Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

September 24, 2025

SHARE

Why Friday Afternoon Matters More Than You Think in Trading

Do you think Friday close is a “quiet affair”? What if we say it’s a time where you can experience sharp reversals or surprise breakouts? Yes, Friday afternoon trading has its own pulse!

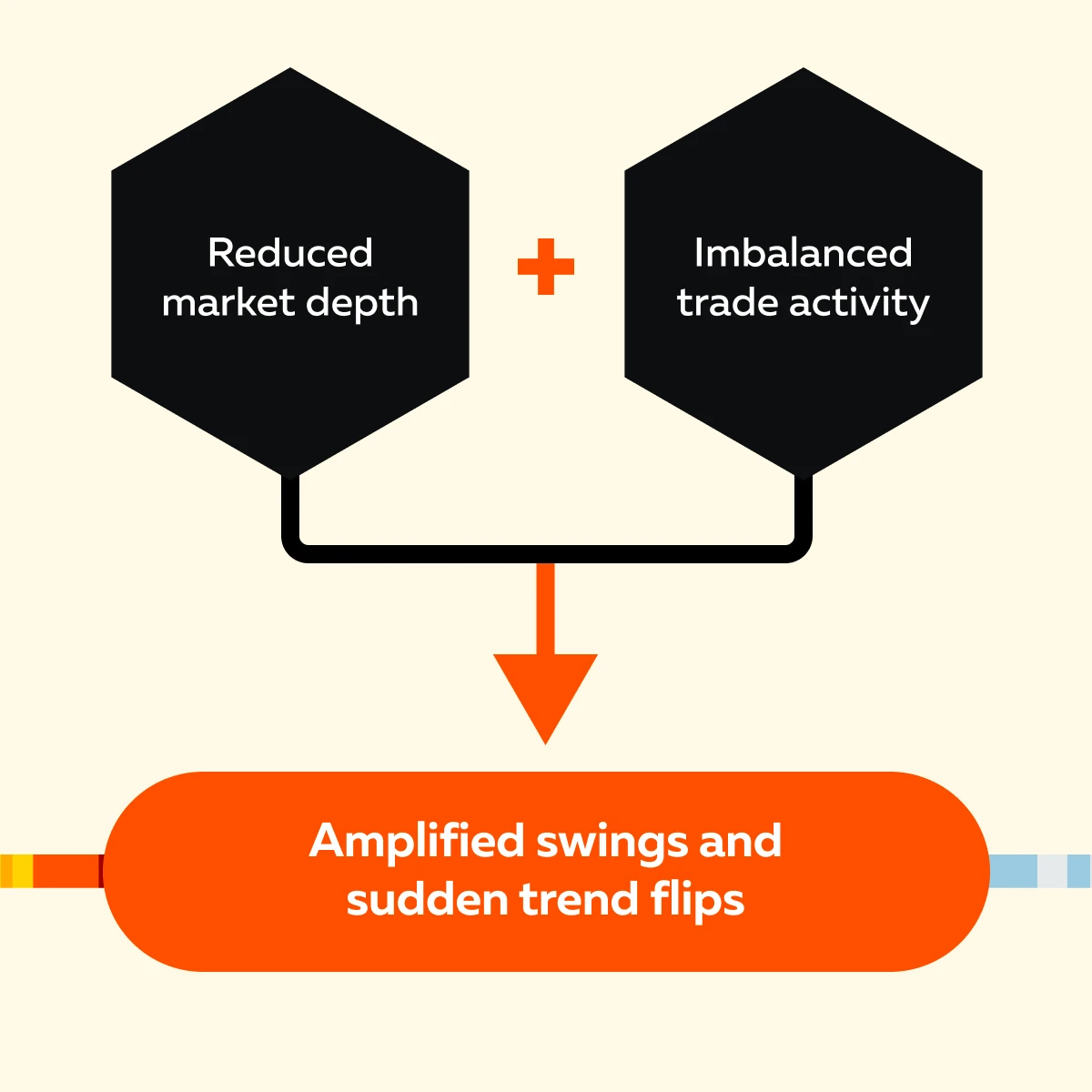

During this time, there is thinner liquidity and unusual order flow, which causes erratic price movements. This market behavior makes Friday’s close trading significantly different from the rest of the week.

