Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

December 29, 2024

SHARE

How Commodities Like Oil and Gold Drive Inflation Hedging Strategies

A popular adage says you can’t escape death or taxes. But inflation is another silent force that can erode your wealth if you’re not prepared. As prices rise, the purchasing power of money declines. However, you can protect yourself by making strategic investments in commodities like gold and oil. Want to learn how?

This article explores how these tangible assets serve as reliable inflation hedges and why savvy investors consider including them in their portfolios. We will start by understanding why commodities hold up against inflationary pressures. Next, we’ll check out gold’s reputation as a stable store of value and oil’s potential for high returns, along with the unique risks each asset carries. Also, you’ll learn how to balance gold and oil for a well-rounded inflation-resistant portfolio and the importance of monitoring these markets using popular market analysis tools like our trading platform, Bookmap. Let’s begin.

Understanding Commodities as Inflation Hedges

Commodities have long been viewed as good hedges against inflation. They provide a buffer to investors when the purchasing power of currency declines. Let’s see why they are so effective.

| Commodities Have Tangible Value | The Supply of Commodities Is Constrained | The Demand for Commodities Keeps Growing |

|

|

|

For more clarity, let’s study an example related to the 2021–2022 inflation spike.

- During the global inflation surge of 2021–2022, commodities like oil and gold experienced heightened investment interest.

- Supply chain disruptions combined with geopolitical tensions (notably in energy markets) led to significant price surges.

- Investors turned to these commodities as effective hedges.

- This shows their protective role in inflationary environments.

Gold as a Traditional Inflation Hedge

Since times immemorial, gold has been widely used by investors to protect their wealth from:

- inflation,

and

- economic uncertainty.

Even today, gold continues to play an important role in financial planning. Let’s understand in detail:

Why is Gold a Reliable Store of Value?

Gold is often regarded as a safe-haven asset. It has a long history of retaining value during times of economic instability and currency devaluation. Throughout centuries, civilizations have turned to gold when paper currencies faltered. This reinforces its reputation as a reliable store of value.

Furthermore, when inflation erodes the value of paper assets, gold usually appreciates. Its value increases as investors flock to it for stability. This happens because gold is not directly affected by monetary policies like:

- interest rate adjustments,

or

- currency printing.

This makes it particularly attractive during periods when other financial assets are under inflationary pressure.

How Has Gold Performed During Inflationary Periods?

