Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

January 14, 2026

SHARE

The Illusion of the Perfect Entry: Why Timing Isn’t Everything

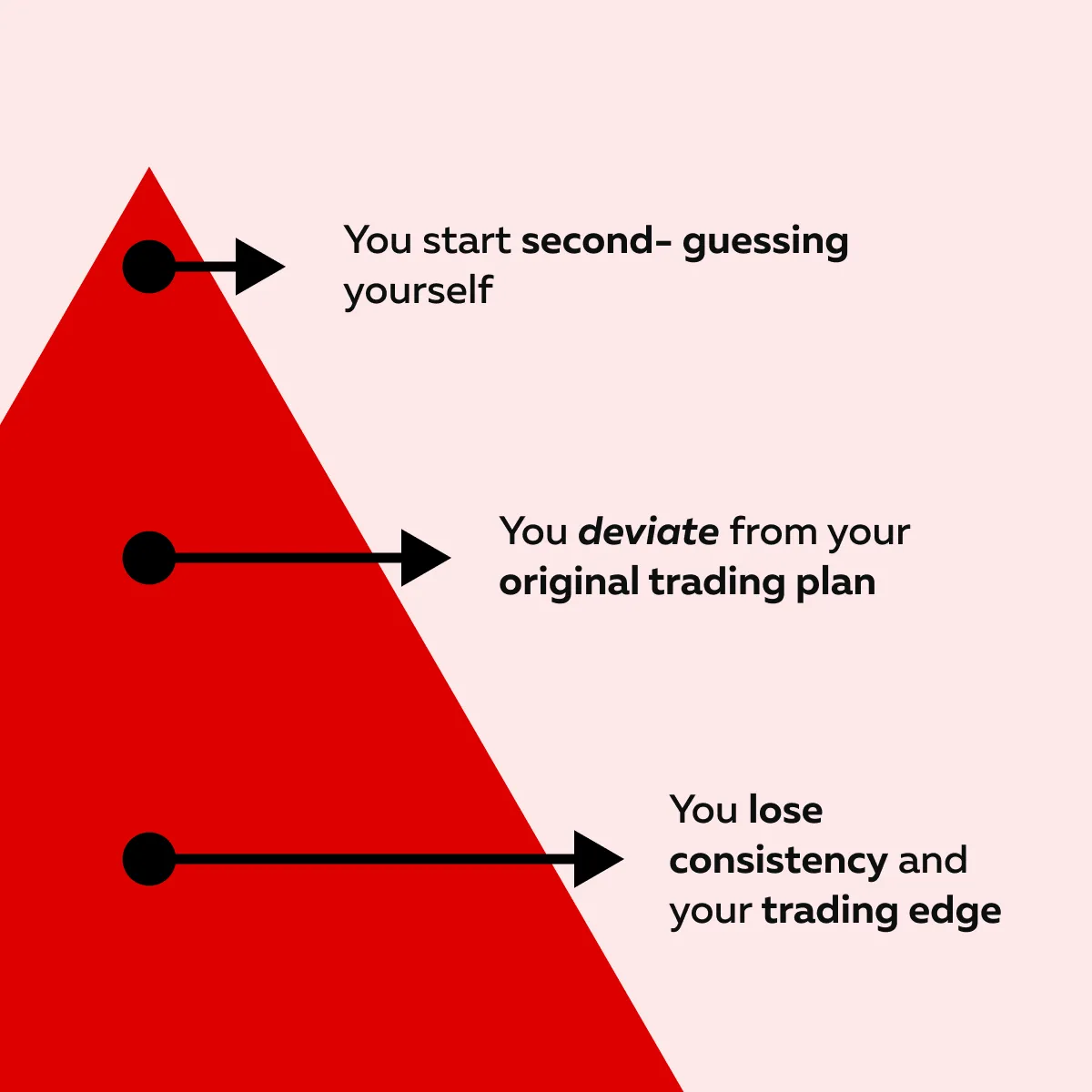

Do you know where most traders burn endless hours? They try chasing that perfect entry trading. And, they keep on waiting for a single tick that seems ideal. But they end up missing solid opportunities and start second-guessing themselves.

