Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 29, 2024

SHARE

Why Bond Prices Typically Rise When Yields Fall (And Vice Versa): Understanding the Inverse Relationship

Bonds provide investors with a relatively safe and steady return. Understanding how bonds work, especially the relationship between bond prices and yields is important for making smart investment decisions.

In this article, we’ll explore the fundamentals of bonds, what they are, how they function, and the different types, such as Treasury bonds, municipal bonds, and corporate bonds. We’ll also discuss why bond prices and yields move in opposite directions and how interest rates and inflation influence the bond market.

Next, you’ll learn about specific scenarios, such as rising inflation or economic uncertainty, and how they affect bond prices and yields. Finally, we’ll cover how understanding these dynamics can help you manage your investments smartly. Let’s begin.

What Are Bonds and Bond Yields?

Bonds are financial instruments that governments or corporations use to generate funds. When you buy a bond, you lend money to the issuer (government or corporation). In return, the issuer agrees to pay you interest, which is called the coupon payment. This interest is paid at regular intervals and is calculated on the bond’s face value. Additionally, you get the principal amount back when the bond matures.

Now, if we talk about a bond’s yield, it represents the return an investor gets on the bond. It’s calculated by dividing the bond’s annual coupon payment by its current market price. Mathematically, it can be presented as follows:

Yield= Annual Coupon PaymentCurrent Bond Price

Next, you should also be aware of the coupon rate. It is the fixed annual interest rate paid on its face value. Be aware that the coupon payment always remains constant, but the bond’s price fluctuates in the secondary market due to changes in:

- interest rates,

- supply and demand,

and

- the creditworthiness of the issuer.

These fluctuations affect the bond’s yield.

Types of Bonds & Their Importance to Traders

Let’s have a look at the various types of bonds and their importance to traders:

A) Treasury Bonds (T-Bonds)

Issued by the U.S. government, Treasury bonds are commonly considered one of the safest investments because they are backed by the government’s full faith and credit. Usually, T-bonds have long-term maturities, often up to 30 years, and offer periodic coupon payments.

Importance to Traders

| Hedge Against Volatility | Flight to Safety |

| Traders use T-bonds to hedge against market volatility since they are less risky compared to stocks. | During economic uncertainty, T-bonds are often seen as a haven. Traders shift to them to protect capital when other investments are more volatile. |

B) Municipal Bonds (Munis)

These are bonds floated by state or local governments to raise capital for public projects like infrastructure. It must be noted that municipal bonds offer an investment that benefits local communities. A key feature of munis bonds is that the interest payments are typically exempt from federal taxes and, in some cases, also from state and local taxes. This makes them especially attractive to investors in higher tax brackets.

Importance to Traders

| Tax-saver bonds | Reduces Risk |

|

|

Benefit from the comprehensive analytics available on our platform, Bookmap. Gain deeper insights into bond price movements and yield changes. Sign up now!

