Ready to see the market clearly?

Sign up now and make smarter trades today

Education

July 8, 2025

SHARE

Stop Hunt or Just Noise? How to Read the Real Intent Behind a Move

In trading, if it looks too clean to be real, it’s probably bait! Many traders fall victim to stop hunts, liquidity traps, and deceptive breakouts.

This article will tell you how to avoid getting trapped. We will study the tricky side of the market where big players use your stop-loss as their entry ticket. You’ll learn what a stop run is, how it appears on order flow, and where it usually happens.

Through simple explanations and real market behavior, we’ll show you how to read absorption, spot fakeouts, and trade the aftermath like a pro. Read this article till the end to not only protect your trades but also turn traps into opportunities!

What Is a Stop Hunt—and What Really Matters

A stop hunt is a special market event. In this situation, the market suddenly moves toward a price level where lots of traders have their stop-loss orders sitting. These levels are usually easy to spot as they revolve around:

- Yesterday’s high or low,

- Round numbers (like 5000.00), and

- The extremes of premarket price movement.

Please note that when these stops get triggered, they act like market orders! What does that mean? They create a burst of liquidity, which big players (like institutions or market makers) use to enter or exit large trades.

Some people call this a “liquidity grab.” However, this term is misleading because it’s not really about taking resting limit orders. Instead, it’s more about:

- Triggering stop orders

and

- Using that liquidity to transact.

