Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

August 8, 2025

SHARE

What Happens to Futures Liquidity During Major ETF Rebalancing?

Those were the last days of the quarter. You found the futures market suddenly came alive in the final minutes of the trading day. This happened on Monday, and it repeated on Tuesday. You witnessed the same yesterday!

No, you’re not imagining things! This is the impact of “ETF rebalancing.” Every quarter or so, large exchange-traded funds like SPY or QQQ adjust their holdings. Why? They try to match changes in the indices they track. Does this sound like a stock market event? Nope! It has a major impact on futures markets, particularly in the S&P 500 (ES) and Nasdaq (NQ) futures, because big funds often use futures to manage their exposure during these rebalances.

And, by doing so, they create some of the most profitable trading opportunities! Want to go deep? In this article, you’ll learn exactly how ETF rebalance trading affects futures prices, when these flows usually hit, and how to spot real institutional activity. Most importantly, you will study how to protect yourself and trade smarter using our avant-garde market analysis tool, Bookmap. Let’s begin.

What Is ETF Rebalancing—and Why Futures Are Affected

ETF rebalancing is when an exchange-traded fund (ETF) updates its portfolio to stay in line with the index it follows. For example:

- Let’s say you are investing in ETFs like:

- SPY (which tracks the S&P 500)

or

- QQQ (which tracks the Nasdaq-100).

-

- Now, these funds occasionally rebalance.

- This means they buy or sell stocks to reflect changes in the index.

- Such a sale/ purchase usually happens every quarter or six months.

So, How Do Futures Come into Play?

During ETF rebalance trading, fund managers often need to buy or sell a large number of stocks very quickly. Usually, they do so near the market’s closing time! But instead of moving billions in actual stocks all at once, which could impact prices, they often use index futures like the:

- S&P 500 futures (ES)

or

- Nasdaq futures (NQ).

But why? This is because futures provide deep liquidity, which is crucial during ETF rebalancing. It allows these managers to adjust their exposure without disrupting the market too much.

However, when everyone is adjusting at the same time, futures flow during ETF rebalance can create sudden spikes or drops in liquidity. Traders often refer to this event as “liquidity vacuums or surges.”

How Futures Liquidity Shifts During Rebalancing

When ETFs rebalance their portfolios, it sends ripples through the futures markets! Futures liquidity doesn’t stay constant. It shifts dramatically, particularly near the close of the trading session.

Let’s look at how these changes happen and what traders should watch for:

Liquidity Pockets Form Near the Close

Most ETF rebalance trading happens in the final 30 minutes of the trading day! That’s when the funds make last-minute moves to adjust their holdings. As a result, futures liquidity, particularly in index futures like ES (S&P 500) or NQ (Nasdaq), appears suddenly at key price levels, such as:

- VWAP (Volume-Weighted Average Price)

or

- The prior day’s high or low.

Let’s understand better through an example:

- Let’s assume ES futures are trading calmly all day.

- Then suddenly, large sell orders pop up exactly at yesterday’s high.

- Now, these orders aren’t random!

- They’re institutions placing orders to manage the futures flow during ETF rebalance.

