Ready to see the market clearly?

Sign up now and make smarter trades today

Education

February 18, 2025

SHARE

Trading Momentum Stocks: Order Flow Strategies for Breakout Opportunities

The mantra of life – when enjoying a good phase, seize every moment! The mantra of stocks – when market trends are right, ride the wave to earn maximum profits! Yes, we can definitely say that trading is a reflection of life itself. Both are driven by “trends,” and when you spot the right ones, success follows. In 2025, momentum trading is expected to be a key trading strategy. It is about catching the wave of stocks that are moving quickly, either up or down. Wish to learn it?

In this article, we will explore everything you need to know about momentum stocks and how to trade them successfully in 2025. You’ll learn what momentum stocks are, why they matter, and how to use order flow tools, specifically Bookmap, to enhance your trades. You will also learn how to spot breakouts, use RSI indicators to judge whether a stock is overbought or oversold, and recognize when momentum is fading. These are all crucial skills that will maximize your trading opportunities.

Lastly, we will look at key sectors, such as AI, electric vehicles (EV), and biotech, that are ripe for momentum trading. These sectors are filled with potential and offer many chances for profit. Let’s begin.

What Are Momentum Stocks and Why Trade Them?

Momentum stocks are those that experience rapid price movements, either upward or downward. Usually, these movements occur due to strong catalysts, such as:

- Earnings reports,

- Major news, and

- Emerging industry trends.

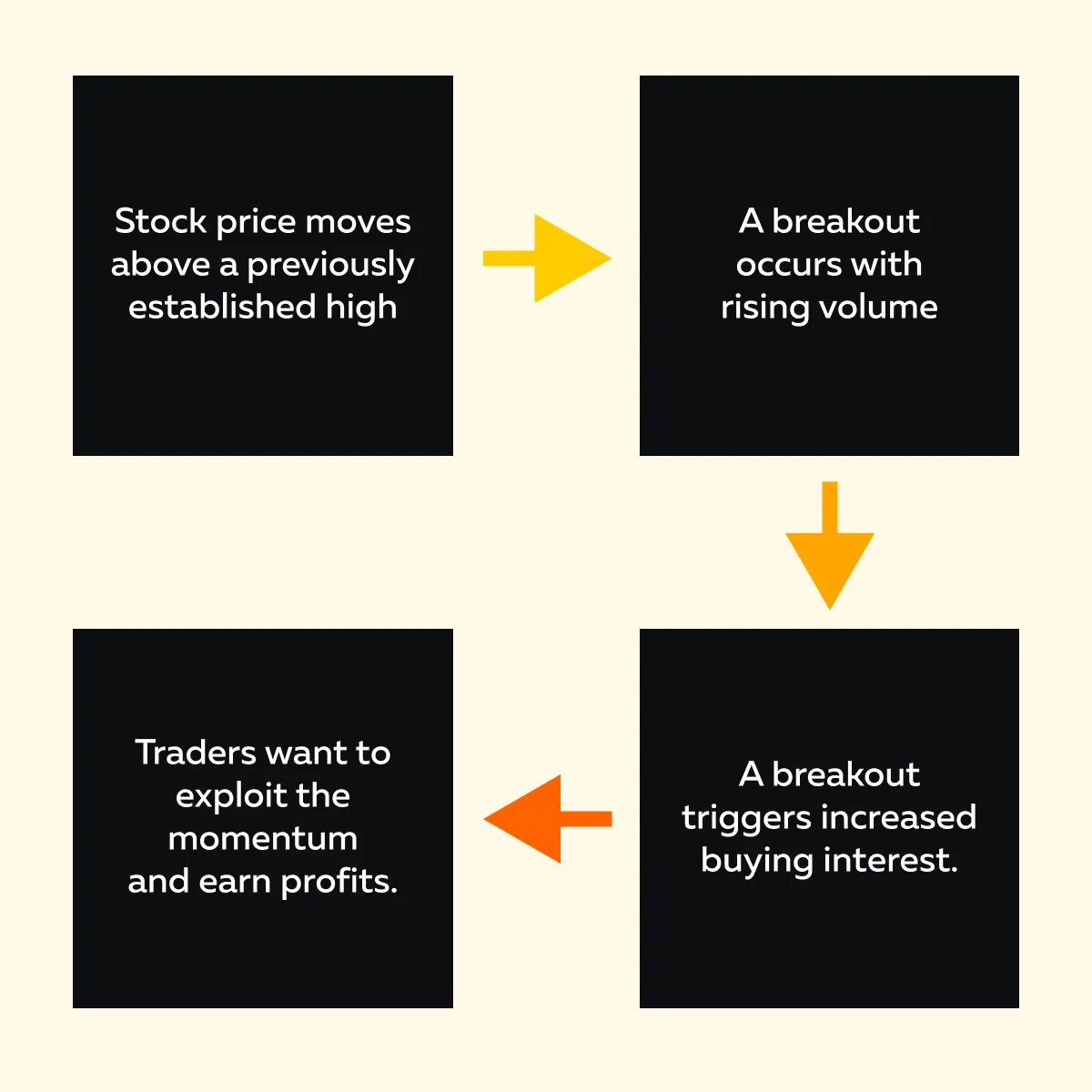

These stocks attract traders who are looking to capitalize on short-term price surges by following the trend until signs of reversal appear. See the graphic below to learn the core idea behind trading momentum stocks:

Why Trade Momentum Stocks?

