Ready to see the market clearly?

Sign up now and make smarter trades today

Stocks

August 6, 2025

SHARE

How Meme Stocks Shook Wall Street: The Trades That Scared Hedge Funds

Once upon a time, Reddit traders went to war with Wall Street. During that time, GameStop wasn’t just a store. It became a battlefield!

The stock market is chaotic. There have been numerous cases when hype defied fundamentals. But do you know which stocks are targeted to create this chaos? – Meme Stocks! Yes, they are hype-based stocks that are highly popular on social media platforms. Sometimes, they are so powerful that they can shake Wall Street.

Want to know about them? In this article, we’ll explore how everyday traders turned stocks like GameStop and AMC into financial firestorms. You’ll learn how short squeezes unfold, why hedge funds suffered massive losses, and how our modern order flow tools, like Bookmap, can help you spot these moves in real-time. Read this article till the end to understand the strategy, the signals, and the lessons from one of the most chaotic chapters in stock market history!

What Are Meme Stocks—And Why Did They Explode?

Meme stocks are shares of companies that suddenly become very popular. This popularity is not because the businesses are doing well. Instead, it’s because people on the internet start talking about them nonstop. Let’s check out some major social media platforms that play a big role in this trend:

The Most Famous Example

GameStop, a video game retailer, became the center of the GameStop short squeeze in early 2021. This happened when a large group of retail investors, everyday people trading from apps like Robinhood, noticed something interesting!

They found that:

- Some hedge funds had bet heavily against GameStop by short-selling its stock

and

- GameStop had more shares shorted than were even available in the market, more than 100% of its float.

This made it extremely vulnerable! So, the internet crowd started buying and holding the stock aggressively. Their goal? Trigger a short squeeze! This means forcing hedge funds to buy back the shares they borrowed at much higher prices. Such a move caused even bigger price spikes.

And it worked! In just a few weeks, GameStop’s stock skyrocketed from about $20 to nearly $483. This led to hedge fund losses on meme stocks, with firms like Melvin Capital losing billions and needing a bailout.

This movement wasn’t just random. Soon, it became a battle of meme stocks vs hedge funds. And for a while, the internet won!

Post this episode, other meme stocks quickly followed, like:

- AMC Theatres,

- Bed Bath & Beyond (BBBY),

- BlackBerry (BB), and

- KOSS.

