Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

August 6, 2025

SHARE

How Dealers Use Futures to Hedge Options—and Why It Moves the Market

Why’s the market so slow or indecisive? Is it being controlled by a mysterious puppet master? Don’t worry, you’re not the only one if you feel the same. But, do you know, who’s behind it? It’s the work of options dealers!

Price action isn’t always driven by news, earnings, or economic data. Instead, it’s the hidden force of dealer hedging that moves things around. So, are you, as a trader, also confused by random drifts, sudden reversals, or those sticky levels near expiry? Read this article till the end.

You’ll learn how dealers hedge options, how delta and gamma influence their behavior, and what causes those melt-ups or flash drops. We’ll also show you how to spot dealer impact in real-time and how you can adjust your trading strategy to avoid traps and ride the flows. Once you understand the mechanics, you’ll never look at price action the same way again!

What Is Dealer Hedging in the Options Market?

When you buy an option (say, a call), the person on the other side (the dealer or options market maker) is selling it to you. That means they are taking on risk. If the market moves, the option’s value changes. This fluctuation can give them a profit or a loss.

But market makers don’t want to gamble! They always want to stay neutral. So, they hedge their exposure.

To stay delta neutral, meaning they don’t profit or lose from directional moves, dealers buy or sell the underlying asset, like futures or stocks, to offset the risk. This process is known as dealer hedging.

Let’s understand better through the example below:

-

- You buy a call option.

- The dealer has “short that call.”

- This means that if the market rises, they incur losses.

- Now, as the market rises, your call option gains value.

- Your call option’s delta increases, meaning it moves more like the underlying.

- Thus, to protect themselves, the dealers must buy the underlying (like futures).

- By doing so, they can balance the risk.

- Such buying by dealers adds upward pressure to prices.

- Be aware that this does not happen because anyone is bullish!

- Instead, it happens because dealer positioning in trading forces them to react to price movements.

Now, what if this happens at scale across many options, especially near expiry? You might wonder why the price keeps pinning to a certain level or drifting oddly. That’s often due to options market makers hedging their positions.

So, what will you do the next time, when you see:

- Price being “pinned”

or

- Price moving without a clear narrative?

You will realize that the price movement is not due to the strong opinions of buyers or sellers. Instead, it is due to the invisible hand of dealers hedging options!

Delta and Gamma: The Mechanics Behind Dealer Flows

Why does the market feel like it grinds, stalls, or reacts sharply for no clear reason? It often comes down to the dealer’s positioning in trading. In particular, it depends on how dealers manage:

- Delta

and

- Gamma.

What’s with these two Greek letters? Let’s learn how they can influence the market’s rhythm:

Delta: How Much the Option Moves with Price

Delta tells us how sensitive an option is to price fluctuations in the underlying asset.

For example:

- A call option has a delta of 0.50.

- Now, if the underlying price goes up $1, the option value increases by $0.50.

Dealers who sold that call are “short the delta.” This means they are exposed if the market moves up. To hedge this, they buy the underlying asset! As the price keeps moving, they adjust their hedge continuously. Please note that this constant balancing act is a key part of how dealers hedge options.

