Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 11, 2025

SHARE

Navigating Regulation SHO: Understanding Short-Selling Rules

Are you a short seller? If yes, then you must have experienced that short selling is exciting and profitable but risky. It is like playing with fire. So, if things go wrong, are you aware of your fire extinguisher?

Regulation SHO is that fire extinguisher. It prevents every short seller from taking unnecessary risks. Obviously, you need to stay compliant, but this isn’t just about following the rules. Instead, it’s about making smart decisions that keep your trades safe and profitable.

In this article, we’ll explain Regulation SHO and its key rules that govern short selling. You’ll learn about the Locate Rule, which ensures you can borrow the shares you want to short, and the threshold securities list, which flags stocks with high fail-to-deliver rates. We’ll also break down the Uptick Rule and its role in preventing downward price spirals during volatile market conditions.

Beyond understanding the regulations, we’ll introduce you to our advanced market analysis tool, Bookmap, and how you can use it to stay compliant. Let’s begin.

What is Regulation SHO?

Regulation SHO is a “rule” introduced in 2005 and implemented by the U.S. Securities and Exchange Commission (SEC). It specifically regulates short-selling practices in financial markets. This regulation curbs potential abuses like naked short selling, a situation when traders sell shares without borrowing or confirming the availability of the underlying security. Such practices distort market prices and lead to manipulation.

A real-life example of naked short-selling abuse is the Overstock.com case in the early 2000s. The company alleged that abusive naked short selling by hedge funds artificially depressed its stock price. Overstock filed lawsuits accusing the funds of using naked shorting to manipulate its share price. This case prompted the SEC to enhance and strictly enforce the rules under Regulation SHO.

What are Some Key Provisions of Regulation SHO?

Regulation SHO requires two important things from traders. These are:

| Locate Requirement | Close-Out Requirement |

|

|

Short-Selling and Its Market Impact

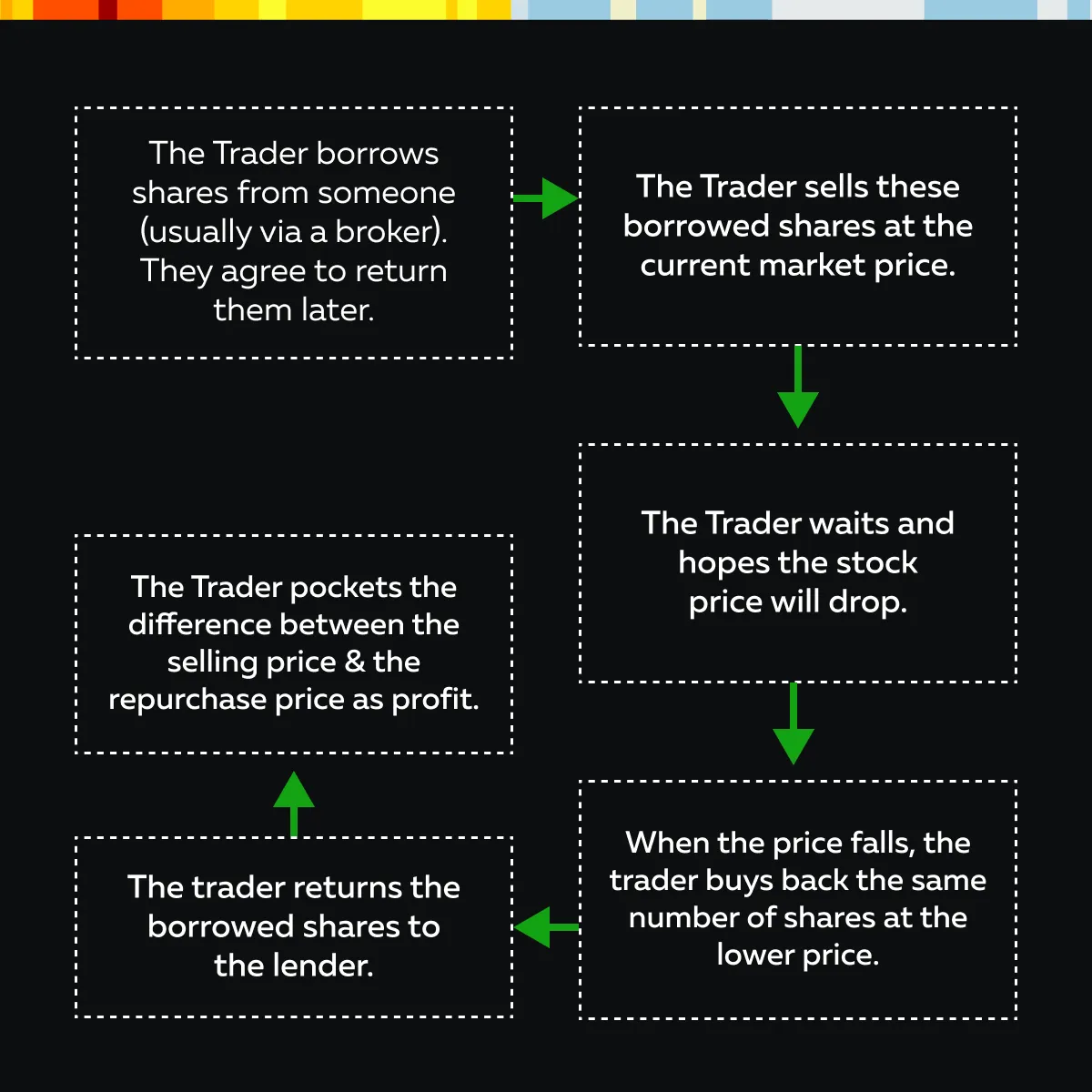

Short-selling is an investment or trading strategy. Here, an investor borrows shares of a stock (or another asset) from a broker and sells them in the market with the hope that the price will fall. The idea is to repurchase those shares at a cheaper price and then return them to the lender, keeping the difference as profit. For more clarity, let’s understand the process through the graphic below:

How Short-Selling Can Be Profitable?

Usually, traders earn profit from declining prices. Unlike traditional investors who make money when stock prices rise, short-sellers profit from price declines. This strategy allows them to benefit during:

- Market downturns,

- Poor earnings reports, and

- Bad news affecting a company’s stock.

For example, during the 2008 financial crisis, many short-sellers profited by betting against companies like Lehman Brothers and Bear Stearns.

How Short-Selling Leads to Market Volatility?

Short-selling destabilizes markets. This effect is felt more particularly during times of extreme volatility or economic crises. When a large number of investors short a stock, they put downward pressure on its price. This amplifies any existing negative sentiment in the market and causes the stock to drop even further.

For example, during the 2008 financial crisis, short-selling in the financial sector drove the prices of many banks and financial institutions lower. This prompted regulators to temporarily ban short-selling in some stocks to stabilize the market.

What is a Short Squeeze?

A short squeeze happens when a stock with significant short interest experiences a rapid price increase. This situation forces short-sellers to close their positions by buying back the stock. This leads to even higher prices as more short-sellers are forced to cover their positions.

A classic example of this can be found in “The GameStop (GME) short squeeze”. This event happened in January 2021. Let’s check it out:

| What was Gamestop? | What Happened? | What was the outcome? |

|

|

|

How Short-Selling Affects Market Liquidity?

Despite the risks, short-selling can also have positive effects on the market. It improves market liquidity as short-sellers increase the number of transactions and make it easier for buyers and sellers to trade. This ensures that markets function smoothly, with more participants on both sides (buy and sell orders).

Furthermore, short-sellers help in identifying “overpriced stocks” by betting against them. Their actions reflect negative sentiment and skepticism about a company’s future performance. When short-selling is done based on well-researched information, it helps uncover the true value of a stock.

Understanding the Key Components of Regulation SHO

Regulation SHO maintains market integrity and prevents market abuses like naked short selling. Below are the key components that traders and brokers must adhere to under this regulation:

1. The Locate Rule

The Locate Rule requires that brokers and dealers must locate and confirm that shares are available to borrow before they initiate a short sale. This requirement prevents naked short-selling.

How does it work?

Before initiating a short sale, the broker must either:

- Have the shares on hand to lend to the short seller,

or

- Obtain confirmation from another entity (e.g., a stock lender) that the shares are available to borrow.

Example:

Say a trader wants to short-sell 1,000 shares of a technology stock. To comply with the Locate Rule, they must first identify a broker that can lend them the shares. If the broker confirms that the shares are available, the short sale can proceed.

2. Threshold Securities

A threshold security is a stock that has a significant number of “fail-to-deliver” positions over a continuous period of time. This means that many short sales in that stock have not resulted in the delivery of shares to the buyers, often due to naked short selling.

How does it work?

A stock is added to the threshold list if it has had fail-to-deliver positions amounting to 0.5% or more of the stock’s total outstanding shares for five consecutive settlement days.

Now, suppose a stock is on the threshold list. In that case, short sellers who fail to deliver the shares they sold short are required to close out their positions by purchasing and delivering shares within a specific timeframe (usually within 13 consecutive settlement days).

Example:

- Let’s say a small biotech company, Company X, has been the target of heavy short-selling.

- Many of these short sales fail to deliver the stock to buyers.

- This stock is added to the threshold list.

- Now, all traders who fail to deliver on their short sales in Company X must purchase the shares and close out their positions.

- This forces short-sellers to cover.

- This covering can increase the stock price due to the increased demand for shares.