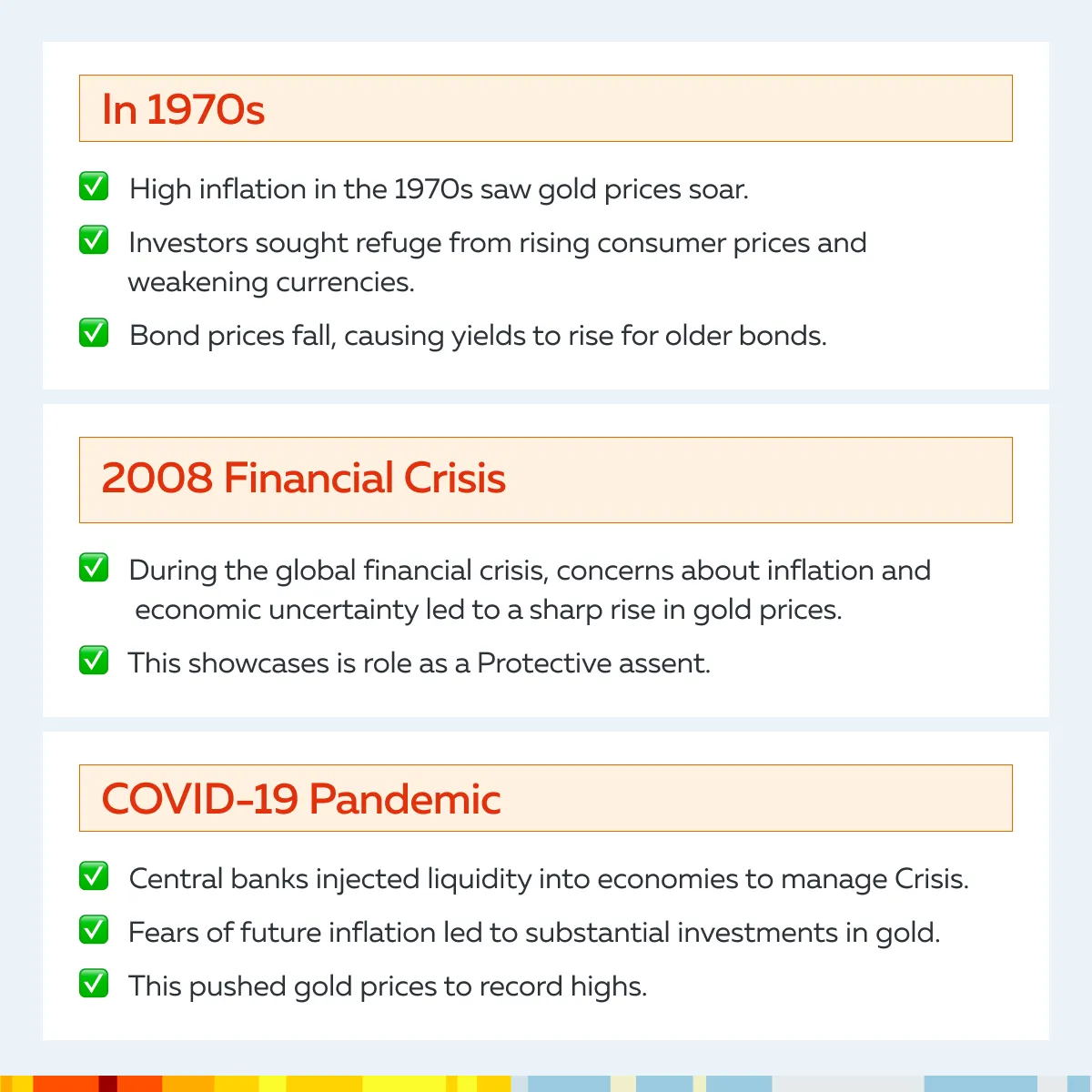

Gold’s performance d uring past inflationary and crisis periods shows its strength as an inflation hedge. Let’s check out the three major historical events to understand why gold is a good hedge.

uring past inflationary and crisis periods shows its strength as an inflation hedge. Let’s check out the three major historical events to understand why gold is a good hedge.

How to Use Gold in a Portfolio for Inflation Protection?

Here are a few strategies to invest in gold:

- Physical Gold:

- Commonly, this includes gold coins, bars, or jewelry.

- With this option, you can buy a tangible form of gold.

- However, you also incur storage and insurance expenses.

- Gold ETFs

- Exchange-traded funds provide exposure to gold prices.

- There is a need to own the metal physically.

- Gold Mining Stocks

- You could invest in mining companies that are responsible for mining gold.

- This offers you a leveraged exposure to gold prices.

- Gold Futures

- In this way, you buy or sell gold at a future date using futures contracts.

- This option is more suitable for experienced investors seeking direct exposure.

Portfolio Diversification

It is worth mentioning that allocating 5-10% of a portfolio to gold provides a hedge against:

- inflation,

and

- market volatility.

For example, if inflation fears arise, a diversified portfolio with gold reduces losses from traditional equity or fixed-income investments. In this way, gold stabilizes the portfolio’s overall returns.

Oil’s Role in Inflation Hedging

Be aware that oil holds a critical position in the global economy. This makes it a powerful force when it comes to inflation. To invest in an informed manner, you must understand the following two fundamentals.

- How do oil prices influence inflation?

and

- How can investors utilize oil to protect against inflationary pressures?

To find better answers to these questions, let’s understand some important concepts in detail:

Why is Oil Tied Closely to Inflation?