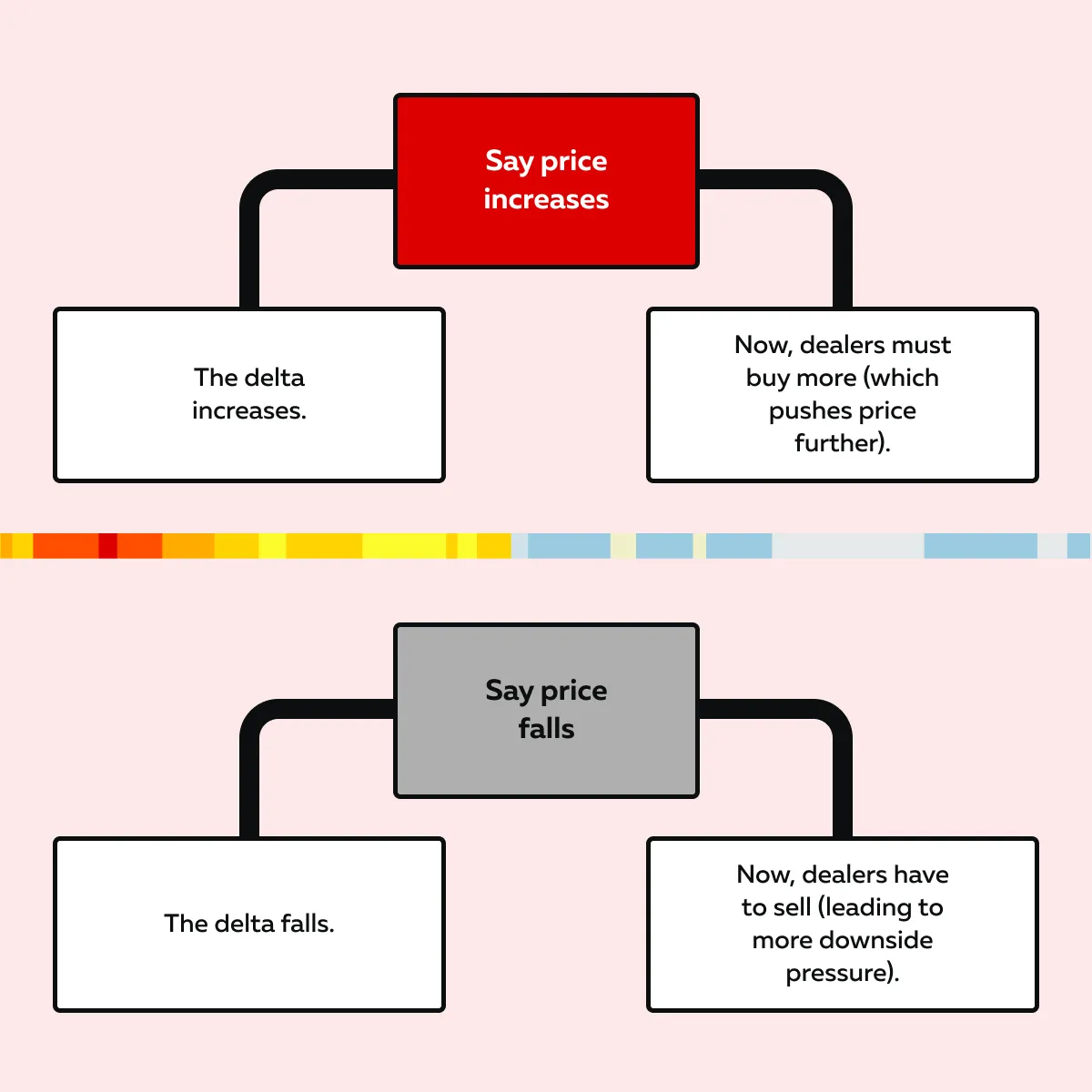

Gamma: How Fast the Delta Changes

So, the delta tells you how much the option moves. Now, the gamma tells you how fast that delta changes! Usually, when options are near-the-money or close to expiry, gamma is high.

That means a small move in the underlying causes big changes in the delta. This change forces dealers to rebalance. Let’s understand how dealers rebalance through the graphic below:

These dealer actions create a loop known as “gamma hedging.” It has been observed that this loop usually dominates short-term price action.

So, do you now understand? This is why markets feel sticky or “pinned” at key strike levels, particularly on options expiry Fridays. In high gamma zones, dealers become very active! Their actions flatten volatility and impact both liquidity and momentum.

How Dealer Hedging Affects Market Behavior

Sometimes the market:

- Ignores news

or

- Behaves strangely, mostly near options expiry.

But why? This isn’t always about sentiment or fundamentals! Often, it’s the result of:

- Dealer positioning in trading

and

- How dealers hedge options.

