Ready to see the market clearly?

Sign up now and make smarter trades today

Market Structure

October 29, 2025

SHARE

Stop Trading Like It’s 2010: What’s Changed in the Market Microstructure

Do you think trading is all about spotting “chart patterns” and hoping for the best? If so, both your methods and approach are outdated!

In 2025, modern markets are faster, smarter, and far more complex than they were a decade ago. Nowadays, liquidity hides in dark pools, and algorithms move in microseconds. The harsh truth? Traditional tools leave you blind to what is really influencing the price. Thus, you, as a trader, must understand how the market operates. It is just as important as having a strategy.

Struggling to keep up? In this article, you’ll understand several market microstructure changes, from fragmented liquidity and engineered stop-runs to advanced algorithmic tactics. Also, you’ll learn why speed, order flow, and hidden volume matter, and how classic indicators can mislead in today’s fast-paced environment.

Read this article till the end to gain real-time insight that reveals where genuine liquidity lies.

Speed and Automation: The Rise of Millisecond Markets

Do you think the stock market will still move at human speed in 2025? Nope! Trades are nowadays executed in microseconds to milliseconds, far faster than a person can react. Most of the liquidity you see on the screen isn’t from humans placing orders manually. Instead, it’s placed, adjusted, or pulled by machines.

But the Old Times Were Not Like This!

Yes, back in 2010, retail traders could still spot a breakout level or a chart pattern and react before prices moved too far. Not anymore. Modern algorithms anticipate those same levels and act first! Based on their anticipation, they might:

- Fade the move (going against the expected direction)

or

- Clear out stop orders to shake out weak hands.

All of this can happen even before most human traders even click their mouse!

