Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

February 18, 2025

SHARE

Futures Spreads 2025: Profiting from Calendar Relationships

Are you still trading a single futures contract? Why not trade two and profit from their relationship? Trading futures spreads is a smart strategy where you try to capitalize on price differences between related futures contracts. Using this approach, you get to manage risk and maximize profits, whether you are comparing contracts of the same commodity (calendar spreads) or dealing with entirely different but related markets (Intermarket spreads).

Wish to know more? In this article, you’ll learn about calendar spreads, which focus on the same commodity with different expiration dates, and Intermarket spreads, which compare different but connected commodities, such as gold and silver.

Next, we will explain how our market analysis tools, like Bookmap’s Multibook feature, allow you to perform spread analysis. You’ll also learn how to identify profitable patterns in seasonal trends, supply-demand positions, and macroeconomic events. Read this article till the end and make smarter trading decisions in the year ahead. Let’s begin.

What Are Futures Spreads?

Futures spreads represent the price difference between two futures contracts. Many traders try to exploit this difference by simultaneously buying and selling related futures contracts. It is a popular futures trading strategy for 2025, as it can maximize returns in volatile markets.

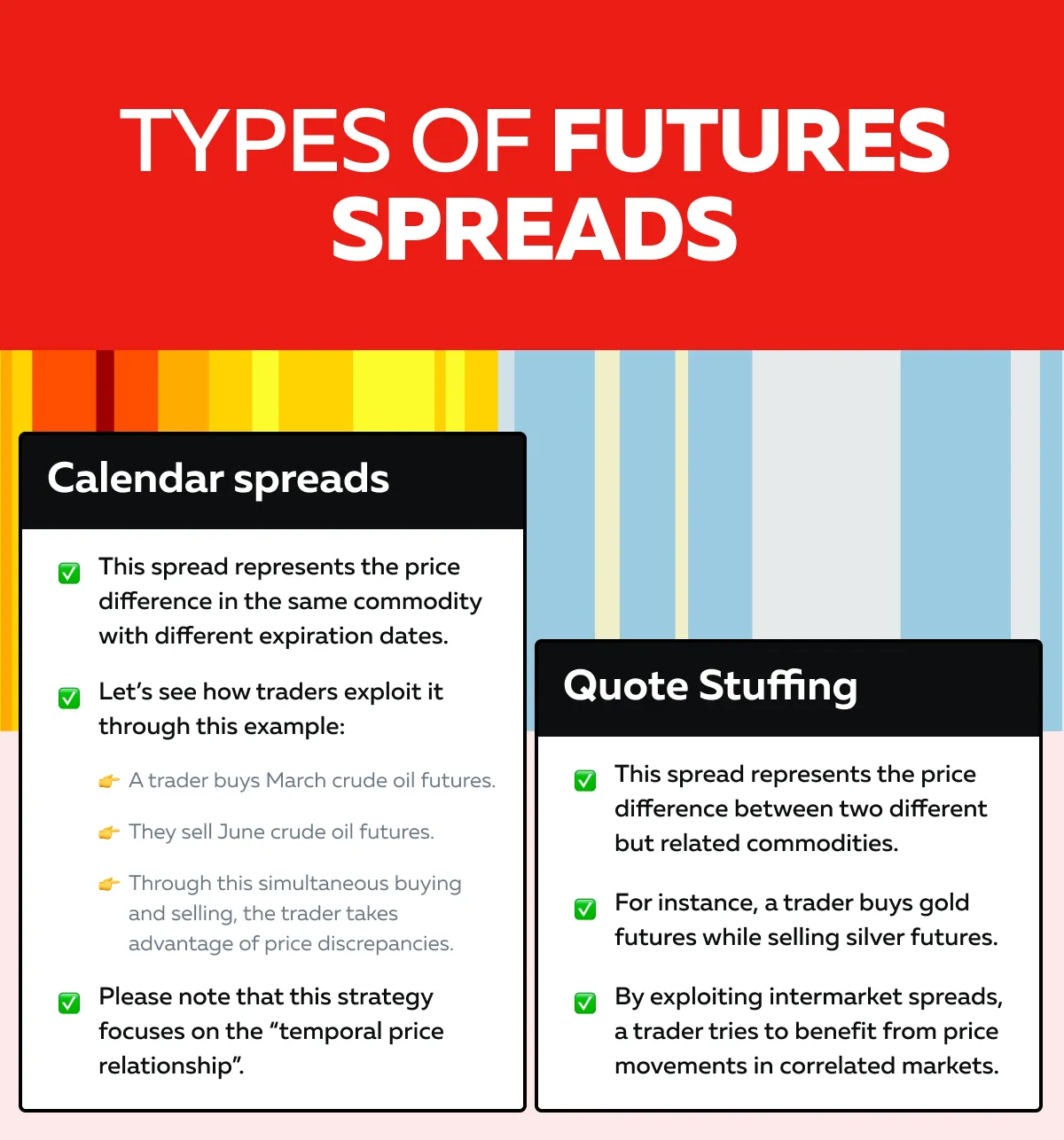

Types of Futures Spreads

Generally, there are two major types of futures spreads: calendar spreads and market spreads.

Why Trade Futures Spreads?

By trading futures spreads, traders can optimize their trading portfolio and exploit opportunities in both calendar spreads and Intermarket spreads. Additionally, it is advantageous because of lower margin requirements and reduced volatility compared to outright trades, as detailed below:

- Lower Margin Requirements:

- Trading spreads often require less capital than outright positions.

- This makes them attractive for capital-efficient trading.

- Also, a reduced margin is a significant advantage for those exploring futures spreads in depth.

- Reduced Volatility:

- Spreads are usually less volatile than outright trades.

- This lower directional risk allows traders to profit from relative price movement.

- At the same time, they can avoid sharp market swings.

Calendar Spreads: Profiting from Seasonal and Supply Dynamics

As mentioned above, to exploit calendar spreads, you trade the price difference between contracts of the same commodity but with different expiration dates. This strategy is among the best futures trading strategies for 2025. That’s because it allows traders to capitalize on market inefficiencies over time.

