Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 29, 2024

SHARE

Why China’s Currency Rises When It’s Ready to Buy Commodities

They say when China moves, the world pays attention. The adage surely holds for its currency- the Yuan, which has proven its ability to send ripples through global markets.

As a trader, are you looking to predict the prices of global commodities? Well, there is no better indicator than tracking the “Chinese yuan.” Yes! Given China’s status as the largest consumer of commodities like crude oil, metals, and agricultural products, even small changes in the yuan can signal big moves in the prices of these essential resources.

In this article, we’ll explore how China’s currency movements affect major commodities, from oil and copper to soybeans. You’ll learn why a stronger yuan often indicates that China is preparing to buy large quantities of these resources and how traders can benefit from this knowledge for smarter trading decisions. We’ll also discuss how the advanced market analysis tools on our platform, Bookmap, can help traders track real-time order flow and spot large transactions. Let’s begin.

How does the value of China’s currency signal commodity purchasing intentions?

China is one of the largest consumers of commodities. It primarily imports commodities such as crude oil, iron ore, copper, and coal. This gives its currency (the yuan) a significant influence in commodity markets. Check the graphic below to understand why China is considered a major consumer of commodities.

Readers must note that this demand is crucial in driving commodity prices. When China signals large purchases, markets respond. Usually, when China plans to increase its commodity imports, a stronger yuan makes purchasing commodities priced in US dollars more cost-effective.

Moreover, strengthening the yuan increases China’s purchasing power and allows it to buy commodities at lower costs. Thus, China’s central bank, the People’s Bank of China (PBOC), takes measures to strengthen the yuan. This especially happens when:

- Commodity prices are expected to rise

or

- When China needs to ramp up imports for infrastructure projects, energy demands, or industrial growth.

Let’s understand these monetary measures better through an example related to Chinese crude oil imports & Yuan movements.

Over the past decade, China’s crude oil imports have surged. In 2013, China imported approximately 6.2 million barrels per day (bpd), which increased to over 11 million bpd by 2023. During periods when China significantly increased its crude oil imports, the yuan has appreciated. This currency appreciation allowed China to lock in better purchasing terms for oil contracts. Also, it reduced the overall cost of imports and gave it a competitive edge in the commodity markets.

Currency Manipulation vs. Market Positioning

China has been accused of currency manipulation over the years. It has been alleged that its central bank has kept the yuan undervalued to boost exports. For the unaware, an undervalued currency makes Chinese goods cheaper on the global market. This maintains China’s position as a dominant exporter.

However, China also engages in market positioning with the yuan, especially when it comes to commodity purchases. This positioning allows the yuan to strengthen and secure better deals in international markets. Let’s understand both these concepts in detail:

| Undervaluation for Exports | Allowing the Yuan to Strengthen for Commodity Purchases |

|

and

|

For a greater understanding, let’s understand through an example related to purchasing metals like copper or aluminum.

- Strategic purchasing of metals

China strengthens the yuan when it plans to increase its purchases of industrial metals like copper or aluminum.

- Increase in imports

In 2020, as global demand for copper surged due to infrastructure projects and a post-pandemic recovery, China increased its imports. The yuan appreciated in the second half of the year and made it more cost-effective for Chinese firms to buy copper (which was increasing in price due to the recovery).

- Competitive Advantage

This strategy allows China to secure raw materials at favorable prices. Consequently, its domestic production capabilities get a boost. For example, by using a stronger yuan to buy copper or aluminum in bulk, Chinese manufacturers lower their input costs and maintain price advantages in the production of goods like electronics and machinery.

Monitor global currency trends and their impact on commodities using our platform Bookmap’s advanced market analysis tools. Get started!

Why Does China Strengthen Its Currency Before Major Commodity Purchases?

China’s economic strategy is deeply connected with its currency management. It allows the yuan to rise before major commodity purchases. See the graphic below to check how this strategy benefits China:

Let’s understand the benefits in detail.