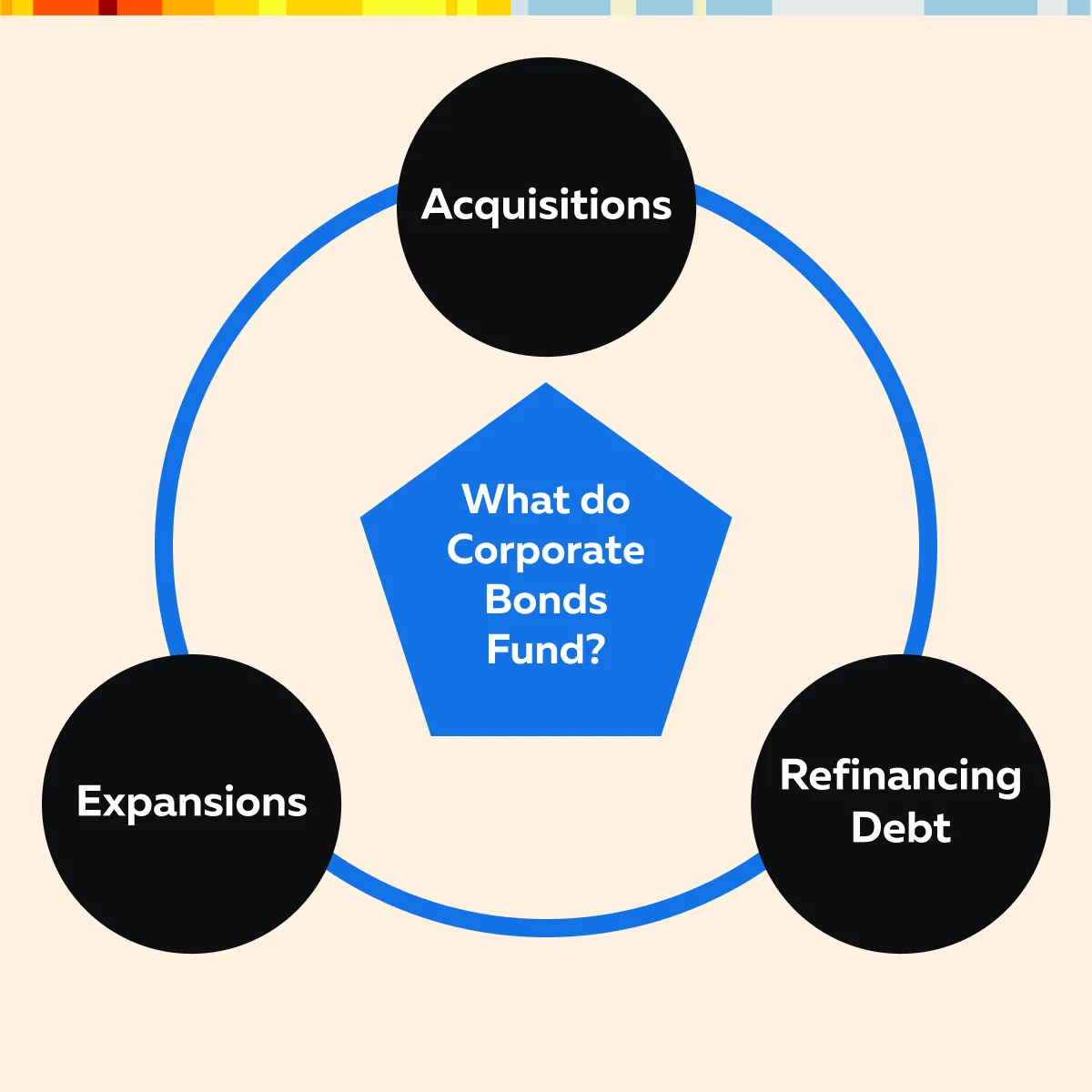

C) Corporate Bonds

Corporations issue bonds to fund different types of projects. Check the graphic below:

These bonds are riskier than government bonds but generally offer higher yields. For more clarity, let’s study its various types:

- Blue-Chip Bonds: Issued by well-established companies with strong financial health. They offer lower-risk and steady returns.

- High-Yield (Junk) Bonds: Issued to the public by companies with credit ratings on the lower side. They offer higher yields but with greater risk.

Importance to Traders

| Low-risk returns | More rewards |

| Several traders favor corporate bonds from blue-chip companies. They generate more stable and lower-risk returns. | For higher potential rewards, risk-tolerant traders invest in high-yield bonds, although these come with a higher risk of default. |

D) Savings Bonds

U.S. savings bonds are low-risk and government-backed bonds. Usually, they are intended for long-term investments. Unlike other bonds, they are not traded on secondary markets.

Importance to Traders

| Stable income | Long-term safe investment |

| These bonds appeal to conservative investors who are looking to earn secure and predictable growth. | While not actively traded, savings bonds offer a safe option for long-term investment portfolios. They are often favored for stability rather than market gains. |

E) Agency Bonds

These bonds are offered to the public by government-sponsored enterprises (GSEs) like Fannie Mae or Freddie Mac. The U.S. government does not fully guarantee these agency bonds, but they are still seen as relatively low-risk investments.

