Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 7, 2025

SHARE

Can Traders Learn from Poker? Understanding Risk, Bluffing, and Probabilities

Poker is similar to trading! Both are games of “incomplete information”. How? In poker, you never see your opponent’s full hand, whereas in trading, you never truly know who’s behind the orders. In both games, it is discipline and reading context that separate the winners from the rest.

Want to be that winner? In this article, you’ll understand how both poker and trading are similar to each other. Next, you will learn what probabilistic thinking is and how you can increase your trading profits by adopting the mindset of a poker player.

Lastly, you’ll also see how real-time market analysis tools like Bookmap can let you “read the table” more clearly. Read this article till the end to trade with a 100% strategy and 0% guesswork.

Poker and Trading Are Both Games of Incomplete Information

Both poker and trading share a fundamental reality! You never see the whole picture. Let’s understand how:

| In Poker | In Trading |

|

|

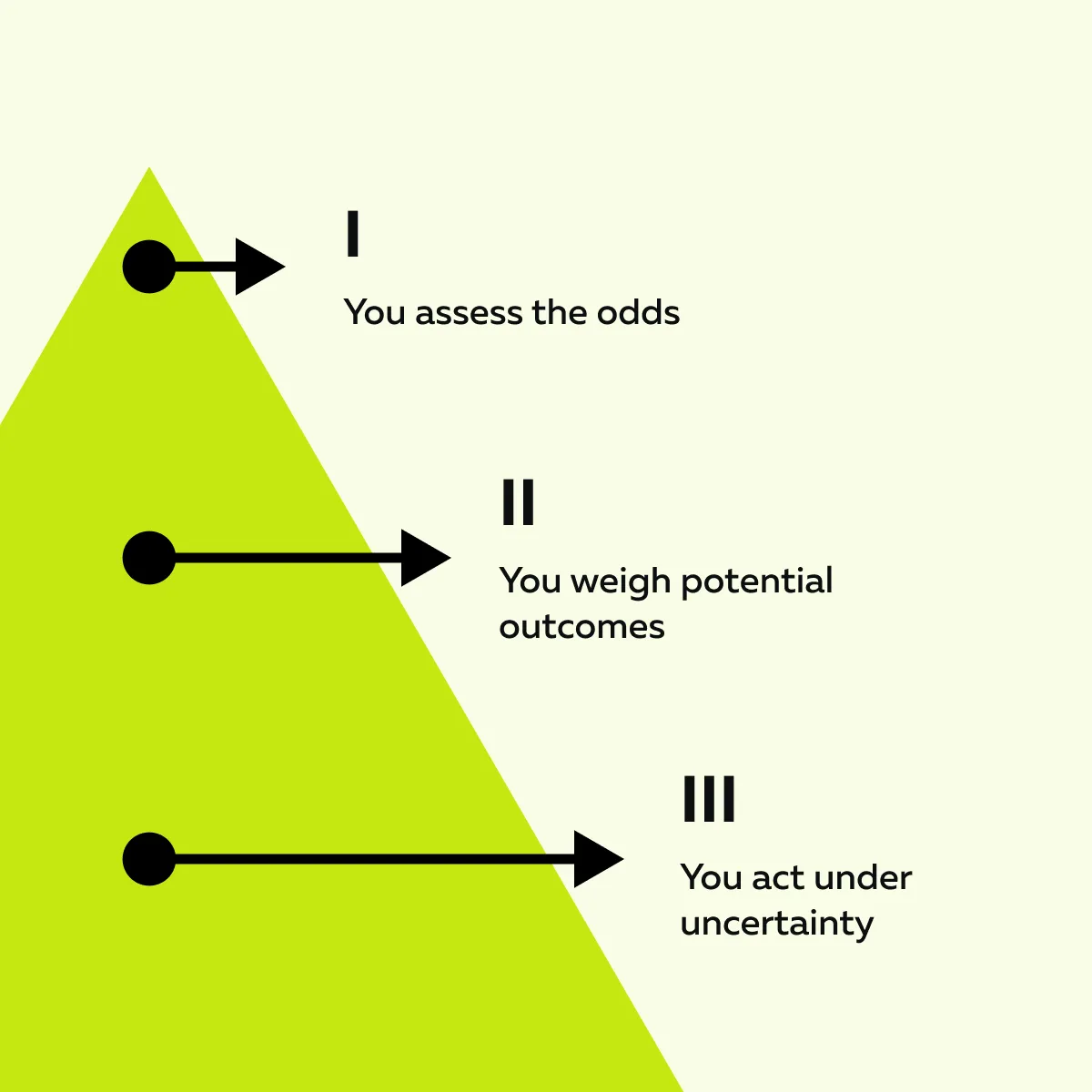

This makes both fields games of “incomplete information”. Now, if you, as a trader, want to succeed in these environments, you must rely on inference + probability rather than certainty. Such a trading style is known as “probabilistic trading”. It is similar to poker decision-making. Let’s see how:

For example,

- Say a trader spots spoofing at key levels.

