Ready to see the market clearly?

Sign up now and make smarter trades today

Stocks

December 29, 2024

SHARE

Stock Splits Explained: How They Can Boost Opportunities for Retail Investors

Do you know why some of the biggest companies on Wall Street “cut their stocks in half”?

Stock splits are like a corporate magic trick. They make shares look cheaper without actually changing the value of the company.

But what’s the real story behind this common strategy? Why do companies like Apple, Tesla, and NVIDIA choose to split their stock?

In this article, we’ll explore the purpose of stock splits and explain how they impact the market and investors. We’ll cover why companies use splits to:

- Enhance affordability,

- Increase trading volume,

and

- Boost appeal among retail investors.

You’ll also learn about the potential risks involved, like short-term volatility, and why it’s crucial to look beyond the split itself to assess a company’s true value. With real examples from major players like Apple, Tesla, and Alphabet, we’ll show how stock splits play out.

Also, we will learn how our advanced market analysis tool, Bookmap, can help you track market trends in real time. Let’s begin.

What is a Stock Split?

A stock split is a corporate action wherein a company divides its existing shares into multiple shares to increase the stock’s liquidity. Due to this split, the value of the company does not change, but the price per share is adjusted proportionally. This makes it more affordable and accessible to investors.

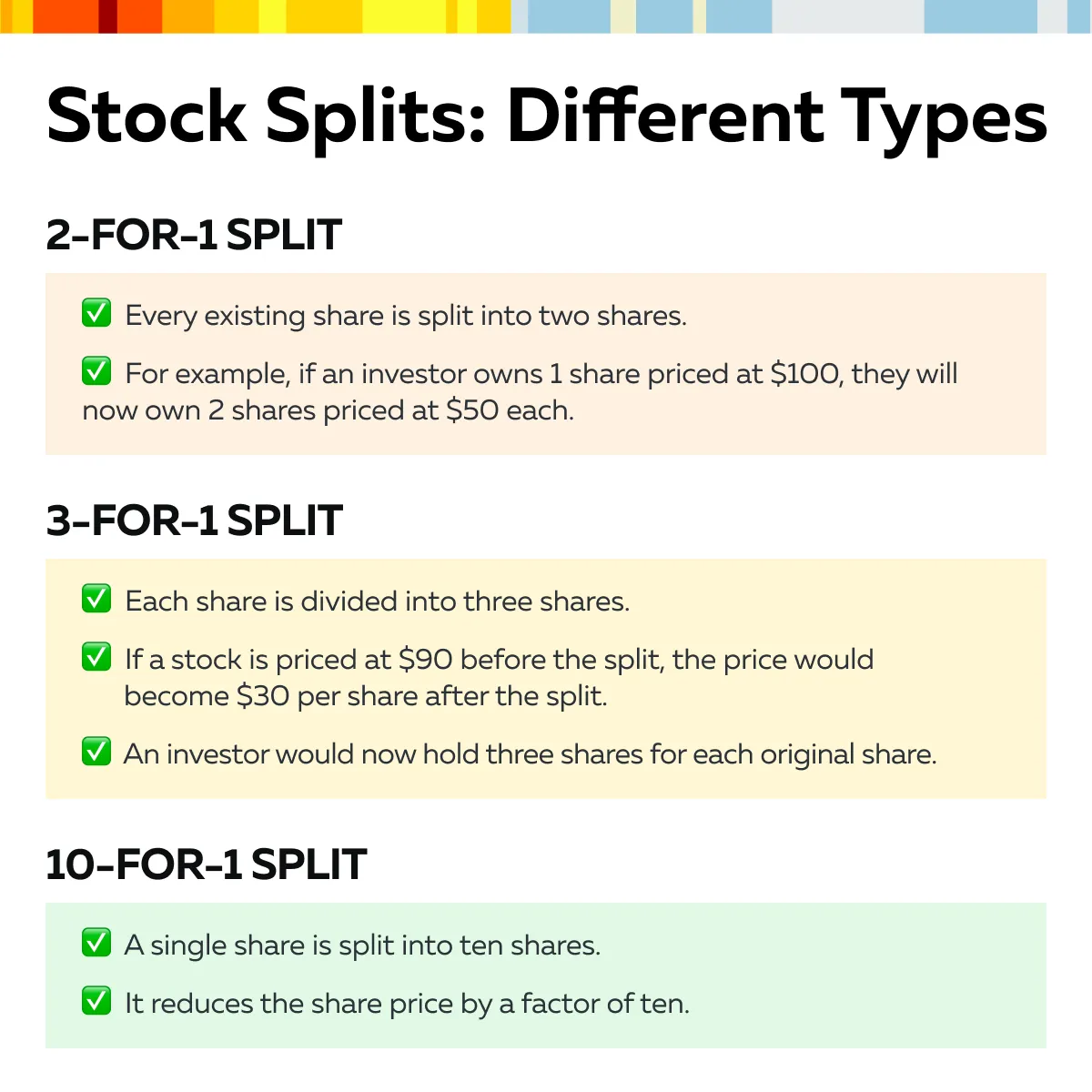

Now, it is worth mentioning that despite the increase in the number of shares, the company’s market capitalization remains unchanged. This happens because the share price decreases in proportion to the number of additional shares issued. To understand the stock split calculation better, let’s consider an example related to a 2-for-1 stock split:

- Let’s assume a company’s stock price is $100.

- A 2-for-1 split is initiated.

- Now, each share is split into two.

- This split makes the new share price $50.

- Assume that an investor held 10 shares before the split.

- The shares were valued at $100 each (total value = $1,000).

- After the split, they would own 20 shares priced at $50 each after the split (still a total value of $1,000).

- Due to the split, the total number of shares increases.

- Also, the shares become more affordable.

- However, the overall value of the investor’s holdings remains the same.

Why Companies Like Apple and Tesla Choose Stock Splits?