In 2025, Algorithms Dominate the Modern Markets

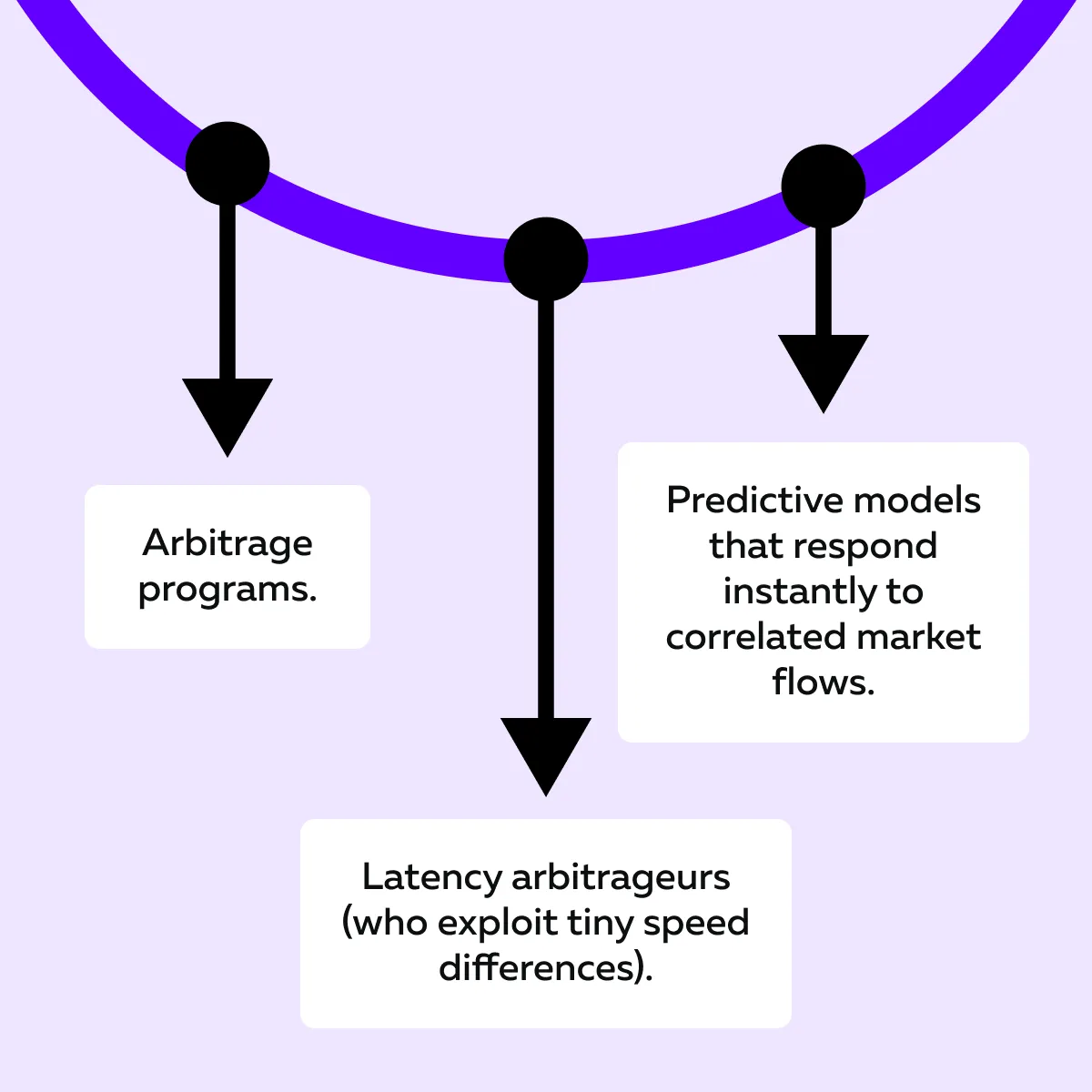

Studies show that in the U.S. stock market, over 70% of trading volume comes from algorithmic trading. That’s a huge chunk! And if you think this is only true for stocks, think again. The Futures markets also see heavy algo activity. And it’s not just high-frequency market makers. You also have to deal with these market players:

So, the power lies with them! They reflect major market microstructure changes. In 2025, it is automation and speed that define who gets the advantage.

How Has Trade Execution Changed in Modern Times?

