Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 5, 2025

SHARE

How AI-Driven Power Demand is Reshaping U.S. Utility Investments

If AI is the brain of the future, electricity is its lifeblood. And that lifeblood is in dangerously high demand! Currently, AI-driven electricity consumption is at an all-time high. As a result, power grids are struggling to keep up. This is forcing utilities to rethink how they generate and distribute energy.

However, this phenomenon also presents lucrative opportunities for investors and traders like you. Want to know how?

In this article, we will understand how the demand for AI power is influencing the U.S. utility sector and what it means for investors, traders, and policymakers. You’ll discover how AI workloads are straining the U.S. power grid and driving massive utility sector investments, which companies (tech giants, AI chipmakers, and utility providers) are leading this energy-intensive revolution, and what risks (from energy shortages to regulatory uncertainty) could disrupt AI-powered industries.

Additionally, you will learn how using our real-time market analysis tool, Bookmap, can let you track market trends in energy and utility stocks. Let’s begin.

The Growing Power Demand from AI and Data Centers

Currently, there is a rapid growth of AI and cloud computing. This growth is:

- Increasing the power demand from data centers

and

- Putting pressure on the U.S. power grid.

As AI workloads scale, utilities must invest in energy infrastructure to meet rising electricity consumption. Let’s understand in detail:

How AI Workloads Are Straining the U.S. Power Grid?

AI-driven technologies are transforming industries. The digital transformation market topped $1 trillion in 2024. It got a major boost from AI and the Internet of Things (IoT). However, such rapid advancement comes with a significant rise in electricity consumption.

Please note that as AI models grow in complexity, they require vast computing power to handle tasks like the following:

- Deep-learning training,

- Real-time decision-making and

- Large-scale data processing.

This increased AI power demand is placing unprecedented pressure on the U.S. power grid. One of the biggest contributors to this surge in energy use is the training of AI models.

For example,

- Training OpenAI’s GPT models involves thousands of high-performance GPUs (graphics processing units).

- They consume enormous amounts of electricity over weeks or even months.

- Also, each new generation of AI models requires more computational resources.

- This further amplifies the demand for power.

Beyond model training, the deployment of AI in real-world applications adds another layer of energy consumption. Most AI-powered systems run in data centers for:

- Cloud computing,

- Machine learning inference and

- AI-driven analytics.

All these systems need continuous access to power. Some hyperscale data centers now consume hundreds of megawatts per facility, equivalent to the energy usage of a small city. This surge in demand creates challenges for power distribution and load balancing. Let’s see how utilities are reacting to this surge in demand:

Be aware that without these investments, the existing grid may struggle to handle the increasing load, which might lead to bottlenecks or reliability issues. To ensure a stable electricity supply, some companies are even exploring alternative solutions such as:

- AI-optimized energy management,

- Renewable power integration and

- Grid-scale battery storage.

Key Companies Driving AI Energy Consumption

The increase in electricity consumption is due to some of the world’s largest technology companies. Check the graphic below to learn about them:

Usually, these industry leaders scale their AI infrastructure. This increases the demand for high-performance computing and pushes the limits of the U.S. power grid.

The Role of Data Centers

Tech giants like Microsoft, Google, and Amazon are at the forefront of this shift. Their investments in cloud-based AI services require vast networks of data centers. Each of these data centers demands enormous amounts of electricity to support AI workloads.

Furthermore, the construction of hyperscale data centers is accelerating at an unprecedented rate. These massive facilities are designed to handle AI and cloud computing demands. They consume hundreds of megawatts per location. As a result, many utilities are racing to:

- Upgrade transmission infrastructure,

- Integrate AI-driven energy management systems,

- Explore next-generation solutions to balance supply and demand.

The Chipmakers are also chipping in.

The heart of AI are GPUs and specialized AI chips. They are made by chipmakers like Nvidia and AMD. These chips led to the development of powerful processors that come with substantial energy requirements. This further increases the burden on the electrical grid.