Let’s find out what’s really happening behind the scenes:

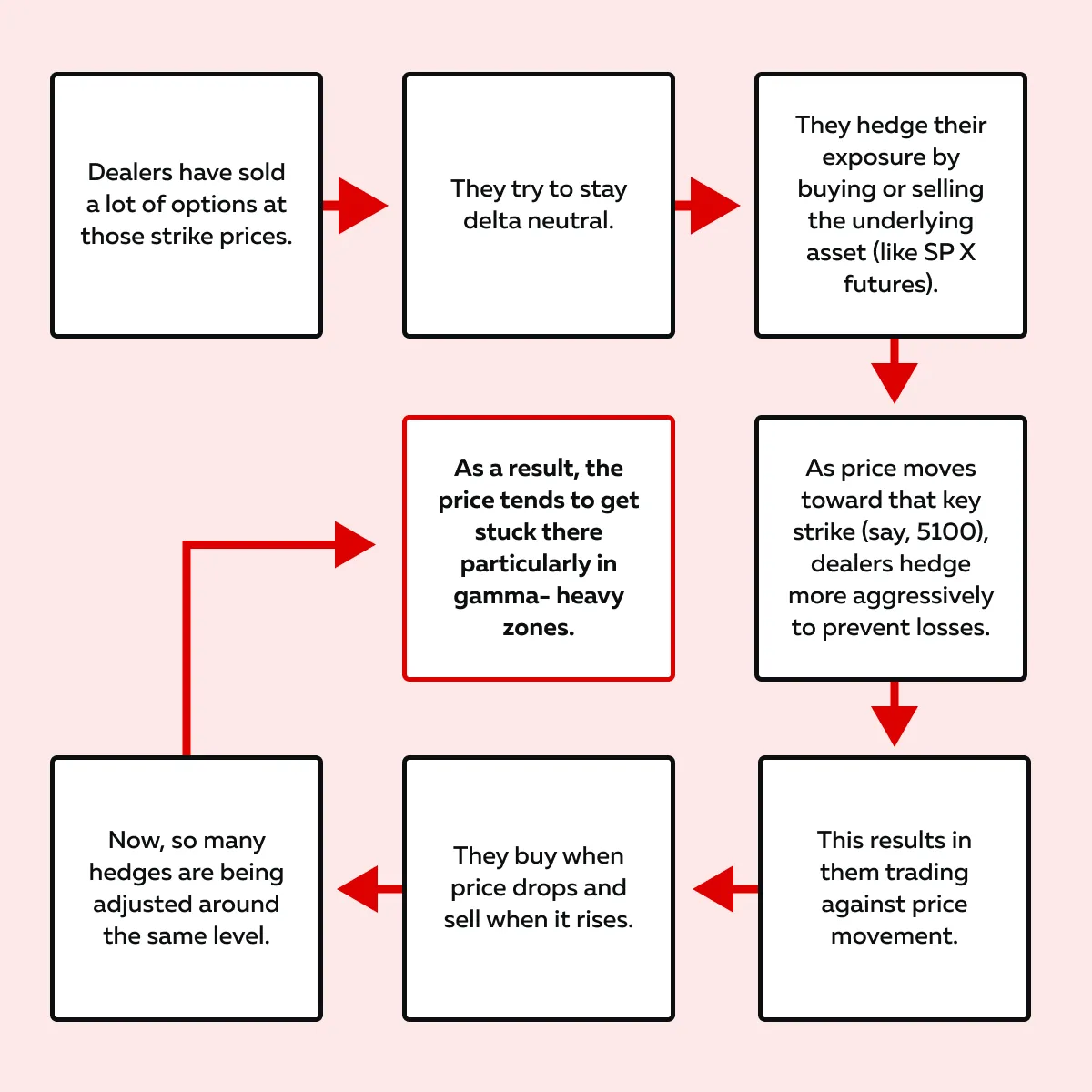

1. Pinning Price Near Expiry

You must have noticed on options expiry Fridays that the market just sits near a certain level. Almost as if it’s magnetized there! That’s called pinning. It often happens near strike prices with high open interest.

Let’s understand why through the graphic below:

For more clarity, let’s study an example:

- SPX hovers around 5100 on a Friday, even if there’s major economic news.

- This happens because that’s where a large chunk of open interest lies.

- Dealer hedging mechanics pull the market toward that level.

- They override short-term news flow.