Want to know more? This article will explain why late Fridays matter and the psychology behind end-of-week trading strategies. Also, we will check out some common Friday market trends and how our advanced real-time market analysis tool, Bookmap, can reveal hidden market moves. Read this article till the end to turn late-session moves into an opportunity!

The Unique Market Psychology of Friday Afternoon

Friday afternoons can feel very different from the rest of the week. Yes, that’s because during this time, most traders try to reduce their risk before the weekend. The effect? It leads to:

- Thinner liquidity,

and

This market behavior creates sharper price swings or reversals compared to mid-week trading. Want to trade better on Friday’s closing? Let’s understand the unique market psychology of “Friday Afternoon” in detail:

Risk-Off Behavior

By Friday afternoon, many traders (specifically large institutions) don’t want to hold risky positions over the weekend. Why? That’s because news, geopolitical events, or economic announcements can break while the markets are closed.

To avoid this “weekend surprise,” they reduce exposure. This move creates end-of-week trading strategies where you often see one-sided flows or sudden position unwinds.

Weekend Gaps and Uncertainty

Markets don’t always pick up on Monday where they left off on Friday! Futures, forex, and even crypto can gap up or down significantly when the market opens after a weekend due to financial events.

As a trader, you should track how prices move late on Friday. It shows you how traders prepare for the weekend and the following week. For example,

- Say traders are expecting news or gaps on Monday.

- Now, they may adjust positions on Friday.

- These actions usually influence the Friday market trends you see near the close.

Spot Friday afternoon setups before the market closes with Bookmap.

Profit-Taking Patterns

Another Friday habit is “profit-taking”. Traders who made gains during the week often close their positions to lock in profits before the close. For example,

- Say many traders were long (buying) all week.

- To book profits, they start selling to exit.

There is a major downside to such closure of winning trades on Friday. The late session liquidity is thin on Friday. There aren’t always enough buyers to absorb that selling pressure. As a result, the price sometimes drops and reverses the earlier uptrend.

The same works in reverse! If traders were short (during the week) and now want to cover their positions, a sudden buying can push prices up.

Liquidity Changes Into the Close

As mentioned above, liquidity can dry up by the Friday close. Due to this, price action becomes less stable, and sometimes you will feel that the price is manipulated around settlement. For more clarity, let’s check out three major liquidity changes you can observe at the Friday close:

I) Reduced Participation

By late Friday afternoon, many traders pack up early for the weekend. Now, this leads to fewer active participants, which causes the order book to become thinner. This reduced participation creates late session liquidity issues, which cause the price to swing more sharply.