Always remember that markets don’t move on wishes! They move on to liquidity, structure, and collective behavior.

So, what’s the smarter approach? Understand the trade structure and focus more on trade execution, not timing. Pro traders think in zones, not price points. They read context and manage risk carefully rather than hunting for exact tops or bottoms.

Read this article to learn how to define valid entry ranges, scale positions, and spot real liquidity. You’ll also understand how real-time market analysis tools, such as Bookmap, can give you a real edge in reading the market.

Why the Search for Perfect Timing Hurts More Than It Helps

Most traders believe that finding the perfect entry point is everything! But that’s a myth. In reality, waiting for that flawless setup often does more harm than good. When you focus too much on timing trades, you either:

- Hesitate too long and miss the move

or

- Jump in too early out of fear that the market will run without you.

Both scenarios damage your confidence + performance! Furthermore, this obsession with precision also adds emotional pressure. Let’s see some of its side effects:

Okay, so what should your approach really be? How you manage risk, entries, and exits matters far more than nailing pinpoint timing. Here’s a simple way to manage each of these three parts better:

| Part I: Risk | Part II: Entries | Part III: Exits |

|

|

|

For example, let’s say you spot price slowing near support. Now, instead of jumping in, you wait for a “perfect” confirmation (a wick or a volume spike). This way, you don’t chase the move and avoid getting caught in the pullback.

So, the lesson? Pay attention to your trade structure and execution plan, not flawless timing. Bookmap shows you where the real battle happens. Trade the structure, not just the entry.

What Pros Focus On Instead of Perfect Entries

Professional traders know that success doesn’t come from catching the exact top or bottom. Instead of chasing perfect entry trading, they focus more on:

- Structure,

- Context, and

- Execution.

The knowledge so gained allows them to identify zones where smart money is active and price reactions are most likely to occur. Let’s break down how pros trade:

