Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

August 25, 2025

SHARE

Why Most Day Traders Lose Money—and What the Winners Do Differently

If trading were as easy as spotting a green candle and clicking “buy,” everyone would be rich and retired by Friday. But what happens instead? Here’s the harsh truth: by Friday, most day traders lose money!

If trading were as easy as spotting a green candle and clicking “buy,” everyone would be rich and retired by Friday. But what happens instead? Here’s the harsh truth: by Friday, most day traders lose money!

Why? It’s not because markets are rigged, but because most traders misunderstand how markets truly work. So, are you also stuck in that same cycle of losses? In this article, we’ll break down why day traders fail and some of the most common mistakes beginners make. More importantly, we will show you what winning traders do differently.

By the end of this article, you’ll learn how to stop chasing price, how to read real market behavior (not just pretty charts), and how to build your edge through patience, discipline, and smart utilization of our advanced market analysis tool, Bookmap. Let’s begin and flip the script on your trading journey!

Why Most Day Traders Lose Money

Multiple studies across different markets show that about 70% of day traders end up with net losses. Want to know what’s worse? Some research suggests that only 1% to 3% of day traders are consistently profitable.

So why does this happen? Don’t most day traders have access to the same charts, tools, and news as professionals? The truth is, it’s not just about the strategy! Instead, it’s about how beginners:

- React to price movements,

- Handle pressure, and

Want some more clarity on why so many fail? Let’s break down some of the most common failure points that explain why day traders fail:

Chasing Price Instead of Reading Flow

One of the biggest trading mistakes beginners make is chasing price. Most day traders jump into a trade just because the stock is moving up quickly! They gain confidence to do so after seeing green candles or a breakout to a new high.

But that’s the wrong approach! Just because the price is moving up doesn’t mean there’s real buying interest behind it. As a smart trader, you should always look at order flow. This shows who is really buying and selling, and how strongly.

For Example:

- Let’s say a stock breaks above resistance.

- A beginner day trader rushes to buy it.

- Why? Because it looks strong on the chart.

- But what’s happening under the surface?

- Big buyers are actually pulling their bids (they’re no longer interested)

and

- The stock is being sold into (known as absorption).

- The sorry result? – The price suddenly reverses.

- The beginner entered too late and got caught at the top.

- Now, they are forced to sell at a loss.

