Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 29, 2024

SHARE

How Rising Copper Prices Can Signal Economic Recovery: From Commodities to Corporate Earnings

Copper may not have the flashiness of gold or the allure of silver, but when it comes to predicting economic trends, copper is the Oracle of commodities. Yes, known as “Dr. Copper,” it is used to forecast economic cycles. This industrial metal is deeply tied to the health of major industries like construction, manufacturing, and electronics. Have you ever tracked copper’s price fluctuations or studied its price action to predict when economies will grow or slow down?

In this article, we study in detail why copper prices matter so much in understanding economic cycles. You’ll learn the copper’s role in industries and what makes it highly sensitive to changes in global activity. Also, you will see how rising or falling prices can indicate economic growth or recession.

We’ll also explore how copper serves as a leading indicator of recovery and impacts both corporate earnings and stock prices. Additionally, you will study trading strategies like Trend-following and Breakout trading. Finally, we will see how tools like Bookmap can assist traders in identifying key market trends. Let’s get started.

Why do Copper Prices Matter in Economic Cycles?

Copper is an important material used in various sectors, such as construction, electronics, and transportation. The demand for copper is tied closely to global economic activity which makes it an indicator of economic health. When industries are booming, the need for copper increases due to its widespread application. Due to this rise in demand, the copper prices are pushed higher. This reflects stronger industrial production and business growth.

“Dr. Copper” and Economic Predictions

Copper is often called “Dr. Copper.” That’s because it’s seen as a predictor of economic trends. When copper prices increase, it usually signals economic recovery or growth, especially in the manufacturing and construction sectors. Most investors and analysts follow this rule because copper is a fundamental material for infrastructure. Usually, higher demand for it indicates rising activity in these sectors.

For example, after the 2008 financial crisis, copper prices rose as new infrastructure projects were sanctioned. Eventually, industrial production grew and showed signs of economic recovery.

In this way, by closely tracking copper prices, economists can assess whether industries are expanding or contracting. This makes it a useful tool for predicting economic cycles.

Copper Prices and Recession: What Happens During Economic Downturns?

During economic downturns, copper prices fall. This happens due to reduced demand for industrial materials. As businesses cut back production and consumers spend less, sectors like construction, manufacturing, and transportation also scale down. Since copper is heavily used in these industries, the demand drops, which ultimately results in lower prices.

For example,

- In early 2020, the COVID-19 pandemic caused a global economic slowdown.

- Many industries halted operations due to lockdowns.

- As industrial activity reduced sharply, global copper demand plummeted.

- This led to a steep decline in prices.

- Such a situation shows the weakening economy and reduced industrial output during the recession.

Are you interested in trading commodities like copper? Leverage Bookmap’s advanced visualization tools to get a clearer view of market trends and potential price movements.

Copper Acts as a Rebound Indicator

Copper prices often act as an early sign of economic recovery after a recession. As businesses restart production and infrastructure projects resume, demand for copper rises. This leads to a rebound in copper prices, which indicates that industrial activity is picking up. Also, it signals improving economic conditions.

For example, in 2021, global economies reopened following the COVID-19 pandemic. As a result, copper prices surged. This rise reflected increased industrial production, with sectors like construction and manufacturing consuming more copper. The price hike was seen as a positive indicator of the return of economic growth.

The Chain Reaction: From Rising Copper Prices to Corporate Earnings

Rising copper prices have a direct impact on industries. Check the graphic below to see which industries are impacted the most:

As copper demand increases, it signals that businesses are expanding operations and investing in infrastructure. Also, it suggests that organizations are increasing production capacity. It must be noted that the sectors mentioned above heavily rely on copper for:

- wiring,

- machinery,

and

- building materials.

Therefore, higher prices suggest that economic activity is intensifying. When companies use more copper, it reflects their confidence in future growth and market demand.

