Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 7, 2025

SHARE

What’s a Good Trade That Still Loses? Redefining Success Beyond P&L

Incurred some losses in the market?

Your P&L is in the red?

That’s okay!

Because not every losing trade is a bad trade, sometimes it’s the tuition fees you pay for long-term success. In 2025, you can’t judge yourself purely by profit and loss. That mindset is a trap!

A trade can follow your system perfectly and be executed with discipline, yet still end in the red. This happens because markets are probabilistic and not predictable! Just like a poker player can lose with a strong hand, traders executing “good trades” can lose due to short-term variance, hidden liquidity, or surprise news.

Solution? You must develop a strong trading psychology mindset.

In this article, you’ll learn how to spot a truly good trade, why losses don’t always mean failure, and why you should adopt a “process over outcome” trading approach. You’ll also check out seven proven techniques to review trades. Let’s begin.

Defining a Good Trade (Beyond Profit)

Do you think a good trade is the one that makes money? Nope! Instead, it is the one that’s built on a repeatable process and reflects discipline. In trading, you can sometimes have good trades that lose, but they are still valuable because they followed your edge and rules.

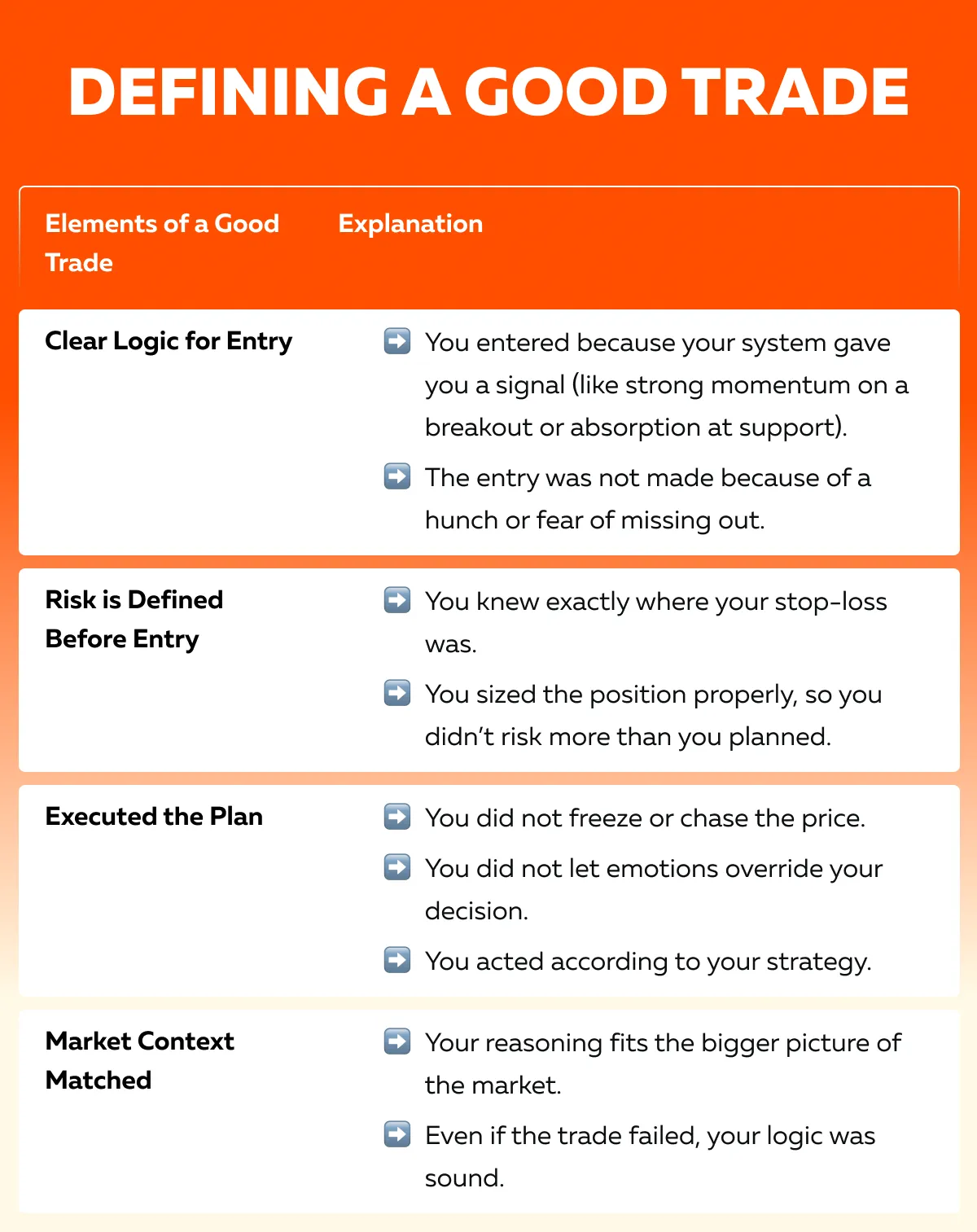

Check out some ingredients of a good trade:

Let’s understand better through an example:

-

- You spotted a liquidity trap on a real-time market analysis tool, like Bookmap.

- You entered a fade.

- Suddenly, unexpected news hit, and you got stopped out.

- Yes, the loss happened!

-

- But it was still a good decision despite trading losses.

- Why? Because you followed your plan.

Always remember that success isn’t measured only by profit, but by whether you stuck to your system. Great setups don’t always pay off, but Bookmap helps you verify if your logic aligns with the real market conditions.

