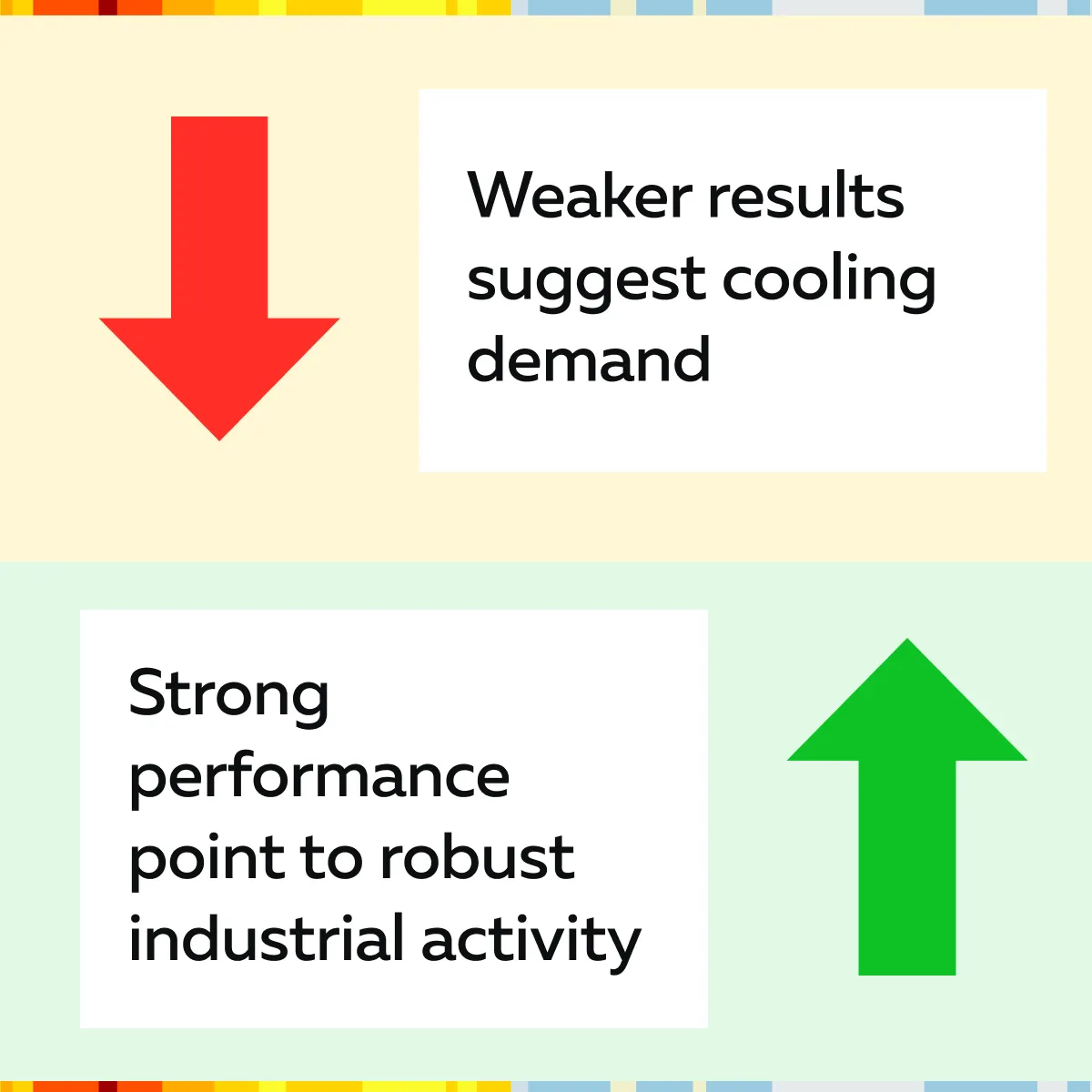

Most traders monitor these stocks. Such monitoring helps them to gauge economic momentum and anticipate market shifts. See the graphic below for more clarity:

Hence, by analyzing bellwethers, investors gain insight into the economy’s direction and can easily adjust strategies accordingly.