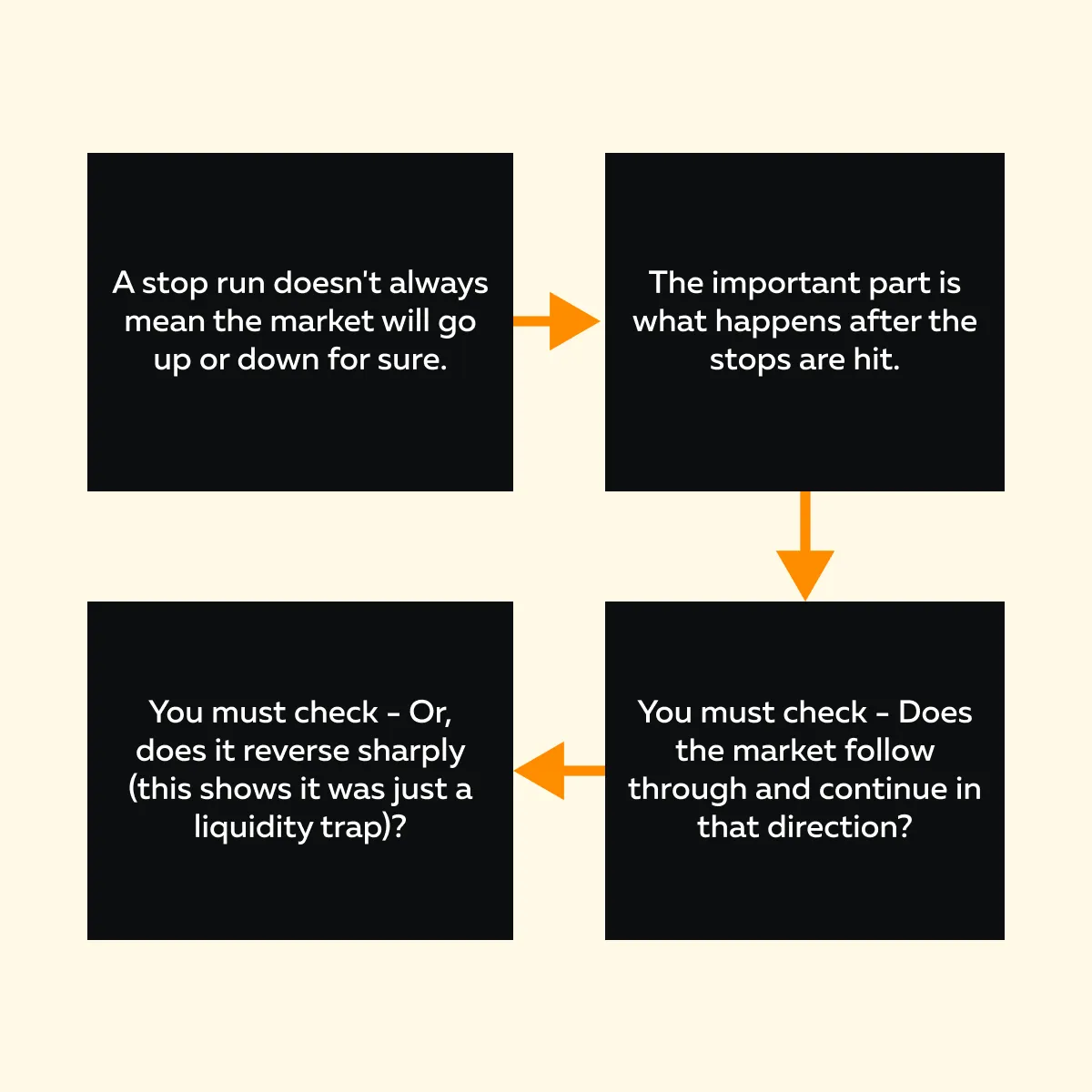

Check out the graphic below to understand what matters:

Example of Stop Run Trading:

- Let’s say the ES futures slowly move down toward yesterday’s low.

- Suddenly, there’s a sharp drop below that level with a burst of volume.

- That’s the stop hunt in action.

- But immediately after, the price shoots back up.

- This indicates that no real sellers were waiting (only stop orders were triggered).

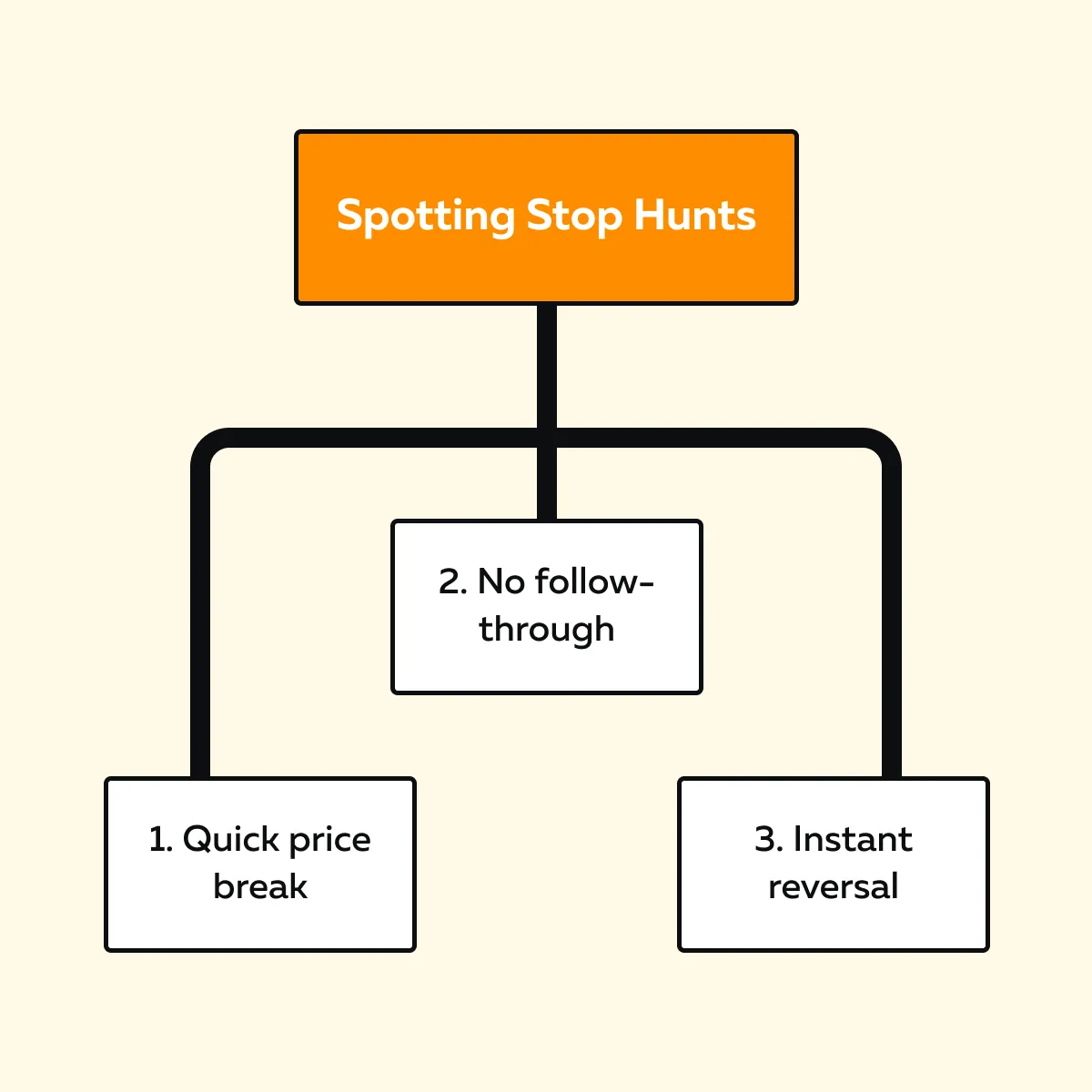

Want to spot stop hunts? You will notice the following:

When you see these signals, realize it’s not a real breakdown. It’s more like a liquidity trap! By understanding how to read these patterns, you can avoid panic exits.

How Stop Runs Appear in Order Flow

At first glance, a stop hunt looks just like a real breakout!

- Price pushes past a key level (say, a previous high)

and

- Traders believe it’s the start of a strong move.

However, be cautious of misleading signals. What really separates a stop run from a genuine breakout depends on what happens after the level breaks. Let’s understand this concept in detail:

1. Aggressive Volume with No Follow-Through

When a stop hunt is happening, you’ll often see a sudden burst of aggressive volume. This means a lot of market orders are hitting the tape. They are pushing the price through a known level (like a swing high).

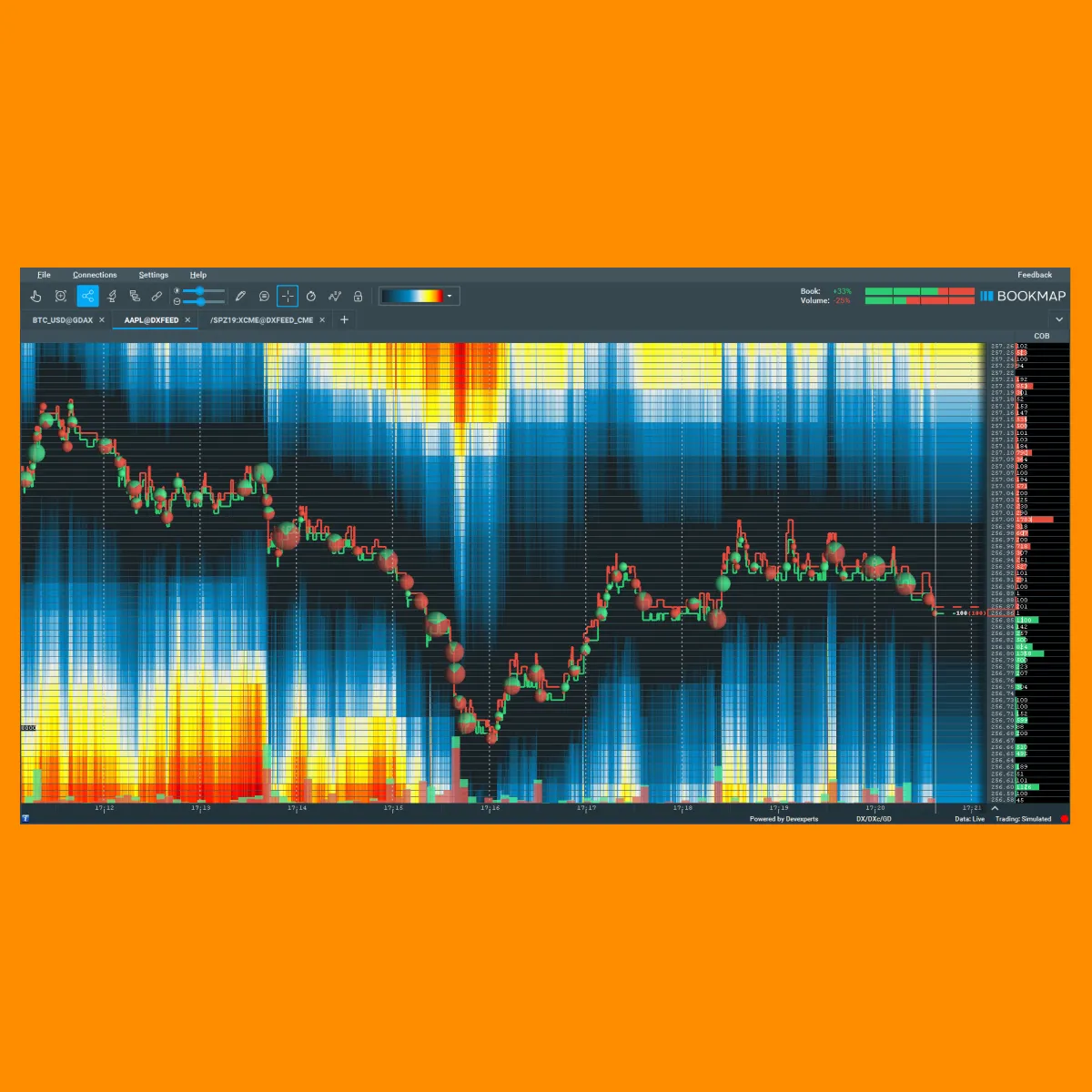

How to spot this? You can visualize these activities on our advanced real-time market analysis tool, Bookmap. On Bookmap, this is visible as clusters of large volume dots.

However, the key insight is:

After the spike:

-

- The price doesn’t continue moving higher.

- It either stalls or reverses quickly.

- You won’t see new bids or offers stepping in to support the new level.

- Strong buyers (or sellers) don’t show any interest in holding that new price range.

- Also, liquidity doesn’t shift to let prices move freely.

- This is a significant clue!

Now, What Does This Mean?

The move was most likely not driven by real buying or selling interest. Instead, it was just stop orders being triggered. Big traders may even be absorbing that flow and are waiting to take the other side for a reversal.

How to Spot Stop Hunts in Bookmap?

-

- Let’s say the price breaks above a swing high.

- On Bookmap, you’ll see green dots (buy market orders) lighting up the chart.

- But right after that, no strong bids appear below to hold the price.

- Then the price drops back below the breakout level (very quickly).

- Note that it is not a real breakout.

- It is likely a liquidity trap.

By using Bookmap, you can understand these patterns and spot stop hunts. This helps you avoid getting caught in them!

See real-time stop runs as they happen—Bookmap’s volume dots and liquidity zones show you what DOM can’t.

2. Absorption After the Stop Run

Sometimes, after a stop run, the price doesn’t continue in the breakout direction. It just stalls! That’s often a sign of absorption.

Understanding Absorption

