Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

July 8, 2025

SHARE

How to Tell If You’re Trading Against a Market Maker (Hint: You Always Are)

If you don’t know who the exit liquidity is… it’s probably you! Trading isn’t just about price. It’s about who is behind the price. Most retail traders unknowingly find themselves trading against a market maker. Usually, they enter just as smart money is exiting! Are you in a similar group? Don’t be!

In this article, you will study how market makers operate, where they hide their liquidity, and how you can easily reveal spoofing and absorption in real-time by utilizing our advanced market analysis tool, Bookmap. Additionally, you’ll learn how to recognize order flow market maker behavior and avoid traps around “perfect” breakout levels. So, do you want to stop chasing moves that were designed to bait you? Read this article till the end.

What Do Market Makers Actually Do?

Market makers operate behind the scenes in every liquid market! They act like “steady hands” and keep the market running by always being ready to buy or sell. Please note that most market makers don’t take big directional bets like retail traders often do. Instead, their job is to make sure there’s always someone on the other side of your trade (particularly, when no one else is willing).

Gain more clarity through the graphic below:

How Market Makers Operate

A market maker’s core function is to quote both the bid (buy) and ask (sell) prices at all times. These are called “resting orders,” which sit in the order book waiting for someone to hit them.

By doing this, market makers provide liquidity to the market. In return, they earn the spread. For those unaware, it is the small difference between their buy and sell prices.

They’re not trying to predict where the market will go. Instead, they respond to the order flow (the stream of buy and sell orders coming into the market). This is why many retail traders unknowingly end up trading against a market maker.

Please note:

- Say you use a market order (which executes immediately)

- The passive order filling your trade is often placed by a market maker.

3 Key Traits of Market Makers

To learn more about the market makers, study these three key traits:

| Passive Liquidity Provision | Inventory Management | Reaction, Not Prediction |

|

|

or

|

Why You’re (Almost Always) Trading Against a Market Maker

Say you’re placing a market order in a liquid instrument. Chances are high that you’re trading against a market maker! They:

- Dominate the passive side of the book,

and

- Are ready to absorb your trade.

By understanding order flow market maker behavior, you can:

- Easily recognize when they’re facilitating normal activity,

or

- When they might be absorbing aggressive flow (which can signal a reversal).