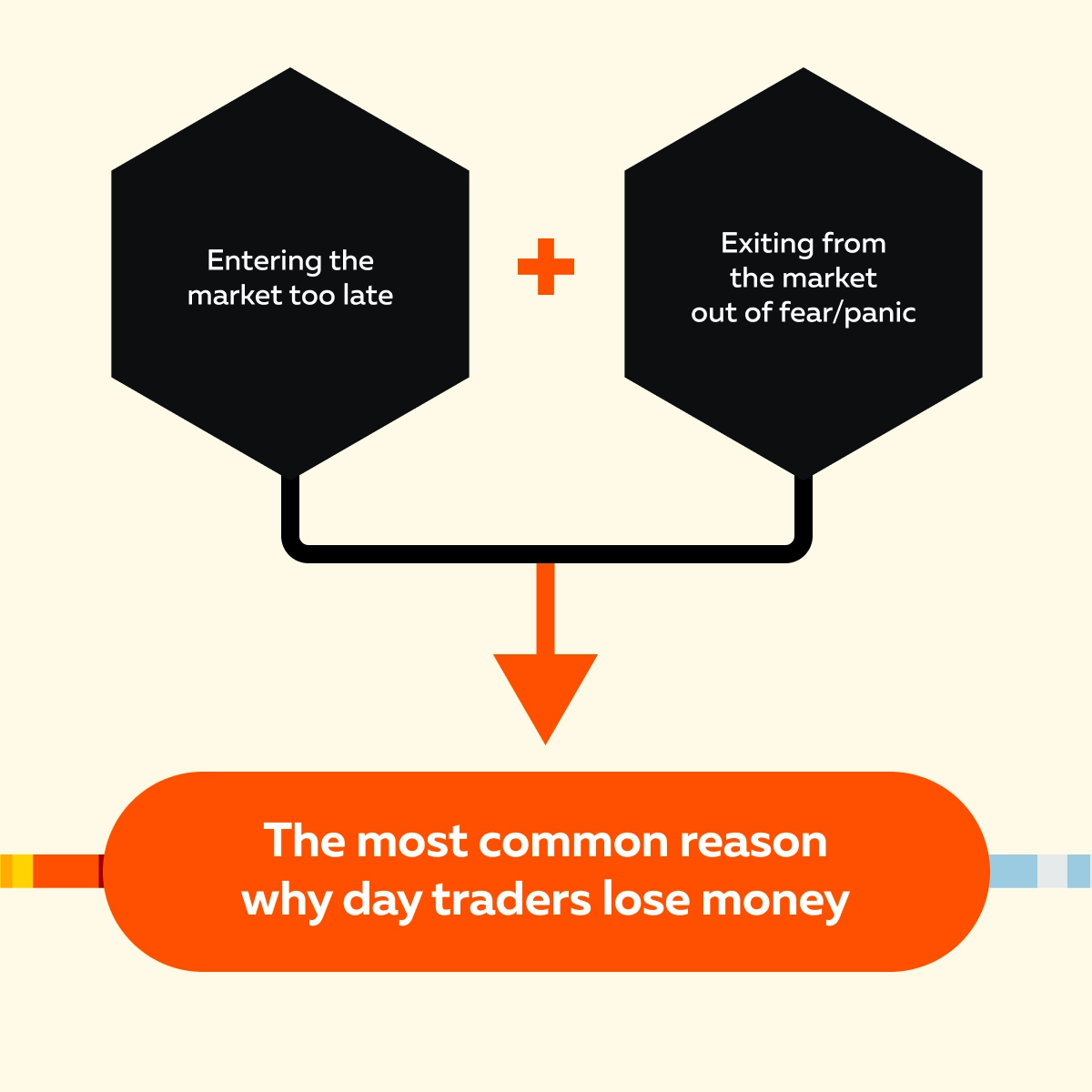

This cycle of entering too late and exiting in panic is a key reason why most day traders lose money. Are you suffering from the same fate? To become a successful day trader, you must read the market’s intent and not just its appearance. Ideally, you should try to focus less on price alone and more on what the buyers and sellers are actually doing in real time.

Using Indicators With No Context

Many beginners rely heavily on tools like:

- RSI,

- MACD, and

- Moving averages.

But here’s the truth! These indicators only show you where the price has already been, not where it’s going. That’s another one of the biggest trading mistakes beginners make.

Think of it like this:

Using indicators without understanding real-time market behavior is like driving while staring into the rear-view mirror. You might know what “just happened”, but you’ll completely miss what’s happening “right now”!

To become a successful day trader, you need to observe real-time actions:

- Where is liquidity stacking up?

- Who is stepping in to buy or sell?

- Is someone absorbing all the aggressive buying?

Always remember that winning traders read the current flow and not just past patterns.

Ignoring the Auction Process

Another reason why day traders fail is that they don’t understand how the market actually moves. As a day trader, you must realize that price doesn’t go up or down just because of news or “magic” chart levels. It moves to find liquidity! These are areas where buyers and sellers are most active.

You must understand that the market is an auction. It tests prices to find where value is accepted or rejected. Let’s understand better through an example:

-

- Let’s say a stock breaks out above resistance, and you jump in.

- But underneath, there’s no real support!

- No buyers are stepping in after the breakout.

- Now, that’s called a failed breakout!

- In such a situation:

- The price will quickly reverse

and

- You’re caught in a losing trade

Do you know who suffers the most from this issue? Mostly, the sufferers are those who focus only on chart patterns and ignore the deeper behavior of the market (why the price is moving, and who’s behind it). As a trader, you must try to understand the auction process to avoid this pitfall.

Poor Risk Management and Overtrading

Even with a good strategy, poor discipline can ruin your trading! Let’s check out the graphic below to learn some more common reasons why most day traders lose money:

Let’s understand these reasons better and see what often happens:

- A trader takes a loss and gets frustrated.