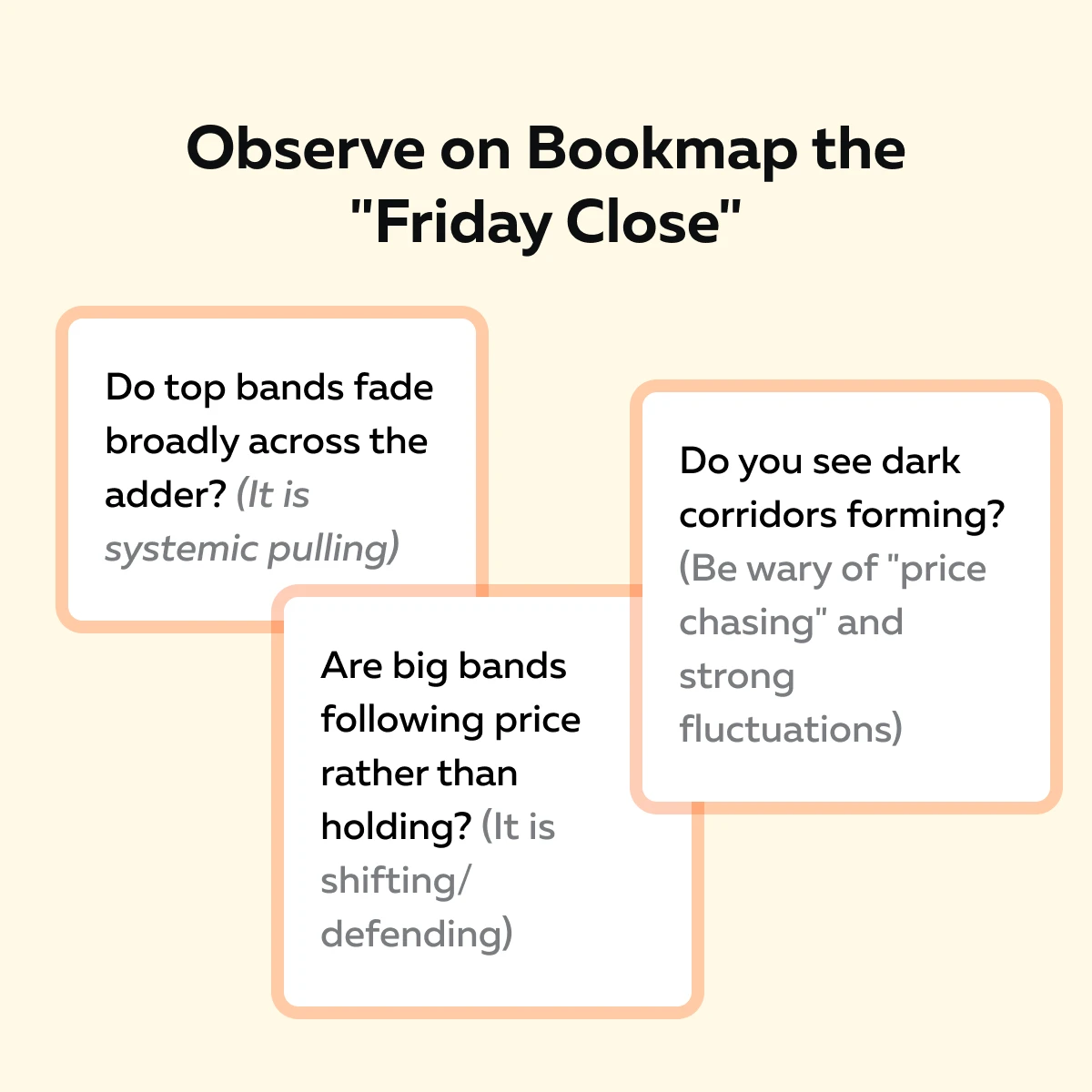

II) Liquidity Shifts (Visible on our Bookmap)

Our platform, Bookmap, is an avant-garde real-time market analysis tool. It offers an advanced “heatmap“. If you analyze our tool Bookmap’s heatmap on Friday’s close, you’ll notice something interesting! Let’s see how you can watch it:

First, You Should Focus on These Three Main Things!

| I) Heatmap Bands | II) Volume Bubbles/Dots | III) Best Bid/Ask and Depth |

|

|

|

Now, Spot These Friday Tell-Tales on our Bookmap’s Heatmap

- Liquidity Pulling (bands fading)

-

- As the close approaches, large resting orders often cancel.

- On our Bookmap, previously bright horizontal bands fade or vanish.

- The Result? – A liquidity gap (darker area) forms.

- Due to the minimal “cushioning,” even small market orders push the price further.

- Liquidity Shifting (bands relocate)

-

-

- Instead of holding a level, big orders reappear a few ticks away (higher/lower).

- On our Bookmap’s heatmap, you’ll see a band disappear at one price and show up at another.

- The interpretation? – Participants are defending/attacking different levels in the close.

- This is a part of their weekly trading strategies (hedging, P&L protection, margin optics, and more).

-

- Air-Pocket Moves (fast vertical prints)

-

- When price enters a dark zone (no bands), you’ll see quick vertical jumps with relatively small bubbles.

- This movement shows that the book is thin, which is why slippage grows.

Need a quick checklist? You can run this every Friday close:

Trade the Friday close with more confidence using Bookmap’s real-time depth data.

III) Settlement Dynamics

In futures markets, Friday’s closing prices carry extra weight. These settlement prices are used to calculate margins and weekly performance.

Because of this, big players try to influence the price near settlement time. Now, this adds another layer of push and pull that you, as a trader, should factor into your end-of-week trading strategies.