Momentum stocks appeal to traders because of their high volatility. Volatility creates frequent trading opportunities. Since these stocks move rapidly, traders can enter and exit positions within short periods, allowing them to make substantial gains.

Mostly, traders identify breakout opportunities and ride trends by analyzing:

- Price trends,

- Volume spikes, and

- Order flow momentum strategies.

Please note that trading breakout stocks with strong momentum can be a lucrative approach when executed with proper risk management.

For more clarity, let’s study some examples from 2024 and learn about some stocks that demonstrated strong momentum in the AI and EV sectors:

| AI Sector Momentum | Electric Vehicle (EV) Sector Momentum |

|

|

Capitalize on strong momentum trends with Bookmap’s advanced trading insights.

Key Indicators to Spot Momentum Stocks

To pick the best momentum stocks in 2025, you must analyze some specific indicators that signal strong price movements. Let’s check them out:

A) Volume Spikes

One of the most critical factors is “trading volume.” It helps confirm whether a stock’s momentum is sustainable. By understanding how volume interacts with price action, traders can:

- Refine their strategies

and

- Capitalize on trends.

Be aware that a sudden surge in trading volume is a key signal that a stock is gaining momentum. When a stock’s volume significantly exceeds its average daily volume, it often indicates heightened interest from:

- Institutional investors,

- Day traders, and

- Algorithmic trading programs.

Why It Matters?

Large volume confirms that a price movement is backed by strong participation. This reduces the chances of false breakouts. For example:

- Say a stock usually trades 1 million shares daily.

- But suddenly, it spikes to 5 million after an earnings surprise.

- Now, this indicates a strong trading breakout stock opportunity.