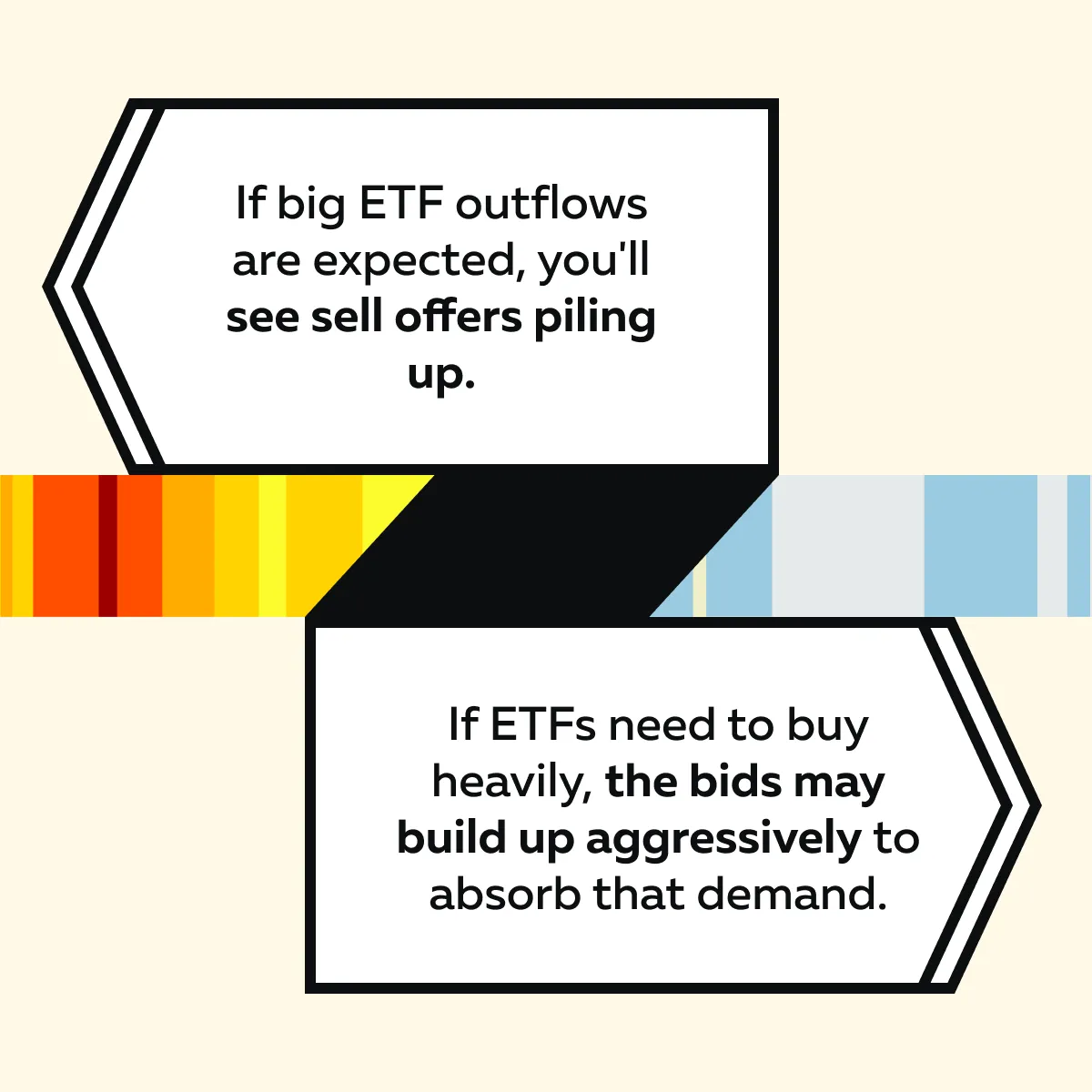

Bid/Offer Depth Becomes Uneven

During rebalancing days, the order book usually behaves oddly. How? Sometimes, you will observe that bid-offer depth, which shows how many contracts are waiting to buy or sell, becomes lopsided.

Let’s see how this happens:

How to spot this lopsidedness? Start using our real-time market analysis tool, Bookmap. Using it, you can do a deep DOM (Depth of Market) analysis and spot these shifts.

Also, such an analysis lets you identify “trap zones” where it looks like there’s support or resistance. However, these zones are created entirely by ETF rebalancing flows! Usually, in these zones, the price quickly reverses after the order is filled.