It means a big trader (or group of traders) is quietly taking the opposite side of all the stop orders getting triggered. While many retail traders are buying or selling because their stops are hit, a larger participant is absorbing that volume (without letting the price move much).

Now, How to Spot It

-

- On Bookmap, you’ll see a lot of volume dots at a certain level.

- But even with all that activity, the price doesn’t move much!

- That tells you someone is taking in all those orders (without pushing the price forward).

- Even though it might look like a breakout at first, there’s no new directional push (no momentum).

- This usually means the market has no real conviction.

- To make sense of it, always check the context.

- Ask yourself the following questions:

- Did the stop run happen right near VWAP (Volume Weighted Average Price)?

- Are we testing the RTH high or low?

- Are we sitting on a round number or an important support/resistance level?

- If these answers are a “yes,” then chances are the stop hunt was actually the end of the move and not the beginning.

Please note that this kind of price action is a hallmark of liquidity traps! The market lures traders into a breakout, only to reverse later.

Where Stop Hunts Typically Occur

Stop hunts aren’t random! Usually, they happen around predictable price levels. These are the places where most traders commonly place their stop-loss orders. Since stop placement follows patterns, big players know exactly where to find that liquidity when they need it!

Let’s look at the common hunting grounds where stop run trading usually shows up:

1. Previous Highs/ Lows and Round Numbers

These are classic stop hunt zones! Why? Because they’re easy for everyone to see. Traders often place their stops:

- Just above a previous high

or

- Just below a recent low

The same goes for round numbers like 4500.00 or 20000.00. These are clean psychological levels that many traders use.

But Here’s the Catch!

When you’re entering a trade near one of these obvious spots, always ask yourself: “If this is a strong breakout, why is someone selling here?”

Now, that’s your clue. If smart money is taking the other side, it may not be a breakout. Instead, it could be a liquidity trap.

2. Premarket Extremes or Opening Ranges

Before the regular trading hours, markets often have low liquidity. That makes it easier to:

- Push prices toward premarket highs or lows

and

- Trigger nearby stops

In the first 15 minutes after the market opens, you’ll often see fake breakouts past those early levels. What’s the key signal? A quick rejection after the break. That’s a strong sign of a stop hunt and is not a true move!