A) Better Buying Power

When the yuan strengthens, it increases China’s purchasing power in international markets where commodities are generally priced in U.S. dollars. A stronger yuan means Chinese companies can convert their currency into more dollars. This enables them to purchase commodities at lower costs. Such a situation is particularly beneficial when global commodity prices are volatile or rising.

For example,

- Say a Chinese oil refinery is looking to buy crude oil.

- Suppose the exchange rate shifts from 7 yuan per dollar to 6.5 yuan per dollar.

- The company can now purchase more oil for the same yuan amount.

- Assume that the refinery buys 1 million barrels of oil at $60 per barrel.

- Now, a stronger yuan means fewer yuan are required to secure that transaction.

- In this way, even minor currency fluctuations can lead to significant cost savings on large orders.

B) Strategic Stockpiling

China often takes advantage of a stronger yuan to stockpile commodities during periods of global economic uncertainty or supply chain disruptions. When the yuan appreciates, China accumulates key resources at lower costs and prepares for future shortages or price spikes. This approach not only ensures long-term supply security but also provides China with a financial buffer.

Moreover, stockpiling essential commodities like crude oil, copper, and agricultural products strengthens China’s ability to weather:

- global market shocks,

- geopolitical tensions,

and

- supply chain disruptions.

It is worth mentioning that during periods of crisis, such as economic recessions or global pandemics, these reserves are crucial for maintaining economic stability and energy security.

For example:

- In the early stages of the COVID-19 pandemic, global oil prices plummeted due to decreased demand.

- China took advantage of the falling prices by significantly increasing its strategic oil reserves.

- During this time, the Chinese yuan had strengthened in 2020.

- Several Chinese buyers used this period of favorable exchange rates to purchase massive quantities of crude oil at discounted prices.

- While oil prices were fluctuating, China’s stronger yuan enabled it to secure oil at relatively low costs.

- This stockpiling protected China from future price volatility.

- Also, it positioned the country advantageously as global demand for oil began to recover.

Key Commodities Impacted by China’s Yuan Movements

Please note that a rising yuan indicates that China is preparing to make substantial commodity purchases. This, in turn, affects global prices and market sentiment. Below are key commodities that are directly impacted by China’s yuan movements:

A) Crude Oil

Crude oil is one of China’s largest imports. The country relies heavily on foreign oil to fuel its:

- industries,

- transportation network,

and

- energy production.

China, as per the stats, is the world’s largest importer of crude oil and consumes over 11 million barrels per day. When it comes to the yuan’s influence on oil prices, be aware that the global oil market is extremely sensitive to China’s purchasing patterns. When the yuan strengthens, it signals China’s intent to increase its oil purchases. Also, a stronger currency lowers the cost of buying oil priced in U.S. dollars.