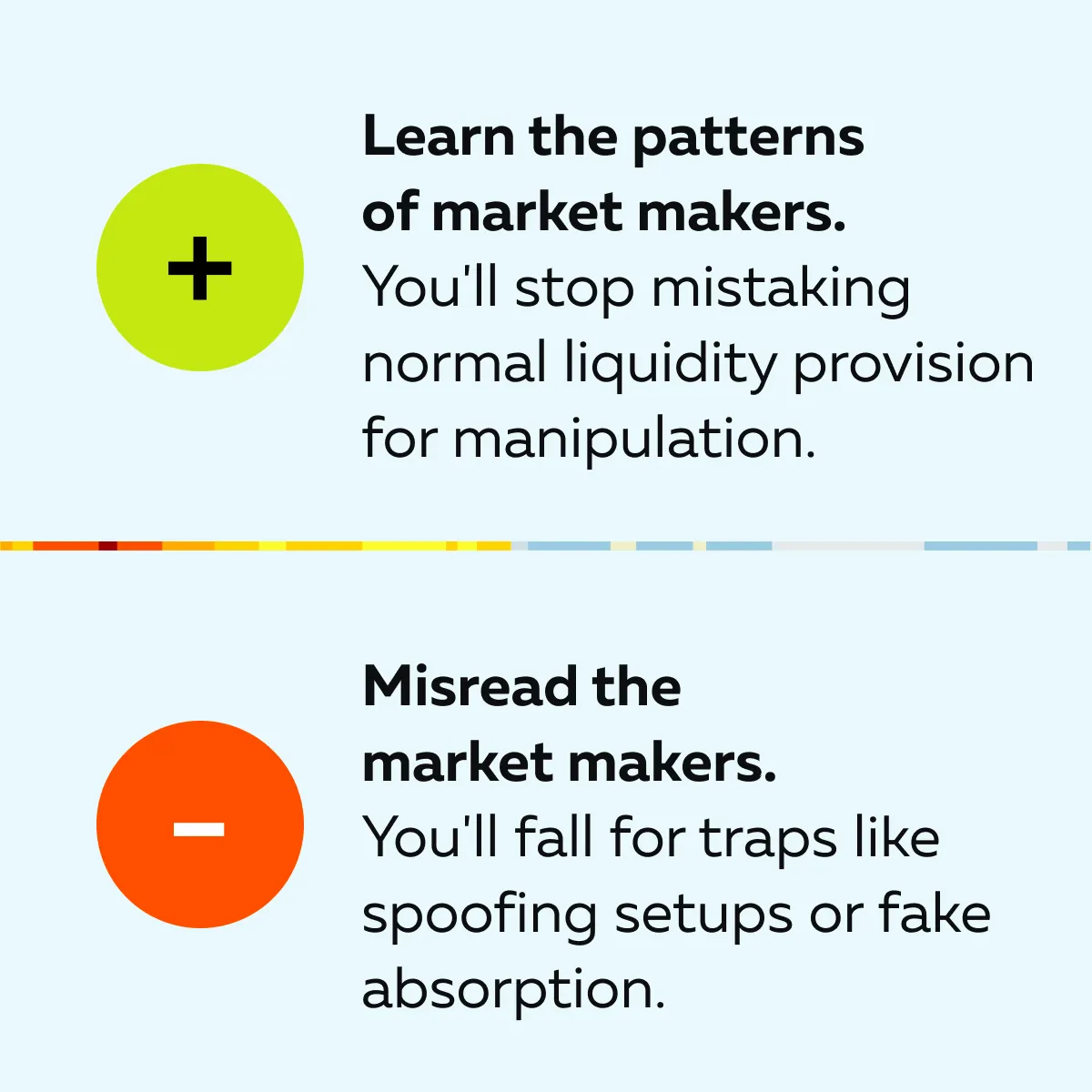

So the real question isn’t if you’re up against a market maker! Instead, it is how well you understand their moves. Check out the graphic below to gain more clarity:

Where Market Makers Show Themselves: Key Zones

Market makers don’t wear name tags! But they leave footprints. If you know where to look, their activity is clearly visible in certain price zones. These zones are areas where they:

- Manage risk,

- Absorb retail flow, and

- Sometimes bait traders into poor entries.

Let’s understand these zones in detail:

1. High-Interest Technical Levels

These are zones that attract retail attention, such as:

- Round numbers,

- The previous day’s high/low,

- VWAP, and

- The opening range.

Market makers know that a lot of order flow concentrates around these areas. This makes them ideal for placing large resting orders.

What to Watch?

- Large orders sitting just above or below these levels.

- Sudden spikes in liquidity when the price nears these zones.

- Price reversals right after tapping the level (particularly if the volume dries up).

The Passive Setup of Market Makers

This is a classic example of trading against a market maker without knowing it. You’re chasing a breakout, while they are:

- Quietly absorbing your order

and

- Preparing for a reversal.

Sometimes, this passive setup may look like spoofing and absorption. However, it’s often just disciplined liquidity provision. Real-time heatmap and volume dots help reveal when someone is playing games on the other side of your trade.

2. False Breakouts and Reversals

Breakouts are like honey for retail traders! Post-spotting them, everyone rushes in aggressively. But this aggressive flow is exactly what market makers feed on. Instead of joining the move, they absorb it by sitting on the other side with large passive sell orders.

For example:

-

- Say the price breaks above a known resistance level.

- This shows strong buyer aggression.

- Suddenly, liquidity appears above the breakout.

- It absorbs all those market buys.

- Later, the price reverses sharply.

Please note that this isn’t necessarily market maker manipulation! It’s more likely that the market maker was managing their inventory. They were selling into buying pressure to rebalance. They’re reacting to demand, not trying to trap traders intentionally.

By understanding this behavior, you can correctly interpret order flow market maker reactions.

3. Thin Liquidity Gaps

These are areas in the market where there are very few resting orders. Traders call them “air pockets.” When price enters these zones, market makers:

- Pull their quotes

and

- Let the price move quickly through the gap.

Why? Because they know retail traders will chase! Once enough activity is triggered, they step back in.

What to Watch?

- Liquidity is being pulled right before a sharp move.

- Low volume during the breakout or breakdown (this suggests the move isn’t genuine).

- New passive liquidity is appearing right at the next major level (ready to absorb late chasers).

Is it Spoofing?

This sequence is often confused with spoofing and absorption. But again, it’s mostly risk-managed participation. When you understand these traps, you’ll:

- Stop seeing every move as manipulation

and

- Start reading it as a strategic positioning by market makers.

Explore Bookmap’s real-time order flow tools to spot market maker activity and avoid common traps.

