Ready to see the market clearly?

Sign up now and make smarter trades today

Stocks

May 5, 2025

SHARE

Investing in Defense Stocks: What Traders Should Know in 2025

Wars may be fought with weapons, but they are funded by investors. The defense sector is one of the few industries that thrives during uncertainty. Due to rising geopolitical tensions and advancing military technology, defense stocks have become a key area of interest for smart investors.

Want to know about the best defense stocks to invest in 2025? In this article, let’s understand how military stocks fit into a long-term investment strategy and how global conflicts impact the stock market. Read till the end to learn the evaluation of military stocks for long-term investments.

What’s Driving the Defense Industry in 2025?

In 2025, the U.S. defense industry is expected to grow steadily and reach around $320.86 billion. Studies estimate it will expand at a CAGR of 3.58% and reach $382.56 billion by 2030. This growth is primarily due to rising investments in emerging military technologies.

Let’s gain more clarity and understand what’s driving the defense industry in 2025:

Government Spending: A Reliable Growth Engine

Military budgets are a top priority for major global powers. Due to this, defense companies are expected to have a steady flow of government contracts. In 2025, the U.S. administration proposed a substantial $849.8 billion defense budget. The U.S. administration is prioritizing the following to strengthen national security:

- Advanced weapons systems like AI-powered drones and hypersonic missiles,

- Cybersecurity and space defense to gain protection against cyber threats and satellite disruptions, and

- Unmanned systems.

A significant portion of the budget, $188.1 billion, is allocated to the Air Force for upgrading and modernizing aircraft. Moreover, stronger NATO commitments are leading to increased military spending in Europe.

For example,

- Due to rising geopolitical tensions, Germany has significantly boosted its military budget.

- This has directly benefited military stocks for long-term investment (such as Rheinmetall and BAE Systems).

As an investor looking for the best defense stocks to invest in 2025, you can consider companies that secure government defense contracts. That’s because these firms are expected to see steady growth due to increased military spending.

Geopolitical Conflicts and Global Tensions

Additionally, several countries are moving away from the post-Cold War era of reduced military spending. They are now focusing on military modernization.

For example,

- China is investing heavily in advanced military technology.

- This has prompted the U.S. and its allies to respond with increased defense budgets.

- This shift is benefiting U.S. defense stocks.

- They are becoming attractive options for those looking for the best defense stocks to invest in 2025.

- As an investor, you must pay close attention to these developments.

Technological Advancements in Military Equipment

The defense industry is rapidly evolving beyond traditional weapons systems. It is now focusing on several cutting-edge technologies. Check the graphic below:

These advancements are also boosting military stocks for long-term investment. Let’s understand them in detail:

- AI-driven intelligence:

-

-

- These are smart systems that analyze threats faster.

- They improve decision-making in combat.

-

- Cybersecurity innovations:

-

-

- These techniques protect military networks from cyberattacks.

- Currently, it is a top government priority.

-

- Space-based defense:

-

- Nowadays, the combination of satellites and space technology is increasingly used in modern warfare.

- It ensures secure communications and surveillance.

Please note that companies investing in these high-tech areas are likely to perform better than traditional weapons manufacturers. For example,

- Northrop Grumman’s B-21 Raider stealth bomber and Lockheed Martin’s F-35 fighter jet showcase the next generation of military assets.

These innovations also influence government defense contracts. Thus, investors looking for the best defense stocks to invest in 2025 may find opportunities in firms leading the charge in military technology.

Key Factors Affecting Defense Stock Performance

When it comes to long-term investments, several factors influence the performance of military stocks. Some of these common factors are listed below:

- Government defense contracts,

- Policy changes,

- Supply chain stability,

- Investor sentiment, and

- Shifting technology trends.

You can track these developments to identify the best defense stocks to invest in 2025:

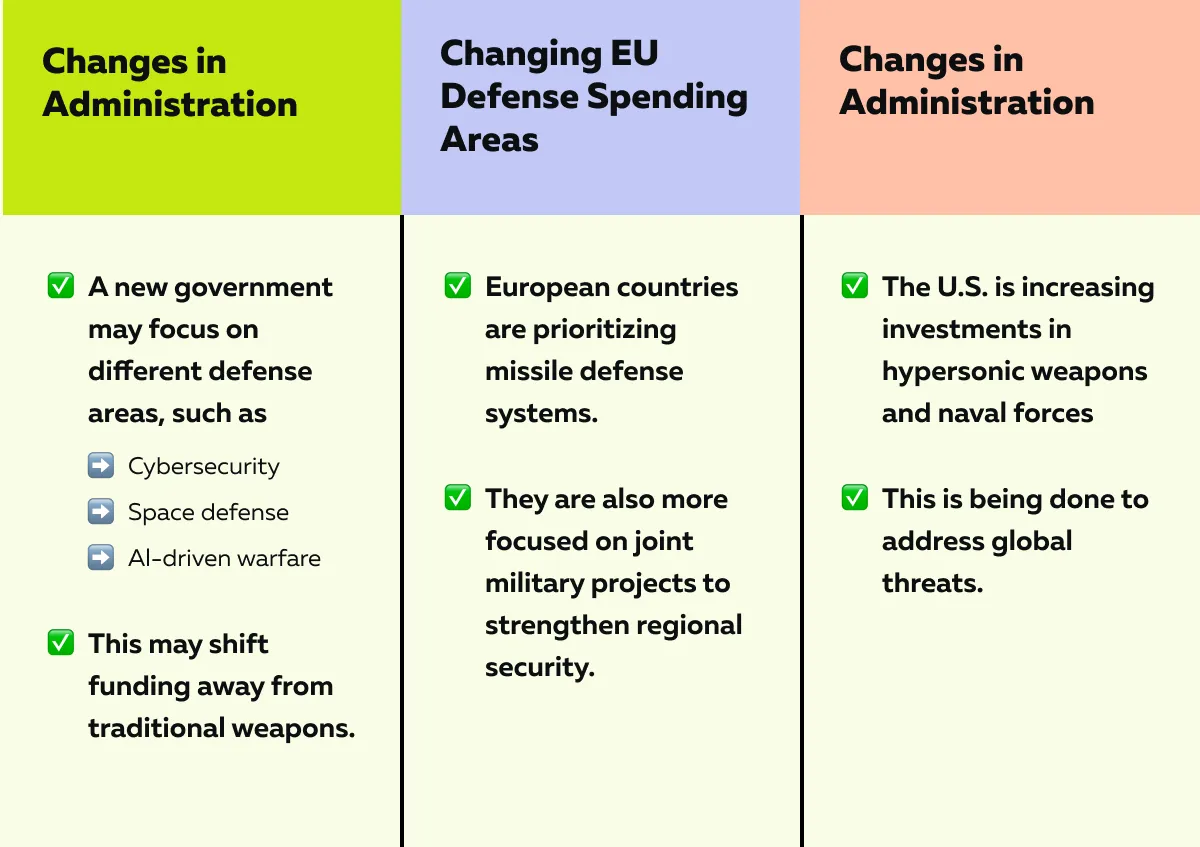

Government Contracts and Policy Shifts

Most defense companies depend on long-term government contracts. That’s because they provide stable revenue. However, political changes can affect military budgets and spending priorities. Let’s see how:

Key Trends to Watch

- Increased NATO defense budgets

-

-

- Many European nations are expanding military spending.

- This is happening due to geopolitical tensions and security concerns.

-

- AI and autonomous weapons

-

-

- Governments are investing heavily in:

- Drone technology,

- AI-driven surveillance, and

- Next-gen battlefield systems.

- This is impacting military stocks for long-term investment.

- Governments are investing heavily in:

-

- Shifting procurement priorities

-

- Traditional military systems may see reduced funding.

- This can happen as governments move toward:

- Quantum encryption,

- Space-based defense, and

- Advanced cybersecurity solutions.

Supply Chain Stability and Global Trade

Be aware that the defense industry depends on a stable supply chain for critical materials like semiconductors and metals. Both of these are used in weapons and military systems. Any disruption in their supply can:

- Impact of military stocks on long-term investment

and

- Affect companies securing government defense contracts.

Let’s see how:

| Semiconductor shortages | Raw material supply issues |

| Delays in chip production can slow down the development of AI-driven defense systems and other advanced military technologies. | Major components like rare earth metals (used in missiles and fighter jets) are vulnerable to global supply disruptions. |

Moreover, rising U.S.-China trade tensions could lead to restrictions on key exports. If this happens, it will significantly affect defense manufacturers. For example,

- The U.S. has placed restrictions on semiconductor exports to China.

- It could force defense companies to find alternative suppliers.