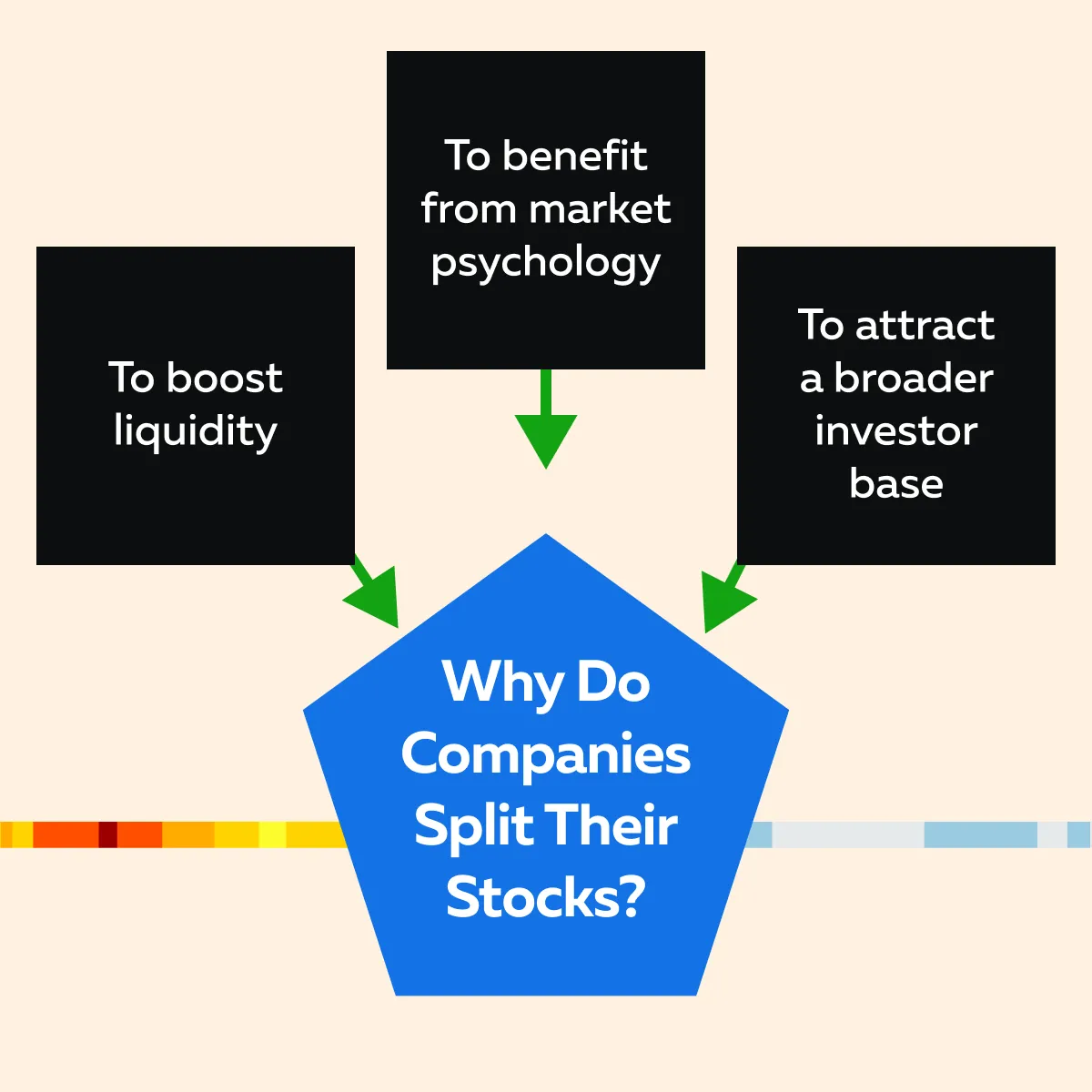

Be aware that stock splits have become a strategic tool for major companies like Apple and Tesla. Such companies do stock splits for various reasons. Check the graphic below:

Let’s explore these key reasons in more detail:

Reason I: Enhanced Accessibility

One of the primary motivations for a stock split is to make shares more affordable and accessible to a larger pool of retail investors. When share prices become very high, smaller investors find it difficult to buy even a single share. This situation limits the stock to a subset of wealthier or institutional investors.

For example:

- Tesla’s 5-for-1 stock split in 2020 lowered its share price from over $1,300 to approximately $400.

- This made Tesla stock more accessible to retail investors who previously couldn’t afford to buy in.

- As a result, more individual investors were able to participate.

- In this way, this split increased the company’s reach and appeal in the market.

- For companies with high brand loyalty, like Tesla, this affordability also creates a larger base of shareholders who are passionate about the company.

Reason II: Boosting Liquidity

A stock split also boosts liquidity by lowering the price per share, which often increases trading volume. When shares are priced lower, they generally become easier to buy and sell. Now, more investors can afford to trade them. Please note that higher liquidity is beneficial because it allows both retail and institutional investors to move in and out of positions with greater ease.

Increased liquidity also helps to stabilize the stock. It reduces the bid-ask spread (the difference between the buying and selling prices), which often makes it less volatile. This stability is particularly appealing to:

- High-volume traders,

and

- Institutional investors.

Thus, by creating a more liquid environment, companies make their stock more attractive to a wide range of investors. Stay in sync with market sentiment following a stock split. Sign up for Bookmap to monitor order flow, liquidity, and market momentum in real time.

Reason III: Market Psychology and Retail Investor Appeal