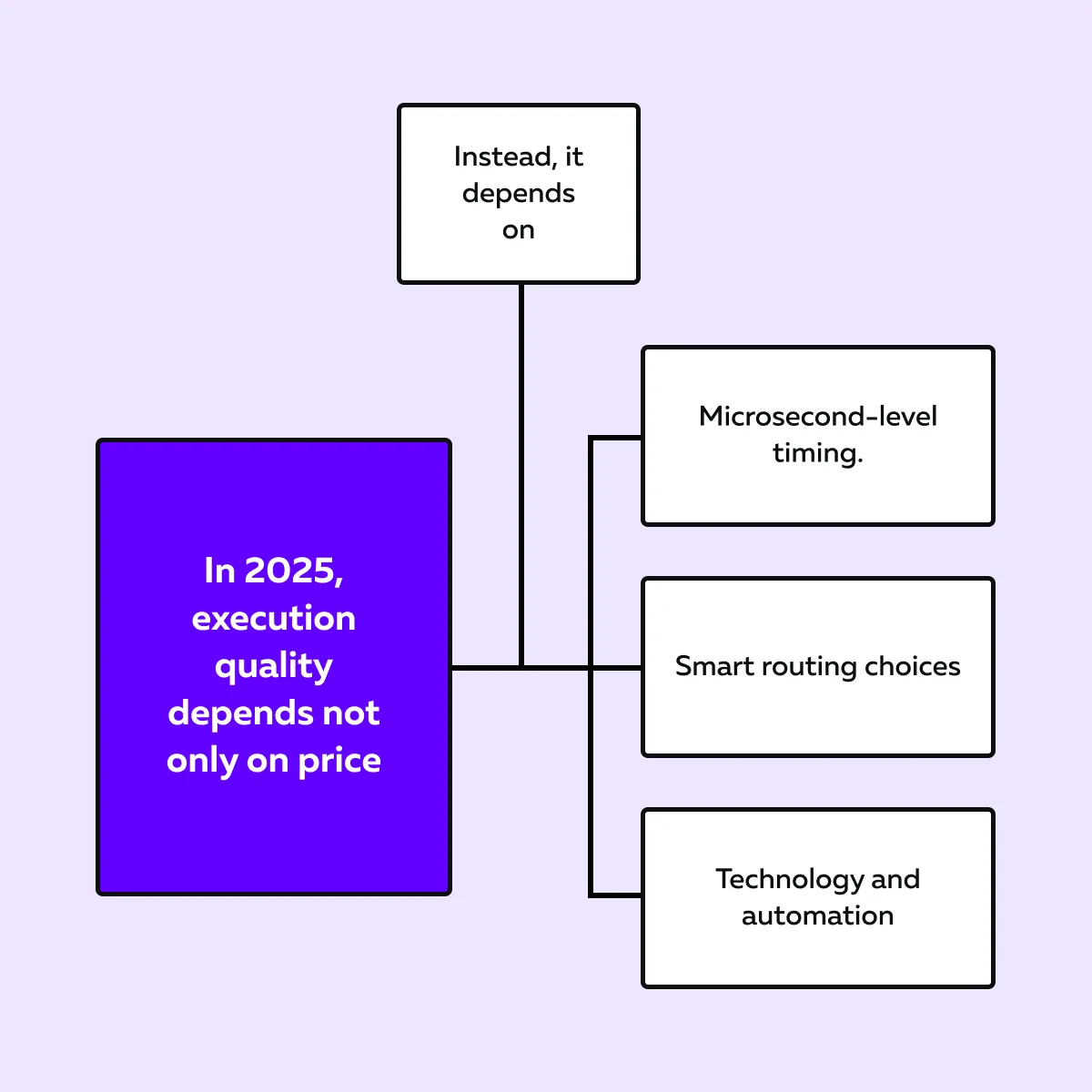

It’s not only about getting the “best price” anymore. Speed and strategy play just an equally important role. The outcome would change depending on the way an order is routed, meaning where it’s sent, how it’s hidden, and when it’s placed. That’s why smart order routing and hidden orders have now become standard tools in the modern trading world.

But Does This Matter for Small Traders Like Me?

Yes! If your order is slow or not routed smartly, you might experience slippage. You may get filled at a slightly worse price than expected. But why? This happens because the liquidity provider or algorithm on the other side had an edge in speed.

So, remember that:

Want to understand modern order flow? Watch it unfold in real time with Bookmap.

Liquidity Fragmentation: Where Did the Market Go?

Want to know about one of the biggest market microstructure changes? It is how liquidity has become scattered and often hidden. Let’s understand this in detail:

Liquidity Is No Longer in One Place!

Back in 2010, most trading volume flowed through just a few major exchanges. If you glanced at the order book, you could get a 100% complete picture of where buyers and sellers stood. Today, things are different!