Why Good Trades Lose (And Why That’s Okay)

Want to know one of the hardest lessons in trading? Good trades can also lose! Yes, and that’s completely normal. Why? That’s because the market is probabilistic and nothing is guaranteed. Even when you make a good trading decision, you won’t always get the result you want. Let’s understand in detail why:

| Reasons Good Trades Can Also Fail | Explanation |

| Edge is Not Certain |

|

| Other Traders Behave Unpredictably |

|

| Long-Term Variance Happens |

|

The Poker Analogy

In the game of poker, let’s say you are holding a strong hand and going all-in. The odds are in your favour. But suddenly, your opponent hit a lucky card on the river! Now, the outcome wasn’t what you wanted, but your decision was still correct.

Trading works the same way! Here also, you’re playing probabilities and not certainties. That’s why trading losses with good decision-making don’t mean failure. With a “process over outcome trading mindset”, you learn to detach from single results. Also, you start measuring progress by discipline and not merely by profit.

See how liquidity shifts before, during, and after your entry. Use Bookmap to improve your trade reviews.

How To Know If It Was Actually a Good Trade

You can’t judge a trade by the P&L alone! Instead, what you must see is whether you followed a repeatable process. Want to adopt a healthy trading psychology mindset in 2025? Check out these seven ways, following which you can recognize if your last trade was actually good:

1) Review the trade without bias

When a trade loses, you’re tempted to rewrite the story. Don’t! Instead, re-watch it calmly and treat it like data (not drama). This is what you should actually do:

- Look at the exact moment you entered and exited.

- Remove feelings and pretend the trade belongs to someone else.

- Now ask – “Would I grade this trade the same if it won?”

- If yes, you probably made a trading decision that was good, even though the trade lost.

