Ready to see the market clearly?

Sign up now and make smarter trades today

Education

June 3, 2025

SHARE

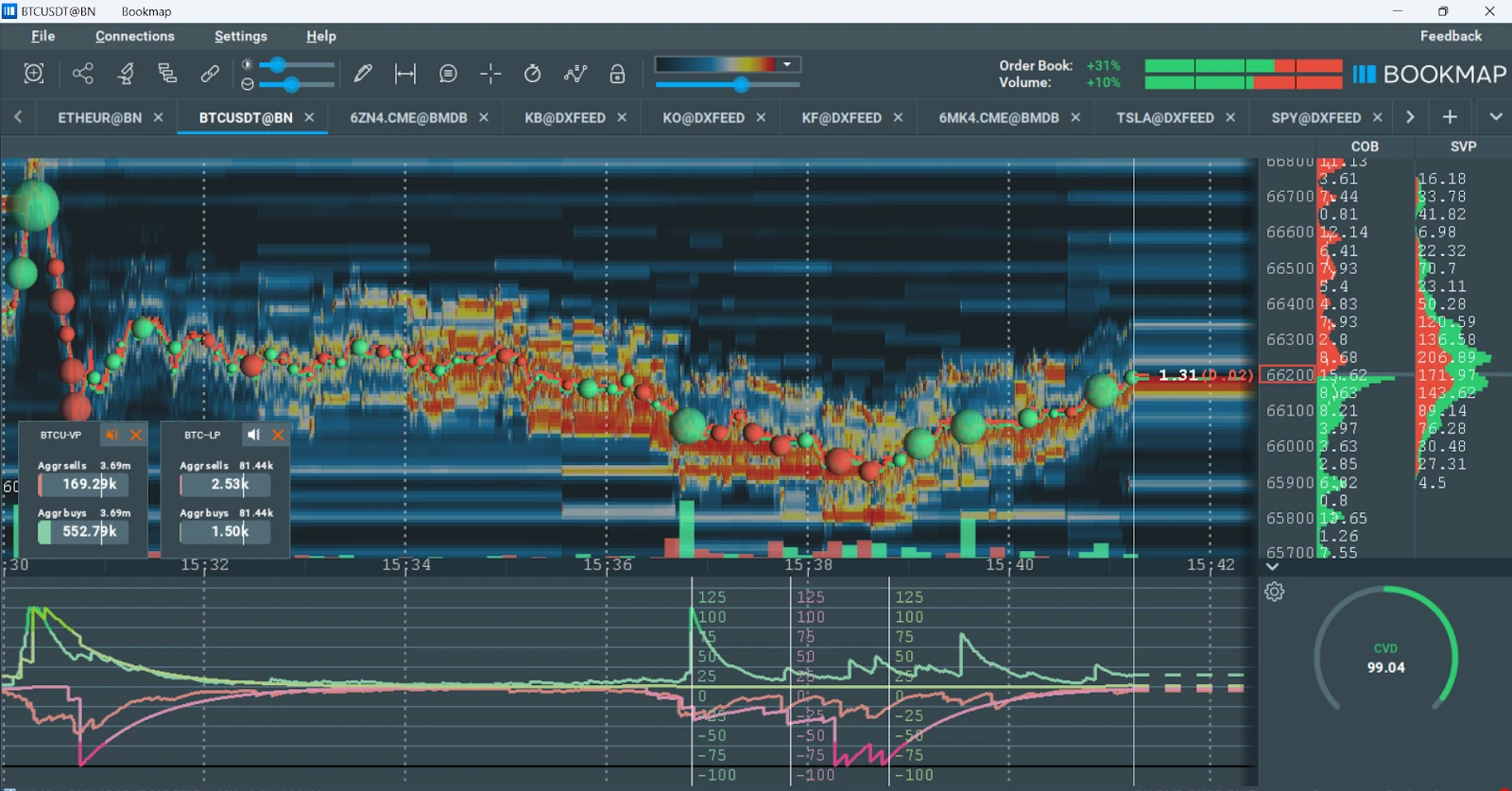

Market Pulse: A Broader View of Market Activity in Real Time

When you’re zoomed in on a single instrument, it’s easy to miss what’s happening in the rest of the market. A sudden move in ES might not make sense—until you see that NQ or RTY just broke key levels. Or maybe a spike in volume in AAPL coincides with aggressive order flow in the SPY. These broader signals are often the missing link.