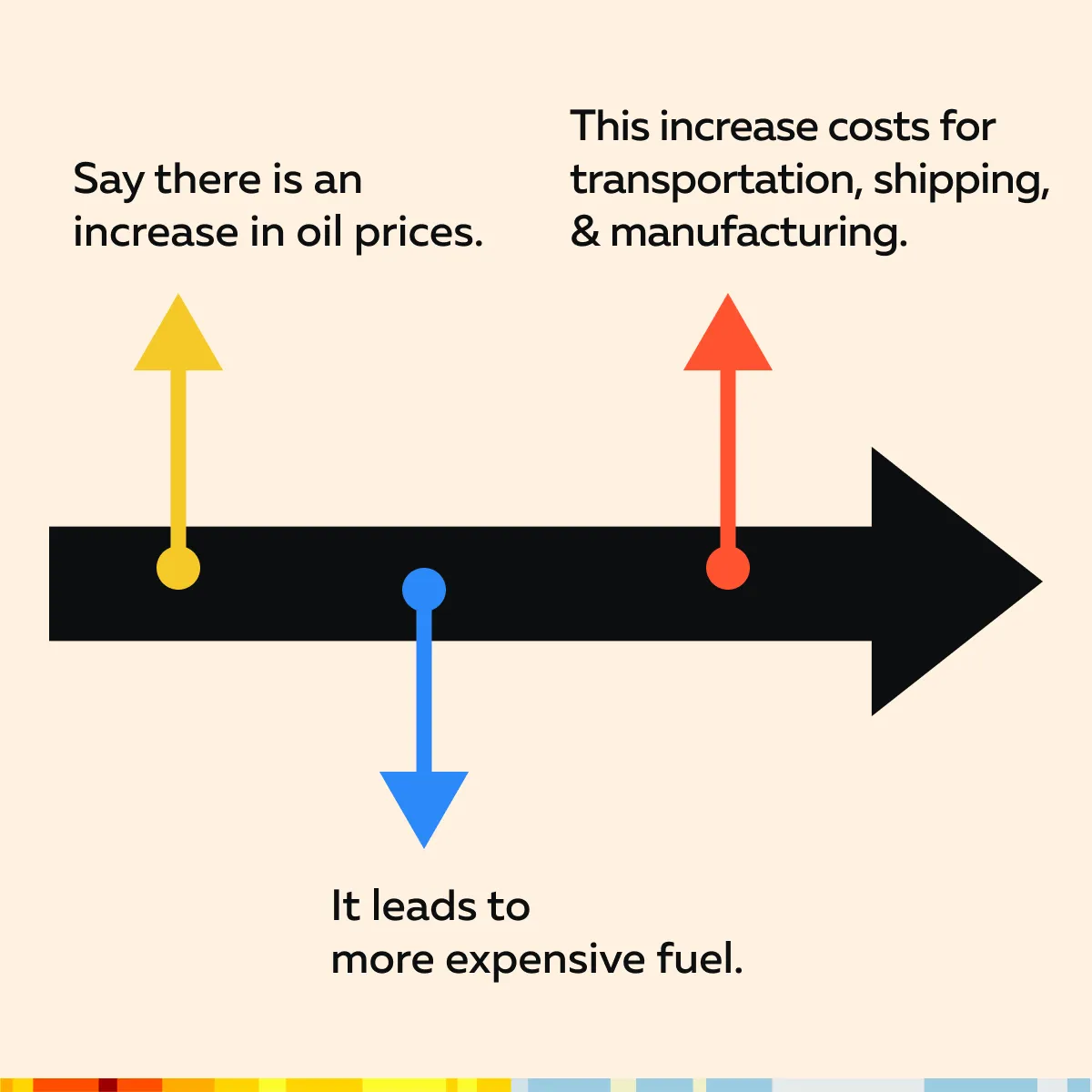

The energy and transportation sectors can’t run without oil. One must note that it plays a fundamental role in energy production and transportation. Oil is a key input in the global supply chain. Hence, any fluctuations in oil prices significantly affect nearly every sector of the economy. Study the graphic below to see what happens when oil prices rise.

Thus, rising oil prices lead to higher costs for businesses that rely on energy for:

- production,

and

- logistics.

These increased costs often get passed on to consumers, which creates inflation. Please note that as transportation expenses surge, the price of goods also rises. This event amplifies broader inflationary trends.

Track commodity-driven market shifts with Bookmap’s order flow tools to refine your inflation-hedging strategy.

Historical Oil Price Surges and Inflation Correlation

To understand the strong link between oil price shocks and inflation, let’s check out some major historical events:

| 1973 Oil Crisis | 2022 Energy Price Hikes |

|

|

How to Invest in Oil for Inflation Protection

By investing in oil, investors can gain a hedge against inflationary pressures. Let’s check out some common options:

- Oil Futures:

- Futures contracts give investors the option to buy or sell oil at a predetermined price in the future.

- They give direct exposure to oil price fluctuations.

- This is a popular choice for those who want to actively trade in oil price movements.

- Oil ETFs

- Exchange-traded funds track oil prices or energy sector performance.

- They provide easy and diversified access to the oil market.

- Also, you don’t have to own the commodity directly via futures contracts.

- Energy Mutual Funds

- These funds invest in a basket of energy-related assets.

- Commonly, these include oil companies and energy infrastructure.

- This option offers a more managed approach to investing in oil.

