Ready to see the market clearly?

Sign up now and make smarter trades today

Education

July 18, 2024

SHARE

The Trading Revolution: How Social Networks Are Changing the Game

Social media can let you earn trading profits. Yes, it’s not just about making conversations or getting likes anymore. It has turned into an advanced trading tool that can help you discern emerging trends and identify trading opportunities.

This article will discuss the transformative power of social trading platforms and how they’re changing the way traders interact, share ideas, and execute trades in the digital age. From understanding the evolution of social trading to exploring emerging trends like artificial intelligence and blockchain technology, we’ll tell you how you can stay ahead of the curve and gain a competitive edge.

Also, we will delineate the benefits of joining popular discord communities, like those offered by Bookmap, and understand how you can benefit from smart networking. Let’s begin.

The Evolution of Social Trading Platforms

Social trading platforms have transformed significantly from simple traditional forums and chat rooms into sophisticated online ecosystems. They have successfully revolutionized how traders interact, share ideas, and execute trades in the digital age. Let’s see how they have emerged and evolved:

The Emergence

- In the early days of online trading, forums and chat rooms provided traders with a platform to discuss:

- Market trends,

- Strategies, and

- Trading opportunities.

- These platforms enabled knowledge sharing among traders and laid the foundation for the social aspect of trading.

The Evolution

Thanks to several remarkable introductions, the social platforms democratized access to financial markets. This allowed individuals to participate in the global financial ecosystem in an unprecedented manner. Let’s see some popular introductions or developments:

| Introductions | Explanation |

| Copy Trading |

|

| Social Sentiment Analysis Tools |

|

| Integration of Algorithmic Trading Strategies |

|

Let’s understand better through a hypothetical example:

Sarah is a novice trader, passionate about learning how to trade stocks. She joins a popular social trading platform to connect with other traders and expand her knowledge.

The Interaction and Collaboration

- Sarah explores various forums and chat rooms on the platform.

- She engages in discussions with experienced traders and fellow beginners on these platforms.

- There, she asks questions, shares her trading experiences, and seeks advice from more seasoned traders.

The Idea Sharing and Knowledge Transfer

- Sarah discovers a group of traders discussing a new trading strategy based on technical analysis indicators.

- Intrigued, she joins the conversation and learns how to interpret chart patterns.

Trade Execution and Copy Trading

- While Sarah is still building her confidence as a trader, she notices a successful trader on the platform who consistently generates profits using a momentum trading strategy.

- Impressed, Sarah decides to allocate a portion of her trading capital to automatically replicate the trades of this experienced trader through copy trading.

- With copy trading enabled, Sarah’s account mirrors the trades executed by the successful trader in real time.

- This enablement allows her to benefit from their expertise and potentially achieve similar returns.

Copy Trading: Defined

Copy trading has emerged as a pivotal feature within social trading networks. It has completely changed the way investors participate in financial markets. Let’s understand this concept in detail:

What is Copy Trading?

- Copy trading lets investors duplicate the trades of experienced traders.

- Primarily, novice investors benefit from the expertise of seasoned traders without requiring extensive market knowledge or analysis.

- Copy trading levels the playing field for retail investors in the financial markets.