These false moves often catch emotional traders. However, if you know how to spot stop hunts, you can stay on the right side!

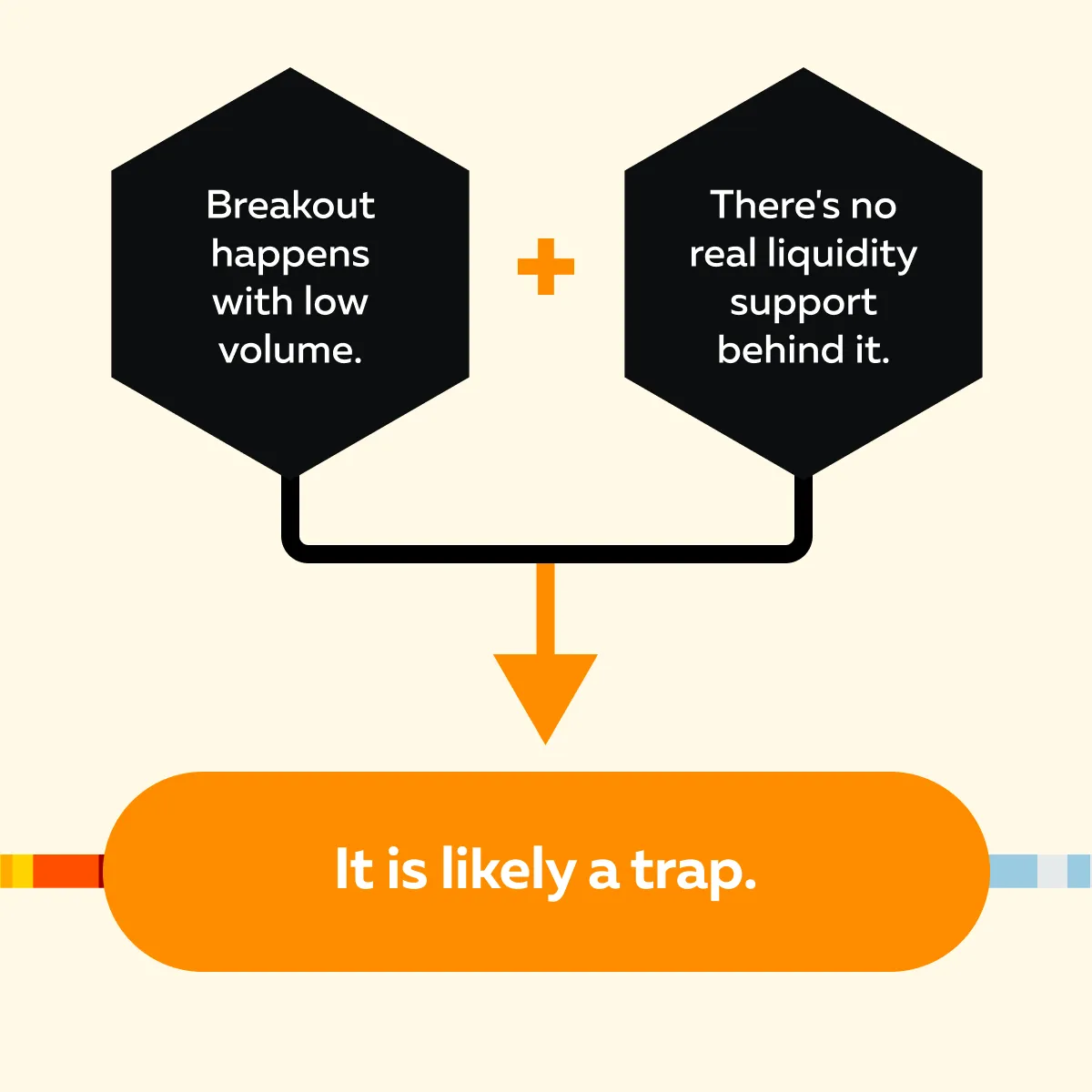

3. Low-Volume Breakouts

Not all breakouts are created equal. Refer to the graphic below to learn how to identify a trap.

As a trader, you must understand that real moves are backed by two things:

- Aggressive market orders (strong buying or selling),

and

- Passive liquidity (bids or offers that stay in place to support the move).

If you don’t see both, chances are it’s just a stop run and not a genuine breakout! Want to avoid getting hunted? Bookmap helps you spot aggressive volume, hidden size, and fake breakouts before it’s too late.

