Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

July 18, 2024

SHARE

Liquidation in Crypto: A Survival Guide for Volatile Markets

Crypto markets are highly volatile with associated risks being significant. Bitcoin, for example, has experienced an annualized volatility of 81% since April 2013. However, like any other form of trading, crypto trading can be highly successful for those who are well-prepared and skilled. Otherwise, the fate is the same – Liquidation.

This article explores how exchanges can liquidate positions and outlines strategies to manage and predict liquidation. The article will also guide you to make a liquidation-proof trading plan based on your trading objectives and risk tolerance. Let’s get started.

What is Liquidation in Crypto Trading?

Liquidation refers to a situation when a trader’s position is forcibly closed by the exchange. This mostly happens due to insufficient funds to support the position. Usually, this situation arises in margin trading, where traders borrow funds from the exchange to amplify their trading positions. Here, it’s worth noting that while leveraged trading allows traders to control larger positions with a smaller amount of capital, it also exposes them to higher risks.

Let’s understand this situation better through a hypothetical scenario.

- Say, a trader opens a leveraged long position, anticipating the price of a cryptocurrency to rise.

- However, the market takes a sudden downturn.

- The assest’s value falls.

- As the asset’s value declines, the trader’s margin balance diminishes.

- It eventually reaches a point where it falls below the maintenance margin level set by the exchange.

- At this point, the exchange steps in.

- It forcibly liquidates the trader’s position to prevent further losses.

The effect of liquidation turns into a cascade during periods of high volatility, when price movements are rapid and unpredictable. As one liquidation triggers another,

- It exacerbates the market downturn.

- It leads to a snowball effect of sell-offs.

- It reduces the prices.

In such volatile conditions, traders need to be aware of their liquidation price, which is the price at which their position will be liquidated. You can also try out Bookmap’s liquidation indicator, which highlights where margin positions are liquidated. The tool enables you to:

- See the price level of the liquidation

- Note volume that was liquidated, and

- Determine whether the event happened on the buy or sell side

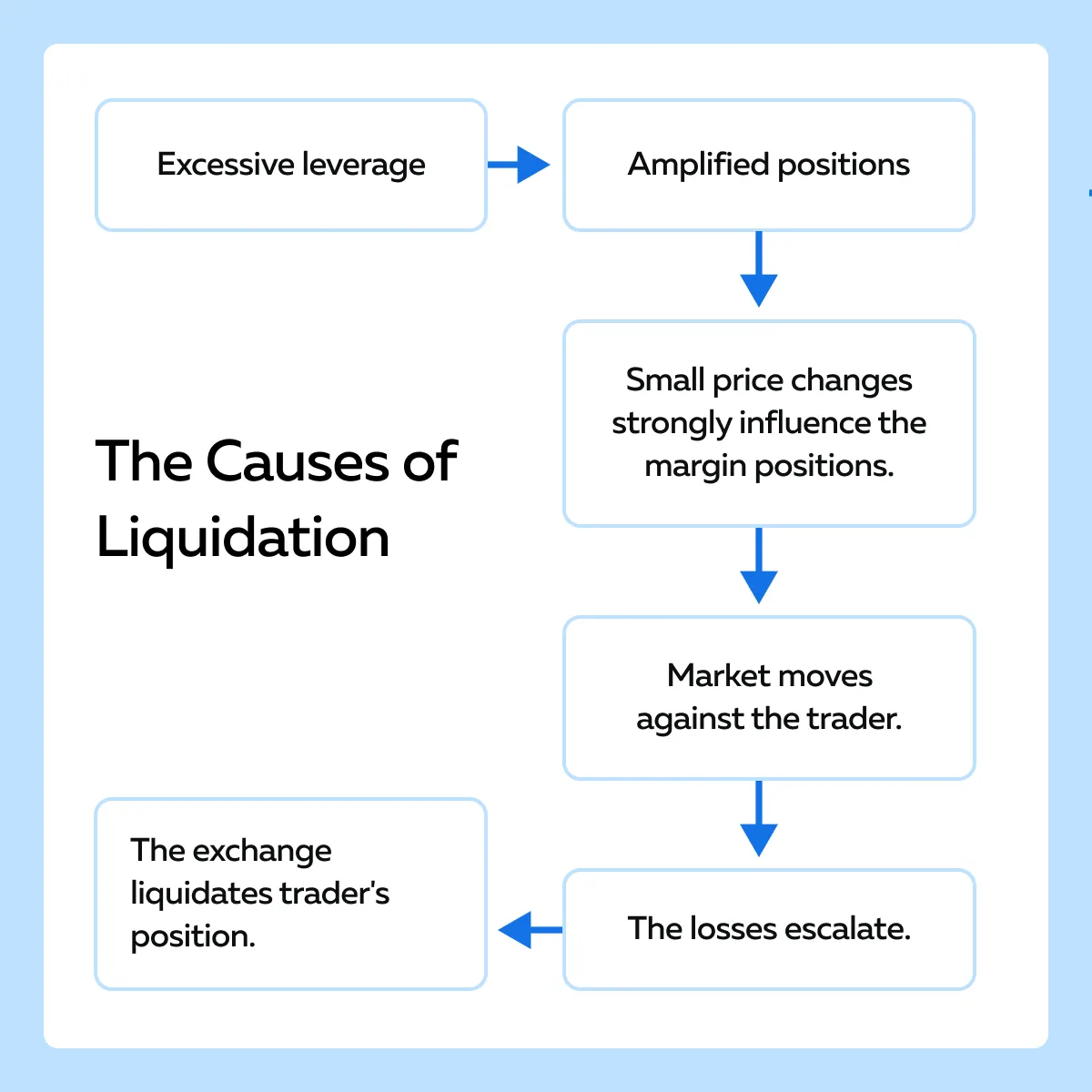

The Causes of Liquidation

One of the primary causes of liquidation is excessive leverage. When traders use high levels of leverage to amplify their positions, even small price movements can have a significant impact on their margin balance. Here’s a graphic to illustrate this point:

Additionally, liquidation can occur due to two other prominent reasons as well:

- Lack of Diversification

-

-

- Concentrating all funds into a single asset or trading pair exposes traders to higher levels of risk.

- A downturn in the price of that particular asset leads to substantial losses.

- It triggers liquidation if margin requirements are not met.

-

- Ignoring Stop-Loss Orders

-

- Ignoring or improperly setting stop-loss orders leaves traders vulnerable to significant downturns in the market.

- Without these safeguards in place, traders find themselves facing liquidation when prices move against their positions.

Some recent examples

Let’s have a look at some recent significant liquidation events in the cryptocurrency market, particularly when leverage is involved:

| Date | Positions Liquidated (in USD) | Explanation |

| April 19, 2023 | $260 million |

|

| April 14, 2023 | $250 million |

|

| October 9, 2023 | More than $100 million |

|

| April 30, 2024 | $325 million |

|

Strategies for Managing and Predicting Liquidation

It must be noted that there are proven tactics that traders can use to both handle and anticipate potential liquidation scenarios. These strategies involve both:

- Utilizing proactive measures,

and

- Reacting promptly to market shifts.

Strategy I: Margin Awareness and Control

Traders must understand margin requirements and the implications of high leverage. To begin with, let’s first understand both these terms separately:

| Margin requirements | High leverage |

|

|

Why should you understand margin requirements and leverage?

- Risk of Losses

-

-

- High leverage means that even small fluctuations in the market can lead to significant losses.

- Traders must know that while leverage can enhance profits, it can also result in rapid and substantial losses.

- Also, trader must use leverage that aligns with their risk management strategy.

-

- Margin Calls and Liquidation

-

- Traders receive a margin call from the broker when:

- A trade moves against them,

- Traders receive a margin call from the broker when:

and

- Their account balance falls below the maintenance margin level.

- This means they must deposit additional funds into their account to meet the margin requirements.

- If traders do not comply, the broker may proceed to liquidate the trader’s positions to recuperate the losses.

- Liquidation often leads to substantial financial losses.

- Sometimes, it wipes out the entire trading account.

- Volatility

-

- Markets may often experience highly volatile, especially in response to economic events or news releases.

- High leverage can exacerbate the impact of market volatility on a trader’s account.

- Traders need to have a thorough understanding of the following:

- Market conditions and

- How using leverage may impacts their positions.

Strategy II: Stop-Loss Orders and Trailing Stops

Several successful traders place stop-loss orders and trailing stops to protect their capital and secure profits in the volatile financial markets. Let’s study them:

What are Stop-Loss Orders?