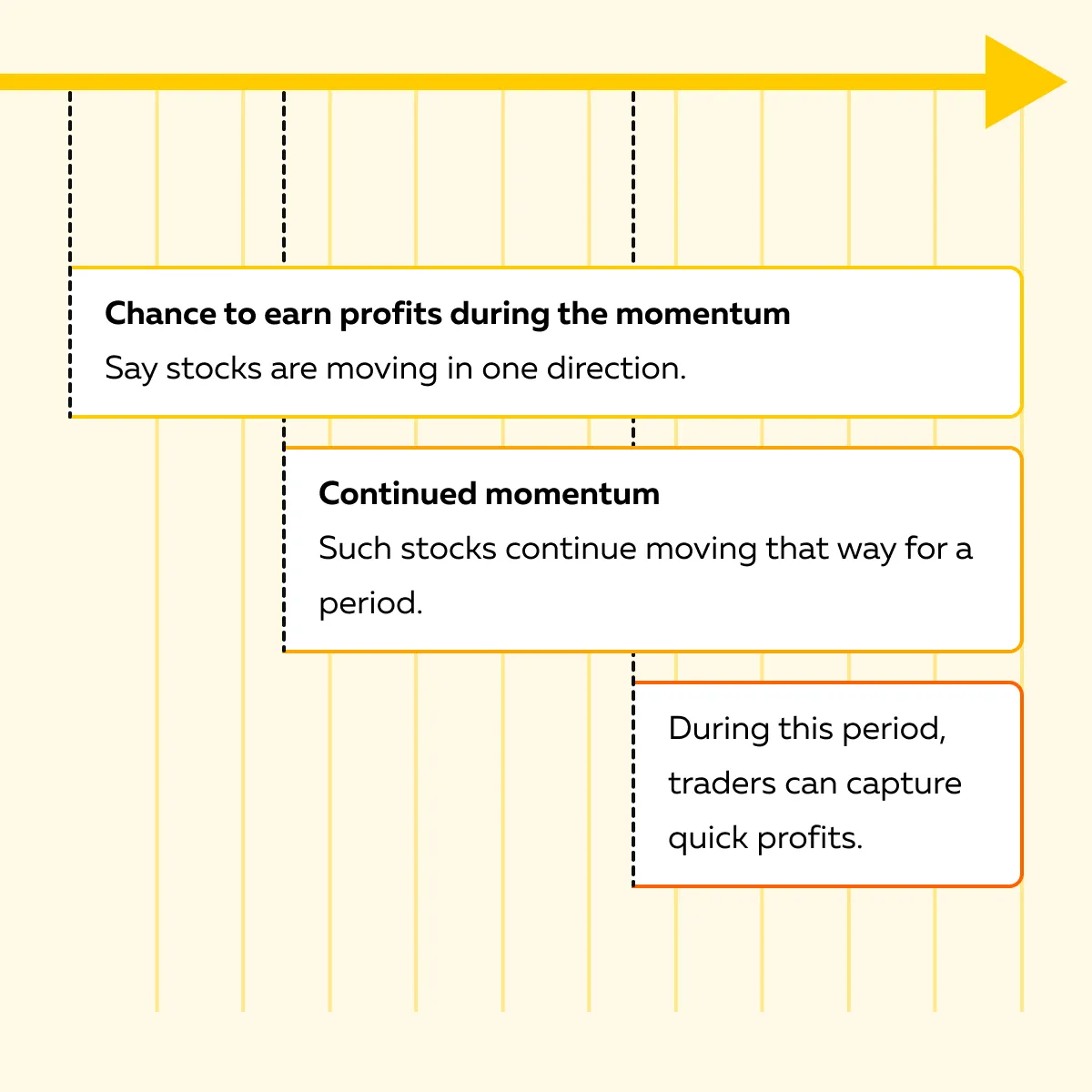

Stay Ahead of the Market Using Bookmap

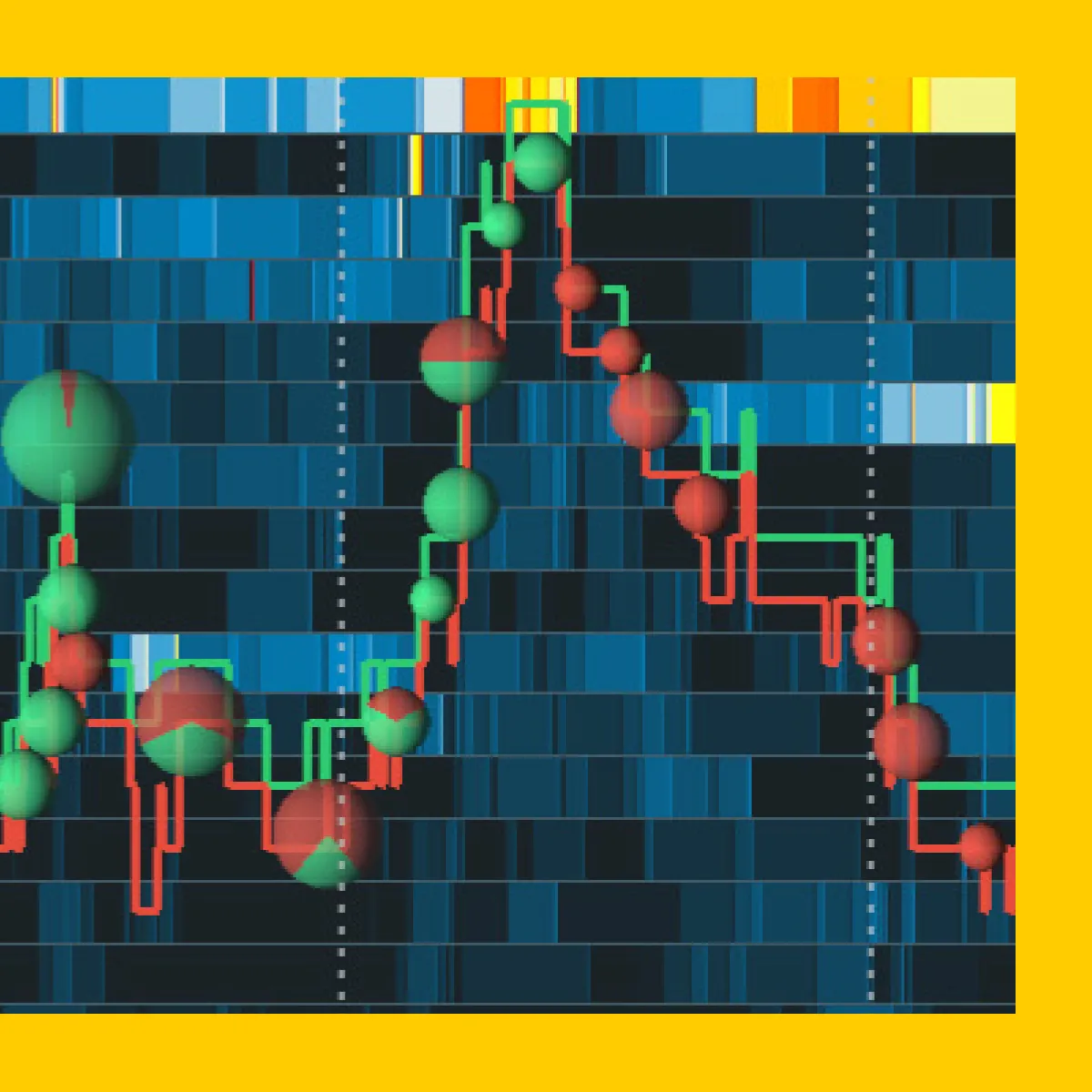

Bookmap is our advanced market analysis tool. Using it, you can develop smart order flow momentum strategies by visualizing volume bubbles. Check the graphic below to see how such a visualization helps:

By tracking volume spikes, traders can enhance their ability to trade momentum stocks. They can also be assured that they are entering positions with strong liquidity and price movement.