Stock splits often allow companies to benefit from market psychology. They create a perception of “discounted” shares, even though the actual value of the stock remains unchanged. For many retail investors, a lower share price feels like a bargain. This leads to increased demand and trading activity post-split. It is worth mentioning that the split itself can generate:

- Excitement,

and

- Sense of accessibility.

This makes it more appealing for investors who might otherwise feel intimidated by high share prices. Additionally, because of the hype and perceived affordability, a stock split increases the stock price in the short term due to increased buying activity. This creates a positive feedback loop that benefits both the company and its shareholders.

How Stock Splits Impact Retail Investors

Stock splits significantly lower the price of individual shares. This fall in value makes them more accessible to a wider range of investors (especially those with limited capital). Retail investors who may have struggled to afford a high-priced stock can now purchase full shares more easily. Let’s understand this better through the following example:

- Say a company has a share price of $1,000.

- Before a stock split, an investor would need a substantial amount of money to buy even one share.

- Now, assume that the company enacts a 5-for-1 stock split.

- This causes the share price to drop to $200.

- Consequently, due to increased affordability, more investors begin to participate.

Besides lowering the share value, stock splits also impact retail investors in these two ways:

- A) Opportunity for Portfolio Diversification

Stock splits allow retail investors to diversify their portfolios. When share prices are reduced, it becomes easier to allocate funds across different high-quality stocks. Rather than investing a large amount of money in a single expensive share, investors can now spread their capital across multiple stocks. This reduces the overall risk. Also, such diversification mitigates losses, as poor performance in one stock may be offset by gains in others. We can understand this better through the given example:

- Say before a split, an investor’s budget only allowed the purchase of one expensive tech stock.

