Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 29, 2025

SHARE

Continuation Setups Explained: How to Trade the Second Leg Like a Pro

Most traders believe that continuation setups are primarily driven by price momentum. But real market moves are far more nuanced than that. You’ve likely seen it happen: price breaks out, you hesitate, and it keeps running. Then, the moment you enter, it reverses.

Don’t want to repeat this similar story? The difference between guessing and reading the market lies in understanding order flow, absorption, and liquidity. Continuation setups aren’t about chasing price! Instead, they’re about recognizing where big traders are re-entering, who’s trapped, and where profits are being taken.

Want to stop chasing trends blindly? Read this article to understand what continuation setups in trading are and how to spot “valid” versus “false” moves. Also, you will learn how to time the second leg using order flow and better read real-time signals.

What Is a Continuation Setup?

A continuation setup is a specific trading pattern indicating that the market is likely to keep moving in the same direction after a short “pause”. Let’s understand this through an analogy:

- Assume that the market is like a car speeding along a road.

- Now, it might slow down briefly at a traffic light (a pause or pullback),

- However, if the road ahead is clear, keep going forward.

In trading terms, the “pause” refers to a consolidation or minor pullback following a strong move, while the “continuation” denotes when the market resumes its original direction.

This Setup is Closely Tied to Trader Psychology

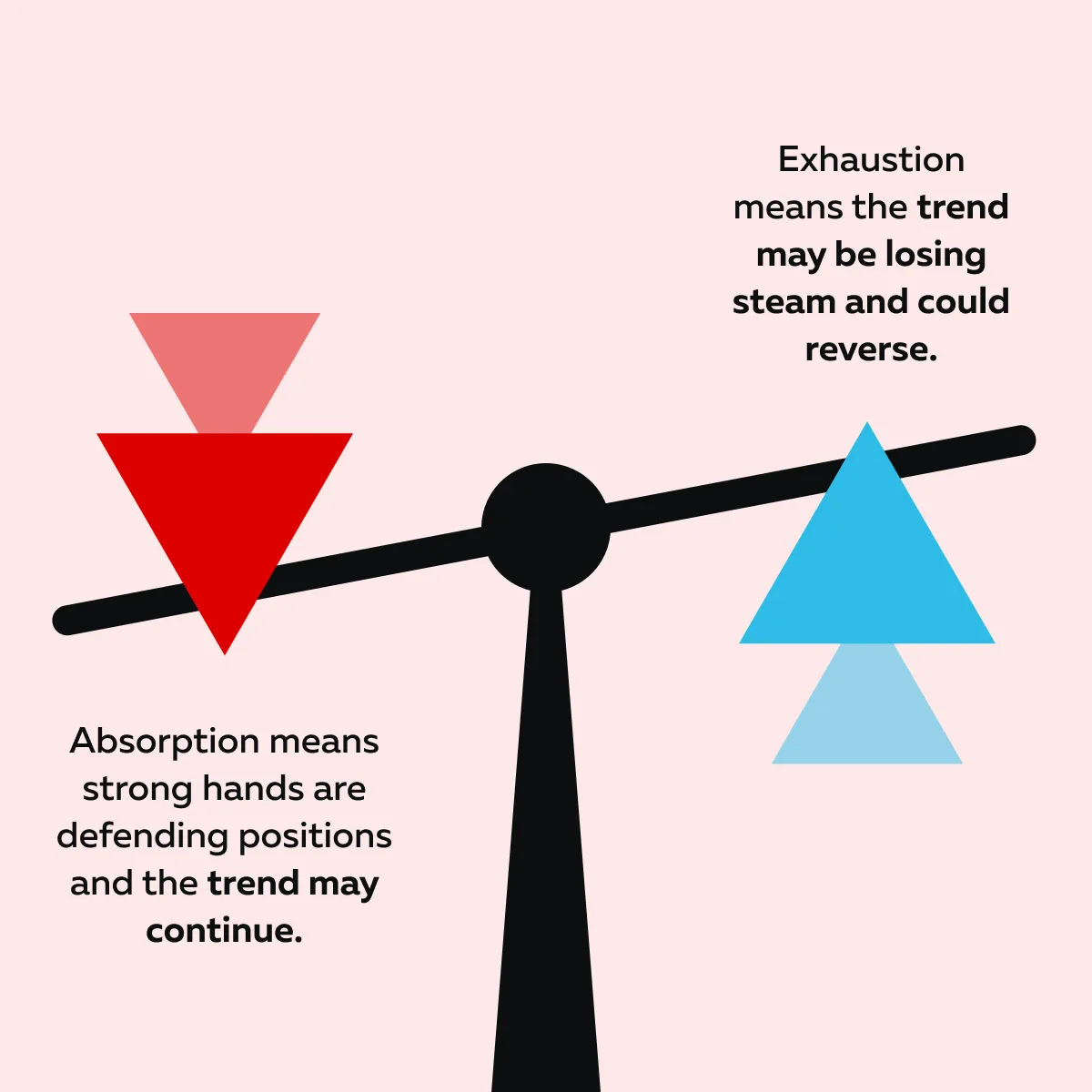

The continuation setup in trading signals that “smart money” (big traders and institutions) remains in control. The market isn’t moving randomly; instead, it shows ongoing participation. In such a trading environment, the main question isn’t “Will price go up?” but rather, “Is this a pause absorption or exhaustion?”

