Ready to see the market clearly?

Sign up now and make smarter trades today

News & Announcements

December 27, 2024

SHARE

Reddit Stocks: A Look at How Social Media is Changing the Stock Market

The stock market isn’t just driven by corporate profits and economic data anymore. The market moves are also fueled by memes and viral trends. Social media platforms of the likes of Reddit, Twitter, and Discord have completely transformed how stocks are traded, giving everyday investors the power to shake up financial markets in a manner once reserved for hedge funds and institutions.

Wish to know how?

In this article, we will study the rise in popularity of meme stocks (stocks that gain momentum through social media buzz rather than traditional analysis). You’ll explore how communities like r/WallStreetBets on Reddit became a hub for retail traders, leading to events like the GameStop short squeeze. We’ll also examine the tactics behind trading these stocks, the importance of risk management in such volatile markets, and how social media continues to influence new meme stocks like Virgin Galactic and BBIG. Finally, we’ll look at how regulators respond to this phenomenon and consider what’s next for retail traders in markets such as cryptocurrencies and penny stocks. Let’s begin.

The Rise of Meme Stocks: A Social Media Phenomenon

Meme stocks are stocks that gain popularity due to hype. Usually, they do not have strong financials, such as considerable company earnings, revenue growth, or market position. These stocks surge in price because they are hyped on social media platforms like Reddit, Twitter, and other forums. For the unaware, retail investors gather on these platforms to discuss stock market trends.

This is different from institutional investors, who usually rely on deep research. Retail investors participating in these discussions often buy stocks based on the following:

- trends,

- viral discussions,

- rumors,

- assumptions,

and

- the potential to go “viral.”

This collective retail interest drives prices up and leads to extreme price volatility. These meme stocks can rise or fall drastically within short periods due to this social media-driven momentum. Since the company’s financial performance doesn’t necessarily back the stock prices, these stocks are highly speculative.

Learn About the GameStop Short Squeeze Event

For more clarity, let’s study one of the most iconic examples of the GameStop short squeeze that occurred in early 2021.

- The GameStop Story

GameStop (ticker symbol: GME) was a brick-and-mortar video game retailer. It had been struggling financially for years due to the internet scavenging away most of its customers. Many large institutional investors, specifically hedge funds, noticed this decline and heavily shorted the stock.

- Reddit’s Role (r/WallStreetBets)

A group of retail investors who regularly exchanged trading tips on a Reddit forum r/WallStreetBets noticed how many institutional investors had shorted GameStop. They saw an opportunity to push back against these hedge funds. By coordinating massive buying efforts, they tried to force the stock price higher. This caused a short squeeze.

For the unaware, a short squeeze represents a situation when the price of a heavily shorted stock starts to rise significantly. Consequently, short sellers face mounting losses. To avoid further losses, they have to “cover” their short positions by buying the stock at higher prices. This buying pressure pushes the stock price even higher and creates a cycle where more and more short sellers are forced to buy back the stock.

- Increase in GameStop Share Price

As retail investors from Reddit and other platforms poured money into GameStop, the stock price soared from around $17 at the start of January 2021 to over $480 by the end of the month. This massive rally was due to the short squeeze, as hedge funds found it tough to cover their positions.

- David vs. Goliath

The GameStop saga was christened as a “David vs. Goliath” battle. Here, retail investors used their collective power to challenge the dominance of large institutional hedge funds. A hedge fund, Melvin Capital (one of the most notable funds shorting GameStop), reportedly lost billions during this short squeeze.

- Regulatory and Media Attention

The GameStop incident drew intense attention from stock market regulators, including that of the market watchdog, the U.S. Securities and Exchange Commission (SEC). Many questions were raised, such as whether the coordinated buying effort on Reddit is a form of market manipulation or simply retail investors exercising their right to buy stocks.

- Financial Media Focus

The financial media picked up the story quickly. There was widespread coverage on mainstream outlets like CNBC, Bloomberg, and The Wall Street Journal. This amplified the meme stock phenomenon even further as more investors (both retail and institutional) became aware of the power of coordinated social media-driven trading.

Terms like “short squeeze” and “diamond hands” (holding a stock despite extreme volatility) became part of everyday conversation among investors. See how social media trends are impacting stock liquidity with our platform Bookmap’s advanced heatmap and real-time data tools. Get started!

How Do Reddit and Social Media Empower Retail Investors?

r/WallStreetBets is a subreddit on Reddit. It was created as a space for retail traders to:

- discuss high-risk stock strategies,

- share trade ideas,

and

- engage in humorous and irreverent content.

This subreddit quickly became a hub where retail investors could share stock tips and strategies. Although many posts were satirical or irreverent, some members identified valuable opportunities, such as stocks that institutional investors heavily shorted. These posts often went viral and created what is now known as “meme stocks.”