- Now, they are dealing with the same dynamics as a poker player who is facing an opponent who overbets the pot.

- Finding similarity? In both cases, the visible action conceals the “real motive”.

Managing Risk Like a Poker Pro

How do poker players win? Do they guess right every hand? Nope! Instead, they:

- Manage risk

- Read the table

- Protect their chips

As a trader, you should also do the same. You mustn’t try to be right every time! But try to play the long game with discipline and emotional control. Let’s understand how you can manage risk like a poker pro through these four proven techniques:

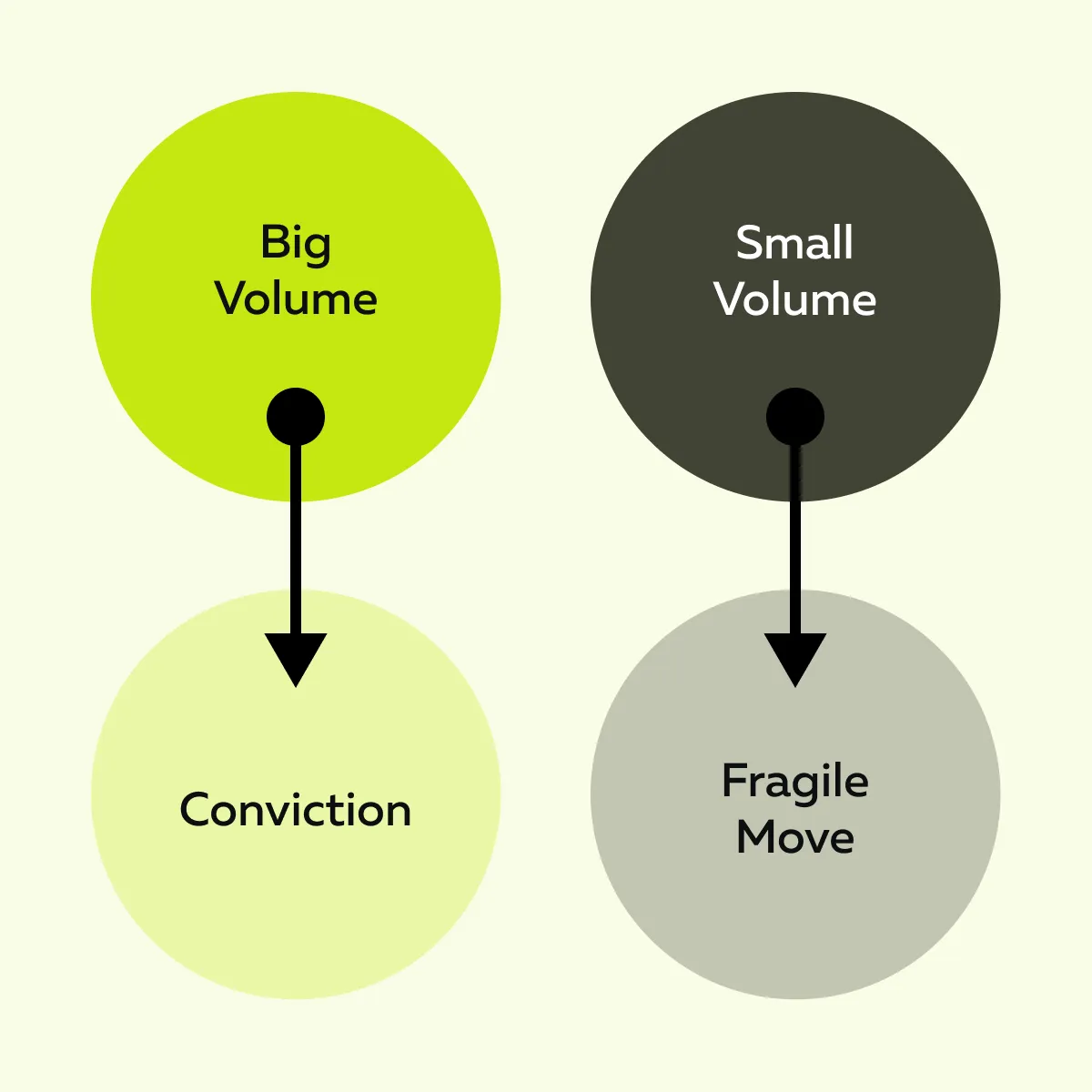

Technique I: Bet Sizing vs. Position Sizing

In poker, no player goes all-in on every hand. Bet size changes depending on the:

- Strength of the hand

and

- Behavior of others at the table

Trading works the same way! Your position sizing should reflect:

- Conviction

- Market volatility

- Your overall capital plan

This is the foundation of probabilistic trading.

Technique II: Pot Odds = Risk/ Reward

Poker players evaluate pot odds before committing chips. In trading, risk/ reward plays the same role. As a trader, you can generate long-term profitability with only a 40% win rate and strong risk/ reward ratios.

Thus, you can safely assume that both poker and trading reward consistency in decision-making and not constant winning.

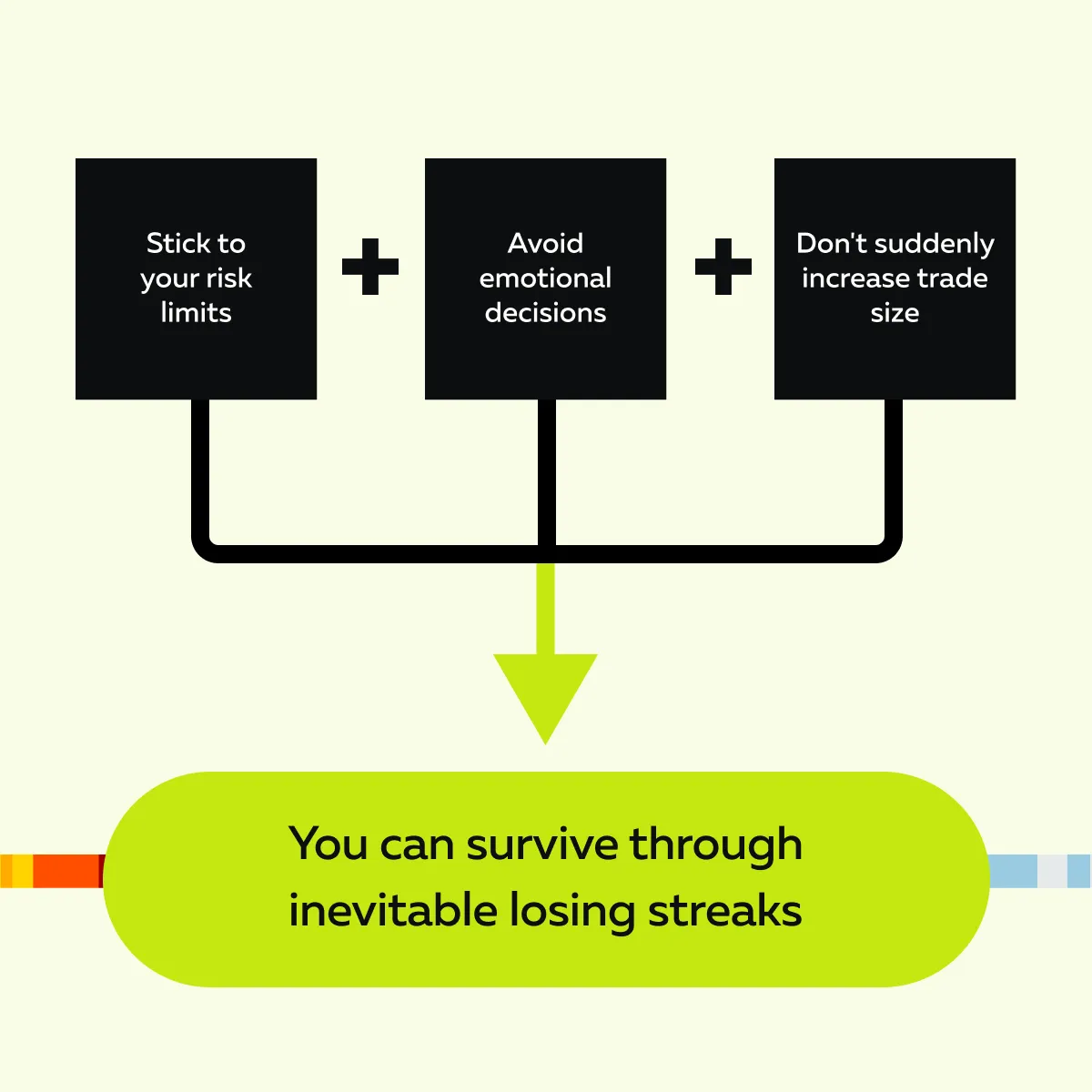

Technique III: Bankroll Management

A poker professional never risks 10% of their bankroll on a single hand. Likewise, traders should avoid oversized trades that can wipe out days or weeks of progress. Instead, follow this approach:

Technique IV: Controlling Tilt and Emotion

In poker, “tilt” describes poor decisions that are a result of frustration or greed. Now, trading has its version – Revenge trading or FOMO. Similarity? Both lead to losses when judgment gets clouded.

To avoid such clouded judgments, you can start using advanced real-time market analysis tools, like Bookmap. How? They let you replay market events. Using Bookmap’s replay mode, you can step back from the heat of the moment and study what really happened in the market.

When you review past events without the pressure of live trading, you can:

- See how order flow and liquidity behaved before a move.

- Spot patterns you missed while trading live.

- Identify if you reacted emotionally rather than logically.

Replay your trades like poker hands—Bookmap’s replay mode lets you study decisions in context.

Bluffing, Spoofing, and the Illusion of Intent

Do you think bluffing is just for poker tables? Beware! It shows up in markets, too. Both poker players and traders often use tactics designed to mislead opponents. This creates the illusion of strength or weakness. As a trader, you must recognize these tricks to survive. Let’s understand in detail:

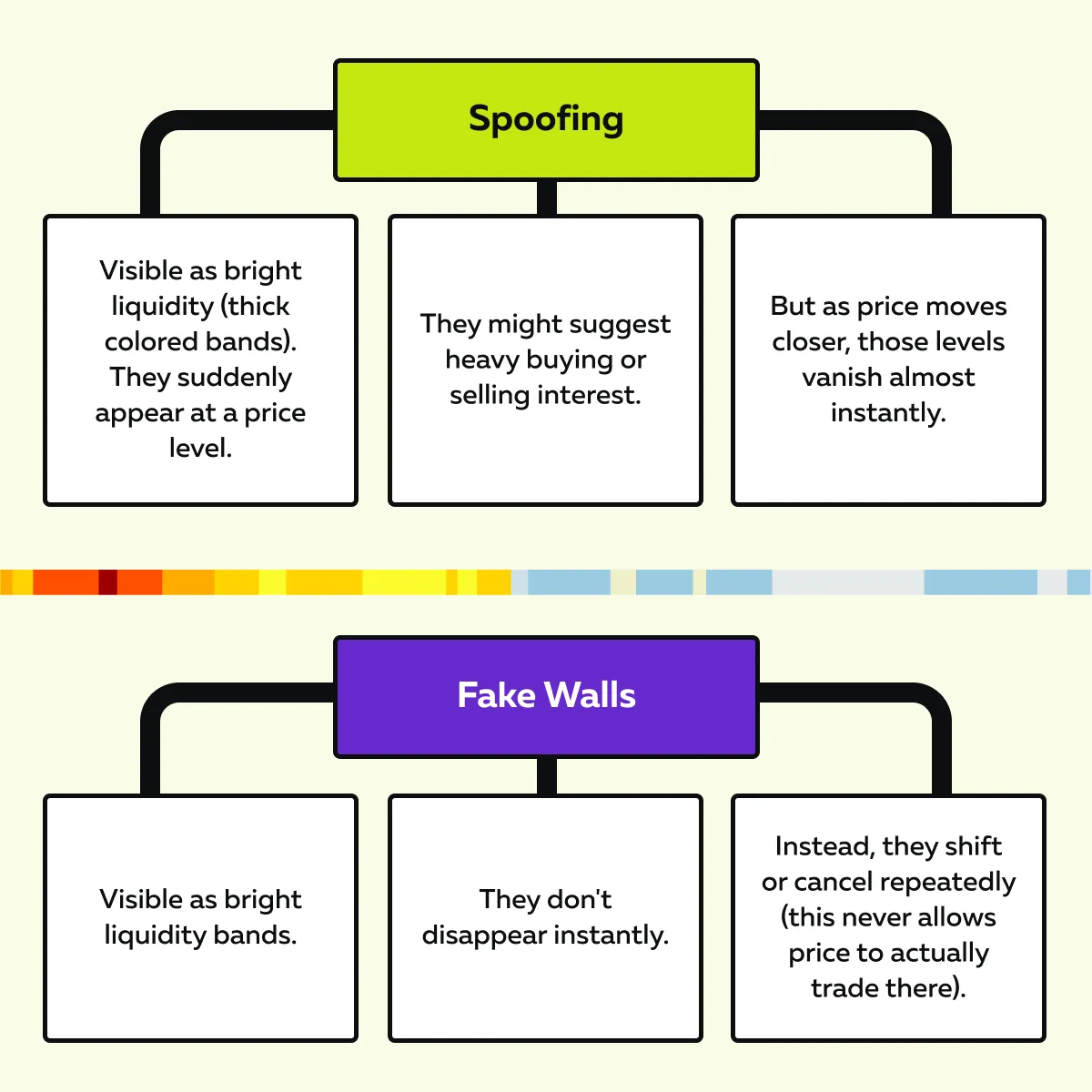

Bluffing in Poker = Spoofing and Fake Walls in Trading

In poker, bluffing is a core strategy! A player with a weak hand bet aggressively to convince others they are holding something strong. Alternatively, that weak hand player can underplay a strong hand so that they can bait opponents into betting.

The goal? To manipulate perception (not just play the cards). Now, in the same way, markets have their own versions of bluffing:

| Spoofing | Fake Walls |

|

|

Both these bluffing tactics trick others into believing there is a strong demand or supply. However, in reality, it’s just smoke and mirrors.

Passive Absorption

Another tactic is passive absorption! A trader hides their true size by quietly filling orders over time. The effect? To outsiders, the order flow looks balanced. But in reality, one participant is absorbing a large volume without showing their full hand.

Any solution? Try to read the order book like a poker table! Just as poker players read the table, traders must learn to interpret market behavior. You can easily visualize these tactics on Bookmap’s heatmap. Let’s see how:

Thinking in Probabilities, Not Predictions

Realize that you can’t win every trade! This is the single biggest mindset change that every trader should make! Let’s see why you should adopt this mindset:

Focus on Process and Not Outcome!

In both poker and trading, you can make the right decision and still lose. Now, that doesn’t mean the decision was wrong! It just means that variance (chance) worked against you this time.

Your goal should be to build an edge! Let’s see how you can do it:

That’s the core of probabilistic trading. For more clarity, let’s study an example related to Texas Hold’em (it is a popular version of Poker):

-

- You’re dealt Ace of Spades and Ace of Hearts (pocket aces, the strongest starting hand).

- Your opponent has the King of Spades and the King of Hearts.

- Pre-flop, you raise.

- Opponent re-raises.

- You go all-in.

- From a probability view, you’re a big favorite.

- There is about an 82% chance of winning.

- Now, the flop comes – King of Diamonds, 7 of Clubs, 2 of Hearts.

- At this time, your opponent has three kings (a set).

- By the river, you lose the hand even though you played it perfectly!

The learning? In both poker and trading, a good decision doesn’t guarantee a win. Over time, the probabilities favor you, but in single instances, variance can hurt.