For those unaware, check out the interpretation of absorption and exhaustion below:

Learn how to confirm continuation with real-time liquidity shifts → Compare Packages.

Let’s Understand Better Through an Example

After a breakout in ES futures, the price might move sideways for a while. You’ll notice aggressive sellers:

- hitting the bid,

- trying to lower the price, and

- Failing to sustain the move.

Now, this is a sign of absorption, where the market is taking in selling pressure before continuing upward. Always remember that the best continuation trades come from analyzing order flow imbalances and market context. Let’s see how you can analyze it:

So, as Tom B (a veteran trader) explains in Trader Lab, a continuation setup is just a pause that prepares the next push. To understand it, you must examine volume, support/resistance, and real-time order flow rather than just guessing.

Anatomy of a Continuation Setup

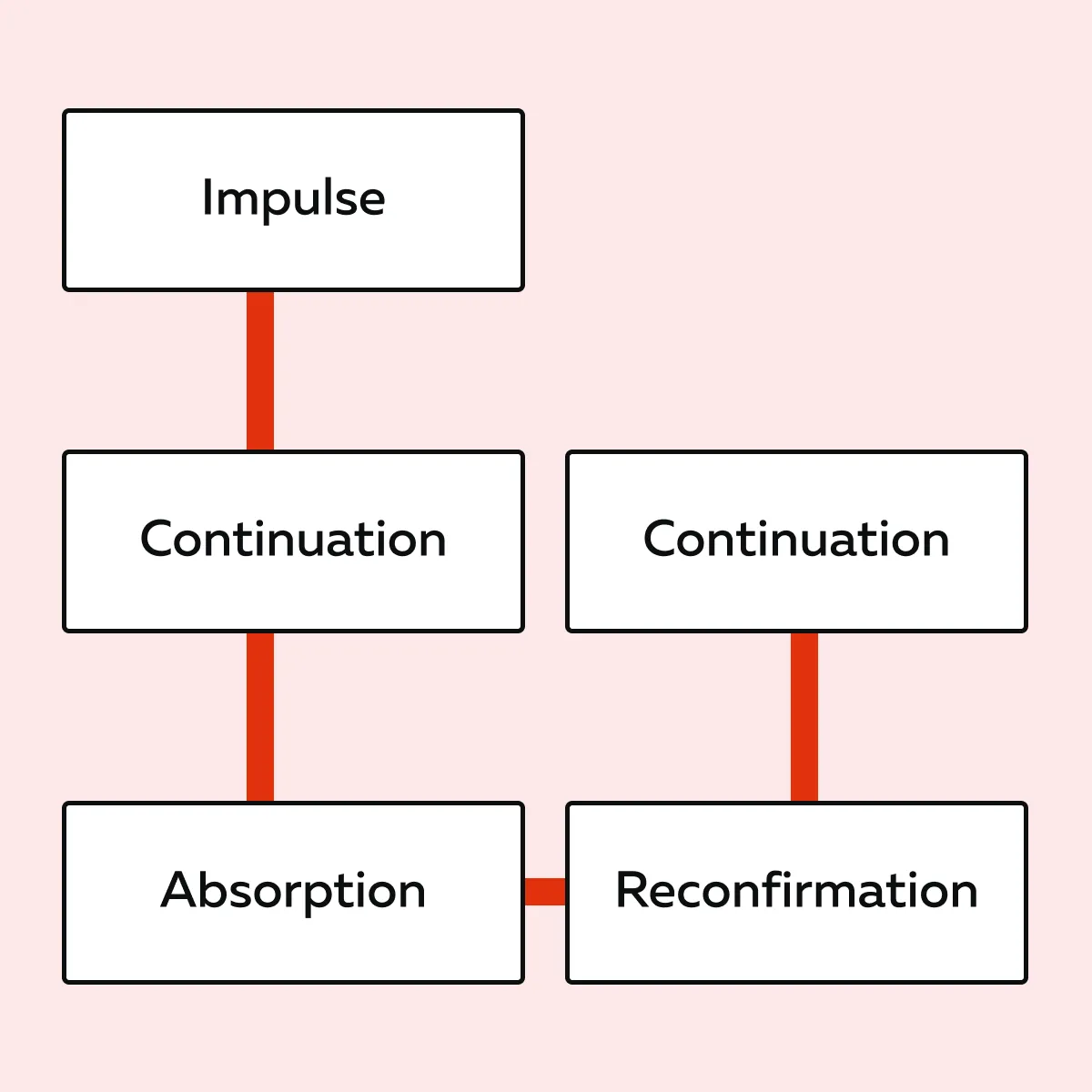

A continuation setup in trading is akin to a story unfolding in the market. It follows a sequence of steps that indicates the trend is likely to continue. Let’s check out the usual flow:

-

- Impulse:

- This is the first strong move in one direction.

