Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

January 27, 2025

SHARE

Trading the Crypto Halving Cycle: Order Flow Insights for 2025

Bitcoin’s halving cycle is like a clock. It slowly ticks toward scarcity and resets the rules of the crypto game every four years. Historically, traders who have analyzed the Bitcoin halving cycles have often generated good returns. Are you aware of this clock yet?

In this article, we’ll explore the impact of Bitcoin’s halving events and examine how they influence price dynamics, liquidity, and market sentiment. You’ll learn about past halvings—2012, 2016, and 2020—and the significant price rallies that followed. This will give you insights into how the crypto halving 2024 might unfold. We’ll also learn key trading strategies, such as positioning ahead of the event, managing volatility, and using advanced tools like Bookmap to monitor Bitcoin order flow in 2025. Additionally, we’ll examine how the halving affects altcoin performance and interacts with macroeconomic trends. Let’s begin.

What is Bitcoin’s Halving Cycle?

Bitcoin’s halving cycle is an event that occurs approximately every four years. During this event, the rewards that Bitcoin miners receive for adding new blocks to the blockchain are reduced by half. This decrease in rewards given to miners maintains the scarcity of Bitcoins. This happens due to a fall in the rate of its supply increase. For example, when the next crypto halving in 2024 happens, the reward per block will drop from 6.25 BTC to 3.125 BTC.

It is worth mentioning that this scarcity mechanism has historically impacted Bitcoin’s price. Reduced supply often coincides with higher demand, which drives up prices. In the past, Bitcoin halving cycles, such as those in 2012, 2016, and 2020, triggered major price rallies in the months following these events. For more clarity, let’s have a look at these past halving events:

| Date | Event | Price impact |

| 2012 Halving (November 28, 2012) | The mining reward was reduced from 50 BTC to 25 BTC per block. |

|

| 2016 Halving (July 9, 2016) | The block reward dropped from 25 BTC to 12.5 BTC. |

|

| 2020 Halving (May 11, 2020) | The reward for mining a block was cut from 12.5 BTC to 6.25 BTC. |

|

We can observe from the above table that each halving reduced the rate at which new Bitcoin entered the market. These halving events:

- Create a perception of scarcity,

and

- Prompt price rallies in the months or years following the event.

As a result, most traders and investors watch these cycles closely, as they significantly influence market sentiment and price trends. Monitor real-time market trends in crypto and plan your trades effectively with Bookmap’s advanced analytics.

Why Halving Matters to Traders?

For traders, the Bitcoin halving cycle is more than just a technical adjustment. For most, it is a market phenomenon. Leading up to a crypto halving, speculative buying often surges, creating anticipation for price rises. Also, this psychological factor creates:

- Short-term volatility,

and

- Trading opportunities.

Moreover, a long-term reduction in supply creates upward pressure on prices. This makes Bitcoin halving cycles central to trading strategies. For example, by using Bitcoin order flow 2025 data, traders can analyze market dynamics and adjust their positions.

Additionally, these cycles offer insights into crypto market liquidity. They show the balance between available supply and demand.

Order Flow Insights Around Halving Events

Bitcoin halving events are typically linked to increased market volatility. Historically, the months leading up to and following a halving cycle see increased price swings.

Example

- During the crypto halving in 2024, traders can witness sharp price movements.

- This is expected to happen as market participants are expecting potential gains.

Also, if we look back at 2020, Bitcoin experienced both surges and corrections before eventually rallying to an all-time high by year-end. Discover how Bookmap’s visualization tools can provide an edge during Bitcoin’s halving volatility.