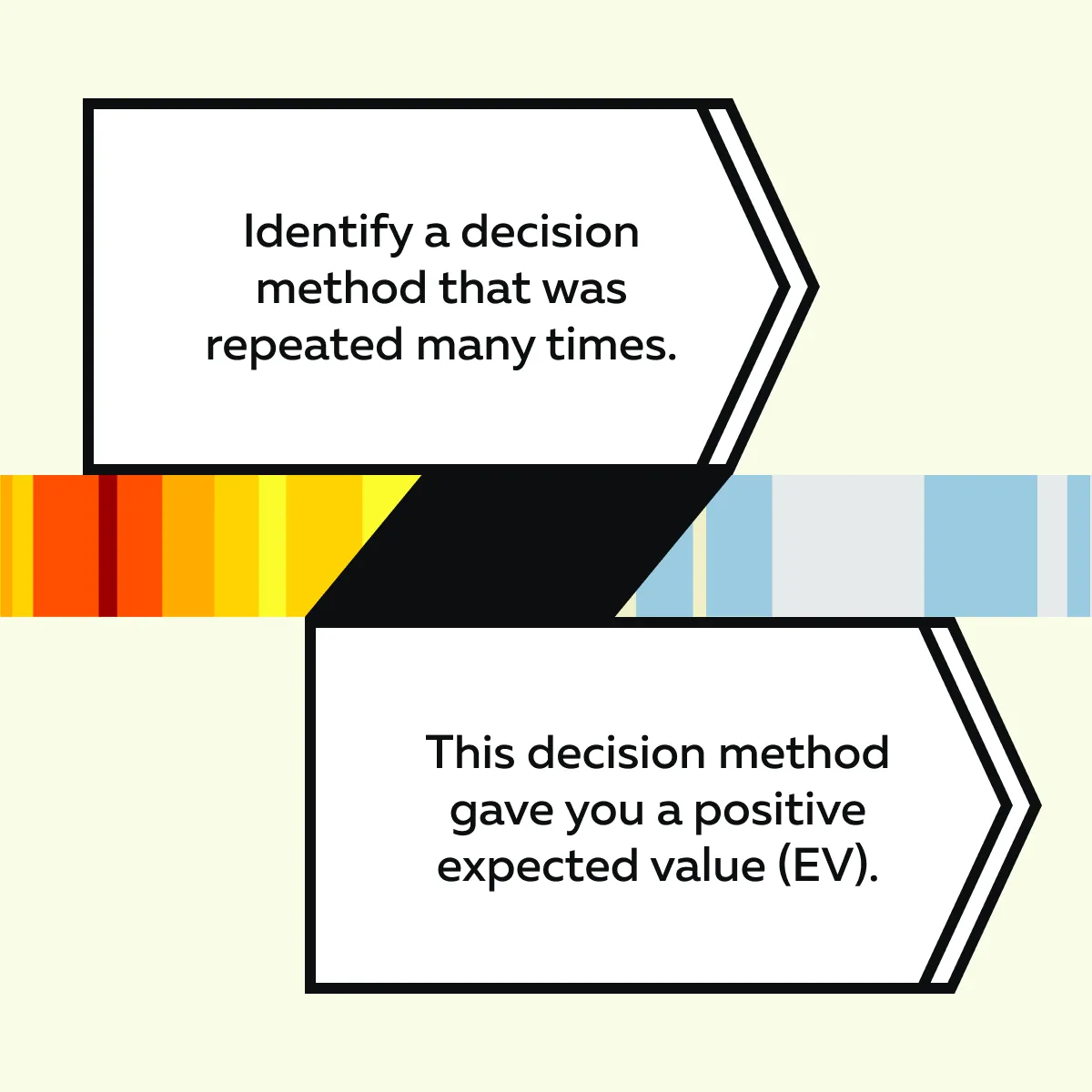

The Concept of Edge and Expected Value (EV)

Edge = your statistical advantage over time. In trading, an edge is usually:

Always remember that a single win or loss doesn’t prove anything! Your edge only shows up across a series of trades. Traders should think it like this, “If I took this trade 100 times, would I come out ahead?”. The answer to this question lies in computing EV and then scaling it.

For a better understanding, let’s study an EV per trade example:

-

- Suppose you have a system with a 40% win rate.

- On each win, you make 2X times the risk (risk: reward = 1:2).

- Now, if we compute EV per 1 unit of risk:

- Win contribution = 0.40 × (+2) = 0.80.

- Loss contribution = 0.60 × (−1) = −0.60.

- EV = 0.80 − 0.60 = +0.20 per unit risk.

- So every time you risk 1 unit, on average, you expect +0.20 units.

- That’s a positive edge!

- Now, let’s say your bet is $100 per trade.

- In this case, your EV per trade = 0.20 × $100 = $20.

- If you execute 100+ identical trades, your expected profit can be 100 × $20 = $2,000.

Why Probabilistic Trading Reduces Emotional Losses?

When you accept that good decisions sometimes lose, you stop treating single outcomes as verdicts on skill. Instead, you adopt “probabilistic thinking”, where you focus more on the process:

Following this approach, you stop thinking about whether this specific trade “felt right.” This reduces tilt/FOMO, which lets you follow the plan after losses.

Use Bookmap to Take Better Probabilistic Decisions

The Bookmap offers two major features – “Volume dots” and “Heatmap”. Through them, you can accurately read market microstructure. Let’s see how:

| Spotting Absorption | False liquidity/spoofing | Volume-confirmed setups |

|

|

|

Stop guessing. Use Bookmap’s volume dots and heatmap to confirm who’s really in the hand.

