Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 19, 2025

SHARE

Triple Witching: What It Means for Traders and How to Handle the Chaos

Triple witching is a unique market event. For most traders, it feels crazy! Price jumps, volume spikes, and weird moves occur that make zero sense.

Yes, it can be messy and noisy, but if you know what to look for, it can also be full of opportunities! The trick? Come in with a plan, do not force trades, and read the order flow. By using our avant-garde market analysis tool, Bookmap, you can gain valuable insights. You can see where liquidity is stacking, where it’s disappearing, and what the volume actually means.

So, if you want to survive and trade profitably on triple witching days, come prepared, stay disciplined, and only strike when your setup is clear. Want to gain more clarity? Read this article till the end.

What Exactly is Triple Witching?

Triple witching is a specific term used in the stock market. It refers to a unique and volatile event. This event occurs when three types of financial derivatives expire at the same time:

- Stock index futures,

- Stock index options,

and

- Single-stock options.

This event happens four times a year on the third Friday of March, June, September, and December. Usually, this simultaneous expiration creates a spike, particularly near the market’s opening and closing hours:

- Trading volume

and

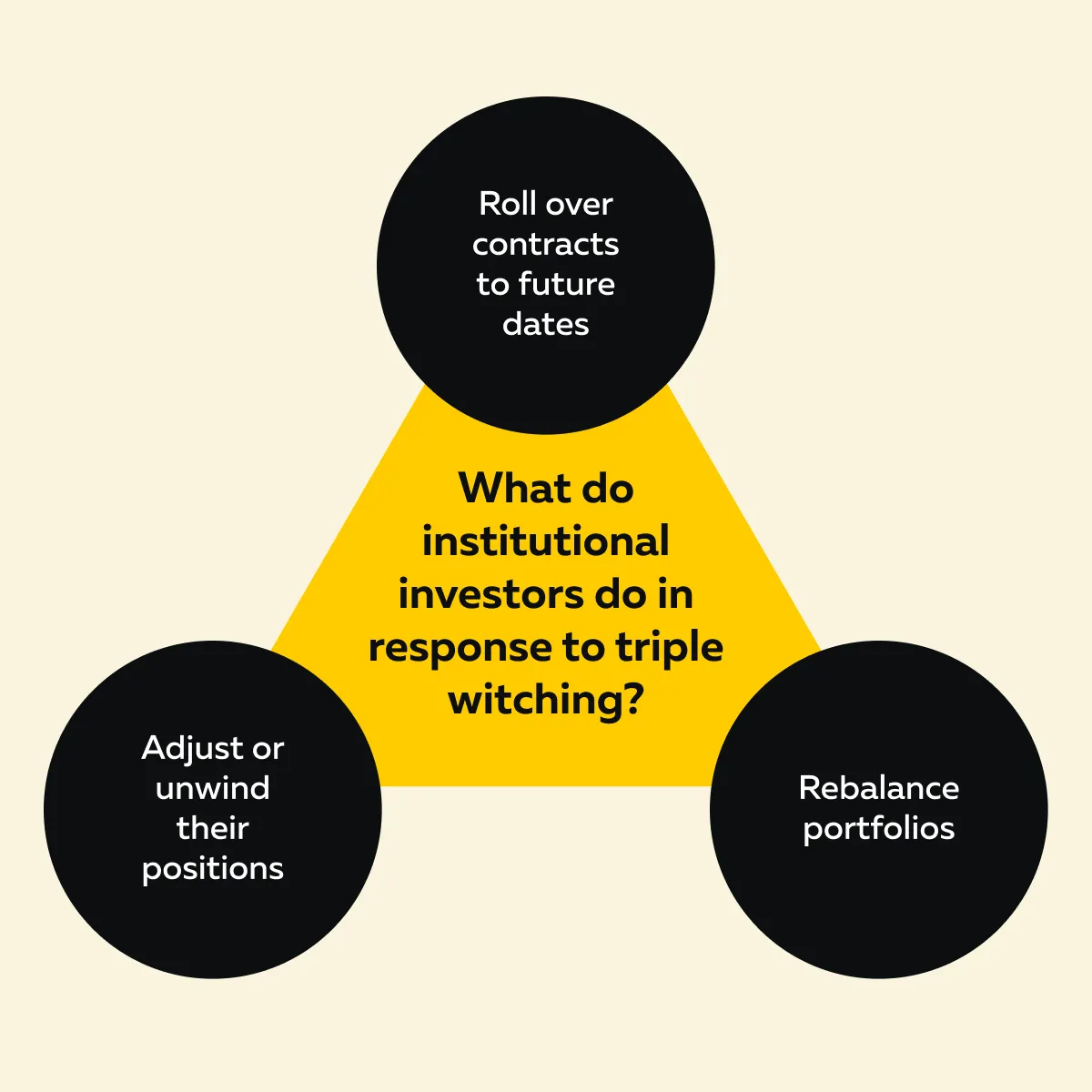

This happens because of large institutional investors. Check out the graphic below to learn what actions they perform in response to triple witching:

These actions lead to sharp price movements and make Fridays particularly active. These days, you can mostly see unusual trading patterns. Volatility is more visible in stocks and indices that are heavily traded through options and futures.

An Important Thing

- You might hear people refer to this event as “quadruple witching.”

- But that term is now somewhat outdated.

- It originally included single-stock futures, but those are rarely traded anymore.

- So today, “triple witching” is the more accurate phrase.

Why Triple Witching Days Matter for Traders

On the triple witching days, you will feel like a storm hitting the markets! That is because volume usually jumps, and prices fluctuate rapidly. Let us see why these days get so much attention:

Volume Surges

One of the most noticeable effects of triple witching trading is the sharp increase in trading volume. This happens because large institutions and hedge funds are forced to take action. They are either:

- Settle their expiring contracts

or

- Roll them over into future months.

Usually, it leads to three common actions:

| Action I | Action II | Action III |

| Closing out positions | Opening new ones | Making adjustments to maintain balance in their portfolios |

As a result, trading volume on these days often spikes by 50% to 100%. This surge particularly occurs in major indices like the S&P 500 or the Nasdaq.

Does triple witching affect only the big players? No! Retail traders can also experience its impact, especially if they are trading stocks or ETFs tied to these indices. By understanding what triple witching is and its effect on volume, you avoid getting caught off guard during these high-activity sessions.