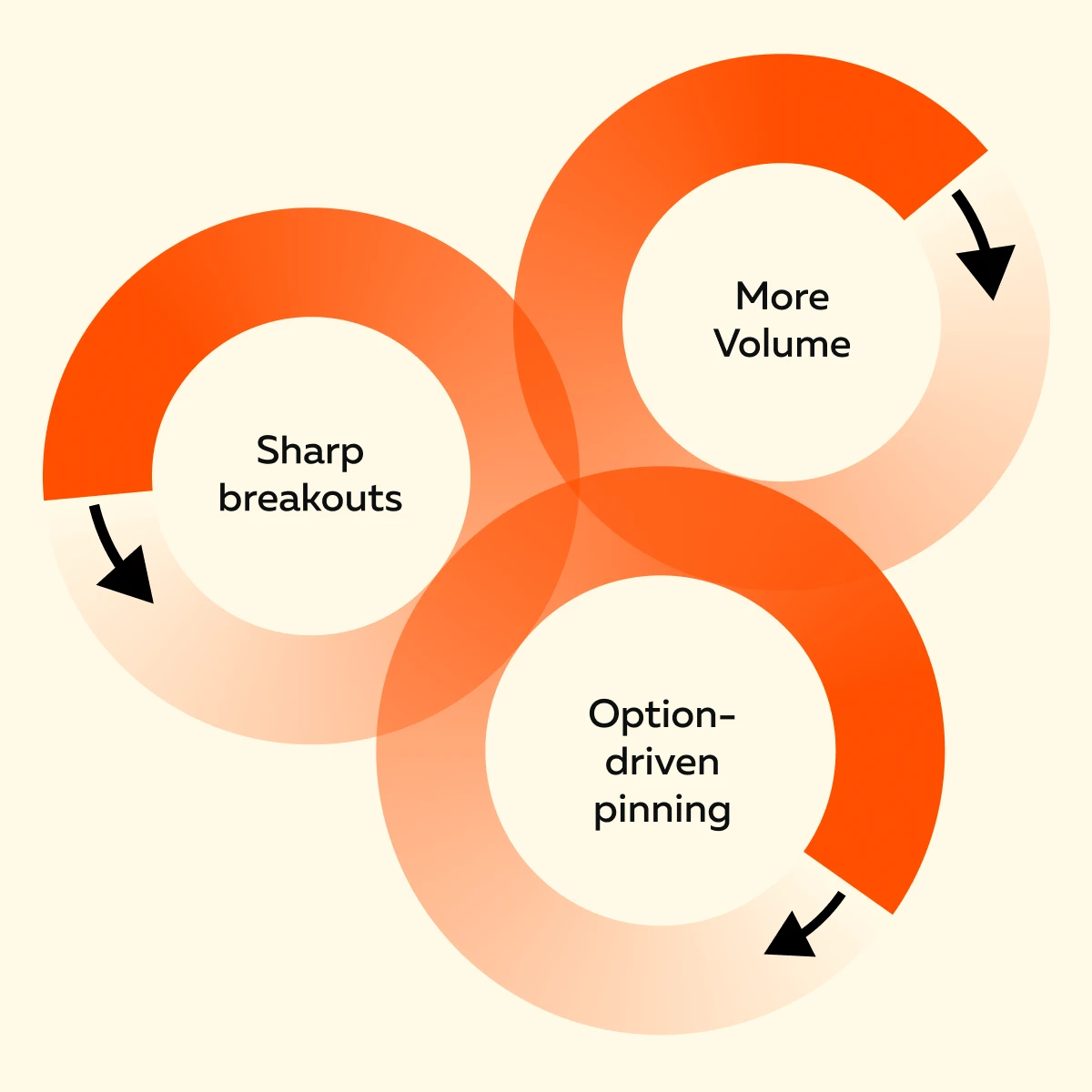

Common Friday Afternoon Patterns

Firstly, let’s see what all Friday afternoons can bring:

As a trader, if you can recognize these patterns, you can avoid getting trapped in end-of-week swings. Let’s understand these most common patterns in detail:

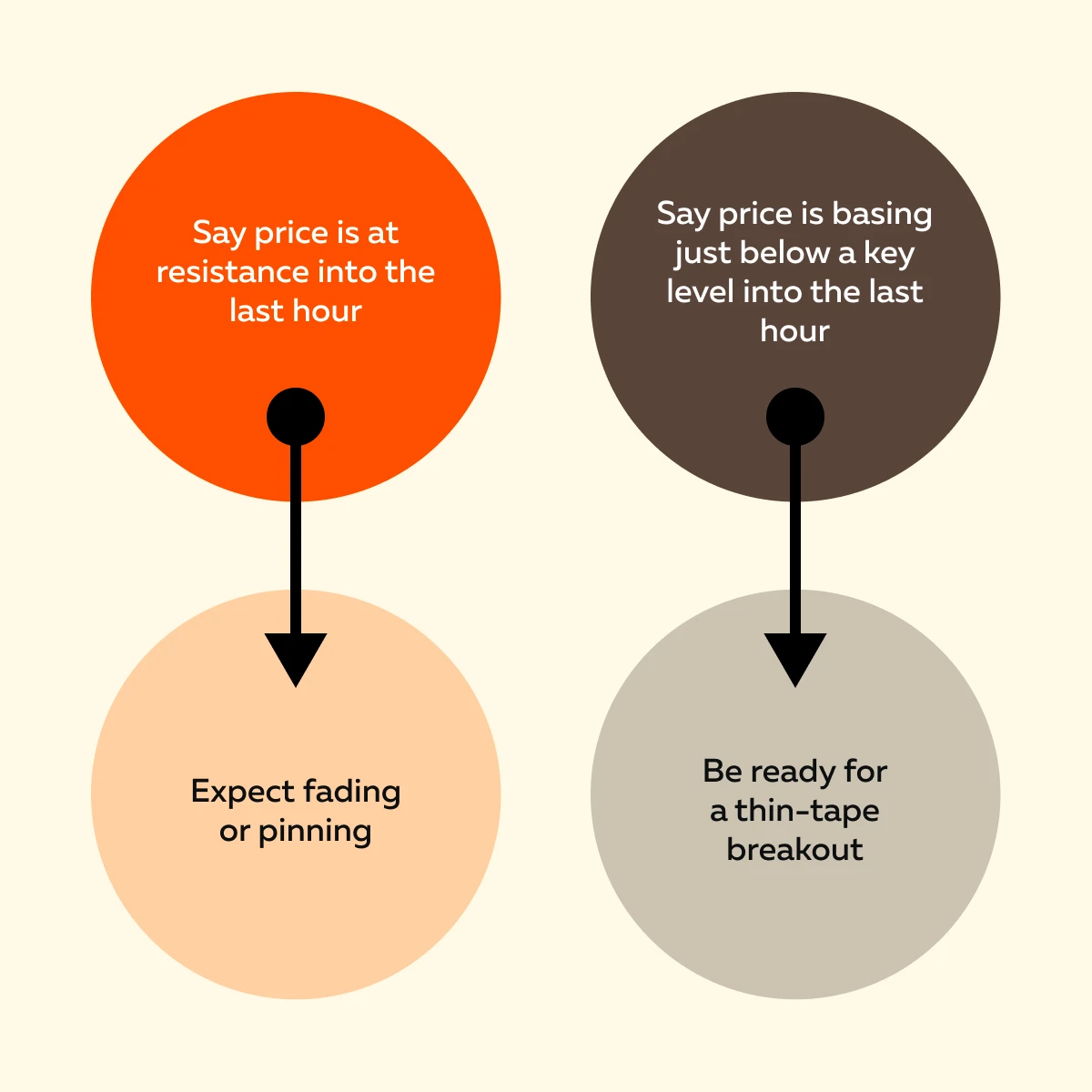

Pattern I: Late-Day Reversals

One of the most frequent Friday market trends is the late-day reversal. A stock or index may look strong in the morning. But as traders square off their positions before the weekend, the momentum fades.

These reversals often happen near important technical levels where traders place stop losses or manage risk. For anyone watching closely, this is a key signal for Friday closing trading tips!

Pattern II: Pinning Around Options Levels

In equities and indices, you’ll often see prices hovering around big options strike prices, such as:

- 5000 on the Nifty

or

- 4500 on the S&P.

But why? This happens because market makers hedge their books and pull the price toward those levels. The effect is a kind of “pinning”. You will feel that the volatility is suppressed. This effect remains visible until just before the Friday close.

On our Bookmap, such a pinning shows up as “thick liquidity bands”, which are sitting right at or near the big strike price. Upon watching, you will observe that the price keeps bouncing in a narrow range between these walls. You’ll notice the following:

Pattern III: Breakout Opportunities

While some markets get pinned, others can explode! Yes, this happens because late-session liquidity is thin. Now, taking advantage of it, large traders can push prices through major support or resistance levels with minimal effort.

These sudden breakouts can catch smaller traders off guard. However, for those prepared, they can be excellent trading opportunities!

How to Prepare for Friday Afternoon Trading

Want to turn your Friday afternoon trading into a profitable session? You should take the following measures:

- Trade your plan and not the clock.

- Wait for the price to reach your mapped levels.

- Maintain a smaller position size.

- Try to improve timing and make better market entries.

- Use limit orders and respect slippage.