1. Structure Over Spot Price

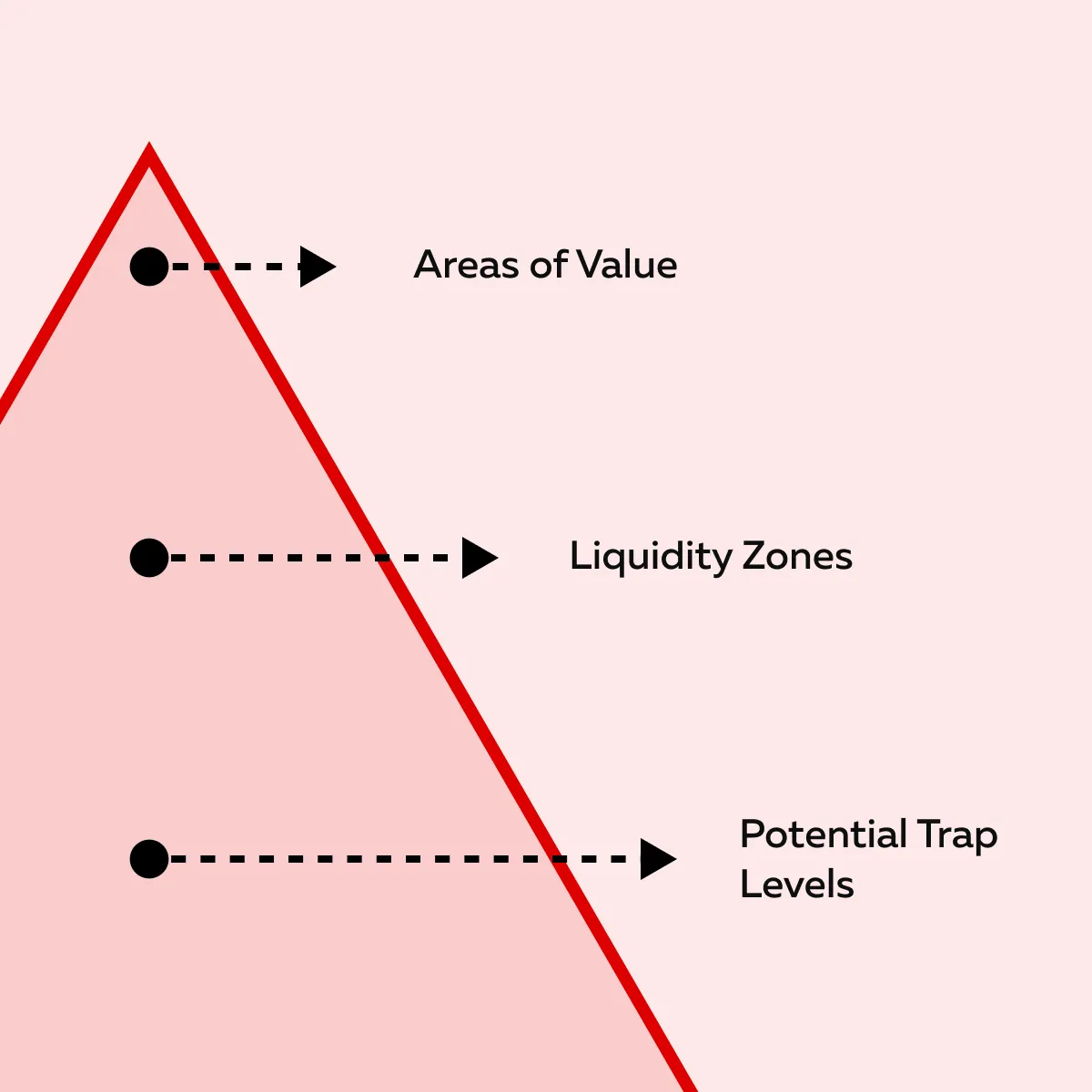

Experienced traders build their plans around market structure, not just the current price. They look for the following:

These are places where big players are likely to act. Always remember that price itself is temporary, but structure reveals collective market intent. For example,

-

- Let’s say a pro trader is buying near a high-volume node showing strong absorption.

- They enter into trade even if the price has already moved a few points.

- Why? Their focus is on trade execution, not clock-perfect timing.

- They are entering where the structure supports the trade.

- They are not chasing a “perfect” tick.

2. Context Over Candles

Do you think a good trade is just about where you enter? Nope! It is also about when and why. Every setup must fit into the bigger market picture, including:

- The time of day,

- Broader market trend, and

- Recent price behavior

Pros understand that an entry outside the right context is just noise! For example, a fade trade during a quiet lunch hour won’t move like one taken at the market open.