Importance to Traders

| Higher yields | Better risk-reward potential |

| Traders prefer agency bonds over Treasury bonds due to their slightly higher yields. At the same time, these bonds maintain a similar low-risk profile. | These bonds maintain a good balance between safety and returns. Mostly, they generate better returns than Treasuries. |

Our market visualization tools help traders and investors anticipate yield curve shifts and bond market movements in real-time. Join Bookmap today!

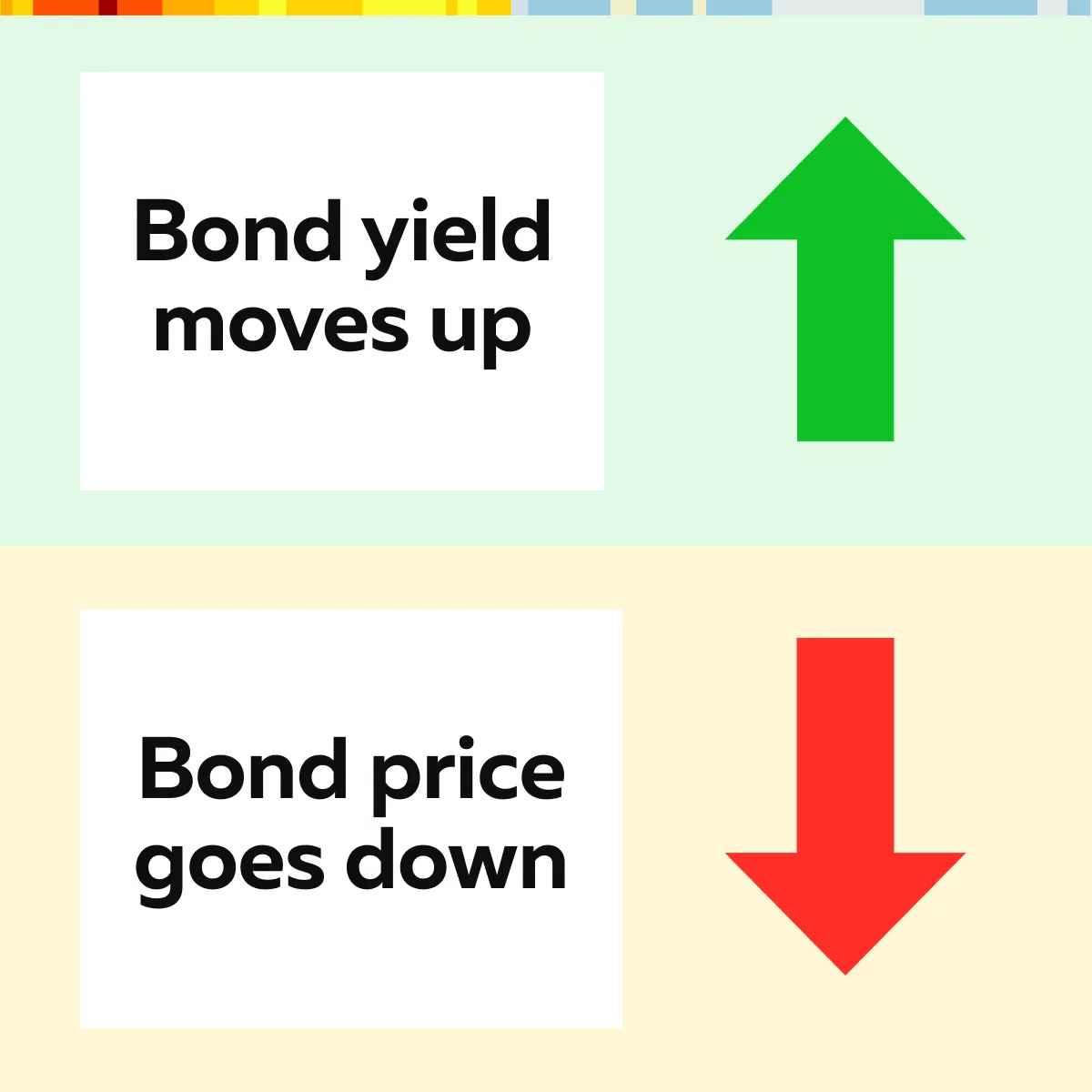

Why Do Bond Prices and Yields Have An Inverse Relationship?