Furthermore, the platform’s “upvote system” enabled the most popular ideas to rise to the top. This viral nature meant that posts about certain stocks (such as GameStop or AMC) could spread rapidly. The use of memes to discuss stock investments gave the community a unique identity. Terms like “diamond hands” (referring to holding a stock through volatility) and “tendies” (profits) became commonplace. This also created an “us vs. them” mentality, which encouraged retail investors to resist selling in the face of price drops.

Retail Traders Are Gaining Influence

Social media platforms of the likes of Reddit, Twitter, and YouTube have given retail investors a platform to share ideas. Previously, retail investors (individuals with smaller amounts of capital) were fragmented. They often lacked the influence to impact stock prices significantly. However, with social media, they could now coordinate their actions.

Traditionally, institutional investors like hedge funds, investment banks, and mutual funds held a dominant influence on stock prices. That’s because they have large capital reserves and advanced data analytics tools. These institutions could buy or sell massive quantities of stock, moving prices in their favor. However, the collective buying power of an ever-increasing base of retail investors has now reduced their power and influence.

Collective Buying Power

What made retail traders on platforms like Reddit so powerful was their ability to act as a unified force. While one retail investor might not have much influence, thousands of retail traders acting together can exert enormous buying pressure on a stock and increase its price upward quickly. This was a major factor in the success of the meme stock phenomenon.

Social media has also democratized access to financial information. Retail investors now have instant access to news, analysis, and real-time discussions about stocks.