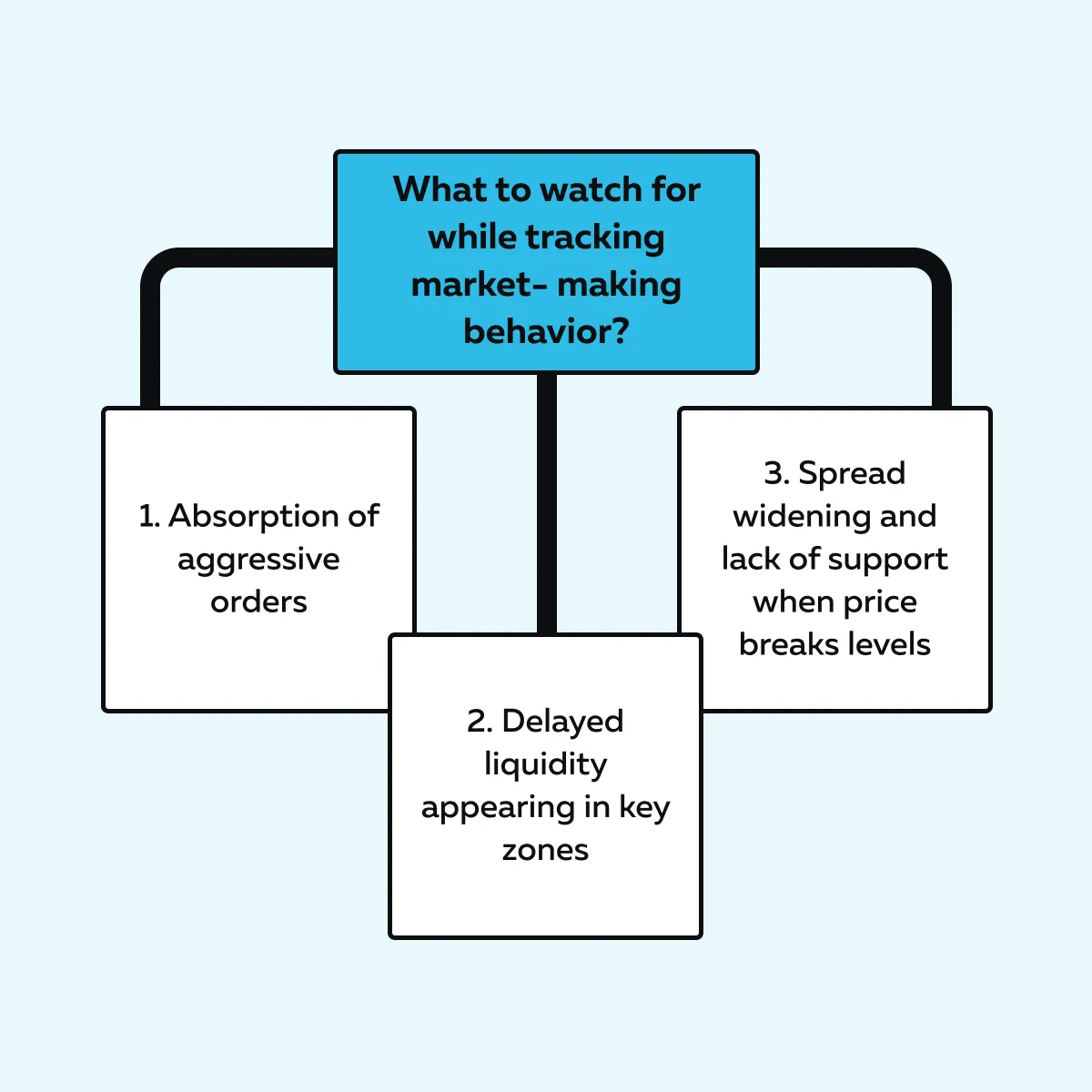

How to Recognize Market-Making Behavior in Real Time

You don’t need to wear a badge scanner to spot market makers! Instead, try to recognize market-making behavior. What does this mean? These are patterns that show how someone is passively managing liquidity (rather than chasing price).

However, these clues are subtle! But once you learn them, you’ll understand when you’re trading against a market maker. Below are three such clues you must try to spot:

1. Price Hits Size—and Reverses Immediately

This is one of the most textbook signs of passive liquidity in action. Suppose you’re using a tool like Bookmap or watching a DOM feed. You observe that:

-

- A large, aggressive buy order (green dot on Bookmap) slams into the offer.

- Instead of price lifting and continuing higher, it stalls or reverses.

- What happened? A passive seller was sitting there with size.

- They absorbed all that buying.

Please note this is not necessarily market maker manipulation. Instead, it’s inventory control. The seller isn’t pushing the price down! They’re simply managing the order flow coming in.

This is often the kind of spoofing and absorption that people misinterpret. In reality, it’s simply a sign of liquidity being offered into aggression.