So, if you’re watching the price “drift” or “stall” into expiry, you’re likely seeing the invisible forces of gamma hedging. Be aware that’s not just indecision! Instead, they are structured flows controlling liquidity and momentum.

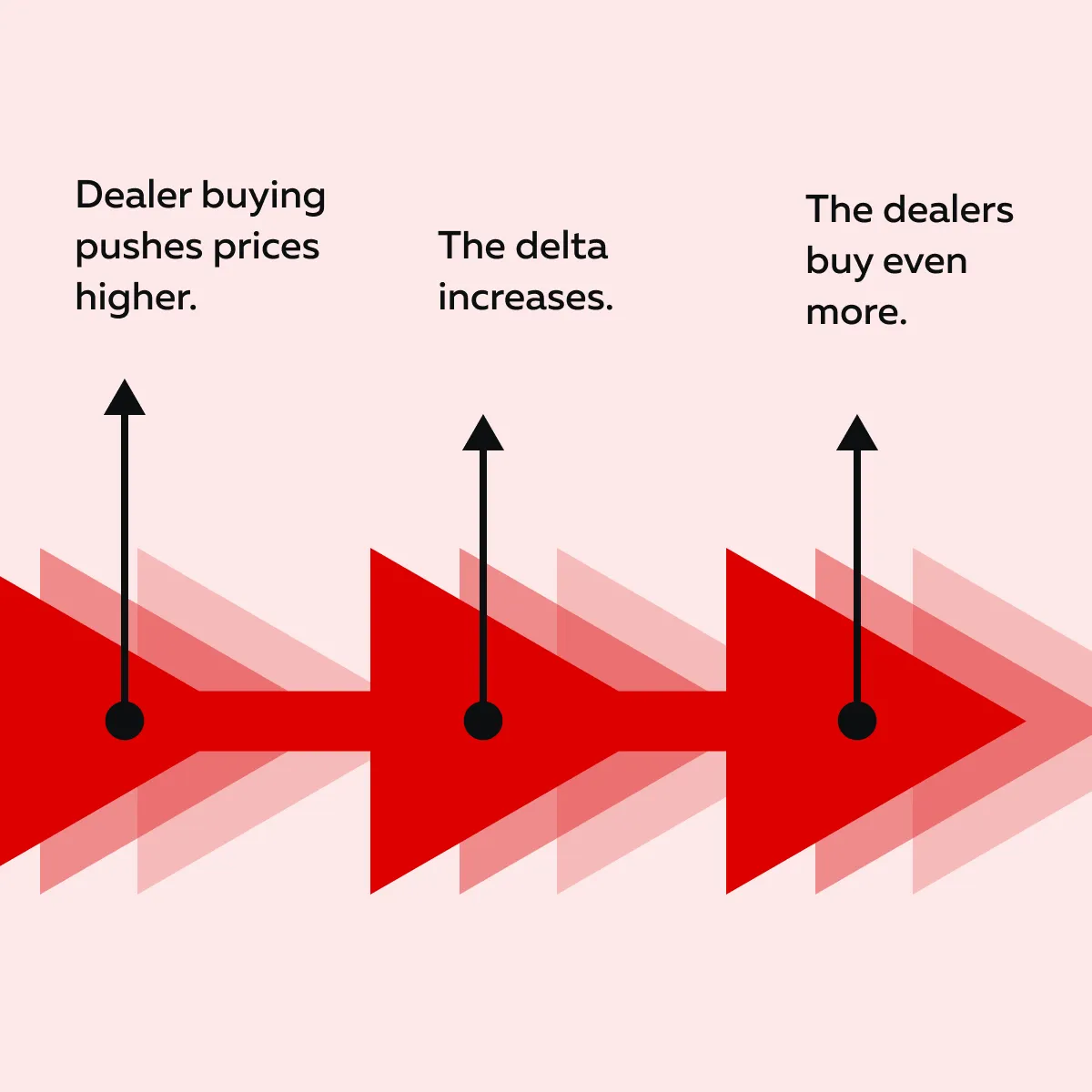

2. Accelerating Moves Outside Key Strikes

Ever seen the market suddenly melt up or drop like a knife, even when nothing major happens? That wild momentum can often be traced back to dealer positioning in trading. This particularly happens when the price moves away from key options strike levels.