Market Pulse fills that gap. It gives traders a real-time dashboard of market-wide activity—letting you track volatility, momentum, and aggressive trading across multiple correlated instruments. Available for both futures and stocks, it’s built to help you stay informed without leaving the Bookmap interface.

What Is Market Pulse?

Market Pulse is a real-time visual dashboard that shows:

- Price movement strength (directional momentum)

- Volume surges (total and aggressive)

- Correlation shifts between key instruments

It works by aggregating live MBO data from multiple symbols and translating it into intuitive visual signals. Traders can choose which instruments to follow—like ES, NQ, RTY, SPY, QQQ, or leading stocks—and monitor shifts without opening new charts.

Learn more or configure your panel via the Knowledge Base.

Why It’s Useful for Futures and Stock Traders

Futures Traders

If you’re trading ES, but NQ is leading the market higher, that divergence matters. Market Pulse helps futures traders:

- Spot correlated directional bias

- Time entries with broader confirmation

- Avoid getting trapped during fakeouts when other markets aren’t aligned

Stock Traders

When monitoring a stock like TSLA, it’s helpful to know what’s happening in SPY or QQQ. If aggressive selling hits across the board, even strong names may pull back. Market Pulse lets equity traders:

- Stay aware of macro pressure

- Track real-time flows in ETFs or peer stocks

- Combine single-stock signals with market structure insights

Use Cases in Practice

Confirming Reversals

You see aggressive selling in your chart, but Market Pulse shows strong buying in the broader index. That contradiction may suggest a local shakeout, not a full reversal.

Identifying Rotations

Volume shifts out of small caps (RTY) and into large caps (NQ)? Market Pulse flags that change instantly—giving you early warning of sector rotation.

Risk Management

If Market Pulse lights up with aggressive selling across multiple indices, that may be a cue to step back, tighten stops, or reduce position size.

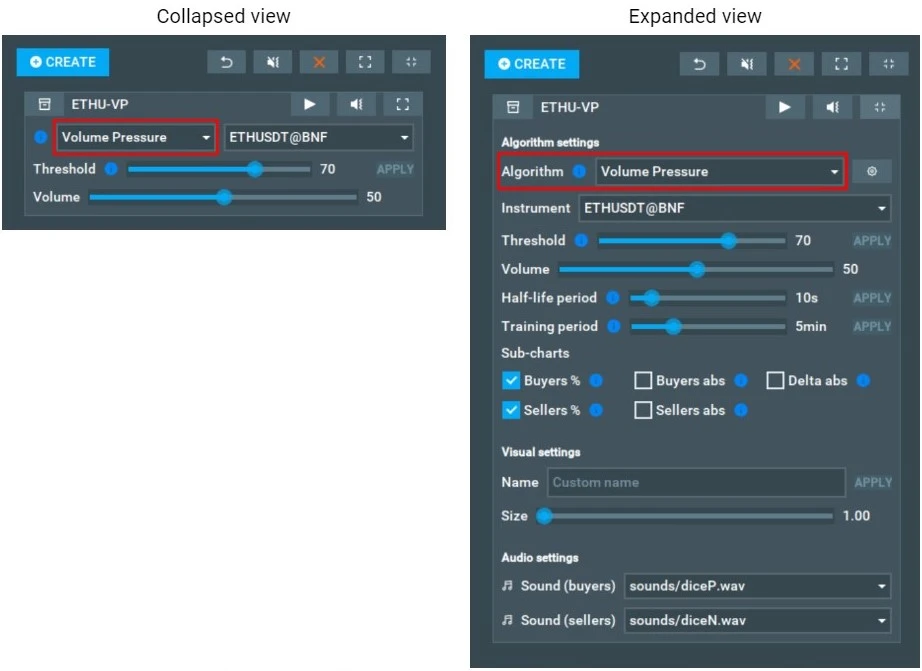

Customization and Integration

Market Pulse is fully customizable:

- Choose which instruments to track

- Adjust sensitivity and signal thresholds

- Display the widget on your Bookmap layout or on a separate monitor

This makes it easy to integrate without cluttering your primary chart view.

Requirements and Access

To use Market Pulse, you’ll need:

- A Bookmap Global or Global+ subscription

- BookmapData for CME futures, or a supported provider like Rithmic

The add-on is available via the Bookmap Marketplace.

Conclusion

Even the best setups can fail in isolation. Market Pulse helps put your trade in context—so you’re not reacting to one chart, but reading the market as a whole.

It’s a simple overlay with a powerful effect: giving you the missing perspective that ties everything together.

Explore the full setup guide to learn more.