B) Price Action and Breakouts

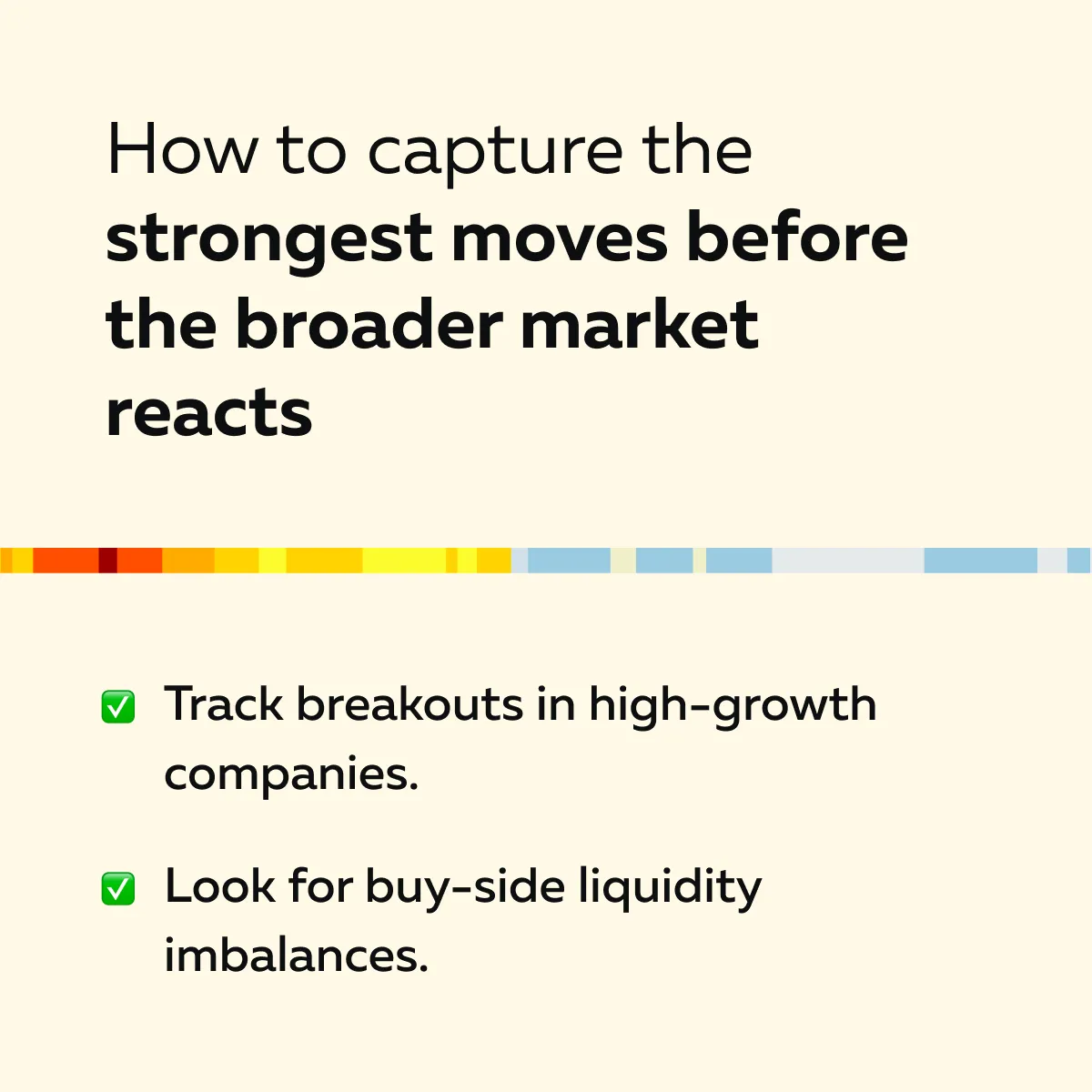

One of the strongest signals for identifying momentum stocks in 2025 is price action. This is particularly true when a stock breaks through key resistance levels. Be aware that a breakout occurs when the stock price moves above a previously established high. This often triggers increased buying interest as traders look to capitalize on the momentum. Such breakouts are usually accompanied by rising volume. This confirms the strength of the move.

For more clarity, check the graphic below:

Why It Matters?

When a stock surpasses resistance, it attracts more traders and institutions. This further fuels the upside. For example:

- Say a biotech stock had been trading near its 52-week high.

- After announcing positive clinical trial results, the stock broke above its previous high.

- This signals a strong trading breakout stock opportunity.

Track directional market moves in momentum stocks with Bookmap’s liquidity heatmap and volume tools.

Using Bookmap to Detect Breakouts

Several advanced traders use Bookmap to track:

- Liquidity zones

and

- Breakout patterns.

By analyzing buy and sell orders, they identify whether a breakout is likely to hold or face resistance. Additionally, they monitor pullbacks on Bookmap. This allows them to confirm whether a stock is:

- In a healthy uptrend

or

- At the risk of a reversal.