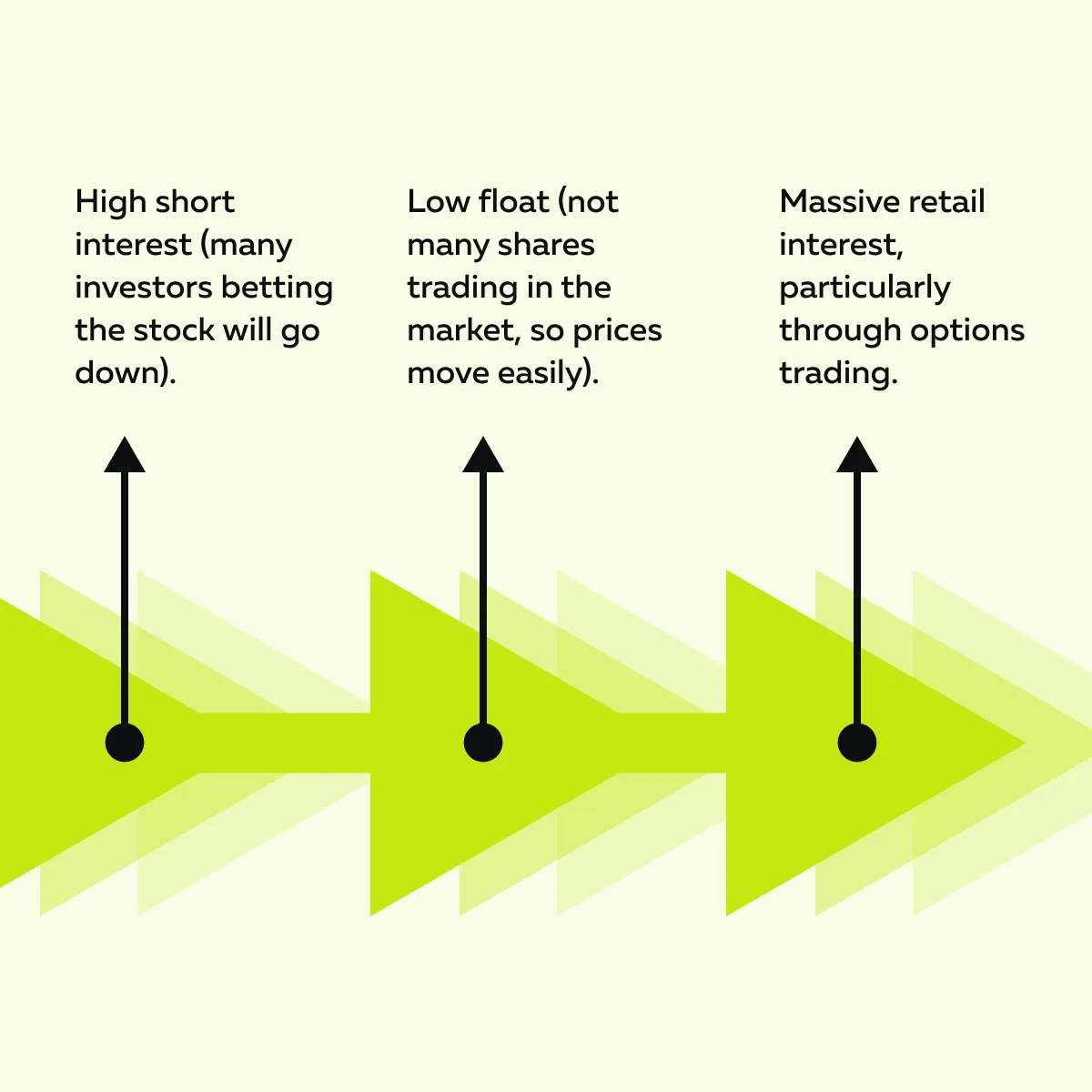

But what are some major traits of meme stocks? Let’s check out the graphic below to learn:

How Hedge Funds Got Caught: The Short Squeeze Mechanism

Many hedge funds believed that certain companies, like GameStop and AMC, were doomed. So, they tried to make money by short-selling their stocks! Confused? For those unaware, shorting means:

- Borrowing shares of a stock.

- Selling them at the current price.

- They hope the price drops so they can repurchase them cheaper and keep the profit.

But things didn’t go as planned!

As these funds piled into short positions, some meme stocks had short interest so high that it went over 100% of the available shares, especially in GameStop’s case. This set the stage for the now-famous GameStop short squeeze.

How did the GameStop Short Squeeze work?

Let’s understand the process:

- Retail traders, many of them from Reddit’s r/wallstreetbets, noticed how exposed the hedge funds were.

- They started buying up shares!

- Particularly, they bought out-of-the-money call options.

- This forced market makers who sell those options to hedge their risk.

- They did the hedging by buying the actual stock.

- As more stock was bought, the price rose sharply.

- This rise triggered margin calls for hedge funds.

- That means their brokers:

- Demanded more money

or

- Asked them to close their short positions.

-

- So, hedge funds were forced to buy back shares at much higher prices.

- This move pushed prices even higher.

- That’s the short squeeze in action!

The result? Hedge funds took massive losses on meme stocks. Melvin Capital took a huge hit, losing billions during the GameStop short squeeze. This clash became a classic case of meme stocks vs. hedge funds.

What Made the Squeeze Even More Powerful?

Short sellers, like hedge funds, were forced to cover their positions. They had to buy back the shares they had bet against. This covering activity shot the stock price up even higher.

Why? Because buying back shares added more demand in a market where everyone was already buying. This created a feedback loop:

- Higher prices led to more forced buying.

- This pushed prices up even more!

That’s how the GameStop short squeeze turned a $20 stock into one worth nearly $500 in just weeks.