- A stop-loss order is an instruction given to a broker.

- The instruction states to close a position automatically when the market price reaches a specified level.

- It serves as a safeguard against excessive losses.

- It limits the amount a trader can lose on a single trade.

- By setting a stop-loss order, traders can:

- Define their maximum acceptable loss upfront and

- Minimize emotional decision-making during market fluctuations.

Let’s understand better using an example:

- Say a trader initiates a long position on Bitcoin (BTC) at $10,000 per coin.

- The trader places a stop-loss order at $9,500 to minimize risk.

- If the price of BTC drops to $9,500 or below, the stop-loss order will be triggered.

- At this level, the position will be automatically closed.

- The loss of the trader will be limited to $500 per coin.

What are Trailing Stops?

We can understand trailing stops as a dynamic variation of stop-loss orders. When the market price moves in the trader’s favor, these trailing stops automatically adjust the stop-loss level. This feature enables traders to secure their profits while still giving the trade room to grow.

Let’s continue with the above BTC trade example:

- Suppose the price of BTC climbs to $10,500 per coin.

- Instead of keeping the stop-loss at $9,500, the trader decides to use a trailing stop.

- They set the trailing stop at $10,000.

- This means that if the price retraces by $500 from its peak, the position will be closed.

- This way, the trader ensures protection against losses if the market experiences an abrupt reversal.

- At the same time, trailing stop-loss orders enables traders to capture additional gains as long as the trend remains favorable.

Strategy III: Diversification Across Assets and Strategies:

Diversification across assets involves investing in a variety of financial instruments such as:

- Stocks,

- Bonds,

- Commodities, and

- Cryptocurrencies.

For example, instead of allocating 100% of their capital to leverage trading on a single cryptocurrency, a trader could:

- Spread their investment across various cryptocurrencies and

- Include some portion in:

- Spot trading or

- Other investment types like staking.

This approach reduces the concentration risk associated with a single asset or trading strategy. Let’s understand better by studying some major benefits of diversification:

- Risk Reduction

-

-

- Diversification spreads risk across various assets and trading strategies.

- This reduces the impact of a single adverse event on the overall portfolio.

- If one asset or strategy experiences a downturn or faces liquidation, other assets or strategies may continue to perform well.

-

- Enhanced Stability

-

-

- Diversification stabilizes portfolio returns over time by investing in assets with different:

- Risk profiles and

- Market correlations.

- Assets that perform differently under various market conditions can offset losses in other areas.

- This offsetting effect leads to more consistent and predictable investment outcomes.

- Diversification stabilizes portfolio returns over time by investing in assets with different:

-

- Liquidity Management

-

- Diversifying investments across liquid assets improves liquidity management.

- It ensures that traders have sufficient funds available to:

- Meet margin requirements or

- Seize investment opportunities.

- Liquid assets can be easily bought or sold without significantly impacting market prices.

- This ease of access provides traders with greater agility in managing their portfolios.

Strategy IV: Regular Portfolio Review and Adjustment:

Traders who regularly review their portfolios can:

- Monitor the performance of their investments and

- Adjust positions based on:

- Current market conditions

and

- Personal risk tolerance.

Let’s understand better through an example:

- After a significant bullish run in the crypto market, a trader decides to reduce their leverage.

- They also decide to take profits on some positions to lower the risk of liquidation in case of a market correction.

- By regularly reviewing their portfolio, the trader can:

- Adapt to changing market events,

- Protect accumulated gains, and

- Prevent potential losses during periods of:

- Heightened volatility or

- Adverse market conditions.

How to Build a Liquidation-Proof Trading Plan

To build a liquidation-proof trading plan, you need to consider various factors, such as:

- Risk management strategies,

- Market analysis techniques, and

- Personal trading objectives.

Let’s learn in five simple steps, how to create a trading plan that withstands the test of volatile markets and minimizes the risk of liquidation.

Step 1: Define Your Trading Goals and Risk Tolerance

To begin with, define your trading goals and risk tolerance. Let’s see how you can do it:

- Establish Clear Trading Objectives

-

-

- Determine what you want to achieve through trading.

- Try finding answers to these questions:

- Are you aiming for short-term profits?

- Do you aim for long-term wealth accumulation?