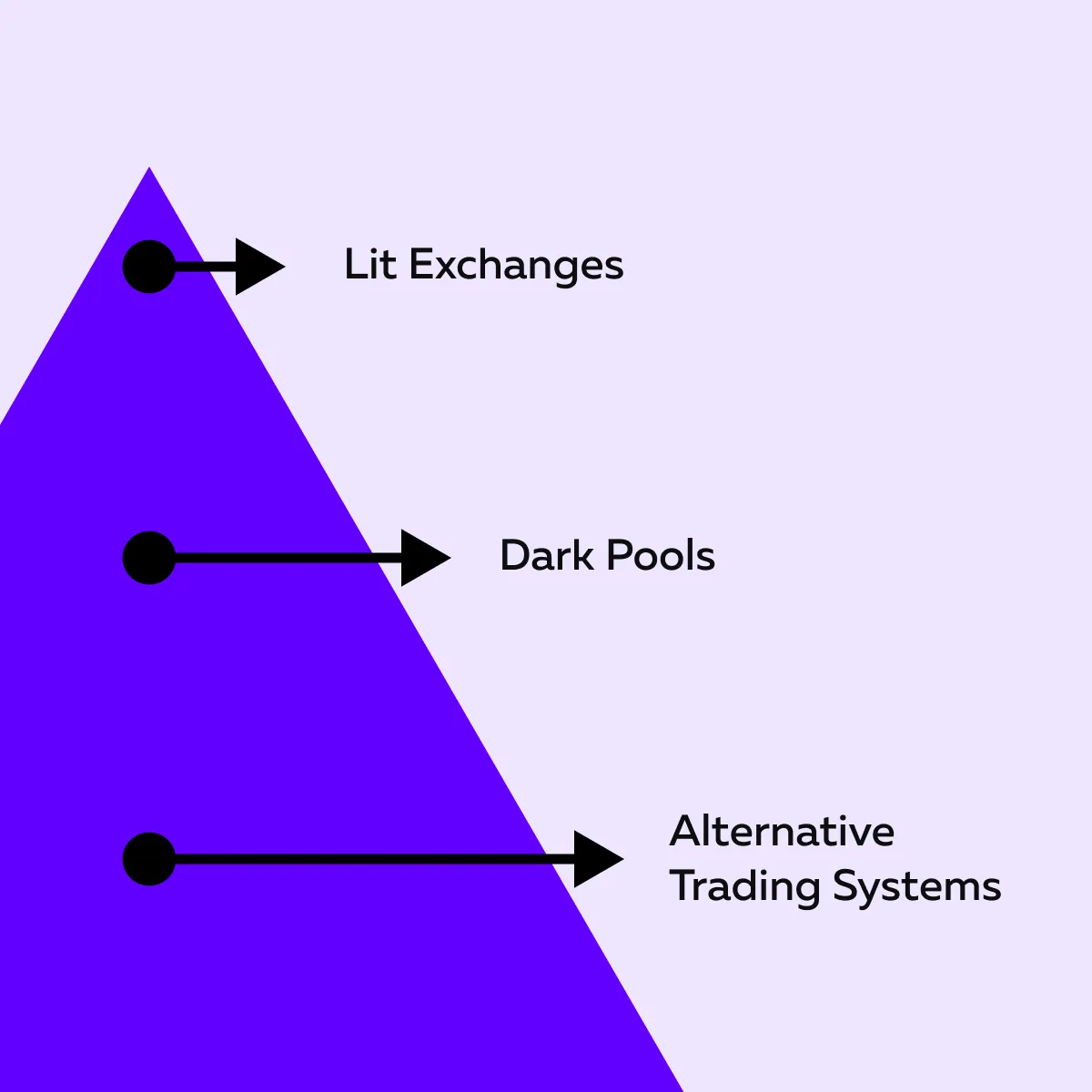

Liquidity is fragmented across dozens of venues, such as:

Due to such fragmentation, the “book” you see on your screen only reflects a slice of the actual market.

Displayed vs. Hidden Liquidity

What you see isn’t always what you get! A large part of liquidity today is hidden through techniques like:

- Iceberg orders (only a small part of the order shows),

- Midpoint peg orders, and

- Dark pool executions.

Because of this, charts and L2 (Level 2) quotes can be misleading. You might think there’s no interest at a certain price level. However, in reality, there could be a hidden size waiting! Even worse, some orders you see might be “bait,” placed to mislead rather than trade.

Any Solution? You Need Advanced Tools That Reveal the Real Flow!