How to Avoid Getting Hunted

Getting caught in a stop hunt can be frustrating!

Want to avoid this trap? Follow these tips and protect yourself (even take advantage of stop run trading when it happens):

- A) Wait for Confirmation

- Don’t jump in just because you see a breakout candle.

- Be patient!

- Let the first move happen.

- Watch for follow-through volume (not just a spike).

- Also, look for stacking liquidity that supports the direction.

If the price pushes through a level but no new buyers or sellers appear, it might be a liquidity trap (not a real breakout).

- B) Use Wider Stops or Manual Entries

- Don’t place tight stops at obvious levels (like prior highs or round numbers).

- This makes you an easy target.

- Instead, place wider stops, or better yet, manage entries manually.

- Place stops in less predictable areas.

- This helps you avoid being swept out by a stop hunt.

- C) Recognize Bait Setups

- For example, if there is a sudden volume spike in an area with no prior activity (called an “air pocket”).

- Exercise caution under such conditions.

- This is often a classic setup for a stop run.

- In such a setup, the price is pushed quickly into low liquidity.

- The move is intended to trigger stops.

- Later, the price reverses.

How to Trade Around Stop Hunts Instead

So far, you have learned how to spot stop hunts. However, it is just the first step! As a smart trader, you must go a step further. This section outlines how to avoid getting hunted and how to trade around these setups:

I) Fade the Fakeout

- Let’s say the price breaks above a prior high.

- Then, it immediately starts showing absorption (lots of volume but no price follow-through).

- After this, it reverses.

This is your chance to fade the move! Ideally, you must take the opposite side of the trap.

II) Join the Unwind

- Once the stop run finishes, the price often snaps back to areas like VWAP or the point of control.

- That’s the market resetting after the trap.

- You can enter in the direction of the unwind and ride it back to balance.

III) Scale in After the Trap

- Instead of going all-in immediately:

- Start with a smaller position once you see signs of reversal,

and

- Add more as real momentum confirms the direction.

- This technique keeps your risk low.

- Also, it lets you build into a high-conviction setup.

IV) Mindset Tip: Be Reactive, Not Predictive

- Avoid speculative predictions where the trap will be!

- Let the stop hunt unfold.

- Then trade what you see and not what you think might happen.

- Be aware that the best setups come after the trap has sprung (not before).

By following these tips, you can easily put yourself in the position of smart money. Don’t be the easy prey!

Conclusion

Stop runs happen in every market. They’re normal. However, they only become liquidity traps when the market breaks a key level and then quickly reverses. This event shows there was no real follow-through. To spot such fake actions, you can start using our real-time market analysis tool, Bookmap. Through Bookmap, you can spot the difference between a real breakout and a stop hunt.

Additionally, always focus on what happens after the level breaks. Ask yourself whether someone is absorbing the move, whether liquidity is stacking up or disappearing, and whether there is a real commitment or just a quick flash of volume. Your goal should be to focus on market behavior—not just price. By doing so, you can avoid getting tricked by fake moves. Also, it teaches you how to fade the fakeouts! Stay one step ahead in stop run trading with Bookmap. Learn to trade around traps—not into them. Learn more in the Learning Center.

FAQ

1. What is a stop run in trading?

A stop run happens when the market pushes to a price level where many traders have placed stop-losses, mostly at:

- Near highs,

- Near lows, and

- Round numbers.

When those stops get triggered, they create quick bursts of buying or selling. Big traders often use this to enter or exit their own trades using that flow.

2. Is a stop run always a trap?

No, not always! A stop run only becomes a trap if the market breaks a level but then reverses quickly. In such a case, the market shows no real interest in continuing. Sometimes, though, the move keeps going, and that becomes the start of a trend.

As a trader, you must watch how the price behaves after the level breaks.

3. How do I recognize a trap after a stop run?

You’ll see that the market has broken a key level with a spike in volume. But then it doesn’t go any further. Instead, it stalls or reverses quickly.

Additionally, there is no new buying or selling interest to support the move. This usually means:

- Someone big is absorbing orders

and

- The breakout was likely a fakeout.

4. Can I profit from stop hunts?

Yes, but don’t try to guess when a stop hunt will happen. It is always better to wait until the stop run finishes. If the price reverses after hitting stops, you can enter in the opposite direction with more confidence.

Ideally, you must trade the reaction, not the initial spike! Why? This is because that’s where real setups often form.