- They might have missed out on investing in other sectors.

- Post-split, the investor can buy a mix of shares from various industries.

- This enhances the return on their investment portfolio.

- B) Potential for Higher Returns

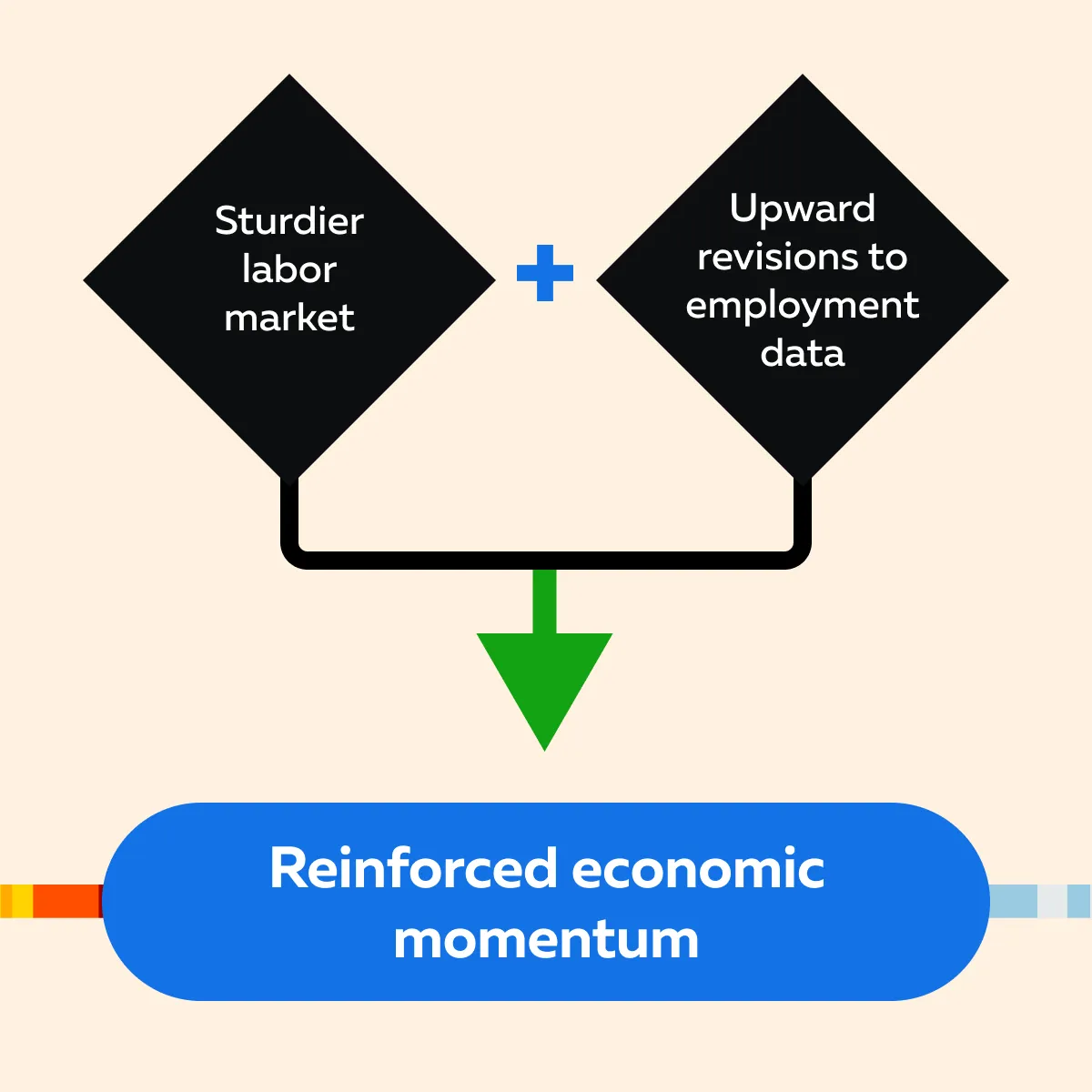

Studies have shown that stocks mostly experience positive performance in the period following a split. This generally happens due to:

- Increased trading volume

and

- Broader investor participation.