Impact on Corporate Earnings and Stock Prices

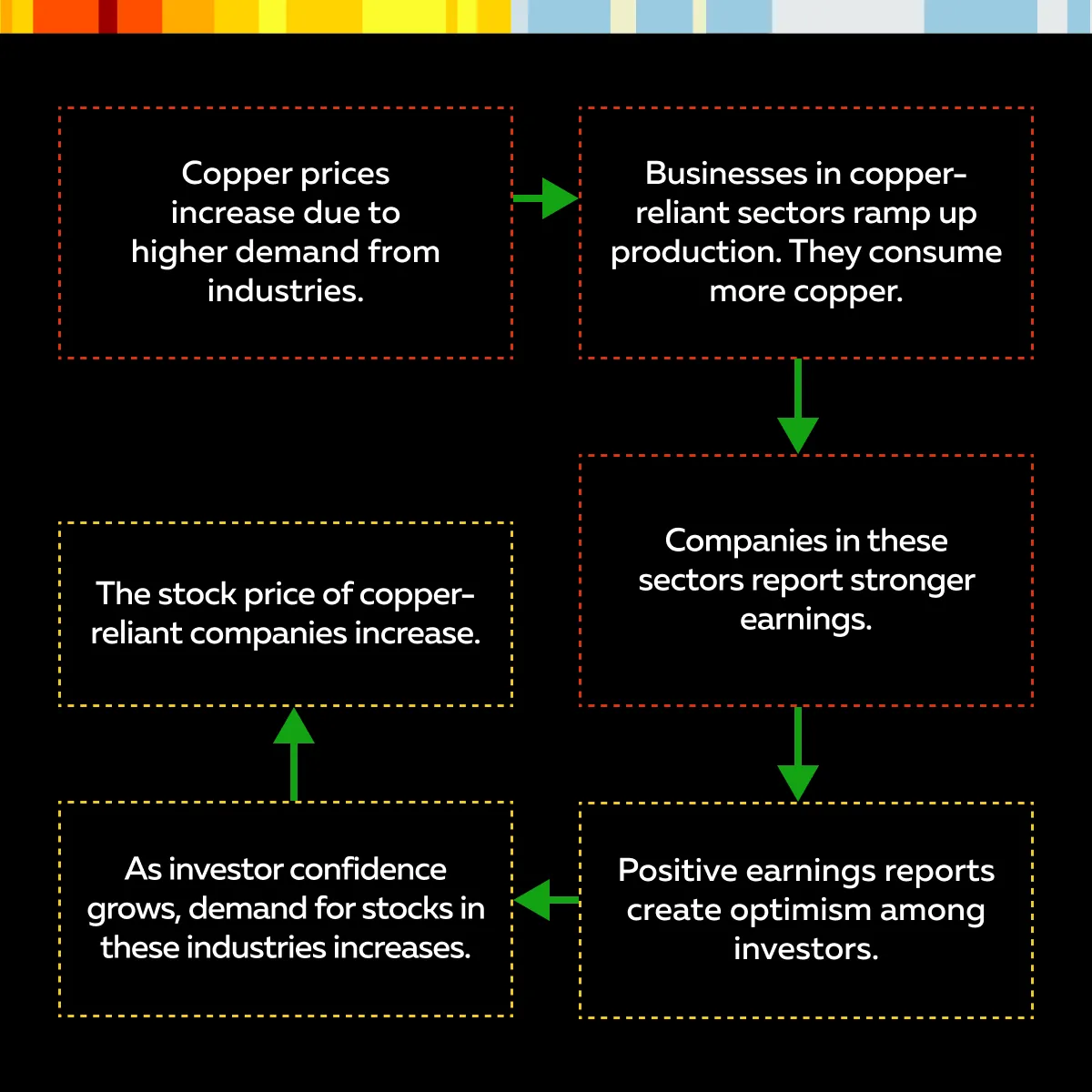

As copper prices rise and industries flourish, companies that rely on copper reflect stronger financial performance. Increased demand for copper-based materials means higher revenues for businesses dependent on it. This surge in earnings leads to more optimistic investor sentiment, which pushes up the stock prices of companies in these industries. For more clarity, understand the concept through the graphic below:

For example:

- Say a construction company reports better-than-expected earnings during periods of rising copper prices.

- Increased demand for copper-based materials such as electrical wiring and pipes signals higher project activity.

- This, in turn, boosts the company’s revenue.

- The company reports strong quarterly earnings.

- This increases its stock price as investors see potential for continued growth.

Stay ahead of market trends by monitoring commodity prices with real-time data. Use our platform Bookmap’s heatmap and order flow tools to track liquidity in key markets like copper.

Tracking Copper Prices for Market Insights

Several investors and analysts track copper prices to understand market trends and economic health. Since copper is used in several industries, its price movements are highly sensitive to shifts in industrial activity. Thus, copper’s demand directly reflects how these key sectors are performing.

How to Use Copper as an Early Warning System?

Copper prices can be used as an “early warning system” to predict economic recovery or slowdown. Because copper is so integral to industrial production, an increase in its price is a sign that businesses are ramping up activity. When copper prices begin to rise, it usually means that companies are preparing for higher output, either due to:

- greater demand,

or

- increased infrastructure projects.