Read the Table, Not Just the Cards: Context Is Everything

You spot a green candle, and you click buy! Trading is not that simple. Markets only reward those people who read the full context and not just one signal. Let’s understand the importance of “market context” in detail:

Why Context Changes the Value of Any Setup

In poker, the same two cards mean very different things. All depends on:

- Your position

- How opponents have bet earlier

- The table’s playing style

Similarly, in trading, the setup itself isn’t enough! You need to weigh the conditions around it before trusting it. The strength of a trading setup largely depends on the context around it:

| Time of day | Market regime | Macro events | Order flow context |

| A breakout at market open (high activity) is more meaningful than one during lunchtime (low activity). | In a trending market, breakouts often succeed. In a choppy market, the same breakout may fail. | News like interest rate decisions or NFP can completely change how the price reacts to setups. | If a breakout happens with strong volume + liquidity support, it’s stronger.

If it happens on weak volume, it’s often a trap. |

For more clarity, let’s study two examples:

Example I: Breakout at 9:35 A.M. During NFP Day vs. Lunchtime Breakout

- Immediately after the market opens, and particularly on major event days (such as Non-Farm Payroll releases), liquidity and participation are high.

- A breakout occurring in this environment has a greater chance of continuation.

- That’s because many market participants are active and reacting to new information.

- In contrast, during midday trading (often referred to as “lunchtime chop”), liquidity is thin and participation is lower.

- Breakouts during this period frequently lack momentum and are more prone to failure.

Example II: Price Move Without Follow-Through Volume:

- Say a breakout does not accompany volume.

- Now, this suggests limited commitment from buyers or sellers.

- In this case, the price can temporarily cross a technical level.

- However, the absence of strong order flow reduces the probability of sustained movement.

- It has also been observed that these low-volume moves reverse quickly.

- They function more as traps than genuine opportunities.

The Bookmap Angle! What to Watch?

On Bookmap’s heatmap, you should watch liquidity persistence and not just its mere presence if heatmap levels refill after price tests them, which suggests real support/resistance. In contrast, if bright liquidity appears then vanishes, that’s a red flag (possible poker-like bluffing in markets).

Next, you can observe volume dots (representing executed trades) that tell conviction. When a large amount of trades (volume) hits a price level and pushes the market through it, the move has real strength. It shows that buyers or sellers are genuinely committed, and the level is being overpowered.

Lastly, on Bookmap, you can get a “absorption vs. breakout” confirmation as follows:

| Dense Heatmap | Empty or Fleeting Liquidity |

|

|

Always remember that good traders wait! They fold low-value setups and preserve capital for better opportunities.

Conclusion

On the surface, poker and trading may look different! But now you know that they share similarities as both demand the same core skills:

- Discipline

- Emotional control

- Thinking in probabilities

So, should you start treating the market like a casino? Nope! Instead, adopt the same strategic mindset as poker professionals. You don’t need to win every hand or every trade! Instead, you must manage risk + protect your capital. Also, focus less on prediction and more on process. Ultimately, the odds will naturally work in your favor.

So, want to stay consistent and keep executing those profitable trades? Bookmap is a real-time market analysis tool. Using it, you can “read the table” by seeing where real liquidity and intent exist. See what the market is really showing—use Bookmap to visualize where real intent lives.

FAQs

1. Is trading like gambling or poker?

Firstly, trading is neither gambling nor poker. However, if you still need a comparison, it can be closer to poker. Why? That’s because both involve uncertainty, but they reward:

- Skill

- Strategy

- Discipline

- Risk management

Furthermore, pure gambling is chance-based. In comparison, in trading and poker, your ability to make decisions and manage risk determines long-term success.

2. What does bluffing look like in trading?

In markets, bluffing often takes the form of “spoofing” or “fake walls”. For those unaware, these are large orders that appear in the order book but are canceled before getting filled.

You can consider them as tricks designed to mislead traders into believing there’s real buying or selling pressure when there isn’t.

3. How do I apply poker thinking to my trades?

The mantra can be “think in probabilities and not certainties!” As a trader, you should manage your trade size like a poker bet, where you never risk too much on one position. Additionally, you should:

- Stay calm

- Avoid emotional decisions like chasing losses

- Focus on results across many trades (not just one)

Such a mindset increases your chances of creating better trade setups.