Key Factors Driving Reddit Stocks

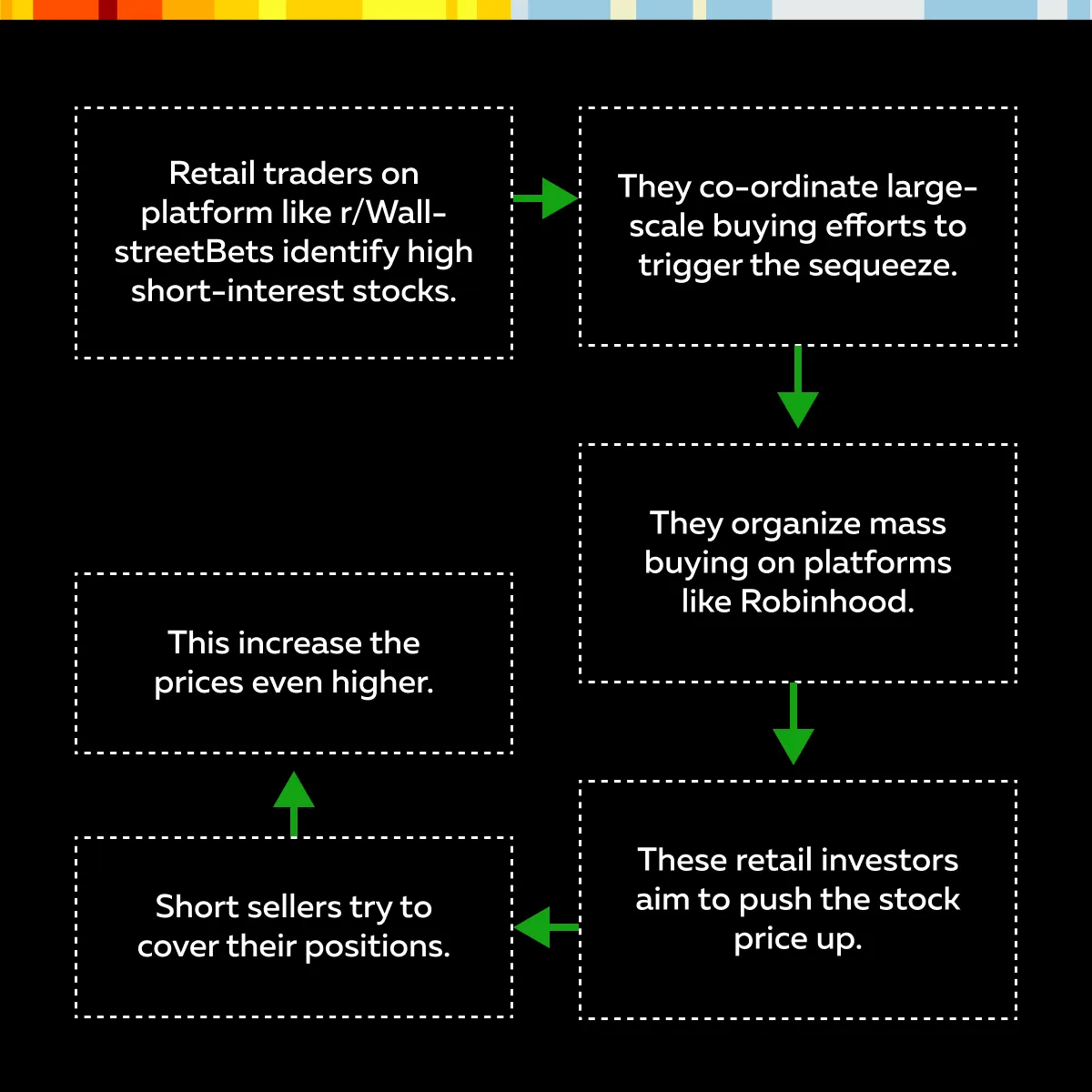

Reddit traders often look for stocks with high short interest. For the unaware, this means a large percentage of the stock’s available shares have been shorted by institutional investors, particularly hedge funds. These stocks become attractive to Reddit traders because if enough people start buying them, it can trigger a short squeeze. Let’s see how this happens through the graphic below:

For a greater understanding, let’s study another example related to the AMC Short Squeeze.

- AMC was a struggling movie theatre chain.

- It became a prime target for Reddit traders in early 2021.

- AMC had a high short interest as institutional investors bet against the company’s future

- Reddit users, primarily from r/WallStreetBets, began buying large quantities of AMC stock.

- The price of AMC skyrocketed from under $2 per share in early 2021 to over $60 by June 2021.

- This forced many institutional investors who had shorted AMC to cover huge losses.

Viral Trends and Fear of Missing Out (FOMO)

One of the key drivers behind Reddit stocks is the viral nature of social media platforms. Stock tips, memes, and success stories about quick profits spread rapidly on Reddit, Twitter, and other forums. This creates a viral loop where more and more investors become aware of the opportunities.

Next, this viral spread creates a strong Fear of Missing Out (FOMO) among retail traders. As more people see others making large profits from rising stock prices, they jump into the trade to avoid missing out on the potential gains. Usually, this FOMO leads to a snowball effect, where a growing number of traders start buying the stock.

As a result, this social media hype causes stocks to surge rapidly, often without any connection to the company’s underlying fundamentals.

Relationship Between Liquidity and Trading Volume

When Reddit traders target a stock, thousands (or even millions) of retail investors buy and sell at the same time. This leads to huge spikes in liquidity.

For example:

- During the height of the AMC rally in 2021, its trading volume surged dramatically.

- At its peak, AMC saw hundreds of millions of shares traded per day.

- This far exceeded its typical trading activity.

While high liquidity allows for easier buying and selling, it also means prices can be extremely unpredictable. This volatility can benefit traders who enter and exit positions at the right time, but it also poses risks for those caught on the wrong side of a price movement.

Strategies for Trading Reddit Stocks

Momentum trading is a popular strategy where traders capitalize on the rapid price movements of stocks. In this strategy, they buy in during the initial surge and sell before the momentum fades. This strategy relies on timing and the ability to ride the wave of increasing demand. For more clarity, study its key principles:

| Buying Early | Exiting Quickly |

|

|

Let’s understand better through an example related to Bed Bath & Beyond (BBBY):

- In 2021 and 2022, Bed Bath & Beyond (BBBY) experienced significant price surges due to its mention on Reddit forums.

- A trader practicing momentum trading bought the stock early when they noticed BBBY gaining attention on Reddit.

- As more retail investors piled into the stock, the price increased further.

- Before the hype died down, the trader sold their position to lock in gains.

It is worth mentioning that momentum traders must act quickly to capture gains before the market shifts. Given how fast social media hype can spread, these stocks can experience rapid price swings within minutes or hours. This makes timely execution highly important.

Risk Management for Volatility

Meme stocks, such as those driven by Reddit interest, are highly volatile. They often experience extreme price drops once the momentum reverses. Hence, traders must be prepared for these sharp fluctuations and protect themselves from substantial losses. To manage risk, traders can:

- Place stop-loss orders,

- Perform position sizing, and

- Avoid FOMO.

Let’s understand in detail.

A) Place Stop-loss Orders

One of the most effective tools for managing risk in volatile meme stocks is the use of stop-loss orders. A stop-loss order automatically sells a stock once it reaches a predetermined price. This risk-management practice helps traders limit their losses if the stock price suddenly drops.

For example:

- Say a trader bought Bed Bath & Beyond (BBBY) stock at $30 during a surge.

- They place a stop-loss order at $27.

- Now, if the price falls to $27, the stop-loss order will trigger.

- It would automatically sell the stock and prevent further losses.

B) Do Position Sizing

Another popular risk management strategy is position sizing. It is the practice of limiting how much of your capital is allocated to any single trade. Given the unpredictable nature of Reddit stocks, traders should avoid putting too much of their portfolio into one position. That’s because it could lead to significant losses if the trade goes against them.