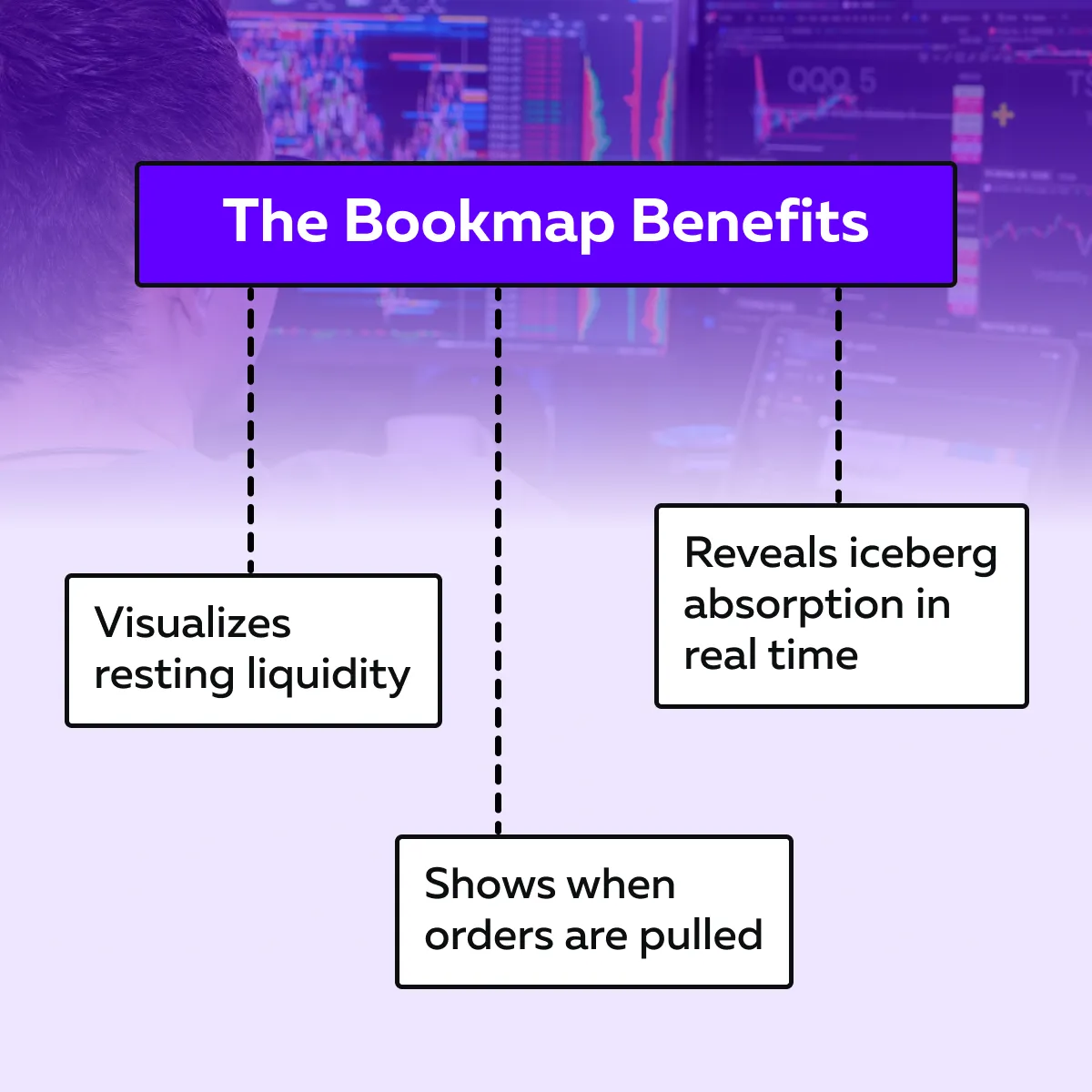

Okay, so how do you succeed in this environment? Most successful traders use market analysis tools, like Bookmap. Let’s see how it helps them:

The trader advantage? With this knowledge, you can easily spot where genuine interest lies, instead of relying only on what’s displayed. See how liquidity actually forms in today’s fragmented market.

The New Algos: How Modern Players Manipulate Price

Do you think the rules are strict and price manipulation has disappeared? Nope! It’s still there and has just become smarter. After regulators cracked down on manual spoofing, where fake orders are placed to mislead others, algorithms stepped in with more advanced tactics.

Spoofing Today is Algorithmic

Nowadays, spoofers do not manually place and cancel large orders. Instead, they use modern algos to do so. These algos use the following tactics:

- Fleeting orders,

- Layered “walls” of liquidity, and

- Conditional logic.

These tricks create the illusion of heavy buying or selling pressure. However, the orders vanish before they ever trade.