Let’s understand how it works:

- Near high open interest strikes, dealers are fairly balanced.

- They’re delta neutral, thanks to hedging!

However, once the price moves outside those key strike zones, particularly post-expiry or after a breakout, dealers’ delta exposure grows rapidly. Let’s break it into two cases:

| The price moves up | The price drops |

|

|

You must realize that this process is part of gamma hedging! In it, dealers hedge options dynamically as delta shifts. This creates feedback loops. Let’s understand how through the graphic below:

The exact process, as mentioned in the above graphic, applies in reverse for selloffs. Thus, these feedback loops make prices accelerate hard in either direction, even without new information. So, how will you interpret the next time the market takes off or crashes “out of nowhere”? The chances are you’re witnessing gamma hedging explained by flow, not just by news!

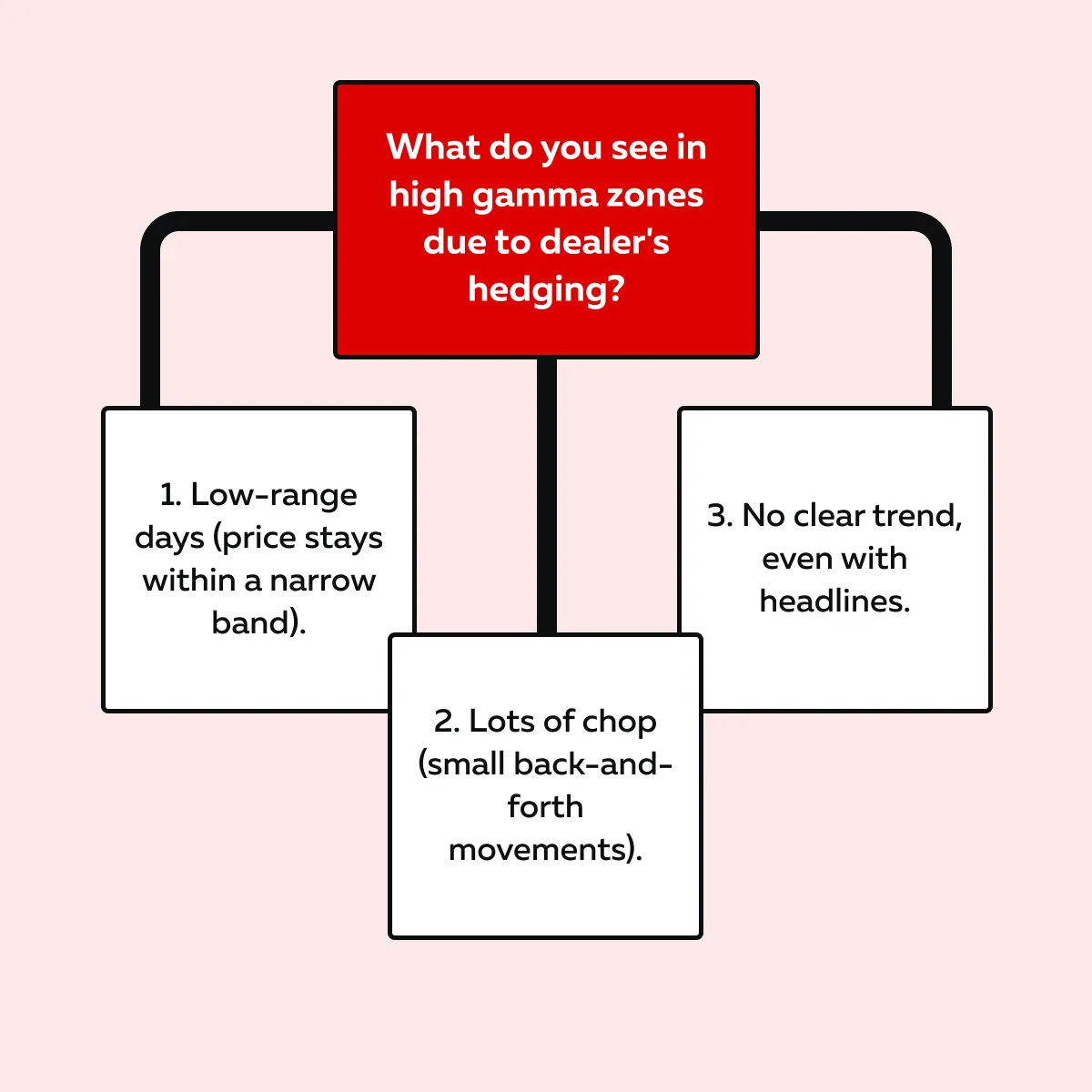

3. Reducing Volatility in High Gamma Zones

Sometimes the market is stuck. It’s barely moving, just chopping in a tight range! Why? This often happens in high gamma zones, particularly:

- Around major strike prices

and

- During 0DTE (zero days to expiry) option activity.

The reason? Dealers’ hedging options are working overtime. Let’s see what’s actually happening:

-

- When options are near-the-money and close to expiry, their gamma is high.

- That means even small price moves cause the delta to change quickly.

- Thus, to stay balanced, dealers must constantly rebalance their hedges!

- To do so, they must:

- Buy a bit when the price dips

and

- Sell a bit when it rises.

- This back-and-forth hedging creates a stabilizing force.

- Now, instead of fueling big moves, dealers are soaking up volatility.

- Their actions keep the price from running too far in either direction.

The effect? In high gamma zones, like around SPX key strikes during 0DTE sessions, you often see the following:

This is the market being “caged” by options market makers hedging aggressively! Due to their gamma hedging, you feel the market is moving slowly or has become indecisive.

See how liquidity builds and disappears in real time—especially when options flows take over. → Compare Plans

Where to Spot Dealer Impact in the Market

Do you often notice strange market moves, sudden stalls, sharp bursts, or slow grinds? Usually, it’s not due to news or fundamentals. Instead, you’re likely seeing dealers hedge options in real time!