Generally, bond prices and yields move in opposite directions. The yield and price of a bond share an inverse relationship. Check the graphic below for more clarity:

The relationship between these two factors depends on the concept of fixed coupon payments and how they interact with changing market prices. Let’s understand in detail:

The Fixed Coupon Payments

When a bond is issued, it offers fixed coupon payments. Investors get regular interest payments based on a percentage of the bond’s face value (also known as the par value). For example,

- Say a bond has a face value of $1,000 and a coupon rate of 5%.

- It will pay $50 in interest annually.

- The payment will remain constant regardless of its current market price.

Now, please note that in the secondary market, bond prices fluctuate due to several factors, such as changes in:

- interest rates,

- economic conditions,

and

- the issuer’s creditworthiness.

When bond prices change, the yield, or return on investment for new buyers, also changes. That’s because the coupon payment remains the same while the bond’s price moves up or down.

How Price and Yield are Related?

We can understand this relationship in two different scenarios:

- Scenario I: When Bond Prices Fall

If the bond’s price decreases, the fixed coupon becomes a larger percentage of the new lower price. This means the bond’s yield increases because investors are now getting the same dollar amount of interest but at a lower purchase price.

For example:

Let’s say the bond originally had a face value of $1,000 and a coupon rate of 5%. This means it pays $50 annually. If the bond price drops to $900, a new investor would still receive the same $50 coupon payment. Check out the bond yields both before and after the price drop:

| Yield before the price drop | Yield after price drop |

| 501000=5% | 50900=5.56% |

We can clearly observe that the fixed coupon payment of $50 now represents a higher return on the investor’s $900 investment. Therefore, the yield rises to 5.56%. In this case, the bond becomes more attractive to potential buyers because it offers a higher return.

Scenario II: When Bond Prices Rise

If the bond price increases, the fixed coupon becomes a smaller percentage of the new higher price. This causes the bond’s yield to decrease. Investors pay more for the same interest payment, which effectively reduces their return.

For example:

Say the bond price rises to $1,100. Now, the yield decreases as follows after the price rise:

501,100=4.55%

In this scenario, the same $50 coupon payment now represents a smaller return relative to the $1,100 price. Hence, the yield falls to 4.55%. This bond becomes less attractive compared to bonds offering higher yields for the same level of risk.