- Or, are you looking for a combination of both?

- Define your objectives in terms of specific outcomes, such as:

- Target returns,

- Income generation, or

- Capital growth.

-

- Quantify Your Goals

-

-

- Set measurable and achievable targets for your trading activities.

- Specify the amount of profit you aim to make within a certain timeframe.

- Alternatively, you can also decide on a percentage return on investment you aspire to achieve.

-

- Assess Your Risk Tolerance

- Evaluate your willingness and ability to tolerate risk in your trading endeavors.

- Consider factors, such as your:

- Financial situation,

- Investment experience, and

- Emotional resilience.

- Determine the level of volatility and potential losses you are comfortable with.

Step 2: Select Appropriate Trading Strategies

Always try to select a mix of trading strategies that:

- Complement each other and

- Provide diversification.

The graphic below shows the kind of strategy you can adopt based on your trading objectives:

Further, you must try integrating risk management techniques into your trading strategies to protect against market volatility and potential losses. To do so, you can utilize stop-loss orders to:

- Limit losses

and

- Preserve capital.

Step 3: Implement Tools for Market Analysis

By utilizing effective market analysis tools, you can make informed trading decisions. Make sure that the tools you use offer real-time market data, including:

- Price quotes,

- Trade volumes, and

- Order book depth.

Furthermore, you can also prefer using visualization tools. These provide insights into:

- Market liquidity,

- Order flow, and

- Volume dynamics.

Bookmap, an advanced market analysis tool, offers visual representations of market activity. You can use it to identify:

- Liquidity levels,

- Order imbalances, and

- Potential price levels of interest.

Step 4: Continuous Education and Adaptation

To stay ahead in the crypto market, you need to continuously educate yourself and adapt to the changing market conditions. Let’s see how you can do it:

- Stay Informed about Crypto Market Trends

-

-

- Keep yourself updated with the latest news and trends in the cryptocurrency market.

- Follow reputable sources such as:

- Crypto news websites,

- Blogs, and

- Social media channels.

-

- Participate in Webinars and Courses

-

- Attend webinars, workshops, and online courses offered by industry experts

- Learn about new:

- Trading strategies,

- Technical analysis techniques, and

- Risk management principles.

- Enhance your trading skills and adapt to evolving market conditions.

- Engage in Community Discussions

-

- Join online forums and social media groups dedicated to cryptocurrency trading.

- Broaden your knowledge by participating in discussions.

- Share insights and learn from the experiences of fellow traders.

Step 5: Regularly Review and Adjust Your Plan

Consistently review and adjust your trading plan. This effort will help you in:

- Staying on track and

- Adapting to changing market conditions.

See how you can do it:

- Set Regular Review Intervals

-

-

- Schedule periodic reviews of your trading plan and performance.

- This could be weekly, monthly, or quarterly, depending on your trading frequency.

- During these review sessions, you must thoroughly analyze your:

- Trades,

- Strategies, and

- Overall portfolio performance.

-

- Assess What’s Working and What Isn’t

-

-

- Evaluate the effectiveness of your:

- Trading strategies,

- Risk management techniques, and

- Decision-making processes.

- Identify areas of strength as well as any weaknesses that need improvement.

- Evaluate the effectiveness of your:

-

- Adapt to Market Changes

-

- Stay attuned to market developments, including shifts in:

- Trends,

- Volatility levels, and

- Macroeconomic factors.

- Adjust your trading strategies and risk management techniques.

- Align with current market conditions and optimize your performance.

- Stay attuned to market developments, including shifts in:

Conclusion

It is a widely believed notion that the crypto market is highly volatile. With frequent occurrences of liquidation, traders must adopt a practical approach to survive in the crypto market. Efforts must be laid on beginning with a well-defined trading plan, which aligns with individual goals and risk tolerance. Then, practical risk management strategies like stop-loss orders and diversification can be implemented.

Traders can also gain a competitive advantage by using advanced market analysis tools like Bookmap, which offers visualization benefits and provides insights into market trends without unnecessary complexity. Lastly, continuously educating oneself and staying abreast of the latest market trends and market shifts through resources like webinars and community discussions is vital.

Are you eager to deepen your understanding and excel in the crypto arena? Read our comprehensive guide “What are liquidations in crypto?” today!