Increased Intraday Volatility

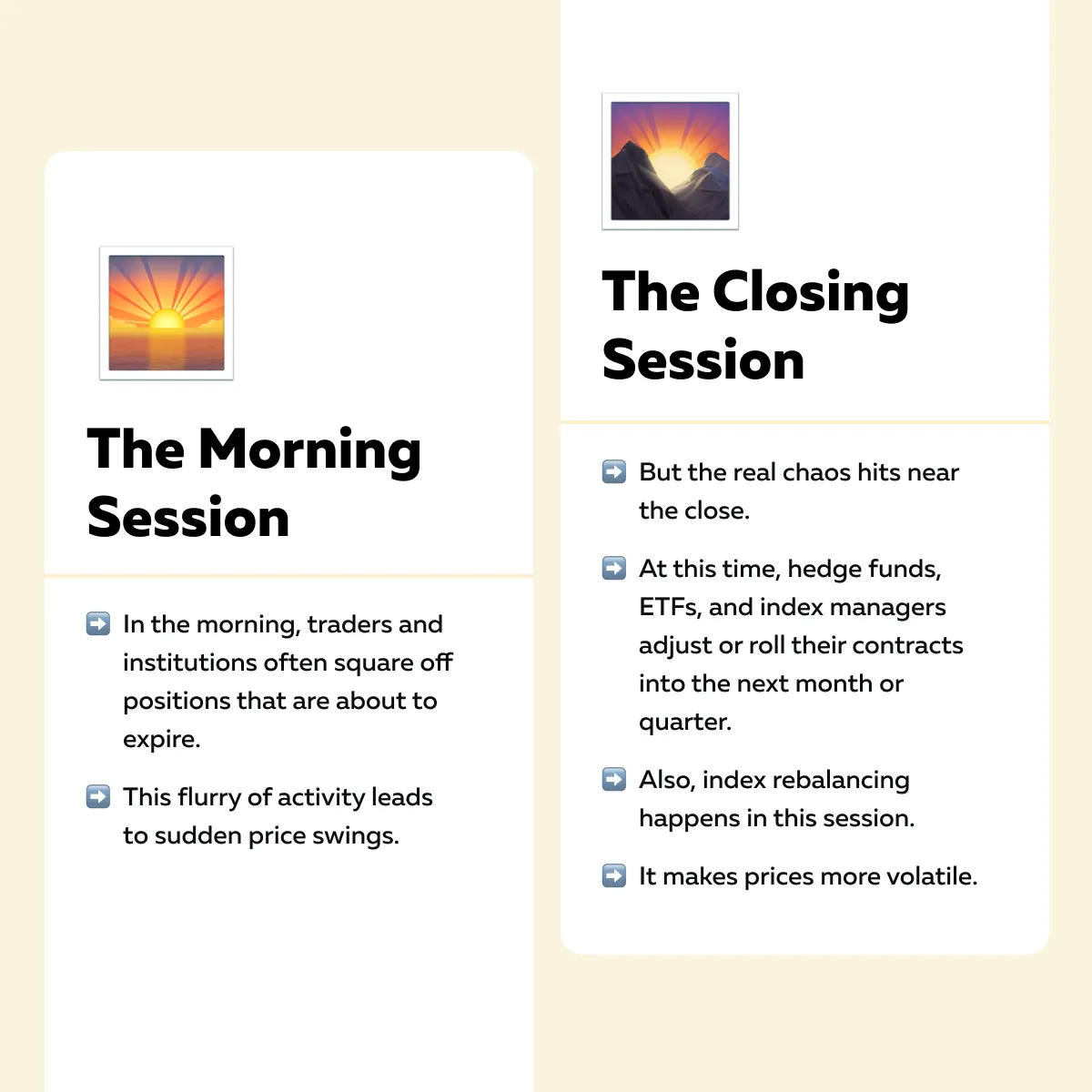

On triple witching days, there is a surge in intraday volatility. This surge is evident during two key times:

- Right after the market opens

and

- Just before it closes.

Check out the graphic below for more clarity:

Please note that even ETFs like SPY or QQQ, which usually trade with high liquidity and relative stability, experience sharp swings or whipsaws during triple witching. Also, these moves occur without any major news, making it tough for traders to interpret what is actually driving the action.

Thus, for anyone involved in triple witching trading, it is important to expect the unexpected! That is because price moves may not follow the usual patterns. Learn how to read volatility in real time—visit the Bookmap Learning Center.

Strange, Non-Fundamental Price Moves

Sometimes, the market can seem to move without any logical reason on triple witching Fridays. A stock might suddenly spike or drop even though there is no news or earnings release. So, what is going on? This often happens due to:

- Options-related flows

or

- Forced institutional adjustments.

For example, during these times, most market makers practice a strategy called “delta hedging.” Using it, they try to stay neutral on their options exposure. Now, this move creates a lot of buying or selling pressure. As a result, this flow pushes prices in one direction temporarily, regardless of what the company or economy is doing.

In other cases, large rebalancing trades or automated algorithms trigger abrupt price moves. They execute orders tied to index changes. To your knowledge, these are called “non-fundamental price moves.” That is because they are not happening because of:

- Actual business performance

or

As a trader who understands triple witching, you must be aware of these odd movements. Please realise that it is now always about fundamentals! Instead, it is about:

- Flows,

- Timing,

and

- Positioning.

When volume surges, clarity matters. Use Bookmap to track where liquidity is building or vanishing.

How Triple Witching Impacts Different Markets

Triple witching does not just affect one corner of the market! It impacts:

- Futures,

- Stocks,

- ETFs,

and

- Options.

Each reacts in its own way. This creates both risks and opportunities. Let us understand in detail:

Index Futures (ES, NQ, etc.)

Triple witching trading impacts index futures like the S&P 500 (ES) or Nasdaq (NQ). During these events, most traders start to:

and

- Move into the next front-month contract.