How U.S. Utilities Are Investing to Meet AI Demand?

To support the increasing power demand, the U.S. utilities are focused on:

- Grid modernization,

- Renewable energy expansion,

- Battery storage solutions,

- Upgrading transmission lines and substations, and

- Increasing power generation capacity.

All these efforts have led to the development of a stable energy supply for AI workloads. Let’s understand in detail:

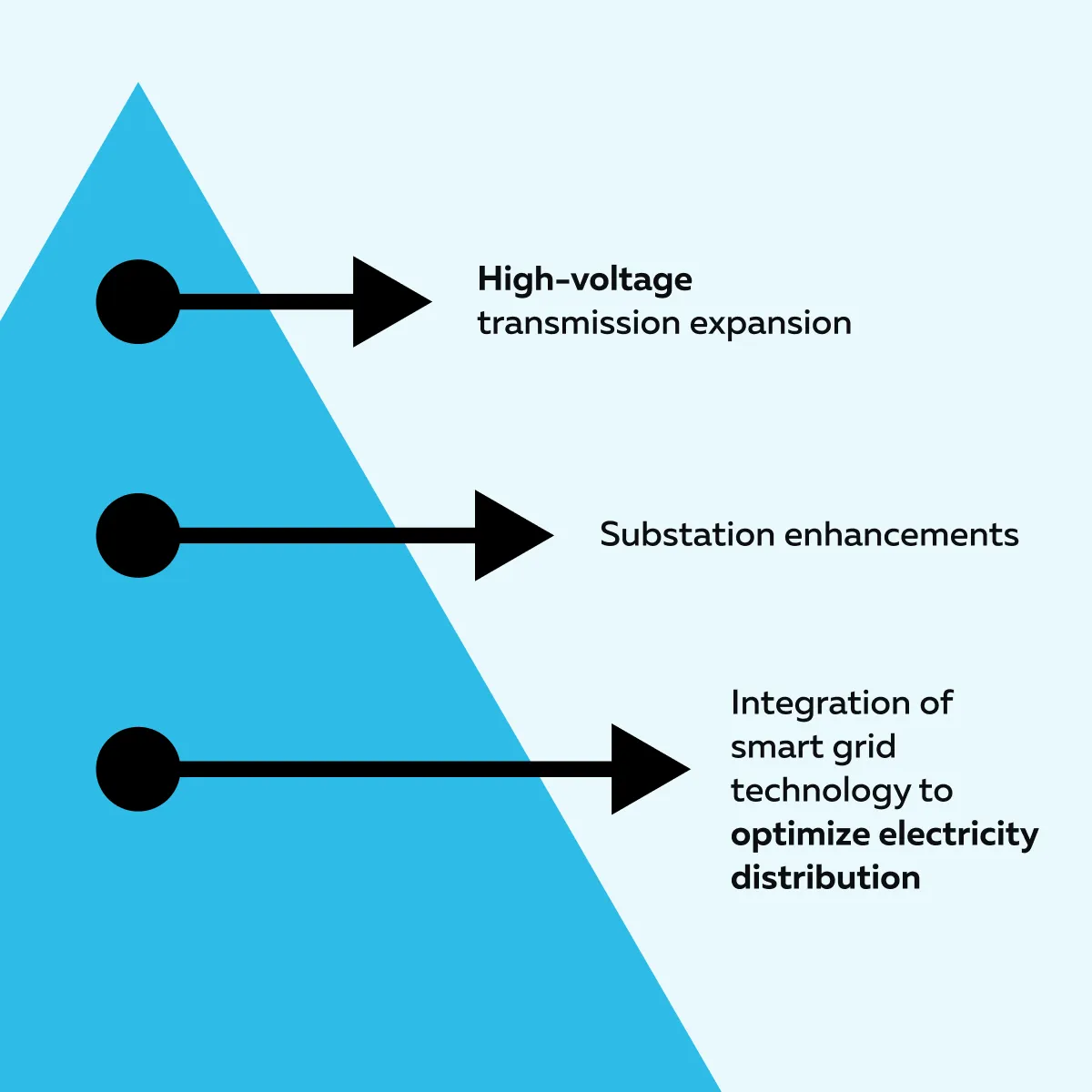

Grid Modernization and Infrastructure Expansion

Due to the rising demand for AI power, most U.S. utility companies are making significant infrastructure investments to prevent grid overload. Be aware that hyperscale data centers require stable and high-capacity power delivery. By 2026, AI data centers are expected to consume approximately 90 terawatt-hours (TWh) of electricity annually. This represents a tenfold increase from 2022 levels.

Thus. Major utility providers (like Dominion Energy and Duke Energy) are leading the way with multi-billion-dollar infrastructure projects. These investments are strengthening the power grid to support the growing number of:

- AI-powered data centers

and

- Cloud computing facilities.

Check the graphic below to learn about some common upgrades:

In the future, it is expected that AI-driven workloads will become a permanent fixture. Therefore, utility companies are ensuring that the grid remains:

- Resilient,

- Scalable, and

- Capable of handling future AI-related demand surges.

The Role of Renewable Energy in Powering AI

Nowadays, AI-driven electricity consumption is skyrocketing. U.S. electricity consumption is projected to reach 4,158 billion kWh in 2025. To supplement grid capacity, utilities are also turning to renewable energy sources such as:

- Solar,

- Wind, and

- Battery storage.

Be aware that renewable energy offers a sustainable alternative to traditional fossil-fuel power plants. Companies like NextEra Energy are making strategic investments in solar farms specifically designed to power AI-driven facilities. These large-scale solar projects are expected to:

- Provide clean and reliable energy to AI companies

and

- Reduce reliance on non-renewable resources.

Get a clearer view of utilities and energy market movements with Bookmap’s advanced visualization tools.

A major challenge