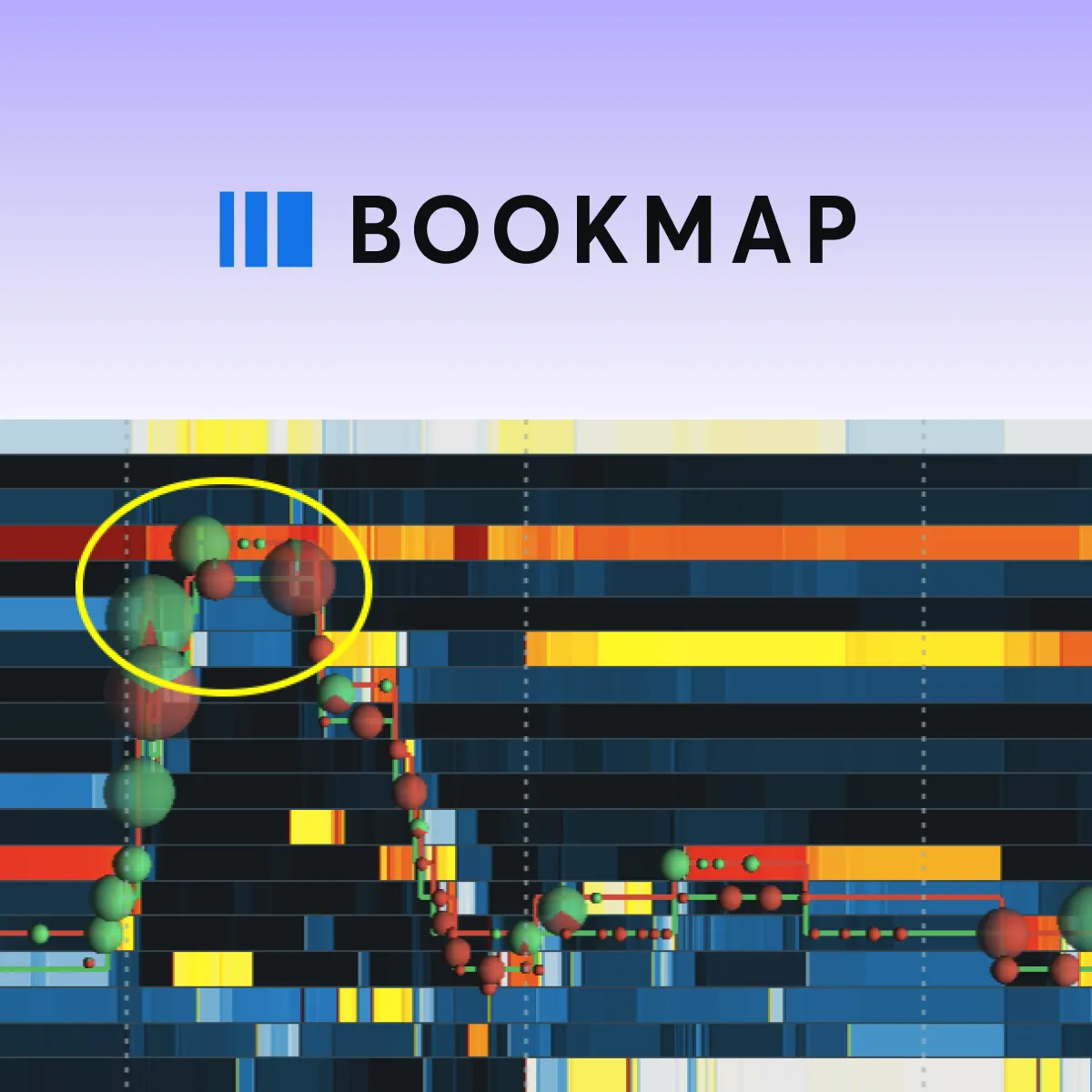

Order Flow Behavior

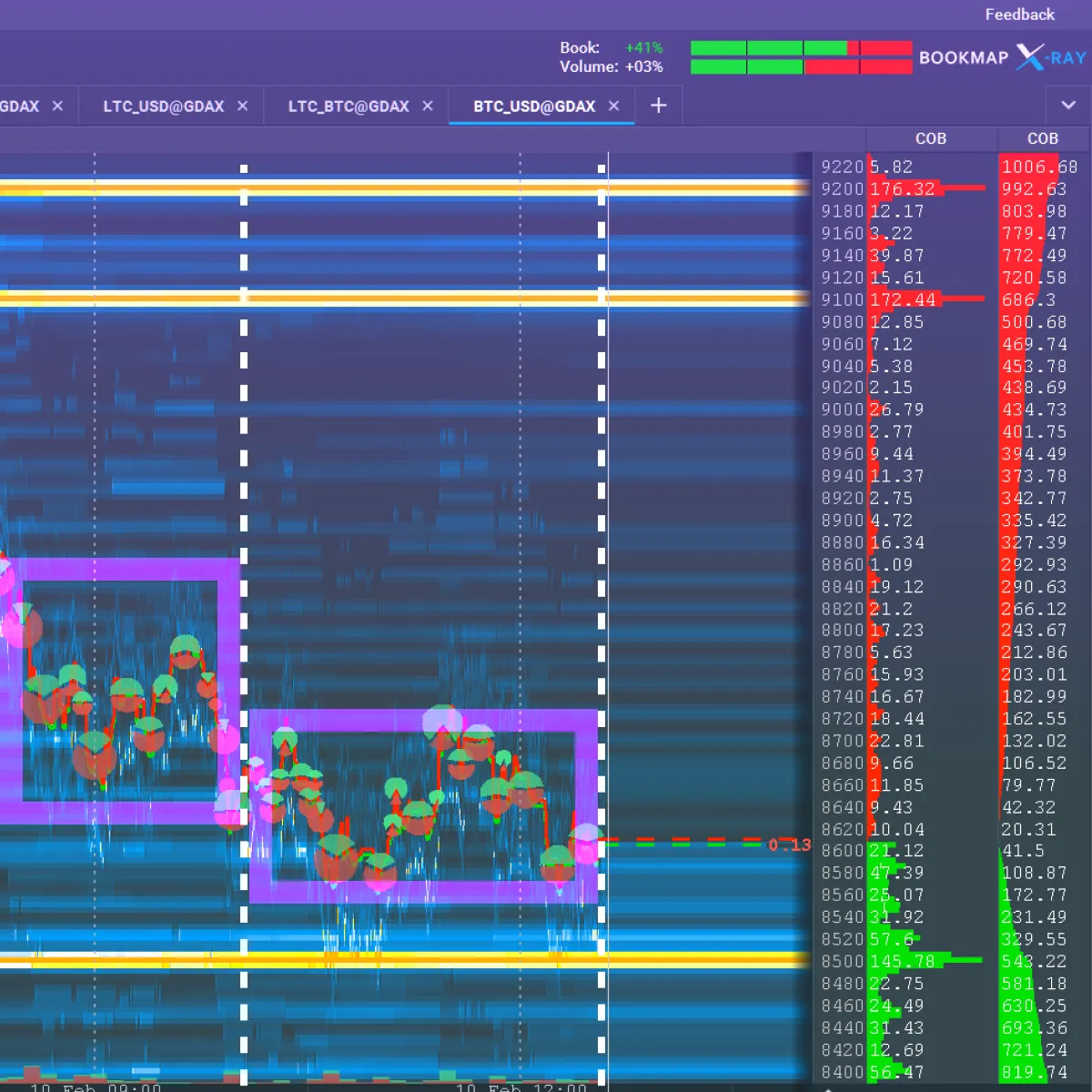

As a trader, it’s important to understand the Bitcoin order flow during halving events. It allows you to identify key market trends. For this purpose, you can start using our advanced market analysis tool, Bookmap. It has modern features like:

- Real-time order flow analysis,

and

- Heatmaps.

These allow traders to monitor liquidity zones (areas where significant buy or sell orders are clustered). It must be noted that during events like the Bitcoin halving cycle, there are sudden spikes in:

- Large buy orders,

or

- Liquidity clusters near critical price levels.

These sudden spikes at such critical price levels signal institutional activity. You can gain valuable insights into crypto market liquidity using our trading platform, Bookmap, to manage your trades effectively.

How Bitcoin Halving Impacts Liquidity?

Bitcoin halving leads to decreased sell-side pressure. This happens because each halving reduces the rewards miners earn for:

- Verifying transactions,

and

- Securing the blockchain.

For example, during the upcoming crypto halving 2024, the block reward will decrease from 6.25 BTC to 3.125 BTC. This reduction means fewer newly minted Bitcoins will enter circulation. In this way, it directly lowers sell-side liquidity.

After halving, miners may choose to hold onto their Bitcoin instead of selling it immediately. That’s because they anticipate higher prices in the future. This behavior further tightens liquidity as less Bitcoin is available for trading in the market.

Moreover, reduced sell-side pressure has historically contributed to upward price momentum. This is why many traders and investors closely monitor halving events.

Increased Retail and Institutional Interest

Generally, halving events draw significant attention from both retail traders and institutional investors. Check the graphic below to learn why:

Let’s understand through an example:

- In 2020, the Grayscale Bitcoin Trust reported increased inflows.

- This happened as institutions positioned themselves ahead of Bitcoin’s price surge.

- This behavior shows how halving cycles can attract large players who:

- Contribute to Bitcoin order flow,

and

- Influence price trends.