Nowadays, Volume and Liquidity Games are Constant

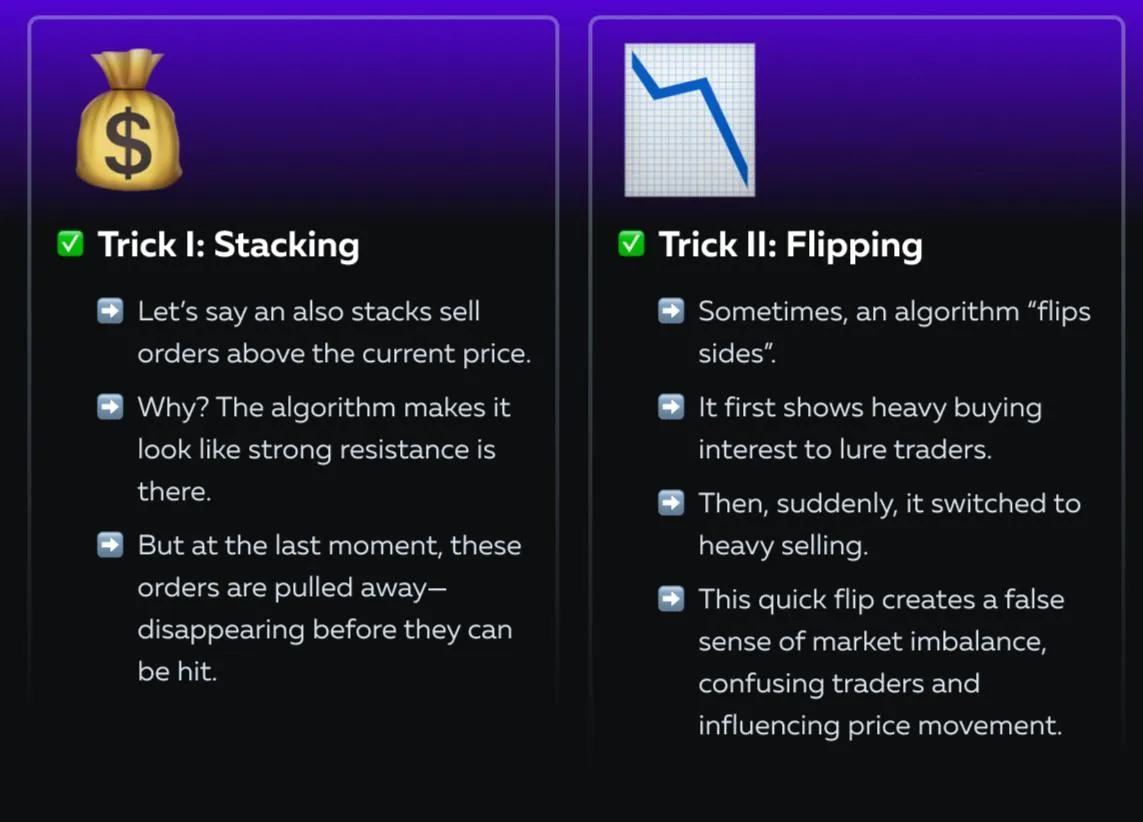

In 2025, an algorithm plays multiple manipulation tricks, two of which are delineated below:

Most retail traders often react to these signals. They try to chase moves that were never real in the first place. Be aware that these tactics are part of ongoing market microstructure changes.

Even the Stop Runs Are Engineered

Do you think stop runs are just accidents? That’s a myth in 2025! In today’s markets, they’re often deliberately engineered by aggressive players. Here’s how it often unfolds in five clear steps:

- Liquidity is temporarily pulled from the order book. This leaves a gap.

- Then, the price is pushed through a key level. This triggers traders’ stop-loss orders.

- As those stops fire, the move accelerates.

- But just as quickly, the price reverses.

- The negative impact? Traders who sold (or bought) during the spike are now trapped.

This tactic is particularly common during rollover periods or times of low trading volume. For example, let’s say in the ES (S&P 500 futures), you might see a price break above a recent high. Then, it spikes for a few seconds, and later collapses right back down.

Do you think that’s a genuine breakout? Not at all! It’s a stop-run engineered by short-term algorithms. Therefore, in 2025, price action alone is no longer enough to judge intent. That’s because algos can manufacture false breakouts that are specifically designed to exploit stop placement and retail reactions.