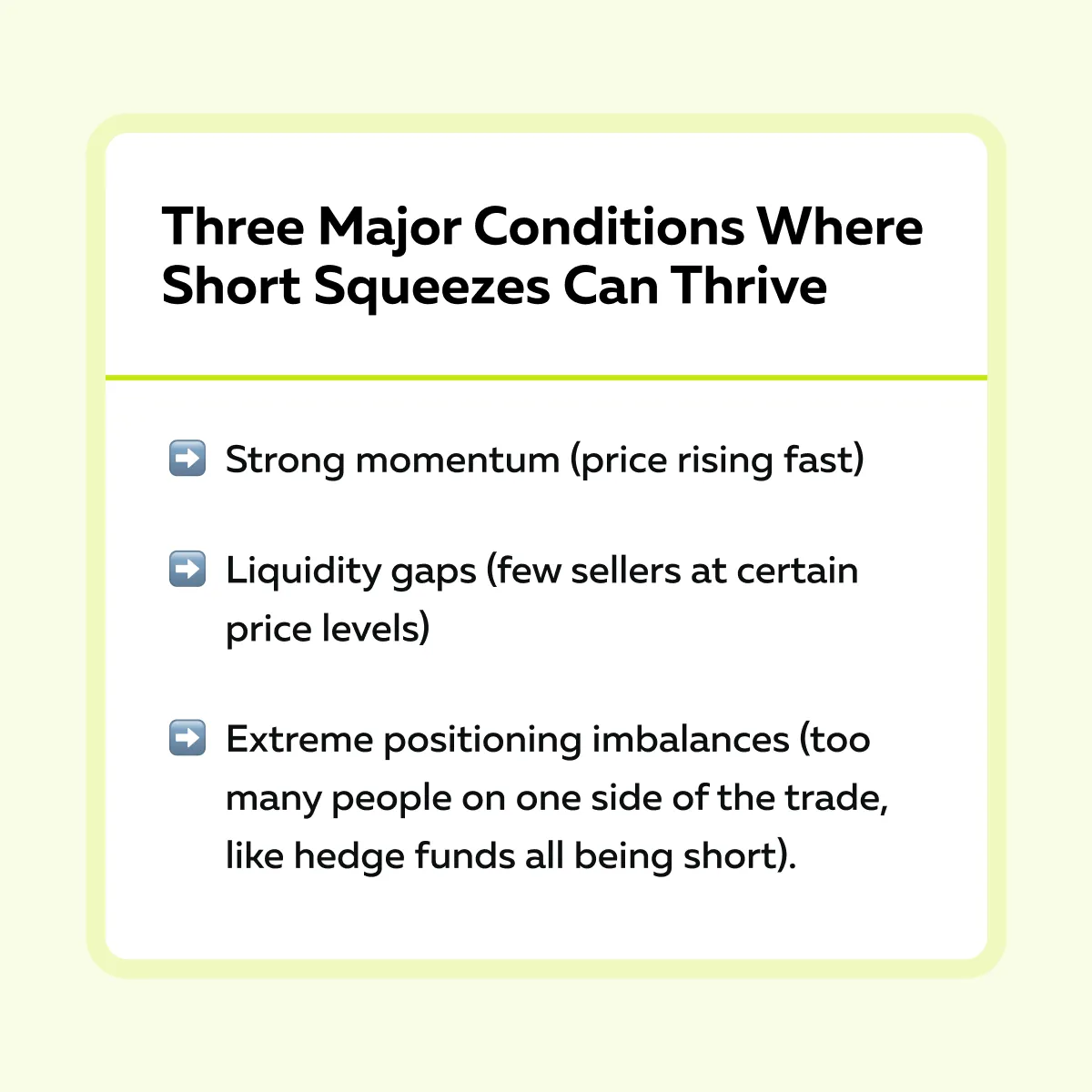

Why Do Squeezes Get So Violent?

You, as a trader, must understand what causes a short squeeze beyond just buying pressure! Check out the graphic below to learn about the conditions where squeezes can thrive:

So, is there a way to spot these three elements? Yes, you can easily spot them using our advanced order flow market analysis tool, Bookmap. Most traders observe the following on our tool:

| Feature | Benefit |

| Heatmap | You can see where big orders are sitting. |

| Volume spikes | You can observe sudden bursts of buying or selling. |

| Bid/ offer changes | You can notice when the buying interest suddenly outweighs the selling interest. |

By using our advanced real-time market analysis tool, Bookmap, you can understand:

- When a meme stock trading strategy might work

or

- When a short squeeze is gaining steam.

Want to see where big players hide their risk? Order flow tools can help spot shifts before the news hits. → Compare Plans

What Scared Wall Street Most: Retail Power and Broken Assumptions

Do you know about the real fear on Wall Street during the GameStop short squeeze?

- It wasn’t the memes!

- Hedge funds weren’t worried about the Reddit jokes, either!

They were terrified of something much more serious, and that is:

- Losing liquidity or not being able to buy or sell quickly without moving the price.