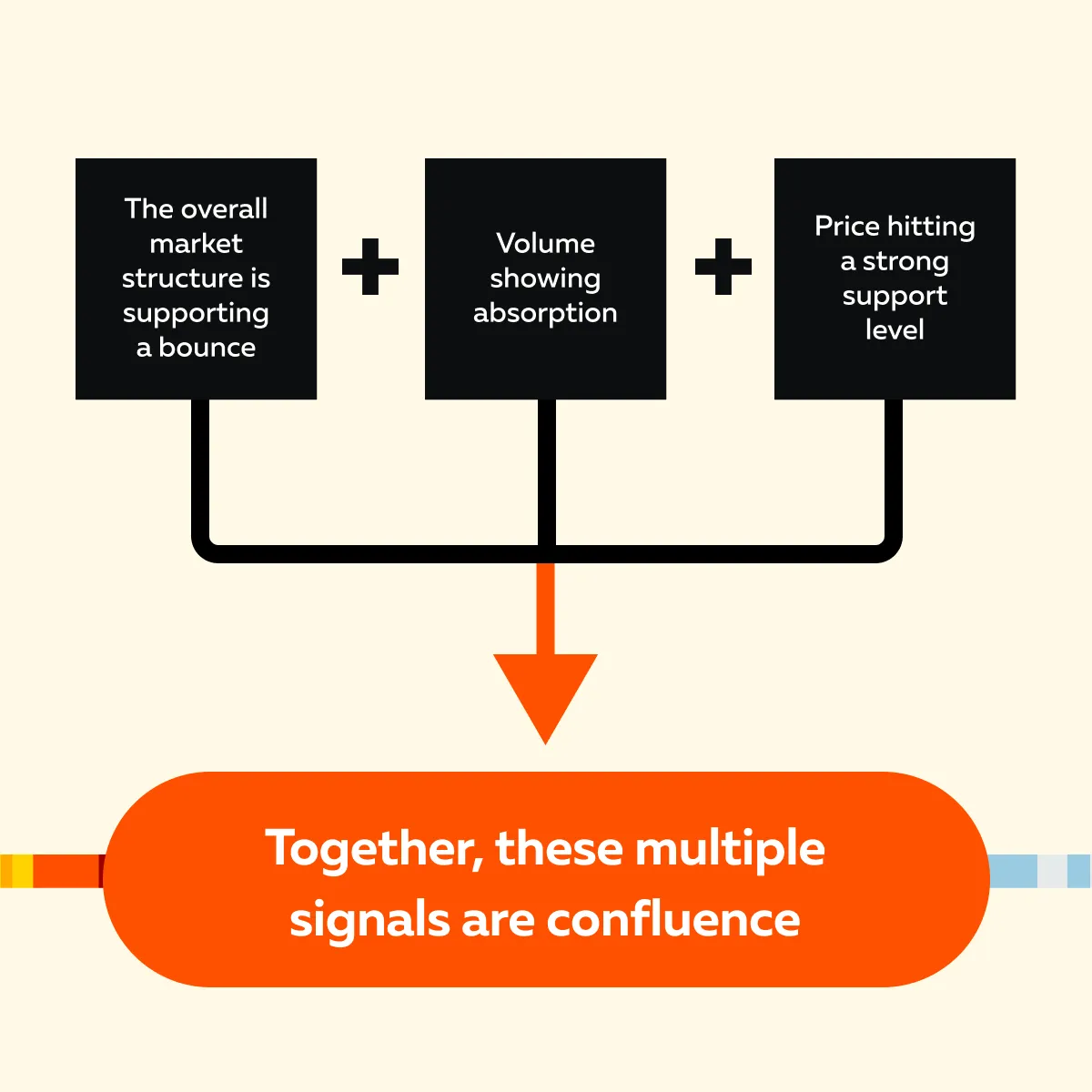

2) Revisit the setup and check – Did you have confluence?

“Confluence” = several signals pointing in the same direction for a trade. Instead of relying on just one reason to enter, you wait until several independent factors agree. For example,

When these separate pieces align, the trade idea carries more weight. Now, to check for confluence in your executed trade, look for the following:

- Liquidity: Was price near a known liquidity pocket (e.g., swing highs/lows, order clusters)?

- Volume: Was volume supportive of the move (surge on breakout, absorption on support)?

- Structure: Did the market structure favor your bias (trend, range, support/resistance)?

If multiple elements matched, your process gave you a valid edge (even if the market later did something unexpected).

3) Did you follow your rules?

This is the hard line between “good idea” and “bad trade.” As a trader, you should always stick to your original trading plan. To check this parameter, look for the following:

- Entry discipline: Did you enter only when your signal triggered, or did you jump in early?

- Position sizing: Did you risk the pre-defined percentage of your account?

- Stop placement: Was your stop set before entry and logical with the setup?

If you stuck to the rules, you practiced process over outcome trading.