- The market moves with high volume and clear liquidity sweeps.

- Big players are pushing prices, which shows strong participation.

- Pause or Pullback:

- After the initial sprint, the market slows down or retraces slightly.

- Traders take profits, but the main trend doesn’t end.

- This pause is a normal part of a continuation setup.

- Absorption:

- Opposing traders (like aggressive sellers in an uptrend) try to push the price back.

- Impulse:

- However, they fail.

-

- Strong hands continue to absorb the selling pressure.

- As an investor, you must interpret that smart money still controls the market.

- This is where you can identify that the trend is likely to continue.

- Reconfirmation:

- Now, the market readies itself to move again.

- You will observe that “volume” and “order flow delta” align with the original trend.

- The interpretation? The market confirms that strong participants remain in control.

- Continuation:

- Finally, the market resumes its original move.

- Traders trapped on the wrong side during the pause help fuel the next leg of the trend.

On Bookmap, You Can Actually See This Play Out Visually

Bookmap is an advanced real-time market analysis tool. On it, you can visualize the continuation setup in trading. This is what you may observe:

- Liquidity gets consumed during the impulse.

- Then it rebuilds:

- Just below (in an uptrend)

or

- Just above (in a downtrend)

- This rebuilding leads to the formation of a pause or pullback zone.

- Such a liquidity rebuilding signals that continuation is ready to happen.

To better understand what a continuation setup in trading is, refer to the flowchart below:

So, want to better understand this sequence and watch order flow and liquidity? On Bookmap, see how liquidity reforms after absorption signals continuation → Compare Packages.