Let’s learn how you can spot this dealer’s impact:

Around Key Options Strikes

Start by monitoring major strike prices with large open interest, such as SPX 5000, 5050, or 5100. These levels act like magnets, especially during expiry weeks.

- When the price hovers near these strikes, dealers get stuck in the hedging game.

- Their delta exposure changes rapidly as prices shift.

- Thus, they keep buying or selling small amounts to stay balanced.

This balancing activity often results in “dealer-induced pinning.” Due to this pinning, the price just drifts or sticks around that level, even if other traders expect a breakout.

On Expiry Days or After Large Options Volume

Fridays, particularly monthly options expiry (OPEX), are critical to watch! On these days, dealers are either:

- Unwinding hedges

or

- Re-hedging for the next cycle.

This causes sharp and strange moves during or right after the session. Once the gamma exposure drops, because all those near-expiry options vanish, the market often “unlocks.” Such an unlocking cause:

- Volatility expansion

and

- More natural directional movement.

So, if you’re watching options market makers hedging tightly into expiry, expect some pent-up energy to be released afterwards!

In Thin Liquidity Conditions

Usually, market liquidity is low during:

- Holidays,

- After hours, and

- Economic uncertainty.

During these times, the dealer hedging pressure stands out more! In these thin conditions, even small delta adjustments by dealers can move the market abruptly. Why? Check out the graphic below:

This is often how you get those sudden “melt-ups” or “flushes” with no obvious cause! Intraday momentum often starts with dealer reactions. Track their impact with better order flow tools. → Compare Plans

How Traders Can Adjust to Dealer-Driven Price Action

By learning how dealers hedge options, you can gain a serious edge, particularly when the price is behaving irrationally. Instead of getting trapped in confusing moves, you can adapt your trading by reading the flows that dealers and market makers are reacting to.

Let’s see how:

1. Respect the Pin

For example, the price is hovering near a high open interest strike, like SPX 5050 or 5100. Now, this usually happens because of dealer positioning in trading. In this technique:

- Dealers are constantly adjusting their hedges.

- They are doing so to stay “delta neutral.”

- Such neutrality creates a gravitational pull toward that level.

