Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

September 5, 2025

SHARE

Is the Bitcoin Halving Still a Big Deal? What Order Flow Says Before and After

Bitcoin doesn’t have a central bank. Instead, it has a calendar! And on that calendar, one date every four years can influence the entire market’s mood. Confused? – We are talking about the “Bitcoin halving”.

This is when miner rewards get cut in half. Due to this event, the new supply of BTC slows down, which creates a scarcity of BTC in the market. In the early days, halvings sent prices soaring almost overnight. However, now, with bigger players and their use of derivatives, the impact is not that strong. But it is still no less important!

The Bitcoin halving impact runs months or years before and after the event. So, want to trade smarter before the next halving event hits? In this article, we’ll explore the concept of halving and examine how Bitcoin’s order flow behaves around it.

Lastly, we will check out some real signals you must observe and see how our avant-garde real-time market analysis tool, Bookmap, can help you!

What Is the Bitcoin Halving, and Why Was It Important?

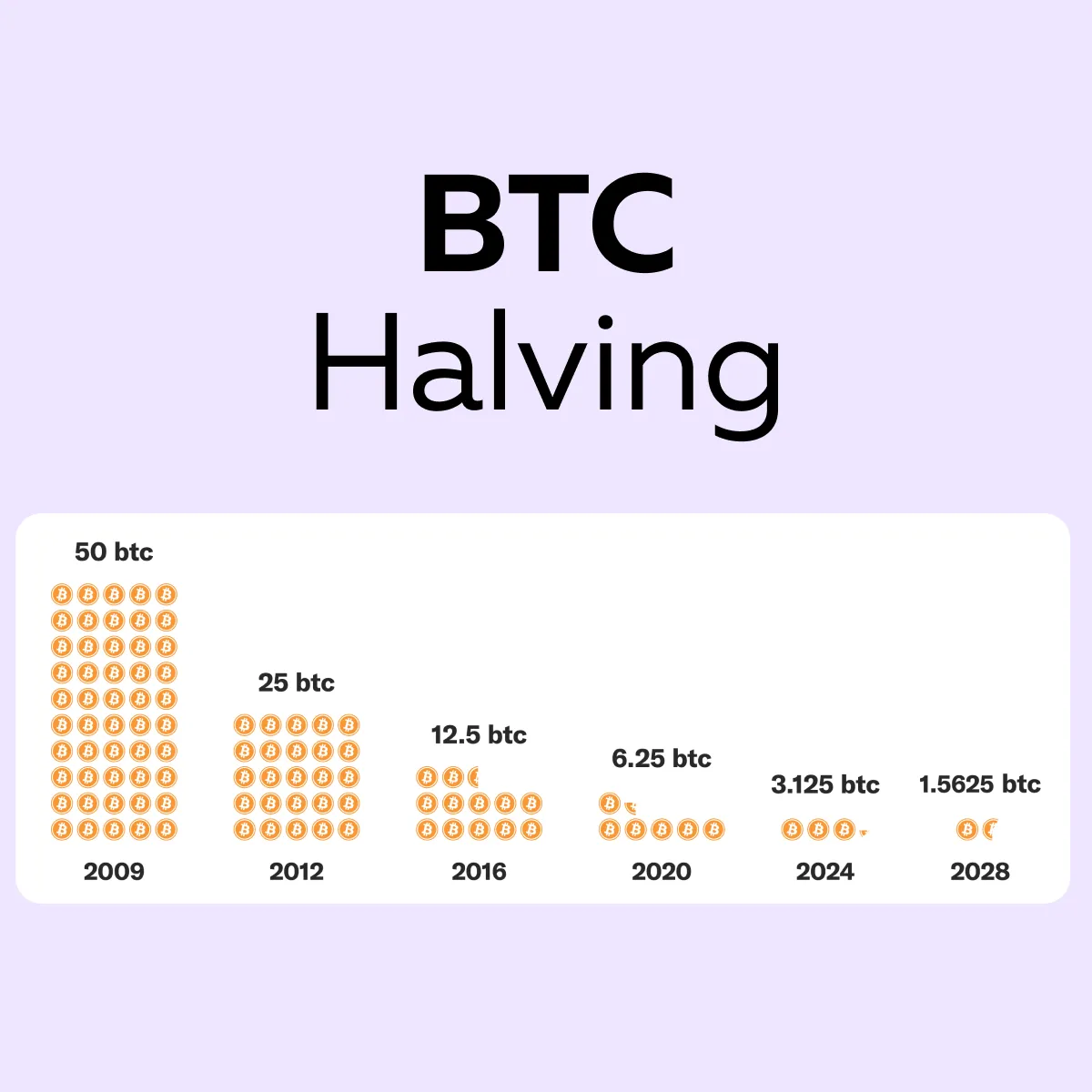

Bitcoin halving is an event that occurs approximately every four years. During this event, the reward that miners earn for adding new blocks to the blockchain is reduced by half. In April 2024, the reward dropped from 6.25 BTC to 3.125 BTC. Through this process, the total supply of Bitcoin is eventually capped at 21 million BTC.