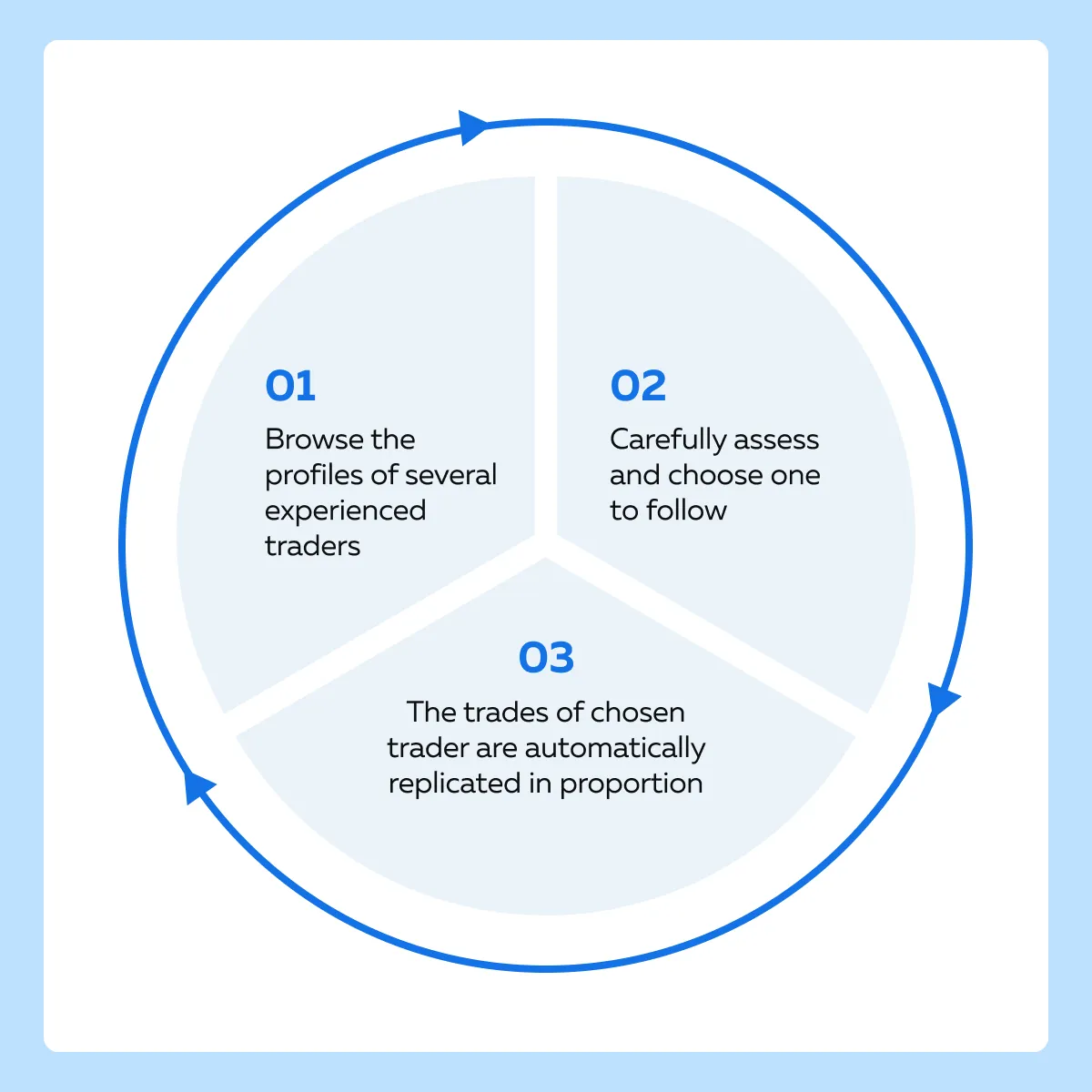

How does it happen?

- Copy trading platforms provide investors with access to a diverse pool of experienced traders.

- Investors can browse through the profiles of potential leaders and their:

- Performance metrics,

- Risk profiles, and

- Trading histories.

- Once an investor selects a leader to follow, their trades are automatically replicated in the investor’s account in real-time.

- This replication happens in proportion to their allocated funds.

Some Successful Copy Trading Strategies

| What’s your intention? | How to do copy trading? |

| Long-Term Investment |

|

| Day Trading |

|

| Diversified Portfolios |

|

| Risk Management |

|

Social Sentiment Analysis Tools

Social sentiment analysis tools utilize advanced algorithms to scour:

- Social media feeds,

- News articles,

- Forums, and

- Other online sources.

They specifically look for mentions, discussions, and sentiments related to specific assets or markets. By aggregating and analyzing this data, sentiment analysis tools provide traders with valuable insights into:

- Market sentiment,

- Investor sentiment, and

- Emerging trends.