This price rise signals economic growth ahead, particularly in sectors like manufacturing and construction. Please note that these sectors are among the first to respond to changes in economic conditions. Investors view this as a signal to start adjusting their portfolios in anticipation of better financial performance from companies tied to these industries.

On the other hand, when copper prices fall, it is often an early sign of an economic slowdown. Reduced demand for copper suggests that:

- industries are cutting back on production,

and

- businesses are anticipating weaker consumer demand.

This can be an early indication that a recession or economic downturn is on the horizon. Also, this prompts investors to take a more cautious approach.

Connecting Copper to Broader Market Trends

Rising copper prices often precede gains in broader stock market indices. This is especially true for economies heavily reliant on industrial production and infrastructure development. When copper prices surge, it indicates that some companies are likely to report stronger earnings due to increased demand for copper-related products and materials.

As the earnings of these companies rise, investor confidence boosts. It often leads to gains in stock prices. For example,

- When copper prices rise, companies involved in mining, construction, and heavy equipment manufacturing experience higher profitability.

- This results in positive earnings reports, which drives stock prices up.

- The increased earnings from companies in these industries boost broader stock market indexes, like the BSE Sensex or Nifty 50.

Spot Market Sentiment and Decide on Investment Strategies

Many investors pay close attention to copper prices. A sustained rise in copper prices leads to a shift in investor sentiment. Many view it as a signal of an improving economy and increased corporate profitability. As a result, they begin investing more in stocks, particularly those in the industrial and manufacturing sectors.

For a greater understanding, let’s check out two popular examples:

| 2008 Financial Crisis | 2021 Reopening of Economy After Covid-19 |

|

|

How to Trade the Copper Recovery?

Copper recovery offers lucrative opportunities for traders. These opportunities are specifically available during periods of economic rebound. Usually, traders capitalize on copper’s upward price movement by employing specific trading strategies, such as:

- Trend-following,

and

- Breakout trading.

Let’s understand both these strategies in detail.

Trend Following

Trend-following is a popular strategy for trading copper during an economic recovery. Traders can use this approach to capitalize on sustained upward momentum. When copper prices break out of a previously established range, this signals:

- growing demand,

and

- the beginning of an uptrend.

In this technique, traders enter long positions. They expect that the trend will continue as industries ramp up production and infrastructure projects accelerate. The key to this strategy is identifying the “right moment to enter the market.” This right moment usually arrives when copper prices show consistent upward movement after breaking out from a range.

For example,

- Say a trader enters a long position when copper prices break above a key resistance level, such as:

- a historical high

or

- an important moving average.

- By doing this, the trader anticipates further demand growth as the economic recovery gains momentum.

- This trend-following strategy allows the trader to ride the wave of rising prices.

Breakout Trading

Breakout trading involves identifying significant price movements above key technical levels. This identification signals the start of a new trend. In copper trading, breakout traders look for moments when copper prices surpass resistance levels, such as:

- a previous high,

or

- a key technical barrier.

Once copper breaks out of these levels, it often signals the beginning of a new upward trend driven by rising demand. Breakout traders aim to enter the market early to capture potential gains.

To easily identify these breakout points, traders can use our advanced market analysis tool, Bookmap. Using it, traders can access our modern feature “heatmap,” which shows clusters of buy orders at key levels. It clearly indicates where a price breakout might occur. For example,

-

- Let’s assume a trader is using Bookmap to monitor copper prices.

- The copper prices hover near a technical resistance level.

- They observe that a large volume of buy orders appears.

- This signals a possible breakout.

- Now, traders use this data to position themselves accordingly.

- They enter long trades once the price moves above the resistance level.

- This confirms the breakout.

Conclusion

Copper is a reliable indicator of economic recovery. It is an integral component in industries like construction, manufacturing, and electronics. When copper prices rise, it signals that these industries are increasing production. This usually reflects broader economic growth. That’s why copper is considered a key commodity for traders and investors who want to track economic health and predict market trends.

Also, to optimize their trading, traders can use our feature-rich tool Bookmap. It allows you to monitor copper price movements closely. Bookmap’s heatmap feature helps traders spot breakout points and areas where buy orders cluster. This makes it easier to identify new trends. By using our platform, traders can execute better-informed decisions while entering or exiting the market based on copper’s performance. Try Bookmap today and improve your market performance without much effort.