2. Liquidity Appears After Price Moves

Sometimes, big resting orders don’t show up until after the market jumps. This delayed reaction is another clue.

-

- Say the price breaks out into a new area.

- The buyers are excited.

- Suddenly, Bookmap’s heatmap levels light up.

- Liquidity appears after the breakout.

- But instead of a follow-through rally:

- Volume dries up

and

- Price fades back down.

- What’s happening here? This is market-making behavior at work.

- These participants are not pushing the market.

- Instead, they’re setting a trap after retail traders have committed.

- They place resting sell orders once the crowd has entered.

- Why? Their aim is to absorb the move and fade it back.

If you don’t read the signs, you’ll fall for this setup when trading against a market maker.

3. Spread Widening + No Follow-Through

This often happens during periods of high volatility:

-

- A level breaks (say, a support or resistance line).

- But instead of new buyers or sellers stepping in to support the move, the spread widens.

- There’s no visible order flow to back the move.

- There is just a floating or unsupported price.

- What does this mean? It signals that market makers have pulled back.

- They’re not interested in chasing the move.

- Instead, they’re waiting for the price to come to a better zone where they can offer liquidity again.

- This behavior is often observed near thin liquidity gaps.

- In these gaps, retail gets baited, and market makers prepare for a reversal.

So, want to read the order flow market maker style? Notice these signs in real-time:

By interpreting the market maker’s moves, you can trade in sync with the real rhythm of the market. Don’t get caught in a market maker trap—see liquidity shifts in real-time with Bookmap.