For a greater understanding, let’s check out some professional end-of-week trading strategies:

1) Plan your week with Friday in mind

Decide early which positions truly deserve weekend risk. Try to map these key weekly levels before Friday:

- Prior week’s high/low

- Weekly open

- Weekly VWAP

- Monday/Tuesday extremes

- Prior to Friday’s close

- Major options strikes

These levels are special as they usually influence Friday market trends (reversals, pinning, or last-minute breakouts). Next, you can write these two quick scenarios:

See how Friday order flow shifts in real time with Bookmap’s heatmap.

2) Use order flow to read intent

Watch the tape! Try to spot sudden bursts of market buys/ sells and disappearing resting orders. These are signs that tell you late session liquidity is thin.

Observe this on Our Bookmap

| Bright Liquidity Bands (Heatmap) Getting Pulled or Shifted | Repeated Absorption at One Level (Lots of Trades But Little Movement) |

| Shows there is less “support”/”resistance.” Thus, you can expect rapid price fluctuations. | This shows someone is defending a price level. Now, if this level breaks, price moves can accelerate. |

Additionally, you can combine order-flow signals with your mapped levels for a better analysis.

3) Adjust position sizing

Trade smaller for late-day setups as thin conditions increase slippage. Follow this simple rule – cut size by 25–50%. Also, prefer limit orders near levels and avoid chasing through air pockets. If you must use a market order, assume extra ticks of slip while doing your risk calculations.

On the other hand, when you are dealing with options, don’t buy or sell a “single” options contract with unlimited risk. Instead, you can use a spread. For example, you can buy one option and sell another at a nearby strike. The benefit? This approach limits both your risk and potential loss.

4) Be Aware of News Timing

Firstly, have a look at some examples of late Friday headlines that can hit a thin tape and cause erratic price moves:

To deal with them, you can build a mini-calendar every Friday morning. In this calendar, you can note any scheduled events in the last two hours. Also, set alerts 60 and 15 minutes before. If a release is pending, either stand down or shrink the size.

Now, after unexpected news, let the first impulse print. Then reassess with order flow and check –Did liquidity return, or did it vanish? As a tip, you should trade only if the structure is clear!

Conclusion

Till now, you must have understood that Friday afternoons are not just quiet hours before the weekend. Through proper analysis, you can determine how traders are positioned and what tone the market may carry into Monday’s open.

Usually, moves near the Friday close are driven by:

- Risk-off behavior,

- Profit-taking,

- Thin liquidity, and

- Settlement dynamics.

All of these create unique opportunities and risks. Furthermore, by studying Friday market trends and understanding common late-day patterns, you can build better end-of-week trading strategies.

Remember, your goal isn’t always to trade more! Instead, it’s to know when to step in and when to stay out. If you want deeper insight into order flow and late session liquidity, start using our advanced real-time market analysis tool, Bookmap. Compare Bookmap packages and track late-session liquidity patterns.

FAQs

1. Why is Friday afternoon trading different from other days?

Friday afternoon is unique because it’s the last chance for traders to adjust before markets close for two days. Usually, many participants reduce exposure to avoid weekend risk.

Now, this changes the usual rhythm of trading:

- Liquidity often drops,

- Order flow becomes uneven, and

- Even small trades can move prices more than normal.

This makes conditions very different from mid-week sessions.

2. Does Friday afternoon always have big moves?

Not always! Some Fridays end quietly! However, when there is thinner liquidity on Friday close, it can exaggerate moves. During this time, even a small wave of buying or selling can push the price farther than usual.

Now, this doesn’t mean Friday always delivers fireworks! But it does mean that traders should be cautious because the likelihood of sharper swings is higher (even when the overall volume is low).

3. Is it risky to hold positions over the weekend?

Yes, it can be risky. That’s because markets are closed while news and global events continue. These reasons commonly cause gaps between Friday’s close and Monday’s open:

- Geopolitical headlines

- Earnings reports

- Unexpected policy changes

Let’s say the market moves against your position. Now, you have no chance to react until trading resumes on Monday.

4. Can Friday patterns be applied to crypto?

Yes! Crypto trades 24/7 and doesn’t “close” for the weekend like stocks or futures. However, Friday patterns still matter because traditional traders and institutions adjust their risk before weekends. Such an adjustment can influence trading flows in crypto, too.

However, weekend activity can also bring its own trends since crypto remains open while other markets pause.