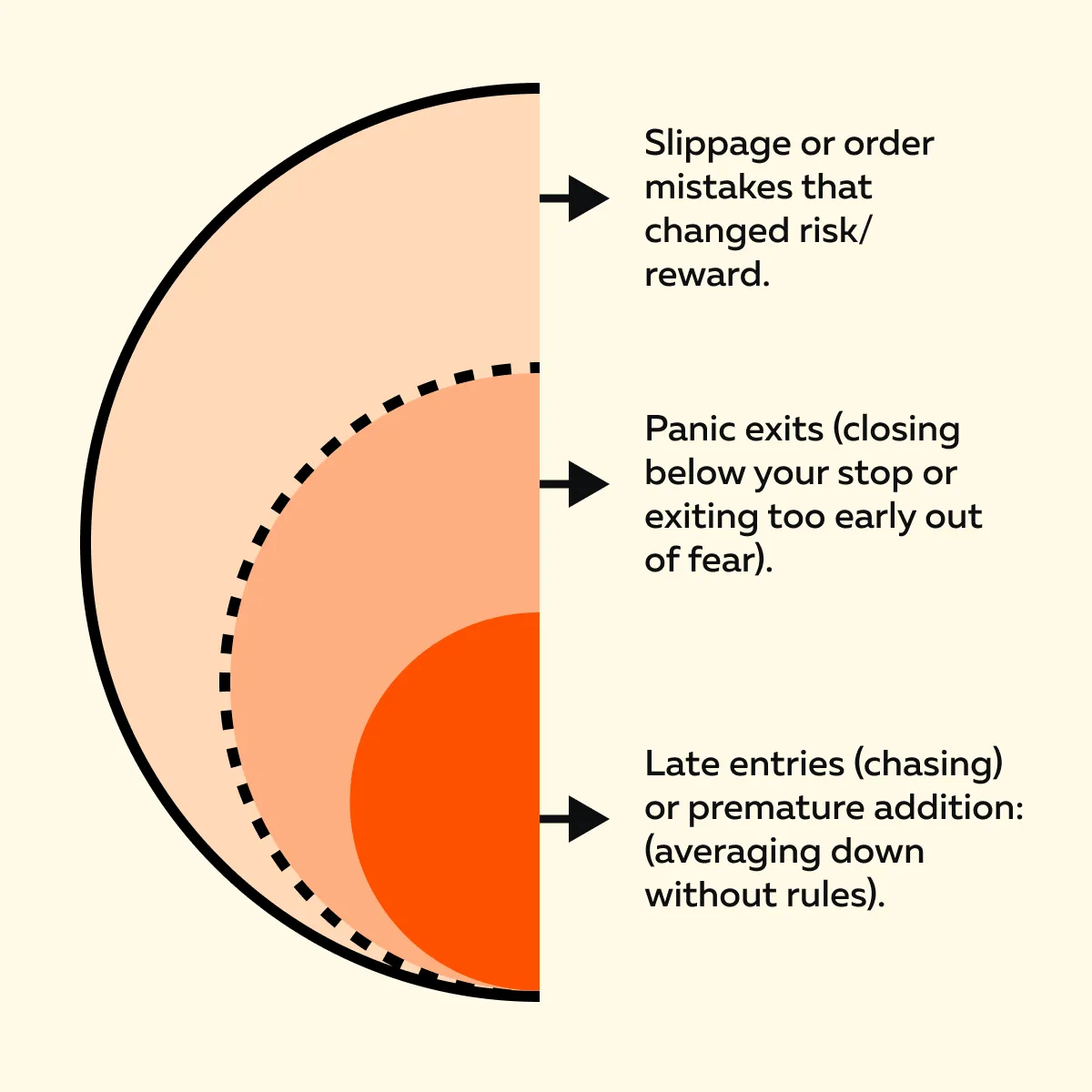

4) Was your execution clean?

Execution errors turn good plans into bad results. To achieve a near-perfect execution, you should watch for the following:

If you executed as planned, you can call that a win in discipline even if the P&L says otherwise.

5) Did you stick to your stop or trailing plan?

A sound exit is as important as the entry. Review your exit discipline as follows:

- Did you allow the stop to work, or did you move it out of fear?

- If you used a trailing exit, was it applied consistently?

- Did you take a planned partial and leave the rest, or did you break the plan?

Always remember that sticking to planned exits = you defended the process.