Thus, if you’re trading short-term, such as scalping, don’t try to force a breakout. Check out the smarter approach through the graphic below:

This is one of the most visible signs of options market makers hedging mechanics at work. The price isn’t moving because nobody “wants” it to, but because dealers are keeping it stable.

2. Look for the “Gamma Flip”

Sometimes, the price suddenly breaks away from a high gamma zone. Once the price escapes that tightly hedged zone, dealers’ delta exposure increases rapidly. As a result, they’re forced to hedge aggressively, and that fuels a momentum move.

For those unaware, this is known as a “gamma flip,” from pinned to trending. Want to know if it’s real? Do the following:

- Use our advanced real-time market analysis tool, Bookmap’s options heatmaps.

- Through it, you can see where gamma support/ resistance levels are.

- Check volume and order flow to confirm strength.

- If it’s backed by dealer hedging pressure, the move can:

- “Melt up”

or

- “Knife down.”

- This is gamma hedging.

3. Think Like a Dealer

This mindset shift can change your trading game. Dealers don’t trade based on opinions. Instead, they manage exposure. Please note that most of their buying and selling is mechanical, not emotional.

So, when you see a sharp move with no real news or weak volume, ask yourself – Is this move being driven by someone who needs to hedge right now?

This question often reveals more than a headline or a chart ever will.

To trade better, you, as a trader, must learn to spot and respect dealer flows, especially around expiry or high gamma zones. By doing so, you are:

- Less likely to get chopped up by strange price behavior

and

- More likely to ride the wave when it matters!

Conclusion

Dealer hedging is one of the most powerful but least understood forces in today’s markets! Even if you never trade options, their impact can influence the price action you see every day.

When dealers hedge options, particularly around big strike levels or expiry dates, they use tools like futures to manage risk. This creates price moves that often have nothing to do with news or sentiment (just pure mechanics).

So, how to deal with it? Start learning how dealer positioning in trading works. Through such knowledge, you can spot when the price is pinned and avoid getting trapped in chop. Also, you can anticipate those sharp “out-of-nowhere” moves.

Additionally, start watching where liquidity builds or disappears and use our avant-garde real-time market analysis tool, Bookmap. It allows you to track options market makers’ hedging behavior professionally. It’s not magic; it just flows!

Still, wondering why the price keeps bouncing off the same levels? Dealer hedging may be the reason. → Compare Plans

FAQs

1. What does it mean when dealers are hedging with futures?

When dealers sell options to traders, they take on risk. This risk is created by fluctuations in the price of the underlying asset. Thus, to protect themselves, they use futures contracts to balance out that risk.

For example:

- They sell a call option.

- Now, they might buy futures to stay neutral.

- This buying or selling of futures by dealers pushes the market in a direction.

- This happens even if there’s no real news or change in fundamentals.

2. What is gamma and how does it affect the market?

Gamma shows how quickly an option’s delta changes as the price moves. Usually, gamma is high in:

- Near-the-money options

or

- Soon-to-expire options.

In these cases, the dealers must adjust their hedges more often. This constant hedging slows down big price swings, while if the price breaks out, this hedging makes the move stronger.

In this way, gamma affects how volatile or stable the market feels. The intensity depends on how hard dealers are working to stay hedged.

3. Why does the price pin at certain strikes during options expiry?

Near options expiry, you’ll often see prices hovering around popular strike prices, like SPX 5000. That’s because dealers have to hedge their risk near those levels. Let’s see how:

- If the price rises, they sell.

- If it falls, they buy.

This back-and-forth creates a “pinning” effect. Due to this effect, the price gets stuck and doesn’t move much. You must interpret this as just dealers balancing their books! It does not happen due to buyers or sellers having strong views.

4. Can I trade better by following dealer flows?

Yes, definitely! If you learn where large options positions are concentrated, you can predict how dealers might hedge. By making such a prediction, you can spot zones where:

- The price might stall (low volatility)

or

- The price might suddenly break out (high momentum).

Also, instead of reacting to news, you’ll understand the mechanics behind price action! And, this will lead to:

- Fewer surprises,

- Fewer bad trades, and

- Better timing (particularly around expiry or major strike levels).