- Next, they enter “revenge trades”.

- Or they double down on a bad trade.

- Why? They are trying hard to recover the loss.

- In this pursuit, they widen stops and hope the market turns around.

Do you know what these are? – These are classic trading mistakes beginners make. Studies show that losing traders place 4x more trades than winning traders. Another research found that frequent traders, such as those executing over 500 trades annually, have a loss rate as high as 80%!

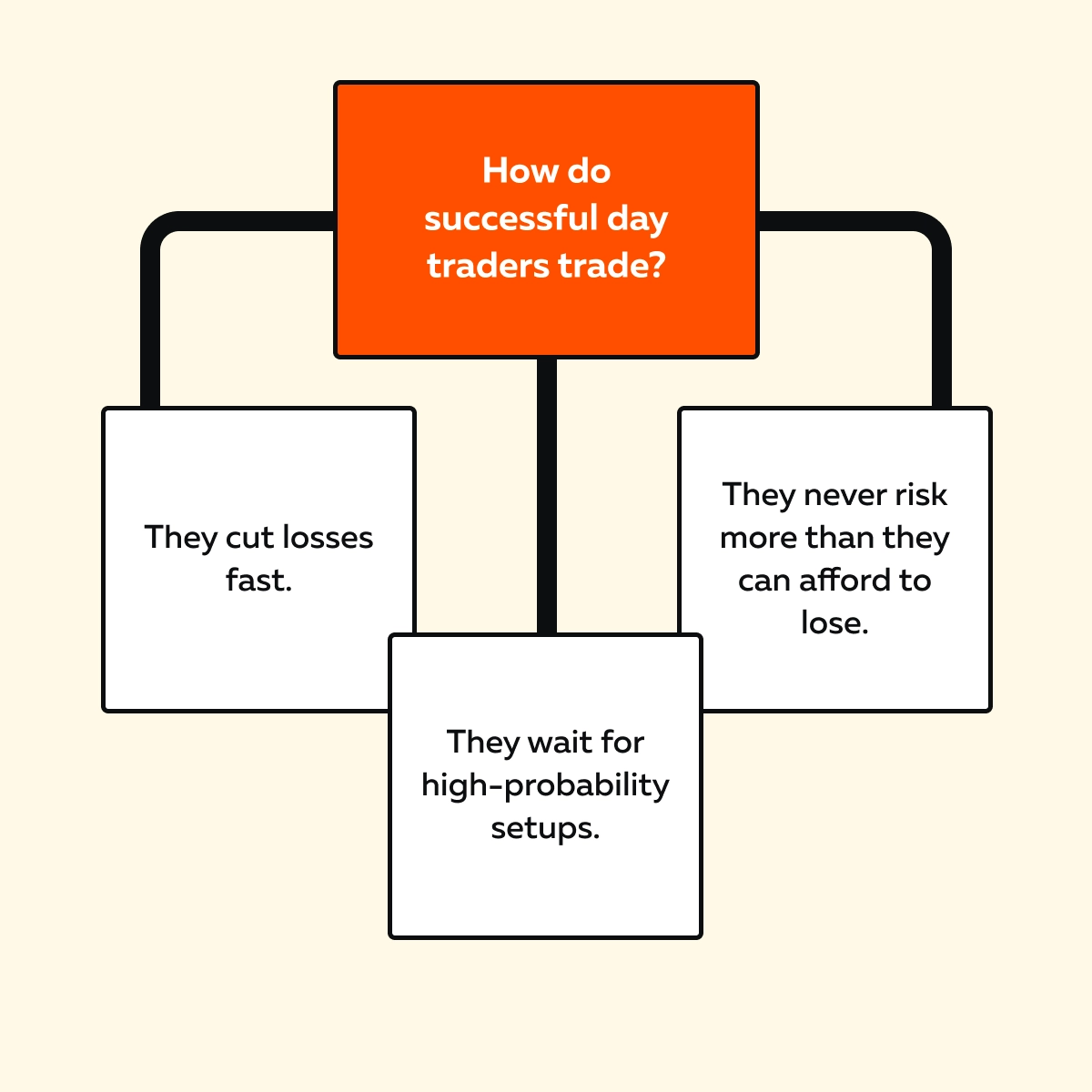

But how do successful traders operate? – They manage risk tightly! Let’s see how through the graphic below:

So, want to become a successful day trader? Protecting your capital is rule #1. You can’t win the game if you’re knocked out early!