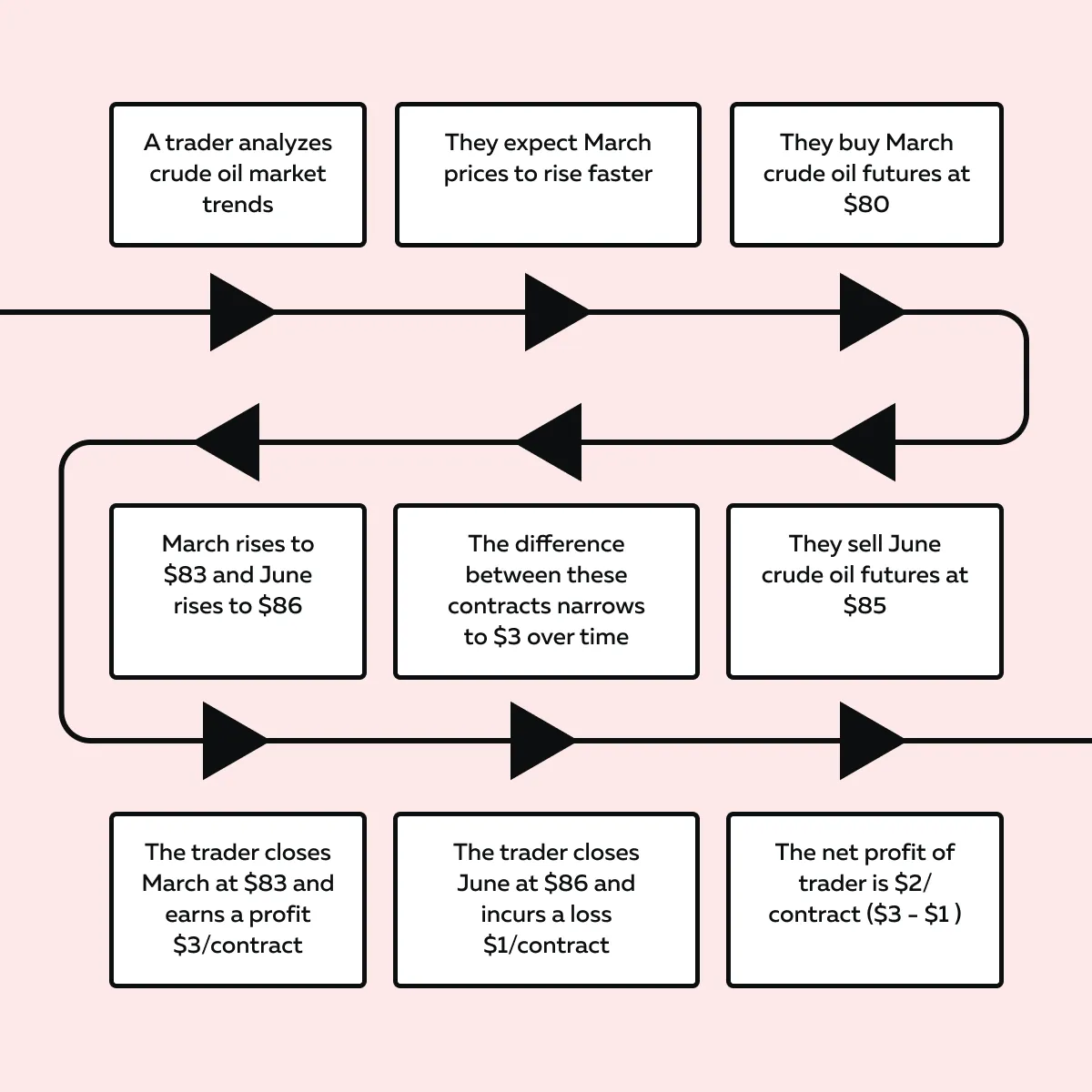

To gain more clarity, check the graphic below showing how a trader profits from a calendar spread through a scenario:

Factors That Influence Calendar Spreads

Primarily, we can point out three main factors that influence calendar spreads: seasonal trends, storage costs, and supply/demand positions. Here are the explanations of these factors:

| Seasonal trends | Storage costs | Supply/demand positions |

|

|

|

Some Famous Calendar Spreads

To better our understanding, let’s have a look at two of some famous calendar spreads:

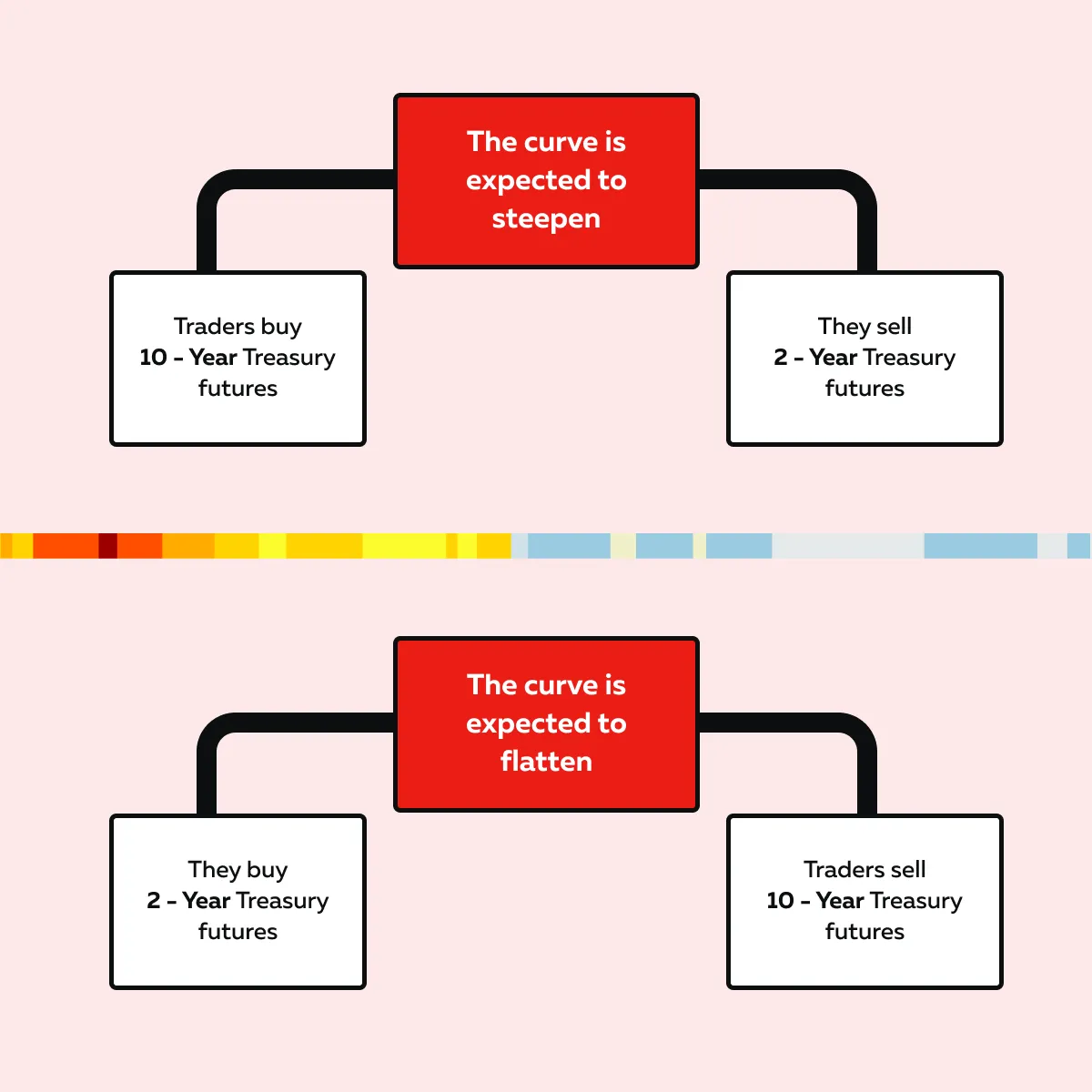

- Yield Curve Trading: 10-Year vs. 2-Year Treasury Note

In this calendar spread, you trade Treasury futures based on the shape of the yield curve. Let’s see how it happens:

The profit comes from changes in the relative yields, which are often influenced by Federal Reserve policy or economic outlook.

- Seasonal Demand: Heating Oil vs. Gasoline Futures

To exploit this spread, traders try to benefit from seasonal patterns in energy demand. Let’s see how it happens through the given example:

The spread profits from the anticipated widening price difference due to seasonal consumption trends.

2025 Calendar Spread Example

In 2025, an OPEC production cut is expected. This cut will impact crude oil prices differently for near-term and long-term futures contracts.

| Near-term price impact | Long-term price impact |

| When OPEC announces a production cut, near-term crude oil futures (e.g., March contracts) usually rise faster due to immediate supply concerns. | Long-term futures (e.g., June contracts) increase more slowly as future supply adjustments take time to materialize. |

Let’s see how traders can use calendar spreads to profit from such events in line with futures trading strategies 2025:

- Say traders buy the March crude oil contract at $80.

- They sell the June contract at $85.

- They are anticipating that the current price gap of $5 will widen.

- That’s because they feel that the cut impacts the near-term market more strongly.

- Now, assume that:

- The March contract rises to $86

and

- The June contract moves to $88.

- The price difference widens from $5 to $8.

- The traders close the spread and capture a $3 profit per contract.

Intermarket Spreads: Capitalizing on Commodity Relationships

Intermarket spreads represent the price difference between distinct but related commodities, such as:

- Gold versus silver

or

- Soybeans versus corn.

This approach allows traders to benefit from the correlation between markets. It is counted as an important futures trading strategy in 2025 for diversifying and hedging risk.

Key Relationships to Watch in 2025

As we navigate through 2025, recognizing some key relationships will empower traders to optimize strategies to enhance profitability and capitalize on market movements.

| Metals | Energy | Agriculture |

|

|

and

|

Example Trade

For more clarity, let’s understand this through an example trade:

- Say a trader buys gold futures and sells silver futures.