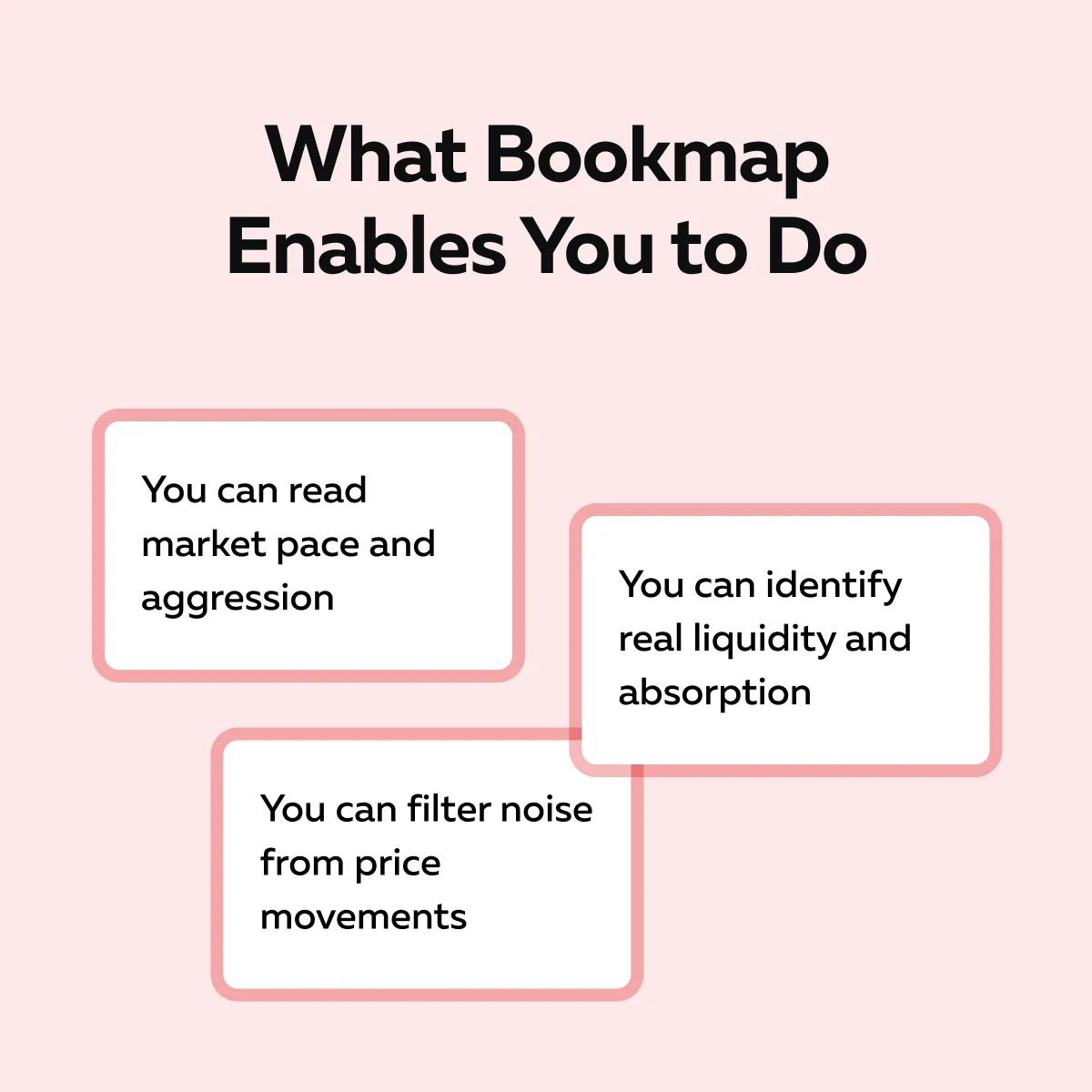

By using pro market analysis tools, like Bookmap, you can easily read pace and aggression. This gives context to your trade execution vs timing decisions. And next, this context filters noise and lets you align entries with real market conditions.

See volume, liquidity, and execution in real time — not just price candles.