Such trade policies impact the stock market by influencing the production costs and profitability of some of the best defense stocks to invest in 2025.

Investor Sentiment and Market Cycles

Investor confidence plays a big role in the performance of military stocks for long-term investment. Defense stocks are often seen as stable because they are backed by government defense contracts. This makes them less vulnerable to market downturns.

That’s because when the economy struggles, investors look for safe options. Since defense spending remains a priority for governments, these stocks usually hold their value. Check out the graphic below to learn how investors use defense stocks in different market phases:

For example,

- In the 2022-2023 bear market, defense stocks outperformed sectors like tech and consumer goods.

- By doing so, they proved their resilience.

- As geopolitical tensions continue to rise, investor confidence in defense companies remains strong.

Monitor real-time defense stock order flow with advanced trading tools.

Top Defense Stocks to Watch in 2025

Due to rising geopolitical tensions and increased military spending, most investors are searching for the best defense stocks to invest in 2025. Please note that companies securing government defense contracts are positioned for long-term stability and growth.

Let’s check out some defense stocks you can include in your portfolio:

Lockheed Martin (LMT)

Lockheed Martin is a global leader in defense technology. It is known for its strong ties to the U.S. government. The company consistently secures major contracts and can be considered for long-term investment. Check out the graphic below to learn about some core products of Lockheed Martin:

While the company is financially strong, its revenue growth depends on future government defense contracts. Still, Lockheed Martin remains one of the most influential stocks in the defense sector.

Northrop Grumman (NOC)

Northrop Grumman is a major defense company. Check out the graphic below to learn about some of its core products:

Due to increasing geopolitical tensions, its role in global security continues to grow. This makes NOC one of the best defense stocks to invest in 2025. Let’s learn some more reasons:

-

- Global reach

- NOC benefits from rising NATO defense budgets and increased European military spending.

- The company is securing strong government defense contracts.

- Global reach

- Future growth

-

- Northrop Grumman is expanding into space and satellite defense.

- It is an area that is becoming increasingly important for national security.

As an investor looking at military stocks for long-term investment, Northrop Grumman’s focus on the latest defense technology and strategic military partnerships makes it a strong contender.

BAE Systems (BA)

BAE Systems is the largest UK-based defense contractor with strong global partnerships. It has a diverse product lineup and can be considered a military stock for long-term investment. Check out the graphic below to learn about some of its core products:

Additionally, BAE benefits from rising NATO defense budgets and increased military spending across Europe. However, despite being well-positioned, it faces strong competition from U.S. firms like Lockheed Martin and Northrop Grumman for government defense contracts.

Rheinmetall (RHMG)

Rheinmetall is Germany’s top defense contractor. It is seeing strong growth due to increased European military spending, which is driven by geopolitical tensions. Check out the graphic below to learn about some of its core products:

Additionally, Germany’s rising defense budget has made Rheinmetall a key supplier for NATO and EU defense forces. However, its performance depends on European defense commitments and political agreements (which can shift over time).

Leonardo S.p.A. (LDO.MI)

Leonardo is an Italian defense company. It primarily focuses on drone technology and the usage of artificial intelligence in military systems. Recently, the company developed a joint venture with Turkey’s Baykar. This makes it a promising stock in the evolving defense sector.

Check out the graphic below to learn about some of its core products:

Additionally, the company has maintained strong NATO partnerships and works closely with European defense programs. It regularly secures major contracts. However, while it has strong government backing, geopolitical risks could impact its exports and production.

Airbus Defense and Space (AIR.PA)

The company is a major player in European defense. It specializes in satellite systems, UAVs, and space-based security solutions. Check out the graphic below to learn about some of its core products:

Additionally, Airbus plays an important role in space defense and satellite communications. The company has secured several key European contracts. While its diversified portfolio is an advantage, shifting defense budgets could impact drone-related investments.

How U.S. Investors Can Invest in European Defense Stocks

Nowadays, European defense firms are attracting global interest due to:

- Increased NATO commitments,

- Global security concern,

- Rising geopolitical tensions, and

- Increasing government defense contracts.

As a U.S. investor looking to gain exposure to military stocks (for long-term investment in Europe), you have several options. Let’s see how U.S. investors can invest:

| ADRs and GDRs | International Brokerage Accounts | Defense-Focused ETFs |

|

|

|

By using these methods, U.S. investors can take advantage of Europe’s rising defense spending. These investments also offer a way to capitalize on the stock market impact of growing military budgets worldwide.