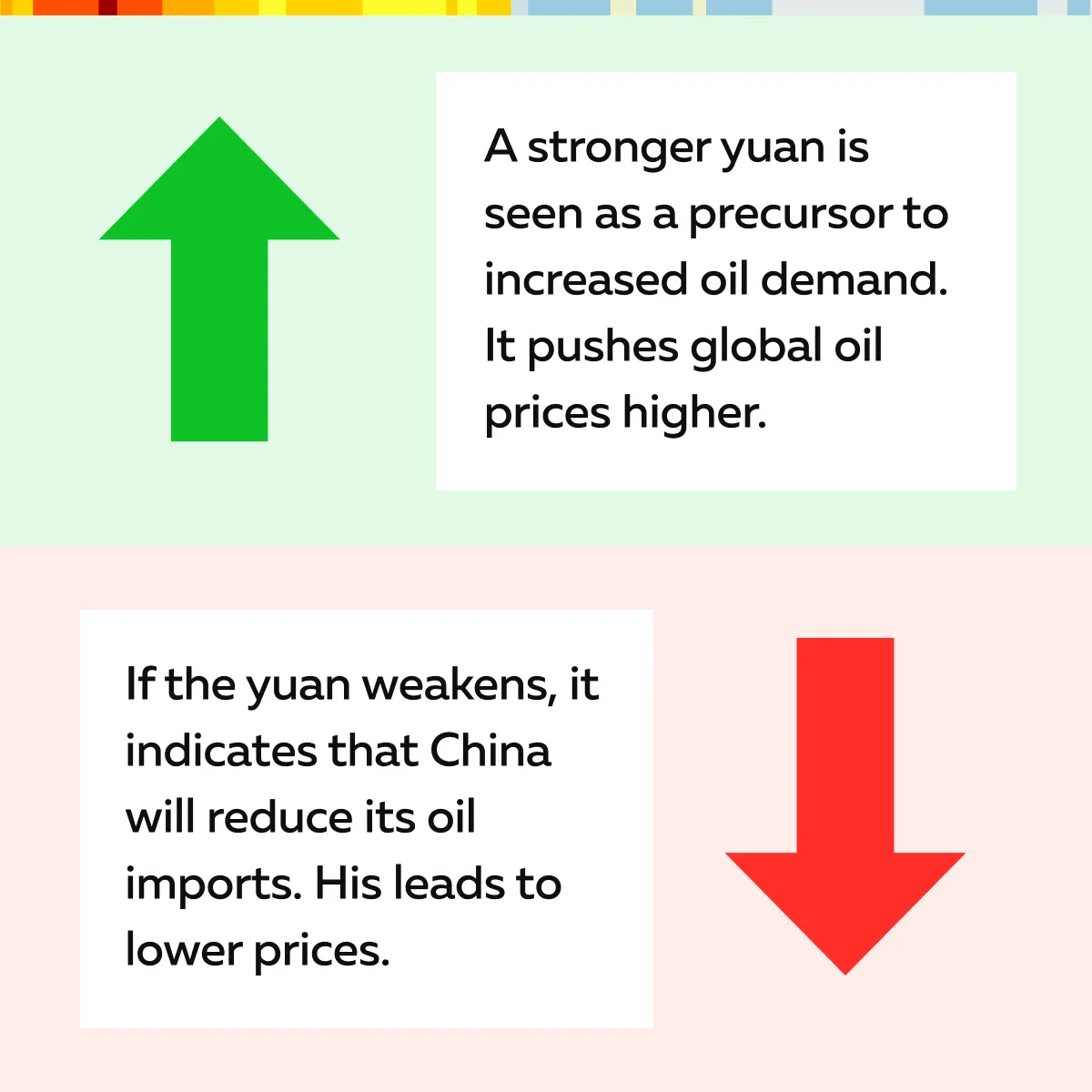

It is for this reason that several traders closely monitor the yuan’s movements for clues about China’s upcoming oil purchases. See the graphic below to understand how they make interpretations:

For example,

- In early 2020, the yuan strengthened, and oil prices dropped due to the pandemic.

- China took the opportunity to purchase and store large quantities of oil.

- This resulted in a spike in oil prices when demand later recovered.

Stay informed on how shifts in the Chinese yuan can signal buying opportunities in commodities. Use our platform, Bookmap, to track real-time market movements.

B) Metals (Copper, Aluminum, Iron Ore)

Metals like copper, aluminum, and iron ore are highly important to China’s massive infrastructure and industrial sectors. One must be aware that China is the largest consumer of these metals globally, and its demand directly affects their prices.

A rising yuan is often seen as a signal that China is preparing for large-scale infrastructure investments, which require significant amounts of metals. When the yuan strengthens, it reduces the cost of importing these metals. This allows China to stockpile resources for upcoming projects.

Copper as a Bellwether

Copper is often referred to as a “bellwether” for global economic health. This is due to its widespread use in construction, electronics, and manufacturing. Generally, the yuan’s movements are closely watched by traders for signs of upcoming infrastructure spending.

When the yuan rises, it often signals that China is ramping up construction projects, leading to higher copper demand. As a result, global copper prices increase in response to a stronger yuan.

C) Agriculture (Soybeans, Corn)

China is one of the leading importers of agricultural products in the world, especially soybeans and corn. These commodities feed its large population and support its livestock industry. Notably, when the yuan strengthens, it makes agricultural imports cheaper for Chinese buyers. This leads to large agricultural purchases, which in turn impact global food prices.