3. Execution and Size

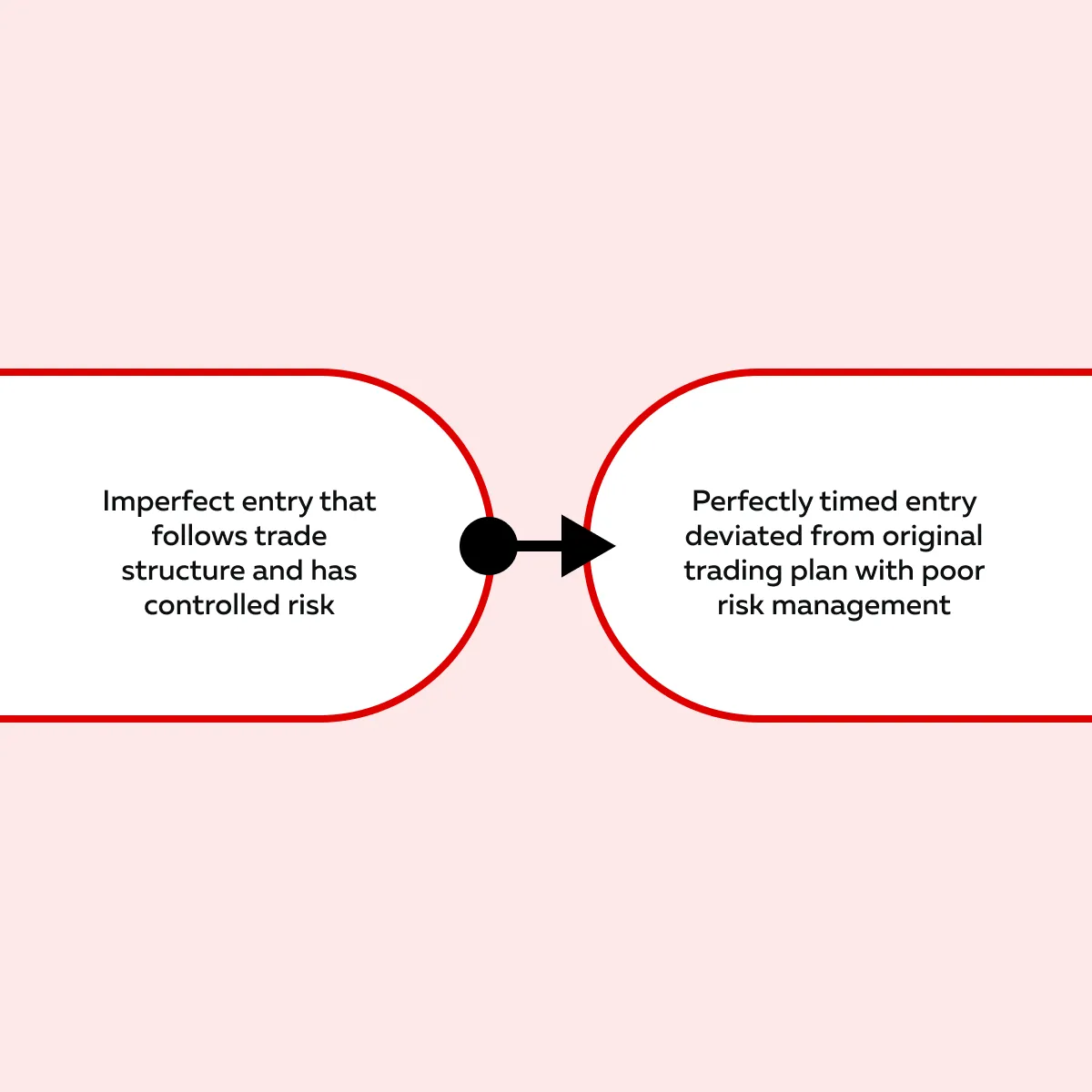

Did you know? Even the perfect entry trading idea falls apart without strong execution. Professionals know that “how” you enter matters more than “when”. That’s why they manage position size, risk, and scaling carefully. They always try to build around zones instead of jumping in all at once!

As a trader, you must note that an imperfect entry with solid trade structure and controlled risk often outperforms a perfectly timed entry with poor management.

That’s why you must learn how to manage trade entries rather than chasing perfect timing.

The Myth of Bottom-Ticking and Top-Ticking

Many traders believe that professionals can time trades perfectly! They have the skills to:

- Buy at the exact bottom

or

- Sell at the exact top.

But in reality, that’s another myth! The idea of perfect entry trading sounds appealing, but those highs and lows are only obvious after the move is over. That means the “perfect” top or bottom of a market move isn’t known while it’s happening. You only realize where the exact high or low was after the price has already moved past it. Thus, in real time, trying to catch that exact point is mostly guesswork.

Furthermore, trying to “call the bottom” often increases risk. Market lows aren’t formed by one magical tick! Instead, they build through:

- Multiple retests,

- Absorption of sell orders, and

- Failed pushes by aggressive traders.

That’s why understanding trade structure is key! It allows you to see how the price reacts and not just where it turns.

The Bookmap Help!