AI-related electricity consumption is not always stable. The fluctuating power needs of AI workloads can create imbalances in the grid.

Therefore, utility companies are investing in large-scale battery storage systems. Using these systems, they can store excess renewable energy and deploy it when AI workloads peak.

Market Impact: Trading and Investing in AI-Driven Utility Stocks

The rising demand for electricity from AI companies is creating new investment opportunities. It is causing utilities to expand energy infrastructure so that they can meet AI power demand. Here, traders and investors like you should keep an eye on:

- Utility stocks,

- Grid modernization projects, and

- Renewable energy investments.

This can help you capitalize on the sector’s growth. Let’s see how:

Utility Stocks Benefiting from the AI Boom

Due to an increase in electricity consumption due to AI, utility stocks are gaining investors’ attention. Companies that are actively expanding their energy infrastructure to support AI workloads are seeing increased demand for their services, making them strong contenders in the stock market.

Some of the key utility stocks to watch

- Dominion Energy (D)

- NextEra Energy (NEE)

- Duke Energy (DUK)

- AES Corporation (AES)

- Southern Company (SO)

These companies are leading the way in AI-related grid upgrades. They are investing billions in power transmission, substations, and renewable energy projects. Their goal is to support data centers and cloud computing. Also, these utilities are working closely with tech companies to provide them with a stable electricity supply for AI-driven operations.

Your role as an investor

Due to a surge in AI power demand, investors like you should rotate into utility stocks. That’s because they offer both stability and long-term growth. Unlike high-volatility tech stocks, utilities provide consistent revenue streams. This makes them attractive for risk-conscious investors who are looking to benefit from the AI and energy infrastructure boom.

The Role of Dividend Stocks in AI-Driven Utilities

One of the key advantages of utility stocks is their stable dividend yields. Many utility companies pay out reliable dividends to their shareholders. This makes them attractive in an uncertain market. For example,

- By investing in high-yielding dividend stocks in the utility sector, you can get steady returns.