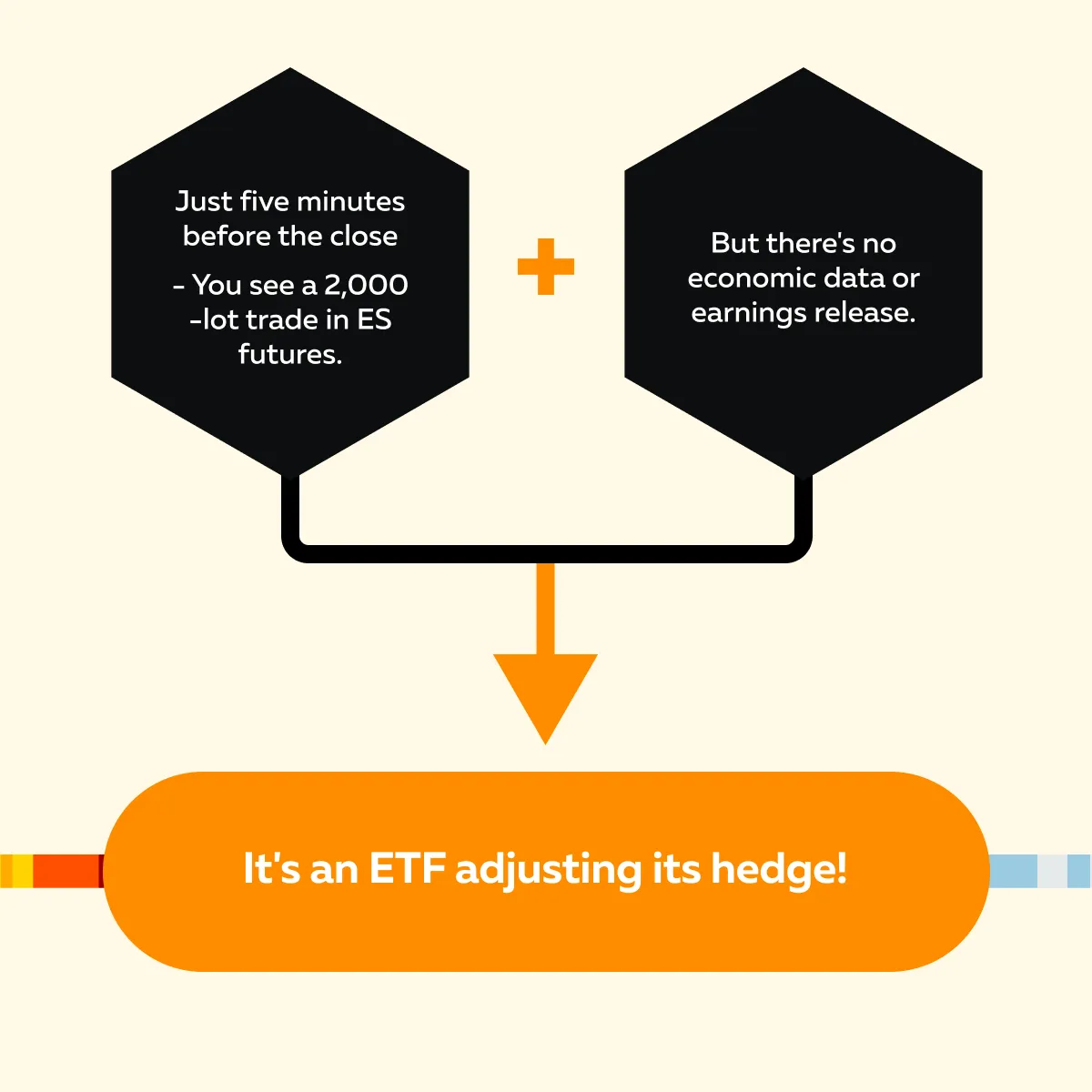

Volume Spikes Without Obvious News

One of the clearest signs of ETF rebalancing impact is a sudden volume spike in futures with no news catalyst. If you see a 2,000-lot trade in ES futures just five minutes before the close and there’s no economic data or earnings release – chances are, it’s an ETF adjusting its hedge!

This kind of ETF hedge-driven futures flow often confuses newer traders! But you must understand it. The benefits? If you don’t understand this flow, there is a high chance you’ll get caught off guard by unexpected moves. This can particularly happen:

- Near quarter-end

or

- Other known exchange-traded fund rebalancing dates.

Trade ETF rebalance days smarter—watch how large players shift liquidity using Bookmap tools.

Practical Strategies for Traders on ETF Rebalance Days

Trading on ETF rebalance days offers unique opportunities. But they also come with some serious risks! So, how to manage them? Since ETF rebalance trading usually creates heavy flows late in the day, you, as a trader, must adjust your strategies accordingly.

Let’s see three simple but powerful approaches to stay smart during these volatile sessions:

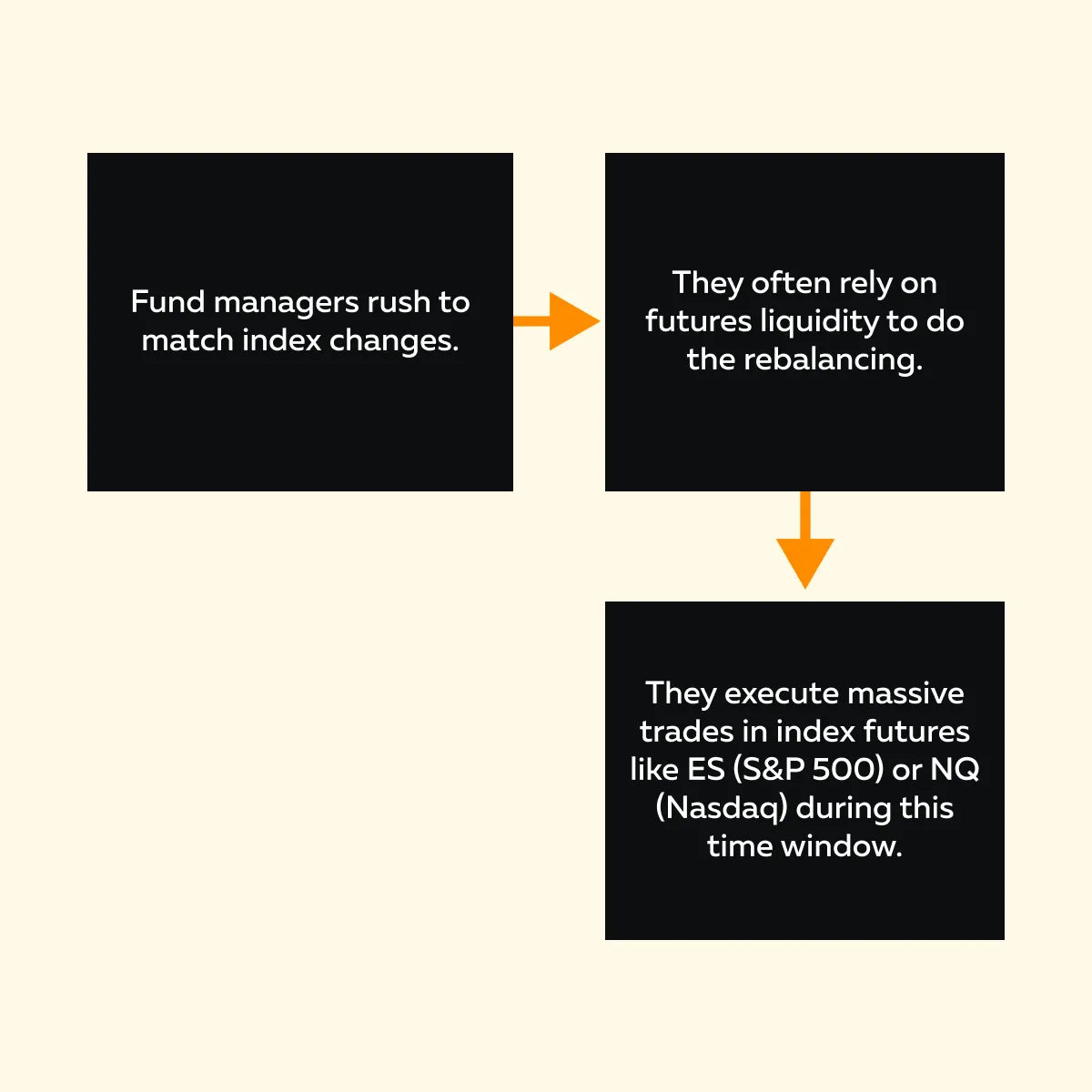

Focus on the Final Hour

The most important action usually happens in the last hour of the trading day, particularly the final 15 to 30 minutes. But what exactly happens? Check out the graphic below to learn how futures flow during the ETF rebalance, which really kicks in in the final hour:

A Pro Tip

Throughout the day, note the price zones where heavy buying or selling showed up. These “liquidity levels” often act like magnets or resistance/ support barriers as the rebalancing flows hit near the close.

Use Order Flow Confirmation

Please don’t assume every late-session spike is due to ETF rebalancing! Instead:

- Be selective,

and

- Wait for real signs of institutional activity.

This is what you should look for as a trader:

| I) Aggressive order flow | II) Fresh liquidity stacking |

|

|

How to watch these signs? You can use our advanced market analysis tool, Bookmap, which tracks real-time order flow. By using it, you can easily confirm whether you’re seeing genuine ETF-driven futures activity or just false moves.

Avoid Overreacting to Early Session Moves

One of the biggest mistakes traders make on rebalance days is jumping in too early! They usually get attracted to some noise that appears in the morning or midday. But please realize that the exchange-traded fund flows that truly impact markets usually don’t hit until much later!