This transition causes what is called a “rollover.” It is a major reason why liquidity temporarily dries up in the expiring contract. Let us see what happens due to dried-up liquidity:

Please note that these moves are not tied to the fundamentals of the market! Instead, they are a result of mechanical trading flows as traders adjust their positions.

Individual Stocks and ETFs

Stocks and ETFs also behave differently on triple witching Fridays, particularly if they have high open interest in options. Usually, they experience sudden price moves near major strike prices.

Take companies like Apple (AAPL) or Tesla (TSLA) for example. Due to the high volume of options traded on these names, their stock prices usually “pin” to a strike price as expiration approaches. In most cases, this happens when:

- Market makers use “gamma hedging” to stay balanced

and

- This hedging activity itself pushes the stock price toward a certain level.

However, sometimes, prices may whip just above or below a key strike level in the last hour of trading. This does not happen because of the news. Instead, it is simply because of options positioning. If you are involved in triple witching trading, this is a pattern to watch closely.

Options Markets

If there is one area that really lights up during triple witching, it is the options market! There is a massive spike in activity in all three contract types:

- Stock index futures,

- Index options,

and

- Single-stock options.

This happens because traders rush to close, roll, or adjust their positions, particularly near major strikes. These moves create:

- Unusual volume spikes,

- Weird pricing,

and

- Short bursts of directional momentum.

Now, during these times, market makers stay neutral. They try to adjust their hedges in real-time, and these adjustments move the market in unexpected ways.

How to Trade Triple Witching Like a Pro

On a triple witching day:

- Volatility is higher,

- Price moves are sharper,

and

- Noise levels spike.

Too tough to trade? No! With the right preparation and mindset, you can stay ahead. Let’s learn how you can trade profitably during these times:

Prep Key Levels in Advance

Before the market opens on a triple witching Friday, mark important levels on your chart. This includes:

- Major options strike prices,

- Recent highs and lows,

and

- Liquidity zones from previous sessions.

These are the areas where price is most likely to react. A great tool for this is our avant-garde market analysis tool, Bookmap. Using it, you can see:

- Where large buy/ sell orders are sitting

and

- Where liquidity is building up.

Through that visual edge, you can easily predict the likely turning points or fakeouts. Please note that this type of prep is a key part of many triple witching strategies. It allows you to avoid being blindsided by sudden volume spikes or price moves.

Trade Smaller and Tighter

The action may seem exciting. But triple witching trading is not the time to go all-in. In fact, one of the smartest moves you can make is to:

- Trade smaller position sizes,

- Use tighter risk management,

and

- Be more selective with your entries.

Yes, volatility can create opportunity! But it can also create noise, fake breakouts, and whipsaws. Always remember that if the move is not clean, do not chase it. It is better to stay patient and wait for clearer setups.

Let Bookmap Show You Where the Big Players Are Active

During triple witching, a lot happens beneath the surface. Usually, big institutions enter or pull large orders suddenly (mostly in the final hour). That is when they:

- Do their rebalancing

or

- Roll contracts into the next month.

By using our modern real-time market analysis tool, Bookmap, you can track this in real-time. You can see when a large order appears or disappears. This often signals something!

For example,

- You see on our avant-garde market analysis tool, Bookmap, that there is a shift in late-day liquidity.

- This is your cue to:

- Tighten your stop

or

- Scale-out of a position.

- Alternatively, you can interpret this as a signal to even jump into a high-probability setup only if the flow lines up.

Triple witching doesn’t have to catch you off guard—see order flow shifts with Bookmap.

Common Mistakes Traders Make on Triple Witching Days

Triple witching can look like a goldmine of opportunity, but it is also full of traps! Many traders get caught making common mistakes that are easy to avoid with the right mindset. Let us study them:

Overtrading the Noise

Just because there is more action on triple witching Fridays does not mean every move is a trade. One of the biggest mistakes is overtrading. In this, you try to:

- Chase every tick

and

- Catch every move.

The end result? You are forced into trades with messy and unclear setups. Please understand that markets can get unpredictable when large institutions are adjusting positions. Thus, instead of jumping into every spike, you should:

- Focus on high-probability setups

and

- Let the triple witching trading volume work for you.