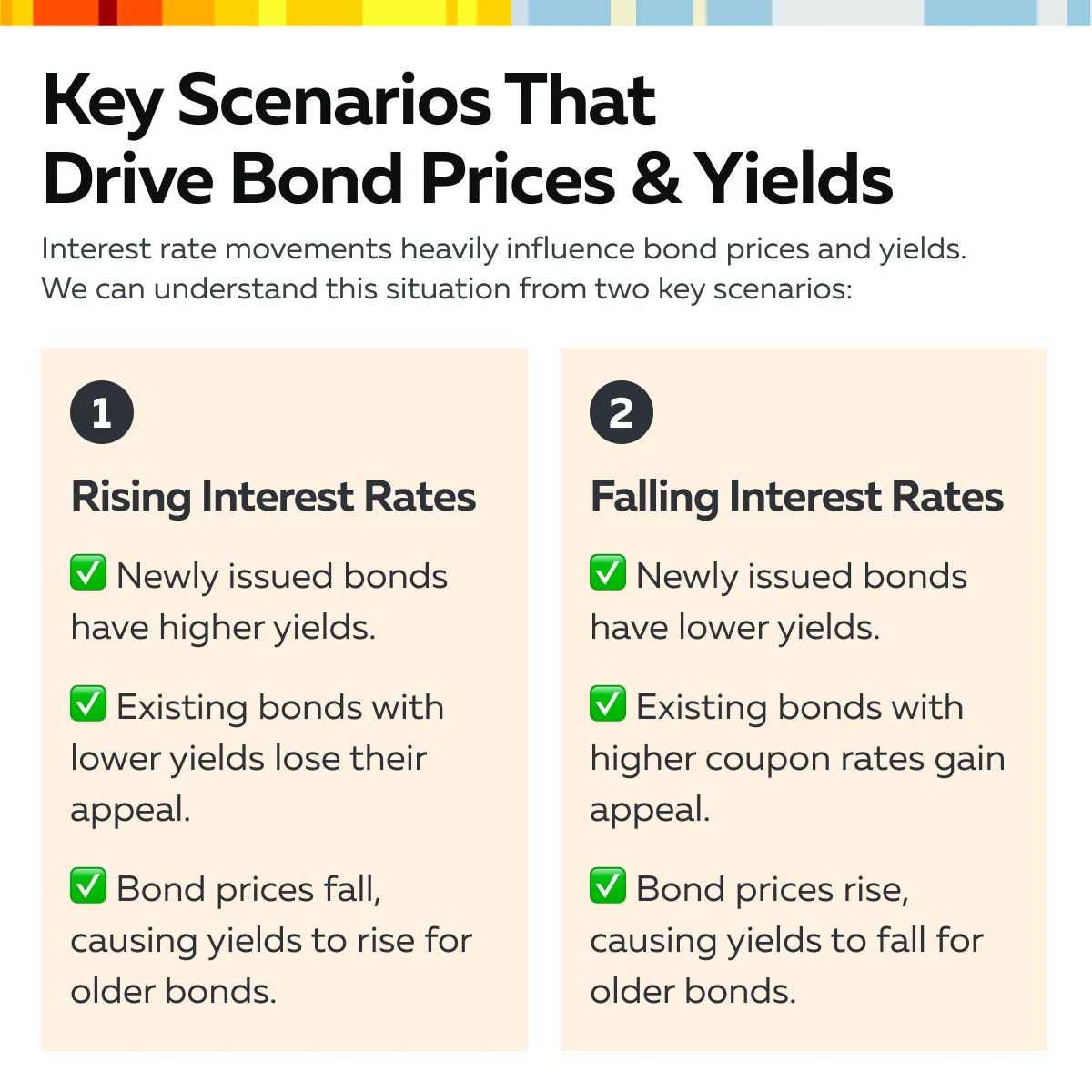

Let’s understand in detail and see how rising and falling interest rates affect the bond market:

Scenario I: Rising Interest Rates

When central banks, such as the Federal Reserve, raise interest rates, newly issued bonds come with higher yields to reflect the increased cost of borrowing. In comparison, existing bonds with lower coupon rates become less attractive because they offer a lower return than the new bonds. As a result, the price of existing bonds drops, making their yields competitive with the newer and higher-yielding bonds.

For Example:

- Let’s assume the Federal Reserve raises interest rates.

- Newly issued bonds offer a 6% yield.

- If an investor holds an older bond with a 4% coupon, new bonds are now more attractive since they provide higher returns.

- Investors may sell their older bonds with lower yields.

- This causes the price of these bonds to drop.

In turn, this situation increases their yield (to bring them in line with the newer bonds).

Old Bond Yield=40New Lower Price >4%

The old bond’s price falls until its yield aligns with the current interest rate environment.

Scenario II: Falling Interest Rates

When central banks lower interest rates, newly issued bonds offer lower yields because the cost of borrowing has decreased. In this scenario, older bonds that have higher coupon rates become more attractive to investors. Since these bonds offer higher returns than newly issued bonds, their demand increases. This drives up their price and pushes down their yield.

For Example:

If interest rates fall and new bonds are issued with a 3% coupon, older bonds with a 5% coupon become highly desirable. Investors will drive up the price of these higher-yielding bonds, which in turn reduces their yield.

Old Bond Yield=50New Higher Price <5%

As the price rises, the yield falls, but the bond remains attractive compared to new bonds with lower coupons.

Scenario: What Happens When Inflation Rises?

It must be noted that rising inflation erodes the purchasing power of money. This means that investors need higher returns to maintain their real income. To control rising inflation, central banks (like the Federal Reserve) often raise interest rates. This is done to reduce borrowing and spending in the economy.