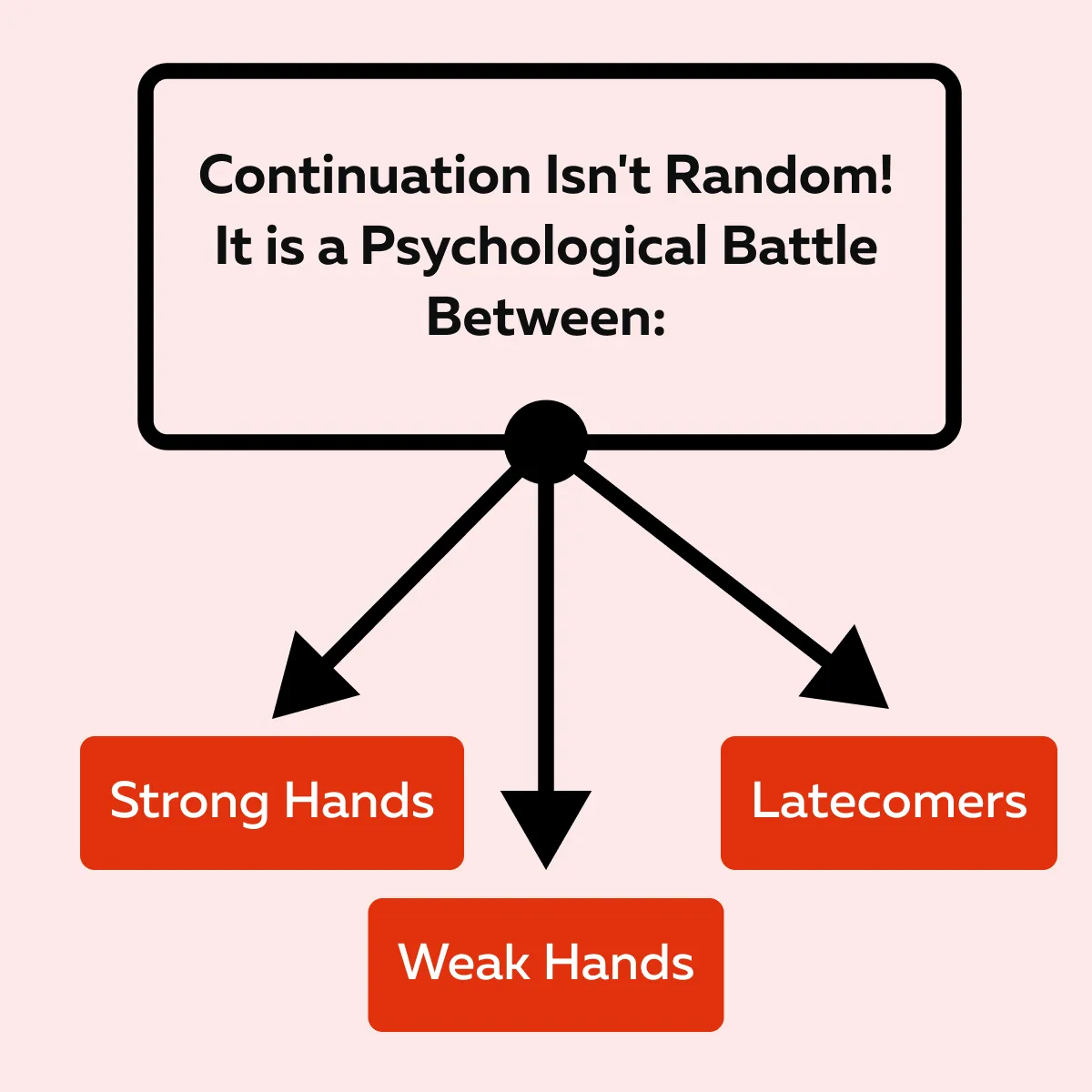

The Psychology Behind Continuations

Do you think a continuation setup in trading is just about price moving on a chart? Nope! It is about what traders are doing during the pause. Let’s have a look at the psychology at play:

| Strong Hands (Smart Money) | Weak Hands | New Traders |

|

|

|

For more clarity, let’s study an example:

- Assume an uptrend, where sellers are pushing hard during a pullback.

- They are trying to reverse the market.

- In such a situation, let’s say the price doesn’t break down.

- Why? That’s because strong buyers are absorbing this selling pressure.

- Now, once these aggressive sellers are exhausted, the market is ready to continue its upward trend.

Tom B calls this “the second wave”. It is a point where professionals re-enter after testing market conviction. So, as a trader, what you must understand is:

As a reader, when you understand this psychology and start using Bookmap, you can better spot continuation setups in trading. See continuation setups unfold in real time with Bookmap’s order flow tools → Compare Packages.

Identifying Valid vs False Continuations

Caution! Not every pause-and-go pattern in the market leads to a true continuation. Yes, some are fakeouts that trap traders. So, how do you protect yourself? Look for “objective cues” that show strong hands are still in control. Let’s explore them in detail:

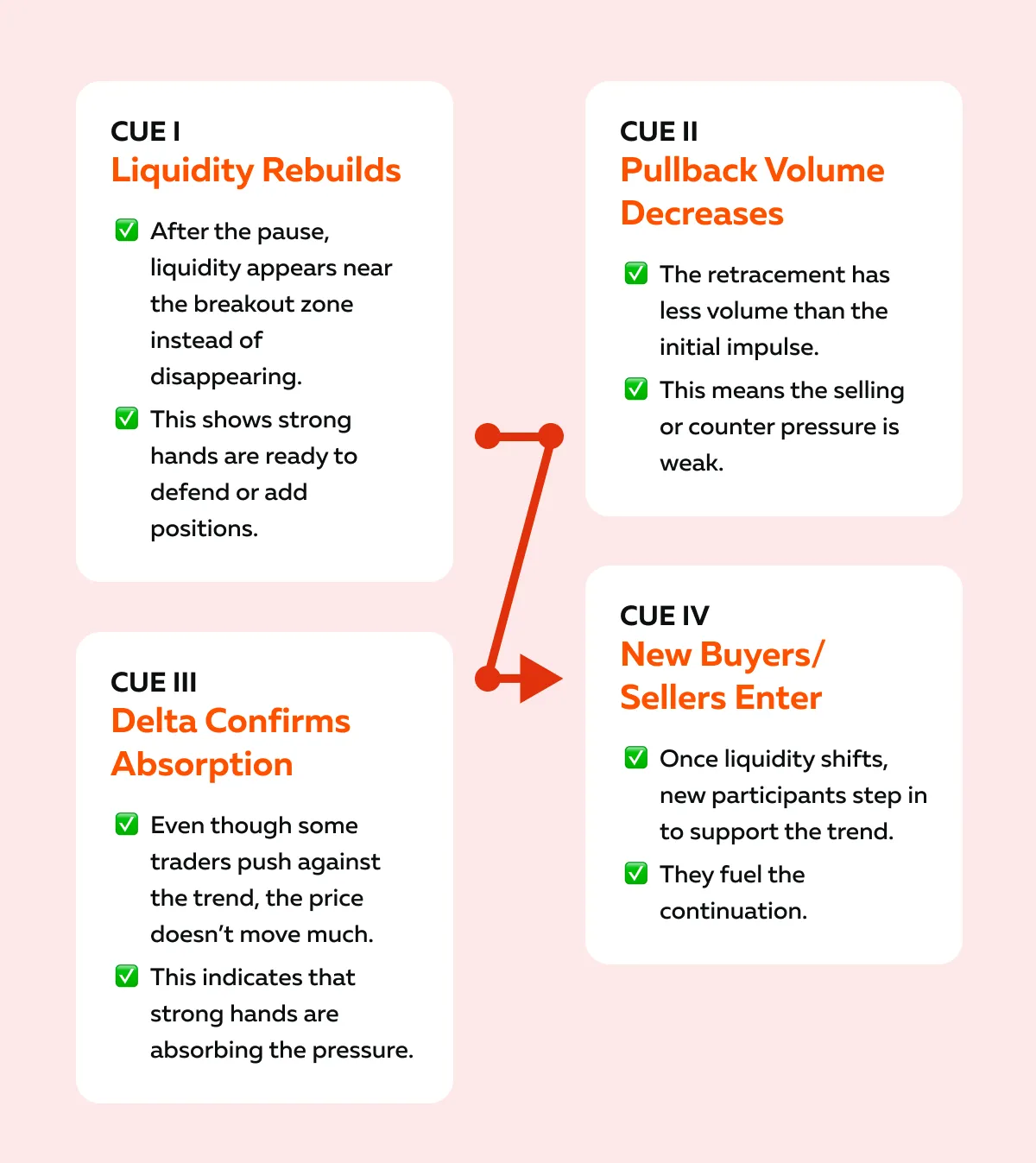

What is a Valid Continuation Setup?

It is a real continuation, which shows that the market has enough support to keep moving in the same direction. Four major objective cues that support this trading setup are:

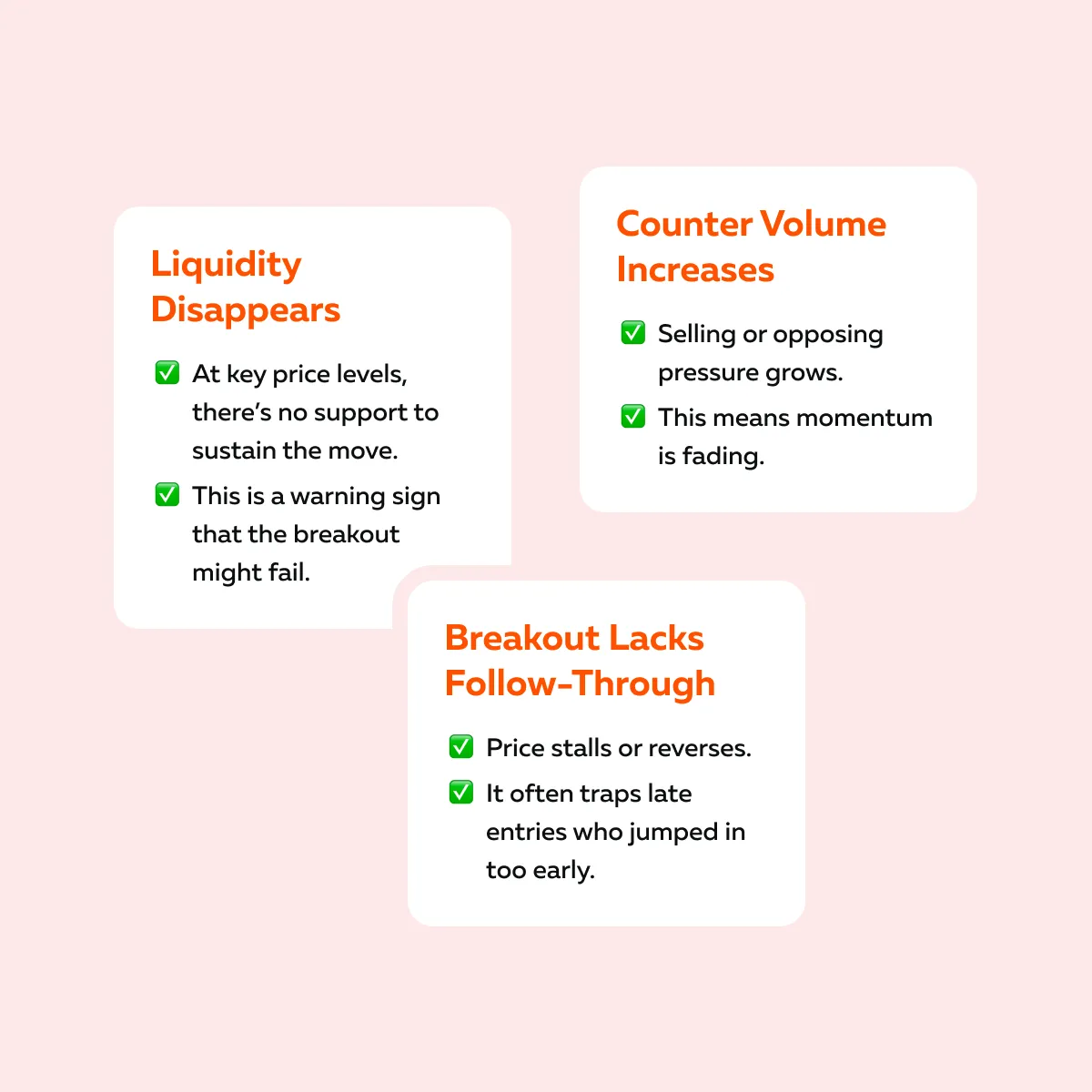

What is a False Continuation Setup?

Now that you know about the real continuation setup, understand what a fake continuation looks like. Always remember that it lacks the strength or follow-through needed to sustain the trend. This weakness can be spotted through these three objective cues:

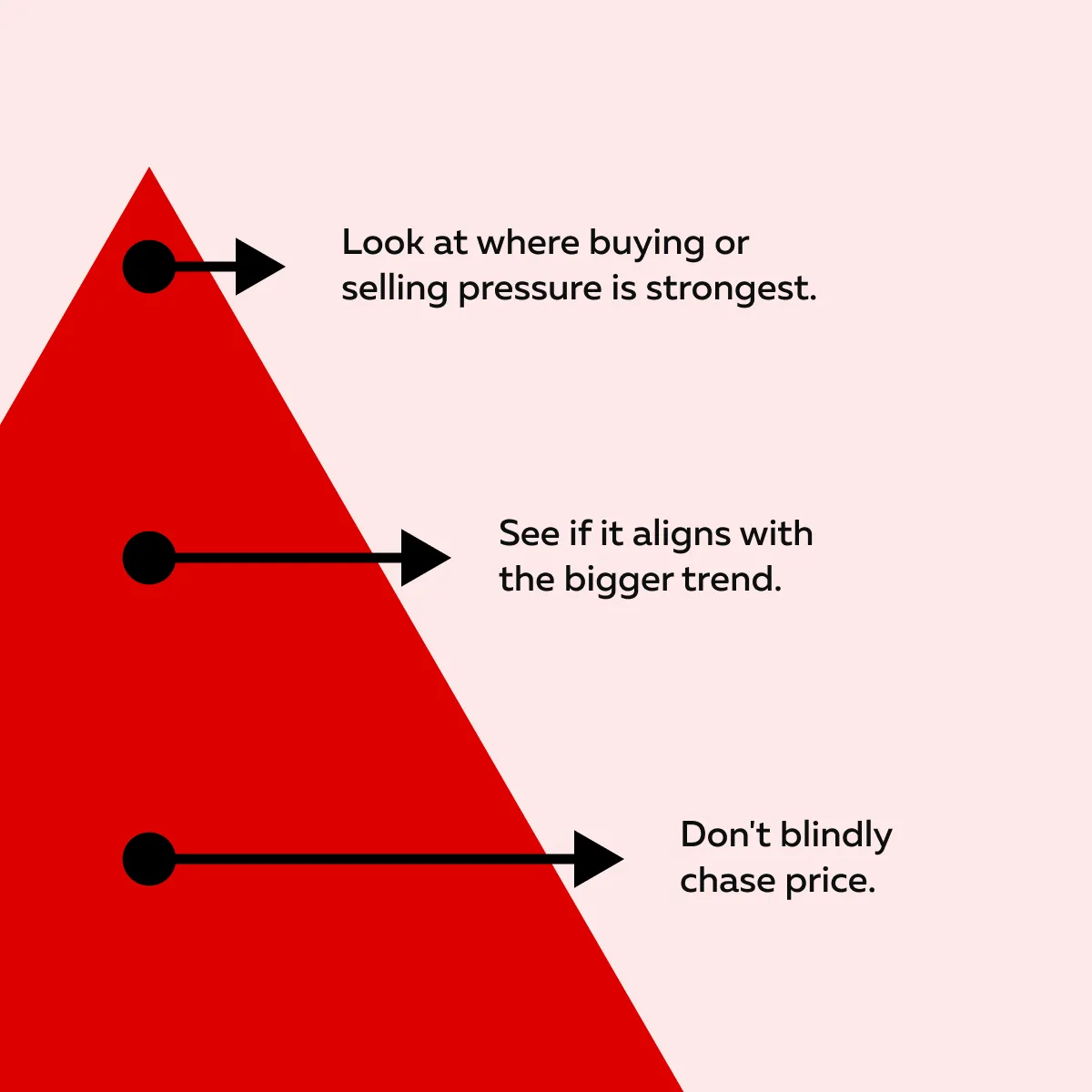

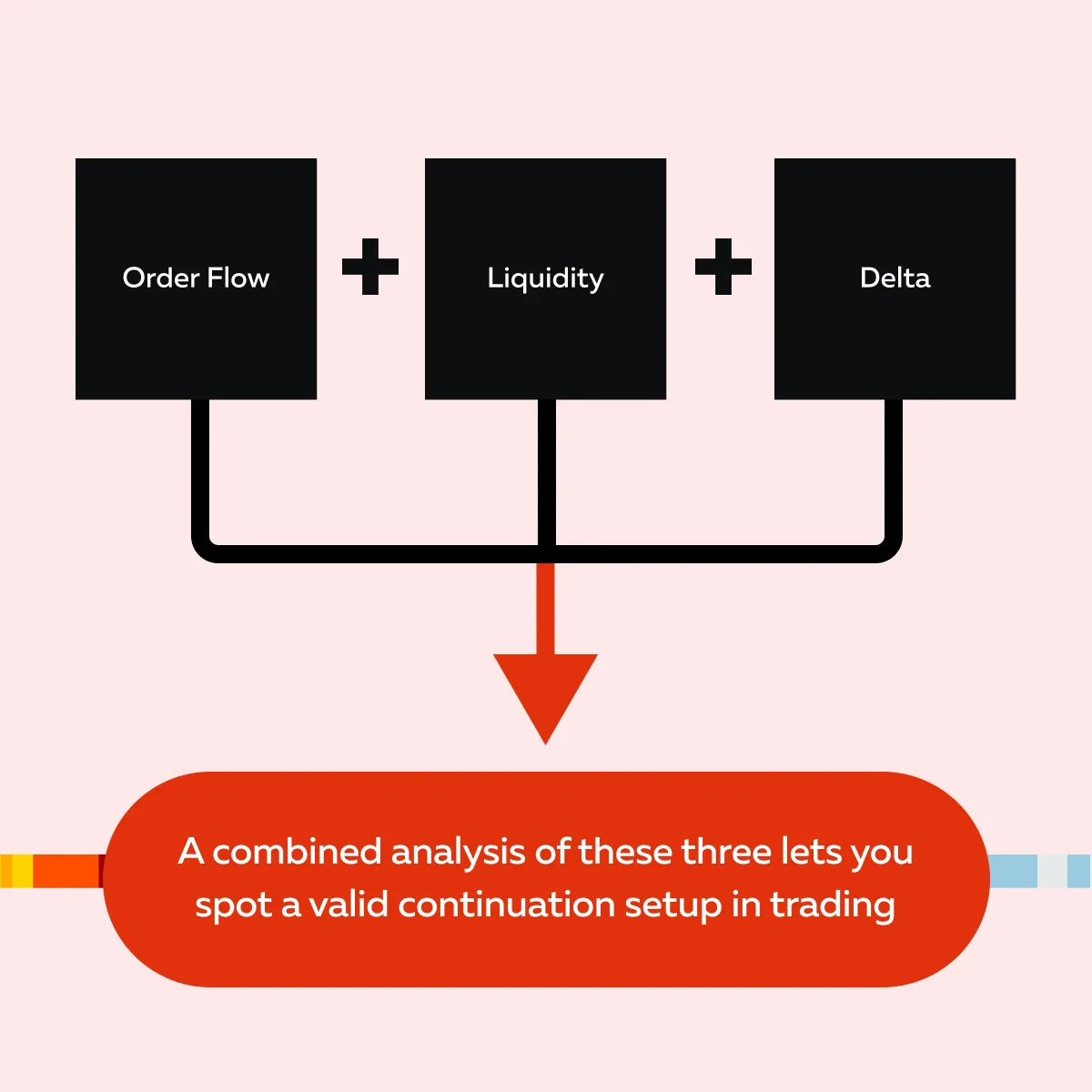

So, where does a valid continuation setup in trading originate? It doesn’t simply arise from tracking price movements alone. Let’s break it down using the chart below:

Need help with spotting true continuation setup? With tools like Bookmap, you can visually confirm the rebuilding of absorption and liquidity. Avoid false continuations with real-time order flow clarity → Compare Packages.

Timing the Entry: Waiting for the Second Leg

Avoid jumping in immediately after the first impulse when trading a continuation setup. Why? Entering too early can be risky, as the market may chop or retrace. A safer approach is to wait for the second leg, which confirms that the trend is truly continuing. Let’s understand this approach in detail:

How to Make Better Entries?