Be aware that the higher liquidity (resulting from a lower share price) attracts more buyers. This situation supports or even elevates the stock price. Check the graphic below:

However, at the same time, it is important to recognize that these returns are not guaranteed. A stock split itself does not change the fundamentals or market value of a company. The motivation for a split often comes after a period of strong performance. This reflects confidence in the company’s growth.

Yet, a split should not be viewed as a predictor of future success. Before making investment decisions, retail investors must evaluate a company’s:

- Overall financial health,

- Business prospects,

and

- Market conditions.

Recent Examples: High-Profile Stock Splits and Market Impact

Let’s explore some notable recent examples to understand how stock splits have impacted the market and investor behavior:

Example I: Apple Inc. (AAPL) – 4-for-1 Stock Split (August 2020)

In August 2020, Apple executed a 4-for-1 stock split. This lowered the price of each share and made it more accessible. Before the split, Apple’s stock price had risen significantly. The company sought to ensure that individual investors, especially those with smaller investment budgets, could continue buying its shares.

| Pre-Split Momentum | Post-Split Impact |

and

|

|

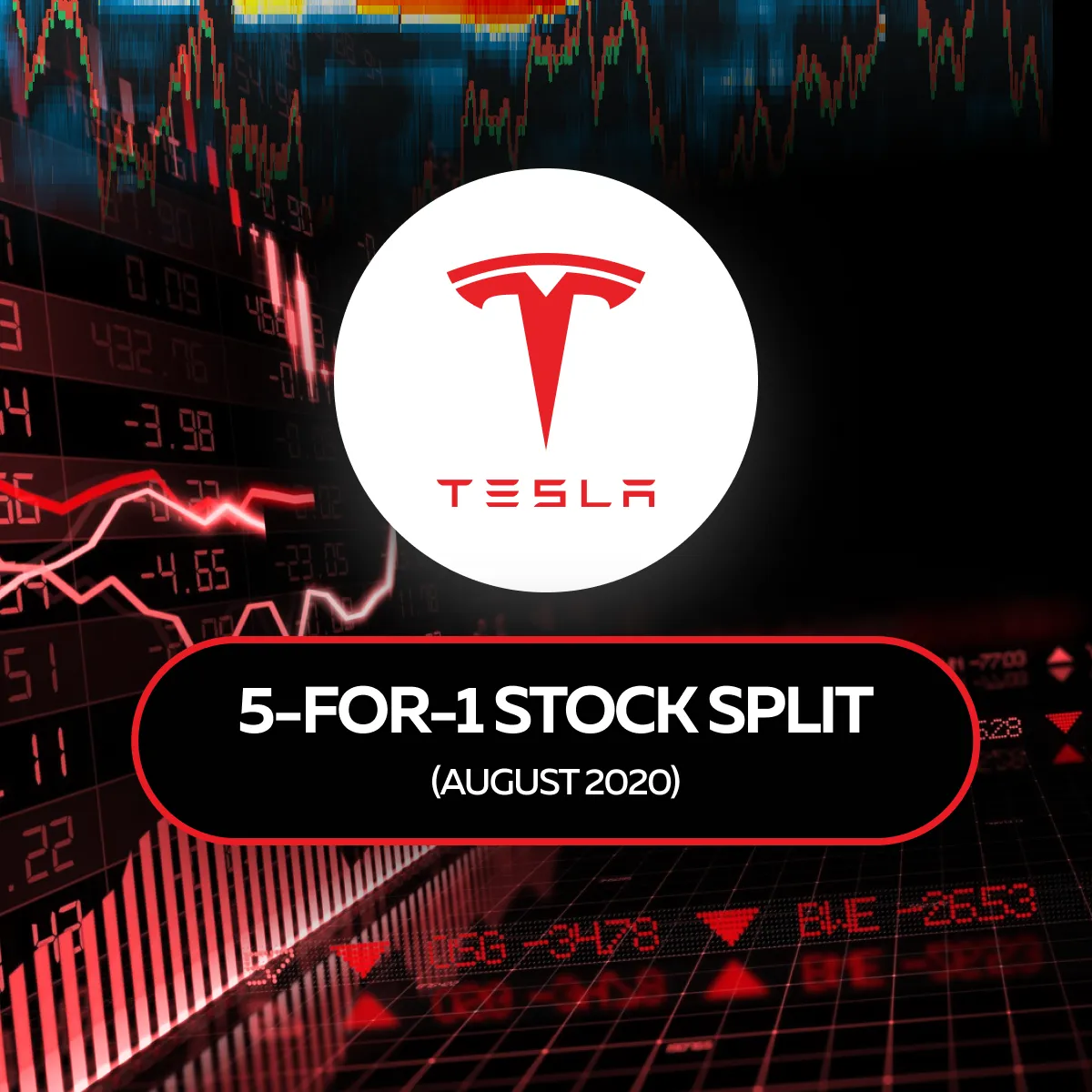

Example II: Tesla Inc. (TSLA) – 5-for-1 Stock Split (August 2020)

Tesla executed a 5-for-1 stock split in August 2020. Tesla’s shares had become prohibitively expensive for many small investors. This split aimed to address this problem by significantly reducing the price per share.

| Pre-Split Surge | Increased Volatility and Trading Volume |

|

|

Example III: NVIDIA Corp. (NVDA) – 4-for-1 Stock Split (July 2021)

NVIDIA announced a 4-for-1 stock split in July 202i. This announcement came at a time when the company had benefited from a tech stock boom. It was mostly due to the strong demand for its GPU technology.

| Market Enthusiasm | Post-Split Participation |

|

|

Example IV: Alphabet Inc. (GOOGL) – 20-for-1 Stock Split (July 2022)

Alphabet (the parent company of Google) conducted a substantial 20-for-1 stock split in July 2022. Given Alphabet’s position as one of the most influential companies in the tech sector, the move had significant market implications.

| Accessibility for Retail Investors | Sector-Wide Attention |

|

and

|

Having read these examples, you must have understood how big companies use stock splits to attract retail investors and boost liquidity. When a stock split happens, it often leads to a spike in both price and trading volume. So, this happens because everyone, especially retail traders and smaller institutional investors, gets excited about the increased accessibility.