Now, as interest rates rise, newly issued bonds offer higher yields to stay competitive with the new interest rate environment. In turn, existing bonds with lower coupon rates become less attractive, and as a result, their prices fall. As bond prices decrease, their yields rise to align with the new higher interest rates.

For example:

- Let’s assume that inflation spikes unexpectedly.

- The Federal Reserve raises interest rates by 1% to control it.

- Investors holding bonds with a lower coupon rate (e.g., 3%) now face a scenario where new bonds are being issued with a 4% coupon.

- As a result:

- Investors start selling off older bonds with lower yields.

- This sell-off drives their prices down.

- As the prices of these older bonds drop, their yields increase to reflect the higher interest rates.

- Old Bond Yield=30New Lower Price >3%

- In this case, inflation-induced rate hikes lead to a broad sell-off in the bond market.

- This results in higher yields across the board.

- Rising yields help to attract investors back into bonds.

- Investors get compensated for the higher inflation and interest rate environment.

Scenario: What Happens in a Flight to Safety?

During periods of economic uncertainty, market crashes, or geopolitical instability, investors often engage in a “flight to safety.” This means they move their money out of riskier assets like stocks and into safer investments like government bonds (especially U.S. Treasury bonds). This shift happens because the government backs them, and they have a lower risk of default.

Now, let’s talk about its effect on bond prices and yields. As more investors flock to bonds, the demand increases. This surge in demand pushes bond prices higher. Since bond coupon payments are fixed, rising prices cause yields to fall. This happens because the same interest payment represents a smaller fraction of the higher bond price.

For example:

- In early 2020, during the first wave of the COVID-19 pandemic, global stock markets crashed.

- The reason was uncertainty and fear of economic downturns.

- Investors rushed to buy safer assets like government bonds.

- This caused bond prices to skyrocket.

- As a result:

- Bond yields fell sharply to historic lows.

- Some government bonds even had negative yields in certain markets.

- Investors were willing to accept very low or even negative returns in exchange for safety.

- Yield Fixed Coupon PaymentHigher Bond Price →Shows decrease in yield.

Using our platform Bookmap’s advanced data visualization tools, you can analyze bond market trends in real time. Start tracking key indicators and make more informed trading decisions today!