The trick? Be selective, not reactive.

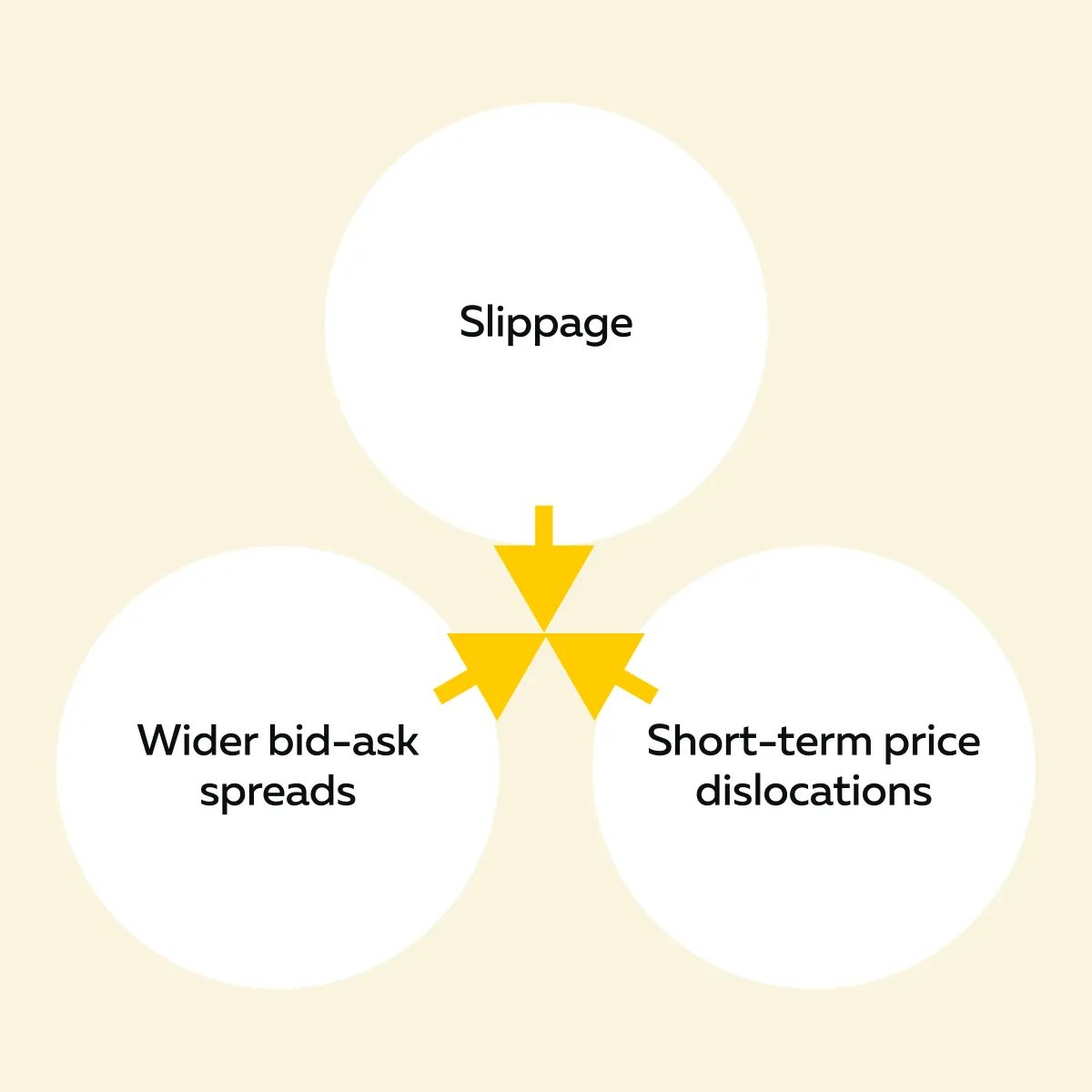

Ignoring Liquidity

Another issue is ignoring liquidity. On triple witching days, bid-ask spreads widen without warning. Mostly, this happens in the final hour of trading. If you are not paying attention, that can lead to:

- Slippage

or

- Getting filled at bad prices.