Track retail and institutional interest after stock splits. Bookmap’s heatmap and order flow tools offer a unique perspective on SPY, AAPL, and other popular stocks.

Why Stock Splits Matter in Today’s Market?

Stock splits hold significant relevance in today’s market. Let’s check out some major reasons:

- A) Accessibility in the Age of “Fee-Free Trading”

Several platforms like Robinhood, ETRADE, and others have eliminated transaction fees. This makes it easier for retail investors to buy and sell stocks without worrying about high costs. Now, stock splits further enhance this ease of access by reducing the price per share.

For example, when a company with a high stock price undergoes a split, retail investors can purchase shares without needing to pay a premium for high-cost stocks. This increased affordability encourages more retail participation. Investors can now buy shares in companies that were previously pretty expensive!

- B) Appeal to Younger Generations

One of the most notable groups benefiting from stock splits is younger investors (particularly Gen Z and Millennials). In the past, stocks like Amazon, Tesla, and Apple were beyond the reach of younger investors. That’s because they didn’t have significant capital to invest. By reducing the price per share, stock splits make investing in well-known companies more attainable.

Let’s understand this through the given scenario:

- Suppose a company has a share price of $1,000.

- A 4-for-1 stock split drops the price to $250.

- This makes it easier for younger investors to:

- Buy multiple shares

and

- Now, these investors are more likely to engage with the stock market.

- Also, they get more inclined to invest in companies that resonate with their interests, such as tech giants or environmentally conscious firms.

- C) Social Media Amplifies Stock Split Hype

Social media platforms, particularly those like Reddit, Twitter, and Discord, amplify the excitement around stock splits. Trading communities, especially those within subreddits like r/WallStreetBets, frequently discuss stock splits. In this way, these platforms create a buzz and lead to collective attention from retail traders. When a company announces a stock split, the news spreads rapidly across these communities.

Investors often speculate that the lower price will lead to a rise in share price. This creates a sense of urgency to buy before the split takes place. The viral nature of social media makes stock splits highly visible events. The excitement around them:

- Push-up trading volumes

and

- Influence short-term price movements.

Take advantage of price shifts during and after stock splits. Bookmap’s liquidity analysis tools can help you spot key trading opportunities.