For a better understanding, check out the “Bitcoin Halving Rewards Reduction Table” below:

| Halving | Year / Date | Block Height | Reward per Block (BTC) |

| 0 | 2009 (Launch) | 0 | 50 BTC |

| 1 | Nov 28, 2012 | 210,000 | 25 BTC |

| 2 | Jul 9, 2016 | 420,000 | 12.5 BTC |

| 3 | May 11, 2020 | 630,000 | 6.25 BTC |

| 4 | Apr 20, 2024 | 840,000 | 3.125 BTC |

| 5 | Apr 2028 (est.) | 1,050,000 | 1.5625 BTC |

| 6 | 2032 (est.) | 1,260,000 | 0.78125 BTC |

| 7 | 2036 (est.) | 1,470,000 | 0.390625 BTC |

| 8 | 2040 (est.) | 1,680,000 | 0.1953125 BTC |

| … | … | … | … |

| 33 | 2140 (est.) | 6,930,000 | 0 BTC |

The above table shows how rewards have reduced over time and how they will keep reducing until around the year 2140, when no new Bitcoins will be created.

Some Key Points

- “Block height” is the number of blocks mined since Bitcoin began.

- Every 210,000 blocks (about 4 years), the reward halves.

- Rewards start high (50 BTC per block in 2009) and keep shrinking until they reach zero.

- By around 2140, no new bitcoins will be created. In 2140, miners will only earn transaction fees.

Why Is BTC Halving Important?

Bitcoin halving means fewer new Bitcoins enter circulation, making the supply more limited. Such a scarcity supports Bitcoin’s long-term price growth. In the early years (2012, 2016), halvings were followed by huge rallies. Why? This partly happened because the market was smaller and less efficient.

However, more recently, the market has matured, and speculation starts months before the halving. This creates a “buy the rumor, sell the news” pattern, where:

- Firstly, prices rise in anticipation

and

- Then cool off after the event.

For example, in 2020, Bitcoin rose nearly 150% in the six months after the halving. However, much of that rally had already begun before the date. Thus, as a trader, you must understand that Bitcoin order flow and sentiment shifts well ahead of the actual halving day.

What Order Flow Reveals Around Halving Events

Want to position yourself better before and after the halving event? You must monitor order flow during the Bitcoin halving event. By tracking the locations of large buy and sell orders, you can easily spot early clues about market sentiment and expected price levels.

Let us understand in detail:

1. Liquidity Shifts Start Weeks Before

In the weeks leading up to a Bitcoin halving, most traders start building positions early. How does this show up in the Bitcoin order flow? – It is visible as layered buy orders (bids) placed well below the current market price.

Now, these stacked bids act like a “soft floor” that helps to slow down any sudden price drops. However, they’re not guaranteed to stay! Large traders sometimes withdraw their bids just before volatility hits.

Need a common sign? You must watch for heavy resting liquidity at big round numbers, like $30,000 or $35,000. Be aware that these round numbers attract a lot of market attention.