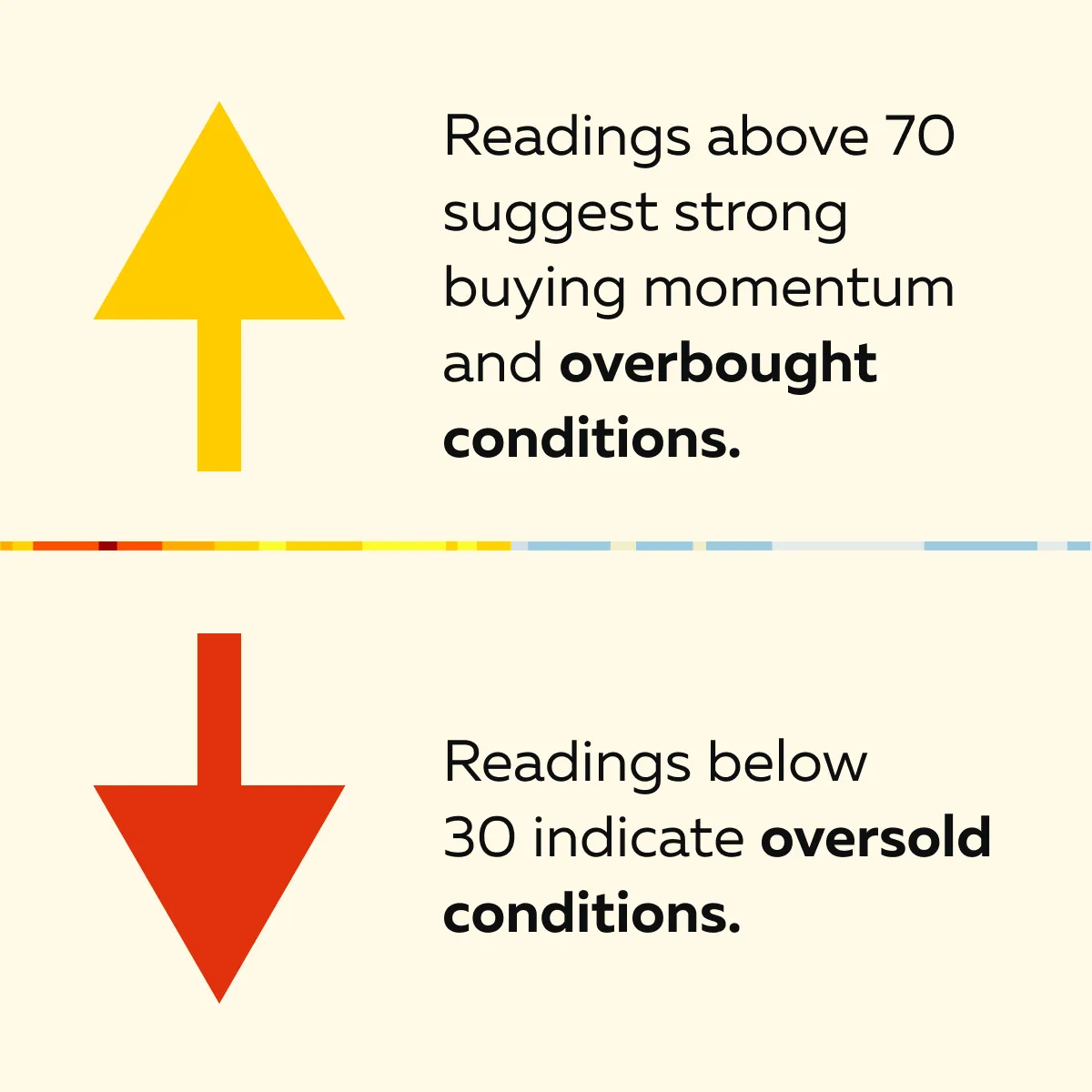

C) Relative Strength Index (RSI) and Trend Strength

The Relative Strength Index (RSI) is a key momentum indicator. It helps traders assess whether a stock is overbought or oversold. RSI values range from 0 to 100. See the graphic below to learn how it is read:

Why It Matters?

An RSI above 70 signals strong momentum. This makes it useful in spotting momentum stocks in 2025. However, excessively high RSI levels may also indicate a likely pullback. Therefore, traders should confirm signals before entering trades.