How to Evaluate Defense Stocks Before Investing

Investing in military stocks for long-term investment requires careful analysis. To identify the best defense stocks to invest in 2025, you should look at:

- Government defense contracts,

- Financial stability,

- Market trends,

- Revenue growth,

- Stock performance.

Below are some key factors that you must evaluate before investing:

Revenue Growth and Long-Term Contracts

One of the most important indicators of a strong defense stock is its ability to secure long-term government defense contracts. These multi-year contracts provide stable revenue and make a company less vulnerable to economic downturns.

Such defense companies (with steady government contracts) can maintain consistent earnings even when the overall stock market is volatile. For example:

- Lockheed Martin’s long-term F-35 contract ensures predictable revenue.

- This allows it to weather short-term market fluctuations better than companies reliant on one-time sales.

Share Price Trends and Market Performance

Defense stocks usually perform better during uncertain times. This happens because governments continue military spending regardless of economic conditions. However, as an investor, you must look at a company’s historical stock performance. Such an analysis can reveal its resilience compared to the broader market.

Please note that if a defense stock consistently outperforms during economic downturns, it shows strong investor confidence and demand for its products.

For example:

- BAE Systems outperformed the FTSE 100 during periods of economic uncertainty.

- This proves that geopolitical tensions and military demand keep its stock stable even in challenging market conditions.

Diversification of Defense Offerings

Some defense companies come with a broad portfolio of:

- Weapons,

- Cybersecurity,

- AI-driven warfare, and

- Space defense.

Such companies are more resilient than those focused on a single product line. Also, these companies can easily adapt to changes in government defense contracts and changing military priorities. Check the graphic below to learn which defense companies are better positioned to win future contracts:

For Example:

- Northrop Grumman’s AI-driven defense initiatives give it an advantage over traditional defense manufacturers.

- Its focus on autonomous military systems and satellite defense makes it ideal for long-term growth.

How Defense Stocks Fit into a Trading Strategy

Defense stocks can be a part of long-term investment portfolios or can even be used in short-term trading strategies. That’s because most defense companies are backed by government contracts. Thus, they often remain stable even during economic downturns.

Let’s see how these stocks fit into different strategies:

Long-Term Portfolio Stability

Most investors include defense stocks in their portfolios because they provide steady returns with lower volatility. Since governments prioritize defense spending regardless of economic conditions. Thus, these stocks usually hold their value.

Unlike tech or consumer stocks, which can be highly volatile, defense stocks offer stability. For Example:

- During market downturns, companies like Lockheed Martin and BAE Systems continue to generate revenue from long-term government defense contracts.

- This makes them reliable holdings.

Trading Defense Stocks in Volatile Markets

For short-term traders, defense stocks can present opportunities during market volatility. That’s because institutional investors and hedge funds often adjust their positions based on the following:

- Geopolitical events

and

- Defense budget announcements.

This leads to significant price movements. As a short-term trader, you can track order flow and liquidity surges in defense stocks to spot potential breakouts. For Example:

- Say there is a sudden increase in trading volume at a key price level in Lockheed Martin’s stock.

- Now, this could indicate that large institutional investors are accumulating shares.

Track institutional buying and liquidity levels in top defense stocks.

Monitoring Government Policy for Market Moves

Be aware that government defense contracts and policy changes have a direct impact on the stock market. Thus, traders and investors who keep an eye on political developments can anticipate major moves in the defense sector. This happens because shifts in defense spending priorities can benefit certain companies while reducing opportunities for others.

For Example:

- Say a new U.S. administration increases funding for AI-powered military advancements.

- Now, companies like Northrop Grumman (which specializes in AI-driven defense systems) may see a rise in stock prices.

Conclusion

The defense sector offers both stability and long-term growth. It is often considered a strong addition to a diversified investment portfolio. Most defense companies earn government defense contracts, which provide them with steady revenue. Thus, they usually perform well even during economic downturns.

As an investor looking for military stocks for long-term investment, you should closely watch global conflicts, geopolitical tensions, and policy changes.

Additionally, to gain a competitive advantage, start using our avant-garde market analysis tool, Bookmap. Using it, you can track order flow and make liquidity analysis. This allows you to track institutional movements in major defense stocks like Lockheed Martin, Northrop Grumman, and BAE Systems. Use Bookmap’s heatmap to identify key support and resistance zones in military-industrial stocks.