Broader Economic Indicators: Insights for Q4 and Early 2025

As Q4 unfolds and 2025 approaches, several broader U.S. economic indicators will play a significant role in shaping investment strategies. Some major indicators to look at are:

Generally, strong consumer spending and employment metrics signal economic resilience. However, persistent inflation and the Federal Reserve’s policy response remain key concerns. Apart from those mentioned in the graphic above, indicators like the ISM manufacturing and services indices also help investors spot:

- economic strength,

and

- emerging weaknesses.

Therefore, investors must monitor major indices, inflation data, and the Fed’s stance on rate adjustments. This tracking helps them to understand market sentiment and sector performance.

Impact of Inflation on Key Sectors

Inflationary pressures have had a mixed impact across sectors. The energy sector, for instance, has experienced price volatility. This volatility was due to global supply constraints and geopolitical uncertainties. Both these factors affect the sector’s energy costs and profitability.

Manufacturing is also under pressure. That’s due to high input costs and squeezing margins. These factors limit output growth.

It is worth mentioning that if inflation persists, the Federal Reserve may be forced to:

- keep rates elevated,

or

- even implement additional hikes.

This move strongly impacts borrowing costs and investment decisions. Now, sectors that may show resilience in this environment include consumer staples. This sector could benefit from steady demand. Companies in this sector are also in a position to pass on higher costs to consumers. This will help them maintain relatively stable profit margins. From the investment point of view, these sectors provide a hedge against inflationary cycles.

Interest Rate Trends

Interest rate trends are important to consider while making Q4 investment strategies. You should especially track these trends when investing in sectors sensitive to borrowing costs, such as technology and real estate.

Now, please note that high interest rates generally suppress tech stock valuations. That’s because the discounted value of future earnings declines. Similarly, real estate markets see reduced demand due to mortgage rates remaining high. If the Federal Reserve hints at rate cuts in response to slowing growth, these sectors see renewed investor interest.

However, if rates stay high to curb inflation, investors may favor defensive or income-generating assets, like dividend-paying stocks and bonds. Geopolitical events, such as upcoming U.S. elections or international tensions in energy-producing regions, also add uncertainty. That’s because these events lead to:

- shifts in economic policies,

or

- disruptions in supply chains.

Therefore, careful attention to these factors is essential for making informed decisions.

Strategies for Adapting to Market Trends

To better deal with the market situation in Q4 2024, investors should respond smartly to:

- economic,

and

- earnings data.