- At the same time, you can participate in the AI-driven energy boom.

As an investor, if you are looking for both growth and income, you may find these stocks appealing. That’s because they offer capital appreciation opportunities along with regular dividend payouts.

How Bookmap Can Help You Track Institutional Flows into High-Dividend Utility Stocks?

Our market analysis tool, Bookmap, is a powerful trading platform. It provides real-time order flow analysis. Using it, you can visualize:

- Market liquidity,

- Price movements and

- Large institutional trades.

When it comes to high-dividend utility stocks, you can use our Bookmap’s features to track institutional buying and selling activity. This allows you to position yourself strategically.

Key Ways Bookmap Traders Can Track Institutional Flows

Let’s check out how you can use some key features of Bookmap:

| Features | Explanation |

| Heatmaps for Large Orders |

|

| Volume Dots and Order Flow Analysis |

|

| Iceberg Order Detection |

|

| Liquidity Shifts and Repricing |

|

Track how institutional investors are positioning in AI-influenced utility stocks using Bookmap’s real-time data.

Risks and Challenges in AI-Driven Power Investments

Investing in AI-driven power infrastructure comes with challenges, such as:

- Energy supply constraints

- Regulatory uncertainty

- Market volatility

As the demand for AI power grows, utilities face pressure to expand grids. While making such an expansion, they need to deal with government policies and interest rate risks. You must analyze these factors while investing. Let’s gain more clarity:

Energy Supply Constraints and Blackouts

By the end of 2025, global AI adoption is projected to surge by 20% and reach more than 378 million users. Due to this increased adoption, the demand for electricity is outpacing the expansion of power grids. AI models, data centers, and cloud computing require massive amounts of energy. This further puts pressure on utilities to scale up quickly.

However, building new power plants, substations, and transmission lines takes time (often several years). Some utility companies have already warned that in certain states, there could be power shortages by 2026. If utilities can’t expand their grids fast enough, the risk of energy constraints and blackouts will rise (especially in areas with high concentrations of data centers).

Regulatory and Policy Uncertainty

The utility sector is heavily regulated. Government policies on energy consumption, carbon emissions, and clean energy could impact the growth of AI-powered industries.

For example,

- Stricter environmental regulations could limit fossil-fuel-based power generation.

- This can force utilities to invest more in renewable energy or other alternatives.

The previous Biden administration’s clean energy mandates could influence which utilities benefit the most from AI-driven growth. Companies that are investing in solar, wind, and battery storage may have an advantage. In contrast, those relying on traditional power sources could face more restrictions.

These policy shifts create uncertainty for investors and businesses trying to plan for long-term energy needs.

Market Volatility in Utility Stocks

AI-driven utility stocks are gaining investor interest. But market volatility remains a key risk. This is primarily caused by rising interest rates, which can make capital-intensive energy projects more expensive to finance.

Furthermore, utility companies rely on borrowing to build new infrastructure. Higher rates could slow down investments in grid expansion and renewable energy projects.

Conclusion

There has been an increasing demand for electricity from leading AI-related companies. This surge in demand is forcing U.S. utility companies to invest heavily in grid expansion, renewable energy, and energy storage solutions. As AI workloads continue to rise, utilities must also modernize their power infrastructure to prevent supply shortages and ensure a stable electricity grid.

This shift presents new opportunities for investors and traders like you. Utility stocks, particularly those involved in AI-powered data centers, energy infrastructure, and grid modernization, are becoming more attractive. High-dividend utility stocks also offer a stable investment option for those looking for steady returns in a growing market.

To gain a competitive advantage, you can start using our Bookmap’s order flow and liquidity tracking tools. They will allow you to monitor institutional activity in utility stocks and energy markets. By tracking large trades and liquidity shifts, you can position yourself for gains as AI-related investments accelerate. Monitor market trends in the utilities sector with Bookmap’s liquidity and order flow insights.