- They are anticipating that gold will outperform.

- Since it is a safe-haven asset, its demand will increase during economic uncertainty.

Track market dynamics for calendar and Intermarket spreads with Bookmap’s intuitive visualization tools.

Tools and Indicators for Trading Futures Spreads

To trade futures spreads profitably, you need several advanced tools and indicators. Using them, you can easily identify profitable opportunities. Let’s see how our modern market analysis tool, Bookmap, can help you:

A) Do Spread Analysis with Bookmap

Bookmap offers a “server-side multibook feature”. It is an excellent tool for real-time spread analysis. Using this feature, you, as a trader, can compare two futures instruments, such as crude oil and natural gas futures, simultaneously.

Let’s understand its practical usage through an example where a trader is analyzing real-time price discrepancies between crude oil and natural gas futures:

- The trader uses Multibook-add on to display live data.

- They observe that crude oil futures are priced at $80 and natural gas futures at $5.

- Bookmap shows an unusual divergence: Crude oil prices are rising faster than natural gas prices.

- The spread widens from $75 (15:1 crude-to-gas price ratio) to $80 (16:1 ratio).

- Witnessing this divergence, the trader:

- Buys one natural gas contract at $5 and

- Sells one crude oil contract at $80.

- Later, natural gas rises to $6, and crude oil stabilizes at $82.

- The spread narrows to $76 (13.67:1 ratio).

- The trader closes the positions.

- They get a $1,000 profit from natural gas and a $200 loss from crude oil.

- This results in a $800 total profit.

Some other key indicators you can check on Bookmap

| Open interest | Volume trends |

|

|

B) Perform a Historical Volatility Analysis with Bookmap

Using our avant-garde tool, Bookmap, you can easily analyze historical price movements. Such an analysis will enable you to predict spread performance under similar conditions. For instance,

- Say you are reviewing past volatility during geopolitical events.

- This helps you, as a trader, anticipate how intermarket spreads (such as gold versus silver) might react.

Identify optimal futures spread opportunities with Bookmap’s advanced order flow analysis.