- Oil-Related Stocks

- In this manner, you invest in companies engaged in:

- Oil exploration,

- drilling,

- In this manner, you invest in companies engaged in:

and

- refining.

- This option gives you a leveraged exposure to oil prices.

Strategic Uses of Gold & Oil for Inflation Hedging

By combining gold and oil in an investment portfolio, you can create a strategic defense against inflation. At the same time, you can balance:

- stability,

and

- growth potential.

Let’s see how you can smartly achieve both of these benefits.

| Aspects | Gold for Stability | Oil for Growth Potential |

| Meaning |

and

|

or

|

| Example |

|

|

How to Monitor Gold and Oil for Strategic Adjustments

To develop an inflation-hedging strategy, investors must actively monitor gold and oil markets. Such monitoring also helps in making timely adjustments and increasing portfolio returns. To do so, you can start using our advanced market analysis tool, Bookmap. It offers real-time data analysis and can significantly enhance your ability to respond to market conditions.

How to Track Price Movements with Bookmap?

Our ingenious platform, Bookmap, is a powerful market analysis tool. It offers real-time visualization of market data, such as order flow and liquidity. Using it, traders can easily get a detailed view of market activity. This allows traders to see:

- where large buy or sell orders are placed

and

- how liquidity shifts in response to market events.

By observing these patterns, investors can smartly predict price movements. Post prediction, they can adjust their positions in gold and oil accordingly. Let’s check how Bookmap can empower you as a trader:

| Conduct Order Flow Analysis on Bookmap | Spot Liquidity Zones on Bookmap |

|

|

How to Use Bookmap for Strategic Adjustments

By using our real-time market monitoring tool, Bookmap, traders can act quickly when market sentiment shifts. Let’s see how:

Let’s understand better through an example:

-

- Suppose our Bookmap shows a sudden spike in gold liquidity.

- This suggests that institutional investors are entering the market.

- This insight signals a strong bullish sentiment.

- It encourages you to increase your gold allocation so that you can hedge against inflation.

Conversely, now assume that oil prices are climbing due to growing buy interest. In this case, you can invest more in oil futures or energy stocks and get higher returns.

Key Risks of Commodities in Inflation Hedging

While commodities like gold and oil are commonly used to hedge against inflation, they have several inherent risks. Investors should carefully consider these risks to create a balanced and resilient investment strategy. Let’s check them out:

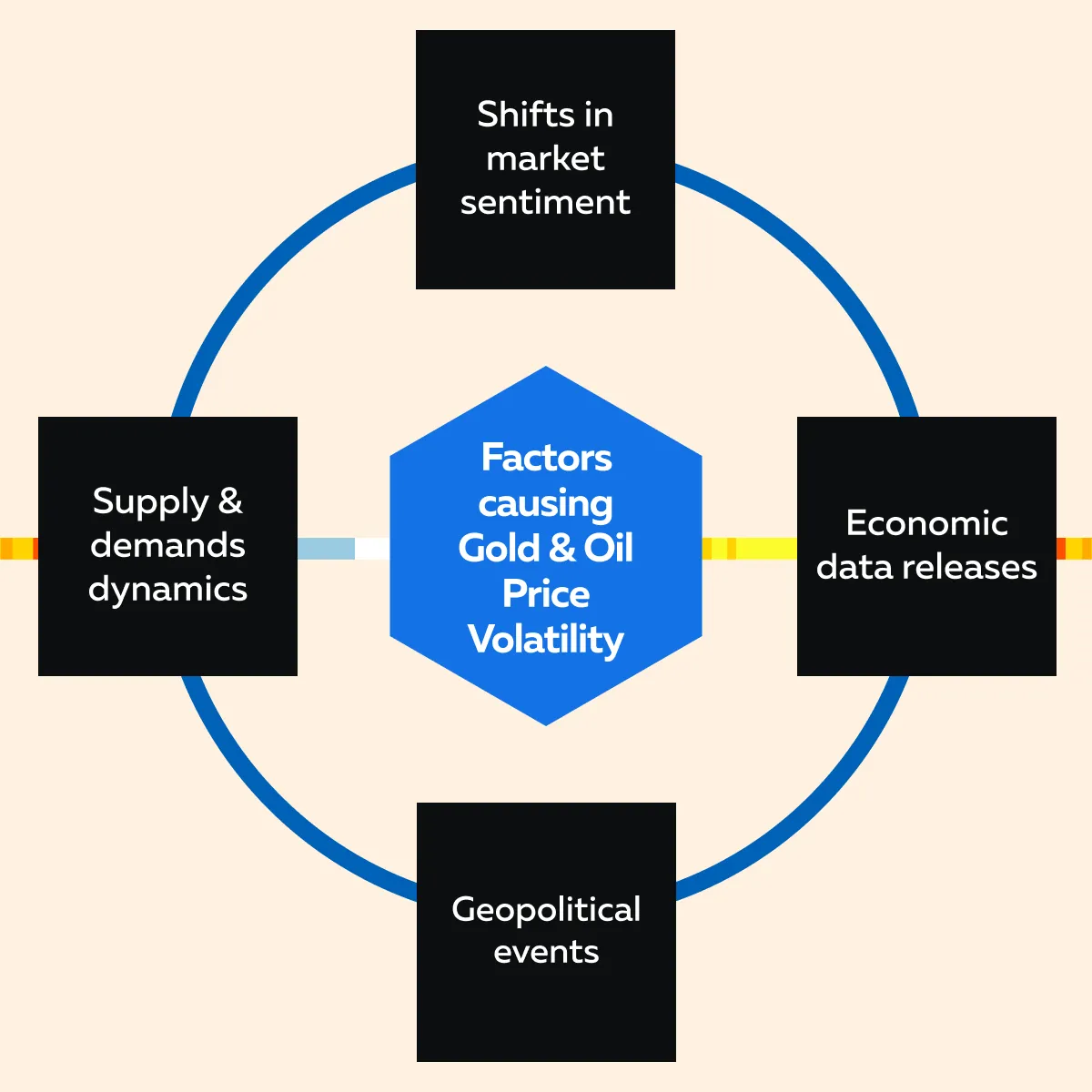

A) Price Volatility

One of the primary risks associated with commodities is price volatility. Both gold and oil are highly susceptible to rapid price changes. That’s because the following factors influence them:

For example, oil prices can swing dramatically due to geopolitical tensions in oil-producing regions. Additionally, there could be rapid fluctuations when there are sudden changes in production quotas set by organizations like OPEC.

Similarly, gold prices fluctuate based on shifts in:

- investor sentiment,

- central bank policies,

and

- currency strength.

For example, during a global recession, the prices of gold and oil behave unpredictably. Even though gold is considered a safe haven, it may not always rise as expected if liquidity crises force investors to liquidate their gold holdings. Oil, on the other hand, experiences sharp declines if economic activity slows. Such unpredictable behavior introduces significant volatility to an investor’s portfolio.

B) Costs of Holding Physical Commodities

Investing in physical commodities like gold comes with substantial costs. Physical gold requires secure storage and insurance. This cost erodes investment returns over time. Moreover, buying and selling physical gold involves high transaction costs, making it less liquid compared to other financial assets.

C) Risks of Futures and Leveraged Investments

Commodity futures markets offer exposure to price movements but also come with high risks. Futures contracts often involve “leverage.” For the unaware, this means investors only need to put down a fraction of the contract value as margin.

While this can amplify gains, it also magnifies losses. There is a possibility of significant losses if prices move unfavorably. Additionally, margin requirements lead to forced liquidation of positions if an investor cannot meet the demands, especially in highly volatile markets.

Conclusion

Both gold and oil act as “inflation hedges.” Each commodity offers several unique advantages. Gold is known for its stability and serves as a reliable store of value, especially during economic uncertainty. It protects against currency depreciation and market volatility, making it a solid anchor in an inflation-resistant portfolio. On the other hand, oil provides growth potential. When inflation rises due to higher energy costs, oil prices often increase, offering strong returns if demand stays high or supply becomes restricted.

Therefore, investors must include both gold and oil in a portfolio to create a balanced hedge against inflation. Understand that gold provides security, while oil brings an opportunity for capitalizing on price surges.

However, both assets come with risks. Commonly, these are price volatility and investment costs. To manage them carefully and optimize investment decisions, investors can start using our advanced market analysis tool, Bookmap.

It offers real-time market data through which investors can monitor price movements in these commodities. By tracking order flow and liquidity, investors can:

- make informed decisions

and

- adjust their portfolios promptly in response to changing market conditions

Hence, staying proactive and well-informed is key to smartly using gold and oil for inflation protection. Protect your investments with Bookmap’s market visualization tools, monitoring real-time movements in gold, oil, and other key assets.