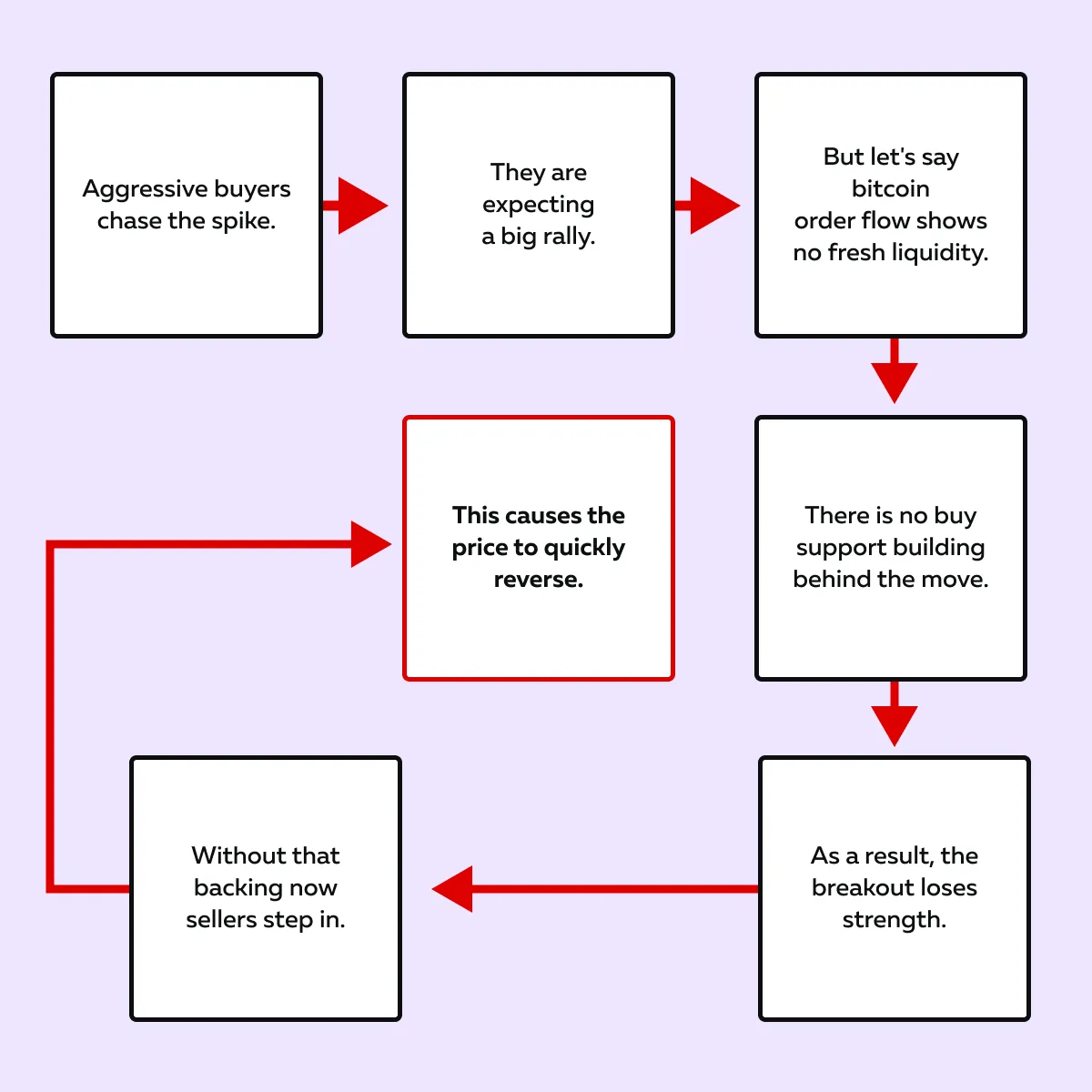

2. False Breakouts and Traps Are Common Right After

Right after a Bitcoin halving, it is common to see the price jump sharply! But not every jump is sustainable. Instead, it can be a classic “trap.” Let us see how it happens:

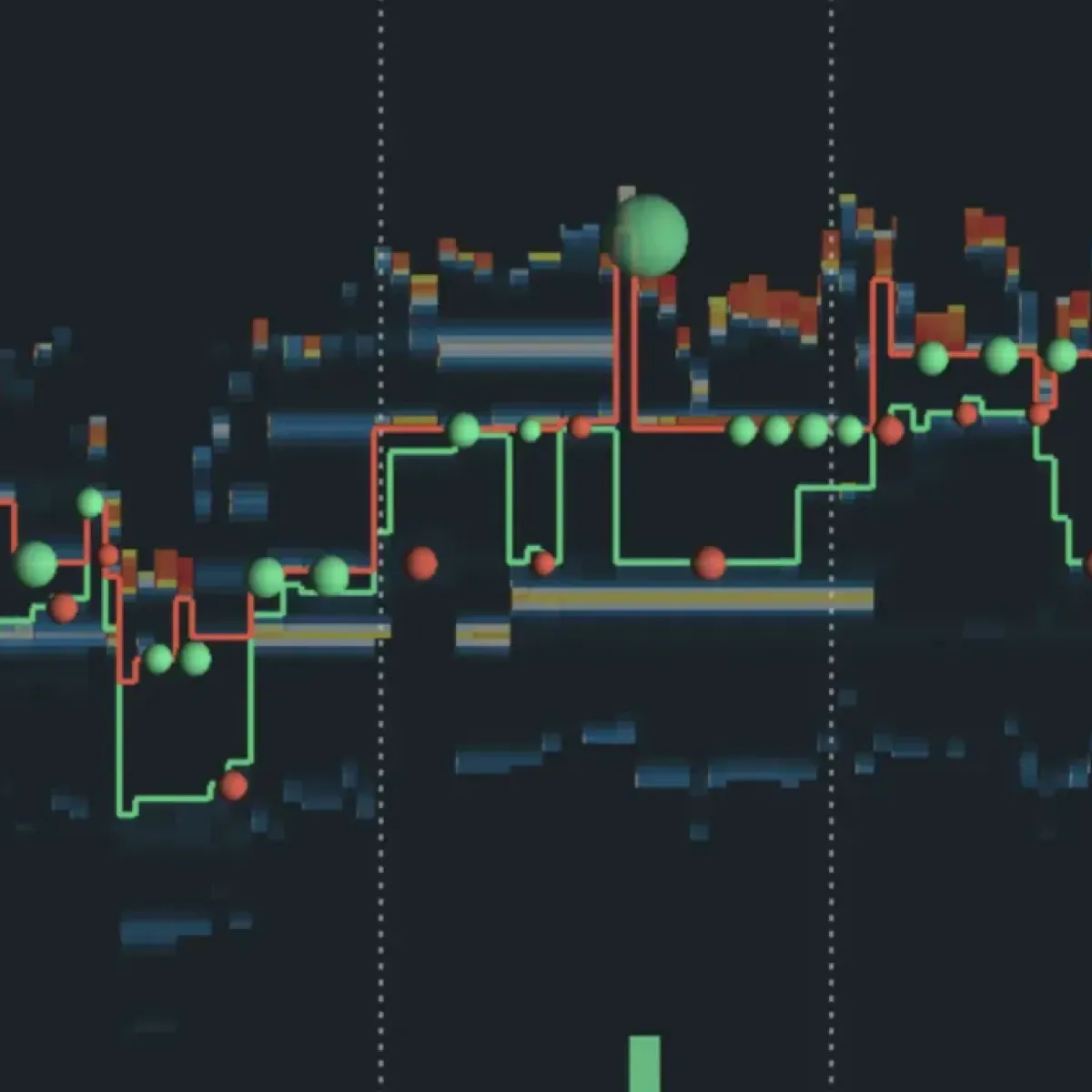

Our trading platform’s Bookmap heatmap is highly useful here! Using it, you can see whether real support is forming under the breakout or if it is just a short-lived squeeze. For example,

- In April 2024, Bitcoin shot up toward $67,000 right after the halving.

- But when liquidity thinned out at higher prices, the rally faded.

- The price dropped back below $60,000 within two days.

Don’t guess how price will react — watch the order flow in real time with Bookmap’s free crypto tools.

3. Icebergs and Hidden Liquidity Play a Key Role

During a Bitcoin halving, large players like institutions usually want to buy or sell without revealing their full size. How do they do it? They use iceberg orders, where:

- Only a small part of the order is visible

and

- The rest stays hidden and gets filled gradually.

It distorts your interpretation! Yes, in Bitcoin order flow, this makes the market look less liquid than it actually is.

Need a sign to spot this? – In such a situation, you will notice the price repeatedly holding at certain levels. This happens even if the visible bids or offers seem thin. That is a clear signal that hidden liquidity is absorbing trades!

The Bookmap Help!

Our marketing tool, Bookmap, comes loaded with iceberg detection features. It allows you to check when the real size is quietly entering the market. This is particularly important during halving events, when stealth accumulation or distribution is taking place.

Want to see how large players are positioned during crypto volatility? Try Bookmap with real-time crypto data.

How the Market Has Changed Since Early Halvings

In Bitcoin’s early days, halvings had a huge and often immediate effect on price! This was largely because:

Due to these market characteristics, the reduced supply from a Bitcoin halving could push prices up strongly. However, today, the trading environment is very different:

- Larger institutional players now dominate

and

- They often hedge their positions using derivatives like BTC futures and options.

The use of these advanced instruments for hedging reduces the short-term impact of Bitcoin halving. Thus, the price moves are less erratic than before.

However, the bigger picture hasn’t changed. The supply is cut in half, and over time, that scarcity will support upward trends.

How Traders Can Prepare for the Next Halving Event

A Bitcoin halving can create big headlines! However, the real advantage comes from reading the market’s behavior and not just the story. To read this behavior, you must do an order flow analysis. This lets you spot when supply, demand, and liquidity actually line up for strong moves.