3. Short-Exempt Orders

Short-exempt orders refer to specific orders where traders are allowed to short-sell without adhering to the “uptick rule”. For those less familiar, this rule restricts short sales on a downtick (i.e., when the recent trade price is lower than the preceding one). The uptick rule was designed to prevent short sellers from contributing to market declines during periods of volatility.

Situations for Short-Exempt Orders

Certain situations allow traders to be exempt from the uptick rule. For example, during market-wide circuit breakers, the SEC allows traders to short-sell without worrying about whether the last price was a downtick. Some other exemptions include short sales “above the national best bid”. This implies that a short sale can occur as long as the price is higher than the highest current bid in the market.

Example:

- Say a market-wide sell-off causes a stock index like the S&P 500 to trigger a circuit breaker.

- All trading gets temporarily halted

- When trading resumes, the uptick rule is suspended for certain orders.

- This means traders can short-sell without waiting for an uptick, even if the stock prices are rapidly falling.

- In this case, the exemption allows liquidity to flow back into the market.

Get a better understanding of market activity before placing your short positions—sign up for our efficient trading platform, Bookmap, and stay compliant with Regulation SHO.

The Uptick Rule and Its Implications

The Uptick Rule was originally introduced by the SEC in 1938. Simply, it is a protective measure to prevent short-sellers from adding undue pressure to a stock’s downward movement, particularly during times of:

- Volatility

or

- Market crashes.

The rule plays a significant role in curbing aggressive short selling that can further depress stock prices. Let’s understand the uptick rule from scratch.

What is the Uptick Rule?

The Uptick Rule is also known as Rule 10a-1. It mandates that a short sale can only be executed at a price higher than the last trade price. This means short sellers cannot execute their trades if the stock price is declining. They must wait for a price uptick. Importantly, this rule was implemented to prevent “bear raids,” where traders aggressively short-sell a stock. This action used to cause rapid price declines and exacerbate panic in the market.

Furthermore, this rule also acts as a safeguard against extreme volatility. It ensures that short sellers don’t pile on stocks during periods when stocks are already under heavy selling pressure. For more clarity, let’s study an example:

- Say a large tech stock is experiencing a significant sell-off due to poor earnings.

- In such a situation, short sellers jump in and short the stock aggressively.

- They bet on further price declines.

- Now, if there were no restrictions, these short sellers could:

- Add to the selling pressure

and

- Accelerate the stock’s decline.

- Whereas, with the uptick rule in place,

- Short sellers cannot execute trades at a lower price if the stock is continuously declining.

- This limits their ability to push the stock price down further.

- They are forced to wait for a price increase before executing short sales.

- As a result, the rate of decline is slowed.

- This gives the market a chance to stabilize and also prevent panic selling.

How Does Uptick Rule Impact Short-Term Traders?

It must be noted that the uptick rule can pose serious challenges for short-term traders. Its negative effect will be felt more by especially those who engage in high-frequency or momentum-based trading strategies. Let’s see how:

| Effects of uptick rule on short-term traders | Explanation |

| Delayed entry |

|

| Strategy adjustments |

|

| Lower liquidity |

|

How to Use Market Data & Tools to Stay Compliant with Regulation SHO?

Compliance with Regulation SHO is important. Non-compliance with the rules can lead to penalties. To stay compliant, traders must utilize:

- Market data

and

- Advanced trading tools.