Why Should You Use Social Sentiment Analysis Tools?

- Identifying Emerging Trends

- Social sentiment analysis tools help traders identify emerging trends by detecting patterns in online discussions and sentiments.

- Detecting Market Sentiment Shifts

- These tools monitor changes in sentiment across various online platforms.

- Traders using social sentiment analysis tools can:

- Detect shifts in market sentiment and

- Adjust their trading strategies accordingly.

- Predicting Price Movements

- Analysis of social sentiment data provides early indications of potential price movements.

- By acting on these indications, traders can anticipate market trends.

Some Case Studies

Let’s understand the practical application of social sentiment analysis tools better through case studies:

| Cryptocurrency Surge | Earnings Announcement Impact | Product Launch Excitement | |

| How did social sentiment analysis tools help? |

|

|

|

| What did traders observe? |

|

|

|

| What trading action was taken? |

|

|

|

Building a Social Trading Network

Building a robust social trading network is essential for traders as it helps in:

- Sharing ideas,

- Gaining insights, and

- Collaborating with like-minded individuals.

Let’s see how you can build your social trading network:

- Connect with Like-Minded Traders

-

-

- Follow relevant hashtags, join trading groups, and participate in discussions on platforms like Twitter, LinkedIn, and Facebook.

- Network with fellow traders at industry events, conferences, and workshops.

- Participate in active trading communities such as:

- Reddit’s r/DayTrading and

- StockTwits

- Use platforms like eToro, ZuluTrade, and Bookmap’s Discord community to connect with traders from around the world.

-

- Establish Trust and Credibility

-

-

- Share your trading experiences, successes, and failures openly to build trust with other traders.

- Share market analyses trade ideas, and educational resources to demonstrate your expertise.

- Regularly participate in discussions and assist other traders.

- Follow through on promises and maintain professionalism in your interactions.

-

- Cultivating Meaningful Relationships

-

- Take the initiative to reach out to other traders.

- Seek guidance from experienced traders.

- Offer mentorship to those who are less experienced.

- Arrange virtual or in-person meetups to:

- Discuss trading strategies and

- Review trade journals.

- Engage in trading competitions like Bookmap’s Blue Jacket competition.

The Bookmap Discord Community

Join like-minded traders in Bookmap’s Discord community to collaborate on trading opportunities across various asset classes, including:

- Equities,

- Cryptocurrencies, and

- FOREX.

Also, you can engage in the Blue Jacket competition, a trade journaling community, and participate in multi-language rooms for diverse perspectives and networking opportunities. Access it now – Bookmap’s Discord Community.

Risks & Considerations in Social Trading

While social trading offers numerous benefits, it also presents some inherent risks. Let’s see some common ones:

- Blindly Following Popular Leaders

-

-

- Relying solely on the trading decisions of popular leaders, without understanding their strategies or risk profiles, can lead to significant losses if their trades turn sour.

-

- Succumbing to Herd Mentality

-

- Following the crowd without conducting independent analysis can result in entering or exiting trades at inopportune times.

- Herd mentality leads to impulsive decision-making rather than rational decision-making.

- Falling Victim to Fraudulent Schemes

- A few traders follow unverified or fraudulent traders.

- They participate in Ponzi schemes disguised as social trading platforms.

How to Maintain Due Diligence and Do Risk Management?

- Conduct thorough research

-

-

- Before following a leader or copying trades, perform due diligence on their:

- Track record,

- Trading style,

- Risk management practices, and

- Reputation within the community.

- Before following a leader or copying trades, perform due diligence on their:

-

- Diversify your portfolio

-

-

- Avoid over-reliance on a single leader or trading strategy.

- Diversify your portfolio across:

- Multiple leaders,

- Asset classes, and

- Risk profiles.

-

- Set risk limits and use stop-loss orders

-

-

- Implement risk management strategies such as:

- Setting maximum loss thresholds and

- Utilizing stop-loss orders.