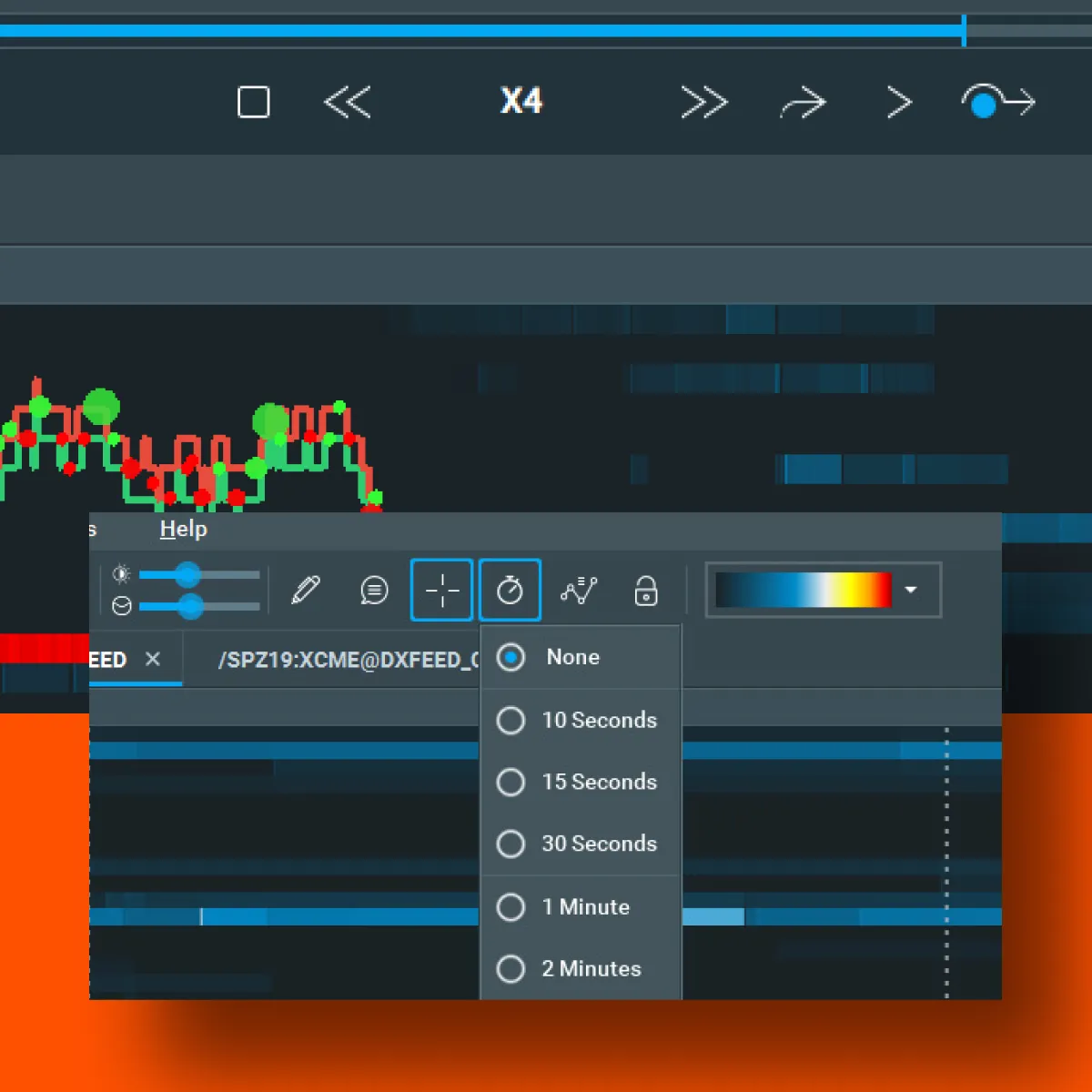

6) Use Bookmap replay mode to re-watch the sequence

In trading, it is easier for emotions to cloud your memory. Now, to clear your memory again, you should replay the trade. This lets you know what really happened. With Bookmap’s replay mode, you can move beyond feelings and check the:

- Actual order flow

- Liquidity changes

- Timing behind the move

This is what you should look for on a replay:

| Absorption | Who faded whom? | Hidden size/sweeps: | Timing |

| Were large orders being absorbed (price tries to move, but big resting orders hold it)?