Furthermore, it’s important to note that most retail traders often look to capitalize on short-term volatility, while institutional investors focus on long-term potential. During halving cycles, both groups are actively involved in buying Bitcoin. This further tightens the available supply.

In this way, the Bitcoin halving cycle reduces the flow of new coins into the market. Also, it intensifies demand from a broad spectrum of market participants.

Strategies for Trading the Halving Cycle

Trading the Bitcoin halving cycle requires careful planning and analysis. Ideally, before the event, traders should study:

- Historical price trends,

and

- Order flow data.

This study allows traders to spot ideal entry points. Also, several past halving cycles show that Bitcoin often consolidates before experiencing significant upward price movement as the halving nears. Let’s understand better through an example:

-

- Say a trader notices a period of price stability or minor fluctuations (a consolidation phase).

- They decide to take long positions during this time.

- The logic is that as the crypto halving 2024 approaches, there will be:

- Reduced supply

and

- Heightened buying pressure.

- Both these factors will lead to an increase in the prices.

As a tip, during such times, traders can use tools like historical Bitcoin order flow data. Also, they can analyze liquidity zones and gain an edge in identifying such patterns.

Hedging Against Volatility

Volatility is a hallmark of halving events. This makes risk management important. To hedge against potential losses or profit from price swings, traders can use derivatives like options and futures. In such situations, strategies like straddles and strangles are particularly useful.

Here’s an example:

- In a straddle, a trader buys both a call option (betting the price will rise) and a put option (betting the price will fall).

- This approach ensures that if the price moves significantly in either direction, the trader can profit.

- These strategies are especially effective during the halving cycle.

- That’s because increased speculation causes sharp price movements in both directions.

Take Advantage of the Real-Time Tools

To smartly trade crypto halving events, you should use popular real-time tools, like our Bookmap. They allow you to track order flow and liquidity. Using Bookmap, you can even monitor large buy or sell orders and liquidity zones.

With these insights, you can easily spot the activities of major market participants, such as institutions or whales (who often position themselves ahead of key price moves).

Let’s understand with the help of the given scenario

- Say a trader sees a sudden cluster of large buy orders.

- This cluster is near a significant support level.

- Now, this situation indicates strong institutional interest in Bitcoin.

- The trader combines this information with crypto market liquidity insights.

- They adjust their strategies and capitalize on upcoming trends.

Use Bookmap’s heatmap and liquidity tools to track crypto market activity in real time.