Potential Risks of Stock Splits for Retail Investors

While stock splits offer several benefits, retail investors should also be aware of the risks associated with them. These risks primarily stem from the psychological effects of stock splits. Some investors face losses when they overestimate the impact of the split. Also, stock splits sometimes increase volatility, which also causes risks for investors. Let’s understand some potential risks of stock splits in detail:

Risk I: Overestimating the Impact of a Stock Split

One of the biggest risks for retail investors is overestimating the impact of a stock split. While a split reduces the price per share, it does not add any value to the company. The total market capitalization remains the same. Check the graphic below to see what gets impacted due to stock splits:

Some investors may mistakenly believe that a stock split is a signal of future growth or increased profitability. However, in reality, it is a simple process that makes shares more affordable. A split does not change the company’s fundamentals, nor does it automatically lead to higher stock prices in the long term.

Retail investors who buy shares based on the misconception that a split will lead to substantial gains may be disappointed if the stock’s performance does not meet their expectations.

Risk II: Increased Short-Term Volatility

Stock splits often lead to increased short-term volatility. When the price of a stock is lowered, it attracts more retail investors, particularly those who want to take advantage of the perceived “discount.” While increased retail participation can boost liquidity, it can also result in speculative activity.

As more retail traders rush to buy in, the stock experiences sharper price fluctuations. This increases the risk for investors who are not prepared for short-term volatility.

Risk III: Speculative Activity Occurs Post-Split

Speculative buying happens due to hype or the belief that the stock will rise after the split. This leads to overvaluation or price bubbles. Now, the stock price can fall quickly if:

- These retail investors decide to sell off their shares

or

- The company’s fundamentals don’t support the high price levels.

Such an event causes losses for those who buy in during the post-split excitement.

Is a Stock Split a Good Investment Signal?

Please note that a stock split alone is not a reliable indicator of a company’s growth potential. While stock splits can make shares more accessible and generate short-term market excitement, the true value of an investment lies in the company’s underlying fundamentals. Check the graphic below:

Therefore, you must assess the fundamentals, not just the split! Before deciding to invest in a company that has undergone a stock split, you must evaluate its core financials, such as:

- Earnings,

- Revenue growth,

- Debt levels,

- Profit margins, and

- Market share.

Be aware that a stock split does not alter a company’s fundamentals. Hence, it is crucial not to confuse the move with a sign of future success or guaranteed growth. Here’s an example:

- Apple’s 4-for-1 stock split in 2020 was preceded by solid fundamentals.

- The company had experienced strong growth.

- This growth was mainly due to its:

- Product innovations,

- Market dominance, and

- Robust earnings.

- The split was a way to accommodate growing retail interest.

- It made the stock more accessible to smaller investors.

- In this case, Apple’s solid performance and market position were the key drivers of demand, not the split itself.

How Can You Gain Deeper Insights into Market Sentiment?

Stock splits affect investor behavior. By tracking liquidity and order flow, you can gain valuable insights. Our advanced market analysis tool, Bookmap, allows investors to monitor real-time market data. This way, you can easily spot the liquidity changes and order flow movements around a stock split. You can also see how institutional and retail investors are reacting to the split and can even observe patterns such as:

- Increased buying activity

or

- Changes in market sentiment.

For example, on Bookmap you observed a high level of institutional buying in response to a split. This event signals confidence in the company’s long-term prospects. In comparison, if you see speculative buying on Bookmap, it indicates short-term volatility.

Conclusion

Stock splits offer several advantages for retail investors. They make shares more affordable. After the split, investors can buy shares of popular companies that might otherwise be out of reach. In this way, by reducing the price per share, stock splits allow more people to invest. This often leads to higher trading volume and provides liquidity that makes buying and selling easier for everyone.

However, investors must remember that a stock split doesn’t change the company’s value or guarantee growth. The decision to invest should be based on a careful review of the company’s underlying fundamentals (its financial health, growth prospects, and market position) and not just the lower share price.

To optimize trading decisions, investors can also consider using our real-time trading tool, Bookmap. It allows you to monitor liquidity and understand how the market responds to these changes. With the right insights and a focus on long-term fundamentals, you can make more balanced decisions in the wake of stock splits. Want real-time insights on stock splits and their market impacts? Use Bookmap’s advanced trading tools to stay ahead of price changes.