What Winning Traders Do Differently

Most people lose in trading because they react to price. They don’t understand the reason behind that price move. That’s why most day traders lose money! They just see a setup and jump in without checking if the move is real or just noise.

But successful day traders do something very different! They prepare, study behavior, and look for confirmation. They don’t blindly follow patterns or indicators. They always want to know – Who’s in control – Buyers or Sellers?

Let’s develop a better understanding and learn how winning day traders develop an edge:

1. They Wait for Confirmation—Not Just a Setup

Winners don’t enter a trade just because price hits support or resistance. Instead, they “wait for signs” that the market agrees with their idea. What kind of signs? Three major signs they usually observe are:

| Sign I | Sign II | Sign III |

| Strong bid stacking (buyers lining up under price). | Aggressive volume (buyers lifting the offer). | Continuation (momentum pushing forward after a breakout). |

Let’s understand better through an example:

Say price breaks the high of the day. Now, a beginner and a veteran trader will handle this situation differently:

| Beginner Trader’s Approach | Veteran Trader’s Approach |

|

|

Winners don’t guess! They let the market show its intent first. And that’s how you become a successful day trader. Try Bookmap risk-free: Visualize liquidity and volume in real time.

2. They Track Liquidity, Not Just Candles

Many beginners focus only on price charts and candlesticks. They think, “If the candle is green, it means buyers are winning.” But that’s a shallow view! If you solely rely on this belief, it’s another reason why you are losing money.

How do winning traders think? They know that price is just the result of trades being matched. Such a matching happens where buyers and sellers agree. What really drives price is “liquidity”. It decides where large orders are placed, pulled, or hit.

Therefore, instead of blindly following candles, smart traders ask:

- Where is liquidity sitting?

- Are large orders real, or are they fake walls?

- Is someone absorbing all the buying or selling?

- Is there real follow-through, or just stop-losses being triggered?

Let’s understand better through an example:

-

- You spot a huge sell order (called an “offer”) sitting at the high of the day.

- Most retail traders see this as resistance.

- Some jump in short, expecting a reversal. Others wait for a breakout to occur.

- But to their surprise, the offer doesn’t get pulled.

-

- Instead, it gets aggressively hit by buyers.

- As a result, the price keeps climbing.

- Now what’s this? – That’s real demand. That’s the intent.

- And that’s the kind of signal successful day traders watch for.

Want to know one of the biggest trading mistakes beginners make? They treat every price move the same. But professionals know – without understanding who’s behind the move, you’re just guessing!

So, how do you become a successful day trader like them? Learn to read liquidity and not just charts. Why? Because liquidity shows intent, and candles only show the result!

3. They Understand Market Context

Another reason why day traders fail is that they treat every trade the same! They do not pay heed to the:

- Time of day,

- Market mood, and

- Broader events.

But successful day traders know that context is everything! They don’t just look for a setup. Instead, they ask the following:

- Is the market open when volatility is high?

- Is it lunchtime, when volume is usually low?

- Are there major news events, like Fed decisions or earnings?

- How did price behave earlier today or this week?

As a smart trader, you need to realize that winners trade less, but they trade smarter! They always wait for the moment when everything lines up. The benefit? That’s how they avoid noise and false signals. So, ignoring market context is one of the most overlooked trading mistakes beginners make.

4. They Review and Adjust Based on Data

Be aware that even top traders aren’t right all the time! So what separates them from the rest? – They learn faster! How? They study their own trades in detail.

They don’t just win and move on or lose and blame the market. Instead, they track every trade and ask:

- Did I follow my plan?

- Did the market show real confirmation?

- Was there real liquidity and flow behind my entry?