Want to avoid this mistake? Start using our modern real-time market analysis tool, Bookmap. It lets you track real-time liquidity. Let us see how such tracking helps you:

Using this information, you can easily decide whether to enter, exit, or avoid a trade altogether.

Misjudging Volatility

Be aware that on triple witching Fridays, volatility does not always equal direction. The big swings you see might just be the result of:

- Options flow,

- Hedging,

and

- Rebalancing.

In most cases, they are not a true trend. To avoid this trap, do not jump into trades based on movement alone. Wait for confirmation, such as:

- Strong volume,

- Order absorption,

and

- Clear breakouts backed by real interest.

Otherwise, you might find yourself on the wrong side of a move that disappears just as quickly as it came. Want to master triple witching strategies? You must learn to:

- Filter the noise

and

- Focus only on setups that show real conviction.

That is what separates pros from frustrated retail traders!

Triple Witching in Bookmap: What to Look For

If you are using Bookmap during triple witching trading, you are already ahead of the game. But on these high-volatility Fridays, knowing what to watch for can make all the difference!

Let us see what key signals you must see and how to spot them:

A) Heatmap Activity Near the Open and Close

The heatmap in our Bookmap shows liquidity in real time. Using it, you can see where large limit orders are waiting to buy or sell. During triple witching, it is important to closely monitor the heatmap immediately after the market opens and just before it closes. These are the times when institutions make big moves:

- Squaring positions in the morning

and

- Rolling or rebalancing in the final hour.

If you notice sudden shifts in liquidity, like a large buy wall disappearing or a sell wall forming fast, that is a signal that a bigger move is coming.

B) Volume Dots Reveal Aggressor Activity

In our market analysis tool, Bookmap, volume dots show who’s in control – buyers or sellers. On triple witching Fridays, you must watch for volume clusters. They form around:

- Major strike prices

or

- Important levels from the previous session.

Now, if you see aggressive buying near a key options level, particularly one with high open interest, it is due to options-related flows, like delta hedging. These trades usually trigger short bursts of momentum, presenting great opportunities if you are ready.