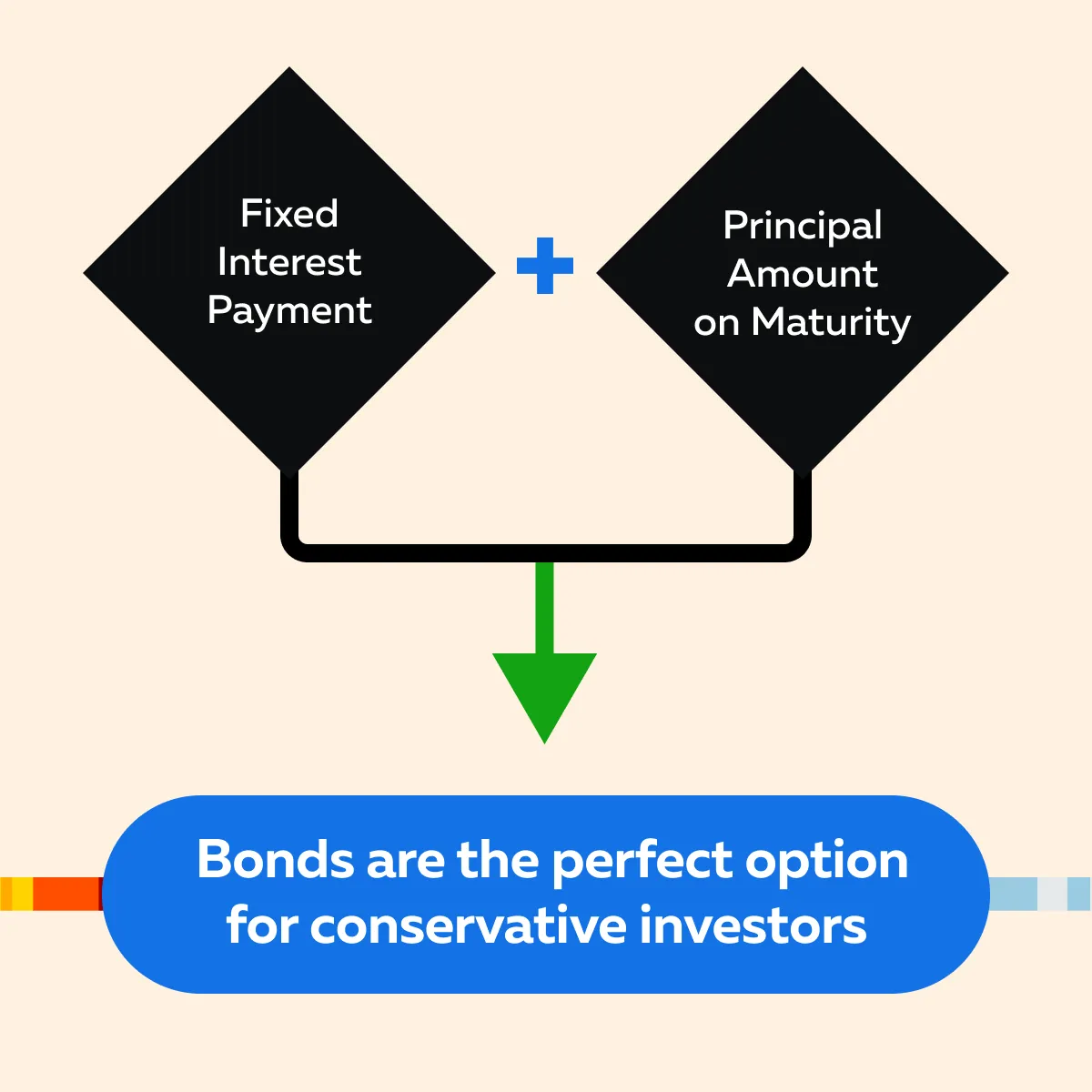

Bond Price vs. Yield: How It Affects Investors?

Long-term investors who buy bonds and plan to hold them until maturity are less concerned about fluctuations in bond prices. They continue to receive the fixed coupon payments (interest) as promised, and at the bond’s maturity, they pocket the face value of the bond (the principal amount). Check the graphic below:

However, even though price fluctuations don’t affect the fixed coupon payments or the principal repayment at maturity, changes in bond prices can impact the overall value of a bond portfolio. If investors need to sell bonds before they mature, they might face a loss if bond prices have fallen. For example:

| Increase in interest rates | Decrease in interest rates |

| If interest rates have risen and bond prices have dropped, selling the bond before maturity could result in receiving less than the initial investment. | If interest rates have fallen and bond prices have risen, selling before maturity could result in a capital gain. |

Guidance for Active Traders

Active traders, who buy and sell bonds before they mature, are much more sensitive to price movements. Since bond prices and yields share an inverse relationship, traders must be vigilant about the following:

- interest rate changes,

and

- economic conditions that influence bond prices.

They must understand the inverse relationship between bond prices and yields. This allows traders to adjust their strategies based on market trends. See the graphic below for a greater understanding:

Conclusion

The inverse nature of the relationship between bond prices and yields is important for both long-term investors and active traders. When bond prices increase, correspondingly their yields go down, and vice versa. This happens because the fixed interest payments, or coupon rates, stay the same, but their value changes based on the bond’s current price.

For long-term investors, this relationship matters less if they plan to hold the bond until maturity. They will continue receiving fixed coupon payments and get the bond’s face value at the end, regardless of price changes in the market. However, if they need to sell the bond early, price fluctuations could affect their return.

For active traders, price movements are critical because they buy and sell bonds before maturity. Therefore, they must have a thorough understanding of how bond prices and yields respond to interest rate changes. This helps them make better decisions about when to buy or sell. Anticipating these shifts can lead to more profitable trades.

Want to make more informed bond trading decisions? Use our real-time data analysis tools to track market trends and better understand the bond market.