- Being in crowded trades when everyone is shorting the same stock.

- Being caught in a reflexive move, where rising prices force more buying and push prices up even more.

The Initial Assumption of Hedge Funds

Many hedge funds had relied on risk models. These models assumed the market would behave in a “rational” way. To predict risk, these models are used:

- Historical volatility

and

- Past behavior.

But they didn’t account for the power of coordinated retail traders acting together through Reddit and other platforms!

Market Mechanics Started to Break

As prices soared and panic spread, the market structure itself came under stress. Let’s check out the three stress signals:

| Signal I | Signal II | Signal III |

|

|

|

One fund manager summed it up best, not by focusing on GameStop’s stock, but by saying, “We weren’t trading GameStop. Instead, we were managing our own risk limits.”

Furthermore, this moment wasn’t just about meme stocks vs. hedge funds! It revealed deep flaws in the system and forced Wall Street to rethink how retail power could significantly influence the market.

Retail traders moved markets once—could it happen again? Read the order flow. → Compare Plans

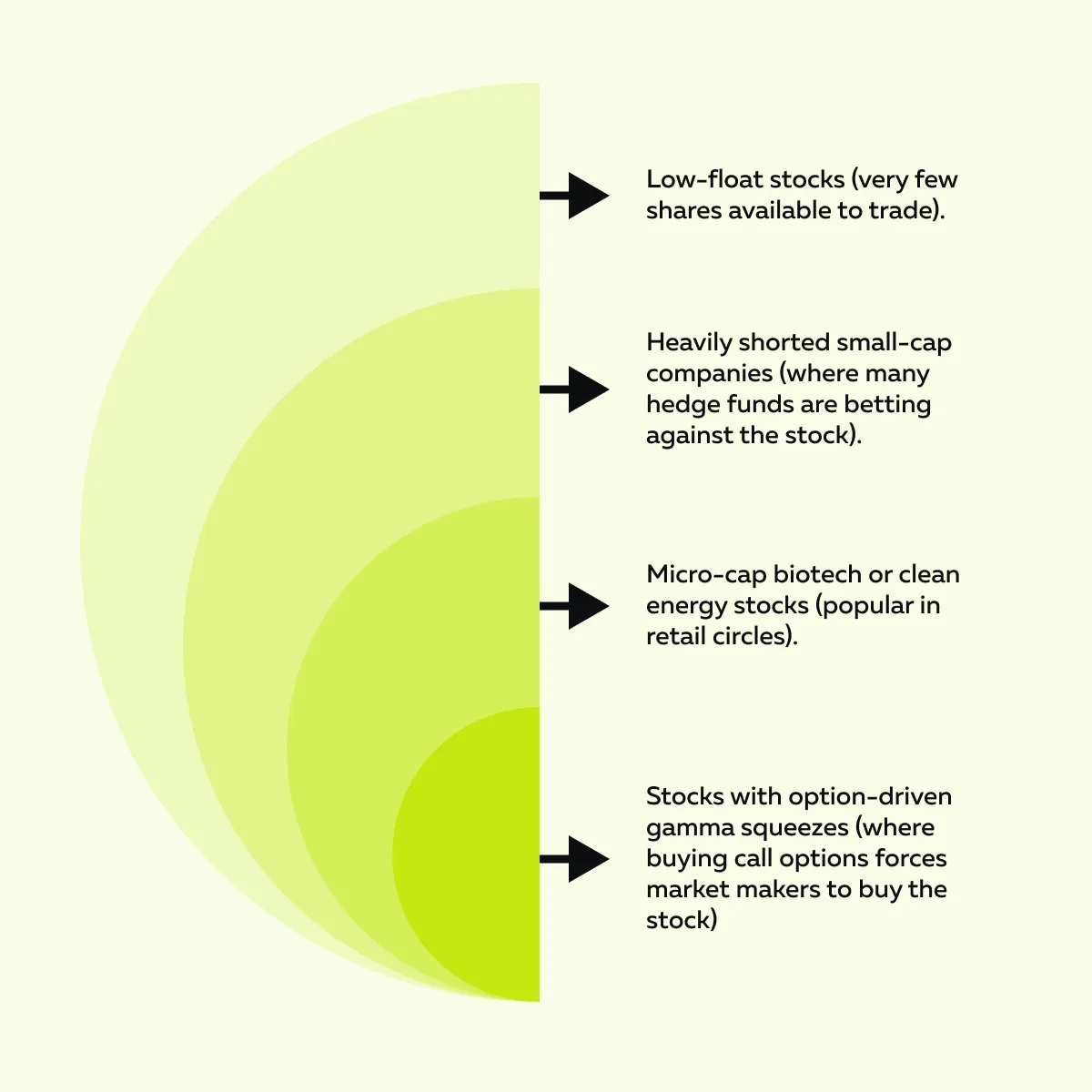

Can It Happen Again? What to Watch in Today’s Market

Yes, meme stock mania can still happen! But it’s changed. The massive and weeks-long frenzy we saw with the GameStop short squeeze is less common now. Retail traders are still powerful. However, today’s meme stock trading is finished within hours or a few days!

So, where do short squeeze conditions form nowadays? Let’s check out the graphic below:

What Traders Should Watch For?

To spot the next potential squeeze or avoid getting caught in a trap, you should look out for the following:

| Crowded short positions | Sudden volume spikes without news | Liquidity vanishing + aggressive buyers stepping in | Late retail entry into a stock that’s already pumped |

|

|

or

|

|

Bonus Tip – Start Using Order Flow Tools!

Our avant-garde real-time market analysis tool, Bookmap, can show what’s really happening under the surface! By using it, you can spot the following:

- Passive resistance, like iceberg orders (hidden sellers sitting quietly),

- Absorption, where big players are taking the other side of the trade, and

- Whether buyers are being forced into thin liquidity. It is a sign the squeeze may be real and accelerating.

Worried? Maybe the full-scale battle of meme stocks vs hedge funds will not be repeated at the same scale. However, the dynamics are still alive. And they are just faster and harder to catch nowadays! So, stay informed and regularly watch the order flow to win this battle.

Conclusion