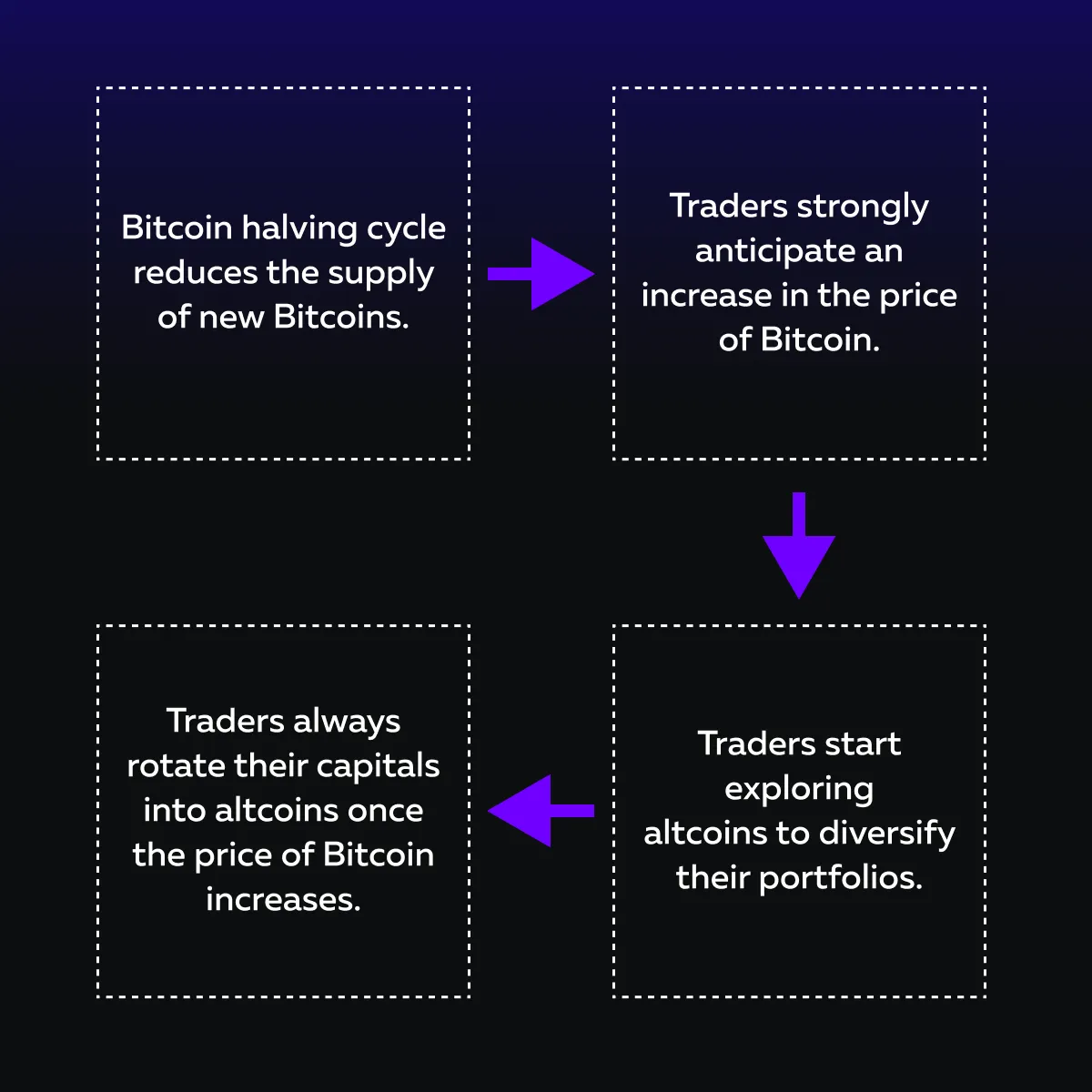

The Broader Impact on the Crypto Market

Please note that Bitcoin halving cycles don’t just affect Bitcoin. Instead, they often have ripple effects on the broader crypto market, particularly altcoins. Check the graphic below to learn why:

Let’s understand through this example.

- During the 2020 halving, Ethereum and other major altcoins saw significant price increases.

- Also, huge spikes in trading volume were noticed.

Generally, traders rotate their capital into altcoins when Bitcoin’s price rises. They do so to capture higher returns in smaller and more volatile assets.

Now, this pattern may repeat during the crypto halving in 2024. Altcoins can again benefit from the overall bullish sentiment in the crypto market. Moreover, please note that altcoin rallies are often correlated with Bitcoin’s performance. Thus, they are a key focus for those seeking crypto market liquidity insights.

Correlation with Macro Trends

Bitcoin’s halving is a significant market event. There are several factors that interact with the halving cycle to amplify or dampen market movements. Know about these factors in the graphic below:

For example,

- In a high-inflation environment, Bitcoin as a scarce and deflationary asset becomes more attractive.

- This was evident during the post-2020 halving rally.

- During this period, pandemic-induced monetary policies were launched, such as:

- Low interest rates

and

- Stimulus measures.

- These policies aligned with Bitcoin’s reduced supply and increased prices to all-time highs.

On the other hand, restrictive monetary policies or declining market liquidity limit the extent of price rallies. This can happen even during a Bitcoin halving cycle. Therefore, traders should always:

- Analyze these dynamics

and

- The Bitcoin order flow 2025 data.

In this way, they can better understand how macro trends influence the effect of halving cycles.

Conclusion

Bitcoin’s halving event is one of the most anticipated events in the cryptocurrency market. It influences supply, price dynamics, and trading strategies.

Be aware that crypto halving cycles reduce miner’s rewards. This decreases the influx of new Bitcoin into the market, which creates scarcity and leads to long-term price increases. Even historically, this has led to heightened volatility and speculative activity before and after the event. Therefore, to trade smartly, traders like you should understand order flow and liquidity. Ideally, try to monitor how large market participants are positioning themselves. Also, analyze key liquidity zones to get insights into market sentiment.

To make an easy and smart analysis, you can start using our advanced market analysis tool, Bookmap. Using it, you can gain a solid grasp of market patterns, historical trends, and advanced analytics. Stay ahead of the crypto halving cycle with Bookmap’s order flow and liquidity tracking tools.