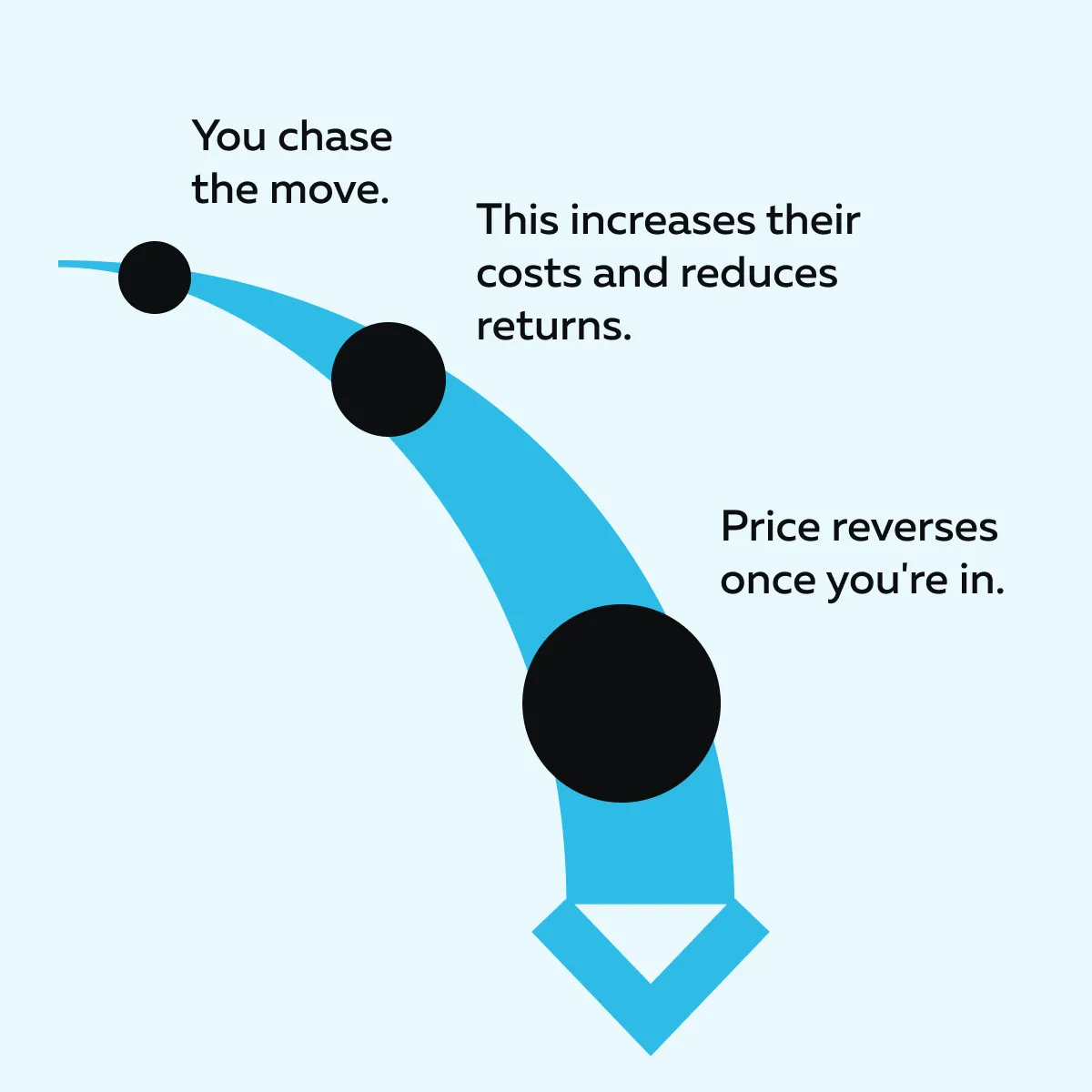

How to Avoid Becoming Exit Liquidity

Did you know? When you, as a trader, chase price with a market order, you become exit liquidity for someone else. And that “someone” is usually a:

- Market maker,

or

- The passive participant who knows exactly where the herd is heading.

Want to stop being the last one in (and the first one to lose)? You need to think differently! Let’s learn how:

Think Like a Liquidity Provider

Before you hit “buy,” ask yourself – Who’s on the other side of my trade?

If you’re using a market order, then someone has placed a resting order. And they’re probably more informed. That person could be a market maker and is absorbing your aggressive entry.

Check out the graphic below to learn how trading against a market maker often plays out:

So, flip your mindset! Don’t chase breakouts blindly. Think like a liquidity provider. Ask yourself – Am I reacting emotionally, or am I letting the trade come to me with structure?

Use Order Flow to Confirm, Not Predict

Please realize that order flow is a reality check! Instead of trying to predict moves, use these order flow market maker cues to confirm what’s happening:

- Is aggressive buying actually moving the price (or getting absorbed)?

- After a breakout, does support rebuild beneath the new level? That’s a good sign!

- Is liquidity pulling away right before you enter? That’s often a trap!

Through these signs, you can easily avoid setups where you’re walking right into spoofing and absorption.

Beware the Perfect Level

You know those clean and picture-perfect breakout levels everyone’s watching? Yes, but market makers know about them, too. And that’s where traps are set!

Please note that:

- Round numbers, like 100 or 500, act as liquidity magnets.

- At these levels, you might see:

- Iceberg orders (hidden size),

or

- Sudden liquidity spikes.

- Here, the price crosses these levels and sucks in aggressive orders.

- Later, it will reverse sharply.

That’s the classic case of becoming exit liquidity! You buy the breakout, but someone else is already positioned and is now using your entry to unload their inventory.

Conclusion

Follow the flow, don’t fall for it! Market makers aren’t villains; they play a very important role in the market. They manage order flow, absorb imbalances, and keep the market functioning.

However, if you don’t understand how they operate, you’ll keep buying when they’re selling (and selling when they’re buying). To avoid this, start using our avant-garde real-time market analysis tool, Bookmap. Through it, you can notice this activity in real-time. You can easily identify where liquidity is added, pulled, or hidden. Learn to spot these patterns, and you’ll stop being the last in line.

Want to learn more? Learn to read the tape like a pro—check out our Learning Center.

FAQ

1. What does it mean to trade against a market maker?

It means you are:

- Using a market order to buy or sell,

and

- A market maker is on the other side with a resting order.

They choose price levels carefully. Usually, they wait for traders like you to jump in. So, unknowingly, you’re helping them manage their trades while entering at points they’ve already prepared to exit from.

2. Do market makers move the market?

Market makers usually don’t try to push prices around. Their job is to provide liquidity by buying and selling when others won’t. They react to other traders’ actions (particularly aggressive order flow).

Please realize that if the price moves after they get involved, it is due to how they absorb or manage that flow. It is not because they’re trying to predict or control price direction.

3. How can I identify market maker behavior?

You must watch how the price reacts at important levels.

- Say big buy or sell orders come in, but the price doesn’t move. Now, that’s absorption.

- Say you see liquidity (big resting orders) suddenly appear around breakout points. Now, this could be a trap.

These signs show that a market maker is managing the flow.

4. Can tools like Bookmap help?

Yes! Advanced order-flow tools, like Bookmap, show you the real-time action behind price moves.

- Bookmap’s heatmap displays where liquidity is sitting.

- On the other hand, the tool’s volume dots show who’s buying or selling aggressively.

With these useful features of our Bookmap, you can easily identify where market makers are placing or pulling orders. This knowledge lets you avoid their traps and make trading decisions based on order flow (not just price action).