Most premature trades during thin midday liquidity often lead to:

- False breakouts

or

- Fake reversals.

You must understand that these early moves rarely reflect actual ETF rebalance trading! They’re more likely to be speculative positioning!

So, stay patient. The futures liquidity situation shifts most dramatically in the final hour, and that’s when the cleanest setups emerge.

Managing Risk Around Rebalancing Liquidity

Most ETF rebalance days are filled with sharp and unpredictable moves, particularly in futures markets. During these times, big players usually enter the scene. If you’re not careful, you can get caught in:

- Fakeouts

or

- Violent reversals.

Let’s see how you can manage your risk smartly during these volatile moments:

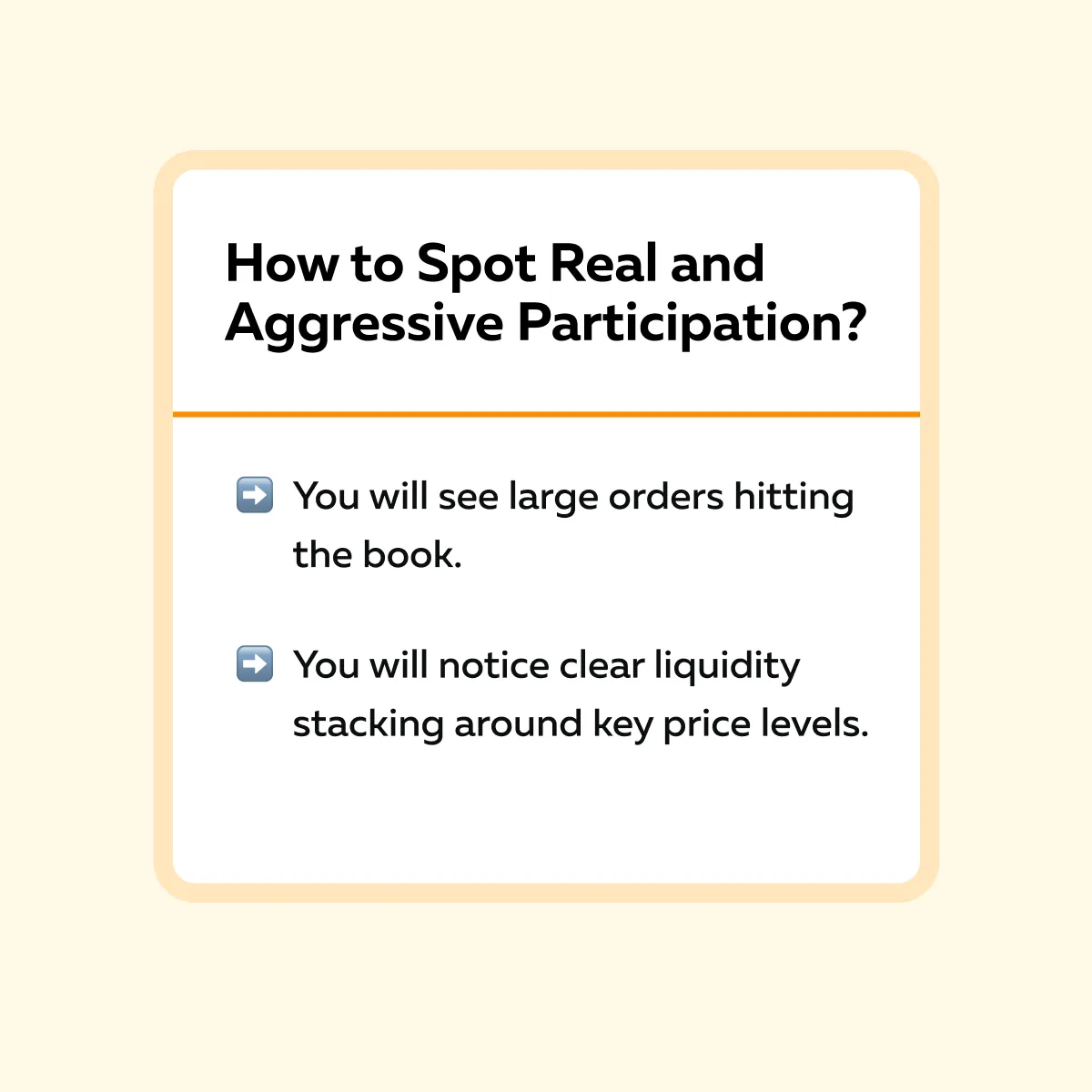

Size Down Unless You See Real Participation

On ETF rebalance days, it’s tempting to go big because of the likelihood of large moves. However, it’s best to reduce your position size unless you see real confirmation, such as:

- Strong volume

or

- Clear order flow.