This validates an “absorption” read you might have had. |

Did buyers show up to fade a move?

or Did sellers suddenly step in? |

Was there a sweep of liquidity that you couldn’t see in the candle chart? | Was your read correct but mistimed?

You can check this by observing whether the same flow happened later, but at a different time. |

A replay can show whether your read was right in concept but unlucky in timing.

7) Now, make the final call!

If your trading process was sound, you won! After reviewing your trade based on the six parameters mentioned above, you can grade your trade:

| Give a “Good” Grade | Give a “Poor” Grade |

|

|

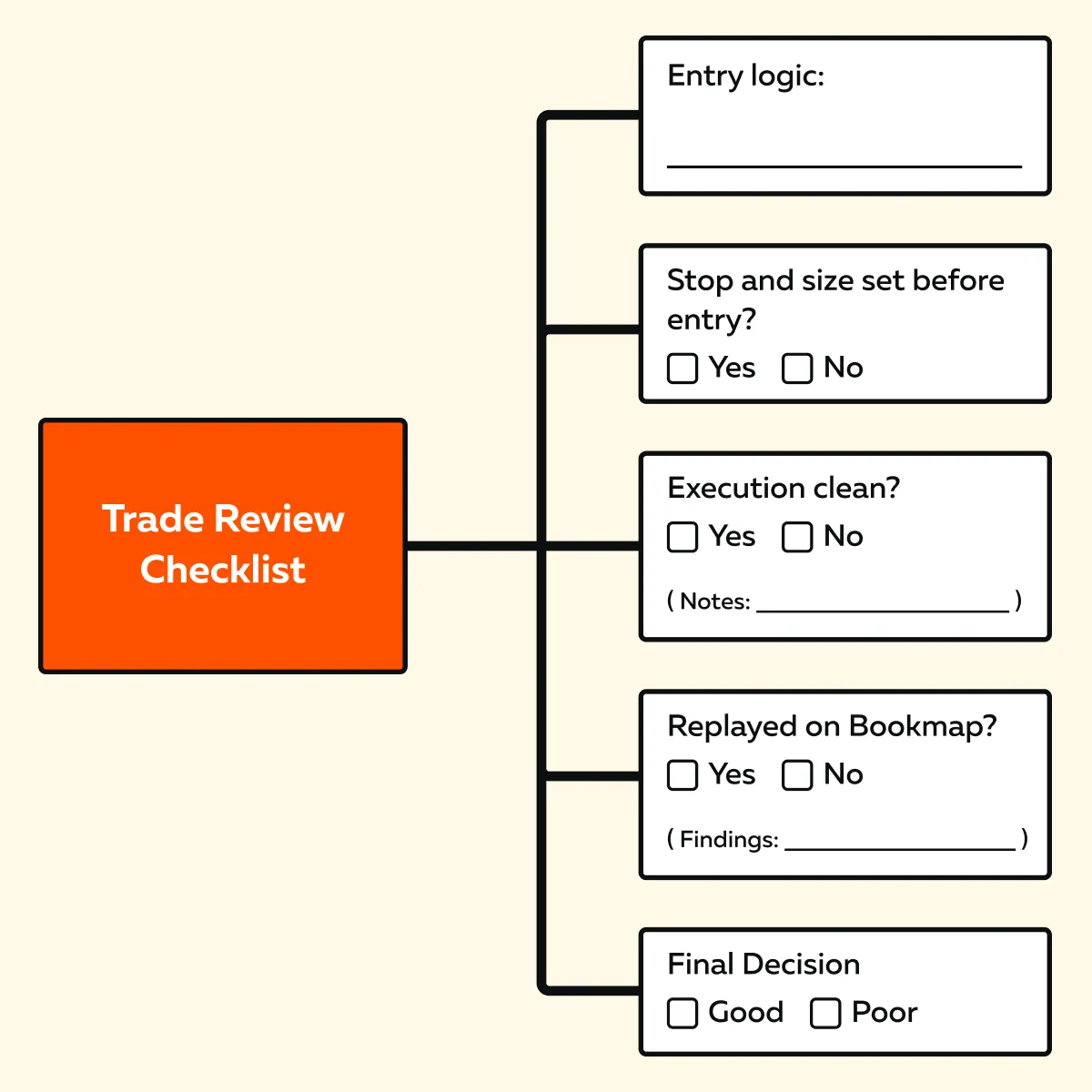

Need a short checklist you can paste into your journal? Refer to the graphic below:

Why This Mindset Matters Long-Term

In trading, if you only judge yourself by P&L, you’re setting yourself up for burnout. That’s because these three factors:

- Emotional Swings:

-

-

- When every win feels like a victory and every loss feels like a failure, you ride a constant emotional rollercoaster.

- That stress makes it hard to stay consistent.

-

- Chasing Behaviour:

-

-

- If you believe that every losing trade means you were “wrong,” you’ll keep hunting for the next quick win instead of refining your method.

-

- Confidence Erosion:

-

- Even when your reasoning is solid, a string of red trades can make you doubt yourself.

This is why you must train yourself to separate execution quality from outcome. To develop a strong trading psychology mindset, instead of asking “Did I win?”, ask:

- Did I follow my setup?

- Did I manage risk correctly?

- Was my execution clean?

If YES, then you had a good trade that lost. Try to make this analysis over a larger sample (say, 100 trades). This type of process over outcome trading reveals whether you truly have an edge or you are only relying on short-term luck.

A Pro Tip

Use process-based journaling. In this journal, write down whether you respected your rules (not just your P&L). Next, start using advanced real-time market analysis tools, like Bookmap. Using it, you can replay volume dots, heatmap changes, and liquidity shifts.

So in 2025, make discipline your benchmark. And the P&L will naturally follow!

Conclusion

So, by now, you must have understood that trading success is not defined by whether a single trade made or lost money. But it is the quality of your decisions! A good trade is one where:

- Your edge was present

- Your risk was clearly defined

- Your execution stayed true to plan

Now, even if the market moved against you, you still won by staying disciplined. With this mindset, you detach yourself from short-term noise and can better avoid emotional swings. To make this process easier, you can use Bookmap to visualize liquidity, volume, and market behaviour. Want clearer decision-making? Use Bookmap to track how trades play out—even when they don’t go your way.

FAQs

1. How can I stay motivated if I’m losing despite following my rules?

It’s normal to feel discouraged when you do everything right and still lose money! Please realize that even good trades can lose because markets are uncertain/probabilistic.

In such an environment, where nothing is certain, what matters is whether you consistently apply your “trading edge”. As a trader, you should track your discipline and review trades over a larger sample (like 50 to 100 trades).

If your process is sound, results will eventually reflect that!

2. What tools help me review good vs bad trades?

A simple trade journal is the first step! In this journal, you should write down your:

- Setup

- Risk

- Execution

Then, use Bookmap replay mode to re-watch what really happened: Was there absorption? Did liquidity shift against you? Such an analysis shows whether your idea was valid, but you got unlucky!

3. Should I ever change my strategy after losing trades?

Even good trades can fail! One or two losses don’t mean your strategy is broken. Only consider changes after analyzing many trades and spotting repeated weaknesses. For example,

- Let’s say your entries are always late

- Or, your stops are too tight.

- Now, that’s a strategy you must improve.

4. What’s the best way to track process over outcome?

You should create a simple checklist for every trade:

- Did I follow my setup?

- Was risk defined?

- Was my execution clean?

- Did I exit according to plan?

Now, score each trade on process (not on profit). By doing so, you measure what you control (your actions) rather than what you can’t control (the market outcome).

5. Do pros also lose good trades?

Yes, absolutely! Even institutional traders with years of experience and advanced tools face losing trades. The difference is that they know losses are part of the probabilities. They do not start feeling that their strategies are “wrong.”

Instead, 100% of their focus is on:

- Managing risk

- Keeping position size appropriate

- Strictly following their trading edge

This mindset allows them to stay disciplined and succeed over hundreds of trades (a few may be exceptions!).