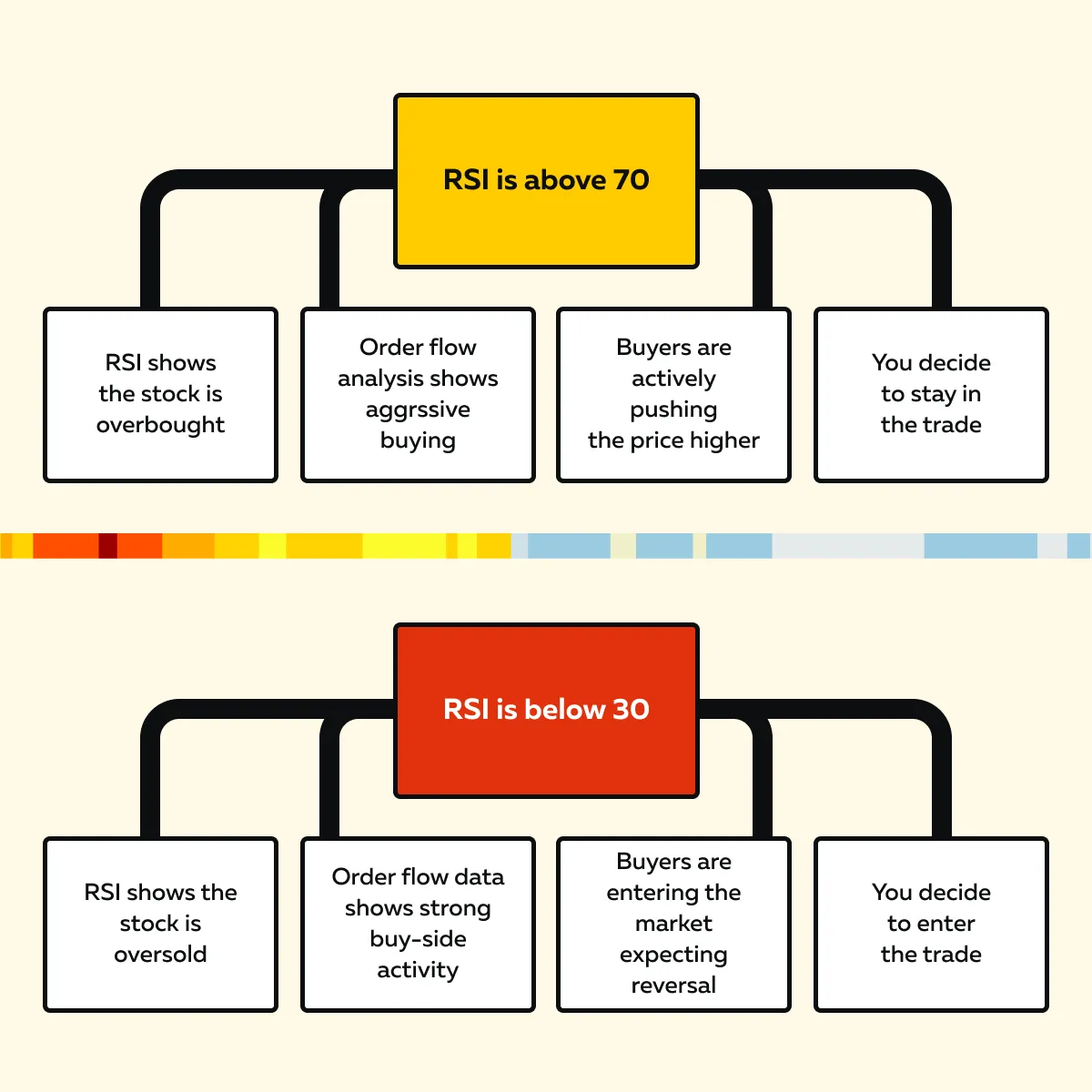

To refine entries, they should avoid relying solely on RSI. Instead, traders can combine RSI readings with order flow momentum strategies. This will allow them to pinpoint high-probability trades.

Using Order Flow Analysis for Confirmation

By integrating RSI with order flow data, traders can determine whether momentum is sustainable. Let’s see how through the graphic below:

In this way, this combined approach enhances accuracy when trading momentum stocks.

Order Flow Strategies for Momentum Trading

To trade momentum stocks profitably, you must have an understanding of order flow. That’s because it reveals the real-time supply and demand positions behind price movements. By analyzing liquidity imbalances, you can anticipate breakouts before they happen. This improves your trade timing and execution.

Let’s check out some popular order flow strategies you can use for trading momentum stocks:

Identifying Breakout Zones with Order Flow

Breakouts occur when a stock moves beyond a key price level. This movement is often fuelled by aggressive buying or selling. Please note that order flow momentum strategies help traders spot these zones by monitoring:

- Liquidity shifts

and

- Large orders.

The Concept of Liquidity Imbalances & Order Stacking

If traders notice large buy orders stacking just above a resistance level, it signals an impending trading breakout stock opportunity. For example:

- Suppose a stock is struggling to break past $1,00.

- But a surge in aggressive buy orders appears above this level.

- This suggests buyers are willing to absorb the selling pressure.

- This situation increases the likelihood of a breakout.

How to Use Bookmap for Confirmation?

Bookmap’s heatmap visualization equips you to see where liquidity is thinning. If sell orders disappear at resistance while buying pressure increases, it indicates that momentum is strong. This tool helps traders confidently enter positions in momentum stocks in 2025.

Riding the Momentum Wave

Once a stock breaks out, traders need to assess whether the momentum is:

- Sustainable

or

- Likely to fade.

A key technique in trading momentum stocks is “following aggressive market orders and large trades.” This enables you to confirm trend strength. It particularly matters because large traders (such as institutions and hedge funds) drive most of the market’s movement. By tracking their activity, you can ride strong trends rather than getting caught in false breakouts.

For example:

- Say a stock surges above the resistance.

- Bookmap’s Depth of Market (DOM) Pro shows sustained buying pressure.

- It validates a long trade.

- Conversely, if large sell orders appear, the move may lose steam.

Order Flow Also Helps in Confirming Momentum

Order flow momentum strategies also help traders differentiate strong trends from temporary spikes. Check the graphic below to learn how:

Spotting Exhaustion and Reversal Signals

Momentum trading is not just about identifying breakouts. It is also about recognizing when a trend is losing steam. Through order flow momentum strategies, traders can spot “exhaustion points.” At these points, buying or selling pressure starts to weaken. This signals a likely trend reversal.

Please note that when trading momentum stocks, knowing when to exit is just as important as knowing when to enter. That’s because if momentum fades:

- A stock can quickly reverse

and

- Wipe out all the gains.

For example:

- Say a momentum stock has been rallying.