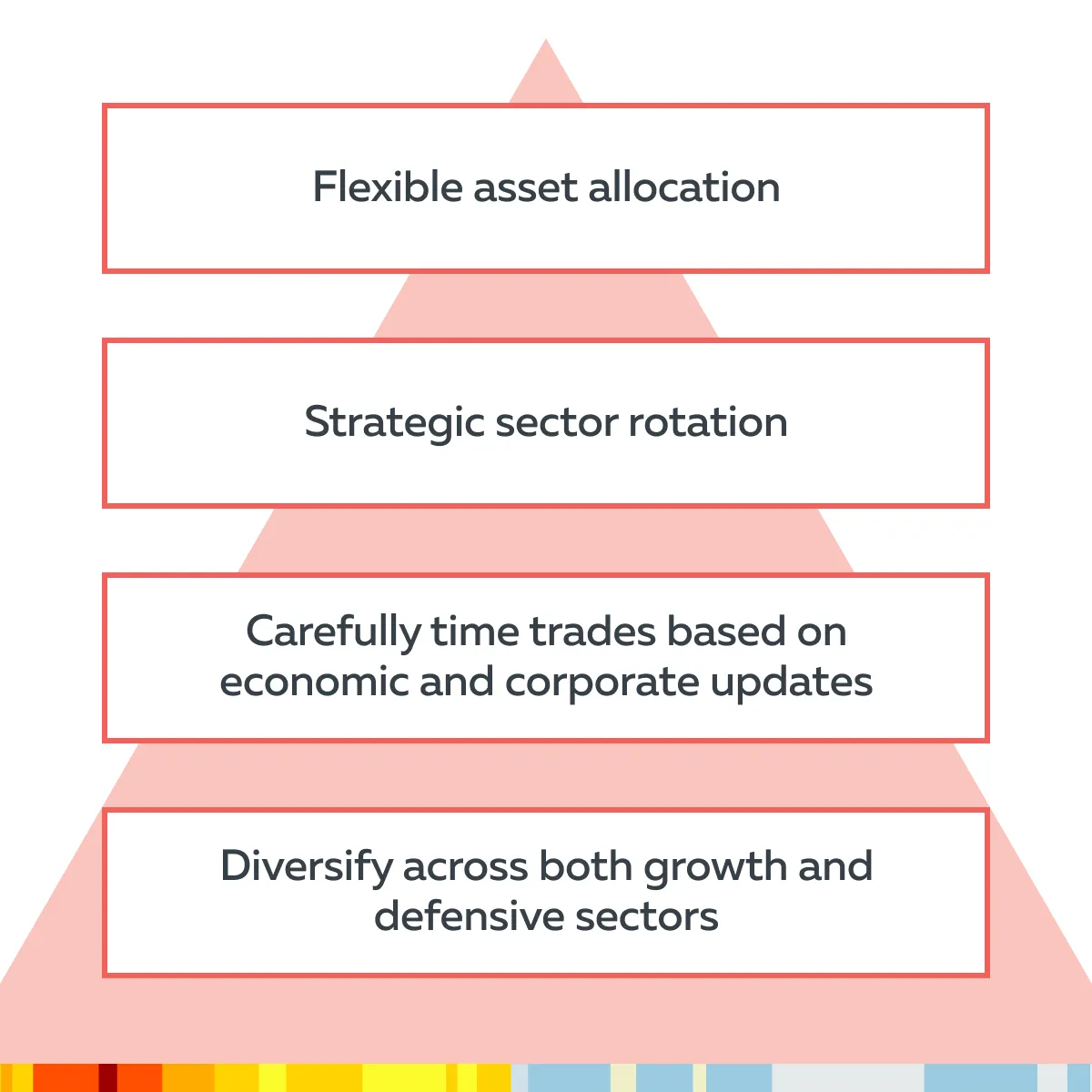

This necessitates analyzing key indicators like inflation rates, GDP growth, and corporate earnings. Based on the understanding gained, you can employ these strategies:

How to Do Sector Rotation Based on Economic Signals?

In sector rotation, investors shift their focus between different sectors based on prevailing economic data. Be aware that during periods of strong economic expansion and robust consumer spending, the following sectors perform well:

- consumer discretionary,

- financials, and

- technology.

For example, if consumer confidence data indicates high spending, investors might favor retail and travel stocks. Conversely, in anticipation of an economic slowdown or weak GDP data, investors may move funds into defensive sectors like healthcare, utilities, and consumer staples.

How to Time Strategies with Economic and Earnings Data?

Investors can optimize the timing of their trades by using economic and earnings data. This optimization can significantly enhance returns and reduce risk. To do so, investors should:

- track economic releases (like job reports and inflation updates),

- immediately observe market reactions, and

- analyze company earnings releases.

While making assessments, it is important to evaluate order flows and price movements. For example:

- Let’s assume there is a positive earnings report from a major tech company.

- Now, this could lead to a quick price surge.

- A savvy investor capitalizes on this movement through short-term trades.

Conclusion

As we finish Q4 and head into 2025, you, as an investor or trader, must understand certain key U.S. economic indicators and major earnings data. These signals provide valuable insights into:

- the health of the economy,

- likely shifts in consumer behavior, and

- market trends.

To better anticipate how different sectors may perform, you should keep an eye on inflation, employment figures, GDP growth, and corporate earnings. This allows you to make timely and strategic moves, such as rotating between growth and defensive sectors or adjusting their asset allocation to minimize risk.

Additionally, by using our advanced market analysis tool, Bookmap, investors and traders get a competitive edge. Using it, traders get real-time insights into market liquidity, order flow, and price movements, allowing them to make speedy and accurate decisions.

By combining economic data analysis with such advanced tools, investors can stay agile. They can adapt to changing conditions and even optimize their strategies. Use Bookmap to track major market movements in real-time so that you can respond quickly to shifts in economic data and earnings results.