Let us understand in detail how you can better prepare for the next halving event:

Use Order Flow to Time Entries, Not the Narrative

Never jump in because of hype! Instead, watch the Bitcoin order flow and try to spot if the market is truly accepting prices above important levels. Take these two actions:

| Action I: Look for Acceptance | Action II: Look for Strong Volume |

|

|

What is the benefit of this approach? You avoid chasing empty breakouts. Also, you improve your timing around the Bitcoin halving impact.

Set Alerts Around Key Liquidity Zones

By setting alerts around key liquidity areas, you can avoid getting caught in stop-runs or fake breakouts, especially during volatile windows like a Bitcoin halving. Alerts provide clear insights into when actual market support is building or disappearing, so you’re reacting to actual conditions rather than making blind guesses.

What to watch for on Bookmap?

| Look at this on Bookmap | Meaning |

| Liquidity appearing |

|

| Liquidity disappearing |

|

| Aggressive executions |

|

| Heatmap changes/iceberg signs |

|

How to set useful alerts?

Follow these pro tips:

- Pick the right price zones

-

-

- Use round numbers, recent highs/lows, or VWAP/POC.

- You can also use the clusters you see on your heatmap as alert levels.

- These are the spots where liquidity normally pools.

-

- Choose meaningful thresholds

-

- Set an alert on size (say, when X BTC / $Y of resting liquidity appears or disappears).

- Alternatively, set an alert on action (say, when executed volume over Z minutes exceeds a common baseline).

- This setting makes your thresholds relative to:

- Average market activity

and

- Your trade size

- Alert on cancellations and refills

-

-

- Set an alert when a large resting order cancels, or when the order book refills.

- This setting is more informative than price alone.

-

- Combine indicators

-

- Pair a liquidity alert with:

- Volume/ execution alert

- Pair a liquidity alert with:

or

- This reduces your false signals.

For more clarity, study an example:

Let us say before a halving, you set an alert for “more than equal to large bids at $30k appear.” Now, there could be two situations:

| Case I: Bids form and persist | Case II: Bids disappear as price tests $30k |

|

|

After a spike, set a new alert for “liquidity above $66k drops by >50% in 5 minutes.” If triggered, that suggests the spike is weak. In that case, you must avoid chasing the breakout.

Don’t Assume Immediate Impact

To most traders, a Bitcoin halving sounds like a guaranteed ticket to higher prices! But markets don’t always work that way. History shows that the impact of a Bitcoin halving can take weeks or even months to fully play out.

Therefore, the key is not to rush in based purely on the event date. Instead, watch the bitcoin order flow closely after the halving. Real accumulation is visible when you observe this:

These signs suggest strong hands are stepping in! Need a reverse situation? On the flip side, sometimes, sharp reversals happen once the market shakes out weak hands — Traders who buy based solely on hype and panic-sell when the price drops.

Thus, patience and strong liquidity analysis always pay better than chasing the first spike!

Conclusion

In 2025, the Bitcoin halving will not deliver the explosive rallies we saw in its early years! However, it still strongly influences the market behavior. As a smart trader, you must track liquidity shifts and Bitcoin order flow before, during, and after the halving event.

The benefit? Such monitoring allows you to easily spot:

- When a move has genuine strength

- When it loses momentum

- When it is just a temporary spike!

Remember, the real edge comes from seeing what is happening under the surface and not just following headlines.

Want to trade Bitcoin halving with 100% clarity and confidence instead of guesswork? Start using our real-time advanced market analysis tool, Bookmap. It allows you to watch liquidity as it builds, disappears, or gets absorbed in real time! Track real-time Bitcoin liquidity before and after halving events — start with Bookmap.

FAQs

1. What is a Bitcoin halving?

A Bitcoin halving occurs when miners start earning only half the Bitcoins they used to for processing transactions and adding them to the blockchain. It is like getting a 50% pay cut!

However, it is pre-planned and happens about every four years to slow down the new BTC supply. This built-in scarcity is part of Bitcoin’s design to preserve its value over time.

2. Does the halving still impact price?

Yes, but in a different way than before! In the past, prices often spiked right after the event. Now, the market is bigger and more complex, which has led to increased volatility and changes in positions both before and after the halving. Usually, an immediate rally is not commonly visible nowadays.

3. How can I trade the halving more effectively?

Don’t buy purely on hype! Instead, watch Bitcoin order flow using our marketing tool, Bookmap. Such an observation will let you see if real buying or selling pressure is building.

As a tip, look for these signs before entering a trade:

- Steady buy orders (bid stacking),

- Hidden large orders (icebergs), and

- Strong trading volume is supporting the move.