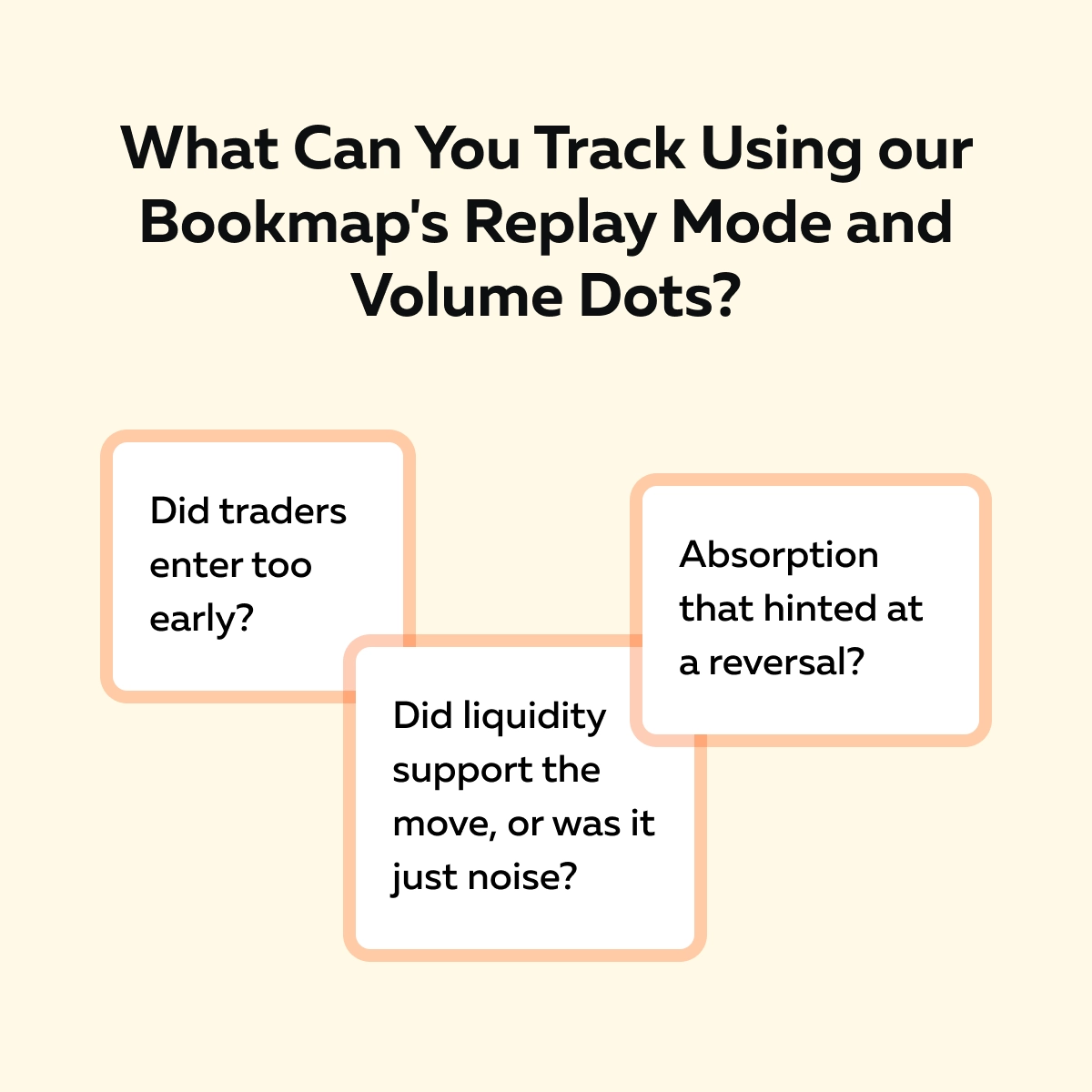

And how do they do this tracking? Most professionals use real-time market analysis tools, like our smart tool, Bookmap. For those unaware, we offer features like replay mode and volume dots through Bookmap. Using them, most pros spot exactly what happened. Let’s understand what they allow you to see:

As you keep using our tool, Bookmap, this review process sharpens your instincts and decision-making. This is how most pros build and refine their trading edge. So, want to trade, based on reality and not hope? See how smart traders read order flow, not just candles!