As a smart trader, you must promptly work on position size because futures flow during ETF rebalance can look real but vanish in a second. By keeping a smaller position size, you remain in the game if the move turns out to be a head fake.

Still, want to scale up? Do this only when there’s real and aggressive participation. Spot this via the graphic below:

See what’s behind the price during index futures spikes—compare Bookmap packages today.

Use Tighter Stops at Key Levels—But Allow Room for Final-Hour Spikes

During the day, you’ll often see key levels develop, such as:

- VWAP,

- Prior highs/ lows, and

- Zones where bids/ offers were stacked earlier.

Please note that these levels matter! They often become targets or turning points when ETF rebalance trading occurs near the close. To trade better, use tighter stop losses near these areas to manage risk.

But with one caveat!

Be aware that prices can temporarily overshoot in the final hour. This happens due to large exchange-traded fund flows hitting the market all at once. So, give a little breathing room! Place wider stops, but if the price doesn’t return or hold quickly after the spike, please EXIT.

Don’t Chase Sudden Moves Without Volume and Liquidity Support

Want to know the worst mistake? – You are chasing a big candle just because it looks exciting! Please realize that if a move isn’t backed by strong volume and liquidity alignment, such as bids lifting or offers stacking, it might be a trap. These traps are particularly set on rebalance days.

So, What Should You Do?

Let the market prove itself! You must wait for confirmation that big players are truly behind the move. If futures liquidity isn’t building in the same direction as price, it is always better to stay out.

Conclusion

You might feel ETF rebalancing is just about shifting stocks! It’s true! But, as a trader, you must not underestimate the direct and powerful impact it has on futures liquidity. During these events, particularly near the close, liquidity can disappear, flood in, or stack suddenly at key price levels.

If you’re not aware of how ETF rebalance trading affects futures flow, it’s easy to get caught in sudden spikes or reversals.

But for traders who understand these impacts and watch real-time order flow, rebalancing days can offer great opportunities! So, what’s the key? Stay patient, confirm with volume and liquidity, and avoid chasing random moves.

As a tip, start using our advanced market analysis tool, Bookmap, to gain a major edge. By using it, you can easily spot when large players are stepping in and where liquidity is building or drying up.

Want to turn your ETF rebalancing days into a profitable affair? Track liquidity changes live during ETF rebalancing—Bookmap’s heatmap shows the flow in real time.

FAQ

1. What time do ETF rebalance flows usually hit futures markets?

ETF rebalance flows usually show up in the last 30 to 60 minutes of the trading session. If you talk about the most intense activity, it often comes in the final 10–15 minutes before the close.

What happens? During this time, large funds adjust their positions. Due to these adjustments, futures flow during ETF rebalance becomes most noticeable.

As a trader, you should be extra alert during this period.

2. Why do futures get affected by stock ETF rebalancing?

Even though ETFs are stock-based, many large funds use index futures to quickly manage their exposure during rebalancing. Why? This is because futures are fast and liquid.

More importantly, they allow funds to match index changes without needing to buy or sell every individual stock immediately.

That’s why ETF rebalance trading creates sudden shifts in futures liquidity near the close.

3. How can traders protect themselves on rebalance days?

Firstly, be patient! Try to avoid trading based on early moves. You must note that most rebalancing flows hit late in the session. Thus, you should always watch for real signs of participation, such as:

- Strong volume

and

- Stacked liquidity.

How to watch these signs? You can start using our real-time market analysis tool, Bookmap. Additionally, try to avoid chasing spikes without confirmation. A strong knowledge of futures liquidity behavior always lets you stay out of traps and find better and safer setups.

4. Does Bookmap help with ETF rebalance trading?

Yes, our advanced market analysis tool, Bookmap, is a powerful tool for rebalancing days! By using it, you can see:

- Real-time liquidity shifts,

- Large trade prints, and

- How buyers or sellers are stacking at certain levels.

This information lets you spot where big players are active and whether a move is real or fake. You can also clearly identify “where” the ETF hedge flows are impacting the futures market.