- But liquidity on the bid side suddenly thins.

- This means fewer buyers are willing to step in at higher prices.

- Now, this indicates a loss of demand and an impending pullback.

How to Use Order Flow for Reversal Detection?

By analyzing order flow on Bookmap, you can easily track where large buyers or sellers disappear. For example, if you observe on Bookmap that aggressive buying has stalled and sell orders have begun stacking up. This signals that the stock’s “trading breakout phase” may be ending.

By recognizing these cues, you can lock in profits before a full-blown reversal occurs.

Sectors and Trends to Watch in 2025

Identifying the right sectors is crucial when trading momentum stocks. That’s because industry trends often dictate where the strongest moves occur. In 2025, the following sectors are expected to remain dominant:

- AI and automation,

- Electric vehicles, renewable energy, and

- Biotech and healthcare.

Let’s learn in detail:

AI and Automation

The world is experiencing rapid advancements in artificial intelligence and automation. There is an increasing adoption of:

- Machine learning,

- Robotics, and

- AI-driven software.

This creates high-growth opportunities in the stock market. Investors and traders can expect strong momentum trends in this sector. Moreover, AI-driven businesses often experience explosive growth. This makes them prime candidates for momentum stocks in 2025.

For example:

- Nvidia, a leader in AI chips, saw massive gains in 2024.

- This happened due to strong earnings and product innovation.

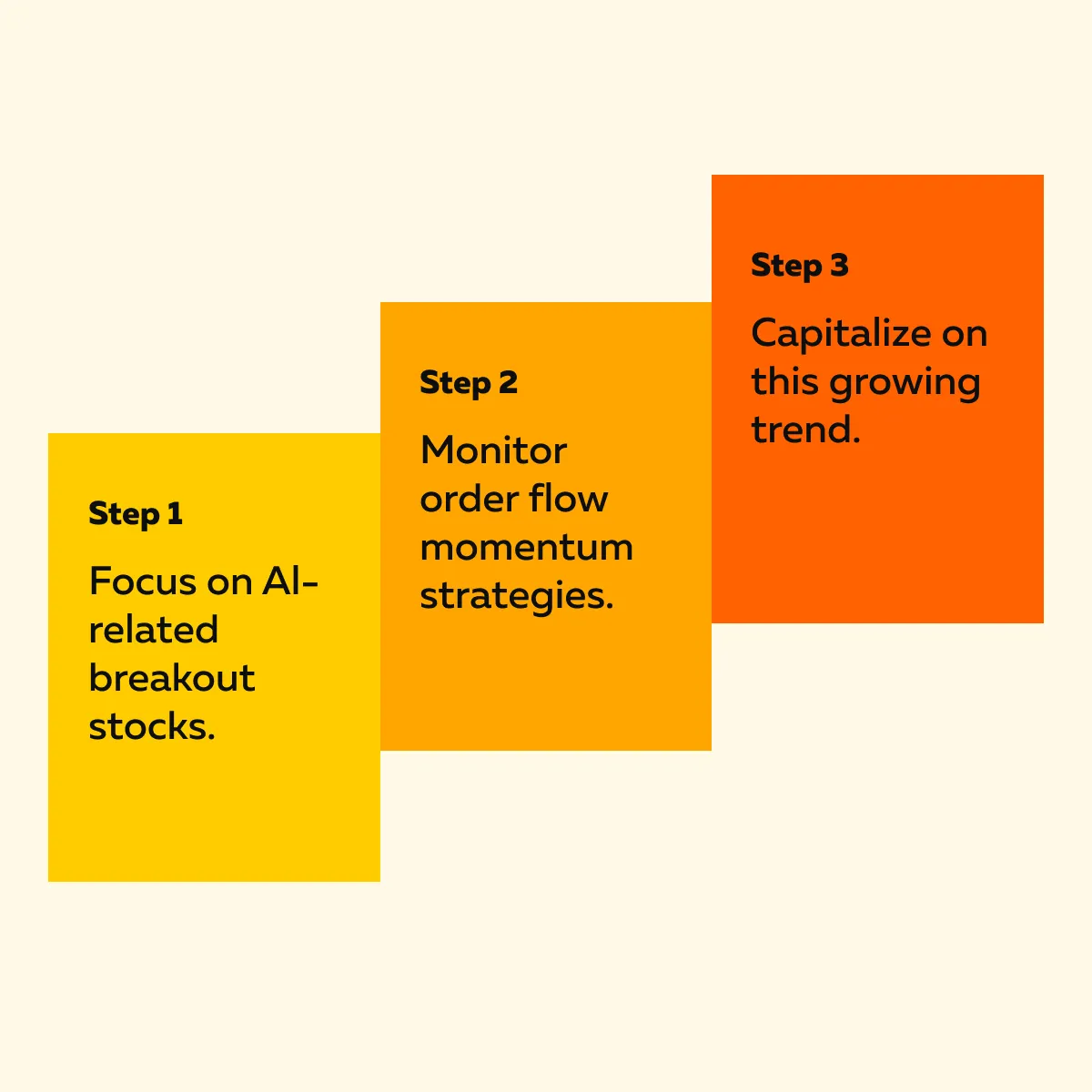

In 2025, smaller AI-focused companies may experience similar momentum. Such momentum is expected after major product launches, acquisitions, or breakthrough innovations. Check the graphic below to learn how traders can identify high-potential opportunities:

Electric Vehicles and Renewable Energy

The EV and renewable energy sectors are set to be major providers of momentum stocks in 2025. As nations invest in green infrastructure, the companies engaged in the following businesses are likely to see strong momentum:

- EV production,

- Battery technology, and

- Clean energy solutions.