What This Means for You as a Trader

Please realize the way markets move today is very different from a decade ago! If you’re still relying on old methods, you’re missing what really influences price. Let’s understand in detail:

Old Tools Miss the Modern Market

Classic indicators, such as moving averages or oscillators, were built around static timeframes and candle patterns. They can still be useful, but they don’t capture the detail of modern price formation.

Most of what moves the market today happens at the microstructure level. It isn’t random, but manufactured by placing or pulling liquidity. Now, most of your trading tools only show price charts. They don’t reveal:

- Order flow—who is buying or selling

- Market depth —how many orders exist at each price

- Volume intent—whether real buying/selling pressure exists

Thus, if you rely solely on these in 2025, you might as well be trading blindfolded.

Your Strategies Must Evolve

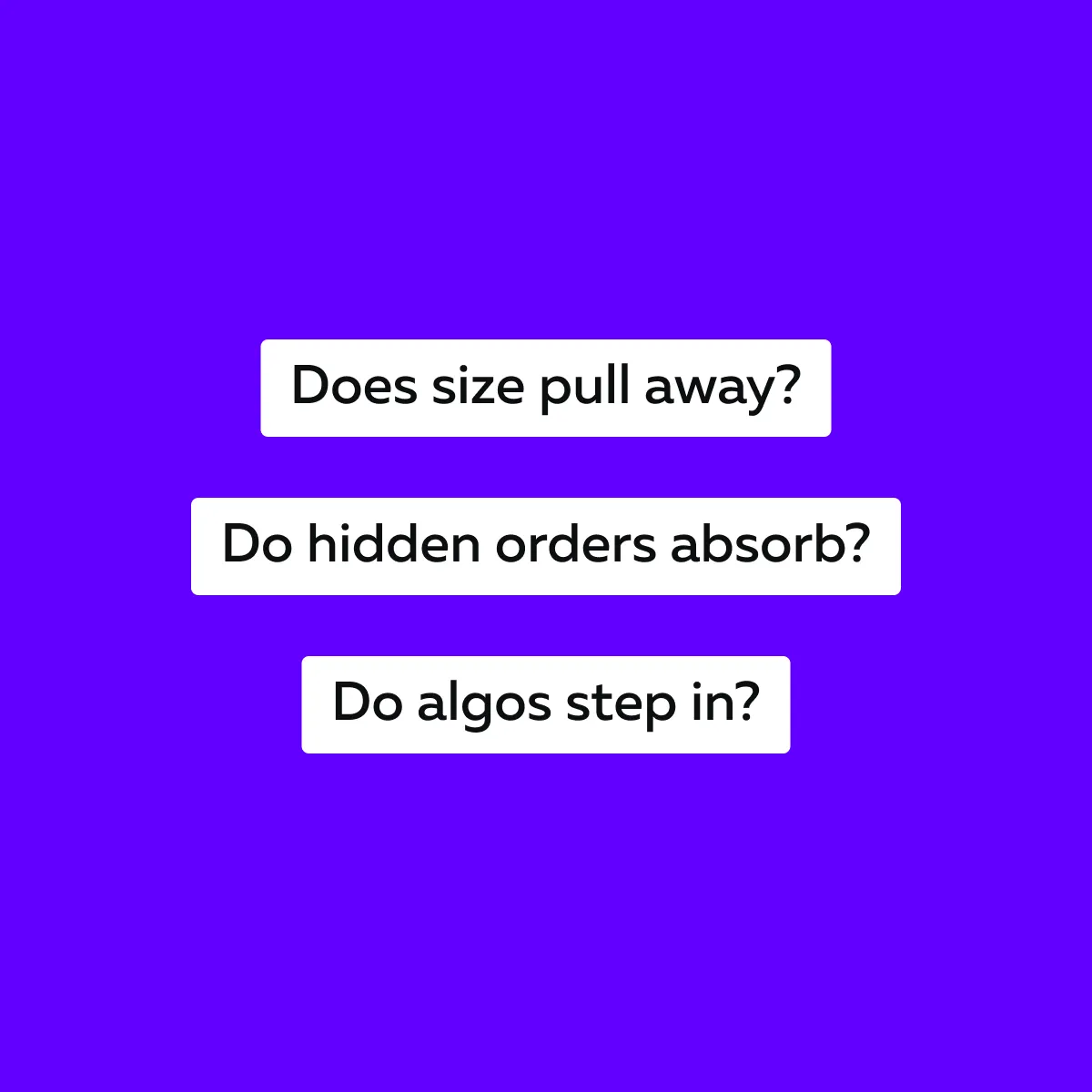

Support and resistance levels alone aren’t enough anymore! You need to understand how liquidity reacts as the price approaches those areas. In 2025, you should find answers to these questions:

These questions matter more than just drawing lines on a chart. Real trading edge now comes from reading liquidity + volume behavior in real time.

Advanced Platforms like Bookmap Add Value!

On Bookmap, you can visualize order flow. This lets you:

- See where algorithms are most active,

- Separate genuine liquidity from fake walls, and

- Spot engineered stop-runs or absorption zones before they trap you.

By shifting from static indicators to Bookmap, you can easily understand how liquidity and volume really influence the price movements.

Conclusion

After reading the entire article, you must have understood that today’s markets have significantly changed. They aren’t just faster! Instead, they’re more complex and fragmented. Also, they are heavily influenced by algorithms that act in ways most traders can’t see on a standard chart.

That’s why your strategies that worked in 2010 will often fall short in 2025. It’s not that you suddenly lost the skill to read markets. Rather, the market microstructure itself has changed. Liquidity now hides and changes in milliseconds. Thus, old tools are less reliable.

So, how to succeed in 2025? You need to see beyond candles and static indicators. You must understand how liquidity appears, disappears, and influences real price action. And that’s where Bookmap comes in.

Using Bookmap, you can get a 100% clear and real-time view of liquidity, order flow, and hidden activity. So, want to trade with confidence? You can’t trade 2025 markets with 2010 assumptions—Bookmap shows you what’s changed!

FAQs

1. What is market microstructure?

Market microstructure is the foundation of trading—the nuts and bolts of how markets operate.! It explains:

- How orders are placed,

- How these placed orders are matched, and

- How these matched orders are executed in the market.

It also covers where trades happen (on exchanges, dark pools, or alternative venues) and how liquidity behaves. By studying microstructure, you, as a trader, can understand why price moves the way it does and how hidden forces influence market behavior.

2. Why does speed matter in modern trading?

Speed matters because the market no longer runs at human pace! Algorithms now dominate trading. They can execute orders in microseconds, which is far faster than any trader can react. This speed gives them an edge in:

- Absorbing liquidity,

- Triggering stops, and

- Faking moves.

All this can happen before retail traders can even respond. Now, if you don’t account for this, there is a high risk of poor fills and slippage. Also, you may be tricked into chasing false breakouts.

3. What is liquidity fragmentation?

Liquidity fragmentation means that trading volume is spread across many different venues instead of being concentrated in one place. Years ago, most activity was visible on a few major exchanges. But now, volume is divided between dozens of:

- Exchanges,

- Dark pools, and

- Private trading systems.

The impact? This makes the market less transparent because what you see on one platform doesn’t reflect all the actual buying and selling.

4. Are spoofing and manipulation still legal?

Spoofing and manipulation of any form have always been illegal. However, in 2025, these tactics have evolved to save themselves from the eyes of regulators. Nowadays, modern algorithms use:

- Fleeting orders,

- Order layering, and

- Quick cancels.

These tactics trick others into believing there’s buying or selling pressure! But why aren’t they caught? These actions happen in milliseconds and often within legal loopholes. That’s why they are harder for regulators to catch. So, these tactics look legal on paper, but the intent is still to mislead other traders.

5. How can I adapt my trading to a modern structure?

Don’t rely only on old indicators or charts! Instead, you must watch:

- How does liquidity form?

- How does liquidity disappear?

- How do trades get absorbed?

To gain further precision, as a trader, you should also study how algorithms behave during:

- News events,

- Low volume hours, and

- Near key price levels.

These analyses can be easily done using market analysis tools, like Bookmap. Using them, you can get real-time visibility into hidden orders and liquidity. The benefit? You trade with context and not guesswork!