C) Sudden Pulls and Order Stacking

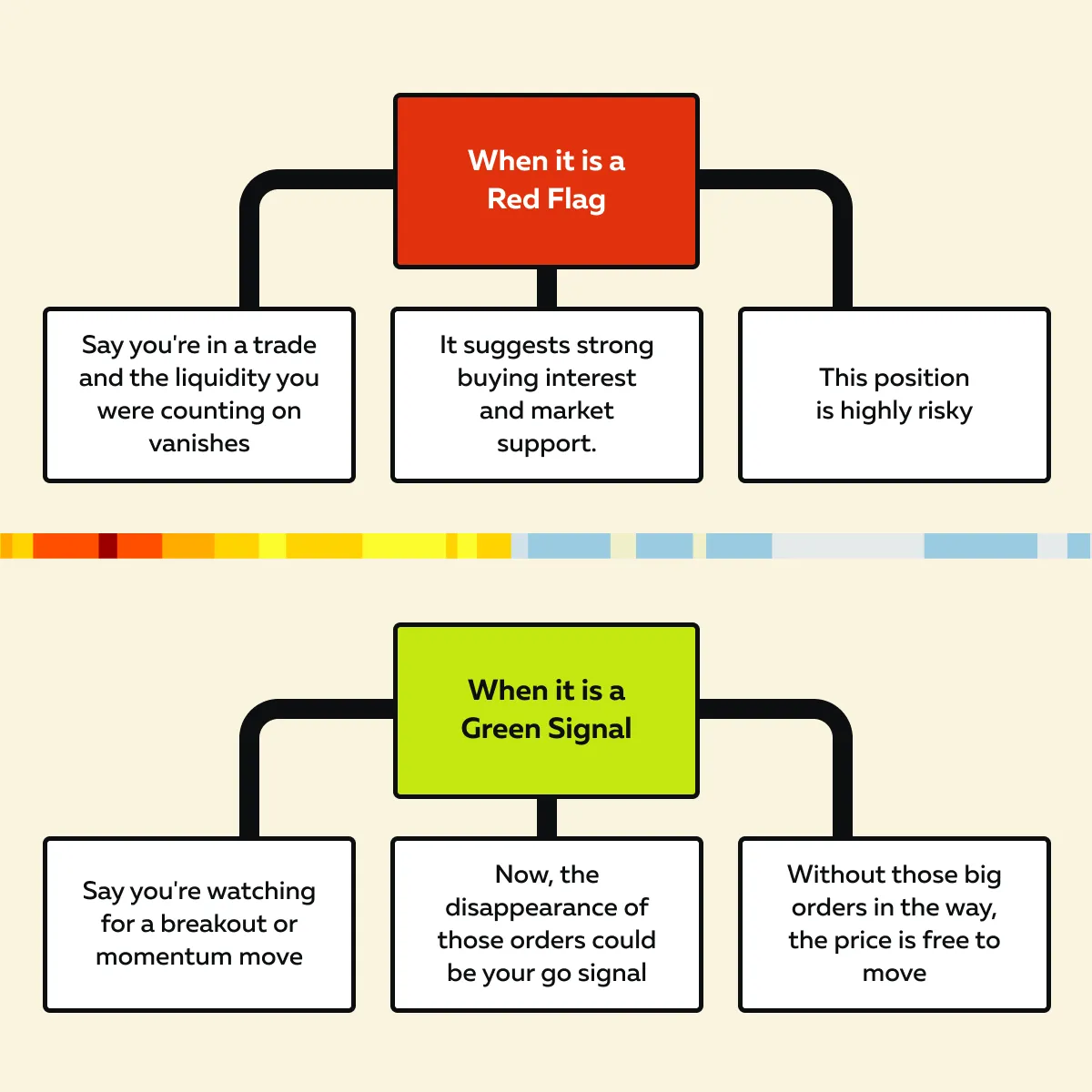

In Bookmap, the heatmap shows where big traders have placed limited orders. They are like walls of liquidity. When those big orders suddenly disappear, it could be both a red flag and a green signal. This entirely depends on your setup:

- If you are in the wrong direction, it is bad news.

- If you are waiting for a breakout, it could be your opportunity.

Let us understand better through the graphic below:

Now, let us talk about orders stacking near support/ resistance. This usually means that big players are getting ready! When you see large orders stack up at key price levels, it is often a sign that institutions or market makers are preparing to do any of the following:

- Defend a price level (support or resistance),

- Absorb incoming orders to slow down a move.

and

- Launch a breakout once enough liquidity builds.

By watching this behavior in real-time through our tool, Bookmap, you can understand triple witching trading more tactically.

D) Caution Near the Close

In the last 30 minutes of triple witching, most institutional-level players rush to rebalance or roll contracts. This leads to frequent changes in the order flow. Also, during these times, volume can be deceptive! It may look strong, but it is not always directional or sustainable.

Thus, you must only trade if you have both the following:

| You have a clear setup | You have confirmation |

|

|

If you do not see those confirmations, it is better to:

- Tighten risk: Reduce your position size or move your stop-loss closer

and

- Sit out: Do not take any trades at all.

As mentioned above, volume can be deceptive at the close. On triple witching Fridays, many trades are just institutions rebalancing or closing positions. They are not real; instead, they are just directional trading. So, let the noise pass, and trade when you have the edge!

Conclusion

Triple witching can be chaotic! But if you are a prepared trader, it can also offer you a real opportunity. In this event, multiple contracts expire at once. This fills the market with noise. During these times, you can clearly see sharp moves, sudden volume spikes, and unpredictable behavior.

Thus, it is easy to get caught up in the action and overtrade, especially near the open and close. But the key is to stay calm and have a clear plan. Most importantly, you must try to read the order flow in real-time. This can be done through our modern real-time market analysis tool, Bookmap.

Our market analysis tool, Bookmap, helps you to cut through the noise! It reveals where big players are active and where real liquidity exists. By observing the heatmap and volume dots, you get early signals, helping you decide whether to act or stay out. So, do you want to turn triple witching trading from confusing to rewarding? Trade when you truly have the edge. Start using Bookmap today!