Still thinking, the meme stock saga was just a wild moment in market history? No, it was a wake-up call! It proved that even powerful hedge funds can be caught off guard by retail traders. This can particularly happen when liquidity dries up, and market behavior turns unpredictable.

Additionally, the chaos during the GameStop short squeeze showed how fast things can spiral when everyone rushes to one side of a trade.

But is it still relevant? For today’s traders, your goal is not to chase the hype! Instead, you must watch these major signals:

- High short interest,

- Sudden volume spikes, and

- Unusual moves in the order flow.

These clues can warn you before the next squeeze hits. Please realize the game hasn’t ended. It’s just changed! The trail is still there. The real question is – Will you spot it in time? Short squeezes leave a trail. Learn to track the real-time liquidity behind the chaos. → View Packages

FAQ

1. What is a meme stock?

A meme stock is a stock that is highly popular on social media platforms, like:

- Reddit,

- Discord, or

- TikTok.

This popularity is based on hype or speculation. In most cases, it is not because the company is doing well financially.

Retail traders or individual investors often buy these stocks in large numbers and try to create big price jumps. Thus, you must be aware that these stocks often move more because of hype than logic or company performance.

2. Why did hedge funds lose money on meme stocks?

Hedge funds lost money on meme stocks like GameStop (GME) and AMC because they bet the stocks would fall. They shorted them! For those unaware, they sold borrowed shares, hoping to buy them back at a lower price.

However, retail traders pushed prices up, forcing hedge funds to buy the stock at much higher prices to exit their positions. As a result, hedge funds lost huge amounts of money.

3. Can a short squeeze be seen in real-time?

Yes, a short squeeze can be spotted while it’s happening. However, you must know what to look for. Firstly, as a trader, you should use our advanced real-time market analysis tool, Bookmap. Using it, you can track:

- Sudden buying pressure,

- Changes in the bid and ask prices, and

- Drops in available shares (liquidity).

On our advanced market analysis tool, Bookmap, you can observe that the prices are increasing rapidly without news, and short interest is high. This is a signal that a squeeze is forming. By watching these patterns live, you can react before the big move is over.

4. Is the meme stock era over?

Nowadays, the big meme stock events, like the GameStop short squeeze, don’t happen often. But that doesn’t mean the era is over! Short squeezes still happen, particularly in small or little-known stocks with:

- High short interest

and

- Low trading volume.

Today, traders need to do more research and use tools, like our advanced market analysis tool, Bookmap, to find these opportunities. The hype has faded, but the market setups that cause squeezes still exist.