C) Avoid FOMO

Meme stocks often experience rapid price spikes, luring traders into buying at inflated prices. Hence, it is important for traders to:

- stick to their pre-planned strategies,

and

- not chase stocks after they have already made substantial gains.

If you try chasing, you may enter the market just before a price reversal. Are you interested in tracking the influence of retail investors on stock prices? Our platform, Bookmap, can help you see trends before they become headlines. Join us now!

How Social Media Continues to Shape Stock Markets?

The inescapable influence of social media on stock trading is likely to be a long-term trend. Social media platforms of the likes of Reddit, Twitter, and Discord have fundamentally changed how retail traders interact with financial markets. Traditionally, stock market insights and advanced trading strategies were confined to:

- institutional investors,

- hedge funds,

and

- professionals with specialized tools.

But now, social media has democratized financial information. They have enabled retail traders to access and share analysis instantly. This shift allows individual investors to stay informed and coordinate trading decisions collectively.

Increased Retail Participation

The rise of these platforms has increased retail investor participation in the stock market. Nowadays, retail traders use platforms like Reddit and Twitter. Check the graphic below to see what they do on these platforms:

Also, social media enables retail investors to move markets in ways that were previously difficult to achieve. Stocks that would normally receive little attention can now be catapulted into the spotlight when they trend on Reddit or Twitter. Once they trend, these unpopular stocks attract large numbers of traders.

Newer Meme Stocks: SPCE (Virgin Galactic) and BBIG

Companies like Virgin Galactic (SPCE) and Vinco Ventures (BBIG) have become the latest targets of social media-fueled trading. Let’s understand in detail:

| Aspects | Virgin Galactic (SPCE) | Vinco Ventures (BBIG) |

| Meaning |

|

and

|

| Example |

|

|

Want to stay ahead of meme stock movements? Use our platform’s Bookmap’s market analysis tools to track order flow in real time.

What’s Next For Reddit Stocks?

The rise of Reddit-driven stocks and massive price volatility piqued the interest of regulatory agencies like the U.S. Securities and Exchange Commission (SEC). Regulators are now considering changes to protect market integrity. Let’s see what steps they are taking:

- Focus on Short Selling Rules

-

-

- One of the areas under review is short selling.

- During the GameStop surge, retail traders deliberately targeted stocks with high short interest.

- This event exposed vulnerabilities in the way short selling is regulated.

- SEC is considering reforms to limit excessive short interest and improve reporting requirements.

-

- Impose new rules on retail trading platforms.

-

- SEC is imposing rules on platforms like Robinhood to prevent disruptions like the halting of trading that occurred during the GameStop saga.

- This includes tighter capital requirements for platforms.

- This requirement will ensure they can handle the extreme volatility created by social media-driven trading.

- Payment for Order Flow (PFOF)

- Another aspect under scrutiny is the controversial practice of payment for order flow (PFOF).

- Trading platforms like Robinhood route orders to market makers in exchange for a fee.

- Critics argue that this practice creates conflicts of interest and may not always result in the best execution for retail investors.

- The SEC is exploring whether to ban or reform PFOF to improve transparency and protect retail traders.

The Evolution of Meme Stocks and New Frontiers

Many retail traders who participated in the original meme stock rallies may look for the next big thing. They can shift their attention to new markets and asset classes. Let’s see what all can be targeted:

| Cryptocurrencies | Penny Stocks and Small-Cap Stocks |

|

|

The Growing Influence of Social Media

Social media platforms of the likes of Reddit, Twitter, and Discord have become central hubs for retail traders to:

- share ideas,

- discuss strategies,

and

- coordinate buying efforts.

As more retail traders join these platforms, the power of collective action in moving markets is likely to grow even further. Please note that in the coming years, retail traders will continue to use these platforms not just for meme stocks but also to explore new sectors and asset classes.

Furthermore, in addition to r/WallStreetBets, new online communities are emerging on platforms like “Discord.” These communities are likely to increase as social media platforms evolve.

Conclusion

Social media has had a deep impact on the stock market. It has given retail traders more influence than ever before. Platforms like Reddit, Twitter, and Discord have allowed everyday investors to come together and share ideas. They are now creating viral trends that can send stock prices soaring or crashing. The rise of meme stocks like GameStop and AMC showed how powerful these communities can be.

As retail traders continue to grow their influence, it’s important to stay informed about the trends emerging on social media and how they can affect the market. Notably, new opportunities are constantly arising in areas like cryptocurrencies and penny stocks, where social media hype plays a central role in price movements.

To make sense of these trends and execute profitable trades, traders can use our advanced market analysis tool, Bookmap. It helps traders to see real-time market data and gain insights into price movements. So, do you wish to stay up-to-date on social media-driven trends? Start using the right trading tools. Start using our platform, Bookmap, today!