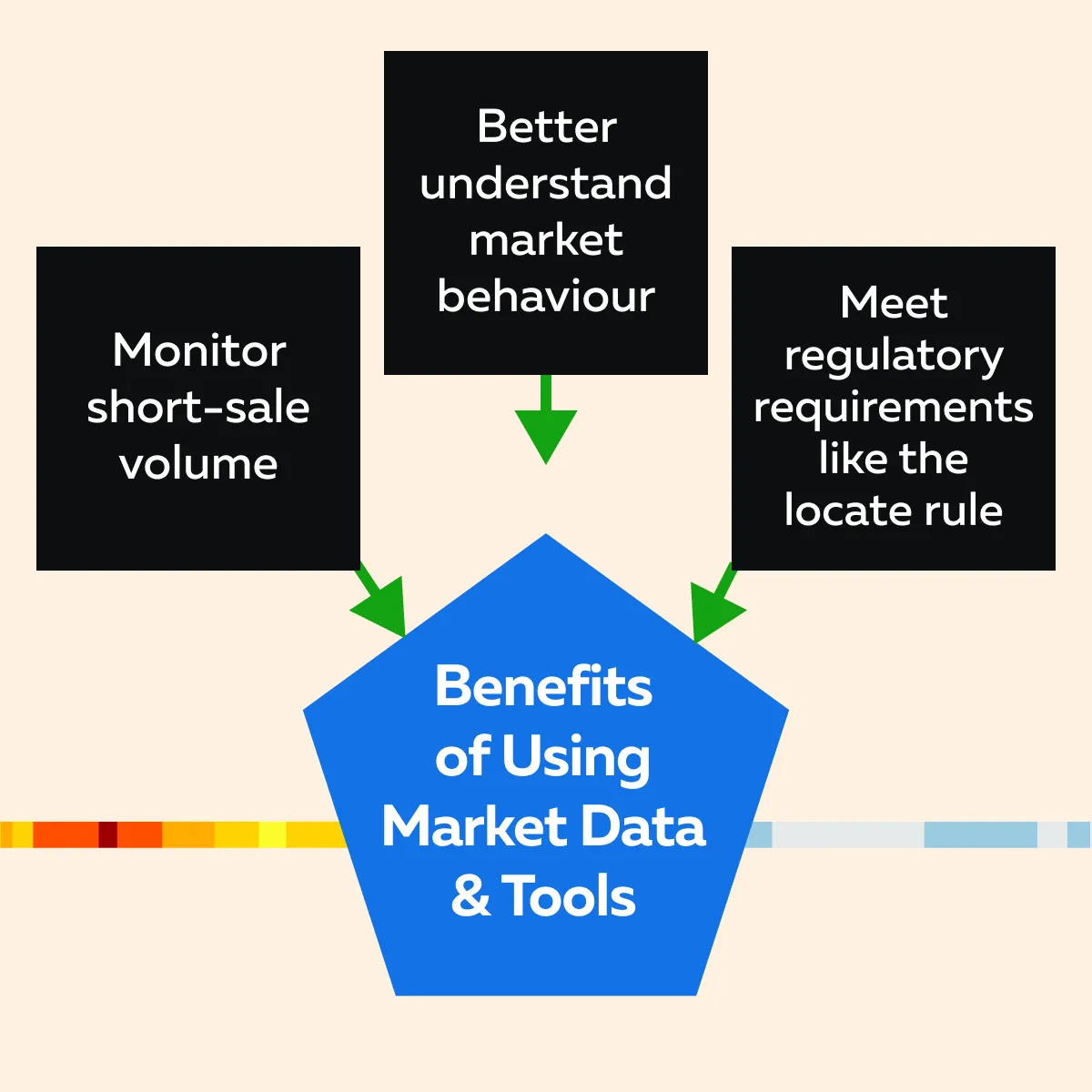

See the graphic below to understand the benefits of their usage:

How Does Monitoring Short-Sale Volume Help?

By monitoring short-sale volume, short-sellers can stay compliant with Regulation SHO. It allows traders to gauge the level of short interest in a stock, which usually indicates:

- Market sentiment,

- Expected price movements, and

- The risk of a short squeeze.

It is worth mentioning that “high short-sale volume” can also indicate that a stock may be under scrutiny for fail-to-deliver positions. If we talk about its practical usage, most short-sellers use data feeds to track short-sale volume in real time. They look at key metrics such as:

- Short Interest Ratio: The ratio of short shares to the total number of shares available for trading.

- Days to Cover: The estimated number of days it would take for all short sellers to cover their positions based on average daily volume.

By monitoring these metrics traders stay compliant as they easily avoid stocks with excessive fail-to-deliver positions. Navigate short-selling regulations with confidence—use our advanced tools at Bookmap to manage your trades. Join us now!

How Tools Like Bookmap Can Help

Bookmap is our advanced market analysis tool. It provides a real-time visual representation of market liquidity. This tool is loaded with modern features like “order flow” and “heatmap”. It allows traders to visualize where large buy and sell orders are placed and how market participants interact with the order book.

Let’s see how its modern features help in short-selling:

| Order Flow Analysis | Heatmap Tool |

|

|

Can Bookmap Help in Managing Risk?

We understand that one of the biggest risks of short selling is being caught in a short squeeze. With Bookmap, traders can monitor market liquidity and order flow. This monitoring allows you to easily detect sudden shifts in supply and demand. Please note that these sudden shifts signal that a short squeeze is imminent. By recognizing these signs early, traders can smartly manage their risk by:

- Adjusting their positions

or

- Closing out shorts before a squeeze occurs.

Conclusion

Regulation SHO is a rule implemented by the SEC that regulates short selling. The regulation’s “Locate Rule” mandates that traders confirm shares are available to borrow before initiating a short sale. This requirement reduces the risk of naked short-selling. Additionally, traders must monitor stocks on the “threshold securities list,” as this can signal a need to close out short positions due to fail-to-deliver issues. By staying aware of these rules, short sellers can easily avoid regulatory violations.

Additionally, to optimize their trading and remain compliant with these rules, traders should use our advanced market analysis tools like Bookmap. It offers better market transparency and risk management. Thanks to its modern features like order flow and heatmap, traders can spot liquidity imbalances and time their trades more strategically, all while staying compliant with Regulation SHO. Start trading with Bookmap today!