Be aware that with increased subsidies and investments in renewable energy, stocks in this sector often experience rapid price surges. This makes them ideal for trading breakout stocks.

For example:

- Till now, Tesla has led the EV momentum wave.

- But in 2025, emerging players like Fisker or Rivian could trigger sector-wide trends.

- These companies will push up valuations across the industry.

Try to Spot Momentum in EV and Renewable Stocks

To profit, you must monitor large institutional orders in leading EV and clean energy stocks. Check the graphic below to see what you must do:

Biotech and Healthcare

In 2025, biotech and healthcare stocks will also drive strong momentum. This will particularly happen when there are FDA approvals or positive drug trial results. These catalysts are expected to trigger rapid price movements, which will create significant trading opportunities for investors.

One must be aware that biotech momentum stocks often experience dramatic price surges due to regulatory news. Usually, it sparks sector-wide rallies.

For example:

- Small-cap biotech stocks frequently see explosive growth after:

- Positive clinical trial results

or

- FDA drug approvals.

- A stock like Moderna or a lesser-known biotech company may experience a significant rally following breakthrough data.

Use Bookmap’s real-time order flow analysis to spot breakout momentum stocks before they move.

Here, The Trick is to Identify Momentum with Order Flow

By analyzing the order flow on Bookmap, you can spot when biotech stocks break through key resistance levels after receiving positive news. During this period, specifically watch for liquidity imbalances and monitor large buy orders.

By doing so, you can ride the momentum wave and capitalize on these breakout stocks before they become widely recognized.

Risks of Momentum Trading and Mitigation Strategies

While momentum trading offers the potential for substantial gains, it also carries significant risks. These risks especially occur when trading highly volatile stocks. To maintain a successful trading strategy, you must understand and try to mitigate these risks. Below are the primary risks associated with momentum trading:

I) Chasing Trades: Entering Too Late

One of the most common mistakes in momentum trading is entering a trade too late. You make this mistake by entering the market after the momentum move has already begun to lose steam. Buying after a substantial run-up exposes you to sharp reversals, resulting in losses.

Solution

To avoid this, use our advanced market analysis tools, such as Bookmap. Using it, you can easily confirm entry points based on real-time order flow data. This equips you to assess if the momentum is still strong.

In this way, you can be assured that you are entering near-optimal levels before prices move too far. Liquidity bubbles and price action signals on Bookmap can help you identify ideal entry points and avoid chasing trades.

II) High Volatility: Sharp Reversals

Momentum stocks are often prone to sharp reversals. This is primarily due to their high volatility. Mostly, momentum trades change direction rapidly. Due to this, you may find yourself trapped in a position (if the trend reverses unexpectedly) which can lead to significant losses.

Solution

Here, you must set tight stop-losses. This will protect your capital in case of reversals. Additionally, liquidity zones should be monitored to know when the buying or selling pressure is diminishing. Such an understanding enables you to anticipate pullbacks before they happen.

Through Bookmap’s heatmap, you can help visualize these shifts in real-time. This allows you to adjust your positions accordingly.

III) Over-leverage: Amplified Losses

Leverage is often used to amplify the profits from momentum trading. However, at the same time, it also increases the risk of sustaining amplified losses. Be aware that over-leveraging can cause significant drawdowns, especially if you are unable to exit a losing position quickly.

Solution

To manage this risk, you should adjust position sizes based on:

- Your risk tolerance

and

- The volatility of the stock.

Try using smaller position sizes during high-volatility periods or when entering at higher levels of risk. This will help you control exposure. It is also necessary to have a risk management plan in place that accounts for possible losses (to avoid devastating setbacks).

Key Risk Management Tools

By understanding these risks, you can increase your chances of success when trading momentum stocks. Additionally, you can ride the momentum wave with a clear and strategic approach. Below are the three common tools/strategies you must follow:

| Analyze on Bookmap | Place stop-loss orders | Stick to an appropriate position size |

and

|

|

|

Conclusion

Momentum trading is becoming increasingly important in 2025. That’s because the markets are continuing to experience rapid price movements. By focusing on stocks that are showing strong momentum, you, as a trader, can capture significant gains over short periods. By focusing on emerging sectors, including AI, electric vehicles (EV), and biotech, you can have a wealth of opportunities to profit. Stocks in these industries often experience rapid growth. This makes them ideal for momentum trades.

However, understanding when momentum will continue or reverse is the key to success. This is where our modern tools, like Bookmap, come in. Using them, you can get a competitive edge by gaining real-time insights into order flow and liquidity trends. Moreover, with Bookmap, you can see where large market players are buying or selling. This facilitates you in entering or exiting trades at the right time.

Explore how Bookmap can enhance your momentum trading strategies with real-time insights into order flow and liquidity trends.