Ideally, you should wait for confirmation. Don’t enter during sideways movement or noisy consolidation. Instead, watch for liquidity to shift in the direction of the impulse. Such a shift shows that strong hands remain in control. Additionally, you may follow these two tips:

| Tip I: Trigger Level | Tip II: Risk Placement |

|

or

|

Need an execution tip? Enter smaller on the first test to minimize risk. If the continuation confirms with another impulse, scale in to increase position size. For more clarity, let’s check out an example:

-

- Assume that in ES futures, there was a strong impulse.

- After it, the price pulled back slightly into absorbed liquidity.

- Now, traders who waited for the second delta impulse (the market’s reconfirmation) got better entries.

- This lowered risk, compared to those who jumped in too early.

Timing your entry in continuation setups is about patience and reading order flow. By waiting for the second leg, you can align yourself with strong hands and liquidity shifts. This alignment significantly increases the chance of a successful trade.

Track delta and liquidity shifts in real time to confirm your continuation entries → Compare Plans

Common Mistakes Traders Make with Continuations

When trading in continuation setups, many traders make some common errors. By avoiding them, you can protect your capital and improve your trading edge. Let’s check them out:

1. Chasing Momentum

Some traders jump in after a strong move has already extended. It is a highly risky approach. That’s because when the initial impulse is over, late entries often get trapped.

Thus, instead, wait for the second leg or reconfirmation. In this phase, liquidity shifts and absorption signals continuation.

2. Ignoring Context

Always remember that not every pullback is a good continuation. Traders sometimes enter inside ranges or near the end of a trend, expecting the move to continue.

Be aware that continuation setups in trading only work when the market context aligns with order flow.

3. Overconfidence

For some new traders, every pullback is a buying or selling opportunity. The end result? Losses! Please note that not all pauses signal continuation, as some are genuine signs of exhaustion.

To avoid this mistake, you should wait until opposing traders (counterflow) are stuck and unable to push the price against the trend. At the same time, ensure liquidity is stable in the area. Entering only then reduces risk and increases chances of a successful continuation trade.

4. No Structure

- Are you trading without a plan?

- Are you ignoring risk placement and volume confirmation?

- You don’t know how to make a delta analysis, and hence, you skip it?

All these are common avoidable errors made by both new and experienced retail traders. Note that continuation setups in trading need structure. Before entering a trade, you should always:

- Decide your stop-loss (the price level where you’ll exit if the trade goes against you),

- Set your trigger level (the price point signaling the trade is valid), and

- Confirm absorption by checking that opposing orders are being absorbed by strong hands.

For more clarity, let’s study an example of how to make good entries:

-

- Let’s say ES futures move from 4400 to 4420.

- Price pulls back to 4415, and sellers push aggressively.

- However, the price holds above 4414.

- Also, the delta is showing more buying than selling.

- Now, this indicates strong hands absorbing counter-traders.

In this situation, once liquidity remains stable around 4415 to 4416, and a delta confirms buying pressure, you may enter a long position. It could be a valid continuation setup.

Conclusion

After reading this article, you now understand that continuation setups in trading occur when professional traders re-enter a trend. Now, to trade successfully in such an environment, you should wait for absorption and liquidity changes and obtain clear confirmation signals before entering.

The advantage? By observing these signals, you can distinguish real continuation setups from false breakouts. Additionally, you can avoid common mistakes, such as entering too early or ignoring context.

Next, it is recommended that you watch the order flow carefully. Try to see where liquidity builds and counter-traders get trapped. This knowledge gives you a real-time edge. You can even utilize leading market analysis tools, such as Bookmap, to make it easier to visualize these dynamics. Trade the second leg, not the fakeout → Compare Plans.

FAQs

1. What is a continuation setup in trading?

A continuation setup occurs when the market pauses after a strong move and then keeps moving in the same direction. It shows that big traders remain active, absorbing opposing orders and supporting the trend. So, the price movement is not random.

2. How can I tell if a continuation setup is valid?

A “valid continuation” setup is created when:

- Liquidity stays near the pullback zone,

- Counter-trades are absorbed, and

- Delta confirms the trend.

Now, if liquidity vanishes or momentum weakens, it’s likely a false setup. Thus, always check order flow and volume to confirm strength before trading.

3. What’s the best way to enter a continuation trade?

Ideally, you may wait until the market shows a clear continuation in the original direction. Then, enter your trade near the sideways pullback area. Also, place your stop-loss just below (for buys) or above (for sells) the price zone where big traders have absorbed the opposing orders. This strategy will help you lower your trading risk.

4. Can I identify continuation setups using Bookmap?

Yes, Bookmap shows real-time order flow, volume, and liquidity changes. This enables you to see if the market is being supported or if counter-traders are being absorbed. This knowledge allows you to identify strong continuation setups before entering a trade.