- These strategies will help you limit potential losses and protect capital.

- Implement risk management strategies such as:

-

- Exercise critical thinking

-

- Evaluate trading signals and recommendations critically.

- Consider their rationale and alignment with your investment objectives and risk tolerance.

Some Real-World Examples

Example 1

A trader blindly follows a popular leader on a social trading platform without conducting proper due diligence. The leader’s reckless trading results in significant losses for the follower.

Example 2

A group of traders succumb to herd mentality during a market frenzy. They blindly enter trades based on social media hype without conducting independent analysis. As the market sentiment shifts, they incur substantial losses.

Example 3

Traders fall victim to a fraudulent social trading platform promising guaranteed returns and high profits. After depositing funds, they discover that the platform is a Ponzi scheme, resulting in the loss of their investments.

The Future of Social Trading and Investing

In 2023, the global social trading platform market reached around $12.9 billion, growing at a CAGR of 64.7%. Copy trading, a type of social trading:

- Generated market revenue of $283.8 million in 2021 and

- Is expected to reach around $11.8 billion in 2028.

These forecasts show that social trading and investing are continuously evolving alongside the development of new technologies, such as:

- Artificial intelligence (AI),

- Machine learning algorithms,

- Blockchain technology, and

- Decentralized finance (DeFi).

Let’s understand them in detail.

The Influence of Artificial Intelligence (AI) and Machine Learning

- AI and machine learning algorithms are increasingly being employed to analyze vast amounts of social data, including:

- Sentiment analysis,

- News articles, and

- Online discussions.

- A careful analysis of this collected data helps to predict market trends and identify trading opportunities.

- Also, these algorithms uncover patterns and correlations in data that human traders usually overlook.

- As AI technology advances, we can expect to see further integration of machine learning algorithms into social trading platforms for more accurate predictions of market behaviour.

How Blockchain and DeFi are Shaping Social Trading Platforms?

| Integration of Blockchain Technology | Decentralized Finance (DeFi) Integration |

|

|

The Continuous Enhancement of Social Networking Features

Social trading platforms will continue to evolve as vibrant communities where traders connect, share ideas, and collaborate on trading strategies. Let’s see some prominent enhancements:

How Can You Adapt?

- Embrace Technology

-

-

- You should embrace technological advancements such as:

- Artificial Intelligence (AI),

- Machine learning,

- Blockchain, and

- Decentralized Finance (DeFi).

- Early adoption would help you optimize your trading strategies and gain a competitive edge.

- You should embrace technological advancements such as:

-

- Continuous Learning

-

-

- Stay informed about:

- Emerging trends,

- Technologies, and

- Market developments.

- Keep learning through education, research, and networking.

- Stay informed about:

-

- Regularly Visit Popular Websites and Publications

-

- To stay informed, you must visit some popular websites and publications such as:

- MarketWatch,

- Investing.com,

- Bookmap,

- Seeking Alpha,

- The Motley Fool, and

- Wall Street Journal.

- To stay informed, you must visit some popular websites and publications such as:

Conclusion

Social trading and investing offer opportunities for traders to collaborate, learn, and profit from the collective wisdom of the crowd. Owing to their increasing popularity, social trading platforms have evolved from traditional forums to sophisticated online ecosystems.

Thanks to the modern introduction of social trading platforms, traders can replicate the trades of experienced investors through copy trading and better understand market sentiment by using sentiment analysis tools. However, it’s crucial to exercise caution and conduct due diligence when participating in social trading. Blindly following popular leaders or succumbing to herd mentality can lead to significant losses.

Therefore, it’s essential to verify traders’ credibility, diversify portfolios, and implement risk management strategies. While emerging trends like AI, blockchain, and DeFi promise exciting opportunities for the future of social trading, maintaining a disciplined approach to decision-making is paramount.

Ready to harness the wisdom of the crowd in your trading? Explore more insights on social trading with Bookmap! Click here to read more.