How to Start Thinking Like a Pro

Are you a beginner wondering how to become a successful day trader? Learn this truth – It’s not about fancy setups or trying to predict the market. Instead, it’s about shifting your mindset. You must shift from:

- Guessing to observing

and

- Reacting to preparing

Let’s understand in detail how to start thinking like a pro trader:

1. Focus on Behavior—Not Predictions

One major reason why most day traders lose money is that they try to predict price direction. On the contrary, pros don’t guess, they watch. They ask –

- What are real traders doing at key levels?

- Are buyers stepping in?

- Are sellers pulling out?

Thus, instead of forecasting, you should observe how the market behaves. That’s where the real clues are!

2. Use Tools That Show Trader Intent

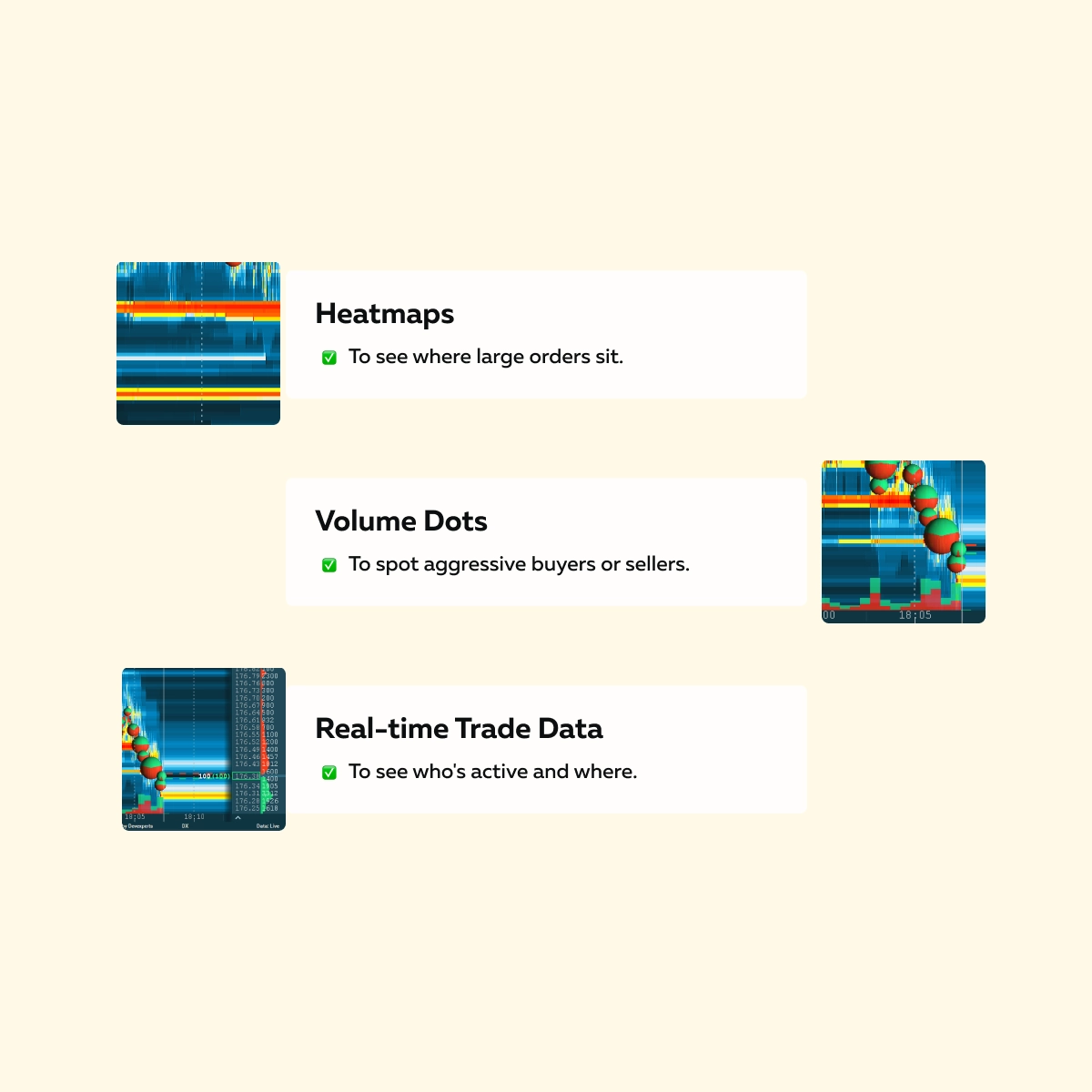

Trading mistakes beginners make often come from using only candlesticks or lagging indicators. Note that these tools show what has already happened and not what’s happening now! If we talk about the pro traders, they always use these tools:

Through these tools, you get to see intent and not just movement! Want them together in a single tool? You can start using Bookmap, our real-time market analysis tool. With Bookmap, you get to observe real-time data via heatmaps and volume dots.

Want to trade like the pros? Compare our platform packages

3. Track Your Trades and Learn From Them

If your trades are consistently losing, don’t just keep repeating the same approach. That’s a big reason why day traders fail. Instead, you should start journaling your trades:

- Did you follow your plan?

- Did you enter too early or too late?

- Was there real confirmation behind the move?

Study your own trading behavior! It is just as important as studying charts. That’s how most winning traders refine their edge over time.

4. Be Selective. You Don’t Need to Trade Everything

Pro traders don’t chase every move! They’re always fine with missing a few trades. Why? That’s because –

- They wait for high-quality setups (the ones backed by flow, structure, and timing).

- They wait for clarity rather than risk money on a guess.

This is one of the hardest mindset shifts! But also one of the most powerful if you want to become a successful day trader! So, are you there yet?

Conclusion

Most day traders lose money because they trade blindly! Usually, they jump into trades without confirmation, ignore real market behavior, and overtrade out of emotion. To make things worse, they rely too much on charts and indicators that show the past (not the present). That’s a big reason why day traders fail.