On Bookmap, you can actually watch this process happen in real time! It helps you easily spot:

- Volume absorption,

- Iceberg orders, and

- Failed attempts to increase the price.

Each of these signals provides early clues of a potential reversal, helping you read what’s really happening beneath the surface — where genuine order flow and intent lie.

How to Think in Zones, Not Points

Most traders make the mistake of treating trade entries like sniper shots! They aim for one perfect price. However, professional traders think in zones, not as single points. A zone is an area where the trade structure supports your idea! It is usually a:

- Pullback area,

- Liquidity pocket, and

- Key level, where buyers or sellers are likely to step in.

The major advantage of planning entries as zones? – You gain flexibility. You can scale in gradually and reduce size if conditions change. Additionally, you can even cut the trade if your setup becomes invalid. This approach reduces emotional pressure and helps you avoid that “perfect entry” illusion.

Thus, as a smart trader, you should always define your trading zone in advance based on context. For example,

-

- Let’s say your zone is “anywhere within this 3-point pullback showing absorption.”

- Now, assume that the price dips into VWAP or a prior breakout level.

- Also, passive buyers appear.

- The trade remains valid.

Always remember that you don’t need to catch the exact bottom tick! The best approach is to react within structure and not predict perfection.

When Entry Does Matter More — and What to Watch For

There are particular times when “trade timing” becomes highly important. That’s mainly during high-volatility sessions or in thin markets where prices fluctuate rapidly. In such conditions, even a small delay or early entry can make a big difference!

But that doesn’t mean you start chasing perfect entry trading! It just means being more aware of structure and confirmation before acting. During these times, your understanding of trade structure becomes even more important. You must try to read what’s happening beneath the surface in the three key ways, as tabulated below:

| Way I: Look For Real Liquidity | Way II: Watch For Stop Runs Followed By Absorption | Way III: Notice Large Volume Dots On Tools Like Bookmap |

|

|

|

These signals let you see where real market participants are active. Also, you gain context for your entries, which reduces reliance on chasing perfect timing.

Conclusion

So, now you know the truth! Perfect entry trading doesn’t exist. Markets move through layers of intent, liquidity, and reaction. The entries are just far too dynamic to time with precision. The harsh truth? The harder you chase that “ideal” tick, the more you drain your confidence and capital.

That’s why, in 2025, change your mindset and start thinking in zones, not points. Try to work around trade structure, manage risk, and, most importantly, trust your process. Remember, it’s not just the timing, but consistent trade execution that separates professionals from hopefuls!

Want to actually see how structure, absorption, and liquidity form in real time? There’s no better tool than Bookmap. Using it, you can visualize market depth + volume flow. Stop chasing perfection. Watch real market structure unfold with Bookmap.

FAQ

1. How do I know if my entry is “good enough”?

A “good” entry isn’t about being perfect. Instead, it’s about being logical. Your entry is valid if it:

- Sits within a solid trade structure,

- Aligns with the market context, and

- Has clear risk parameters.

If all these parameters are followed, you don’t need the best price. Just try to spot a controlled setup that fits your plan.

2. Is it okay to scale into positions?

Yes! Many professionals build positions gradually within trade zones, instead of entering all at once. The technique of scaling allows you to:

- Adapt your trades as price develops,

- Manage risk better, and

- Avoid getting shaken out by short-term volatility.

3. What tools help spot good structure?

Bookmap is one of the most used advanced real-time market analysis tools. Using it, you can easily visualize:

- Volume,

- Liquidity, and

- Order flow.

Additionally, you can actually see where buyers and sellers are active and where strong reactions are most likely.

4. Why do I always feel like I enter too early or too late?

That feeling comes from “hindsight bias”. It is the tendency to believe, after an event has happened, that you “knew it all along” or should have predicted it.

In trading, this makes you feel like you entered too early or too late because, looking back, the “perfect” price seems obvious. The solution? Always focus on your trade structure, risk, and process. Don’t blame yourself for not hitting a perfect tick!