Building a Futures Spread Strategy for 2025

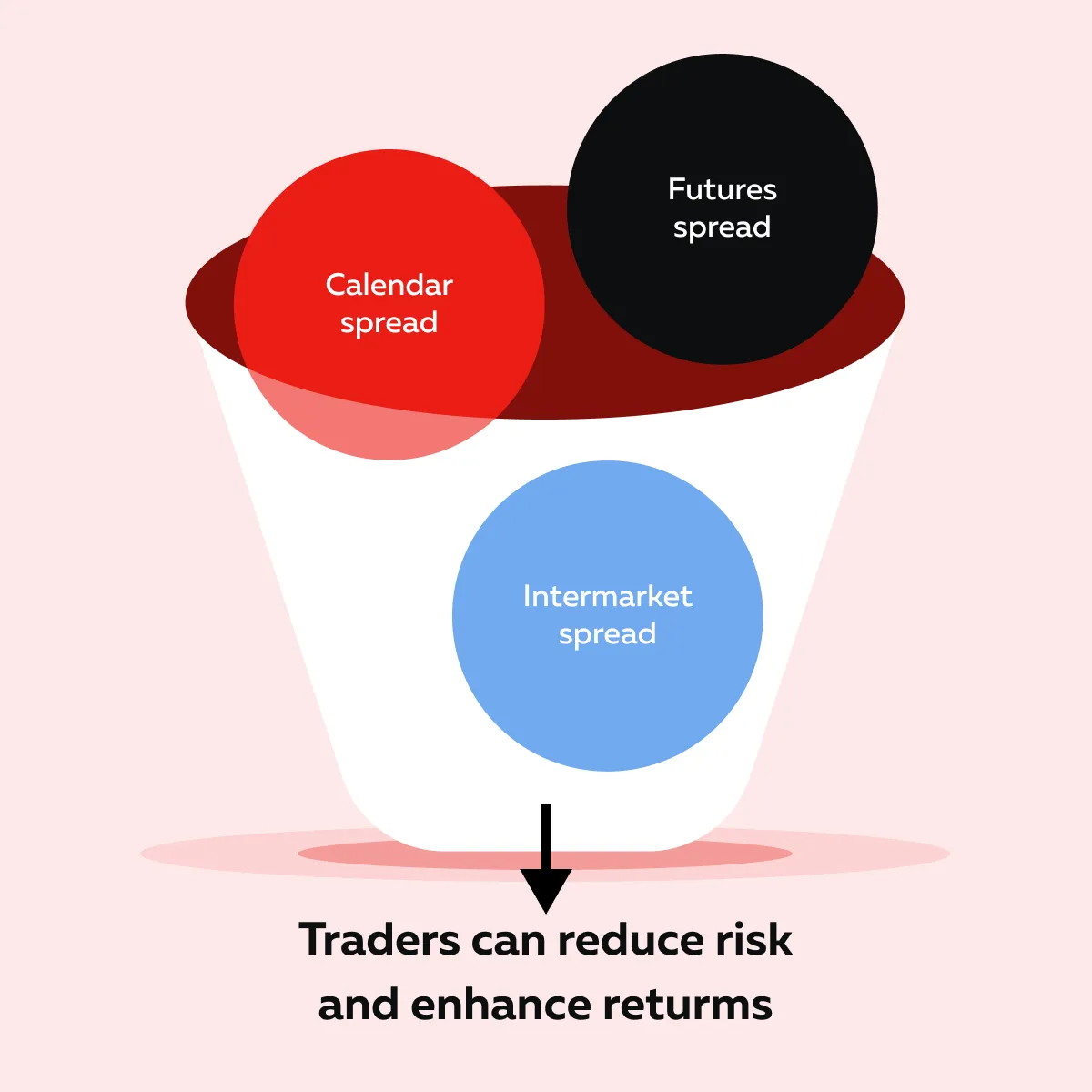

To develop a successful futures trading strategy for 2025, you will need to utilize our analytical tools like Bookmap. Also, you must diversify and try to improve your timing. Here is how mastering the three types of spreads can help you:

Now, let’s have a look at some popular ways through which you can build smart futures trading strategies 2025:

I) Backtesting and Simulation

By testing strategies with historical data, you can easily refine your entry and exit points. For example,

- Say you are using our Bookmap’s replay feature.

- Using it, you try to simulate trading crude oil calendar spreads during periods of past market volatility.

- This allows you to visualize how well your strategy would have performed in varying market conditions.

II) Diversification Across Spreads

Diversification is the key to minimizing risk while maximizing opportunities. To create a balanced portfolio, you can combine:

- Energy-based calendar spreads (e.g., crude oil with different expiration dates)

and

- Agricultural intermarket spreads (e.g., corn vs. soybeans).

This approach gives you exposure to multiple markets and even reduces the impact of adverse movements in any single sector.

III) Timing the Market

One must be aware that timing is highly important for successful spread trading. As a trader, you should try to align your trades with macroeconomic events, such as:

- Federal Reserve rate decisions

or

- Geopolitical developments.

That’s because such events significantly impact the performance of futures spreads. For example, intermarket spreads between gold and silver could react strongly to inflation-related announcements, while calendar spreads in energy markets might shift due to OPEC production changes.

Conclusion

To trade futures spreads, you simultaneously buy and sell related futures contracts. Primarily, they are of two types: calendar spreads and intermarket spreads. Both these spreads allow you to capture price differences that are driven by supply-demand dynamics, seasonal trends, or macroeconomic factors. They also require lower-margin investments, which makes them ideal for capital efficiency.

However, to succeed, you must stay informed and try to understand the relationships between contracts (such as those in energy or agriculture). Such an understanding can help you reveal profitable patterns.

Also, you should use our modern market analysis tools, like Bookmap. It comes with a special Multibook feature. Using it, you can analyze live order flows and price discrepancies. This offers you deeper insights for better decision-making. Maximize your futures trading strategy with Bookmap’s real-time data and liquidity tools.