Do you know what winning traders do? They don’t use magic indicators. They simply read the market better. They focus on behavior:

- Who’s buying

- Who’s selling

- Where orders are stacking

- Whether the move has real intent

So, want to become a successful day trader like them? Start trading smarter. Don’t just follow the price. Instead, learn to read the story behind it. Our platform, Bookmap, helps you do exactly that! By using Bookmap, you can clearly see the real-time market activity and visual order flow, so you can stop guessing and start visualizing the market’s true intent. Explore Bookmap’s features for more clarity.

FAQ

1. Why do most day traders lose money?

Most day traders lose money because they focus only on price charts and indicators without understanding why prices move. They chase trades that look exciting but have no real support behind them.

Furthermore, they also:

- Risk too much,

- Trade too often, and

- Don’t follow a plan.

As a smart trader, you must understand that without reading actual market behavior, it’s easy to fall into traps and lose consistently.

2. How do I know if I’m trading like a pro?

You’re trading like a pro when you stop guessing and start waiting for the market to confirm your ideas. Instead of jumping in on every signal, you check whether real buyers or sellers are active.

Additionally, you start paying attention to liquidity and observe how orders are placed and how they move. You also rely less on indicators and more on market behavior and trade data.

3. Is Bookmap only for experienced traders?

Not at all. Our market analysis tool, Bookmap, has several advanced features, but its interface is designed in a way that many beginners use it to learn how the market works.

As a beginner, you can start using Bookmap to easily see:

- What’s happening in real time

- Where big traders are placing orders

- Who’s buying or selling aggressively

- Whether a move is strong or weak

The answers to these questions let you understand the “why” behind the price movements. And when you have this knowledge, you stop following them blindly.

4. What’s the most important skill for day trading success?

The most important skill is “patience”! As a day trader, you should always wait for the right opportunity. You should never force yourself into trades. Now, after patience comes “discipline”. You must follow your rules and manage your risk.

But want to know the real game-changer? It is learning to read the order flow! You must always know:

- Who’s in control of the market

and

- Whether a move has real strength

These skills separate successful traders from those who keep making the same mistakes.