For example,

- China’s soybean imports are closely tied to its economic and food security strategies.

- During trade tensions with the U.S. in 2018, China adjusted its soybean imports to reduce reliance on U.S. suppliers.

- However, during periods of a stronger yuan, it resumed large-scale purchases from the global market.

- This move affected global soybean prices and impacted the agricultural economies of countries like Brazil and the U.S.

How Traders Can Leverage China’s Yuan Movements in Commodities Trading?

Traders who closely follow China’s economic activity understand that the yuan’s movements provide valuable clues about upcoming commodity market shifts. Changes in the yuan’s value signal major buying activity. This directly impacts global commodity prices. Below are ways traders can benefit from the yuan’s movements in commodities trading:

Using the Yuan as an Indicator for Commodity Price Movements

When the yuan strengthens, it indicates that China is preparing to make large commodity purchases. A stronger yuan improves China’s purchasing power and reduces costs for Chinese companies importing these resources.

Traders may utilize this consolidation as a leading indicator. They can position themselves to capitalize on rising commodity prices due to increased Chinese demand. As the yuan rises, traders can anticipate greater demand for commodities. Usually, this situation leads to upward price movements in the markets.

For Example:

- Say a futures trader specializes in crude oil, copper, or other commodities.

- They monitor the yuan’s strength as part of their strategy.

- The trader notices that the yuan has been appreciating steadily.

- This signals China’s intent to ramp up its commodity purchases in the near future.

- As a result, the trader takes long positions in crude oil or copper futures.

- They expect prices to rise as China’s purchasing activity increases.

Use Bookmap’s Tools for Spotting Large Transactions in Commodities Markets

Our platform, Bookmap, is an advanced market analytics tool known for its:

- real-time order flow,

and

Using it, traders can easily observe market depth and significant transactions in real time. This is particularly useful in commodities trading, where large purchase orders from major players, such as China, can lead to rapid price shifts.

If we specifically talk about Bookmap’s heatmap feature, it allows traders to visualize liquidity levels and trading volumes. It clearly shows where large buy and sell orders are clustered. By monitoring these liquidity shifts and price levels, traders can identify areas of high interest or large transactions tied to Chinese purchasing activity. Let’s understand better through an example:

- Say a trader is following the copper market.

- They notice that the yuan is strengthening.

- They use the heatmap tool on our platform, Bookmap, to track real-time buy orders in the copper market.

- They observe a sudden influx of large buy orders on Bookmap.

- This placement of buy orders, coupled with a rising yuan, indicates that Chinese firms are stockpiling copper for upcoming infrastructure projects.

- Observing this, the trader decides to go long on copper futures or options.

- They are anticipating a price increase driven by China’s buying activity.

In this way, the trader gained a competitive advantage using Bookmap. They were able to spot areas of significant liquidity, such as large buy orders, and received actionable insights.

Conclusion

China’s currency movements (especially a rising yuan) are key indicators of upcoming large-scale commodity purchases. As the world’s largest consumer of resources like crude oil, metals, and agricultural products, China’s buying power significantly impacts global commodity prices. When the yuan strengthens, it increases China’s ability to purchase these commodities at lower costs. Consequently, this indicates a higher demand in markets such as crude oil, copper, and soybeans.

As a result, several traders keep monitoring the yuan’s value to gain insights related to price movements in the commodities market. A stronger yuan often signals that China is about to increase its purchases, which can push prices higher. By recognizing this pattern, traders can position themselves to take advantage of these shifts.

To further enhance and optimize their trading strategies, traders can use our advanced market analysis tool, Bookmap. It offers real-time tracking of order flow and liquidity. Also, Bookmap’s heatmap tools help traders spot large buy orders and liquidity shifts. This allows them to align their trades with market movements driven by Chinese purchasing activity. Do you wish to profit from global commodity demand? Join our platform, Bookmap, today and predict market moves before others.